What is the Scalable Software-Defined Networking Market Size?

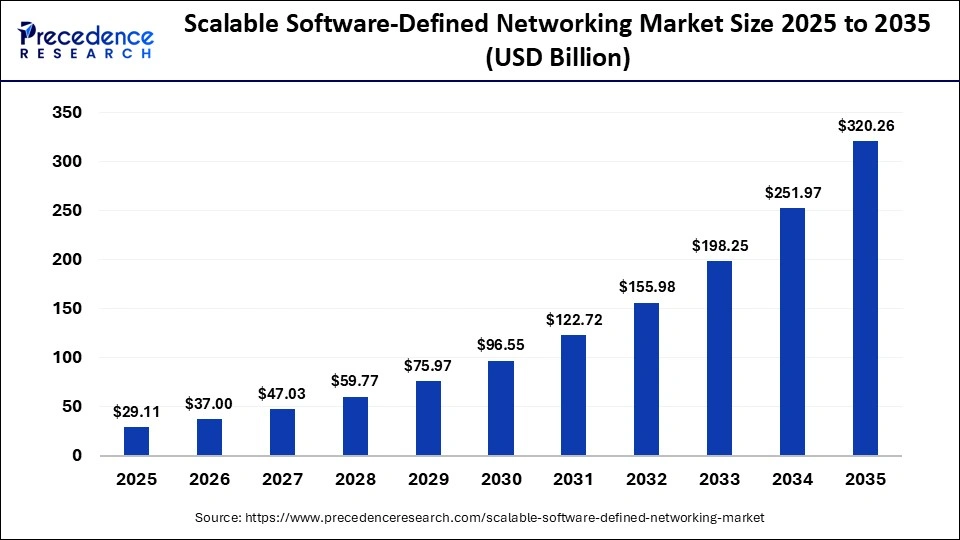

The global scalable software-defined networking market size accounted for USD 29.11 billion in 2025 and is predicted to increase from USD 37.00 billion in 2026 to approximately USD 320.26 billion by 2035, expanding at a CAGR of 27.10% from 2026 to 2035. The market for scalable software-defined networking is witnessing unprecedented growth, driven by the growing demand for network efficiency and increasing integration of artificial intelligence (AI) for smart automation.

Market Highlights

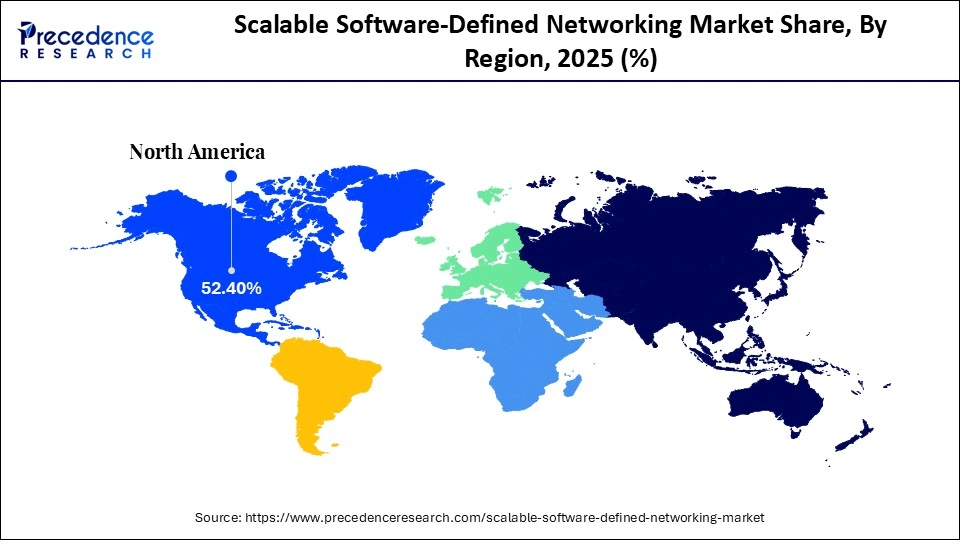

- North America dominated the market, holding the largest market share of 52.4% in 2025.

- The Asia-Pacific is expected to expand at the fastest CAGR of 26.5% between 2026 and 2035.

- By type/technology, the SD-WAN segment contributed the largest market share of 36.8% in 2025.

- By type/technology, the hybrid SDN segment is expected to grow at a strong CAGR of 24.4% between 2026 and 2035.

- By component, the SDN solutions/controllers segment held the major market share of 57.8% in 2025.

- By component, the services (Integration, Consulting, Support) segment is poised to grow at a significant CAGR of 24.3% between 2026 and 2035.

- By end-user, the enterprises segment generated the highest market share of 48.7% in 2025.

- By end-user, the service providers segment is expected to expand at a remarkable CAGR of 24.6% between 2026 and 2035.

- By deployment model, the on-premises segment captured the biggest market share of 65.4% in 2025.

- By deployment model, the cloud-based (SaaS) segment is growing at a double-digit CAGR of 25.1% between 2026 and 2035.

- By application, the data center networking segment accounted for the largest market share of 52.4% in 2025.

- By application, the cloud computing segment is projected to grow at a significant 25.0% CAGR between 2026 and 2035.

Market Overview

Scalable software-defined networking refers to programmable network architectures that separate the control plane from the data plane, allowing centralized network intelligence and policy control independent of underlying hardware. This architectural decoupling enables administrators to define, modify, and enforce network behavior through software, improving visibility, consistency, and operational control across complex environments.

SDN platforms support dynamic resource allocation, network virtualization, and multi-tenant architectures, making them well suited for large scale deployments in data centers, enterprise networks, and telecom infrastructures. By abstracting network functions, SDN enables faster provisioning, simplified configuration management, and more efficient traffic routing based on real-time demand.

Through automation and centralized policy enforcement, scalable SDN improves network agility, performance optimization, and cost efficiency. These capabilities are particularly critical for cloud-native workloads, software-defined data centers, and high-traffic environments that require rapid scaling, reliability, and flexible network orchestration.

How Is AI Impacting the Growth of the Scalable Software-Defined Networking Industry?

As AI technology advances, integration of artificial intelligence is driving innovation and accelerating growth in the scalable software-defined networking market by strengthening security, predictive analytics, and network automation capabilities. AI and machine learning reduce reliance on manual network configuration by continuously analyzing traffic patterns, device behavior, and performance metrics across large and complex network environments.

AI enables predictive maintenance by identifying early indicators of hardware failure, performance degradation, and configuration drift before service disruption occurs. Machine learning models detect anomalies and security threats in real time, allowing SDN controllers to isolate affected segments, enforce policies, and remediate issues automatically, improving network resilience and uptime.

AI-powered analytics improve congestion prediction and traffic optimization by dynamically adjusting routing policies based on application priority and network conditions. These capabilities are driving a shift toward more autonomous, self-optimizing networks that can adapt to changing workloads, reduce operational risk, and support scalable deployment across data centers, enterprise networks, and telecom infrastructures.

Scalable Software-Defined Networking Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to experience accelerated growth. The growth of the scalable software-defined networking market is driven by the rising adoption of cloud services and virtualized environments, rapid expansion of 5G networks & IoT, and growing need for network automation. Additionally, the increasing demand for secure, agile, and scalable connectivity solutions is anticipated to drive the market's growth in the coming years.

- Global Expansion: Several leading players in the scalable software-defined networking (SDN) market, including Cisco Systems, Intel, Hewlett Packard Enterprise (HPE), Juniper Networks, Huawei, and IBM, are actively expanding their geographical presence through strategic initiatives such as new service launches, partnerships/collaborations, and acquisitions to cater to the ongoing demand for network automation and cloud integration. For instance, in May 2025, Hewlett Packard Enterprise (HPE) announced expansions of its HPE Aruba Networking wired and wireless portfolio, along with new HPE Aruba Networking CX 10K distributed services switches, which feature built-in programmable data processing units (DPU) from AMD Pensando to offload security and network services to free up resources for complex AI workload processing.

- Major Investors: Several major companies and strategic investors are actively engaged in the scalable software-defined networking (SDN) market, including leading technology companies, venture capital firms, and networking firms such as VMware, Juniper Networks, Hewlett Packard Enterprise (HPE), Nokia Corporation, Huawei Technologies Co., Ltd., Cisco, and IBM. The investment is driving innovation through advanced product offerings.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 29.11 Billion |

| Market Size in 2026 | USD 37.00 Billion |

| Market Size by 2035 | USD 320.26 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 27.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type/Technology, Component, Application, End-User, Deployment Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type/technology Insights

What Causes the SD-WAN Segment to Dominate the Scalable Software-Defined Networking Market?

SD-WAN: The segment held the largest market share of 36.8% in 2025. The growth of the segment is driven by the widespread adoption of cloud-based services, growing demand for cost-effective network solutions, and increasing need for enhanced security and centralized network management. Conventional WANs often struggle with latency and poor user experience for cloud-based applications, whereas SD-WAN overcomes these issues by allowing direct-to-cloud access at branch locations.

Hybrid SDN: The segment is expected to grow at a remarkable CAGR of 24.4% between 2026 and 2035, driven by its ability to integrate traditional network architectures with software-defined networking capabilities. This approach provides enterprises and service providers with flexibility to support cloud migration, 5G rollout, IoT connectivity, and AI-driven network automation without fully replacing legacy infrastructure. Hybrid SDN models enable organizations to gradually modernize their networks by overlaying centralized control, programmability, and policy automation on existing hardware.

Deployment Mode Insights

Which Segment Dominated by the Deployment Mode in the Scalable Software-Defined Networking Sector in 2025?

On-Premises: The segment is dominating the scalable software-defined networking sector by holding a share of 65.4%, owing to the stringent data privacy laws and increasing need for data control. On-premises deployment mode is preferred where data privacy and compliance are crucial. On-premises allows for full data and security control to manage sensitive workloads, especially in finance, healthcare, and government organizations.

Cloud-Based (SaaS): The segment is the fastest-growing in the scalable software-defined networking industry, with a CAGR of 25.1%. Cloud-based (SaaS) deployment model offering various benefits such as cost-effectiveness (pay-as-you-go), flexibility, and scalability. Cloud-based solutions support remote work, seamless integration with growing hybrid/multi-cloud environments, and eliminate the need for high upfront capital investment. Cloud-based (SaaS) enables seamless integration and management across diverse cloud ecosystems.

End-user Insights

What Causes the Enterprises Segment to Dominate the Scalable Software-Defined Networking Sector?

Enterprises: The segment is dominating the scalable software-defined networking sector by holding a majority share of 48.7%, owing to the increasing need for agility, automation, cost-effectiveness, and high security to support digital transformation, cloud adoption, hybrid work models, and IoT. Several enterprises across various sectors like finance, healthcare, and retail are widely adopting cloud-based (SaaS) for modernization, enhancing operational efficiency, and improving customer engagement.

Service Providers: The segment is the fastest-growing in the scalable software-defined networking market, with a CAGR of 24.6%. Software-defined networking allows telecom providers to efficiently manage escalating data traffic, which includes centralized control, automation, traffic management, and network scalability. Moreover, the increasing need for flexibility, efficiency, traffic management, and supporting the ongoing demands like 5G, cloud services, and IoT are anticipated to drive the segment's growth during the forecast period.

Component Insights

Why Are SDN Solutions/Controllers Dominating the Scalable Software-Defined Networking Market?

SDN Solutions/Controllers: The segment dominates the scalable software-defined networking market, holding a 57.8% share. The growth of the segment is supported by the rising demand for centralized control, network virtualization, and automation. Moreover, the increasing need for cost optimization and smooth integration with cloud services, IoT, and 5G networks is bolstering the segment's expansion during the forecast period.

Services (Integration, Consulting, Support): The segment is the fastest-growing segment in the scalable software-defined networking market and is set to grow at a CAGR of 24.3%, owing to the rising importance of centralized control, the rising need for traffic management, and a surge in network threats that are encouraging businesses to adopt security measures. The services include integration, consulting, and support. Services play a vital role in integrating with the cloud and meeting the needs of digital transformation.

Application Insights

What Has Led the Data Migration Segment to Dominate the Scalable Software-Defined Networking Market?

Data Center Networking: The segment is dominating the scalable software-defined networking market by holding a share of 52.4%. The growth of the data center networking segment is driven by several factors, such as the rising demand for flexible, automated, cost-effective, scalable, and efficient network management for cloud computing and virtualization. Scalable software-defined networking can manage complex network flows and automate operations. The rapid growth of cloud computing and virtualization significantly increase the demand for SDN to efficiently manage dynamic workloads and resources.

Cloud Computing: The segment is the fastest-growing segment of the scalable software-defined networking market, with a growth rate of 25.0%. owing to the rising cloud adoption. Several cloud providers are widely using SDN to optimize their infrastructure. In addition, the rapid digital transformation enables more enterprises to move to the cloud, and software-defined networking becomes crucial for managing hybrid and multi-cloud setups.

Regional Insights

How Big is the North America Scalable Software-Defined Networking Market Size?

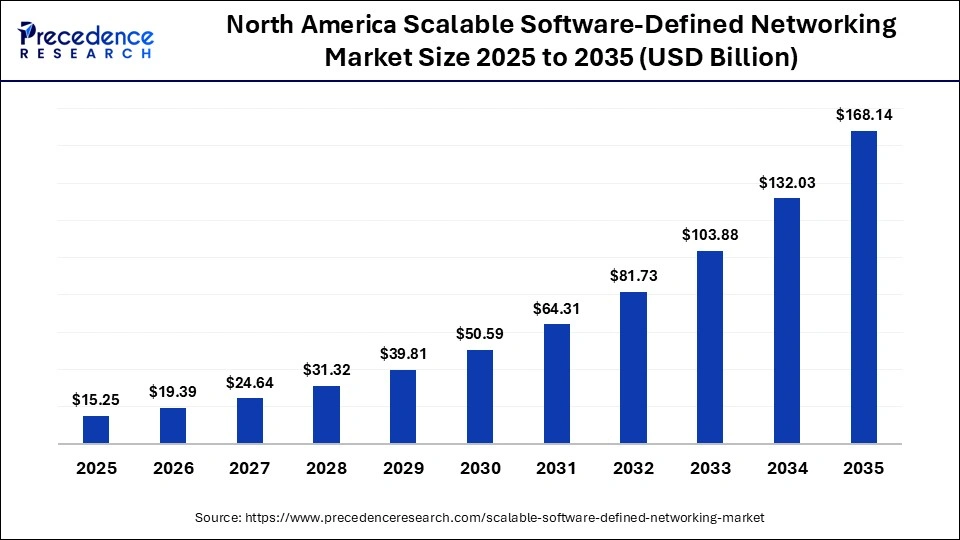

The North America scalable software-defined networking market size is estimated at USD 15.25 billion in 2025 and is projected to reach approximately USD 168.14 billion by 2035, with a 27.13% CAGR from 2026 to 2035.

What Has Led the North America Region to Dominate the Scalable Software-Defined Networking Market?

North America dominates the scalable software-defined networking market, holding a 38% share in 2025, supported by a mature cloud computing ecosystem, strong enterprise IT adoption, and large-scale investments in digital infrastructure. The region benefits from widespread deployment of hyperscale data centers, advanced enterprise networks, and early adoption of programmable networking architectures that rely on SDN for centralized control, automation, and scalability.

The United States and Canada are driving this dominance through expanding 5G infrastructure, edge computing rollouts, and heavy investment in software-defined data centers. Telecom operators, cloud service providers, and large enterprises are increasingly using SDN to manage complex, high-traffic environments, support network slicing, and enable low-latency services.

High-value sectors such as defense, aerospace, automotive, and critical infrastructure further reinforce demand for scalable SDN solutions. These industries require highly secure, resilient, and programmable networks to support autonomous systems, ADAS development, mission-critical communications, and real-time data processing. In parallel, rising R&D funding, government-backed digital modernization programs, and defense contracts are accelerating adoption of AI-enabled SDN platforms, sustaining North America's leadership in the scalable software-defined networking market.

What is the Size of the U.S. Scalable Software-Defined Networking Market?

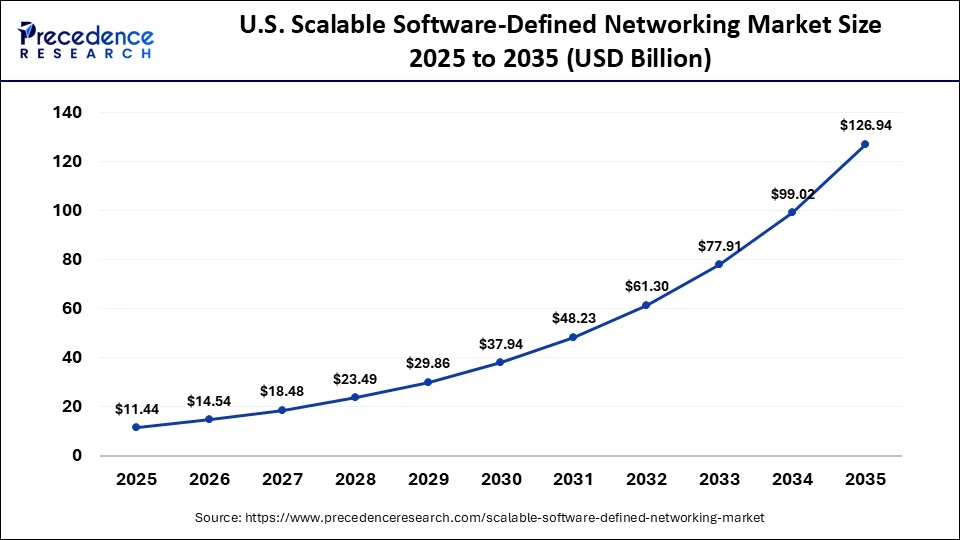

The U.S. scalable software-defined networking market size is calculated at USD 11.44 billion in 2025 and is expected to reach nearly USD 126.94 billion in 2035, accelerating at a strong CAGR of 27.21% between 2026 and 2035.

How Is the United States Transforming the Scalable Software-Defined Networking Market?

The United States is transforming the scalable software-defined networking market. The United States is a major contributor to the market for scalable software-defined networking in the North American region. The country has a massive expansion of data centers for cloud computing, AI, and ML, which drives the demand for FPGAs for accelerating workloads and managing massive data. The country is a global leader in innovation and is home to major FPGA firms such as AMD/Xilinx, Microchip Technology, Lattice, Intel, and others. Moreover, increasing investments in data centers, aerospace, and defense, along with the increasing adoption of AI, autonomous vehicles (ADAS), and 5G tech, are anticipated to foster market growth during the forecast period.

How Is the Asia Pacific Region the Fastest-Growing in the Scalable Software-Defined Networking Market?

Asia Pacific is the fastest-growing region in the scalable software-defined networking market, registering a 26.5% CAGR, driven by rapid digital infrastructure expansion and aggressive network modernization initiatives. Countries such as China, Japan, South Korea, India, and Taiwan are heavily investing in cloud-native data centers, telecom virtualization, and enterprise network digitization, creating strong demand for scalable SDN architectures.

The region's growth is primarily driven by the large-scale rollout of 5G networks, where SDN plays a central role in network slicing, traffic orchestration, and low-latency service delivery. Telecom operators across Asia Pacific are increasingly adopting SDN to manage dense, heterogeneous networks and support rapid growth in mobile data traffic, edge computing, and private 5G deployments.

Asia Pacific is also a global hub for consumer electronics manufacturing, smart city projects, and IoT adoption. The rising deployment of connected devices, industrial automation systems, and AI-enabled applications requires flexible, programmable, and centrally managed networks, accelerating adoption of SDN across enterprises and service providers. This convergence of 5G expansion, cloud adoption, and IoT growth is expected to sustain strong momentum for scalable software-defined networking across the region during the forecast period.

China's Scalable Software-Defined Networking Market Analysis

The country is experiencing significant growth. The country has a well-established presence of prominent semiconductor companies. The country has a large production scale of consumer electronics, especially IoT & smart home devices, smartphones, drones, smart home devices, gaming consoles, TVs, and cameras (advanced image/video processing). The country's growth is supported by the robust digital infrastructure, rapid deployment of 5G networks, rising expansion of the automotive industry, supportive government Initiatives, and high adoption of emerging technologies like AI, ML, and the Internet of Things (IoT).

How Is the European Region Responsible for Growth in the Scalable Software-Defined Networking Market?

The European region holds a substantial share in the scalable software-defined networking market, supported by early and widespread adoption of advanced digital networking technologies across multiple industries. Countries such as Germany, France, and United Kingdom are leading adopters of SDN due to strong investments in 5G deployment, artificial intelligence, and high-performance computing infrastructure that require programmable, low-latency, and highly scalable network architectures.

A sustained surge in R&D expenditure, particularly in automotive, industrial automation, and smart manufacturing, is accelerating demand for SDN-enabled networks that can support real-time data exchange, edge computing, and secure connectivity. Europe's supportive government frameworks for digital transformation, along with strict data protection and network reliability requirements, are further reinforcing adoption of centralized and policy-driven network management models.

In addition, the rapid expansion of aerospace and defense programs across Europe is driving demand for highly secure, software-defined networks capable of supporting mission-critical communications, simulation environments, and distributed command systems. The growing need for network programmability, resilience, and interoperability across civilian and defense applications continues to position Europe as a key market for scalable software-defined networking solutions.

Germany Scalable Software-Defined Networking Market Analysis

Germany scalable software-defined networking market is experiencing significant growth, driven primarily by the robust semiconductor infrastructure, widespread rollout of 5G network infrastructure, and rapid technological advancements such as AI, Machine Learning, and IoT.

The growth of the region is also largely driven by the growing demand in various industries such as automotive (ADAS, infotainment, autonomous driving, sensor fusion), 5G & Telecommunications (high-speed 5G networks), consumer electronics (smartphones, cameras, TVs, and PCs), aerospace & defense (radar, signal processing, flight control, and UAVs), and industrial/IoT (industrial automation).

What Are the Significant Factors Driving the Growth of the Middle East & Africa Region in the Scalable Software-Defined Networking Market?

The scalable software-defined networking market is expected to grow at a notable rate in the Middle East & Africa region, supported by accelerating digital infrastructure development and rising investment in hyperscale and colocation data centers. Countries such as the United Arab Emirates and Saudi Arabia are deploying SDN-enabled architectures to support cloud services, smart city platforms, and government digital transformation programs.

Growth is further attributed to increasing deployment of 5G networks, which require software-defined control for traffic orchestration, network slicing, and latency management. Telecom operators and enterprises in the region are adopting SDN to modernize legacy networks and improve scalability across distributed environments.

Rising demand from sectors such as automotive manufacturing, consumer electronics, energy, and logistics, combined with growing R&D expenditure and rapid adoption of virtualization technologies, is reinforcing SDN uptake. These factors collectively support steady expansion of scalable software-defined networking solutions across the Middle East & Africa region during the forecast period.

South African Scalable Software-Defined Networking Market Analysis

The country is experiencing remarkable growth. The country's growth is driven by the rise in digital transformation and infrastructure upgrades, especially in telecommunication and data processing. The emergence of 5G technology, growing demand for consumer electronics, increasing demand for high-performance computing, and a surge in government-backed funding are anticipated to drive the market's growth in the country. In addition, the rising incorporation of advanced technology, such as AI, cloud computing, autonomous vehicles (ADAS), and IoT, along with the significant growth in data centers, is expected to drive the expansion of the scalable software-defined networking market during the forecast period.

Scalable Software-Defined Networking Market Companies

- Cisco Systems, Inc.

- VMware, Inc

- Juniper Networks, Inc.

- Hewlett Packard Enterprise (HPE)

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Arista Networks, Inc.

- Big Switch Networks (Arista)

- Pluribus Networks

- Pica8, Inc.

- Intel Corporation

- IBM Corporation

- Ciena Corporation

- Dell Technologies, Inc.

- Citrix Systems, Inc.

Recent Developments

- In April 2025, ZeroTier, one of the world's leading software-defined networking companies, announced the launch of a partner program to expand delivery of its next-generation secure networking platform. This new program is designed to empower channel partners, resellers, integrators, and other technology providers to deliver modern networking solutions to their customers.(Source: https://fox59.com)

- In April 2025, at Auto Shanghai 2025, Intel unveiled the second-generation Intel AI-enhanced software-defined vehicle (SDV) system-on-chip (SoC), the automotive industry's first multi-process node chiplet architecture. It is engineered to meet the growing demands of intelligent, connected vehicles. The new SoC provides automakers with scalable performance, advanced AI capabilities, and optimized cost efficiency. Intel also announced new strategic collaborations with leading automotive innovators ModelBest and Black Sesame Technologies to expand Intel's automotive ecosystem and accelerate innovation in AI-powered cockpits, integrated advanced driver-assistance systems (ADAS) solutions, and energy-efficient vehicle compute platforms.(Source: https://newsroom.intel.com)

Segments Covered in the Report

By Type/Technology

- SD-WAN

- Open SDN (OpenFlow-based)

- SDN via API (Programmable network using vendor APIs)

- SDN via Overlay (VXLAN/GRE/NVGRE overlays)

- Intent-Based & Policy-Driven SDN

- Hybrid SDN

By Component

- SDN Solutions/Controllers

- Services (Integration, Consulting, Support)

- Infrastructure (Switches, Routers, NICs)

By Application

- Data Center Networking

- Cloud Computing

- Network Virtualization

- Campus Networks

- Security & Micro-Segmentation

By End-User

- Enterprises

- Service Providers

- Government & Public Sector

- Education

By Deployment Model

- On-Premises

- Cloud-Based (SaaS)

- Hybrid

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting