What is the Quantum-behavior AI Training Market Size?

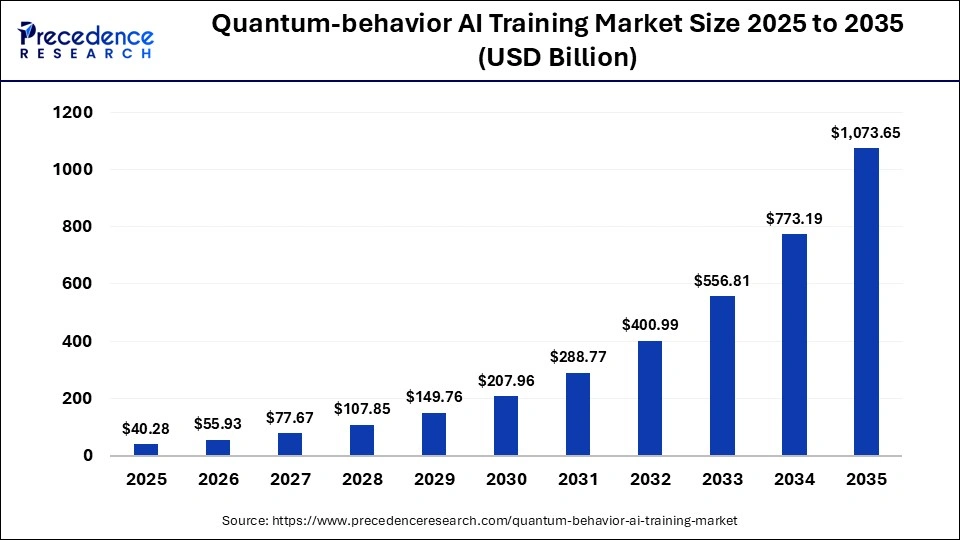

The global quantum-behavior AI training market size accounted for USD 40.28 billion in 2025 and is predicted to increase from USD 55.93 billion in 2026 to approximately USD 1,073.65 billion by 2035, expanding at a CAGR of 38.86% from 2026 to 2035. The market growth is attributed to increasing government investments, the expansion of hybrid quantum-classical AI research, and the rising adoption of cloud-based quantum computing platforms.

Market Highlights

- North America dominated the market with the largest market share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By component, the hardware platforms segment contributed the highest market share in 2025.

- By component, the services segment is growing at a strong CAGR between 2026 and 2035.

- By technology, the behavioral AI Modeling segment held a major market share in 2025.

- By technology, the hybrid AI-quantum computing segment is expected to expand at a notable CAGR from 2026 to 2035.

- By deployment mode, the cloud-based segment captured the highest market share in 2025.

- By deployment mode, the on-premises segment is poised to grow at a healthy CAGR between 2026 and 2035.

- By end-use industry, the BFSI segment generated the biggest market share in 2025.

- By end-use industry, the healthcare segment is expanding at the fastest CAGR between 2026 and 2035.

What Is Quantum-Behavior AI Training?

Quantum-behavior AI training refers to the use of quantum computing principles and quantum-inspired models to enhance the training efficiency and problem-solving capabilities of artificial intelligence systems. Adoption of these approaches is being driven by strong investment momentum and strategic national priorities that position quantum-enhanced AI as a long-term technological differentiator.

Governments and public research institutions are committing substantial funding to build foundational quantum computing infrastructure and integrate it with advanced AI training frameworks. Direct investment in quantum hardware, software, and hybrid quantum-classical systems, alongside coordinated national research agendas, continues to play a central role in accelerating innovation and adoption of quantum-enhanced AI training methodologies.

Quantum-Behavior AI TrainingMarket Trends

- Strategic IPO Activity Boosting Industry Capitalization: Major quantum computing firms, such as Honeywell's Quantinuum, are pursuing IPOs in 2026, signaling broad investor confidence in quantum AI synergy. This is creating a momentum of increased interest and investment to promote further R&D, commercialization, and implementation of quantum-enhanced AI training solutions.

- Increasing Focus on Quantum AI Safety and Risk Management: Authoritative financial and governance institutions are noting the significance of quantum technologies as both opportunities for computation and cybersecurity threats. This emphasis is driving investment in systems of hybrid security-conscious quantum-AI systems.

- Consolidation and Strategic M&A Fueling Capability Expansion: Quantum industry consolidation, such as D-Wave's acquisition of Quantum Circuits Inc. in early 2026, demonstrates how firms are combining technologies to boost commercial readiness. The trend of this consolidation forms larger technology stacks that reinforce the hybrid workflow and expedite the hands-on implementation of quantum-AI training workflows in use cases.

Quantum-Behavior AI Training MarketGrowth Factors

- Increasing Focus on AI-Enhanced Drug Discovery: Pharmaceutical companies are fueling adoption by leveraging quantum-AI models for faster molecular simulations and predictive analytics.

- Advancements in Quantum Error Correction: Improvements in qubit stability and error mitigation are propelling higher reliability in AI training applications.

- Growing Investment in Academic and Industry Collaborations: Cross-sector partnerships are boosting innovation pipelines, accelerating algorithmic development, and commercialization.

- Rising Implementation in Financial Modeling: Financial institutions are driving adoption by applying quantum AI for portfolio optimization, risk assessment, and predictive analytics.

Worldwide Infrastructure and Research Momentum in Quantum-Behavior AI Training

- Most global AI compute capacity rankings show country-level leadership in AI infrastructure. The USA leads with 39.7M H100 equivalents, followed by the UAE and Saudi Arabia.

- North America leads global quantum compute capacity, with approximately 40-50 operational industrial/research quantum computers located in the United States and Canada as of 2025, providing the primary infrastructure that would support quantum-enhanced AI training activities.

- Asia-Pacific accounts for a growing portion of quantum compute resources, with around 15-20 industrial/research quantum computers distributed among Japan, Singapore, China, and other Asia-Pacific research institutions by 2025, reflecting increasing regional capacity that can support quantum-enhanced AI training experiments.

- India's National Quantum Mission (NQM) 2025, a ₹6003.65 crore (USD 730 M) government-funded program by the Department of Science & Technology focused on building quantum technology infrastructure, research, and workforce training nationwide.

- A global survey of 500 business leaders found that more than 60% of companies are actively investing in or exploring quantum AI technologies, which implicitly includes quantum-inspired algorithm approaches alongside broader quantum AI research and hybrid methods.

- China is the world leader in quantum-related patent filings, holding approximately 7,308 quantum technology patent applications in 2024, accounting for about 60% of global filings, driven by strong state-backed research and institutional participation.

- IBM Quantum Platform provides access to at least 12 active cloud accessible quantum processors, which researchers and developers can use to run experiments, hybrid workflows, and early quantum AI model training tasks over the cloud as of June 2025.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 40.28 Billion |

| Market Size in 2026 | USD 55.93 Billion |

| Market Size by 2035 | USD 1,073.65 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 38.86% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Technology, Deployment Mode, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did Hardware Lead the Charge in the quantum-behavior AI training market?

The hardware segment dominated the quantum-behavior AI training market in 2025, as organizations focused on putting the physical backbone needed to facilitate hybrid quantum-classical AI workloads. Investors invested heavily in hardware companies, with early investments and mega acquisitions. Rising deployment of quantum processors, cryogenic systems, and specialized control electronics is enabling early-stage experimentation and workload scaling.

Close collaboration between hardware developers, cloud providers, and research institutions is accelerating access to quantum compute resources for AI training. In parallel, growing demand for fault-tolerant architectures and system reliability is reinforcing continued capital allocation toward quantum hardware development.

- In 2025, the USD 1.08 billion acquisition of Oxford Ionics by IonQ spurs the development of next-generation processors that can be used to run experimental quantum AI tasks. Furthermore, the governments and laboratories around the world also adopted 5 into high-performance computing environments, thus fueling the segment growth.

The service segment is expected to grow at the fastest rate during the coming years in the quantum-behavior AI training market, as enterprises shift from building internal capabilities to extracting measurable value from hybrid quantum AI systems. Market signals indicate that organizations are investing more in managed services, professional consulting, and integration offerings to operationalize quantum AI workloads, optimize hybrid algorithms, and customize solutions for domain-specific challenges. Partnerships among software vendors, research institutions, and industry participants are reinforcing this shift by delivering outcome-oriented solutions rather than standalone quantum hardware.

Growing complexity of quantum-classical system integration is increasing reliance on specialized service providers with domain and algorithm expertise. Demand for ongoing system tuning, performance benchmarking, and skills training is further accelerating service adoption. In parallel, cloud-based access models are enabling enterprises to consume quantum AI capabilities through subscription and service-led engagement frameworks.

Technology Insights

Why Did Behavioral AI Modeling Dominate the Market for Quantum-Behavior AI Training in 2025?

Behavioral AI modeling segment held the largest revenue share in the quantum-behavior AI training market in 2025. Due to its enhanced developers' predictive accuracy, generalization, and decision-making behaviors with statistical learning, with advanced feature representations on massive datasets.

Financial, healthcare, and autonomous systems teams had a significant investment in behavioral modeling. They are propelling the real-world applications to risk prediction, anomaly detection, and user behavior analysis. Moreover, this wide range of usage enhanced the behavioral AI modeling as the preferred method, as quantum integration was still in the experimental or early adoption phase.

Hybrid AI-quantum computing segment is expected to grow at the fastest rate in the coming years in the quantum-behavior AI training market, as researchers signpost meaningful performance and utility gains by combining classical AI algorithms with quantum computation subroutines. The work in hybrid frameworks is seen as a new direction in which quantum processors are assisting in sections of workflows, whilst classical systems do the other sections to improve the overall process. Furthermore, the hybrid quantum-classical methods capture rising investment and deployment interest for their fault-tolerant quantum processors.

Deployment Mode Insights

Why Did the Cloud-Based Segment Dominate the Quantum-Behavior AI Training Market?

The cloud-based segment dominated the quantum-behavior AI training market in 2025, due to the fact that it provided the most easily accessible and scalable avenue. This helps organizations experiment, train, and execute quantum-enhanced AI workloads without procuring specialized infrastructure. Large platforms, such as the Quantum Platform of IBM are remote access to a pool of superconducting quantum processors. This allows scientists around the world to do experiments without significant capital investments. Moreover, the large research ecosystems released strategic roadmaps highlighting hybrid workflow orchestration between cloud and local clusters, indicating long-term cloud leadership in the market.

On-premises segment is expected to grow at the fastest CAGR in the coming years in the quantum-behavior AI training market, as organizations seek greater control and integration of quantum computing resources directly within dedicated enterprise or research environments. Enterprise data centers are moving towards hybrid infrastructures that can support quantum processors in addition to classical HPC systems. This allows researchers to consolidate sensitive workloads and break their reliance on third-party cloud providers. Furthermore, the organizations willing to move to on-site deployment to gain the full performance advantages and get predictable access, making this segment grow in the coming years.

End-Use Industry Insights

Why Did BFSI Dominate the Quantum-behavior AI Training Market During 2025?

The BFSI segment held the largest revenue share in the quantum-behavior AI training market in 2025, due to the aggressive application of advanced techniques of computation by financial institutions. This addresses complex optimization and predictive tasks, which classical analytics cannot effectively solve.

Financial institutions finance pilot projects with hybrid neural architectures that enhance the fidelity of portfolio simulation and risk surface analysis. Global quantum workshops like the Quantum Artificial Intelligence Workshop (QCE 2025), where researchers demonstrated novel algorithmic strategies right out of financial applications. Furthermore, the financial services also accelerated quantum research intersections by participating in international forums, thus facilitating the market.

Healthcare segment is expected to grow at the fastest rate in the coming years in the quantum-behavior AI training market, owing to the growing deployment of quantum machine learning to improve diagnostic accuracy and accelerate complex biomedical analysis. Major organizations combined quantum and machine learning studies with clinical and bioinformatics to formulate systems that solve real medical issues. Additionally, the medical research institutions' broader integration of quantum AI workflows into healthcare for rising clinical demand in the coming years.

Regional Insights

Why is North America dominating the Global Market of Quantum-behavior AI training?

North America led the quantum-behavior AI training market, capturing the largest revenue share in 2025, due to the presence of a high concentration of research infrastructure, national labs, and strategic public-private collaborations. This is a fast integration of advanced quantum and AI training in this region.

The Quantum Leadership Act of 2025, by the U.S. Department of Energy, to invest heavily in quantum R&D, included numerous funds to build hybrid quantum systems. These factors bolster U.S. strength in both software and hardware development, as well as workforce development. Additionally, these tiers of quantum-strengthened infrastructure, cross-institutional initiatives, and talent support the leadership role of North America in quantum-augmented AI development.

U.S. Centers Quantum-Behavior AI Training Market

The U.S. leads the market due to its voluminous research environment, government funding, and solid collaboration between the government and the sector. In 2025, the U.S. Department of Energy increased hybrid quantum-classical computing initiatives with an investment of USD 625 million. Moreover, early adoption by leading industries reinforces the country's long-term dominance and influence in shaping the future of quantum-enhanced AI.

Why Is Asia Pacific Projected to Grow in the Future Years at the Highest Rate in the Quantum-Behavior AI Training Market?

Asia Pacific is anticipated to grow at the fastest rate in the quantum-behavior AI training market during the forecast period, as governments and institutions allocate more strategic plans. They are investing in quantum technology, integrating advanced computing infrastructure, and developing a more diverse and technically skilled workforce to strengthen their global innovation position.

Rising national quantum missions and long-term AI roadmaps are accelerating early adoption of hybrid quantum-AI research and pilot deployments. Expansion of public-private research collaborations is improving access to quantum hardware, talent, and applied use cases across industries. In parallel, growing demand from sectors such as finance, healthcare, and telecommunications is reinforcing sustained regional investment in quantum-behavior AI training capabilities.

In 2025, Singapore introduced Hybrid Quantum Classical computing (HQCC 1.0), funded by the national government with USD 24.5 million. Furthermore, these synchronized investments and new infrastructures are bound to increase the contribution of the Asia Pacific to the global quantum AI innovation.

Singapore's Rapid Rise in Quantum-Behavior AI Training Market Developments

Singapore is leading the charge in the Asia Pacific market, owing to the government-driven initiatives, tactical infrastructures, and robust research networks. Singapore-MIT Alliance for Research and Technology (SMART) is working on combining quantum computing and AI to solve complex optimization, drug discovery, and predictive analytics. Furthermore, its geographical locations of strategic research groupings and state-of-the-art infrastructure further facilitate the quantum-enhanced AI training in the coming few years in the Asia Pacific.

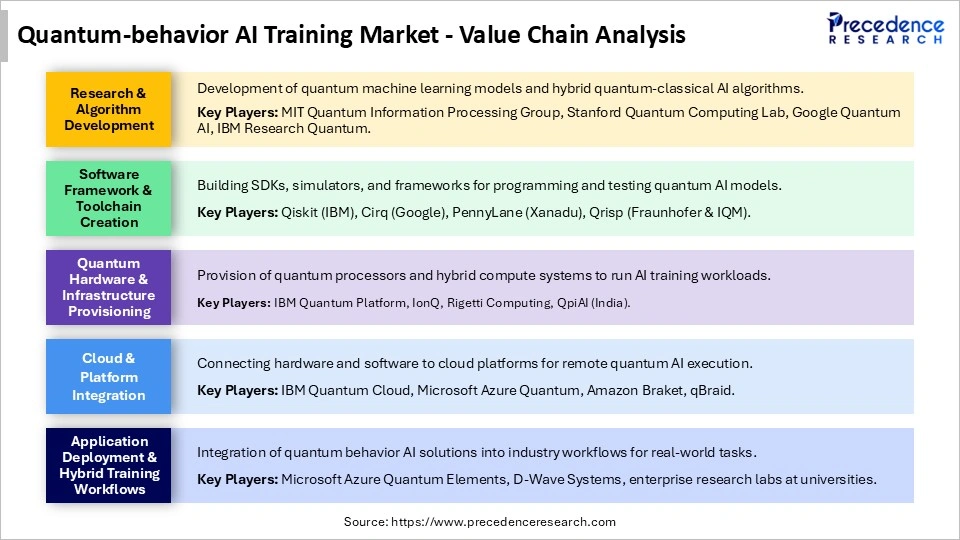

Quantum-behavior AI Training Market Value Chain Analysis

Who are the Major Players in the Global Quantum-behavior AI Training Market?

The major players in the quantum-behavior AI training market include Zapata Computing, Xanadu, Rigetti Computing, QC Ware, Microsoft, IBM, Honeywell Quantum Solutions, Google Quantum AI, Fujitsu, D-Wave Systems, Amazon Web Services (AWS), and Alibaba Cloud.

Recent Developments

- In December 2025, researchers in China unveiled what they are calling the world's first quantum scientific computing platform, a development they say could transform how scientists and engineers approach problems that overwhelm today's high-performance computers. Introduced by the Shanghai Jiao Tong University Chongqing Institute of Artificial Intelligence and reported by Chongqing Daily, the platform aims to deliver faster results for applications spanning energy, finance, and other complex fields.(Source: https://thequantuminsider.com)

- In October 2025, NVIDIA announced NVIDIA NVQLink, an open system architecture designed to tightly couple the extreme performance of GPU computing with quantum processors, enabling the construction of accelerated quantum supercomputers.(Source: https://nvidianews.nvidia.com)

- In September 2025, Oxford Quantum Circuits (OQC) and Digital Realty launched the first quantum-AI data centre in New York City at the JFK10 facility, powered by Nvidia GH200 Grace Hopper Superchips. The facility integrates superconducting quantum computers with AI supercomputing under one roof. OQC's GENESIS quantum computer became the first such system deployed in a New York data centre, engineered to support hybrid workloads and enterprise adoption. Future GENESIS systems will include Nvidia-accelerated computing and CUDA-Q integration as standard.(Source: https://dig.watch)

- In May 2025, Qubit Pharmaceuticals, a deeptech company focused on drug discovery, unveiled the “world's most advanced” quantum-AI model to explore a new range of therapeutics. Developed in partnership with Sorbonne University, the model simulates molecular behavior with unprecedented precision and computational speed, drastically reducing the need for costly laboratory experimentation and chemical synthesis of drug candidates.(Source:https://pharmaceuticalmanufacturer.media)

Segments Covered in the Report

By Component

- Hardware

- Services

By Technology

- Behavioral AI Modeling

- Hybrid AI-Quantum Computing

- QML

By Deployment Mode

- Cloud-Based

- On-Premises

By End-Use Industry

- Aerospace

- BFSI

- Government & Public Sector

- Healthcare

- Manufacturing

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting