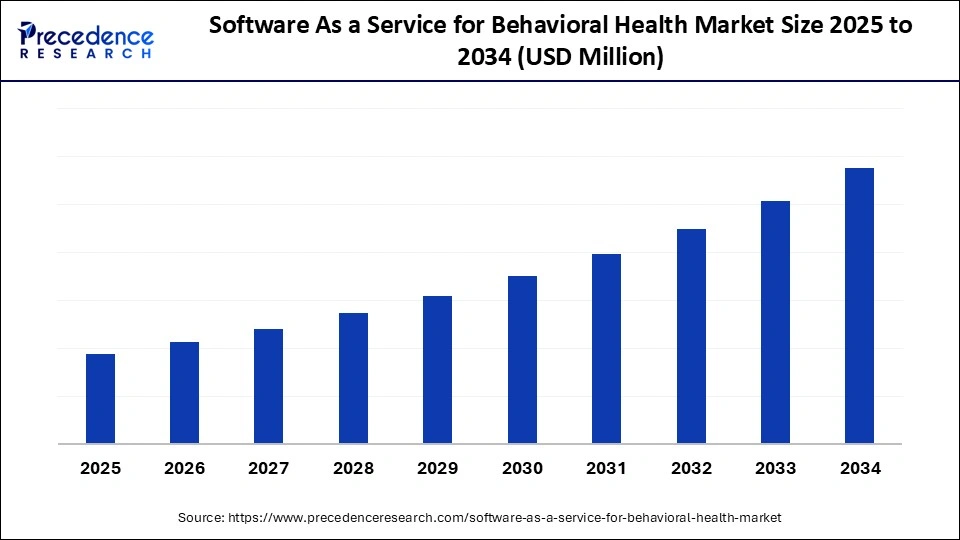

What is the Software as a service for Behavioural Health Market Size?

The global software as a service for behavioural health market is expanding rapidly with increasing adoption of cloud platforms for therapy management, telehealth, and analytics.This market is growing as demand for accessible, scalable, and integrated digital solutions for mental health and wellness management increases.

Market Highlights

- North America dominated the market, holding the largest market share of 37.90% in 2025.

- Asia Pacific is expected to grow at a notable CAGR of 13.30% from 2026 to 2035

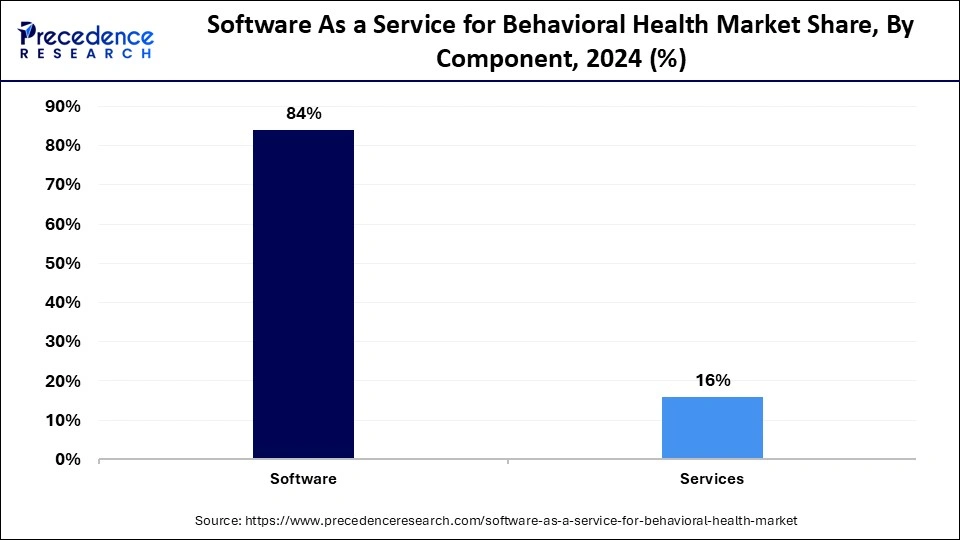

- By component, the software segment held the largest market share of 84% in 2025.

- By component, the services segment is growing at a strong CAGR of 11.2% from 2026 to 2035

- By functionality, the clinical functionality segment contributed the biggest market share of 55.10% in 2025.

- By functionality, the administrative functionality segment is expanding at a healthy CAGR from 2026 to 2035

- By deployment model, the public cloud segment generated the major market share of 61.20% in 2025.

- By deployment model, the private cloud segment is set to grow at the highest from 2026 to 2035

- By end user, the healthcare providers segment held the largest share at 43.20% in 2025.

- By end user, the patients/clients segment is expected to grow at the fastest rate from 2026 to 2035

Market Overview

The global software as a service for behavioural health market is rapidly growing, driven by supportive laws incorporating mental health into general healthcare, growing demand for digital care solutions, and growing awareness of mental health issues. Mobile apps and cloud-based platforms are expanding access to counseling and therapy.

In June 2024, Talkiatry, a US-based virtual psychiatry and therapy provider, secured a $130 million investment from Andresen Horowitz to expand services and staff, aiming to meet rising demand for mental health care.

Technology Shifts in Behavioural Health Software as a Service

- Telehealth and Mobile Platforms: Increasing the availability of apps for ongoing monitoring, counseling, and remote therapy. Mobile solutions let patients contact providers at any time, schedule appointments, and monitor progress. Additionally, telehealth lowers geographic barriers, making it more accessible to marginalized communities.

- Data Security and Compliance Enhancements: Secure patient data management with HIPAA-compliant platforms and advanced encryption. These safeguards guard against hacks and breaches involving private patient data. Wider adoption is encouraged by improved compliance features that also increase trust between patients and providers.

Major Trends of the Software As a Service for Behavioural Health Market

- Increased Use of Artificial Intelligence for Clinical Decision Support: By incorporating artificial intelligence into their platforms, behavioural health Software as a Service (SaaS) Solutions are providing clinical decision support, automating documentation of sessions, and identifying early warning signs of relapse or disengagement from treatment.

- Advancement in Measurement-Based Treatment Models: Many SaaS Vendors are utilizing structured outcome measurement instruments in their platforms, which allow for continual Monitoring of patient progress through standardised assessment tools.

- Transition to Modular, Interoperable Solutions: As the Behavioural Health Sector moves toward modular software architecture (to allow for flexibility and integration with electronic health records (EHR), Billing Systems and Third-Party Analytics), SaaS products are being developed with open Application Programming Interfaces (APIs) and interoperable frameworks to prevent vendor Lock-In and create a vehicle to allow for scalable system customisation

Software as a service for Behavioural Health Market Outlook

The software as a service for behavioural health market is expanding rapidly as medical professionals use digital tools to improve patient care and expedite administrative processes. One of the main growth drivers is the rising demand for virtual mental health services and teletherapy.

Eco-friendly digital platforms are being integrated by providers to cut down on carbon emissions and paper use. Because they reduce the need for on-site infrastructure, cloud-based solutions also encourage energy efficiency.

Data analytics platforms, personalized therapy apps, and AI-owned behavioural health tools are being introduced by creative startups. Venture capital is being drawn to early-stage businesses to expand their offerings for patients and providers of mental health services.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Functionality, Deployment Model, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Software as a service for Behavioural Health MarketSegmental Insights

Component Insights

The software segment dominated the software as a service for behavioural health market with an 84% share in 2025, driven by the extensive use of administrative and clinical software by healthcare providers, which makes telehealth and effective patient management possible. A growing number of providers are depending on integrated platforms, which integrate therapy management, billing, and scheduling into a single system.

The services segment is expected to be the fastest-growing segment in the market for software as a service for behavioural health during the forecast period, driven by the growing need for consulting implementation and support services that enable suppliers to seamlessly incorporate SaaS solutions into their business processes. Rapid adoption rates are being facilitated by the expansion of remote maintenance and training services.

Functionality Insights

The clinical functionality segment dominated the software as a service for behavioural health market with a 55.10% share in 2025, since teletherapy management, treatment planning, and electronic health record tools are essential for patient care delivery and are given top priority by healthcare providers. Clinical software's sophisticated analytics and reporting features are enhancing judgment and results.

The administrative functionality segment is expected to be the fastest-growing segment in the market, with a CAGR of 11.2% during the forecast period, driven by the need for operational efficiency and for maximizing billing, scheduling, and compliance management solutions. Automated routine administrative tasks are becoming more productive and reducing errors. The use of administrative solutions is being further stimulated by the healthcare industry's growing compliance requirements.

The financial functionality segment shows notable growth in the software as a service for behavioral health market, as it enables providers to efficiently manage billing, claims, and payment processing. These tools streamline revenue cycle management, reduce administrative burdens, and minimize billing errors. By improving financial transparency and reimbursement accuracy, they help behavioral health organizations maintain operational stability and sustainability.

Deployment Model Insights

The public cloud segment dominated the software as a service for behavioural health market with a 61.20% share in 2025. It is the favored deployment option because it provides behavioural health providers with scalability, affordability, and accessibility. Providers gain from simple software updates, low upfront costs, and rapid deployment. The adoption of public clouds is also being aided by the growth of telehealth services and multi-location operations.

The private cloud segment is expected to be the fastest-growing segment in the market during the forecast period, as businesses place a greater emphasis on compliance, data security, and tailored solutions for private behavioural health information. Adoption of the private cloud guarantees more control over patient data. Large hospitals with strong privacy requirements and integrated health systems also favor it.

The hybrid cloud segment is an important part of the software as a service for behavioral health market, offering a balance between data security and accessibility. It allows organizations to store sensitive patient data on private servers while leveraging public cloud resources for scalability and cost efficiency. This deployment model supports regulatory compliance, flexible data management, and improved interoperability across healthcare systems.

End User Insights

The healthcare providers segment accounted for the largest share of the market in 2025, with 43.20%, using SaaS platforms to expand telehealth offerings, optimize operations, and enhance patient care. Therapy centers, clinics, and hospitals are integrating software to effectively handle high patient volumes. Provider adoption is also being aided by the growing need for outcome-based care models.

The patients/clients segment is expected to be the fastest-growing market segment during the forecast period, reflecting the growing popularity of remote therapy tools and smartphone apps that enable people to conveniently manage their mental health. Digital platforms that connect directly with patients are becoming more popular for tracking therapy, counseling, and self-evaluation. This growth is accelerated by increased awareness of mental health issues and the availability of virtual care solutions.

The employers / corporate wellness programs segment is a growing area in the software as a service for behavioral health market, as organizations increasingly recognize the value of mental health support for employees. These programs use digital behavioral health platforms to provide accessible counseling, stress management, and wellness tracking tools. By integrating behavioral health services into workplace wellness initiatives, employers can enhance productivity, reduce absenteeism, and promote overall employee well-being.

Software as a service for Behavioural Health Market Regional Insights

North America dominates the behavioural health SaaS market, supported by favorable regulatory frameworks, a high rate of digital adoption, and sophisticated healthcare infrastructure. Its market position is strengthened by the early adoption of telehealth solutions and the presence of top software providers. The dominance of behavioural health technologies is further solidified by rising investments in them.

U.S. Country-Level Analysis

The U.S. market continues to grow steadily, due to sophisticated healthcare infrastructure, broad digital adoption, and laws that encourage mental health and telehealth services. Cloud-based platforms for clinical administrative and patient engagement functions are quickly integrated by providers.

Asia Pacific is expected to be the fastest-growing region, driven by a rise in government programs encouraging the use of digital health and a rise in public awareness of mental health services. The growth of telehealth networks and cloud infrastructure is speeding up adoption. Campaigns for mental health awareness and cross-border partnerships are also fueling the market's explosive expansion.

India Country-Level Analysis

The India market shows consistent growth in the software as a service for behavioural health market, driven by the growing use of teletherapy, increased awareness of mental health issues, and growing internet penetration. To provide urban and semi-urban populations with access to mental health services, startups are launching mobile-first AI-powered platforms. With the help of government programs encouraging digital health and the development of cloud infrastructure, hospitals, clinics, and individual practitioners are adopting digital health, making India one of the world's fastest growing.

Software as a Service for Behavioural Health Market Companies

- Headquarters: Austin, Texas, United States

- Year Founded: 1977 (Cerner founded in 1979; acquired by Oracle in 2022)

- Ownership Type: Publicly Traded (NYSE: ORCL)

History and Background

Oracle Corporation, founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates, began as a database software company and evolved into one of the world’s largest enterprise technology providers. The company has expanded through strategic acquisitions to offer cloud infrastructure, enterprise software, and industry-specific solutions.

In 2022, Oracle completed its acquisition of Cerner Corporation, a leading provider of electronic health record (EHR) systems, for approximately $28 billion. The acquisition marked Oracle’s major expansion into healthcare technology, positioning the company as a global leader in health information systems and analytics. Through Cerner, Oracle delivers cloud-based behavioral health and population health management solutions for hospitals, clinics, and healthcare organizations.

Key Milestones / Timeline

- 1977: Oracle Corporation founded in Santa Clara, California

- 1979: Cerner Corporation founded in Kansas City, Missouri

- 2004: Oracle launches its suite of healthcare enterprise applications

- 2022: Oracle completes acquisition of Cerner Corporation

- 2024: Launch of Oracle Health platform integrating AI, cloud, and behavioral health analytics

Business Overview

Oracle operates as a global provider of enterprise cloud computing, software, and IT services. Through Oracle Health (Cerner), the company offers healthcare information systems designed to improve clinical workflows, patient engagement, and population health outcomes. Oracle’s behavioral health software provides digital tools for case management, patient records, telehealth, and data-driven treatment planning.

Business Segments / Divisions

- Cloud Infrastructure (OCI)

- Applications (Fusion, NetSuite)

- Oracle Health (Cerner)

- Database and Analytics Solutions

Geographic Presence

Oracle serves customers in more than 175 countries, with regional offices and R&D centers across North America, Europe, Asia-Pacific, and the Middle East.

Key Offerings

- Oracle Health EHR Platform (Cerner)

- Behavioral Health Management Systems

- Population Health Analytics and AI Tools

- Cloud-based Healthcare Data Integration

- Patient Engagement and Telehealth Platforms

Financial Overview

Oracle reports annual revenues of approximately $52 billion USD, with growing contributions from cloud infrastructure and healthcare technology. The Cerner acquisition has accelerated Oracle’s healthcare revenue growth through global EHR adoption and cloud-based data solutions.

Key Developments and Strategic Initiatives

- February 2023: Launched Oracle Health Data Intelligence platform integrating AI for population and behavioral health analytics

- October 2023: Announced Oracle Health integrated behavioral health EHR module

- March 2024: Expanded Cerner Millennium platform capabilities for tele-behavioral health and remote patient monitoring

- July 2025: Introduced Oracle Cloud for Healthcare, enabling unified data architecture across health systems

Partnerships & Collaborations

- Partnerships with major healthcare systems for integrated behavioral health data management

- Collaborations with AI firms and universities to advance predictive analytics for patient outcomes

- Alliances with government health agencies for population health modernization

Product Launches / Innovations

- Oracle Health EHR Behavioral Module (2023)

- AI-based patient risk stratification and decision support tools (2024)

- Oracle Cloud Data Platform for healthcare interoperability (2025)

Technological Capabilities / R&D Focus

- Core technologies: Cloud infrastructure, AI, database management, and EHR interoperability

- Research Infrastructure: Global Oracle Labs network in the United States, Europe, and Asia

- Innovation focus: AI-driven healthcare analytics, data integration, and patient engagement technologies

Competitive Positioning

Strengths: Strong enterprise cloud foundation, global reach, integration with AI and analytics

Differentiators: Unified healthcare data platform combining cloud, AI, and EHR capabilities

SWOT Analysis

Strengths: Global brand strength, scalable infrastructure, and healthcare data expertise

Weaknesses: Complex integration between legacy Cerner and Oracle systems

Opportunities: Expansion in behavioral health analytics and cloud-based healthcare systems

Threats: Competition from Epic Systems and regional EHR providers

Recent News and Updates

- May 2024: Oracle Health launched AI-powered behavioral health clinical workflow module

- September 2024: Oracle opened new healthcare innovation hub in Nashville, Tennessee

- January 2025: Announced collaboration with major U.S. health systems to expand cloud-based behavioral health data platforms

- Headquarters: Verona, Wisconsin, United States

- Year Founded: 1979

- Ownership Type: Privately Held

History and Background

Epic Systems Corporation was founded in 1979 by Judith R. Faulkner as Human Services Computing, initially focusing on database systems for medical practice management. Over time, Epic became one of the world’s largest developers of electronic health record (EHR) software, serving hospitals, clinics, and healthcare networks worldwide.

Epic’s solutions support clinical, administrative, and operational functions, including behavioral health management, population health, and telemedicine. The company’s behavioral health modules allow providers to document, manage, and analyze mental health care and treatment plans within an integrated EHR ecosystem.

Key Milestones / Timeline

- 1979: Founded in Madison, Wisconsin, as Human Services Computing

- 1983: Released first EHR product for healthcare practices

- 2003: Expanded EHR systems to large health networks and academic medical centers

- 2015: Introduced EpicCare behavioral health and psychiatry modules

- 2023: Launched AI-driven clinical decision support tools for mental health

- 2025: Expanded Epic’s Cosmos platform to integrate population-level behavioral health data

Business Overview

Epic Systems develops and provides software solutions for healthcare organizations, enabling comprehensive management of patient data, clinical workflows, and analytics. Its behavioral health systems are part of the EpicCare suite, integrating seamlessly with inpatient and outpatient care modules to support therapy documentation, medication management, and patient engagement.

Business Segments / Divisions

- EpicCare Electronic Health Records

- MyChart and Patient Engagement Platforms

- Cogito Data and Analytics

- Behavioral Health and Population Management Solutions

Geographic Presence

Epic’s EHR software is used by healthcare organizations in more than 15 countries, with the majority of installations in the United States, Canada, Europe, the Middle East, and Asia-Pacific.

Key Offerings

- EpicCare Behavioral Health Module

- MyChart for patient communication and telehealth

- Cogito analytics and population health tools

- Epic Cosmos data platform for research and outcomes

- AI-driven clinical decision support for mental health treatment

Financial Overview

Epic Systems generates estimated annual revenues of approximately $4–5 billion USD, maintaining strong profitability as a privately held company. Its customer base includes leading academic medical centers, integrated delivery networks, and behavioral health providers.

Key Developments and Strategic Initiatives

- April 2023: Expanded behavioral health EHR capabilities with predictive analytics for suicide prevention

- September 2023: Enhanced telepsychiatry workflows integrated into EpicCare

- February 2024: Announced AI partnership for mental health risk assessment and treatment optimization

- August 2025: Launched integration of behavioral data within Epic Cosmos for population-level insights.

Partnerships & Collaborations

- Collaborations with major health systems to improve behavioral health data collection

- Partnerships with AI developers for clinical decision support

- Academic collaborations for population health and mental health research

Product Launches / Innovations

- AI-driven behavioral health assessment module (2023)

- Tele-behavioral health integration for MyChart (2023)

- Enhanced outcomes analytics dashboard for behavioral care (2024)

Technological Capabilities / R&D Focus

- Core technologies: EHR systems, AI and analytics, cloud interoperability, patient engagement tools

- Research Infrastructure: Corporate campus in Verona, Wisconsin, with global R&D partnerships

- Innovation focus: Population-level health analytics, integrated behavioral care, and AI-driven diagnostics

Competitive Positioning

- Strengths: Deep integration across clinical systems, high customer retention, strong brand reputation

- Differentiators: Seamless integration of behavioral health within broader EHR ecosystem

SWOT Analysis

- Strengths: Comprehensive EHR capabilities, large U.S. market share, innovation in patient engagement

- Weaknesses: Limited international penetration, slower cloud adoption

- Opportunities: Growth in behavioral health data analytics and AI integration

- Threats: Increasing competition from Oracle Health (Cerner) and emerging SaaS providers

Recent News and Updates

- May 2024: Epic announced integration of behavioral and physical health data across EpicCare systems

- October 2024: Launched expanded Cosmos database for mental health population studies

- January 2025: Introduced new AI-driven clinical support tools for behavioral health management

Other Compnaies in the Software as a service for Behavioural Health Market

- Netsmart Technologies: Netsmart is a leading provider of cloud-based behavioral health software specializing in EHR, telehealth, and case management solutions. Its myAvatar and CareFabric platforms deliver end-to-end tools for mental health providers, social services, and substance use treatment centers. Netsmart's focus on value-based care and interoperability makes it a top SaaS player in behavioral health.

- Qualifacts Systems: Qualifacts delivers behavioral health-specific SaaS solutions through its CareLogic and Credible platforms. These systems streamline clinical, administrative, and billing workflows for community mental health centers and human services organizations. Its data-driven analytics and telehealth integration enhance outcome tracking and reporting capabilities.

- AdvancedMD: AdvancedMD offers a cloud-based EHR and practice management suite tailored for behavioral health practitioners. Its platform includes e-prescribing for controlled substances, therapy documentation, and telepsychiatry features. The company emphasizes flexibility and ease of integration for small to mid-sized behavioral health practices.

- CureMD: CureMD provides SaaS-based EHR and telehealth solutions for behavioral and mental health providers. Its intuitive interface simplifies treatment documentation, patient engagement, and compliance with HIPAA and Meaningful Use standards.

- NextGen Healthcare: NextGen Healthcare's SaaS platform supports behavioral health practices with integrated EHR, analytics, and patient engagement tools. Its interoperability with medical and social service systems enables holistic patient care.

- Allscripts Healthcare: Allscripts offers cloud-based EHR and behavioral health solutions through its Veradigm platform. Its focus on care coordination and population health analytics improves treatment outcomes and operational efficiency.

- athenahealth: athenahealth delivers a cloud-native healthcare network that connects behavioral health providers with broader medical ecosystems. Its behavioral health suite includes telehealth, patient engagement, and revenue cycle management modules.

- Meditab: Meditab's Intelligent Medical Software (IMS) provides behavioral health EHR and practice management features in a SaaS format. Its focus on customizable templates and multi-specialty support benefits outpatient mental health clinics.

- NextStep Solutions: NextStep Solutions specializes in behavioral health SaaS software with advanced scheduling, outcomes measurement, and compliance tools. Its HIPAA-compliant cloud architecture supports collaborative and evidence-based care.

- ICANotes: ICANotes provides behavioral health-specific documentation software with pre-built templates for psychiatry, therapy, and substance use treatment. Its cloud deployment enhances accessibility for multi-location practices.

- The Echo Group: The Echo Group offers EchoVantage, a cloud-based EHR designed for behavioral health and human services organizations. The platform integrates billing, reporting, and outcome tracking into a single SaaS interface.

- Welligent: Welligent, a subsidiary of ContinuumCloud, provides a fully cloud-based EHR and mobile app for behavioral health, addiction treatment, and social services. Its real-time data access improves clinician mobility and care coordination.

- BestNotes: BestNotes offers an all-in-one behavioral health EHR, CRM, and billing platform hosted in the cloud. It's tailored for small and mid-sized practices and includes outcome tracking, telehealth, and compliance automation.

- Kipu Health: Kipu Health focuses on cloud-based EHR systems for addiction treatment and behavioral health facilities. Its platform supports electronic charting, billing, and reporting, offering seamless integration for recovery centers and mental health clinics.

Recent Developments

- In July 2025, Lyra Health, a leader in workforce mental health solutions, introduced Lyra Empower. This AI-powered platform aims to provide personalized mental health support to employees, leveraging artificial intelligence to match individuals with appropriate care resources.(Source: https://finance.yahoo.com)

- In October 2025, Qualtrics, a customer service software company, announced the acquisition of health-tech firm Press Ganey Forsta for $6.75 billion. This strategic move aims to merge Qualtrics' AI-driven customer experience tools with Press Ganey's extensive footprint in the healthcare sector, enhancing AI capabilities in regulated industries.(Source: https://www.ft.com)

Software as a service for Behavioural Health MarketSegments Covered in the Report

By Component

- Software

- Integrated Software Suites

- Enterprise Resource Planning (ERP) for Behavioral Health

- Care Coordination Platforms

- Standalone Software Modules

- Electronic Health Records (EHR)/Electronic Medical Records (EMR)

- Practice Management (PM)

- Revenue Cycle Management (RCM)

- Telehealth / Telepsychiatry Platforms

- Patient Engagement Portals/Apps

- Clinical Decision Support (CDS) Tools

- Prescription Management / E-Prescribing

- Therapy & Intervention Specific Software

- Outcome Measurement & Reporting Tools

- Population Health Management (PHM) for Behavioral Health

- Remote Patient Monitoring (RPM) Software

- Digital Therapeutics (DTx)

- Workforce Management & Staff Scheduling

- Data Analytics & Business Intelligence (BI) Dashboards

- Secure Messaging & Collaboration Tools

- Compliance & Regulatory Reporting Software

- Integrated Software Suites

- Services

- Implementation & Integration Services

- Consulting & Advisory Services

- Training & Education Services

- Maintenance & Support Services

- Customization & Development Services

- Data Migration Services

By Functionality

- Clinical Functionality

- Electronic Health Records (EHR)

- Patient Demographics & History

- Diagnosis & Treatment Planning

- Progress Notes (SOAP, DAP, BIRP)

- Medication Management & E-Prescribing

- Clinical Assessments & Screening Tools

- Labs & Imaging Integration

- Interoperability with other Health IT Systems (e.g., HIEs)

- Care Coordination

- Referral Management

- Shared Care Plans

- Interdisciplinary Team Collaboration

- Telehealth / Telepsychiatry

- Secure Video Conferencing

- Virtual Group Therapy

- Asynchronous Communication (Secure Messaging)

- Remote Monitoring of Patient Data

- Clinical Decision Support (CDS)

- Evidence-Based Treatment Protocols

- Drug-Drug Interaction Alerts

- Clinical Guideline Reminders

- Outcome Measurement & Reporting

- Patient Reported Outcomes (PROs)

- Clinical Quality Measures (CQMs)

- Treatment Effectiveness Tracking

- Longitudinal Data Analysis

- Electronic Health Records (EHR)

- Administrative Functionality

- Patient/Client Scheduling & Appointment Management

- Online Booking

- Automated Reminders

- Waitlist Management

- Document Management & Secure Storage

- Consent Forms & Intake Documents

- Scanned Documents & Attachments

- Case Management

- Individualized Care Plans (ICPs)

- Discharge Planning

- Social Determinants of Health (SDOH) Tracking

- Workforce Management

- Staff Scheduling & Roster Management

- Credentialing & Licensing Tracking

- Performance Monitoring

- Business Intelligence (BI) & Analytics

- Operational Dashboards

- Patient Flow Analysis

- Staff Productivity Reports

- Patient/Client Scheduling & Appointment Management

- Financial Functionality

- Revenue Cycle Management (RCM)

- Patient Registration & Eligibility Verification

- Insurance Verification

- Claims Submission (EDI)

- Denial Management

- Payment Posting & Reconciliation

- Accounts Receivable Management

- Billing & Coding

- CPT/HCPCS Code Management

- ICD-10/11 Coding Support

- Automated Billing Rules

- Managed Care & Payer Relations

- Contract Management

- Authorization Tracking

- General Ledger & Accounting Integration

- Payroll Management

- Revenue Cycle Management (RCM)

By Deployment Model

- Private Cloud

- Dedicated Cloud Instance

- Virtual Private Cloud (VPC)

- Public Cloud

- Multi-tenant SaaS

- Hybrid Cloud

By End User

- Healthcare Providers

- Hospitals & Health Systems

- Psychiatric Hospitals

- General Hospitals with Behavioral Health Units

- Integrated Delivery Networks (IDNs)

- Community Mental Health Centers (CMHCs)

- Federally Qualified Health Centers (FQHCs)

- County/State Mental Health Agencies

- Private Practices

- Individual Practitioner Offices (Psychiatrists, Psychologists, Therapists, Counselors, Social Workers)

- Group Practices

- Rehabilitation Centers

- Substance Abuse Treatment Centers

- Mental Health Rehabilitation Facilities

- Residential Treatment Centers (RTCs)

- Long-Term Care Facilities

- Correctional Facilities

- Hospitals & Health Systems

- Payers

- Commercial Health Insurance Providers

- Government Payers (e.g., Medicaid, Medicare, VA)

- Third-Party Administrators (TPAs)

- Patients/Clients (Direct-to-Consumer)

- Mental Wellness Apps (Mindfulness, Meditation, Mood Tracking)

- Virtual Therapy Platforms (Consumer-facing)

- Peer Support Networks

- Digital Self-Help Tools

- Employers / Corporate Wellness Programs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting