What is the Solid Rocket Engine Market Size?

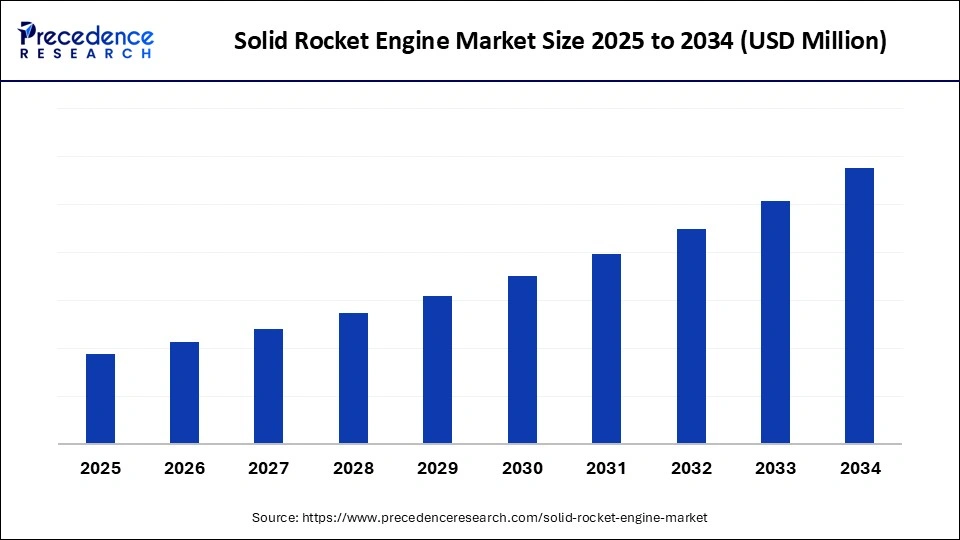

The global solid rocket engine market is witnessing steady growth as governments and private players invest in dependable, quick-launch propulsion systems for defense, satellites, and deep-space missions.The market is growing due to increasing demand for reliable propulsion systems in defense applications and expanding satellite launch programs.

Solid Rocket Engine Market Key Takeaways

- North America dominated the solid rocket engine market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By platform, the ballistic missiles segment captured the biggest market share of 45% in 2024.

- By platform, the small-launch vehicle motors segment is expected to grow at the fastest CAGR during the forecast period.

- By propellant type, the composite propellant segment contributed the highest market share of 60% in 2024.

- By propellant type, the composite modified double base (CMDB) segment is projected to grow at the fastest rate in the solid rocket engine market.

- By thrust/size, the medium-sized segment held the maximum market share of 50% in 2024.

- By thrust/size, the small tactical engines segment is the fastest-growing during the forecast period.

- By end use, the government & defense segment accounted for the significant market share of 70% in 2024.

- By end use, the space & commercial launch segment is emerging as the fastest growing during the forecast period.

- By manufacturing model, the OEM defense primes segment generated the major market share of 55% in 2024.

- By manufacturing model, the new-space startups segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

The solid rocket engine market is witnessing steady growth, driven by the need for dependable and affordable propulsion systems, growing investments in defense modernization, and rising demand for satellite launches. Due to their ease of use, high thrust-to-weight ratio, and ability to operate in harsh environments, solid rocket engines are commonly found in tactical defense systems, space launchers, and missiles. Market adoption is also being accelerated by government efforts to fortify space exploration programs and the increased focus on rapid response defense capabilities. Furthermore, improvements in propellant formulations and materials are enhancing the effectiveness and efficiency of solid rocket engines, making them a vital component of both commercial and military aerospace applications.

- In August 2025, L3Harris Technologies unveiled a new expanded facility for manufacturing inert solid rocket motor components, investing $20 million in upgrading capacity.(Source: https://aviationweek.com)

How Are Advancements in Additive Manufacturing Shaping the Solid Rocket Engine Market?

Additive manufacturing is significantly transforming the solid rocket engine market by enabling much faster development cycles, reducing complexity, reducing production and lead times, and allowing for more optimized designs. Companies can quickly iterate and produce parts or entire engines that would be difficult or too expensive to make using traditional manufacturing methods, thanks to techniques like laser power bed fusion and 3D printing of high-performance alloys. This is helping new entrants compete with established propulsion manufacturers, cutting costs and speeding up innovation.

- In July 2025, Ursa Major launched a multi-year licensing agreement with Syndrite to use its LPBF software and tooling for metal additive manufacturing of high-performance rocket propulsion systems. (Source: https://www.prnewswire.com)

Solid Rocket Engine Market Growth Factors

- Defense Modernization: Rising investments in advanced missile systems are boosting demand for solid rocket engines.

- Satellite Launches: Growing satellite deployment needs strong, reliable boosters.

- Propellant Innovations: New formulations improve efficiency, thrust, and safety.

- Private Space Growth: Emerging space companies rely on cost-effective solid propulsion.

- Additive Manufacturing: 3D printing and advanced materials cut costs and enhance performance.

- Cost-Effectiveness: Solid rocket engines are simpler and cheaper to produce compared to liquid propulsion systems.

- High Reliability: Their proven track record in extreme conditions ensures widespread defense and space adoption.

- Government Space Programs: Increased funding for exploration and satellite missions is driving demand.

- Rapid Response Capability: Solid propulsion allows quick launch readiness, crucial for defense applications.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform / Product Type, Propellant Type / Chemistry, Thrust / Size Class, End-Use / Customer, Manufacturing / Supply Model, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Defense Expenditure

Solid rocket engines are crucial to the high thrust and reliability of advanced missile systems and tactical weapons, which are in high demand due to the increasing global defense budgets. To maintain technological superiority and enhance national security, nations are investing in the modernization of their defense capabilities. The U.S. clearly shows this trend, where firms like General Dynamics and Lockheed Martin are increasing production to satisfy military requirements, leading to growth in the solid rocket engine market. For example, in response to the increasing demand, General Dynamics has started producing solid rocket motors in Arkansas.

- In August 2024, Lockheed Martin & General Dynamics announced a strategic teaming agreement to produce solid rocket motors to enhance domestic supply chain resilience.(Source: https://news.lockheedmartin.com)

Technological Advancements

Advances in manufacturing processes, materials, and propellant formulations are improving solid rocket engines' efficiency and performance. Innovations such as high-strength alloys and additive manufacturing are driving improvements in reliability and reducing production costs. Agnikul Cosmos, for instance, has demonstrated the potential of contemporary manufacturing techniques by creating the largest single-price 3D printed Inconel rocket engine in the world.

- In August 2025, Agnikul Cosmos unveiled the world's largest single-piece 3D printed Inconel rocket engine and secured a U.S. patent for its design and manufacturing process.(Source: https://www.voxelmatters.com)

Restraints

Supply Chain and Material Availability Issues

The cost and availability of vital components, such as propellants and specialty metals, present challenges for the solid rocket engine market. Trade restrictions, supply chain disruptions, and geopolitical unrest can all impact the timely acquisition of these materials, leading to delays and increased production costs. Consider that the U.S. has encountered supply issues because of its dependence on single-source vendors for some parts.

- In December 2024, Northrop Grumman addressed supply chain concerns by diversifying its supplier base and investing in domestic production capabilities for solid rocket motor components.(Source: https://dsiac.dtic.mil)

Defense Modernization Programs

The cost, storage life, and logistical benefits of solid motor-based artillery rocket tactical missile systems and modern rockets continue to receive top priority in national defense budgets worldwide. If qualification delivery and security-cleared manufacturing requirements are met, this results in predictable procurement pipelines. To increase addressable spend and lower qualification complexity, suppliers should aim for modular designs that work with multiple platforms. Important competitive differentiators include establishing rapport with primes, fulfilling MIL-spec testing, and maintaining surge production capacity. Offer local production or offset options to nations seeking to develop their own defense capabilities, some of which may be through.

Opportunities

Growing Demand from Small Satellites & Launch Vehicles

The need for affordable high-thrust solid rocket engines is increasing due to the rise in small satellite launches and specialized small launch vehicles. Boosters and upper stages prefer these motors because they are dependable, easy to use, and quicker to prepare than liquid systems. Businesses that create modular standardized SRMs can land long-term agreements with satellite operators. Given that constellations need to be launched frequently, the demand curve is anticipated to continue rising. For vendors who can provide both performance and quick turnaround, this is a great opportunity.

Aftermarket Services & Modular Components

Beyond manufacturing motors, there are numerous opportunities to offer certified testing services, igniter nozzle upgrades, and modular SRM kits. As a result, suppliers can strengthen their relationships with customers and generate steady income streams. Even after initial sales, providing maintenance and refurbishment services guarantees continued engagement. Businesses that manufacture plug-and-play motor parts with a standardized interface will be distinguished. Particularly appealing to smaller launch companies with constrained internal resources is the aftermarket focus.

Platform Insights

Why Did Ballistic Missiles Dominate the Solid Rocket Engine Market in 2024?

Ballistic missiles remain the dominant platform for solid rocket engines due to established procurement pipelines, standing defense budgets, and the strategic significance of solid propellant boosters for missile readiness and storage life. They are the solid rocket engine industry's dependable backbone due to their large unit values, consistent government funding, and legacy designs and logistical familiarity. Moreover, modernization initiatives and missile defense strategies are further fueling the segment's dominance.

Small-launch vehicle motors are the fastest-growing segment as the need to launch constellations and small satellites grows quickly. These vehicles appeal to new-space companies and commercial players because they provide flexible and affordable launch options. Due to the increasing trend of satellite miniaturization and the need for quick deployment, small-launch motors offer flexible and scalable solutions. Space commercialization is one of the most dynamic market segments, and its growth is being accelerated by increased private investments and government support.

Propellant Type Insights

Why Did the Composite Propellant Segment Dominate the Solid Rocket Engine Market in 2024?

Composite propellant dominates the solid rocket engine market because, in comparison to conventional propellants, it provides better performance, a higher energy output, and ease of manufacturing. Its extensive use has been guaranteed by its adaptability in both space and military applications. The material can be modified to meet various thrust requirements, which increases its suitability for use in a variety of rockets and missiles. Its function as the foundation of solid propulsion systems is also being strengthened by developments in propellant chemistry, which are increasing efficiency.

The composite modified double base (CMDB) is the fastest-growing segment in the solid rocket engine market because it combines the benefits of double-base and composite propellants. Due to its superior energy density, stability, and high performance, it is ideal for next-generation missile systems. The increasing demand for sophisticated weapons with higher payload capacities and longer ranges drives this market. Additionally, continued research into better CMDB formulations is probably going to hasten the aerospace and defense industries' adoption of this technology.

Thrust/Size Insights

Why Did the Medium-Sized Segment Dominate the Solid Rocket Engine Market in 2024?

Medium-sized solid rocket engines dominate the market as they strike a balance between power, cost, and operational flexibility. These engines are widely used in tactical missiles, medium-lift launch vehicles, and defense systems. Their ability to provide reliable propulsion for diverse missions ensures sustained demand. Additionally, increasing government defense budgets and the need for versatile missile systems are strengthening this segment's leadership in the market.

Small tactical engines are the fastest-growing thrust category due to their widespread application in small launchers, portable defense systems, and short-range missiles. The use of lightweight rapid-response propulsion systems has increased due to growing worries about border security and regional conflicts. The increasing deployment of unmanned systems that need compact propulsion solutions further supports the demand. The quick expansion of this market is still being driven by its operational agility and cost-effectiveness.

End Use Insights

Why Did the Government & Defense Segment Lead the Solid Rocket Engine Market in 2024?

Government & defense led the end-user segment due to the important part solid rocket engines play in national defense plans and missile programs. Global defense organizations continue to fund space defense initiatives, deterrence systems, and missile modernization. Solid propulsion is essential for military applications, which guarantees a steady flow of funding. Additionally, partnerships between governments and defense prime ministers uphold this dominance by guaranteeing deployment readiness and technological advancement.

The space & commercial launch segment is the fastest growing, driven by plans for satellite deployment and the growth of private space firms. For quick and affordable satellite launches and space exploration missions, solid rocket engines are being utilized increasingly. The market is expanding more quickly due to the rise in demand for low-Earth orbit (LEO) satellites for navigation, Earth observation, and communications. Opportunities for the expansion of commercial space are also being created by new competitors and policies that encourage them.

Manufacturing Model Insights

Why Did the OEM Defense Primes Segment Dominate the Solid Rocket Engine Market in 2024?

OEM defense primes registered their dominance over the market in 2024 as they possess the infrastructure, resources, and long-standing expertise to produce advanced solid rocket engines. Their established government contracts and defense partnerships ensure a steady demand pipeline. These companies also lead in R&D investment, ensuring innovation and consistent product quality. Their strategic collaborations with international defense agencies further consolidate their market dominance.

New-space startups are the fastest growing, propelled by their cost-effective solutions and creative approaches to solid propulsion. These companies' emphasis on rapid prototyping and small satellite launches is reshaping the sector. Their competitive advantage stems from their ability to quickly adopt new materials and manufacturing techniques like additive manufacturing. The growth trajectory of private space initiatives is being accelerated by the government's support and the infusion of venture capital.

Regional Insights

Why did North America dominate the market in 2024?

North America dominates the solid rocket engine market due to its robust space exploration program, sophisticated defense infrastructure, and significant industry participants. The U.A. leads in space launches and defense missile programs, guaranteeing a strong need for reliable rocket propulsion. The region's leadership is further reinforced by government-sponsored programs like the Department of Defense's missile modernization and NASA's Artemis program. Its dominance is strengthened through ongoing innovation and partnerships with private companies.

Asia Pacific is growing rapidly, driven by ambitious space programs, worries about regional security, and rising defense spending. Further propelling adoption is the rising need for independence in defense and domestic space projects. Cooperative private companies and supportive government policies are accelerating the region's growth in the solid rocket engine market. The fast industrialization and growing demand for satellite-based services are also influencing its growth trajectory.

Solid Rocket Engine Market Companies

- Northrop Grumman

- L3Harris Technologies

- Aerojet Rocketdyne

- Nammo

- Lockheed Martin

- Raytheon Technologies (Raytheon Missiles & Defense)

- BAE Systems

- MBDA

- Avio

- Roketsan

- Avibras

- Mitsubishi Heavy Industries (MHI)

- CASIC (China Aerospace Science & Industry Corporation)

- Ursa Major Technologies

- Anduril Industries

- General Dynamics

- NPO

- Propulsion-specialist SMEs

Recent Developments

- In August 2025, Anduril Industries became the third U.S. supplier of solid rocket motors, breaking a decades-long duopoly held by L3Harris and Northrop Grumman. Anduril launched a $75 million SRM manufacturing facility in McHenry, Mississippi, employing over 100 people and aiming to produce 6,000 tactical SRMs annually by 2026.(Source: https://www.reuters.com)

- In August 2025, Ursa Major completed successful static fires of a new extended-range 2.75-inch solid rocket motor in collaboration with BAE Systems. The motor, featuring Highly Loaded Grain propellant technology, is set for a flight test demonstration in fall 2025.(Source: https://www.ursamajor.com)

- In July 2025, L3Harris Technologies announced plans to build more than 20 new large solid rocket motor manufacturing facilities in Calhoun County, Arkansas. The new campus will create 50 new jobs over two years, adding to L3Harris' approximately 1,300-person workforce in Camden.(Source: https://www.arkansasedc.com)

Segments Covered in the Report

By Platform / Product Type

- Ballistic Missiles (SRM stages)

- Cruise / Tactical Missile Motors

- Rocket Artillery / MLRS Motors

- Launch Vehicle Boosters & Strap-ons (space launch)

- Sounding Rockets / Suborbital Motors

- Small Launch Vehicle Motors / Kick Stages

By Propellant Type / Chemistry

- Composite Propellant (AP/HTPB)

- Double-Base Propellant (nitrocellulose/nitroglycerin)

- Composite Modified Double-Base (CMDB) / Advanced blends (aluminum-loaded, energetic additives)

- Hybrid (solid fuel + liquid/oxidizer niche)

By Thrust / Size Class

- Small Tactical (kN range man-portable rockets, small missiles)

- Medium (artillery/MLRS)

- Large (ICBM/SLBM and large booster segments)

- Upper-stage / Kick motors (lower thrust, longer burn)

By End-Use / Customer

- Government & Defense (ballistic & tactical missiles, rocket artillery)

- Space & Commercial Launch (boosters, strap-ons, small-launch vehicles)

- Test & Research (sounding rockets, suborbital research)

- Industrial (specialty motors for emergency systems, ejection systems)

By Manufacturing / Supply Model

- OEM defence primes (in-house manufacture or long-term contracts)

- Specialized SRM manufacturers/propulsion houses (tier suppliers)

- New-space/Startups (vertical integration for small launchers)

- Government-owned/strategic facilities (in some countries)

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting