What is RF Antennas Market Size?

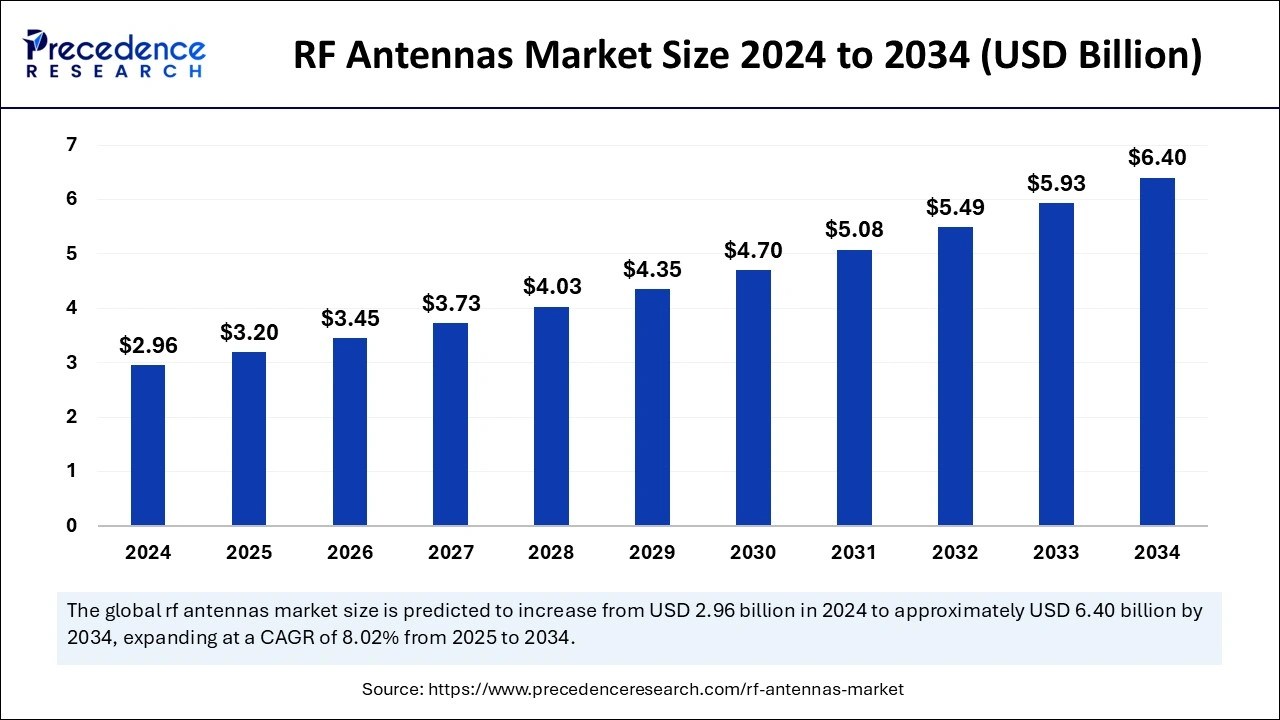

The global rf antennas market size is estimated at USD 3.20 billion in 2025 and is predicted to increase from USD 3.45 billion in 2026 to approximately USD 6.40 billion by 2034, expanding at a CAGR of 8.02% from 2025 to 2034. The market growth is attributed to the increasing demand for high-speed, reliable communication systems across various industries, including telecommunications, defense, and IoT.

Market Highlights

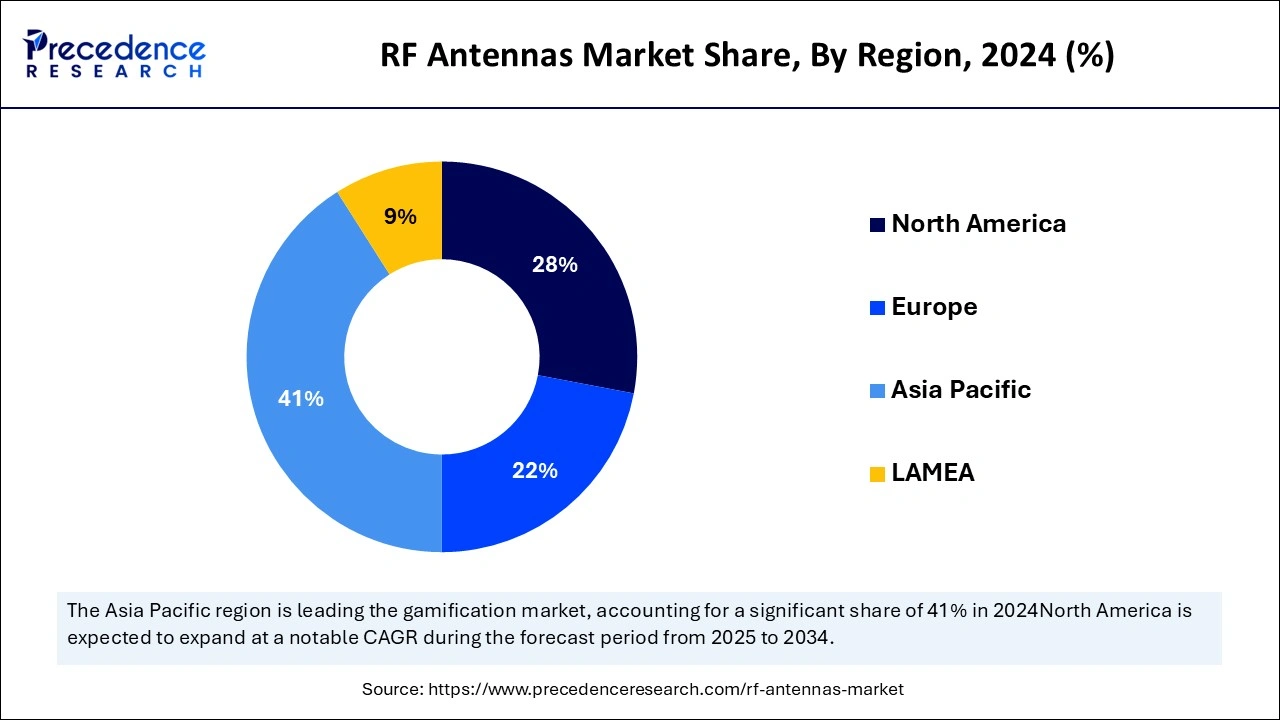

- Asia Pacific dominated the global RF antenna market with the highest market share of 41% in 2024.

- North America is projected to host the fastest-growing market in the coming years.

- By component, the monopole segment held a dominant presence in the market in 2024.

- By component, the patch segment is expected to grow at the fastest rate during the forecast period.

- By frequency band, the VHF/UHF segment accounted for a considerable share of the market in 2024.

- By frequency band, the S band segment is anticipated to grow with the highest CAGR during the studied years.

- By industry vertical, the aerospace and defense segment led the global market in 2024.

- By industry vertical, the healthcare/medical segment is projected to expand rapidly in the market in the coming years.

Strategic Overview of the Global RF Antennas Industry

A high number of organizations are adopting 5G technology which increases market opportunities for the RF antenna market. RF antennas help 5G networks work at high frequencies with low delays, which are majorly used in support of self-driving vehicles and Internet-connected city systems across industries. ITU forecasts that 5G connectivity support half of the world's population by 2025 which is expected to generate rising demand for sophisticated antenna systems. Furthermore, ongoing technology advancements in RF technology for better signal transmission systems further fuel the market in the coming years.

Impact of Artificial Intelligence (AI) on the RF Antennas Market

The RF antenna market is transforming through artificial intelligence systems that enhance both design techniques and operational performance improvements. Engineers use AI algorithms to study electromagnetic signals while finding the best antenna shapes and hiding system performance in different situations which saves both development and production funds. Advanced artificial intelligence tools help factories produce better results by acting faster and reporting problems sooner. Machine learning technology helps network operators create smooth 5G, satellite communication, and Internet of Things (IoT) connections by improving the performance of RF antennas.

RF Antennas Market Growth Factors

- The rising demand for IoT devices and interconnected systems is fueling the need for advanced RF antennas to support seamless communication.

- The expansion of satellite communication networks globally is driving the demand for high-performance RF antennas for reliable connectivity.

- Advancements in autonomous vehicle and drone technologies are increasing the need for RF antennas to enable secure, real-time data transmission.

- The increasing adoption of wearable technologies and smart consumer devices is boosting the demand for compact, efficient RF antennas.

- The growing need for high-speed broadband connectivity in underserved regions is spurring the development and deployment of advanced RF antennas.

- Continuous investments in defense and aerospace sectors for secure communication systems are creating a steady demand for advanced RF antennas with enhanced capabilities.

- The rapid development of smart cities is driving the requirement for advanced communication infrastructure, significantly increasing the need for the RF antenna market.

Market Outlook

- Market Growth Overview: The RF Antennas market is expected to grow significantly between 2025 and 2034, driven by the internet of things proliferation, automotive industry advancements, and defense and aerospace investments.

- Sustainability Trends: Sustainability trends involve energy efficiency in design and operation, eco-friendly materials and manufacturing, and product lifecycle management and recycling.

- Major Investors: Major investors in the market include The Vanguard Group, Inc., BlackRock, Inc., State Street Corporation, and Capital Research Global Investors.

- Startup Economy: The startup economy is focused on 5G mmWave and Beamforming technology, IoT and Device connectivity, and software-defined and AI-enabled antennas.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.20 Billion |

| Market Size in 2026 | USD 3.45 Billion |

| Market Size by 2034 | USD 6.40 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.02% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Frequency Band, Industry Vertical, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

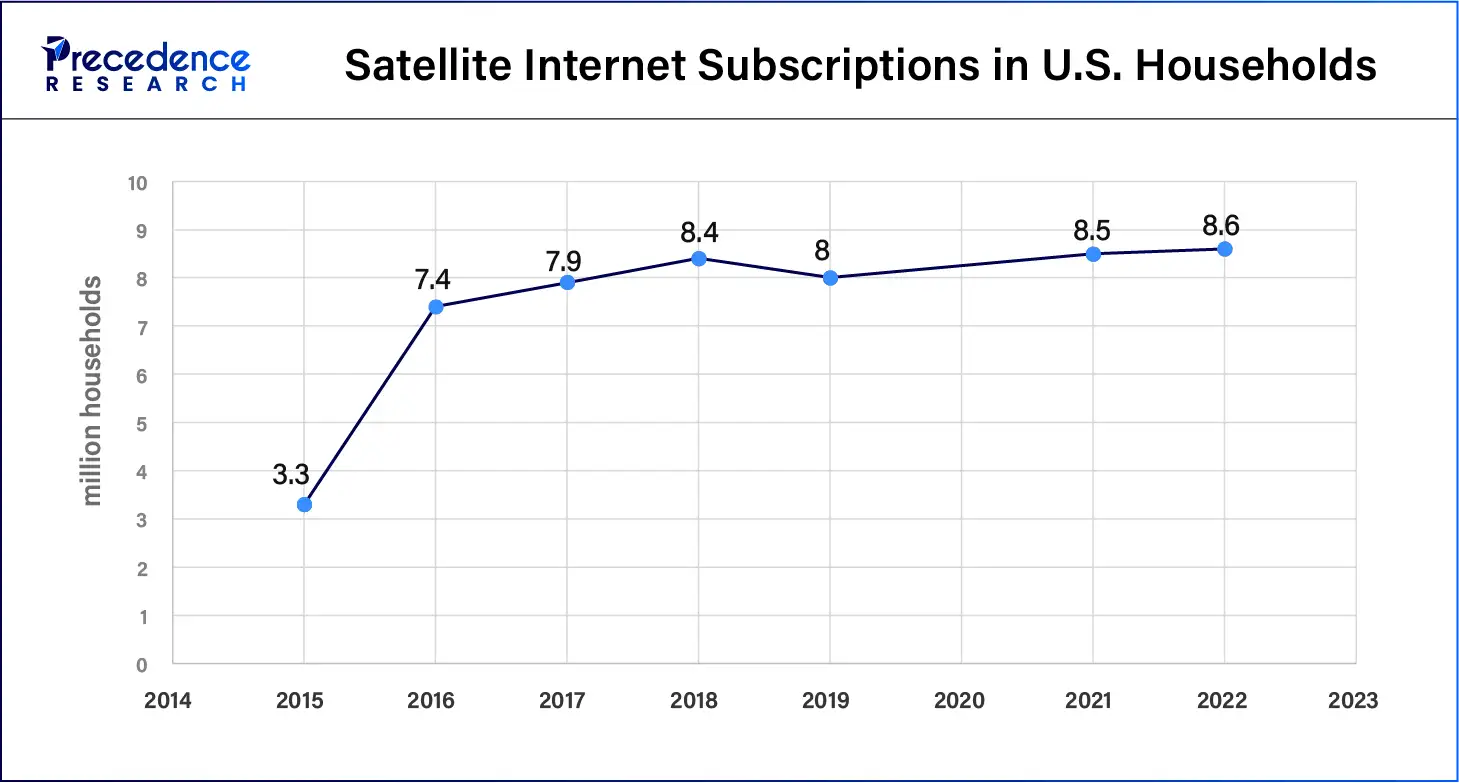

Surging satellite communication demands

Surging satellite communication needs are projected to boost the RF antenna's market technology development, thus fuelling the market in the coming years. Growing demand for satellite communication drives companies to enhance their radio frequency antenna production lines. The increasing use of small satellites including CubeSats confirms the present market evolution. Through its CubeSat Launch Initiative NASA launched 162 small satellites by September 2023 to educate and research institutions about space missions. Since 2013 ESA led several mission flights for in-orbit CubeSat tests to enhance small satellite technology.

New space technology requires enhanced RF antennas to provide uninterrupted signal transmission between satellites and ground stations. Beamforming technology through phased array antennas creates better transmission signals that stay focused and run without interruptions. Moreover, the rising use of small cost-effective CubeSats demands antennas that work well in different extreme settings while staying small and affordable.

Restraint

Competition from alternative technologies

Competition from alternative technologies is expected to hamper the RF antenna market. Alternative communication technologies that use light transmissions limit RF antenna expansion, especially in particular markets. Modern optical communication systems that move data faster and carry flow attract users building high-speed networks and satellite platforms. Using optical systems for high-performance tasks cut into the demand for basic RF antennas. RF antennas continue to play essential roles within multiple communication systems while evolving under pressure from advanced industry alternatives.

Opportunity

High military and defense investments

High military and defense investments are expected to create opportunities for key players in the RF antenna market. Secure communication systems grow with defense spending as military units search for better ways to send data securely using advanced RF antennas. Governments across all nations are investing in their defense budgets to create more powerful military forces with better secure connections. Antenna manufacturers should expect strong market demand to expand their offerings for secure wireless communication in tough conditions. The increasing demand from military operations and intelligence operations for dependable connections will continue to support the development of advanced RF antenna technology.

- According to the 2024 report by the Stockholm International Peace Research Institute, global military expenditure totaled USD 2,443 billion in 2023, reflecting a 6.8% increase in real terms compared to 2022.

Segment Insights

Component Insights

The monopole segment held a dominant presence in the RF antenna market in 2024, due to the users rely on them in mobile networks and for wireless communication plus smart device applications. Monopole antenna demand continues to lead because 5G infrastructure projects keep increasing worldwide. The report from GSMA forecasts global 5G connections hit 1.8 billion by 2025 which drives the need for lower-cost efficient wireless antennas, including monopoles. Monopole antenna use in smartphones and wireless tech boosts market expansion, as regions with fast 5G adoption trends need these products.

The patch segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the modern communication systems requiring advanced antennas. The rising need for satellite services creates a strong demand for patch antennas, as these small antennas offer outstanding performance in minimal space. Furthermore, the high demand for smaller electronic devices and better communication systems further fuels the patch antennas segment.

Frequency Band Insights

The VHF/UHF segment accounted for a considerable share of the RF antennas market in 2024, due to its vast utilization in communication systems because television stations and military forces rely on it plus satellite operators depend on it. The VHF/UHF radio spectrum offers suitable frequencies for creating straight-line-radio signals which emergency responders and military depend on. Global expansion of 5G networks using UHF frequencies leads to rising demands for RF antennas in this sector. Furthermore, VHF/UHF is used in numerous communication systems for public safety and broadcasting needs, thus fuelling its segment growth in the coming years.

- According to the GSM Association, a non-profit organization representing mobile network operators globally, 5G networks are projected to cover one-third of the world's population by 2025.

The S band segment is anticipated to grow with the highest CAGR during the studied years, owing to its operating range between 2 GHz and 4 GHz provides both strong transmission distances and high data speeds useful for satellite and weather operations and air traffic control. As the global need for satellite broadband services grows in distant areas the S-Band helps to make these services possible. Developed economies want more powerful communication networks for both military and air travel which boosts S Band usage.

Industry Vertical Insights

In 2024, the aerospace and defense segment led the global RF antenna market, as they handle all military networks plus space and radar functions. The aerospace defense sector needs high-performance RF antennas for clear secure communication during harsh conditions. Through satellite communication and radar development programs, the Department of Defense says their ongoing investment in communication systems supports higher RF antenna demand. Furthermore, the governmental focus on advancing defense programs creating demand for secure communications facilitates the market in this sector.

- According to the 2025 report by the Center for Strategic & International Studies, the U.S. Department of Defense (DOD) has initiated acquisition programs to actively adopt advanced and superior technologies from other countries.

The healthcare/medical segment is projected to expand rapidly in the market in the coming years. The growth comes from medical facilities using more wireless healthcare equipment and telehealth systems plus enhancing their diagnostic capabilities. Medical technology growth of remote patient monitoring devices and wearable heart rate monitors produces substantial demand for reliable RF antennas in medical settings. The continuous development of wireless body area networks (WBANs) requires medical devices that use specialized RF antennas to process data quickly and operate with little power.

- According to Now Health Insurance, a global insurance provider, 80% of people have accessed care via telemedicine at least once in their lives, as stated in their 2024 report.

Regional Insights

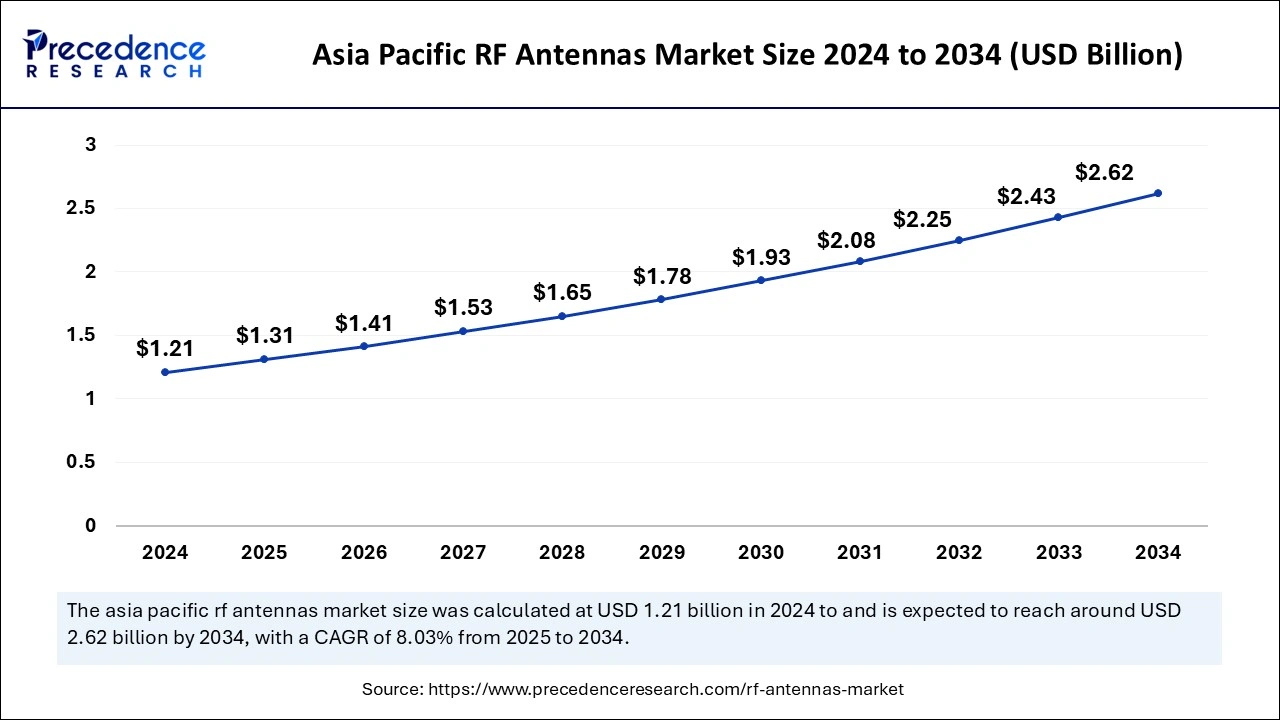

Asia Pacific RF Antennas Market Size and Growth 2025 to 2034

The Asia Pacific rf antennas market size is exhibited at USD 1.31 billion in 2025 and is projected to be worth around USD 6.40 billion by 2034, growing at a CAGR of 8.03% from 2025 to 2034.

Asia Pacific dominated the global RF antenna market in 2024, as it experiences fast 5G network development as the industry grows with advanced technology. China joins Japan South Korea and India in fast implementing 5G technologies that create an expanding market for RF antennas used in mobile communication systems. The region advances smart cities plus autonomous cars while expanded satellite communication needs push RF antennas to develop. Major RF component producers in Asia Pacific create strong local demand for RF antennas, as the region produces these components.

- According to Cisco's 2024 report, a global technology leader, Asia Pacific had 2.6 billion total internet users by 2022, accounting for 62% of the population, compared to 1.7 billion users (41% of the population) in 2017.

North America is projected to host the fastest-growing RF antenna market in the coming years, due to excessive spending on modern communication technology and network construction throughout the United States and Canada. North America leads in RF antenna usage, with fast 5G network implementation and sustained work on defense projects plus widespread adoption of IoT devices. According to the FCC, the 5G network expansion in North America needs advanced RF antenna technology based on FCC data. North America leads defense and military technology use with U.S. Department of Defense investments in reliable military networks satellites and radar systems, which further cates the demand for advanced military-grade RF antennas in this region.

- According to the U.S. Department of Defense, the Defense Department outlined a USD 849.8 billion budget request to fund operations for the fiscal year 2025.

U.S. RF Antennas Trends

U.S. aggressive deployment of 5G infrastructure, the expansion of IoT ecosystems, and significant investments in defense technologies. The strong focus on advanced, compact designs like phased array and massive MIMO antennas to manage higher frequencies and data volumes efficiently. Innovations in materials and integration are addressing the demand for multi-band, high-performance solutions for everything from autonomous vehicles to military applications.

India RF Antennas Market Trends

India's proliferation of IoT across various sectors and the government's "Make in India" initiative, which encourages domestic manufacturing and innovation. The market is also benefiting from government-led infrastructure projects, such as the Smart Cities Mission and initiatives in the defense and aerospace sectors, boosting demand for advanced antenna solutions.

RF Antennas Market Value Chain Analysis

- Research, Design, and Engineering

This initial, high-value stage involves theoretical research, modeling, simulation, and the creation of antenna prototypes tailored to specific frequency bands and performance requirements (e.g., massive MIMO for 5G, V2X for automotive).

Key Players: Qualcomm, Ericsson, L3Harris Technologies, and Lockheed Martin. - Raw Material Sourcing and Component Manufacturing

This stage focuses on procuring essential materials like copper, aluminum, steel, specialized plastics, and ceramics, as well as the manufacturing of standardized electronic components (e.g., PCB boards, feed cables, connectors).

Key Players: TE Connectivity - Manufacturing and Assembly

In this stage, the designed antennas are mass-produced and assembled using techniques like stamping, molding, soldering, and specialized surface-mount technology (SMT).

Key Players: Laird Connectivity, Airgain, Ericsson, Samsung and Apple - Distribution, Sales, and Marketing

This stage involves the storage, logistics, sales, and marketing efforts to deliver antennas to end-customers, including telecom operators, automotive manufacturers, defense contractors, and consumer electronics firms.

Key Players: Arrow Electronics and Mouser Electronics

Key Players in RF Antennas Market and their Offerings

- Abracon LLC: Abracon contributes as a key supplier of frequency control, passive components, and integrated antenna solutions, providing essential timing and connectivity components that ensure signal integrity for various RF applications.

- Analog Devices, Inc.: This company drives the market through its expertise in high-performance RF and mixed-signal integrated circuits (ICs), supplying vital components that enable advanced beamforming and signal processing in modern antennas.

- CPI International Inc.: CPI primarily contributes to the defense and satellite segments of the market, manufacturing high-power amplifier components and antenna-related systems for critical communication and radar applications.

- Infineon Technologies AG: Infineon provides essential semiconductor solutions, including RF switches and power amplifiers, which are integrated into antennas to improve performance, efficiency, and switching capabilities across different frequency bands.

- KYOCERA AVX Components Corporation: This company contributes by supplying a wide range of passive components and specialized standard and custom antennas (e.g., in-device and external) used in diverse applications from automotive to IoT.

- MACOM Technology Solutions Holdings, Inc.: MACOM supplies high-performance analog semiconductor solutions for the RF, microwave, and millimeter-wave markets, enabling advanced communication and radar systems that rely on sophisticated antennas.

- Microchip Technology Incorporated: Microchip provides a variety of semiconductor products, including microcontrollers and RF components, which are used to control and manage the functions of smart and complex antenna systems.

- MicroWave Technology, Inc: This firm contributes by specializing in the design and manufacture of GaAs-based microwave components and integrated circuits crucial for high-frequency antenna systems, particularly in SATCOM and defense.

- Mitsubishi Electric Corporation: Mitsubishi is a major player providing end-to-end solutions, contributing high-quality antenna systems for ground stations, defense radar, and automotive applications, leveraging its diverse engineering capabilities.

- Murata Manufacturing Co., Ltd: A key supplier of passive components and modules, Murata contributes compact, high-efficiency antennas and front-end modules, facilitating miniaturization and integration into consumer electronics and IoT devices.

- National Instruments Corporation: National Instruments provides the essential test and measurement equipment (now part of Emerson) required for prototyping, validating, and ensuring the quality and performance of advanced RF antenna designs.

- NXP Semiconductors N.V: NXP supplies a broad portfolio of RF components and connectivity solutions, including highly integrated V2X antenna modules and Wi-Fi/Bluetooth components that are essential for connected cars and IoT devices.

- Qorvo Inc: Qorvo is a leader in RF front-end solutions, providing essential components like power amplifiers and filters that work seamlessly with antennas to manage signal transmission and reception in smartphones and 5G base stations.

- Radiall: Radiall designs and manufactures interconnect solutions and components for RF and microwave applications, providing essential connectors, cables, and switches that link antennas to the rest of the communication system.

- Renesas Electronics Corporation: Renesas contributes embedded processing and connectivity solutions, including RF transceivers and microcontrollers, which manage the data flow and operation of intelligent antenna systems.

- Skyworks Solutions, Inc: This company is a major supplier of high-performance analog and mixed-signal semiconductors, providing integrated RF front-end modules and power amplifiers vital for smartphone and wireless infrastructure antennas.

- STMicroelectronics N.V: STMicroelectronics contributes a broad range of semiconductor products, including RF transceivers, microcontrollers, and sensors that enable the functionality of IoT-enabled and smart antenna systems.

- TDK Corporation: TDK contributes by supplying a vast array of passive electronic components and integrated modules, including advanced RF filters and antennas, crucial for optimizing signal performance in compact electronic devices.

- Texas Instruments Incorporated: TI provides essential analog and embedded processing chips that manage power and process signals for complex antenna systems, contributing to their efficiency and functionality in various applications.

Latest Announcements by Industry Leaders

January 2025 – Company

CSO – Norbert Muhrer

Announcement - Quectel Wireless Solutions, a leading provider of IoT solutions, is showcasing its comprehensive product portfolio at CES 2025, held at LVCC, North Hall – Booth 9863. The exhibition highlights several innovative offerings, including the compact LS550G GNSS module, which will be available in Q2 2025. This module features multi-constellation support and an advanced SIP design, delivering exceptional performance in applications demanding high accuracy, low power consumption, and compact form factors.

Recent Developments

- In September 2024, Huawei introduced the Alpha series antenna, marking a breakthrough for mobile AI applications. This series integrates high efficiency, digital capabilities, and easy deployment, meeting the rising demands for greater bandwidth, lower latency, and efficient operations in the evolving mobile AI era.

- In September 2024, AntennaWare, in collaboration with Raycom, unveiled the Sub-GHz BodyWave antenna designed for body-worn UHF transmitter packs in challenging RF environments. This technology extends range and reliability while enhancing compatibility with current TV and film production equipment.

- In May 2024, Abracon launched a line of high-accuracy GNSS antennas, offering revolutionary improvements in location-based services. These antennas deliver superior precision, fast signal acquisition, and energy efficiency, advancing GPS and related systems.

- In January 2024, Avnet expanded its RFSoC Explorer Toolbox with support for 5G mmWave Phased Array Antenna Module (PAAM) Development. This platform facilitates the rapid development of advanced 5G systems with high-performance components for efficient over-the-air prototyping.

Segments Covered in the Report

By Component

- Dipole

- Loop

- Monopole

- Patch

By Frequency Band

- C Band

- L Band

- S Band

- VHF/UHF Band

- Others

By Industry Vertical

- Industrial

- Healthcare/ Medical

- Aerospace and Defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting