Storage Area Network (SAN) Market Size and Forecast 2025 to 2034

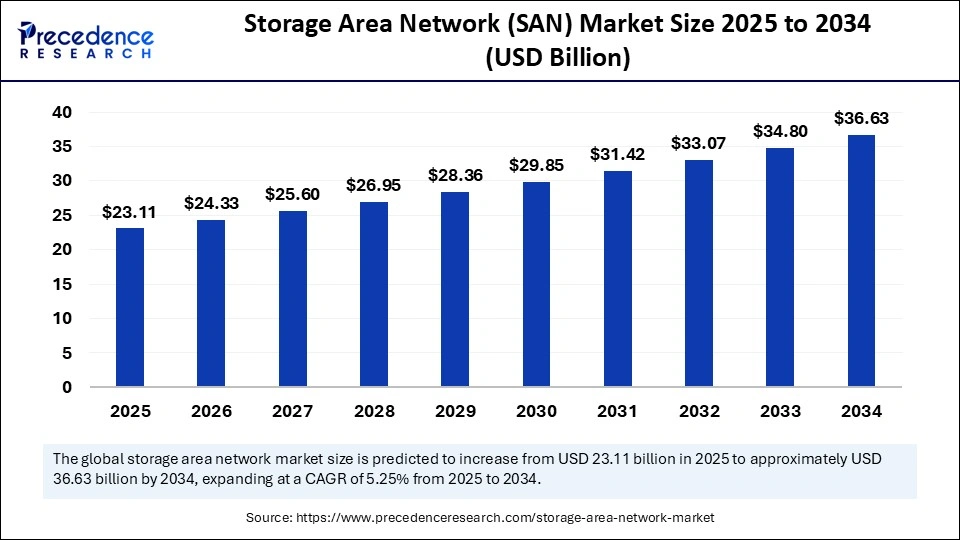

The global storage area network (SAN) market size accounted for USD 21.96 billion in 2024 and is predicted to increase from USD 23.11 billion in 2025 to approximately USD 36.63 billion by 2034, expanding at a CAGR of 5.25% from 2025 to 2034. The market is growing due to the rising demand for high-performance, scalable, and secure data storage solutions driven by cloud adoption, big data analytics, and enterprise digital transformation.

Storage Area Network (SAN) Market Key Takeaways

- In terms of revenue, the global storage area network (SAN) market was valued at USD 21.96 billion in 2024.

- It is projected to reach USD 36.63 billion by 2034.

- The market is expected to grow at a CAGR of 5.25% from 2025 to 2034.

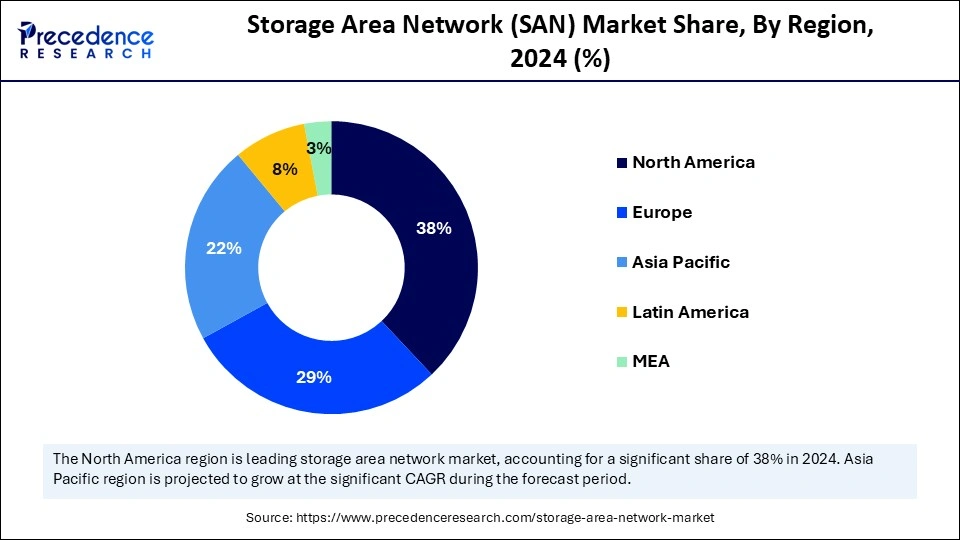

- North America dominated the storage area network (SAN) market with the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By component, the hardware segment captured the biggest market share of 45% in 2024.

- By component, the software segment is expected to grow at the fastest CAGR during the forecast period.

- By technology, the Fiber Channel (FC) SAN segment contributed the highest market share of 40% in 2024.

- By technology, the NVMe-oF & iSCSI SAN segment is expected to grow at the fastest CAGR overt the forecast period.

- By system type, the enterprise SAN segment held the maximum market share of 50% in 2024.

- By system type, the mid-range SAN segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the IT& telecom segment generated the major market share of 30% in 2024.

- By end-use industry, the healthcare & life sciences segment is emerging as the fastest growing forecast period.

Market Overview

The global storage area network (SAN) market is experiencing steady growth as enterprises prioritize scalable, high-performance, and secure storage infrastructure to manage surging data volumes. Low-latency high-throughput data access across industries is becoming increasingly dependent on SAN solutions due to digital transformation, the growth of IoT devices, and the growing use of cloud and hybrid environments. SAN is being used by businesses in industries like BFSI, healthcare, telecom, and IT services to support real-time analytics, business continuity plans, and mission-critical workloads. Furthermore, SAN is being transformed into a future-ready backbone for contemporary data centers by the growth of virtualization, software-defined storage, and AI-driven data management. This robust adoption trend highlights the importance of SAN as a key component of enterprise IT strategies, guaranteeing interoperability, scalability, and dependability in ever more complex digital ecosystems.

- On 9 July 2025, Novodisq, a New Zealand startup, launched its Novoblade system at the Flash Memory Summit. With 144 TB SSD blades, it delivers up to 230 PB per rack, targeting high-density SAN and hyperconverged setups.(Source: https://www.techradar.com)

How Is Cloud Adoption Influencing the SAN Market?

Organizations' growing need for scalable, secure, and high-performance storage infrastructures that can easily integrate with hybrid and multi-cloud environments is driving the storage area network (SAN) market. Businesses moving mission-critical apps and data workloads to cloud platforms require low-latency, high-throughput block storage, which SANs are uniquely positioned to provide. Enterprises push for digital transformation, which places a higher priority on agility, predictable performance, and improved data resilience, core SAN strengths that help guarantee consistent performance and smooth interoperability between on-premises infrastructure and cloud storage systems, further accelerating this trend.

- In January 2025, Broadcom Inc. unveiled the Brocade G710, an entry-level Gen 7 Fibre Channel SAN switch engineered for high-performance cloud-ready storage networks. The G710 delivers exceptionally low 460 nanoseconds port-to-port latency at 64 G speed, boasts industry-leading energy efficiency (~65 W), six-nines (99.9999 %) availability, self-healing cyber-resilient architecture, and a rare lifetime warranty—making it an ideal bridge between robust on-prem SAN infrastructure and the flexibility demanded by hybrid cloud environments(Source: https://www.globenewswire.com)

- In February 2024, Microsoft officially launched Azure Elastic SAN, the industry's first fully managed, cloud-native SAN service designed for seamless migration to the cloud. This offering brings enterprise-class performance and scalability, with support for high-throughput workloads like SQL clusters and VDIs, alongside cloud-native benefits such as policy-based management, encryption, autoscaling, and enhanced security—empowering organizations to integrate SAN-like block storage directly into their cloud operations(Source: https://azure.microsoft.com)

U.S. Storage Area Network (SAN) Market Size and Growth 2025 to 2034

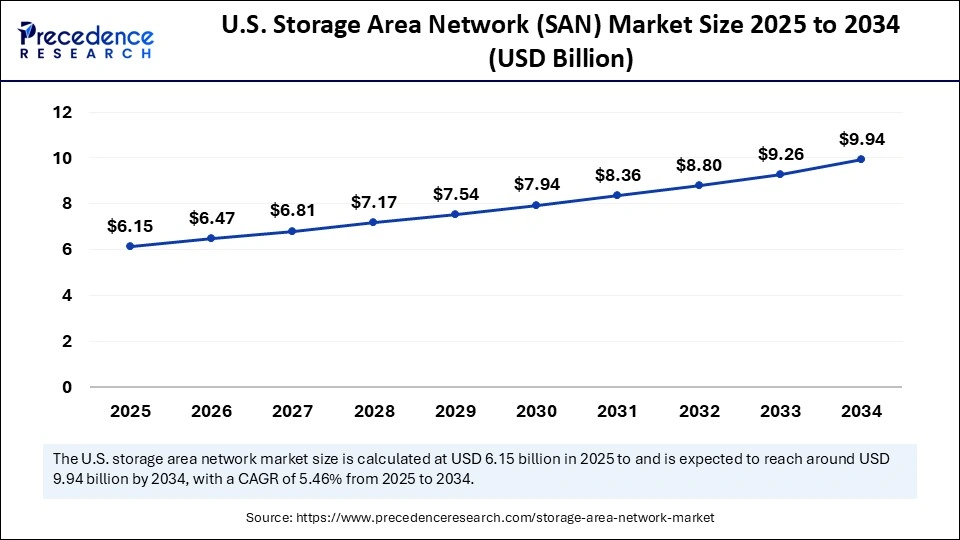

The U.S. storage area network (SAN) market size was evaluated at USD 5.84 billion in 2024 and is projected to be worth around USD 9.94 billion by 2034, growing at a CAGR of 5.46% from 2025 to 2034.

Why Did North America Dominate the Storage Area Network (SAN) Market in 2024?

North America dominates the storage area network (SAN) market because of its advanced IT infrastructure, large number of data centers, and presence of top technology suppliers. The region's dominance is further cemented by significant investments made by cloud service providers and enterprises in cutting-edge storage solutions. Additionally, the area is leading the way in the adoption of cutting-edge technologies like edge computing, 5G, and AI, all of which require strong SAN infrastructure. The need for sophisticated SAN systems is further increased by government and corporate cybersecurity initiatives.

Asia Pacific is the fastest-growing storage area network (SAN) market, fueled by a surge in e-commerce, fast digitization, and the enormous amount of data generated by connected devices. The region's growing investments in 5G rollouts, smart cities, and cloud infrastructure are speeding up the adoption of SANs. Additionally, the number of SMEs and mid-sized businesses in the area is growing significantly, which is driving up demand for scalable and affordable storage. Increased industry adoption of digital transformation projects is accelerating market momentum even more.

Storage Area Network (SAN) Market Growth Factors

- Rising Data Volumes: Explosive growth in enterprise data from IoT devices, digital transactions, and multimedia content is creating demand for efficient and scalable storage infrastructures.

- Cloud Adoption: Increasing migration of business workloads to hybrid and private cloud environments is fueling the need for SAN systems that deliver high-speed connectivity and reliable storage performance.

- Big Data & Analytics: Expanding use of AI, machine learning, and real-time analytics requires robust storage solutions capable of handling massive, unstructured datasets.

- Virtualizations & Data Centers: Rapid expansion of virtualized environments and modern data centers is boosting the need for centralized, high-availability storage networks.

- Business Continuity & Disaster Recovery: Rising focus on data protection, backup, and disaster recovery solutions is driving organizations to adopt SAN for improved resilience and uptime.

- Digital Transformation Initiatives: Enterprises embracing digitalization, automation, and advanced IT infrastructure are increasingly deploying SAN systems to meet performance and security needs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.63 Billion |

| Market Size in 2025 | USD 23.11 Billion |

| Market Size in 2024 | USD 21.96 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Business Continuity & Disaster Recovery

Companies are giving resilience and disaster recovery top priority as cyber-attacks and system failures increase. Advanced failover backup and replication features are offered by SAN systems to guarantee data security and speedy recovery. Because of this, SAN is a reliable option for businesses that cannot afford to lose mission-critical operations. SAN adoption for secure recovery strategies is also being strengthened by the increased emphasis on compliance standards such as GDPR and HIPAA on a global scale.

- 9 July 2025 – Cerabyte announced the launch of ceramic-based storage tablets, designed for ultra-long-term retention, projecting 100+ PB per rack by 2030, offering enterprises an archival SAN alternative for compliance-driven disaster recovery.(Source: https://www.techradar.com)

Advancements in Storage Technology

Innovations such as NVMs over Fiber Channel, Gen 7 SAN switches, and software-defined SAN are making storage more agile, energy efficient, and performance-driven. These advancements are reshaping SAN into a future-ready technology that supports next-gen workloads while lowering operational costs. The ongoing convergence of SAN with cloud native and AI-ready storage solutions is opening new revenue opportunities for providers.

- 15 January 2025 – Broadcom Inc. once again reinforced SAN modernization with its Gen 7 Fibre Channel innovations, highlighting that faster, more secure, and energy-efficient SAN technology will continue to lead digital infrastructure upgrades.(Source: https://www.globenewswire.com)

Restraints

High Deployment and Maintenance Costs

The substantial capital expenditures needed for SAN infrastructure in terms of network software and hardware components may be unaffordable for SMEs. Energy use upgrades and hiring qualified IT personnel all contribute to the overall cost. Instead of using traditional SAN, this cost barrier frequently forces smaller businesses to use cloud-native or hyperconverged alternatives. Additionally, emerging market businesses with tight budgets frequently cannot afford such high storage expenditures, which restricts the adoption of SAN.

- In July 2025, Novodisq announced its Novoblade SAN system with 144 TB SSD blades, but its high cost (over USD 2 million per system) highlights the affordability challenge for many enterprises, limiting broader adoption.(Source: https://www.techradar.com)

Competition from Cloud and Hyperconverged Infrastructure (HCI)

Traditional SAN systems are becoming less necessary due to the quick expansion of cloud storage and hyperconverged infrastructure. Due to their ease of scalability, reduced upfront costs, and flexibility, these alternatives are appealing to businesses going through digital transformation. This tendency is especially pronounced in small and medium-sized enterprises. Further pressuring SAN adoption rates are vendors who market cloud and HCI services as easier substitutes.

- In July 2025, Cloudian announced an upgrade to its HyperStore platform with vector database integration, a cloud-aligned solution that reduces dependence on traditional SAN by delivering cloud-like scalability for AI workloads.(Source: https://en.m.wikipedia.org)

Opportunities

Integration with Edge Computing

Vendors of SANs have the chance to offer small, powerful storage solutions designed for edge environments as businesses move workloads closer to the edge for faster data processing. IoT applications, latency-sensitive use cases, and real-time analytics can all be supported by edge SAN systems, opening new revenue streams. This development is in line with sectors like telecom and automotive that are quickly implementing infrastructure enabled by 5G.

- In May 2024, Dell Technologies announced the expansion of its PowerFlex software-defined storage platform with edge-ready SAN solutions, enabling telecom operators to integrate high-performance storage with 5G and edge computing deployments.(Source: https://investors.delltechnologies.com)

Adoption of NVMe-over-Fibre Channel

Businesses are quickly adopting NVMe-over-Fibre Channel (NVMe/FC) to enable mission-critical workloads with reduced latency and increased throughput. The opportunity to improve conventional Fibre Channel environments and provide next-generation performance is thus presented to SAN providers. Adoption of NVMe/FC is anticipated to hasten SAN modernization as real-time applications become increasingly important.

- In March 2024, Hitachi Vantara announced the launch of its Virtual Storage Platform One, which integrates NVMe-over-Fibre Channel for ultra-fast SAN performance, targeting enterprises running high-performance databases and AI workloads.(Source: https://www.hitachivantara.com)

Component Insights

Why Did the Hardware Segment Dominate the Storage Area Network (SAN) Market in 2024?

Hardware currently dominates the storage area network (SAN) market as businesses still rely on reliable physical infrastructure to manage enormous amounts of both structured and unstructured data, including disk arrays, switches, and host bus adapters. The demand for dependable high-performance storage infrastructure in data centers, along with significant capital expenditures by cloud service providers and hyperscale's keeps hardware at the forefront. Furthermore, the growing need for scalable on-premises storage and all-flash arrays keeps the hardware market strong. Businesses continue to favor physical infrastructure for workloads that are mission-critical and require guaranteed uptime.

Software is emerging as the fastest growing component in SANs, driven by the growing use of cloud-based orchestration platforms AI AI-enabled storage management, and storage virtualization. Because of their scalability, automation, and cost effectiveness, software-defined SAN solutions are becoming increasingly appealing to businesses updating their IT infrastructure. Additionally, companies can adopt multi-cloud strategies and lessen their reliance on hardware thanks to software advancements. Continuous growth in this market is also being fueled by the move toward subscription-based business models.

Technology Insights

How Did the Fiber Channel Segment Dominate the Storage Area Network (SAN) Market in 2024?

Fiber channel technology dominates the SAN market because it has demonstrated dependability, has extremely low latency, and can handle workloads that are vital to big businesses and financial institutions. Its market leadership is guaranteed by its extensive use in high-performance settings, especially those where data security and constant availability are essential. Fiber channel has a well-established ecosystem with robust vendor support and interoperability guidelines. Fiber channel remains at the forefront despite new competitors because of this long-standing trust.

NVMe-oF & iSCSI SAN are witnessing the fastest growth, driven by the need for more economical deployment models high high-bandwidth applications, and quicker data processing. Because of their scalability and performance benefits, these technologies are ideal for contemporary workloads like real-time applications, analytics, and artificial intelligence to reduce latency in storage environments. Businesses are using NVMe-oF more. In the meantime, SMEs and expanding companies find iSCSI SAN to be a desirable option due to its affordability.

System Type Insights

Why Did the Enterprise SAN Segment Dominate the Storage Area Network (SAN) Market in 2024?

Enterprise SAN systems have dominated the market since big businesses require storage solutions that are highly scalable, secure, and performance optimized to support mission-critical apps, cloud workloads, and big data analytics. The fact that they can incorporate sophisticated features like high availability and automated tiering reinforces their acceptance. With stringent compliance controls, large enterprises frequently need multi-petabyte storage capacity. Enterprise SANs are therefore the standard option for sectors like telecom, IT, and BFSI.

Mid-Range SANs are the fastest growing segment as mid-sized businesses and MEs look for more affordable storage options without sacrificing functionality. There is a high demand for these systems, particularly those with modular deployment models, due to the growth of SaaS provider startups and digitally changing industries. Due to their ability to balance affordability and cutting-edge features, these SANs are attractive for expanding IT requirements. Simplified management interfaces are the focus of vendors in an effort to draw in mid-market clients.

End Use Industry Insights

Why Did the IT & Telecom Segment Dominate the Storage Area Network (SAN) Market in 2024?

IT & telecom remains the dominant end-use industry for SANs due to the need for constant connectivity, the expansion of 5G networks, and the enormous amount of data being generated. The leadership of this industry is cemented by its ongoing investments in massive data centers and hyperscale infrastructure. SAN demand is also being driven by telecom initiatives related to digital transformation and cloud adoption. The industry's emphasis on faster data processing and uptime assurances serves to further solidify its leadership.

Healthcare & life sciences are the fastest growing industries for SAN adoption, driven by genomic research, electronic health records, and the explosion of medical imaging data. The industry's quick adoption is driven by the need for safe, large-capacity, and compliant storage. Furthermore, AI in personalized medicine and diagnostics is generating data-intensive environments that require dependable storage. To stay up with the latest advancements in digital health, hospitals and research facilities are investing quickly in contemporary SAN architectures.

Storage Area Network (SAN) Market Companies

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Cisco Systems, Inc.

- Broadcom Inc. (Brocade)

- NetApp, Inc.

- Hitachi Vantara (Hitachi Ltd.)

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- Pure Storage, Inc.

- DataCore Software Corporation

- StarWind Software Inc.

- Nutanix, Inc.

- NEC Corporation

Recent Developments

- In 26 May 2025, Synology announced the launch of the PAS7700, a high-performance NVMe active-active storage solution with non-disruptive maintenance, 3-2-1-1 data protection, and advanced hardware security boosting reliability for enterprise SAN applications. This move strengthens Synology's positioning in mission-critical enterprise environments. (Source:https://www.techradar.com)

- In 2025, Adata revealed Project Titan, an experimental SSD under its Trusta brand boasting breakthrough speeds beyond 10,000 MB/s, and a unique DisplayPort output melding storage with high-resolution display workflows. This innovation signals Adata's ambition to redefine enterprise-grade SSD capabilities.(Source: https://www.techradar.com)

Segments Covered in the Report

By Component

- Hardware (switches, HBAs, cables, servers)

- Software (management, analytics, virtualization)

- Services (installation, consulting, maintenance, managed services)

By Technology

- Fibre Channel (FC) SAN

- iSCSI SAN

- Fibre Channel over Ethernet (FCoE)

- NVMe over Fabrics (NVMe-oF)

- Others (InfiniBand, ATA over Ethernet)

By Application

- Data Backup & Recovery

- Disaster Recovery & Business Continuity

- Data Archiving

- High-Performance Computing (HPC)

- Virtualization & Server Consolidation

- Others

By End-Use Industry

- IT & Telecom

- BFSI (Banking, Financial Services, Insurance)

- Healthcare & Life Sciences

- Government & Defense

- Retail & E-Commerce

- Manufacturing

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content