Thermal Management for Advanced Driver-Assistance Systems Market Size and Forecast 2025 to 2034

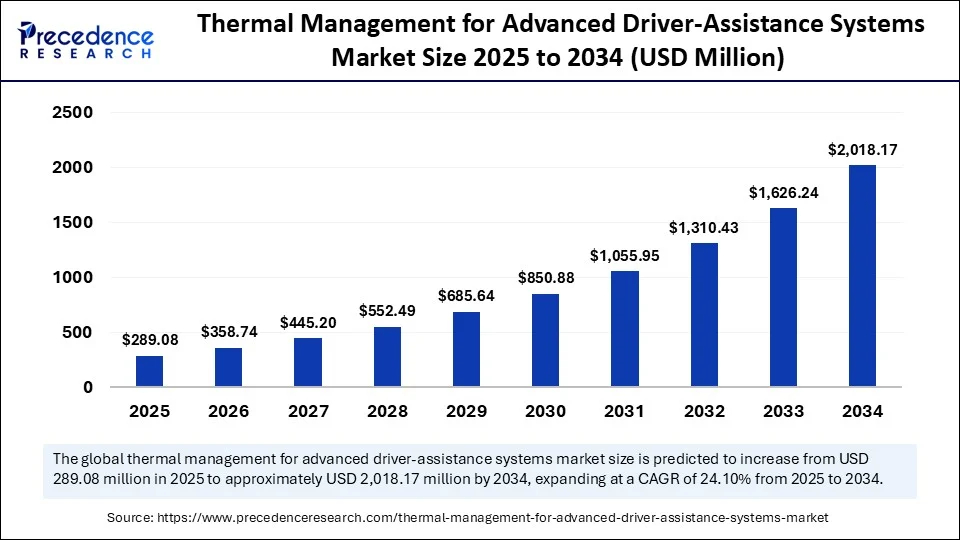

The global thermal management for advanced driver-assistance systems market size accounted for USD 232.94 million in 2024 and is predicted to increase from USD 289.08 million in 2025 to approximately USD 2,018.17 million by 2034, expanding at a CAGR of 24.10% from 2025 to 2034. The market is growing due to the rising integration of high-performance sensors and electronic control units in vehicles that generate significant heat, which requires efficient thermal regulation for optimal functionality and safety.

Thermal Management for Advanced Driver-Assistance Systems MarketKey Takeaways

- In terms of revenue, the global thermal management for advanced driver-assistance systems market was valued at USD 232.94 million in 2024.

- It is projected to reach USD 2,018.17 million by 2034.

- The market is expected to grow at a CAGR of 24.10% from 2025 to 2034.

- Asia Pacific dominated the thermal management for advanced driver-assistance systems market in 2024.

- The Middle East and Africa is expected to grow at the fastest rate in the coming years.

- By component type, the thermal interface materials segment held the largest share of the market in 2024.

- By component type, the thermoelectric coolers segment is observed to grow at the fastest rate during the forecast period.

- By technology type, the passive cooling segment led the market in 2024.

- By technology type, the active cooling segment is expected to grow at the fastest CAGR in the upcoming period.

- By ADAS component, the cameras segment generated the major market share in 2024.

- By ADAS component, the ECU segment is expected to grow at the fastest CAGR during the projection period.

- By material type, the metal-based segment contributed the biggest market share in 2024.

- By material type, the graphene and carbon-based materials segment is emerging as the fastest growing.

- By vehicle type, the passenger vehicles segment held the highest market share in 2024.

- By vehicle type, the electric vehicles segment is observed to grow at the fastest CAGR during the forecast period.

- By level of autonomy, the level 1-2 (driver assistance) segment dominated the market with the largest share in 2024.

- By level of autonomy, the level 4-5 (high/full automation) segment is expected to grow at the fastest rate in the upcoming period.

How is AI Revolutionizing the Thermal Management for Advanced Driver-Assistance Systems Market?

Artificial Intelligence is transforming thermal management in cars with ADAS by enabling predictive, real-time heat regulation across various components, including cameras, radars, and ECUs. By forecasting thermal loads and proactively adjusting cooling systems based on continuous data from sensors, vehicle dynamics, and environmental inputs, artificial intelligence algorithms enhance energy efficiency, prevent component overheating, and extend system lifespan. AI is an essential enabler in the drive toward safer, smarter, and more autonomous vehicles because of this dynamic approach, which guarantees dependable ADAS performance even under demanding driving conditions or high processing loads.

Market Overview

The thermal management for the ADAS market refers to the technologies, systems, and materials used to regulate and dissipate heat generated by sensors, cameras, radar, LiDAR, control units, and other electronics within advanced driver-assistance systems. As vehicles become more autonomous, ADAS components must operate reliably across varied conditions, making active and passive cooling systems vital to prevent thermal degradation, ensure accuracy, and improve the longevity of high-performance automotive electronics.

Thermal Management for Advanced Driver-Assistance Systems MarketGrowth Factors

- Rising Adoption of ADAS Features: The increasing demand for safety, comfort, and automation in vehicles is driving the integration of ADAS technologies, which in turn boosts the need for effective thermal management systems to ensure the optimal performance of sensors and ECUs.

- Miniaturization and High-Power Electronics: The shift toward compact and powerful components, such as LiDARs, radars, and onboard processors, has increased heat generation, necessitating advanced thermal management solutions to maintain reliability and prevent overheating.

- Electrification of Vehicles: The surge in electric and hybrid vehicle adoption, which relies heavily on electronic systems for autonomous features, has created additional heat dissipation challenges, accelerating demand for sophisticated thermal management systems.

- Stringent Safety and Performance Regulation: Government and industry mandates for advanced safety systems in vehicles have led to increased implementation of ADAS technologies, indirectly propelling the need for efficient thermal control mechanisms.

- Technological Advancements in Cooling Solutions: Innovations in materials, liquid cooling systems, and thermoelectric modules are making thermal management systems more efficient, compact, and tailored to meet the evolving demand for next-gen ADAS.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2,018.17 Million |

| Market Size in 2025 | USD 289.08 Million |

| Market Size in 2024 | USD 232.94 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 24.10% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component Type, Technology Type, ADAS Component, Material Type, Vehicle Type, Level of Autonomy, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Do Thermal Management Systems Impact the Overall Efficiency of Electric Vehicles (EVs) with ADAS Integration?

EV thermal systems often draw power directly from the battery, which reduces the car's range. Battery thermal management becomes a priority with cooling ADAS sensors and processors. Thermal management systems have the potential to drastically reduce energy efficiency if not properly optimized, particularly under high-load conditions. These days, OEMs are creating integrated thermal management loops that utilize a single fluid channel to manage the inverters and batteries of ADAS systems. Predictive algorithms are also used in smart cooling controls to lessen the likelihood of overcooling or undercooling. One of the primary challenges for EVs with advanced ADAS features remains striking a balance between performance and energy efficiency, boosting the need for efficient thermal management solutions.

Increasing Integration of ADAS in Modern Vehicles

The need for efficient thermal management systems has increased due to the rapid integration of ADAS features, such as adaptive cruise control, lane departure warning, and automated emergency braking, in both luxury and mid-range automobiles. The heat output from radar sensors, cameras, and EUCs is rising because automakers are making ADAS standard in new models. Keeping thermal loads under control has become a crucial design factor as car electronics get more complex. System performance may suffer in the absence of effective heat dissipation, potentially leading to sensor failure and safety hazards. For manufacturers, this means that thermal solutions are a strategic priority.

Restraints

High Cost of Advanced Thermal Management Systems

The high cost associated with advanced thermal management systems hinders the growth of the thermal management for advanced driver-assistance systems market. Implementing advanced thermal solutions, such as liquid cooling, phase change materials, or thermoelectric devices, adds a substantial cost to the ADAS setup. This high cost can limit adoption, especially in price-sensitive vehicle segments such as compact and mid-range models. Many OEMs prefer to invest in visible comfort or infotainment features over backend cooling tech, making thermal systems a lower priority. In regions where ADASS penetration is still growing, cost remains a decisive barrier to thermal technology upgrades.

Design and Integration Complexity

Efficient thermal management requires seamless integration into already crowded vehicle architectures. ADAS components, such as radar, cameras, and ECUs, are often located in tight areas, limiting airflow and heat dissipation options. Cooling systems must be compact, lightweight, and non-intrusive, which increases design time and complexity. This integration challenge is even more pronounced in EVs and luxury vehicles with layered electronic systems and aesthetic constraints.

Opportunities

Development of Integrated Thermal Management Systems for EVs and ADAS

As the integration of ADAS in electric vehicles (EVs) is increasing, both systems generate a significant amount of heat, resulting in a high demand for integrated cooling architectures that can control multiple systems simultaneously. It is possible to decrease component redundancy and increase energy efficiency by combining thermal gaps for battery inverters and ADAS ECUs. This provides thermal system suppliers with the opportunity to collaborate with OEMs to jointly develop multifunctional units. It enables manufacturers to optimize weight and space while improving vehicle performance.

Growing Demand for Compact and Modular Cooling Solutions

The trend toward miniaturized EUCs, which are densely packed sensors, requires compact thermal solutions that deliver high efficiency in small form factors. Modular cooling units that can be easily integrated across different ADAS platforms offer cost advantages and faster development. Manufacturers are increasingly seeking plug-and-play thermal modules compatible with various vehicle models. This allows suppliers to serve multiple OEMs with scalable, adaptable systems.

Component Type Insights

Why Did the Thermal Interface Materials (TIMs) Segment Dominate the Market in 2024?

The thermal interface materials dominated the thermal management for advanced driver-assistance systems market with a major share in 2024. This is mainly due to the increased adoption of materials like pads, gels, greases, and adhesives. These materials provide inexpensive, highly effective ways to transfer heat between heat spreaders or sinks and heat-generating ADAS components. Their versatility, simplicity of use, and compatibility with smaller electronics make them popular in radars, cameras, and ECUs. The majority of ADAS platforms favor them because they can maintain ideal operating temperatures without requiring significant structural alterations.

The thermoelectric coolers segment is expected to grow at the fastest rate in the coming years due to their precise and localized cooling capabilities, which are crucial for high-performance ADAS, such as LiDAR and AI-powered ECUs. With no moving parts, TECs provide quiet, vibration-free, and maintenance-free thermal control, making them ideal for autonomous vehicles that require precise temperature regulation. As ADAS becomes increasingly data-intensive, the demand for active thermal components, such as TECs, is accelerating.

Technology Type Insights

How Does the Passive Cooling Segment Dominate the Thermal Management for Advanced Driver-Assistance Systems Market in 2024?

The passive cooling segment dominated the market while holding the largest share in 2024. This is mainly due to the increased adoption of passive cooling solutions, which offer a dependable, affordable, and energy-free nature. Passive cooling techniques, including heat spreaders, natural convection, and conduction, are widely employed. Because of their simplicity and longevity, these techniques are preferred for cars with basic ADAS capabilities (Levels 1-2). The segment's dominance is further reinforced by their extensive use in mid-range vehicles and their simplicity of integration into small ADAS modules

Active cooling systems, including liquid circulation, peltier modules, and forced-air mechanisms, are experiencing rapid growth due to rising power densities in ADAS ECUs, LiDARs, and AI processors. As vehicles move toward higher levels of autonomy, passive methods are no longer sufficient. Active cooling ensures precise, real-time heat control. These systems are increasingly adopted in premium EVs and fully autonomous prototypes.

ADAS Component Insights

What Made Cameras (Front, Rear, Surround View) the Dominant Segment in the Market in 2024?

The cameras (front, rear, surround view) segment dominated the thermal management for advanced driver-assistance systems market in 2024 due to their wide application in both basic and advanced ADAS features, including lane detection, traffic recognition, and parking assistance. Most new vehicles are equipped with multiple cameras, each requiring consistent thermal regulation to ensure image clarity and processing accuracy, especially in outdoor environments.

The ECUs (Electronic control units) segment is expected to grow at the fastest rate in the upcoming period because they play a crucial role in processing the massive amounts of data coming from various ADAS sensors, particularly in cars that are Level 3 or higher. As AI algorithms and sensor fusion become more widely used, the thermal load on ECUs is rising quickly, increasing the need for effective cooling solutions designed specifically for these high-performance computing units.

Material Type Insights

Why Did the Metal-Based (Aluminum, Copper) Segment Dominate the Thermal Management for Advanced Driver-Assistance Systems Market in 2024?

The metal-based (aluminum, copper) segment dominated the market with the biggest revenue share in 2024. This is primarily due to their high conductivity, affordability, and widespread use in automotive systems. These materials are widely used in heat sinks, housings, and spreaders because they offer robust performance and easy manufacturability for mass-production vehicles. Their proven durability and cost efficiency make them the backbone of most current ADAS cooling designs.

The graphene & carbon-based materials segment is growing at the fastest rate due to their superior thermal conductivity, lightweight nature, and potential for miniaturized cooling applications. These advanced materials are ideal for next-gen ADAS modules that demand high efficiency in compact spaces. As R&D matures, they are expected to replace traditional metals in premium and high-automation vehicles.

Vehicle Type Insights

How Does the Passenger Vehicles Segment Dominate the Market in 2024?

The passenger vehicles segment dominated the thermal management for advanced driver-assistance systems market in 2024. This is mainly due to the increased production of these vehicles, and most of them are equipped with basic to mid-level ADAS features. Passive and hybrid cooling systems are in high demand due to the need to thermally manage a variety of sensors and ECUs in these vehicles, particularly in small engine bays.

The electric vehicles segment is expected to grow at the fastest CAGR in the upcoming period due to their compact layouts and heavy reliance on electronic components, which exacerbate thermal challenges because ADAS in EVs generates additional heat. Integrated thermal systems that manage battery motors and ADAS cooling are currently necessary. The need for advanced energy-efficient thermal management is growing as EV adoption picks up speed worldwide.

Level of Autonomy Insights

Why Did the Level 1-2 (Driver Assistance) Segment Dominate the Market in 2024?

The level 1-2 (driver assistance) segment dominated the thermal management for advanced driver-assistance systems market in 2024 due to its broad market penetration and regulatory encouragement for safety features such as lane assistance and adaptive cruise control. These systems require moderate thermal support, usually managed by passive methods, making them both cost-effective and scalable for OEMs across all price points.

The level 4-5 (high/full automation) segment is growing at a rapid pace due to its reliance on high-performance computing, continuous real-time processing, and dense sensor networks, all of which produce a significant amount of heat. Strong multi-zone thermal management systems are necessary for these cutting-edge vehicles to guarantee continuous operation safety and efficiency, particularly in autonomous fleets and robotaxis.

Regional Insights

What Made Asia Pacific the Dominant Region in the Thermal Management for Advanced Driver-Assistance Systems Market in 2024?

Asia Pacific registered dominance in the market by capturing the largest revenue share in 2024. This is primarily due to the increased production of vehicles, the rapid adoption of driver assistance technologies, and the strong presence of automotive electronics manufacturers. The region has witnessed increased integration of Level 1 and Level 2 ADAS features in passenger vehicles, driven by growing safety awareness and supportive regulatory trends. Local suppliers and OEMs are heavily investing in compact, cost-effective thermal management solutions to support mass market adoption, making the region a global hub for both production and innovation in automotive thermal systems.

The Middle East & Africa is expected to grow at the fastest CAGR in the coming years. The growth of the market in the region is attributed to the increasing use of contemporary safety and automation features. There is increasing demand for efficient thermal control of electronic components as luxury and electric cars become more widely available in the region. Furthermore, reliable and effective thermal solutions are necessary to ensure continuous ADAS performance in the region due to harsh climates. Increased investment by international automakers, growing disposable income, and the development of infrastructure all contribute to growth.

Thermal Management for Advanced Driver-Assistance Systems Market Companies

- Henkel AG & Co. KGaA

- 3M Company

- Laird Performance Materials (DuPont)

- Honeywell International Inc.

- Boyd Corporation

- Panasonic Industry Co., Ltd.

- Rogers Corporation

- Parker Hannifin Corporation

- Sekisui Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Fujipoly

- Bosch Thermal Systems

- Continental AG

- Valeo SA

- DENSO Corporation

- Gentherm Inc.

- Modine Manufacturing Company

- Toshiba Materials Co., Ltd.

- Calyos

- ATS (Advanced Thermal Solutions, Inc.

Recent Developments

- In May 2025, Mahindra & Mahindra Limited (M&M) gave MAHLE the "Special Appreciation Award" for its Intelligent Thermal Management System (ITMS). MAHLE has developed the system especially for the first platform of battery electric vehicles (BEV) XEV 9e and BE 6 from M&M.

(Source: https://newsroom.mahle.com) - On 26 March 2025, HELLA announced the launch of new OE thermal components for ADAS calibration, HVAC, and powertrain cooling at Automechanika Birmingham.

(Source: https://www.autoresource.co.uk)

Segments Covered in the Report

By Component Type

- Thermal Interface Materials (TIMs)

- Pads, gels, greases, and adhesives

- Heat Sinks & Spreaders

- Liquid Cooling Systems

- Thermoelectric Coolers (TECs)

- Phase Change Materials (PCMs)

- Fans, Blowers, and Active Air Cooling Units

By Technology Type

- Passive Cooling

- Convection, conduction, heat spreaders

- Active Cooling

- Liquid circulation

- Peltier-based (TEC)

- Forced air cooling

By ADAS Component

- Cameras (Front, Rear, Surround View)

- Radar Modules

- LiDAR Units

- Ultrasonic Sensors

- ECUs (Electronic Control Units)

- Driver Monitoring Systems (DMS)

By Material Type

- Metal-Based (Aluminum, Copper)

- Polymer-Based Composites

- Ceramics

- Graphene & Carbon-Based Materials

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

By Level of Autonomy

- Level 1–2 (Driver Assistance)

- Level 3 (Partial Automation)

- Level 4–5 (High/Full Automation)

By Region

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting