Stromal Vascular Fraction Market Size and Forecast 2025 to 2034

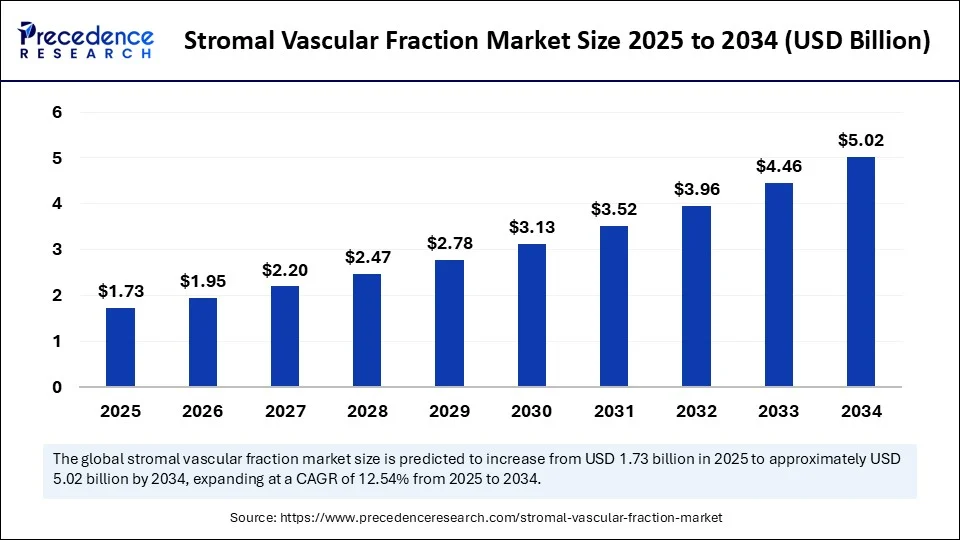

The global stromal vascular fraction market size accounted for USD 1.54 billion in 2024 and is predicted to increase from USD 1.73 billion in 2025 to approximately USD 5.02 billion by 2034, expanding at a CAGR of 12.54% from 2025 to 2034. The stromal vascular fraction market is witnessing rapid growth, driven by the rising demand for regenerative medicine and stem cell–based therapies, advances in automated isolation technologies, increased demand for minimally invasive procedures, and progress being made in clinical research.

Stromal Vascular Fraction MarketKey Takeaways

- In terms of revenue, the global stromal vascular fraction market was valued at USD 1.54 billion in 2024.

- It is projected to reach USD 5.02 billion by 2034.

- The market is expected to grow at a CAGR of 12.54% from 2025 to 2034

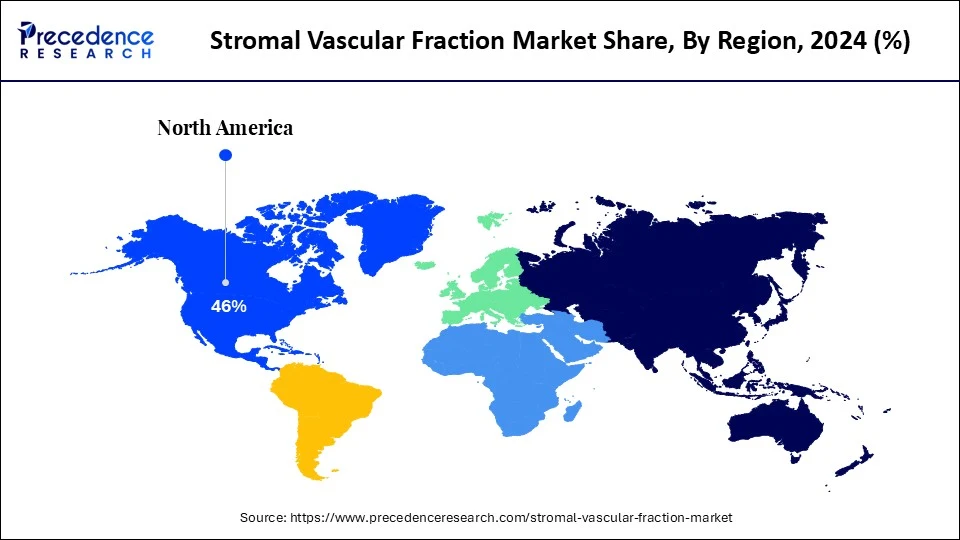

- North America dominated the stromal vascular fraction market with the highest revenue share of 46% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By type, the autologous SVF segment held the biggest market share in 2024.

- By type, the allogeneic SVF segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By product/component, the SVF isolation systems (devices & kits) segment led the market in 2024.

- By product/component, the enzymatic reagents and solutions segment is expected to expand at a notable CAGR over the projected period.

- By source of tissue, the adipose tissue segment captured the highest market share in 2024.

- By source of tissue, the umbilical cord tissue segment is expected to expand at a notable CAGR over the projected period.

- By application, the orthopedic & musculoskeletal disorders segment contributed the a major market share in 2024.

- By application, the aesthetic & cosmetic procedures segment is expected to expand at a notable CAGR over the projected period.

- By end user, the stem cell & regenerative medicine clinics segment held a significant market share in 2024.

- By end user, the cosmetic & dermatology clinics segment is expected to expand at a remarkable CAGR over the projected period.

How Is AI Transforming the Stromal Vascular Fraction Market?

Artificial intelligence is revolutionizing the stromal vascular fraction market by improving cell processing and enabling the development of personalized medicine. AI optimizes cell processing and isolation techniques, leading to higher cell yields and purity. In June 2025, a report published by NIH stated that AI-enabled automated platforms have emerged as a promising approach to optimizing SVF processing by enhancing efficiency and standardization, an important aspect for clinical-grade regenerative medicine therapies.(Source:https://pmc.ncbi.nlm.nih.gov)

In South Korea, the ACS automated SVF platform reliably isolated SVF with very high yields, averaging 19 × 10^6 nucleated cells with 85 ± 12% viability, and provided structured data points that can be used for optimizing SVF processing. They are alsoworking on developing machine learning models to predict clinical outcomes following SVF treatments in patients, predominately with musculoskeletal and inflammatory conditions, that could ultimately establish a data-driven treatment protocol. All factors considered, AI is shaping up to be an important enabler of scalability and regulatory compliance in the stromal vascular fraction market.(Source: https://pmc.ncbi.nlm.nih.gov)

U.S. Stromal Vascular Fraction Market Size and Growth 2025 to 2034

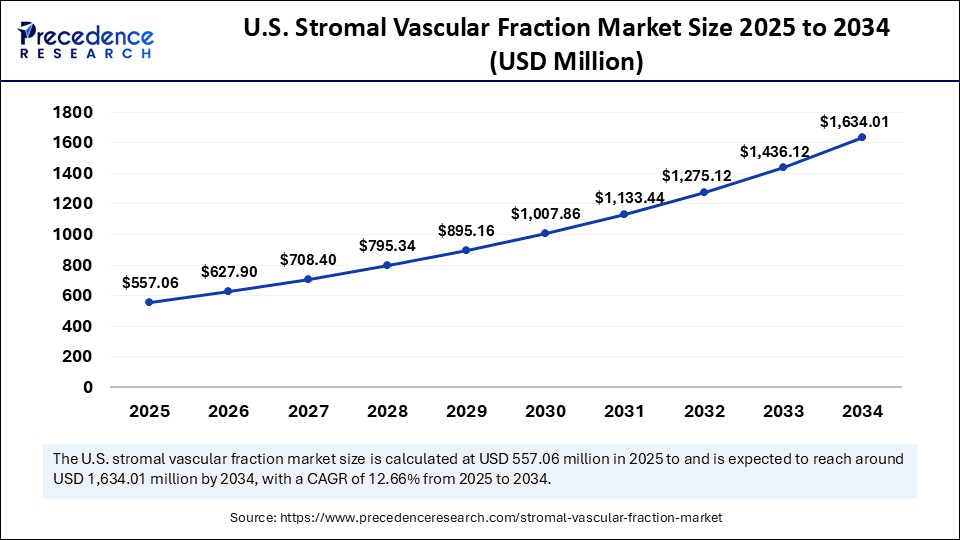

The U.S. stromal vascular fraction market size was exhibited at USD 495.88 million in 2024 and is projected to be worth around USD 1,634.01 million by 2034, growing at a CAGR of 12.66% from 2025 to 2034.

What Made North America the Dominant Region in the Stromal Vascular Fraction Market?

North America dominated the stromal vascular fraction market with a major share in 2024. This is primarily due to innovations in regenerative medicine, established healthcare infrastructure, and the demand for personalized cell therapies. There is a high adoption rate of new medical treatments, particularly in orthopedics, aesthetics, and wound care, which bolsters market growth. Additionally, strong national regulatory bodies, a well-established pharma industry, and continued efforts toward clinical trials support market growth.

The U.S. remains at the helm of the North American market. The presence of the well-established biotechnology sector and rising focus on stem cell-based regenerative therapies are driving market growth. With many FDA-approved investigational models currently in place and numerous clinical investigations underway, there is a high demand for SVF to treat conditions such as arthritis, neurodegenerative diseases, and skin repair (including wound care and skin grafts). Academic Medical Centers and private firms invest significant financial resources in SVF research, development, and commercialization, thereby supporting market growth.

European Stromal Vascular Fraction Market Trends

Europe is the second-largest market due to a strong healthcare system, a rise in clinical trials, and focus on regenerative and aesthetic medicine. Countries in Europe are adopting SVF technology for orthopedic, dermatologic, and autoimmune applications. There is a research-based medical practice, heightened patient awareness, and a strong culture of ethical decision-making, which enables medical professionals to utilize SVF for innovative yet safe procedures. Public and private sector investment in stem cell research is facilitated by government-funded research grants and increased partnerships and collaborations within the EU. In summary, Europe is emerging as a major player in the global SVF market.

Germany is a prominent country in Europe, boasting considerable biotechnology infrastructure, hospitals equipped with advanced technology and facilities, a robust clinical trial culture, and clear guidelines for medical practice. Germany is conducting clinical studies on SVF for the treatment of musculoskeletal disorders, wound healing, cosmetic use, and other applications. Although everything is heavily regulated in Germany, the country's regulatory framework for ethical research makes it an attractive target for local and international biotech investment. Regenerative therapies are encouraged by public health initiatives, and research collaboration is growing between university laboratories and private sector laboratories.

What Makes Asia Pacific the Fastest-Growing Region in the Stromal Vascular Fraction Market?

Asia Pacific is growing rapidly in the market because of expanding medical tourism, increased interest in regenerative therapies, and increased investment in stem cell research. There is a greater demand for cost-effective, minimally invasive treatment options for orthopedic, cosmetic, vein, and chronic inflammatory issues. With government support for biotechnology innovation, as well as public relaxation of regulations in certain countries, there is sufficient political and practical support to encourage the use of SVF in the clinical setting and expand the range of therapeutic options that SVF patients may offer. As healthcare infrastructure continues to expand, the market in the region is set to rise.

Japan is a major force within the Asia Pacific stromal vascular fraction market. This is due to its supportive regulatory landscape and focus on regenerative medicine. Japan has a fast-track approval process for regenerative therapies, allowing developers to move more quickly into the clinical application phase of SVF-based therapies. As an aging population with a strong need for new and progressive therapeutic options, Japan has a timely regulatory landscape that allows people to think about adopting SVF therapies in a positive direction.

Market Overview

The stromal vascular fraction market refers to the global industry centered on the isolation, processing, and therapeutic application of SVF, a heterogeneous cell population derived from adipose (fat) tissues. SVF includes adipose-derived stem cells (ADSCs), endothelial cells, pericytes, T cells, and other regenerative components, used in regenerative medicine and aesthetic procedures. SVF therapies are being increasingly utilized in orthopedic, cardiovascular, dermatological, and autoimmune disorders owing to their anti-inflammatory, angiogenic, and tissue-repair properties. The market includes devices, kits, reagents, services, and clinical applications for SVF extraction and deployment.

Stromal Vascular Fraction MarketGrowth Factors

- Demand for Regenerative Medicine: SVF is being increasingly utilized in therapies for tissue repair and healing, particularly in orthopedics and aesthetics, due to its regenerative, anti-inflammatory, and angiogenic properties.

- Improved Extraction Techniques: Advancements in both enzyme and mechanical isolation methods can enhance the viability and yield of SVF cells, resulting in more reproducible and scalable procedures for clinical and research-oriented uses of SVF.

- Care Burden Due to Chronic Disease: The increased incidence of osteoarthritis, diabetes, and atherosclerotic heart disease has led to a greater need for new, innovative cell-based therapies (i.e., SVF) as potential long-term solutions in health care.

- Increased Regulatory Support: As frameworks for regulated autologous and minimally manipulated cell therapies evolve, they are reducing barriers to SVF research, trials, and commercialization in jurisdictions worldwide.

- Greater Focus on Personalized Therapies: SVF offers enhanced compatibility for autologous applications, aligning with the current trend toward personalized medicine. With patients receiving their own tissues, there is less risk of rejection or negative immune responses, creating a safer and more effective environment for therapy.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 5.02 Billion |

| Market Size in 2025 | USD 1.73 Billion |

| Market Size in 2024 | USD 1.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product/Component, Source of Tissue, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Clinical Trial Approvals and Regulatory Support are Driving the Growth of the Stromal Vascular Fraction Market?

One major driver of the market is the emergence of FDA-compliant clinical trials, which confirm safety and efficacy in humans, particularly in the areas of orthopedics and regenerative therapies. SVF is used in treating various conditions like OA, wound healing, and cosmetic procedures. For instance, in April 2024, a multisite FDA-approved study treated patients with knee osteoarthritis (K/L grades 2-4) with centrally manufactured autologous adipose-derived SVF. The study demonstrated significant improvements in both pain and function up to the 12-month mark, with excellent tolerability; safety events were all at a non-harmful level.(Source: https://jointechlabs.com)

In October 2024, the U.S. Court of Appeals for the Ninth Circuit ruled that SVF procedures were considered drugs under the Food, Drug, and Cosmetic Act, creating further regulatory oversight and standardization necessary for institutional adoption. This ruling furthered payer confidence and advanced research investment, making SVF a more credible and scalable therapy.(Source: https://www.isctglobal.org)

Restraint

Complexity of SVF Procedures

The technical complexity and resource intensity of the entire therapeutic process create a major challenge for the stromal vascular fraction market. Taking adipose tissue through liposuction, enzymatically digesting it, centrifuging it, filtering it, characterizing it using flow cytometry, and finally isolating and preparing the cells all require specialized equipment, GMP-grade facilities, and highly trained staff. In the USA, the FDA now considers SVF a "drug" when manipulated beyond minimally manipulated, which warrants the strictest controls of every step of the processing.

These technical/logistical prerequisites, especially in low-resource regions, can create geographic inequities in access. Additionally, ethical issues related to the manipulation of human cells introduce further scrutiny from the public and regulators, particularly in countries with suboptimal stem-cell frameworks. In combination, these barriers continue to limit the scalability and reach of SVF therapies significantly.

Opportunity

Is Point-of-Care SVF Technology Changing the Face of Regenerative Treatments?

A significant area of opportunity for the stromal vascular fraction market lies in point-of-care (POC) SVF processing systems. These small, fully automated devices enable clinicians to isolate SVF from a patient's adipose tissue at the point of care, thereby minimizing laboratory processing and quality control concerns and reducing contamination risks. Currently, the medical literature is filled with clinical trials utilizing POC SVF devices in the treatment of chronic diabetic foot ulcers, highlighting rapid healing times, reduced length of hospital stays, and a decrease in the burden of care.

Meanwhile, in Europe, orthopedic centers are beginning to collaborate with SVF to regenerate articular cartilage, potentially eliminating the need for invasive joint replacements. This clinical confidence in the immediate use of SVF therapy legitimizes the need for a personalized, minimally invasive regenerative medicine approach.

What Made Autologous SVF the Dominant Segment in the Market?

The autologous SVF segment led the stromal vascular fraction market while holding the largest share in 2024. This is primarily due to its low immunological risk. It utilizes the patient's tissue, enabling personalized treatments. This method enables added safety, compliance with ethical considerations, and the ability to provide a better fit for the patient, particularly in personalized regenerative therapies.

The allogeneic SVF segment is expected to grow rapidly in the upcoming period because it can be produced in mass and used in a wide variety of patients. It has the highly attractive benefit of being an off-the-shelf product, providing a more standardized therapeutic use for a tightly defined patient population. This allows for large patient cohorts for clinical applications and facilitates clinical troubleshooting for future research.

Product/Component Insights

Why Did the SVF Isolation Systems Segment Dominate the Stromal Vascular Fraction Market in 2024?

The SVF isolation systems segment dominated the market with the largest share in 2024. The dominance of SVF isolation systems stems from their ability to provide an essential step in the rapid and consistent separation of stromal vascular fraction cells from adipose tissue. They are a ubiquitous choice in clinical and research laboratories, as they are the step required for the efficient and consistent separation during the isolation process, while ensuring cell functionality and sterility. The increased use of minimally invasive cell therapies bolstered the need to isolate stromal vascular fraction, making SVF isolation systems crucial in routine clinical and regenerative settings among clinicians and regenerative medicine practitioners.

The enzymatic reagents & solutions segment is expected to grow rapidly, given their critical role in the separation of SVF cells from tissue, due to their unique function in degrading the extracellular matrix to liberate SVF from the tissue. They are highly effective in maximizing cell yield and preserving cellular function in more sophisticated isolation protocols. The increased usage of SVF for various cosmetic, orthopedic, and research applications has also increased demand for standardized and precise enzymatic processing.

Source of Tissue Insights

How Does the Adipose Tissue Segment Lead the Stromal Vascular Fraction Market?

The adipose tissue segment dominated the market in 2024, as it is the leading source of the stromal vascular fraction due to its plentiful supply, accessibility, and high regenerative cell yield. Adipose tissue contains a plethora of mesenchymal stem cells, endothelial cells, and growth factors that are involved in the amniotic environment, which may have effective therapeutic applications. The fact that liposuction is a minimally invasive procedure, as it involves removing adipose tissue, lends itself to its regular clinical use. Adipose tissue is compatible with widely accepted SVF derivation techniques and has demonstrated efficacy in orthopedics, musculoskeletal therapies, and cosmetic procedures.

The umbilical cord & tissue segment is likely to grow at the fastest rate, primarily due to the collection not being invasive, its youthful cell profile, and its effective regenerative potential. The umbilical cord and associated tissues, such as the placenta, offer an available source of allogeneic cells that do not harm the donor, which is an ethical plus. SVF from the umbilical tissue is currently being explored in clinical research studies and regenerative medicine, particularly due to its immune-modulatory properties and potential as off-the-shelf therapies. With the increasing interest in perinatal tissues and the expanding infrastructure for biobanking, umbilical cord tissue is quickly becoming a viable alternative for next-generation cell-based therapies.

Application Insights

Which Application Segment Dominate the Market in 2024?

The orthopedic & musculoskeletal disorders segment dominated the stromal vascular fraction market with the largest share in 2024. This is primarily due to the increased demand for regenerative therapies that promote tissue healing, reduce inflammation, and improve mobility. SVF is gaining momentum for many conditions, including osteoarthritis, tendon injuries, and cartilage degeneration, where traditional therapies do not provide long-term relief. SVF is particularly effective at inducing healing and regulating the immune response, and is well-suited for joint and soft tissue repair.

The aesthetic & cosmetic procedures segment is expected to grow at the fastest CAGR in the coming years, driven by the increasing demand for natural, regenerative options for anti-aging and skin rejuvenation therapies. Due to its regenerative and angiogenic properties, SVF is used for facial fat grafting, scar revision, and hair restoration. In terms of SVF-derived treatments, the aesthetic application is appealing to many patients, given the popularity of minimally invasive, stem cell-enhanced cosmetic changes in dermatology and plastic surgery. Additionally, as customer emphasis is on individualized, long-lasting aesthetic results, SVF is quickly becoming a recognized option for safe, effective, and convenient treatments within the global beauty and wellness industry.

End User Insights

Why Did the Stem Cell & Regenerative Medicine Clinics Segment Dominate the Stromal Vascular Fraction Market in 2024?

The stem cell & regenerative medicine clinics segment dominated the market in 2024 due to their specialization in cell-based therapies as a means to repair tissue and aid in the treatment of chronic pain and degenerative conditions. These clinics have advanced infrastructure and expertise to isolate, process, and administer SVF in a clinical environment. These clinics have established themselves as key innovators in the market and are the main drivers for personalizing minimally invasive, autologous SVF-based treatments.

The cosmetic & dermatology clinics segment is likely to grow at the fastest rate over the projection period. These clinics are increasingly utilizing SVF in treatments for facial rejuvenation, scar reduction, and hair regrowth. All are capitalizing on the regenerative promise of SVF. The popularity of non-surgical beauty therapies enhanced by stem cell treatments or SVF offers consumers an attractive solution to achieve natural-looking and long-lasting results. The expansion of medical aesthetics, coupled with increasing awareness of regenerative skincare treatments, is rapidly advancing SVF-based aesthetic procedures into dermatologic and cosmetic practices worldwide.

Stromal Vascular Fraction Market Companies

- InGeneron, Inc.

- Cytori Therapeutics

- IntelliCell Biosciences

- Human Med AG

- Tissue Genesis

- Celltex Therapeutics

- Antria

- GID Group, Inc.

- Ranfac Corp.

- LifeCell International

- TissYou Biotech

- Medikan International

- XCellCure

- Pluristem Therapeutics

- Black Beret Life Sciences

- Cellprothera

- VetStem Biopharma (animal SVF applications)

- Sanakin GmbH

- Lipogems International

- BioRestorative Therapies

Recent Development

- In September 2024, Jointechlabs, Inc. announced the European CE Mark approval of its Mini-Stem System, the world's first product to produce injectable microfat (MFAT) and isolate SVF from fat, bringing joint pain and arthritis relief to the EU. This revolutionary product paves the way for non-surgical treatment of joint pain and arthritis, in addition to sports injuries. Mini-Stem System produces microfat that can also be used in wound healing and as a biologic filler in aesthetic procedures.

(Source: https://jointechlabs.com)

Segments Covered in the Report

By Type

- Autologous SVF

- Allogeneic SVF

By Product/Component

- SVF Isolation Systems (Devices & Kits)

- Enzymatic Reagents & Solutions

- Centrifuges & Consumables

- Culture Media

- Cryopreservation Equipment

- Software & Imaging Tools

By Source of Tissue

- Adipose Tissue

- Umbilical Cord Tissue

- Placental Tissue

- Bone Marrow

By Application

- Orthopedic & Musculoskeletal Disorders

- Aesthetic & Cosmetic Procedures

- Wound Healing & Dermatology

- Cardiovascular Diseases

- Autoimmune & Inflammatory Disorders

- Neurological Disorders

- Diabetes & Metabolic Diseases

- Others (e.g., pulmonary, renal, liver diseases)

By End User

- Hospitals & Surgical Clinics

- Stem Cell & Regenerative Medicine Clinics

- Cosmetic & Dermatology Clinics

- Academic & Research Institutes

- Biotech & CROs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting