What is Sterilization Consumables Market Size?

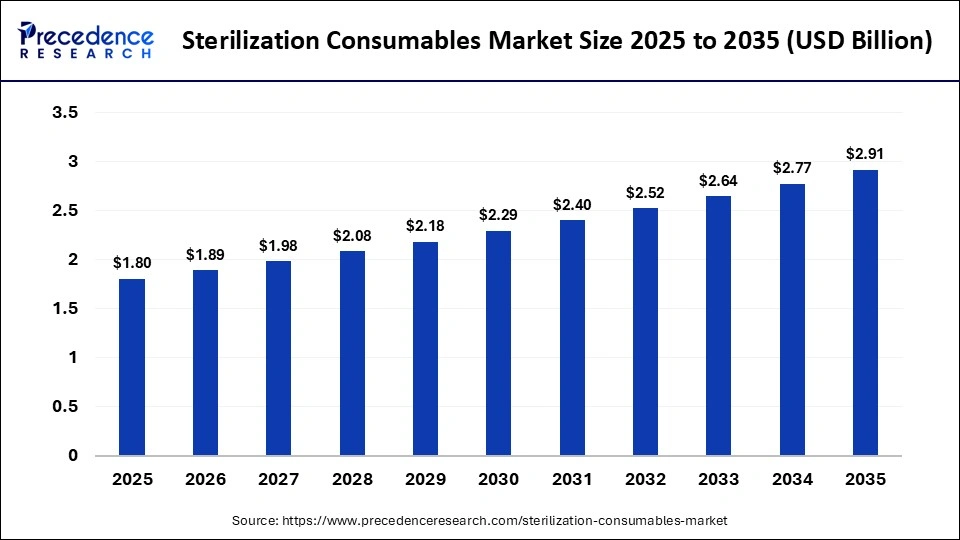

The global sterilization consumables market size was calculated at USD 1.80 billion in 2025 and is predicted to increase from USD 1.89 billion in 2026 to approximately USD 2.91 billion by 2035, expanding at a CAGR of 4.92% from 2026 to 2035. The sterilization consumables market is driven by the growing focus on infection control and patient safety across healthcare settings.

Market Highlights

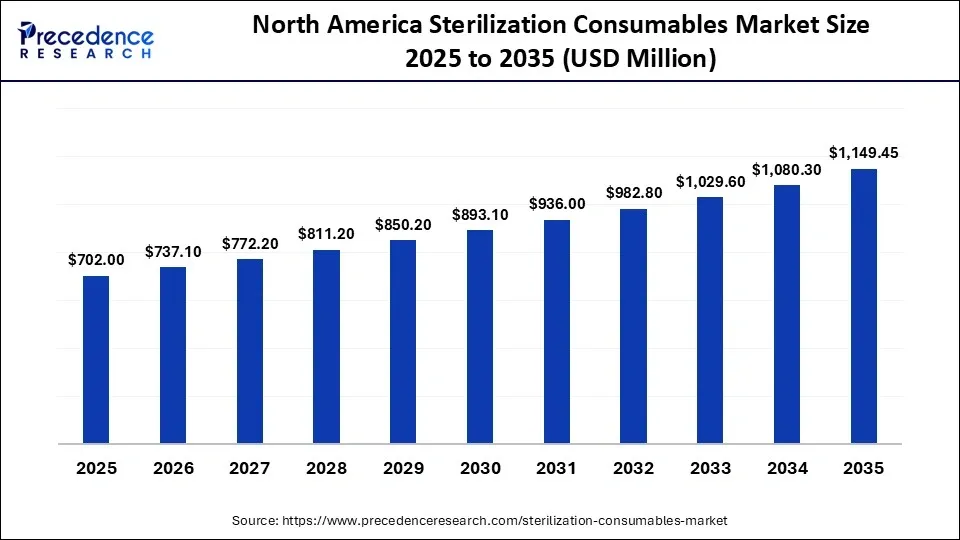

- By region, North America dominated the global sterilization consumables market, accounting for 39% of the market in 2025.

- By region, Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product type, the biological sterilization indicators segment held a dominant position in the market by capturing a share of 28% in 2025.

- By product type, the sterilization pouches & wraps segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By technology/sterilization method, the steam/autoclave sterilization consumables segment accounted for a major revenue share of 42% in the market in 2025.

- By technology/sterilization method, the low-temperature sterilization consumables segment is expected to grow at the highest CAGR during the studied years.

- By end-user, the hospitals & surgery centers segment led the global market with a share of 56% in 2025.

- By end-user, the ambulatory surgical centers segment is expected to expand rapidly in the market in the coming years.

- By sales/distribution channel, the direct OEM / manufacturer sales segment registered dominance in the global market by holding a share of 45% in 2025.

- By sales/distribution channel, the online / e-commerce platforms segment is expected to witness the fastest growth in the upcoming period.

Market Overview

The sterilization consumables market is expanding due to an increasing emphasis on infection control and patient safety across healthcare, life sciences, and industrial sectors. Rising surgical procedures, hospital-acquired infections, and strict regulatory sterilization requirements are boosting the demand for single-use consumables. Healthcare facilities are increasingly adopting disposable products like sterilization wraps, indicator strips, and disinfectants to prevent cross-contamination. Moreover, the growth of pharmaceutical manufacturing, medical device production, and laboratory research further drives the market growth.

Sterilization Consumables Market Trends

- The growing utilization of single-use products, including disposable sterilization consumables, by healthcare institutions to reduce the possibility of cross-contamination and standardize infection control and patient safety protocols.

- The demand for advanced sterilization indicators is rising due to the critical need for accurate monitoring, validation, and record-keeping of sterilization cycles across different sterilization technologies.

- The shift toward low-temperature sterilization for heat-sensitive medical equipment is driving demand for compatible consumables, including specialized indicators, wraps, and packaging products.

- The increasing regulatory and compliance requirements worldwide are boosting demand for certified sterilization consumables that offer traceability, quality assurance, and adherence to proper sterilization protocols.

- The expansion of healthcare infrastructure in emerging economies is driving the demand for sterilization consumables, as these products are essential for preventing infections and supporting routine clinical procedures.

How is AI Impacting the Sterilization Consumables Market?

Artificial Intelligence is significantly transforming the sterilization consumables market by improving efficiency, accuracy, and regulatory compliance. Machine learning algorithms assist in forecasting equipment maintenance and consumable replacement cycles and minimizing downtime and interruptions to the process. Hospitals and laboratories heavily use AI-driven tracking and documentation systems to enhance the traceability of sterilization consumables to aid regulatory and audit compliance. Additionally, smart inventory management uses AI to predict required supplies, such as indicator strips, pouches, and disinfectants, based on procedure volumes and historical usage patterns.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.80 Billion |

| Market Size in 2026 | USD 1.89 Billion |

| Market Size by 2035 | USD 2.91 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product Type,Technology / Sterilization Method,End-User,Sales / Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Did the Biological Sterilization Indicators Segment Hold a Major Share of the Sterilization Consumables Market?

The biological sterilization indicators segment held a major market share of 28% in 2025. This is because of the ability of biological indicators, such as spore strips and self-contained vials, to directly determine microbial inactivation, which makes them the gold standard for sterilization assurance. Their popularity is strengthened by stringent regulatory provisions in hospitals, pharmaceutical manufacturing, and the production of medical devices. Also, the growing knowledge of hospital-acquired infections and the growing number of surgical operations have intensified the demand for biological sterilization indicators.

The sterilization pouches & wraps segment is expected to grow at the fastest CAGR in the market between 2026 and 2035. The growth of the segment is driven by their compatibility with multiple sterilization methods, including steam, ethylene oxide, and low-temperature systems. Rising surgical volumes, outpatient procedures, and the shift toward minimally invasive surgeries are boosting demand for effective instrument packaging. Additionally, innovations in packaging materials with better barrier properties and improved seal integrity are further accelerating adoption.

Technology / Sterilization Method Insights

Why Did the Steam / Autoclave Sterilization Consumables Segment Lead the Sterilization Consumables Market?

The steam/autoclave sterilization consumables segment led the global market, accounting for 42% of the market in 2025. This is because steam sterilization is regarded as the most economical and environmentally friendly way of sterilizing reusable medical devices and laboratory equipment. The widespread use of autoclaves has driven steady demand for complementary sterilization consumables, including biological and chemical indicators, wraps, and sterilization trays. Clinics, hospitals, and research laboratories favor autoclaves for their proven effectiveness, shorter cycle times, and capacity to handle large instrument volumes. Additionally, steam sterilization's strong presence in regulatory guidelines and infection control standards reinforces its dominant position in the market.

The low-temperature sterilization consumables segment is expected to grow at the highest CAGR in the upcoming period due to the growing use of heat-sensitive and moisture-sensitive medical equipment, such as endoscopes, robotic surgical equipment, and advanced diagnostic equipment. Low-temperature sterilization methods, like hydrogen peroxide vapor and gas plasma, require specialized consumables, including compatible indicators, packaging, and filters. As medical devices become more complex and costly, low-temperature sterilization is increasingly essential to preserve their functionality and performance.

End-User Insights

What Made Hospitals & Surgery Centers the Leading Segment in the Sterilization Consumables Market?

The hospitals & surgery centers segment led the global market with a maximum share of 56% in 2025. This is because of their high volume of surgical and diagnostic procedures requiring extensive use of indicators, wraps, pouches, and disinfectants. Strict regulations and accreditation standards enforce rigorous sterilization monitoring and documentation, creating recurring demand. Additionally, rising chronic illnesses and an aging population are increasing hospitalizations and surgeries, while hospitals' early adoption of new sterilization technologies further boosts consumable usage.

The ambulatory surgical centers segment is expected to expand at the fastest CAGR over the forecast period because ASCs perform a high volume of elective and minimally invasive procedures that require rapid instrument turnaround. They rely heavily on disposable consumables such as pouches, wraps, and indicators to ensure compliance with sterilization standards while minimizing reprocessing time. Additionally, the rising number of ASCs, favorable reimbursement policies, and growing patient preference for cost-effective outpatient surgeries are driving increased demand for these consumables.

Sales / Distribution Channel Insights

Why Did the Direct OEM / Manufacturer Sales Segment Dominate the Sterilization Consumables Market?

The direct OEM / manufacturer sales segment dominated the global market with a share of 45% in 2025. This is because hospitals, laboratories, and clinics prefer sourcing directly from manufacturers to ensure product authenticity, quality, and compliance with stringent regulatory standards. Direct sales provide a reliable supply of critical consumables such as biological indicators, wraps, and pouches, minimizing the risk of counterfeit or substandard products. Additionally, manufacturers can offer customized solutions, technical support, and bulk pricing, which strengthens long-term relationships with large healthcare facilities. This direct engagement ensures consistent supply, faster delivery, and better service, reinforcing the segment's leading position in the market.

The online / e-commerce platforms segment is expected to expand at a rapid pace in the market in the coming years. This is mainly due to the convenience and efficiency it offers to hospitals, clinics, laboratories, and ambulatory surgical centers. These platforms allow easy product comparison, quick ordering, and doorstep delivery, minimizing procurement delays and streamlining inventory management. Growth is further fueled by manufacturer-operated online stores and third-party medical supply marketplaces, which increase accessibility. Additionally, post-pandemic trends toward contactless purchasing and digital supply chain solutions have accelerated adoption in the healthcare sector.

Region Insights

How Big is the North America Sterilization Consumables Market Size?

The North America sterilization consumables market size is estimated at USD 702.00 million in 2025 and is projected to reach approximately USD 1,149.45 million by 2035, with a 5.05% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Global Sterilization Consumables Market?

North America led the sterilization consumables market while holding a major share of 39% in 2025 and is expected to sustain its position in the market in the upcoming period. The region's leading position in the market is attributed to a high number of surgical operations, well-established hospital chains, and high uptake of sophisticated sterilization technology. FDA and other regulatory bodies have mandated strict sterilization requirements, which causes continuous demand for validated consumables.

Also, the existence of leading market participants, ongoing advancements in sterilization techniques, and excessive healthcare expenditures contribute to the region's dominance. The growing awareness of hospital-acquired infections and a strong focus on patient safety are likely to ensure the long-term growth of the market.There is also vigorous production of pharmaceuticals and medical devices, which also contributes to high consumption levels.

How Big is the U.S. Sterilization Consumables Market Size?

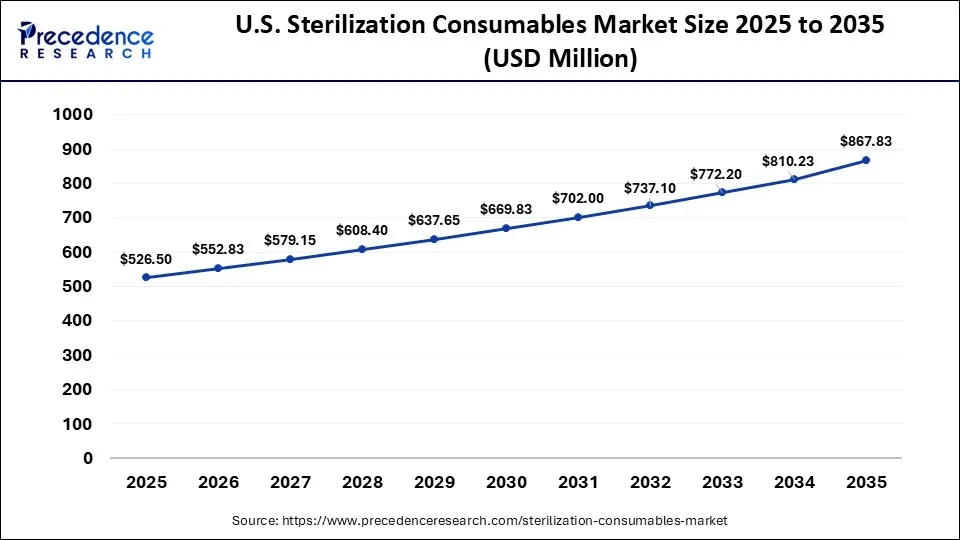

The U.S. sterilization consumables market size is estimated at USD 526.50 million in 2025 and is projected to reach approximately USD 867.83 million by 2035, with a 5.12% CAGR from 2026 to 2035.

The sterilization consumables market in the U.S. is growing due to increasing demand for infection control across healthcare settings, driven by heightened awareness of hospital-acquired infections and stringent regulatory standards for sterilization. Rising surgical procedures, expanding healthcare infrastructure, and the adoption of advanced sterilization technologies are boosting the consumption of sterile supplies such as wraps, pouches, indicators, and chemical agents. Additionally, ongoing investments in patient safety initiatives and compliance with CDC and FDA guidelines are further accelerating market growth.

How is the Opportunistic Rise of Asia Pacific in the Sterilization Consumables Market?

Asia Pacific is expected to witness the fastest growth during the predicted timeframe due to expanding healthcare infrastructure and increasing healthcare expenditures. Countries like China, India, and Southeast Asian nations are investing heavily in hospitals, surgical facilities, and pharmaceutical manufacturing. Rising awareness of infection control, stricter regulatory standards, and increasing surgical volumes are driving demand, while the growth of medical tourism and outpatient care centers further boosts the market. Additionally, low-cost manufacturing and growing adoption of modern sterilization technologies are supporting rapid market expansion.

Who are the major players in the global sterilization consumables market?

The major players in the sterilization consumables market include STERIS (U.S.), Getinge (Sweden), ASP (Fortive) (U.S.), Solventum (U.S.), Hygiena LLC (U.S.), Terragene (Argentina), Ayka Medical Inc. (India), BiomatiQ Scientific Pvt. Ltd. (India), Tuttnauer (Netherlands), and LISTER BIOMEDICAL CO., LTD (China)

Recent Developments

- In May 2025, the U.S. FDA 510(k) clearance was given to True Indicating, LLC on its CSPN-15 Type 5 integrating indicator in steam sterilization. This licensure allowed the product to be commercially offered in the entire American healthcare market. (Source:https://www.trueindicating.com)

- In June 2024, Getinge was involved in a conference held in Frankfurt, Germany, as part of the ACHEMA 2024, where the company presented the latest sterilization and life science solutions. The event assisted in building a strong brand presence and creating awareness of its cutting-edge sterilization technologies in the international market. (Source: https://www.epa.gov)

Segments Covered in the Report

By Product Type

- Biological Sterilization Indicators

- Spore strips

- Vials

- Chemical Sterilization Indicators

- Indicator tapes

- Chemical integrators

- Sterilization Pouches & Wraps

- Paper/plastic pouches

- Wrap rolls

- Labels & Documentation Consumables

- Filter Cartridges & Breathable Barriers

- Other Consumables (detergents, indicator cards)

By Technology / Sterilization Method

- Steam / Autoclave Sterilization Consumables

- Ethylene Oxide (EO) Sterilization Consumables

- Radiation (Gamma / E-Beam) Consumables

- Low-temperature Sterilization Consumables (H2O2, Ozone)

- Other Technologies

By End-User

- Hospitals & Surgery Centers

- Diagnostic & Imaging Centers

- Ambulatory Surgical Centers (ASCs)

- Pharmaceutical & Biotech Manufacturing

- Research & Academic Labs

- Other End-Users

By Sales / Distribution Channel

- Direct OEM / Manufacturer Sales

- Distributors & Dealers

- Online / E-commerce Platforms

- Group Purchasing & Tender Agreements

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting