Specialty and High Performance Films Market Size and Forecast 2025 to 2034

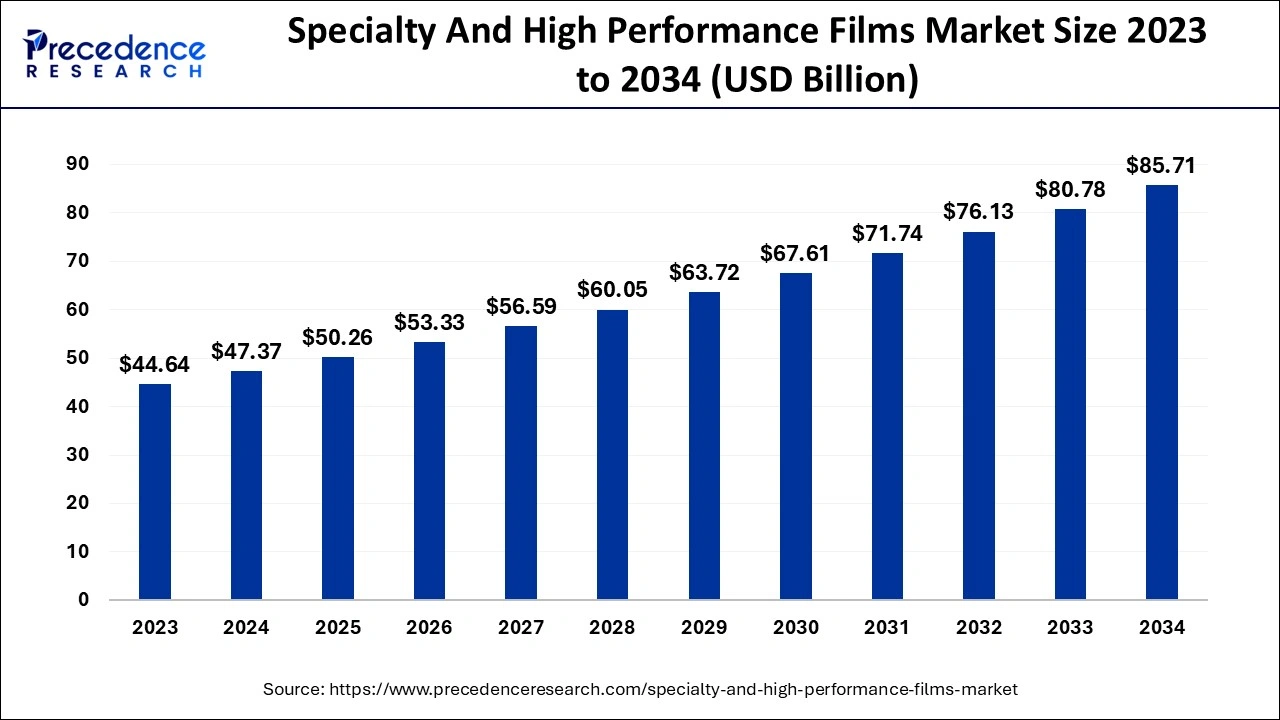

The global specialty and high-performance films market size was calculated at USD 47.37 billion in 2024 and is projected to surpass around USD 85.71 billion by 2034, expanding at a CAGR of 6.11% from 2025 to 2034. Advancements in materials science are the key factor driving market growth. Innovations in film manufacturing techniques, along with increasing regulatory pressures, are also fuelling market growth.

Specialty and High-Performance Films Market Key Takeaways

- The global specialty and high-performance films market was valued at USD 47.37 billion in 2024.

- It is projected to reach USD 85.71 billion by 2034.

- The specialty and high-performance films market is expected to grow at a CAGR of 6.11% from 2025 to 2034.

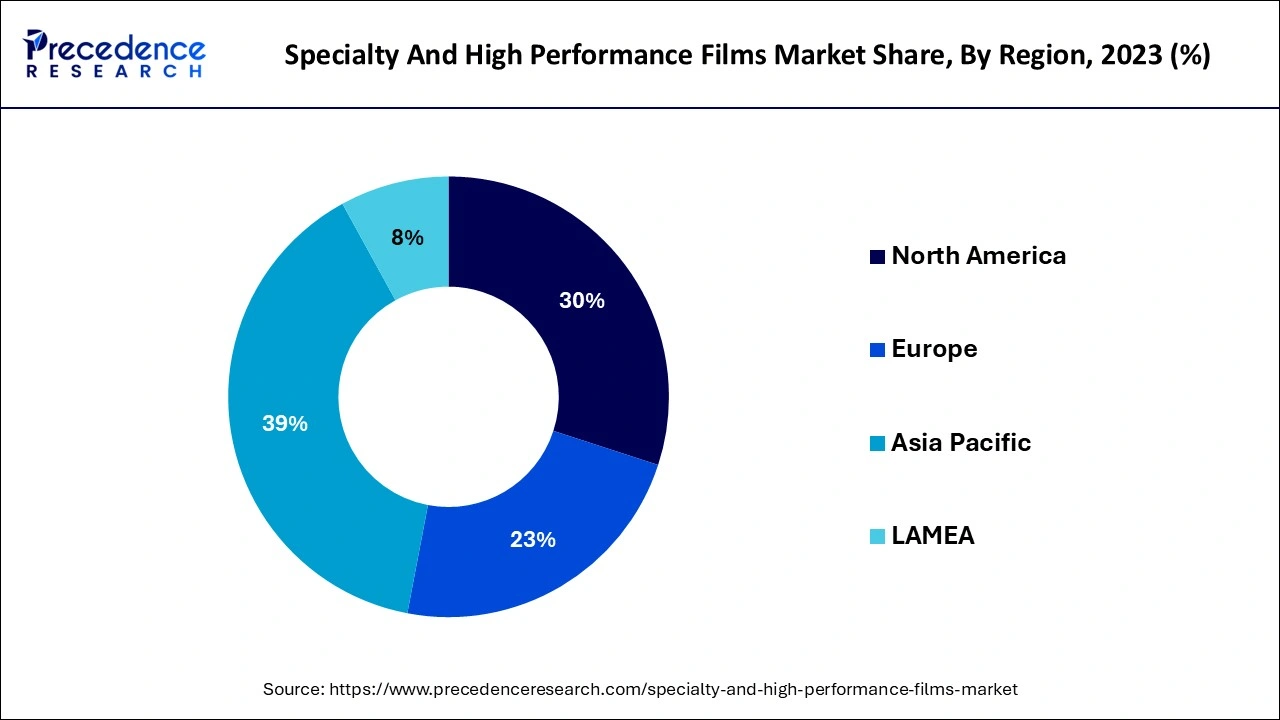

- Asia Pacific dominated the specialty and high-performance films market with the largest market share of 39% in 2024.

- North America held a significant share of the market in 2024.

- By product, the polyester segment accounted for the highest market share of 69% in 2024.

- By product, the polycarbonate segment is projected to grow at a notable CAGR of 7.41% over the forecast period.

- By application, the barrier segment dominated the market in 2024.

- By application, the decorative segment is anticipated to grow at a significant rate over the studied period.

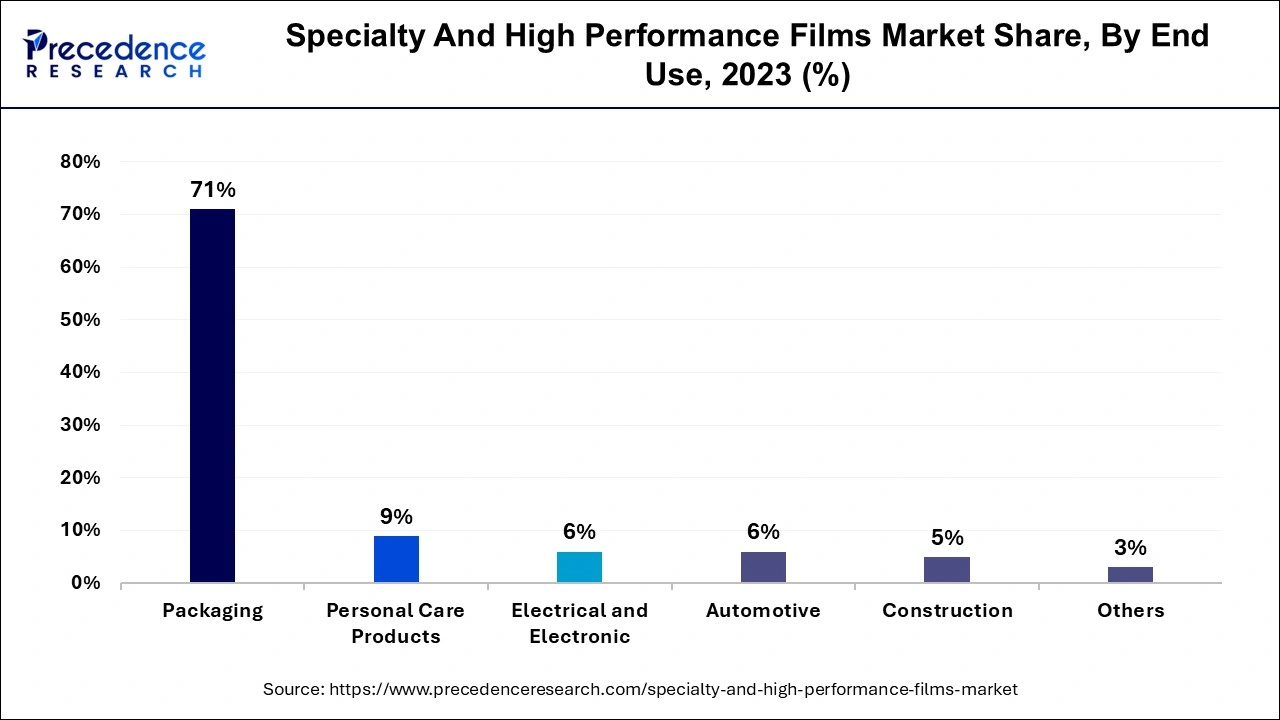

- By end use, the packaging segment accounted for the highest market share of 71% in 2024.

- By end use, the construction segment is expected to grow at the fastest rate during the projected period.

Impact of AI on Specialty and High-Performance Films Market

AI is transforming the market significantly due to its ability to process data. The implementation of AI-driven analytics has streamlined production operations, increased efficiency, and decreased costs. AI integration in materials science impels the development of innovative film properties and customization. Furthermore, AI ensures scalability and consistent quality in the production process, driving the specialty and high performance films market growth over the forecast period.

- In June 2024, Evertis launched the Evercare brand, set to be a major provider of specialty and innovative medical-grade films created to offer superior performance and support regulatory compliance to the healthcare market.

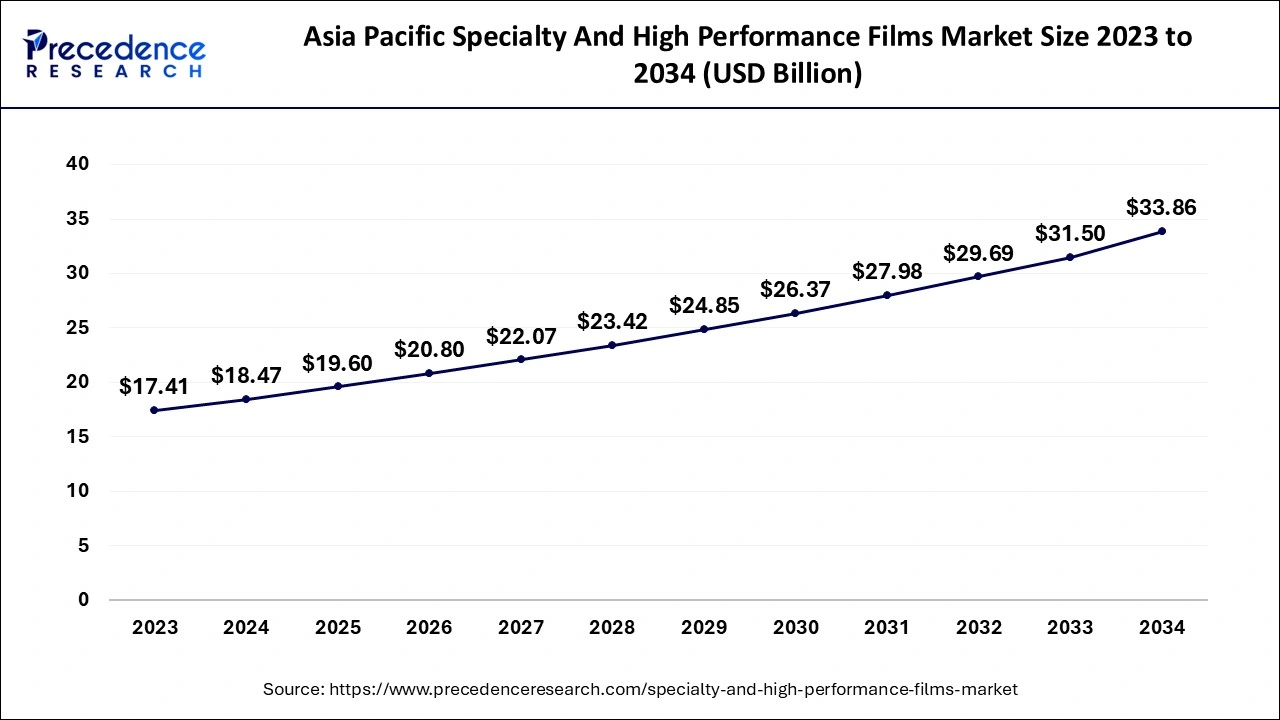

Asia Pacific Specialty and High Performance Films Market Size and Growth 2025 to 2034

The Asia Pacific specialty and high-performance films market size is evaluated at USD 18.47 billion in 2024 and is projected to be worth around USD 33.86 billion by 2034, growing at a CAGR of 6.25% from 2025 to 2034.

Asia Pacific dominated the specialty and high performance films market in 2024. The dominance of the segment can be attributed to the rising need for innovative building materials, such as protective films and efficient glazing for construction applications. Furthermore, developing countries in the region, like China, India, and others, experience substantial growth in the packaging industry, such as food & beverage packaging, which can impact market growth positively.

- In July 2024, Elementis, a top name in specialty chemicals for paints, coatings, and industrial applications in China, is expanding its commitment to the region. This initiative focuses on the company's innovative NiSAT (Non-Ionic Synthetic Associative Thickeners) technology.

North America held a significant share of the specialty and high-performance films market in 2024. The growth of the region can be driven by increasing demand for specialty films that provide improved performance properties, including flexibility, durability, and resistance to atmospheric factors. However, technological advancements and a surge in demand for specialty films in industries like automotive and electronics are driving the market growth.

Market Overview

The specialty and high performance films market covers a wide range of innovative materials designed to fulfill particular technical and functional demands across different industries. These films are created to offer exceptional features like flexibility, durability, and thermal resistance. Film applications range from the medical sector to electronics and packaging, where efficiency and reliability are important as industries continue to develop the requirements for advanced film solutions that improve sustainability and product efficiency, which impact market growth positively.

10 Biggest Construction Companies in the World (2024)

| Companies | Revenue in billions |

| ACS Actividades de Construcción y Servicios S.A. | €39 billion |

| HOCHTIEF | €21.1 billion |

| Vinci | €48.05 billion |

| China Communications Construction Group Ltd. | $79.8 billion |

| Bouygues | €35.55 billion |

| Strabag | €15.7 billion |

| Power Construction Corp | ¥347.7 billion |

| China State Construction Engineering Corporation (CSCEC) | ¥203 billion |

| Skanska AB | KR160.3 billion |

| Ferrovial | $13 billion |

Specialty and High Performance Films MarketGrowth Factors

- The growing need for lightweight, durable materials is expected to boost market growth soon.

- Manufacturers are emphasizing developing films that meet industry standards, which can propel specialty and high performance films market growth shortly.

- Rising investments in research and development will likely contribute to the market expansion further.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 85.71 Billion |

| Market Size in 2024 | USD 47.37 Billion |

| Market Size in 2025 | USD 50.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.11% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising demand for packaging applications

The specialty and high performance films market is witnessing significant growth due to the increasing demand for advanced packaging solutions across different industries, such as pharmaceuticals, food, and consumer goods. Additionally, these films provide improved barrier characteristics, ensuring increased shelf life and product safety, which are necessary for controlling quality and decreasing material waste. Also, there is a growing consumer preference for eco-friendly and sustainable products, which is driving producers to utilize environmentally friendly practices.

- In March 2024, TOPPAN Inc. Group company India-based TOPPAN Speciality Films Private Limited (TSF) designed GL-SP, a barrier film that utilizes biaxially oriented polypropylene (BOPP) as the substrate and will further launch production and sales.

- In July 2024, Innovia Films, a material science pioneer and a major manufacturer of BOPP films, announced the launch of a white ultra-low-density film that was specifically designed to be a good fit for ice cream flow wrap packaging.

Restraint

High competition from alternatives

The market confronts huge competition from alternative materials, including metal, glass, and traditional plastics, which may provide reduced costs and a well-established market presence. However, this competition can negatively impact growth opportunities and the share of specialty films, especially in cost-sensitive applications.

Opportunity

Rise in new installation of photovoltaic systems

There has been a surge in photovoltaic electricity generation, which is expected to fuel the demand for specialty and high-performance films in the market. Specialty films are compatible with both flexible and rigid thin-film photovoltaic modules and act as a base for highly functional barrier layers. Furthermore, these films offer excellent mechanical properties and dielectric strength and also provide environmental resistance. The new installation projects for this system can propel speciality and high performance films market growth.

- In November 2023, Netherlands-based Mito Solar, a developer of high-end custom solar modules, unveiled Skylar, a film that enhances the efficiency of specialty PV modules as a power transformation efficiency booster. The product was onboard several of the top Challenger class finalists in this year's Bridgestone World Solar Challenge.

Product Type Insights

The polyester segment led the specialty and high performance films market in 2024. The dominance of the segment can be attributed to the increasing utilization of these films as substrates for displays, circuits, and touchscreens because of their high thermal stability and electrical insulation properties. Additionally, the rapid evolution in the electronics industry, which is distinguished by the development of more compact and innovative devices, will shortly boost the demand for high-performance polyester films.

The polycarbonate segment is anticipated to show the fastest growth over the forecast period. The growth of the segment can be linked to the superior optical clarity and impact resistance properties offered by these films. Which makes them compatible for use in electronic displays and protective coatings. Furthermore, the rising adoption of sustainable building practices from the construction industry can facilitate the use of polycarbonate films in the specialty and high performance films market.

- In November 2022, Petrochemical manufacturer SABIC unveiled the launch of a polycarbonate-based copolymer resin well-suited for photovoltaic connector bodies.SABIC claims that this specialty resin surpasses competitive materials such as polyphenylene ether (PPE), glass-reinforced nylon, and standard PC.

- In June 2023, A Multi-national producer of Methacrylate, Rhm, signed the Sale and Purchase contract for the acquisition of Functional Forms, the polycarbonate-based films and sheet business unit of SABIC.

Application Insights

The barrier segment dominated the specialty and high-performance films market in 2024. This is because the rising use of barrier films in photovoltaic systems and flexible packaging markets like food packaging is promoting this segment's expansion. Moreover, increasing consumer preferences for longer-lasting and convenience products continue to stimulate the demand for high-performance barrier films through the projected period.

The decorative segment is anticipated to grow at a significant rate over the studied period. The growth of the segment can be driven by the rising trend towards customizable and modern interiors, along with the need for cheap design solutions, which propels the adoption of decorative films in interior design and architecture. Also, Decorative films are extensively used in architectural applications such as wall coverings, surface finishes, and window film because of their ability to offer stylish improvements.

End Use Insights

In 2024, the packaging segment dominated the specialty and high-performance films market by holding the largest market share. The dominance of the segment can be credited to the increasing use of these films in packaging due to their durability and barrier properties, improving the shelf life of goods. Moreover, in the food market film packaging keeps the food fresh for a longer duration of time and prevents food wastage.

- In July 2024, Trinseo, a specialty materials solutions provider, announced the launch of LIGOS A 9200, an acrylic waterborne adhesive created for the dry lamination of flexible packaging structures that meet food.

The construction segment is expected to grow at the fastest rate in the specialty and high-performance films market during the projected period. These films are utilized in architectural facades, surface coverings, and decorative window films to create modern and unique designs. Also, the construction segment uses these films to determine structural reinforcement characteristics and weather resistance for buildings. Designers and architects also seek advanced paths to achieve aesthetically appealing spaces.

Specialty and High-Performance Films Market Companies

- BASF SE

- Clariant AG

- Albemarle Corporation

- Songwon Industrial Co., Ltd.

- Nouryon

- LANXESS AG

- Evonik Industries AG

- Kaneka Corporation

- The Dow Chemical Company

- ExxonMobil Corporation

Recent Developments

- In May 2024, Clariant AG launched a range of advanced solutions at NPE 2024 to significantly decrease the environmental impact of plastics, especially in specialty and high-performance films.

- In January 2024, LANXESS unveiled a sustainability film underscoring its commitment to sustainable practices within the specialty and high-performance films sector. This film specifies how the company combines sustainability into its production processes.

- In January 2023, Covestro and LANXESS joined forces to greener raw materials, resulting in a yearly decrease of up to 120,000 tons in CO2 footprint

- In October 2022, Toppan unveiled a new product of GL Barrier brand products focused on transparent barrier films by creating new polypropylene (PP) mono-material barrier packaging with outstanding heat and water resistance.

- In September 2022, Jindal launched new high-barrier Ethy-Lyte films, which can be utilized in the flexible packaging market as PE printing films for recyclable mono-PE structures.

Segments covered in the report

By Product

- Polyester

- Nylon

- Fluoropolymer

- Polycarbonate

- Others

By Application

- Barrier

- Safety and Security

- Decorative

- Microporous

- Others

By End Use

- Packaging

- Personal Care Products

- Electrical and electronic

- Automotive

- Construction

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting