What is the Quick Service Restaurants Market Size?

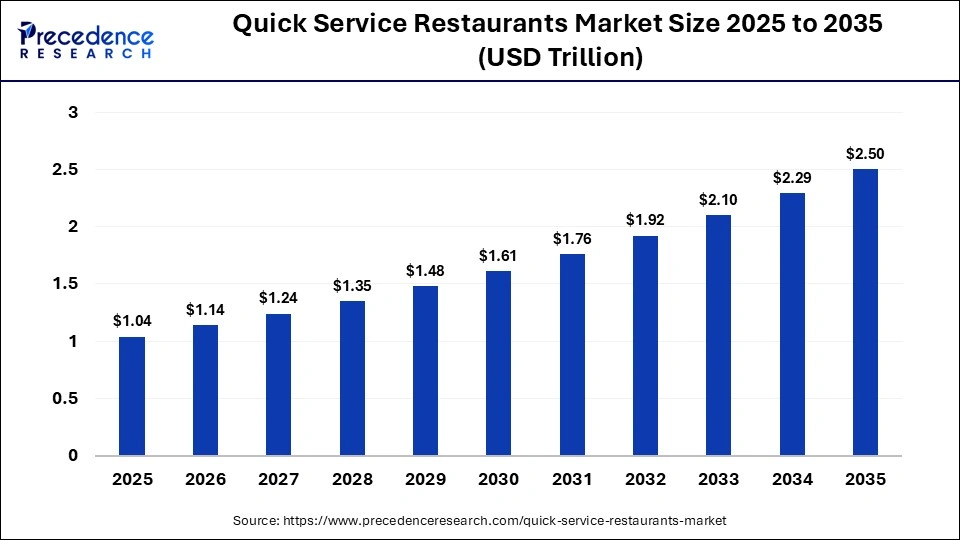

The global quick service restaurant market size is calculated at USD 1.04 trillion in 2025 and is predicted to increase from USD 1.14 trillion in 2026 to approximately USD 2.5 trillion by 2035, expanding at a CAGR of 9.16% from 2026 to 2035. The quick service restaurant (QSR) sector, commonly referred to as the fast-food market, is a high-velocity segment of the global foodservice industry defined by speed of service, consistent quality, affordable pricing, and high customer throughput.

Market Highlights

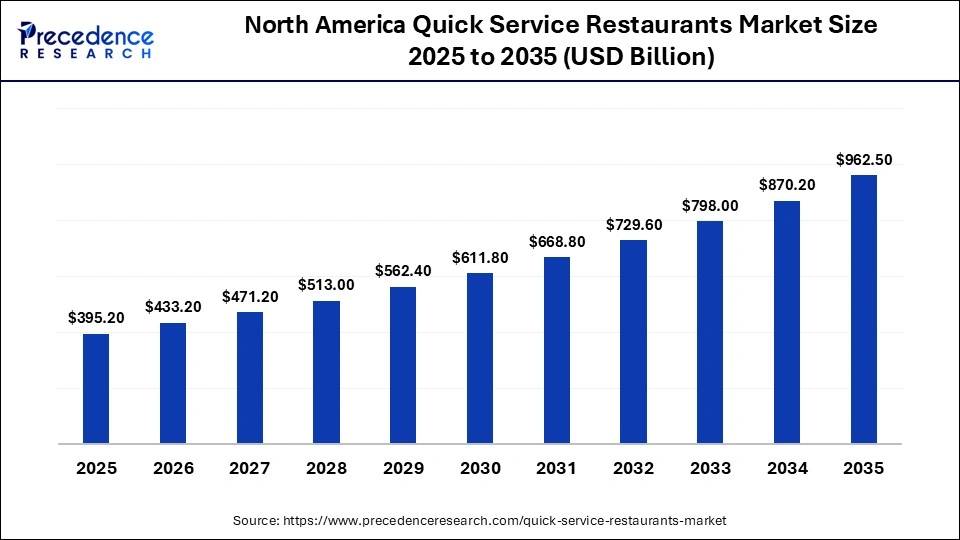

- North America dominated the market with the biggest market share of 38% in 2025.

- Asia Pacific projected to grow at a significant CAGR from 2026 to 2035.

- By service type, the dine-in segment contributed the largest market share of 54% in 2025.

- By service type, the takeaway segment is expected to grow between 2026 and 2035.

- By cuisine type, the American segment contributed the highest market share in 2025.

- By cuisine type, the Italian segment is projected to grow at a significant rate from 2026 to 2035.

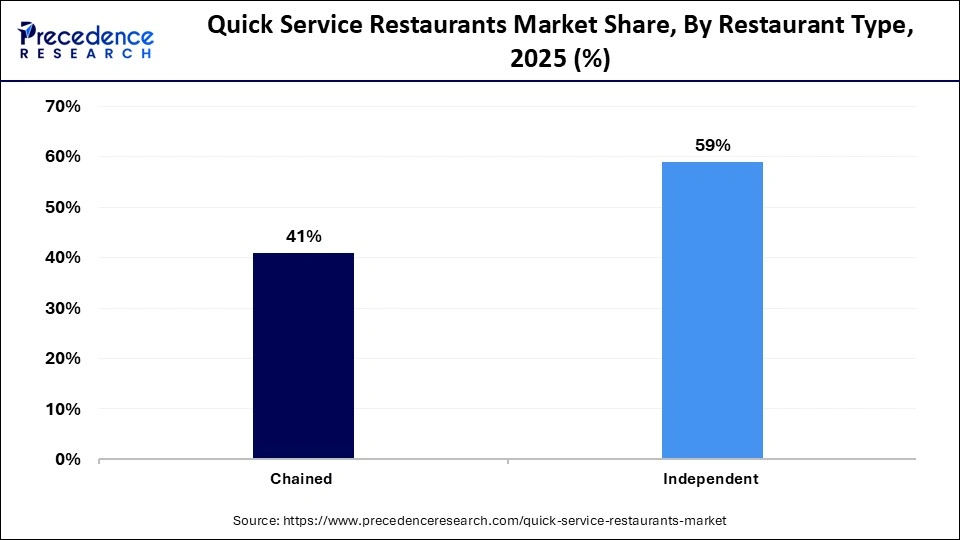

- By restaurant type, the independent segment contributed the largest market share of 59% in 2025.

- By restaurant type, the chained segment is projected to grow at a significant CAGR from 2026 to 2035.

Market Overview

- Industry Outlook: QSR market is changing to a more tech-enabled, more environmentally responsible, and consumer-forward market. The major dynamics in the industry are: Consolidation and mergers: Operators are consolidating to increase supply chain resiliency and increase geographic footprint.

- Brand diversification: QSR chains are exploring different formats such as express counters, micro-restaurants, and co-located quick service lounges.

- Global Expansion: Expansion across the globe focuses on localization of menu tastes, adherence to local dietary standards, and cultural marketing. QSR brands are aggressively pushing out of the traditional strongholds of North America and Western Europe into rapidly growing regions like Asia-Pacific, Latin America, and the Middle East.

- Major Investment: The activity of investment into the QSR sector remains raging on in several fronts: Real estate growth and franchising. Delivery, CRM, and operations delivery technology platform. Green packaging and green kitchen facilities. Preparation and service of AI and automation. Market and brand renewal. Increasingly, private equity and venture capital are being used to finance a new type of hybrid and technology-based QSR format that lies between convenience and quality.

Key Technological Shifts in the Quick Service Restaurants Market

Online ordering platforms and mobile applications have completely transformed the interaction of consumers with brands by making it personalized with promotions, loyalty opportunities, and friction-free checkouts. In-store self-service kiosk will help to reduce queuing duration, enhance accuracy in order placement, and enable restaurants to cut down the labor expenses and offer menu customization. Cloud kitchens use order-management solutions that are interconnected with aggregators and POS solutions to optimize the workflow, eliminate bottlenecks in the kitchen, and increase delivery volume without substantial real estate investments. Demand forecasting, dynamic pricing, recommendation engines, and targeted marketing campaigns require artificial intelligence and analytics power--assisting operators to waste less and engage customers more. Robotic food prep, automated order sorting, and delivery bots are being brought to market in selected markets, and they increase speed, hygiene, and operational efficiency.

What Are the Key Quick Service Restaurants Market Trends?

- Health-led Menus: Customers are also demanding healthy, plant-based, and transparent ingredient products, which has pushed QSRs to launch more nutritious menus and offerings that are free of allergens.

- Premiumization of Offerings: The premium segment of the traditionally value-oriented QSR brands is driven by the demand for higher-quality ingredients, craft drinks, and menu items inspired by chefs.

- Sustainability & ESG Focus: To match the expectations of consumers and the pressure of regulations, QSR operators are going to use sustainable packaging, decrease single-use plastic, and take responsibility.

- Growth of Drive-thru and Delivery: Store footprints and service priorities have been transformed by the development of third-party delivery and drive-through services, particularly after the pandemic.

- Loyalty & Personalization: Digital-powered loyalty programs stimulate repeat purchase behavior by increasing customer lifetime value through personalisation based on data.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.04 Trillion |

| Market Size in 2026 | USD 1.14 Trillion |

| Market Size by 2035 | USD 2.5 Trillion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.16% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Cuisine Type, Cuisine Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Service Insights

Why the Dine-in Segment Dominated the Quick Service Restaurants Market?

The dine-in segment dominated the market in 2025, driven by its ability to offer immediate service, brand experience, and consistent customer engagement. Physical outlets enable QSR brands to maintain operational control over food quality, hygiene, and service standards. Dine-in formats benefit from impulse purchases, bundled meals, and upselling opportunities that increase average order value. Strategic store locations in urban centers, malls, highways, and transit hubs continue to drive high footfall. Integration of self-service kiosks and digital menus has enhanced speed while preserving the in-store experience. Additionally, dine-in outlets serve as brand anchors that support delivery and takeaway operations.

The takeaway segment is estimated to be the fastest-growing in the quick service restaurants market during the forecast period, due to rising consumer preference for convenience and time efficiency. Increasing urban work pressures and changing lifestyles favor quick pick-up models over extended dining. The growth of online ordering platforms has streamlined takeaway workflows and reduced waiting times. Compact store formats and express counters have enabled QSRs to expand rapidly in high-density locations. Takeaway services also reduce operational costs related to seating, staffing, and space utilization. This model offers scalability and flexibility, making it attractive for both established brands and new entrants.

Cuisine Insights

Why American segment dominated the Quick Service Restaurants Market?

American

The American segment is dominating the quick restaurants market, driven by familiarity all over the world, has a uniform preparation technique, and is more popular. Burgers, fried chicken, sandwiches, and fries are menu items that are acceptable to a large variety of consumers. Customers are highly loyal to brands with a strong brand recognition and similar taste profiles. The US cuisine can comfortably be localized without losing the essence of the menu. Standardized ingredient supply chains and efficient supply chains augment regional scalability. The innovation on the menu keeps the dominance going despite the increased competition with other cuisines.

Italian

The Italian segment is expected to be the fastest-growing in the quick service restaurants market, because it is considered an indulgent and comforting food. Pizzas, pastas, and baked goods like dishes are flexible in terms of customization, as well as bundle value. The Italian QSR formats are effectively suited to the delivery and takeaway formats, and they facilitate fast growth. Growing consumer demand grows because of cheese-based and oven-baked products. Geometrization and artisan inputs in Italian cuisine are other elements of premiumization. Its flexibility in casual and fast-service offerings hastens the growth of markets.

Restaurant Insights

Why independent segment dominate the Quick Service Restaurants Market?

The independent segment is dominating the quick service restaurants, driven by regional tastes, diets, and price sensitivities. Reduced barriers to entry enable an independent response to consumer preferences. Independents have a large number that use lean cost bases and direct customer interaction. They have a strong presence in the new and price-sensitive markets.

Chained

The chained segment is anticipated to be the most rapidly expanding segment because it is scalable, offers brand consistency, and standardization of operations. Expansion models that are based on franchises allow faster geographic penetration at reduced capital risk. Good brand equity fosters consumer loyalty and loyalty. A centralized procurement and technology integration increases the efficiency of costs and quality control. Chained QSRs are the leaders in digital adoption, loyalty programs, and decision-making based on data. They can achieve consistency and local adaptation, which enhances global expansion.

Regional Insight

How Big is the North America Quick Service Restaurants Market Size?

The North America quick service restaurants market size is estimated at USD 395.20 billion in 2025 and is projected to reach approximately USD 962.50 billion by 2035, with a 9.31% CAGR from 2026 to 2035.

Why is North America Dominating the Quick Service Restaurants Market?

North America is dominating the quick service restaurants market, driven by the developed foodservice ecosystem, consumer spending power, and brand penetration. Convenience dining culture has been fully developed in the region, with the extensive presence of drive-through systems and sophisticated digital ordering systems. Customers have been more engaged with mobile applications, loyalty schemes, and delivery systems, which has increased their customer purchasing frequency. In North America, QSR operators are also the leaders in operational efficiency, automating, data analytics, and supply chain optimization. The fact that there are global giants in QSR and large franchise networks further enhances regional market dominance.

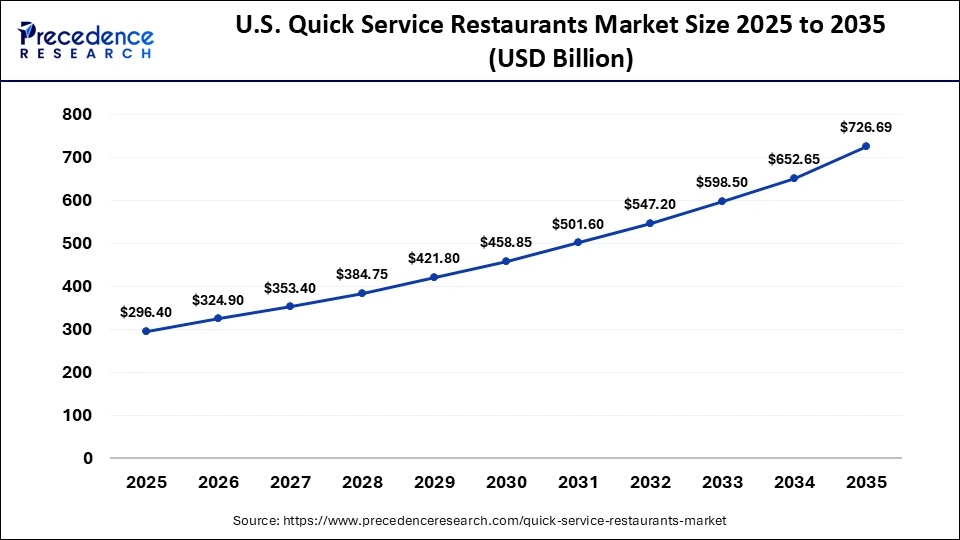

What is the Size of the U.S. Quick Service Restaurants Market?

The U.S. quick service restaurants market size is calculated at USD 296.40 billion in 2025 and is expected to reach nearly USD 726.69 billion in 2035, accelerating at a strong CAGR of 9.38% between 2026 and 2035.

U.S. Energy Transition Market Trends

The U.S. is the largest and most successful quick service restaurants market in the region at the country level, based on the high urban density, time-constrained lifestyle, and high level of adoption of delivery. The brands of the U.S. predetermine international standards in the standardization of the menu, the sophistication of the supply chain, and digitalization. The next is Canada, which is a secure and developing market with a high brand loyalty, a growing demand for healthier menus with low-calorie content, and strict regulations to control food quality.

How is Asia Pacific the fastest-growing region in the Quick Service Restaurants Market?

Asia Pacific is the fastest-growing region in the quick-service restaurant industry, due to rapid urbanization, population growth, and the transformation in the diet. The trend of growth in disposable incomes and greater involvement of the working population has resulted in a rush towards demand for cheaper and more convenient food. The area has high digital receptivity that is evolving around mobile ordering and delivery services as the major growth strategy in the QSR. Growing mall restaurants, transit stations, and cloud kitchens are transforming the regional QSR market.

China Energy Transition Market Analysis

China can be attributed to the significant growth driver because it has a huge urban population and a digitally connected food delivery ecosystem. Mobile-first ordering and cashless transactions are well accepted by Chinese consumers, and they encourage the quick scaling of QSR. India is a promising quick service restaurants market that has a young population, emerging urbanization, and exposure to world food brands. Value pricing, innovation in Indian QSRs' menu, and localization of international products favor Indian QSR growth. Japan is a mature and yet innovation-oriented market, that is efficiency-oriented, automation-oriented, and premium convenience-oriented.

Quick Service RestaurantsMarket Value Chain Analysis

- Raw Material Sourcing: The QSR value chain is based on the procurement of raw materials. It involves agreeing with the main manufacturers and food ingredients suppliers. Quality, food safety, and regulatory compliance. Using long-term supplier contracts to stabilize prices.

Key players: Jubilant Food Works Ltd, McDonald's Corp., & Restaurant Brands Asia Ltd

- Cold Chain: Cold chain logistics play a critical role in ensuring food safety and freshness: Temperature-controlled storage from supplier facilities to distribution centers, refrigerated transport to prevent spoilage and maintain hygiene. Real-time monitoring systems to track conditions via IoT sensors. Centralized distribution hubs that optimize delivery routes and reduce lead time. Cold chain efficiency is key to maintaining product integrity, reducing waste, and complying with food safety regulations.

Key players: Yum! Brands Inc

- Distribution to Retail: Coordinated delivery scheduling to individual stores or cloud kitchen hubs. Cross-docking strategies to minimise stock holding and reduce costs. Integration of delivery systems with store inventories and POS systems, and synchronised inventory replenishment based on demand forecasts and sales data.

Key players: Yum! Brands Inc

Who are the Major Players in the Global Quick Service Restaurant Market?

The major players in the quick service restaurant market include Chick-fil-A (U.S.), Papa John's International, Inc. (U.S.), Subway IP LLC (U.S.), Starbucks Corporation (U.S.), Yum! Brands, Inc. (U.S.), McDonald's Corporation (U.S.), Restaurant Brands International Inc. (Canada), The Wendy's Company (U.S.), Dunkin (Inspire Brands) (U.S.), Domino's Pizza, Inc. (U.S.).

Recent Developments

- In January 2026, the mandatory 10-minute delivery guarantee by quick-commerce platforms is ending after intervention by the Union Labour Ministry due to growing worries about gig workers' safety and conditions. Reports indicate that Union Labour Minister Mansukh Mandaviya successfully urged leading delivery aggregators to abolish the strict 10-minute deadline after extensive discussions.

- In January 2026, Saudi quick-service chain Kudu opened its first international franchise in Kuwait's Al-Kout Mall, partnering with Las Palmas Restaurant Company to bring its popular sandwiches and meals to a new market, marking a key step in Kudu's international expansion and offering Kuwaiti customers fresh, regionally-flavored fast food.(Source: https://qsrmedia.asia)

Segment Covered in the Report

By Service Type

- Dine-In

- Takeaway

- Delivery

By Cuisine Type

- American

- Italian

- Asian

- Others

By Restaurant Type

- Chained

- Independent

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting