What is the Software-Defined Vehicles Market Size?

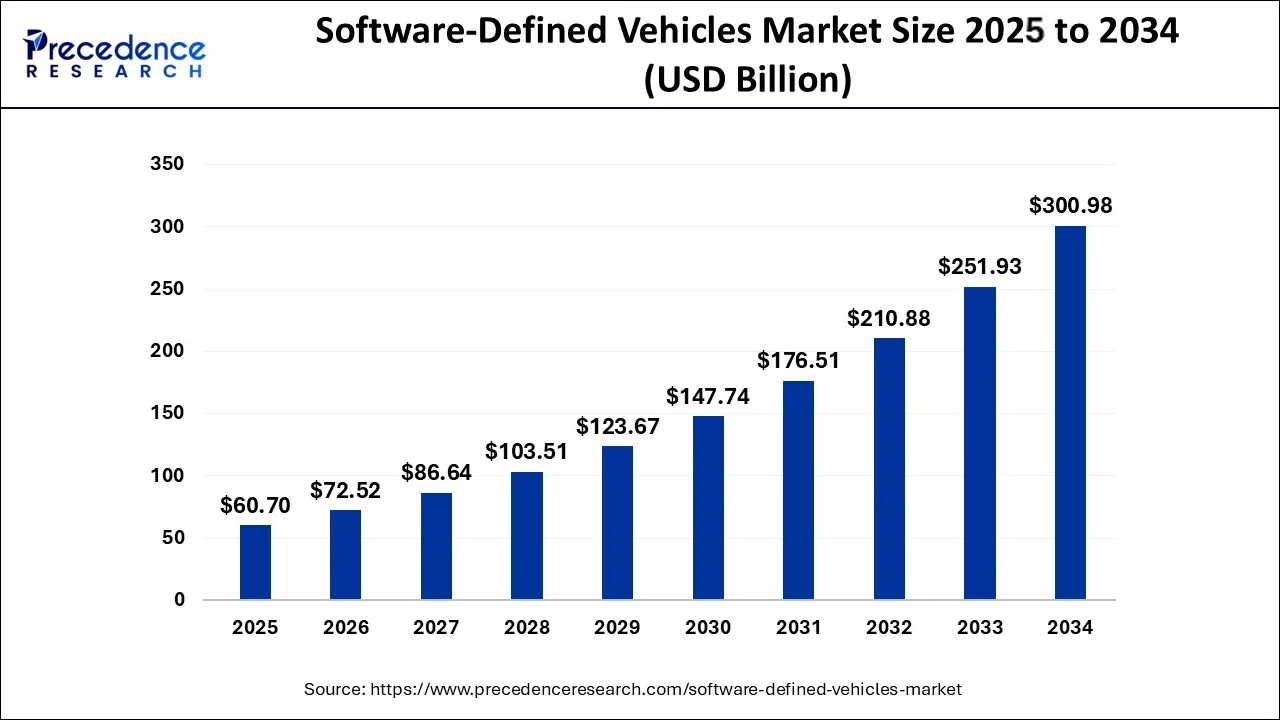

The global software-defined vehicles market size is accounted at USD 60.70 billion in 2025 and predicted to increase from USD 72.52 billion in 2026 to approximately USD 300.98 billion by 2034, growing at a CAGR of 19.47% from 2025 to 2034.

Software-Defined Vehicles Market Key Takeaways:

- The Asia Pacific market is predicted to appear as the most encouraging market from 2025 to 2034.

- By propulsion, the electric vehicles (EVs) segment is expected to expand at the highest CAGR from 2025 to 2034

- By propulsion, the internal combustion engine (ICE) vehicles segment is predicted to grow at the quickest CAGR from 2025 to 2034.

- By application, the ADAS & safety segment is projected to grow at the highest CAGR from 2025 to 2034.

- By application, the body control & comfort systems is the fastest-growing segment from 2025 to 2034.

- By vehicle type, the passenger car segment is expected to expand at the highest CAGR from 2025 to 2034.

- By vehicle type, the commercial vehicle segment is predicted to grow at the fastest CAGR from 2025 to 2034.

- By level of autonomy, the Level 3 segment is expected to expand at the highest CAGR from 2025 to 2034.

- By level of autonomy, the Level 1 segment is predicted to grow at the fastest CAGR from 2025 to 2034.

Market Overview

The Software-Defined Vehicles Market refers to the use of software-defined networking (SDN) and software-defined architecture (SDA) technologies to enhance the functionality, safety, and efficiency of vehicles. This technology is becoming increasingly popular in the automotive industry as it allows vehicles to be more connected, customizable, and secure. It also allows for more efficient communication between the various systems within the car, such as the engine, braking, and safety systems. Some of the key drivers of the software-defined vehicles market include the increasing demand for connected and autonomous vehicles, the growing need for improved safety features, and the rising demand for more efficient and environmentally friendly vehicles.

SDVs enable customers to receive firmware patches, enhancements to infotainment, tuning, and monitoring of key functional capabilities like vehicle and powertrain dynamics, and feature-on-demand comfort services via over-the-air (OTA) updates.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 60.70 Billion |

| Market Size in 2026 | USD 72.52 Billion |

| Market Size by 2034 | USD 300.98 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.47% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Propulsion, By Application, By Vehicle Type and By Level of Autonomy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase safety and upgradation

Software-defined vehicles are easier to upgrade and have enhanced features by utilizing over-the-air software as per the need of the driver. SDVs have the potential to significantly reduce the number of accidents caused by human error. The vehicle also has an anti-collision and driver assistance feature for enhanced safety. The updates are independent of the model of the vehicle as well as the speed and agility of the vehicle.

Greater accessibility

SDVs have the potential to provide greater mobility for people who are unable to drive due to physical disabilities or other reasons. With the help of advanced software and technology, SDVs are programmed to safely transport passengers with different mobility needs.

Restraints

Increase cost as well as rising infrastructure

Software-defined vehicles are generally more expensive than traditional cars due to the different technology and components required, making them less accessible to some consumers. For software-defined vehicles to function properly, there needs to be a robust infrastructure in place to support them. This includes high-speed internet, 5G networks, and other technologies that may not be widely available in some areas.

Opportunities

During the transition to software-defined vehicles, conventional automobile manufacturers will face difficulties and challenges, as well as chances for new automotive industry players such as chip suppliers, software suppliers, and Internet companies. The transformation to software-defined vehicles will be an unstoppable trend driving the growth of the automotive business over the next 5-10 years. All businesses in the industrial chain must conduct comprehensive evaluations and forward planning in order to maintain initiative during the new industrial transformation.

Propulsion Insights

Electric Vehicles (EVs) sector is anticipated to grow at the highest CAGR from 2024 to 2034. EVs use electric motors and batteries to power the vehicle. Software-defined EVs optimize battery usage, improve charging times, and provide more accurate range estimates. Electric vehicles are powered by electricity and have a battery that stores energy, while software-defined vehicles are equipped with advanced software that controls various aspects of the vehicle, such as performance, safety, and entertainment.

The internal Combustion Engine (ICE) Vehicles segment is anticipated to grow at the fastest CAGR from 2025 to 2034. These are vehicles that use a traditional gasoline or diesel engine to power the vehicle. In the case of internal combustion engines, software-defined vehicles are equipped with electronic control units (ECUs) that use various sensors to monitor engine performance and make adjustments to the fuel injection, ignition timing, and other engine parameters to optimize performance and fuel efficiency.

These adjustments are made in real-time, providing drivers with a smooth and efficient driving experience. ECUs are also used to diagnose engine problems and alert the driver when maintenance is required. This help prevents severe damage to the engine and saves the driver money on costly repairs. Overall, software-defined vehicles equipped with internal combustion engines provide drivers with greater control, performance, and efficiency while also helping to reduce emissions and improve the longevity of the engine.

The battery electric vehicles (BEVs) segment held the largest share of 45.20% in the 2024 global software-defined vehicles market. The BEVs are a justified platform and a primary catalyst for this market's evolution. The major role of the BEVs is to offer significant architecture and pick (execute) cases that allow connectivity, updates and extensive software control that defines the best of the market presence and potential. Overall, the segment specifies and contributes to the growth of this market.

The fuel cell electric vehicles (FCEVs) segment is expected to grow at a CAGR of 22.40% during the forecast period. The FCEVs are known for integrating specialised, critical software to retain their robust powertrain, allowing OTA updates and advanced features with safety to drive the software-defined vehicles sector as a whole. The development is driven by technological advancement and personalisation, bridging OTA updates into the FCEVs.

Application Insights

ADAS sector is expected to grow at the highest CAGR during the projected period. ADAS technologies are designed to help drivers avoid accidents by providing warnings, alerts, and automated responses to potential hazards on the road. Some of the most common advanced driver assistance systems (ADAS) features include lane departure warnings, adaptive cruise control, automatic emergency braking, and blind-spot monitoring. Overall, the ADAS and safety segment of the software-defined vehicles market is expected to experience significant growth in the coming years as more automakers and consumers seek out advanced safety features to improve the driving experience and reduce the risk of accidents.

Body Control & Comfort Systems is the fastest-growing sector from 2025 to 2034. This segment encompasses all the systems that control various aspects of the vehicle's body and interior, including lighting, climate control, infotainment, and more. This growth is likely to be supported by ongoing advancements in software and technology, as well as increasing regulatory support for autonomous driving and other advanced vehicle features.

Vehicle Type Insights

On the basis of vehicle type, the passenger car sector is anticipated to grow at the highest CAGR from 2025 to 2034. The growth of the segment is due to the cost-effective alternative being introduced, like natural ventilation as well as increasing passengers' comfort. The car producers have increased recently, which is further anticipated to boost the growth of the passenger car industry. Along with this, the rising concern regarding fossil fuel emissions, energy security, as well as increasing competitiveness between sectors is anticipated to encourage the government to make investments and generate incentives in the automotive sector, thus expanding the market of the software-defined vehicle market.

On the other hand, the commercial vehicle sector is anticipated to grow at the fastest CAGR during the projected period. The expansion is due to the rising implementation of sports utility vehicles, mainly in emerging countries. The growth is also attributed due to development in the supply chain and logistics industries. Manufacturers of light industrial vehicles are moving toward an electric, sustainable, and clean world. Several OEMs are developing novel paradigms to transform conventional commercial vehicle base approaches.

The passenger vehicles segment held the largest share of 67.40% in the 2024 global software-defined vehicles market. The passenger vehicles are poised with premium/luxury and economy class, and the emerging demand for tech comfort travel, with all the required necessities to stay satisfied throughout the journey. The increased number of innovations and revenue translates to various definitions of growth in favor of market growth.

The segment contributes with its constant demand and need among the travellers and local groups, significantly helping the market to accelerate in the long run.

The commercial vehicles segment is expected to grow at a CAGR of 17.20% during the forecast period. The segment is a smart, adaptive platform that allows new business model to carry out their logistics business smoothly with various options to handle the supply service, keeping quantity, quality and size factors prior to the beginning of the supply chain. The HCVs, buses, LCVs and coaches options ease the supply process respective of the product's physical specificity.

Level of Autonomy Insights

The Level 3 sector is anticipated to grow at the highest CAGR from 2025 to 2034. In level 3, the vehicle is able to drive itself in certain situations, but the driver must be ready to take control when prompted. These are automated and are mainly used to avoid accidents.

Level 1 is anticipated to grow at the fastest CAGR during the projected period. This is also known as the driver assistance level; in this, the vehicle is able to assist with steering, braking, or accelerating, but the driver remains in control.

Software Functionality

The ADAS/ autonomy software segment held the largest share of 28.90% in the 2024 global software-defined vehicles market. Software support is essential, so this segment plays a crucial role in this market. The ADAS is a main brain function for balancing vehicle functions, perceiving the environment, and take safety crucial decisions with the mindful level of automation. The segment is leading with its primary position in operating the software-defined vehicles.

The key development is the improvisation and advancement-based study to fuel the performance and promote the growth of the market.

The OTA updates/ remote diagnostics segment is expected to grow at a CAGR of 20.60% during the forecast period. The segment is important to introduce remote maintenance, new feature offerings and consistency in improvement. As observed, remote diagnostics are crucial for predictive maintenance, for solution and real-time health monitoring. The segment is leading due to its resolution skill to further mitigate vehicle downtime and physical recalls, alongside allowing new business models to flourish, new vehicles and other multiple suitable businesses.

Deployment Mode Insights

The on-board software segment held the largest share of 41.90% in the 2024 global software-defined vehicles market. The segment will deliver as the central intelligence that manages all vehicle features and operations. The major role involves advanced features via a centralised and flexible architecture, and decoupling the hardware from the functionality. The OTA updates, connectivity, personalisation and communication harness the segment to further contribute to automation in the market.

The hybrid (vehicle + edge + cloud) segment is expected to grow at a CAGR of 20.80% during the forecast period. The hybrid deployment amalgamates on-premises, involving edge and in-vehicle and public cloud environments to control data security, real-time performance, cost efficiency and scalability. The segment offers a flexible, resilient and integrative platform that allows easy software operation, deployment and development throughout the entire vehicle lifecycle. The segment is emerging due to its interconnected ecosystem-building potential, benefiting several other factors influencing the software-defined vehicles sector.

Regional Insights

The North American region, which includes the United States and Canada, is expected to be a significant player in the software-defined vehicles market. The presence of major automotive manufacturers and technology companies in this region, along with the increasing demand for electric and autonomous vehicles, is expected to drive growth.

Europe is also expected to be a significant software-defined vehicle market player. The region has a strong automotive industry and is home to several major automotive manufacturers, making it a hub for innovation.

Connectivity Type Insights

The embedded (OEM-integrated modules) segment held the largest share of 52.50% in the 2024 global software-defined vehicles market. The segment is a huge technological support, uplifting and harnessing as and when the market thrives with updates and development. The segment is responsible for data processing, validating crucial functions and allowing the advanced software features to merge in the advancement that precise the modern driving experience. OEM is leading from the distributed simple ECUs to unify components in a quality centralised performance automating architecture.

The integrated/ hybrid connectivity platforms segment is expected to grow at a CAGR of 19.60% during the forecast period. The segment acts as a main gateway for software-defined vehicles (SDVs). It's an easy, secure and reliable ‘always-on' connectivity throughout the diverse network surrounding and geographic regions. The main role involves providing a remote software update, continuous communication and real-time data exchange that bolsters the global software-defined vehicles market.

Software-Defined Vehicles Market Companies:

- Tesla, Inc.

- Toyota Motor Corporation

- Volkswagen Ag

- General Motors Company

- Stellantis NV

- BYD Company Limited

- Hyundai Motor Company

- Ford Motor Company

- Honda Motor Co., Ltd.

- Mercedes Benz Group AG

- BMW Group

- Suzuki Motor Corporation

Recent Developments:

- In October 2020, Tesla released its FSD Beta software to select Tesla owners. The FSD Beta utilizes a combination of cameras, sensors, and AI to enable semi-autonomous driving capabilities. The software has been met with excitement and skepticism, with some early testers reporting impressive results and others experiencing issues.

- In January 2021, General Motors announced its Ultium Platform, a flexible, software-defined vehicle architecture underpinning many of its future EV models. The platform is designed to support various vehicle types, from small cars to large trucks, and will be capable of delivering over-the-air updates to improve performance and functionality.

- In March 2022, Wipro Limited announced the launch of its “Cloud Car” platform, which was unveiled at MWC Barcelona.

Segments Covered in the Report

By Vehicle Type

- Passenger Vehicles

- Economy

- Premium/Luxury

- Commercial Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Buses & Coaches

- Special Purpose Vehicles

- Off-highway Vehicles (Construction, Mining)

- Agricultural Vehicles

- Defense/Armored Vehicles

By Software Functionality / Application Area

- Infotainment & Human-Machine Interface (HMI)

- Advanced Driver Assistance Systems (ADAS) / Autonomy Software

- Telematics & Connectivity (V2X, 5G)

- Vehicle Control & Operation

- Battery Management Systems (BMS)

- Digital Cockpit / Instrument Cluster

- Over-the-Air (OTA) Updates / Remote Diagnostics

- Fleet Management & Mobility Services Software

By Propulsion Type

- Battery Electric Vehicles (BEVs)

- Hybrid Electric Vehicles (HEVs / PHEVs)

- Internal Combustion Engine (ICE) Vehicles

- Fuel Cell Electric Vehicles (FCEVs)

By Connectivity Type

- Embedded (OEM-integrated modules)

- Tethered (via smartphone, etc.)

- Integrated / Hybrid Connectivity Platforms

By Deployment Mode

- On-Board Software (Edge Processing)

- Cloud-Connected Software (Vehicle-Cloud Integration)

- Hybrid (Vehicle + Edge + Cloud orchestration)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting