Sweeteners Market Revenue to Attain USD 150.08 Bn by 2033

Sweeteners Market Revenue and Trends 2025 to 2033

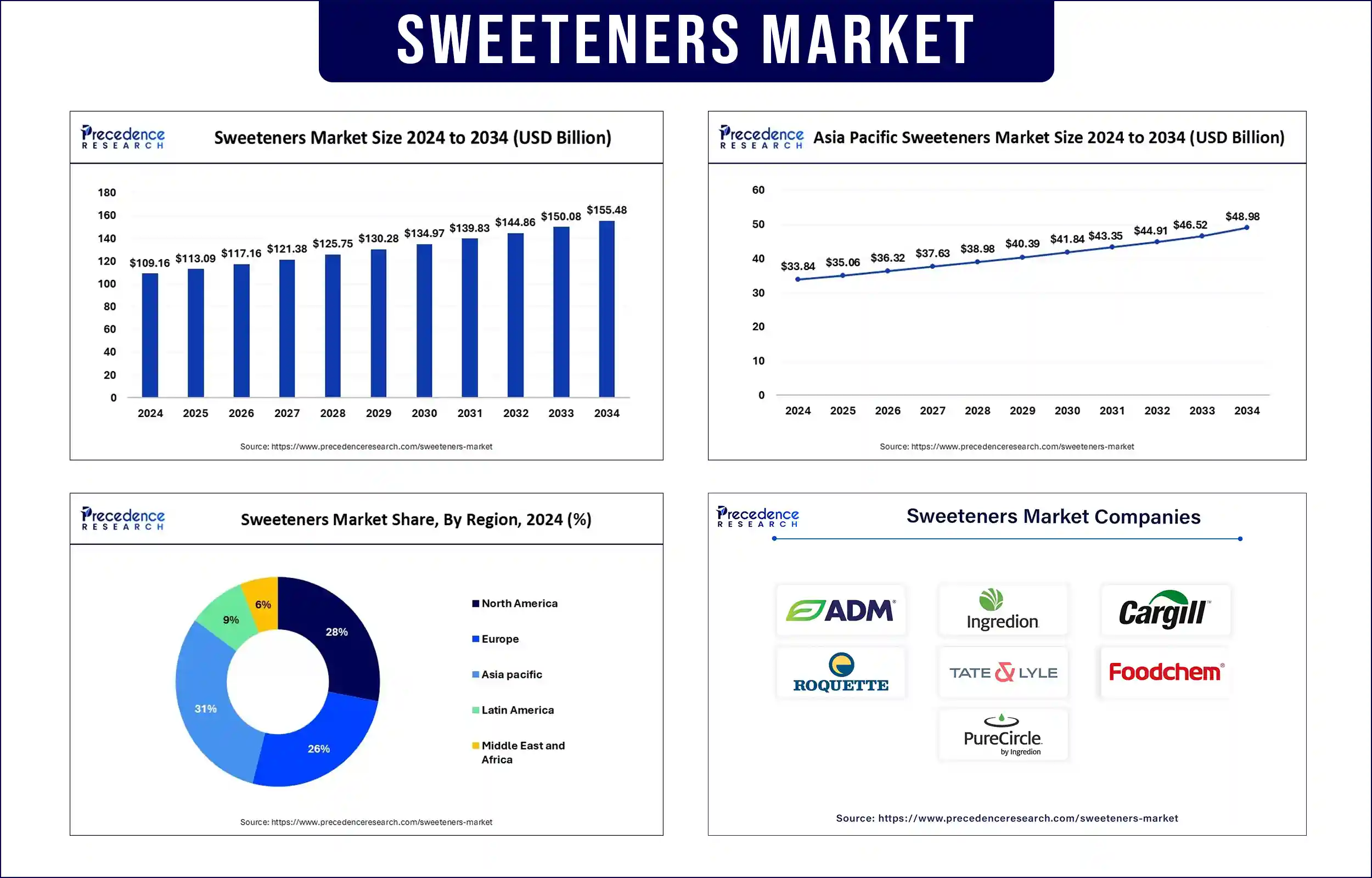

The global sweeteners market revenue was valued at USD 113.09 billion in 2025 and is expected to attain around USD 150.08 billion by 2033, growing at a CAGR of 3.60% during forecast period. The growth of the market is driven by the rising demand for natural sweeteners.

Market Overview

The worldwide sweeteners market is witnessing rapid growth due to the increasing consumer demand for natural, low-calorie, and healthier sugar substitutes. As awareness of the ill effects associated with excessive sugar consumption increases, the demand for sweeteners also increases. The growing prevalence of diabetes and obesity across the globe is boosting the demand for sugar alternatives. Moreover, people have become more health-conscious than ever before. Thus, they are actively looking for low-sugar goods. Food manufacturers are seeking new ways to reduce sugar in their products without compromising on taste. This, in turn, boosts the demand for sweeteners.

Although there are several opportunities in the market, it faces many challenges. High production costs and supply chain issues can limit access for some consumers. However, changing consumer preferences open up new avenues for market growth. Key players operating in the market are developing new sweeteners with improve taste profiles and health benefits, attracting a large number of consumers. In addition, rising product approvals and the widespread acceptance of new sweeteners are expected to drive the growth of the market. With sustainability becoming a major concern, companies are leaning toward sustainable sourcing to lower their carbon footprints and build customer loyalty.

Major Trends in the Sweeteners Market

Demand for Natural Sweeteners

With the increased prevalence of obesity, diabetes, and heart diseases, all of which are linked to the excessive consumption of sugar, people are actively looking for plant-based alternatives to sugar. Stevia, monk fruit, and agave nectar are healthy, plant-based alternatives to sugar. In addition, the rising awareness among people about the health benefits of plant-based sweeteners is likely to boost the growth of the market.

Sugar Reduction

People are rapidly reducing their daily sugar intake to lead healthy lives due to the growing awareness of the drawbacks of sugar. This, in turn, is boosting the demand for zero-calorie or sugar-free products. With increasing rates of obesity and type 2 diabetes, food & beverage manufacturers are marketing low-glycemic and keto-compatible sweeteners, which contain low amounts of calories, to target health-conscious audiences, including diabetic people and fitness enthusiasts.

Technological Innovations

Innovations in sweeteners production, such as fermentation, extraction, and blending technologies, are reducing costs. These technologies are enabling the development of new formulations with enhanced flavor profiles. Key companies in the market are diversifying their product portfolio by launching new products to meet varying consumers' demands. Products like liquid sweeteners, flavored sweeteners, and single-serve sachets are gaining popularity.

Report Highlights of the Sweeteners Market

Type Insights

The sucrose segment dominated the market with the largest share in 2024. This is mainly due to the increased demand for natural sweeteners. Glucose and fructose are disaccharides that can be processed to sucrose. As sugarcane is a primary source of sucrose, it is commercially utilized to produce the end products. It is widely used in bakery food items. Sucrose is also used in medicine preparations due to its contribution to the palatable taste and smell of the drugs. There are several drugs, ranging from chew tablets to lozenges, syrups, and gummies, in which sucrose is used.

Application Insights

The bakery & confectionery segment dominated the market in 2024 and is likely to maintain its growth trajectory in the coming years. This is mainly due to the rising demand for low-calorie baked goods. Sucrose is commonly used as a sweetener in bakery and confectionery goods. Sucrose is an indispensable ingredient in baked products because it provides a specific color, structure, and shape.

Form Insights

The solid segment dominated the market in 2024 as it is the most common form of sweetener available. The solid form of sweeteners possesses several functional benefits. Solid sweeteners find extensive applications in bakery, confectionery, and other food & beverages. These sweeteners are widely preferred for their long shelf life.

Regional Insights

Asia Pacific dominated the sweeteners market with the largest share in 2024. This is mainly due to the increase in a health-conscious population and a burgeoning middle-class population. There is a high prevalence of diabetes, boosting the demand for alternatives to sugar among diabetic patients. Countries like China, India, and Japan have emerged as major markets due to the increased awareness among people about the availability of natural sweeteners. With the growing disposable income, healthcare spending is increasing. Moreover, an aging population in these countries further bolsters the growth of the market as older adults are more prone to diabetes.

North America is projected to witness significant growth during the forecast period. The growing health consciousness among people and the rising obesity rates are major factors boosting the demand for sweeteners. There is a high demand for low-calorie products in countries like the U.S. and Canada. Health-conscious consumers in the region are actively looking for sugar substitutes, such as stevia, sucralose, and erythritol. In addition, the presence of a well-established food & beverage industry, with the increasing production and adoption of carbonated soft drinks, dairy products, and confectionery, is likely to support regional market growth.

Sweeteners Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 113.09 Billion |

| Market Revenue by 2033 | USD 150.08 Billion |

| CAGR from 2025 to 2033 | 3.60% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In October 2024, at SIAL Paris, IMC Ingredients unveiled a coconut-based sweetener to meet the growing demand for natural, high-fiber, and low-calorie ingredients. This new sweetener is ideally in tune with trends for reduced sugar and increased high-fiber content, without compromising taste.

Sweeteners Market Key Players

- ADM

- Ingredion

- Cargill, Incorporated

- Roquette Frères

- Tate & Lyle

- Foodchem International Corporation

- PureCircle

- Pyure Brands LLC

- Beeyond the Hive

- Dabur India Ltd.

- Kerry Group plc

- Ajinomoto Co., Inc.

- International Flavors & Fragrances Inc.

- DFI Corporation

- Nascent Health Sciences, LLC

Market Segmentation

By Type

- Sucrose

- High-fructose Corn Syrup

- Polyol Sweeteners/Sugar Alcohols

- Sorbitol

- Xylitol

- Mannitol

- Maltitol

- Isomalt

- Erythritol

- Lyxitol

- Others

- High Intensity Sweeteners

- Aspartame

- Sucralose

- Saccharin

- Cyclamates

- Acesulfame Potassium (Ace- K)

- Stevia

- Monk Fruit (Luo Han Guo)

- Brazzein

- Others

- Allulose

- Tagatose

- Cambya

- Others

By Form

- Solid

- Liquid

By Application

- Bakery & Confectionery

- Beverages

- Dairy & Frozen Desserts

- Pharmaceuticals

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2529

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344