What is the Security Automation Market Size?

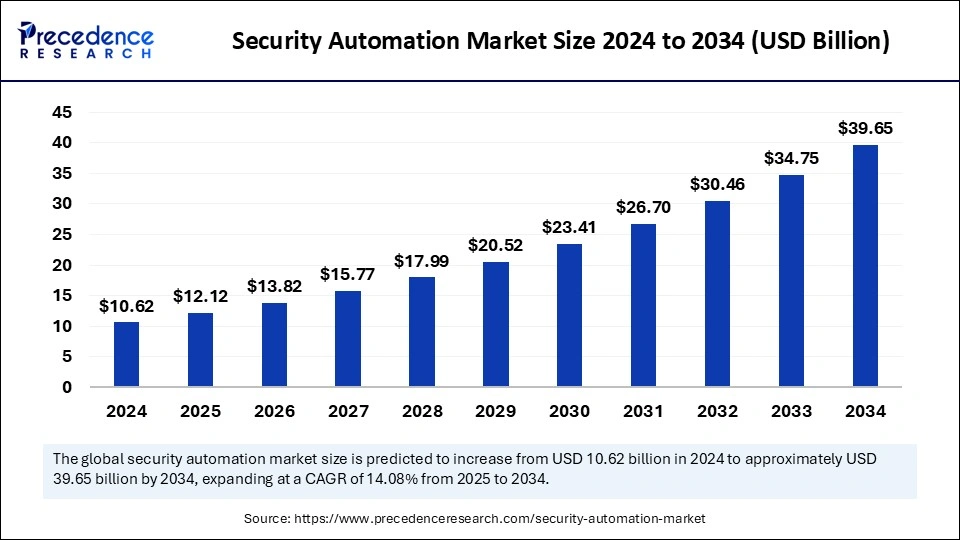

The global security automation market size is calculated at USD 12.12 billion in 2025 and is predicted to increase from USD 13.82 billion in 2026 to approximately USD 39.65 billion by 2034, expanding at a CAGR of 14.08% from 2025 to 2034.

Security Automation Market Key Takeaways

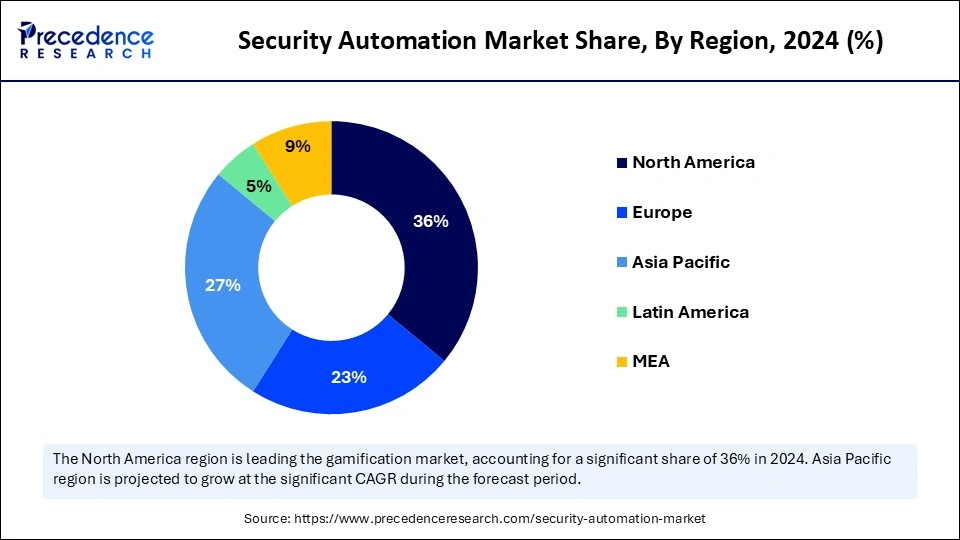

- North America dominated the security automation market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 15% in the market during the forecast period.

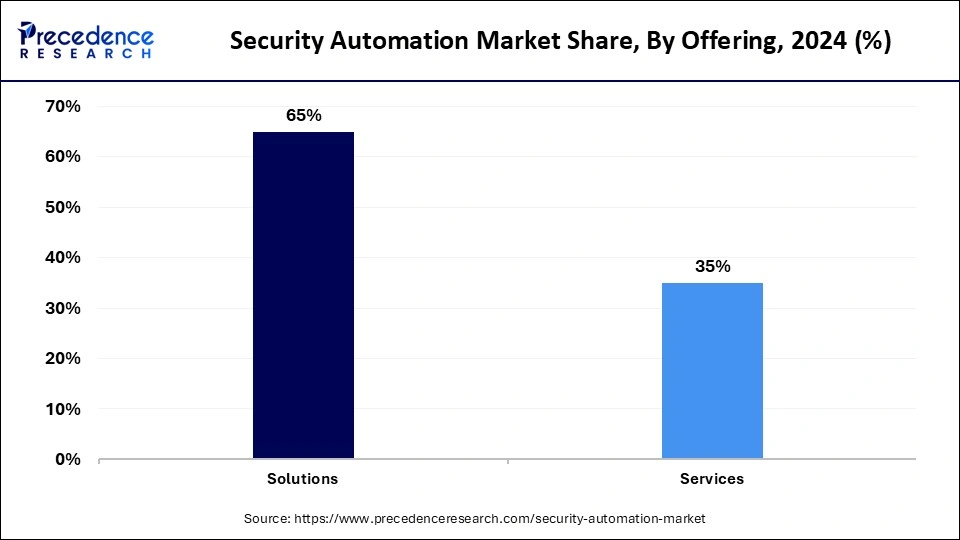

- By offering, the solutions segment contributed the biggest market share of 65% in 2024.

- By offering, the services segment is likely to grow at the highest CAGR over the studied period.

- By deployment mode, the cloud segment held the largest share of the market in 2024.

- By deployment mode, the on-promise segment is anticipated to witness significant growth in the coming years.

- By application, the endpoint security segment led the security automation market in 2024.

- By application, the incident response management segment is expected to show significant growth throughout the forecast period.

- By code type, the full code segment led the market with the largest share in 2024.

- By code type, the no code segment is projected to expand at the highest CAGR over the studied period.

- By vertical, the BSFI segment held the largest market share in 2024.

- By vertical, the healthcare and life sciences segment is expected to expand rapidly during the forecast period.

- By technology, the AI & ML segment led the market in 2024.

- By technology, the UEBA (User Behavior & Entity Behavior Analytics) segment is anticipated to grow at a significant rate in the coming years.

Market Overview

Security automation is a technology that automatically manages and responds to security-related tasks and incidents, reducing the necessity for manual intervention. The main benefit of security automation is the seamless integration of different systems and tools for streamlining repetitive security tasks, like compliance reporting, threat detection, vulnerability management, and incident reporting.

The rise in the incidence of cyber threats and growing concerns about security propels the growth of the worldwide security automation market. There is a heightened need for automated security solutions among businesses to decrease manual labor, enhance protection, and improve accuracy in cyber threat detection. Advancements in technology and the rise in the adoption of cloud and IoT devices among organizations are boosting the demand for robust security solutions, contributing to the growth of the market.

Why is security moving from manual rulebooks to automated playbooks?

Security automation is transforming how organizations detect, respond to, and prevent threats both in cyberspace and in the physical world. Once limited to specific scripts and playbooks, it now encompasses automated incident response, identity access automation, policy-driven cloud security, automated vulnerability remediation, and integrated physical-cyber orchestration. Drivers include the relentless growth of the attack surface, the acute shortage of skilled defenders, regulatory pressures for faster breach notification and containment, and the economic imperative to reduce dwell time and mean-time-to-repair.

Impact of AI on the Security Automation Market

Artificial intelligence is greatly revolutionizing the security automation market. AI technology improves the operational efficiency, accuracy, and reliability of security solutions. AI-driven security systems can quickly learn and adapt to security measures that help in boosting the threat detection capacity. With AI-powered security tools, it becomes easy to identify and counteract security threats quickly. AI and machine learning models can scan huge amounts of data to identify anomalies and patterns, fostering accurate threat detection. This enables real-time threat detection, which is a huge advantage for organizations.

Vulnerability management can be improved through AI by prioritizing and identifying weaknesses in the system. This helps the organization to make informed decisions about tweaking security as needed. Another benefit of AI technology is predictive analytics. Through predictive analysis, AI can predict potential cyber incidents by analyzing patterns, identifying possible vulnerabilities, and predicting future attacks. This enables organizations to strengthen their security solutions proactively.

The optimization and streamlining of tedious security tasks such as malware scanning, network monitoring, and patch management can be easily done by AI. This reduces the necessity of manual intervention, leaving resources for better-suited tasks.

Market Outlook

- Industry Growth Overview: The security automation market is rapidly expanding, driven by increasing demand for advanced surveillance, access control, and integrated security solutions across commercial, industrial, and residential sectors. Rising security concerns, technological advancements in AI and IoT, and the adoption of smart infrastructure and automated monitoring systems are also driving the market.

- Sustainability Trend: The sustainability trend is reshaping the market by driving demand for energy-efficient, eco-friendly security systems that minimize power consumption and reduce carbon footprints. Companies are increasingly integrating smart, sustainable technologies, such as solar-powered sensors, low-energy IoT devices, and automated building management systems, enhancing both operational efficiency and environmental responsibility.

- Major Investors: Major investors in the market include technology-focused venture capital firms, cybersecurity and automation companies, and government agencies funding smart infrastructure and public safety initiatives. Their investments accelerate the development of advanced AI-driven security systems, expand the deployment of automated surveillance and access control solutions, and support innovation that enhances efficiency, scalability, and real-time threat prevention.

Security Automation Market Growth Factors

- The rising integration of innovative technologies like AI, ML, and big data in security systems to improve the accuracy in threat detection is boosting the growth of the market.

With the increasing adoption of cloud computing and IoT devices, there is a high demand for security solutions among businesses, which influences the security automation market. - Stringent regulations regarding security and compliance requirements are boosting the demand for automated security solutions to protect valuable data and infrastructure.

- An increase in investment to strengthen the IT infrastructure further supports the market.

- The rising digitization also contributes to market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 39.65 Billion |

| Market Size in 2025 | USD 12.12 Billion |

| Market Size in 2026 | USD 13.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.08% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Deployment Mode, Application, Code Type, Vertical, Technology and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Cyber Threats

The increasing frequency of cyberattacks worldwide is a major factor driving the growth of the security automation market. According to research conducted by Check Point, an average of 1,876 cyberattacks per organization was recorded in Q3 of 2024, a 75% increase in cyberattacks compared to the same period in 2023 and a 15% rise from the previous quarter. This escalation and increasing frequency of cyber threats has made robust security solutions necessary. These attacks are becoming more sophisticated; this is where security automation makes a difference.

With the rising complexity of IT infrastructures and increasing volumes of data, the need for security solutions is rising. Security automation helps organizations address their security concerns through real-time detection, proactive defense, and rapid response, which helps easily tackle security challenges. Security automation enables routine security checks that do not require manual intervention and minimizes the risks of human errors.

Advancements in technology have improved the reliability and accuracy of security automation solutions, attracting a larger user base. Integrating security automated solutions helps organizations protect their data from hackers.

Restraint

High Initial Investment

Implementing security automation solutions requires substantial investments in hardware as well as software. This cost factor creates challenges for businesses, especially small-scale businesses with budget constraints, limiting the growth of the security automation market. Moreover, integrating security automation solutions into the existing security system is complex and time-consuming, making it vulnerable to cyber threats.

Opportunity

Technological Advancements

Continuous technological advancements create immense opportunities in the market. Technologies like blockchain and AI enhance the scalability of security solutions. These technologies lead to the development of cost-effective solutions, making them appealing to small and medium enterprises (SMEs). Key players operating in the market are offering easy-to-deploy, scalable, affordable, and tailored security automation solutions, specifically targeting SMEs. The necessity for security solutions is expected to rise in the coming years due to the rising digitization. This encourages market players to bring innovations and launch sophisticated products to cater to varying consumer demands.

Segment Insights

Offering Insights

The solutions segment led the security automation market by holding the largest share in 2024. This is mainly due to the increased need to detect threats proactively. SIEM, SOAR, and XDR solutions help automate the threat detection process and have the ability to respond quickly to incidents. These solutions are preferred for their comprehensive threat detection capabilities, scalability, efficiency, and seamless integration into existing security infrastructure. These solutions allow organizations to comply with regulations as well as provide advanced threat detection abilities. With increasing cyber threats across the world, the demand for sophisticated threat detection solutions has increased, supporting segmental growth. These solutions also help protect the company's data and address changing cybersecurity issues.

The services segment is expected to grow at the highest CAGR during the forecast period. Organizations have recognized the complexity and difficulty of integrating security automation solutions within the existing infrastructure, boosting the demand for managed and professional services. Professional service providers provide expertise in seamlessly integrating and deploying security automation solutions that suit the organization's requirements. Moreover, these services help optimize the performance of security automation.

Deployment Mode Insights

The cloud segment accounted for the largest share of the security automation market in 2024. The increased adoption of cloud computing by organizations is a key factor that supported the segment's dominance. Cloud-based solutions provide flexibility and scalability, which allows companies to allocate resources based on demand and evolving business needs. These solutions offer affordable solutions that do not require high upfront investments as well as reducing the cost of maintenance. Rapid deployment and provisioning of cloud-based solutions help faster integration and enhance agility to tackle upcoming threats. Cloud-based solutions are widely preferred for their comprehensive threat detection and response capabilities.

The on-promise segment is anticipated to witness significant growth in the coming years. There are strict regulatory requirements for certain industries, like finance, healthcare, and government. On-premises solutions allow these industries to ensure compliance and data sovereignty. Moreover, on-premises deployment offers greater control over security infrastructure, appealing to organizations with changing requirements. The rising data privacy and protection concerns further boost the segment's growth.

Application Insights

The endpoint security segment led the security automation market in 2024. Endpoint security solutions are the primary entry points for cyber threats, and ensuring secure applications running these endpoint security solutions is a high priority for organizations. Automated endpoint security solutions can quickly detect and respond to threats in real-time. The complexity of modern applications requires real-time monitoring and detection of threats, making endpoint security solutions crucial. Integration with DevOps practices is smoothened through security automated solutions, which further helps segment growth.

The incident response management segment is expected to grow at a significant rate during the projection period. The rising incidences of cyber threats are a key factor supporting segmental growth. Organizations are increasingly seeking solutions for quickly responding to incidents. The incident response management solutions allow swift and effective detection of threats and respond quickly to minimize potential damage risk.

Code Type Insights

The full code segment accounted for the largest market share in 2024. The rise in DevSecOps practices and security integration into DevOps workflow has increased the adoption of full code security automation. This code type enables developers to detect and remedy vulnerabilities during the coding stage, reducing the risk of security problems. Full code security automation is popular amongst organizations that are seeking security solutions across their entire codebase.

The no code segment is expected to expand at the highest CAGR during the forecast period. No-code platforms help non-technical users create and deploy automated security solutions that do not require coding. The convenience of rapid deployment and the absence of coding provide flexibility, customization options, and tailored security workflows.

Vertical Insights

The BSFI segment dominated the security automation market with the largest share in 2024. Stringent regulatory requirements for data security and compliance are a major factor boosting the adoption of security automation solutions among banking and finance organizations. These organizations leverage security automation solutions to proactively identify vulnerabilities, respond to security threats, detect behavior, and analyze data breach risks. There is a heightened need for continuous monitoring of cyber threats, along with the rapid response to emerging threats. With security automation, BFSI organizations can tackle evolving cyber threats.

The healthcare and life sciences segment is anticipated to show the fastest growth throughout the assessment years. Healthcare organizations generate huge amounts of patient data, which is vulnerable to data breaches. Thus, these organizations require robust solutions to protect sensitive patient data. Security automation solutions help these organizations improve threat detection as well as quickly respond to incidents.

Technology Insights

The AI & ML segment held the largest share of the security automation market in 2024. This is mainly due to the increased demand for improved threat detection solutions. Integrating AI and ML technologies in security automation enhances the capabilities of threat detection and predictive analysis capabilities that benefit end-users. With AI and ML technologies, security automation solutions can continuously monitor network traffic and detect malicious activities in real-time, mitigating the risk of cyber threats.

On the other hand, the UEBA (User Behavior & Entity Behavior Analytics) segment is predicted to witness significant growth during the forecast period. UEBA solutions help in improving threat detection by analyzing user and entity behavior patterns. Real-time monitoring capabilities of these solutions help organizations to respond quickly to cyber threats.

Regional Insights

U.S. Security Automation Market Size and Growth 2025 to 2034

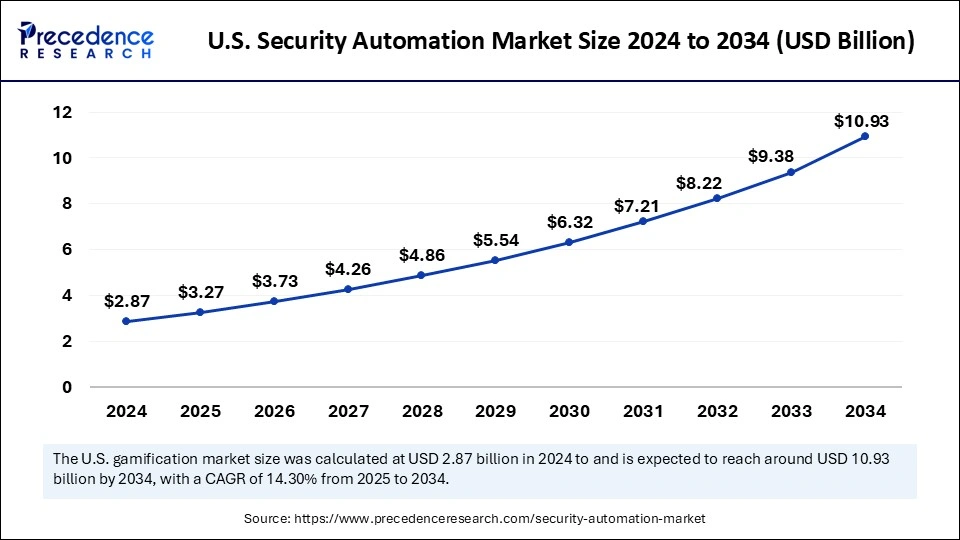

The U.S. security automation market size is exhibited at USD 3.27 billion in 2025 and is projected to be worth around USD 10.93 billion by 2034, growing at a CAGR of 14.30% from 2025 to 2034.

North America held the dominant share of the security automation market in 2024. The advanced technological infrastructure in the region is a key factor that supported the region's dominance. There is a significant rise in cyberattacks and cyber threats that encouraged small as well as mid and large enterprises to adopt advanced security solutions, including security automation to protect their sensitive data. The presence of leading market players has paved the way for innovation and rapid implementation of these solutions. Governments around the region have implemented strict regulations regarding data security, further bolstering the region's market.

The U.S. is a major contributor to the North American security automation market. The growing number of ransomwares, cyber espionage, and phishing incidents are driving the demand for advanced security solutions. Integration of innovative technologies like AI and ML has further enhanced automated security solutions' abilities, magnifying its demand in the country. Strict regulatory requirements and compliance are further boosting the adoption of these security solutions to avoid any backlash.

What Makes Asia Pacific the Fastest-Growing Region in the Security Automation Market?

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The rising digitization in various sectors like finance, manufacturing, and healthcare is a major factor supporting the market's growth. With the rise in the adoption of Internet of Things, cloud computing, and AI solutions, the volume of data is increasing, making it difficult to monitor cyber threats to humans. This, in turn, encourages organizations to adopt security automation solutions since they continuously monitor cyber threats and respond quickly. Government around the region are also focusing oncybersecurity measure to enhance data security and protect the infrastructure, contributing to regional market growth.

China is a major contributor to the Asia Pacific security automation market due to its large-scale investments in smart cities, digital infrastructure, and advanced surveillance technologies. The country's strong manufacturing ecosystem and rapid adoption of AI, IoT, and facial recognition systems further accelerate the growth of security automation solutions. Additionally, rising urbanization and government-led public safety initiatives continue to drive widespread deployment of automated security systems across sectors.

What Makes Europe a Notably Growing Area in the Market?

Europe is projected to witness notable growth in the security automation market in the foreseeable future. The rising initiatives by the European Union (EU) to enhance cybersecurity measures lead to the increasing integration of automated security solutions. Public-private partnerships, like the European Commission's collaboration with the European Cyber Security Organization (ECSO), are accelerating the development as well as deployment of advanced cybersecurity solutions. The significant investment in developing cybersecurity technologies in Germany will boost market growth in Europe.

Germany is a major contributor to the European security automation market due to its strong industrial base, advanced manufacturing sector, and high adoption of smart building and industrial automation technologies. The country's emphasis on cybersecurity, critical infrastructure protection, and Industry 4.0 initiatives drives significant investment in automated security systems. Additionally, strict regulatory standards and a strong focus on workplace safety further support demand for integrated security automation solutions across commercial and industrial environments.

Germany focuses on automation in manufacturing and critical infrastructure, emphasizing OT/ICS-safe playbooks and thorough certification processes. German companies favor deterministic automation with detailed audit trails, role-based approval workflows, and integration into industrial control change-management procedures. Strong vocational cybersecurity training programs support a growing pool of automation-savvy integrators and SOC operators.

What Potentiates the Security Automation Market in the Middle East & Africa?

The Middle East & African countries are investing heavily in security automation, owing to national digital transformation initiatives, smart-city developments, and energy-sector cyber-resilience projects. Major utilities, telecom companies, and oil & gas firms focus on automation to protect OT/SCADA systems and enable quick incident response across distributed assets. Due to talent shortages, the region favors managed automation services and centralized SOCs that provide standardized playbooks across multiple locations. GCC countries are advancing faster with automation, thanks to substantial public investments and a strategic emphasis on cyber sovereignty. All these factors potentiate the market in the Middle East & Africa.

The UAE is advancing automated security across government and critical infrastructure by leveraging sovereign cloud initiatives and national SOC frameworks to expand playbooks. South Africa leads regional fintech and telecom automation adoption through automated fraud detection and incident response to safeguard high-volume transaction systems. Both markets emphasize partnerships with global vendors while developing local system integrators to adapt playbooks and meet compliance needs. Public–private exercises and cyber drills regularly test automated response capabilities, boosting institutional confidence.

Value Chain Analysis

- Component & Technology Suppliers

This stage includes companies that provide core hardware components (sensors, cameras, controllers) and foundational technologies such as AI chips, networking modules, and IoT platforms that enable automated security systems.

Key Players: Intel, Qualcomm, Bosch Sensortec, Sony (image sensors), and NXP Semiconductors. - Security Automation System Manufacturers

Manufacturers design and assemble integrated security automation products, including smart cameras, intrusion detection devices, access control systems, and automated monitoring hardware, using advanced technologies like AI, machine learning, and edge computing.

Key Players: Honeywell, Bosch Security Systems, Hikvision, Dahua Technology, and Axis Communications. - Software & Platform Developers

These companies develop the software, analytics engines, and cloud-based platforms that enable automation, remote management, real-time alerts, and AI-driven threat detection within security ecosystems.

Key Players: Cisco, IBM, Johnson Controls, Genetec, and Milestone Systems. - System Integrators & Solution Providers

System integrators connect hardware and software components into complete, customized security automation solutions for clients, ensuring interoperability, network integration, and on-site configuration.

Key Players: Siemens Smart Infrastructure, ATOS, NEC Corporation, and Securitas Technology.

Security Automation Market Companies

- Cisco Systems, Inc.

- CrowdStrike

- CyberArk Software Ltd.

- IBM Corporation

- Palo Alto Networks

- Red Hat, Inc.

- Secureworks, Inc.

- Splunk Inc.

- Swimlane Inc.

- Tufin

Recent Developments

- In December 2024, Rapid7 launched its expanded cloud security automation suite. This suite will offer businesses enhanced capacities for automated vulnerability management and real-time threat detection and help optimize their security solutions.

- In September 2024, Tata Consultancy Services (TCS) announced that they had extended their partnership with Google Cloud in order to introduce two new AI-powered cybersecurity solutions.

Segments Covered in the Report

By Offering

- Solutions

- SOAR

- XDR

- SIEM

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud

- On-premises

By Application

- Network Security

- Firewall Management

- Intrusion Detection & Prevention System

- Network Traffic Analysis

- Network Access Control

- Others

- Endpoint Security

- Threat Detection and Prevention

- Configuration Management

- Malware Detection and Protection

- Phishing and Email Protection

- Others

- Incident Response Management

- Incident Triage and Escalation

- Evidence Gathering

- Incident Categorization and Prioritization

- Workflow Orchestration

- Others

- Vulnerability Management

- Prioritization

- Vulnerability Scanning and Assessment

- Patch Management and Remediation

- Vulnerability Remediation and Ticketing

- Others

- Identity & Access Management

- Single Sign On (SSO)

- User Provisioning and Deprovisioning

- Access Policy Enforcement

- Multi-factor Authentication

- Others

- Compliance & Policy Management

- Automated Compliance Auditing

- Audit Trail Generation

- Regulatory Compliance Reporting

- Policy Enforcement Automation

- Others

- Data Protection & Encryption

- Encryption Key Management

- Data Loss Prevention

- File and Database Encryption

- Others

By Code Type

- No Code

- Low Code

- Full Code

By Vertical

- Manufacturing

- BFSI

- Healthcare & Life Sciences

- Media & Entertainment

- Energy & Utilities

- Retail & E-commerce

- Government & Defense

- IT & ITES

- Others

By Technology

- AI & ML

- Predictive Analytics

- Robotic Process Automation (RPA)

- User & Entity Behavior Analytics (UEBA)

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting