What is the Time Sensitive Networking Market Size?

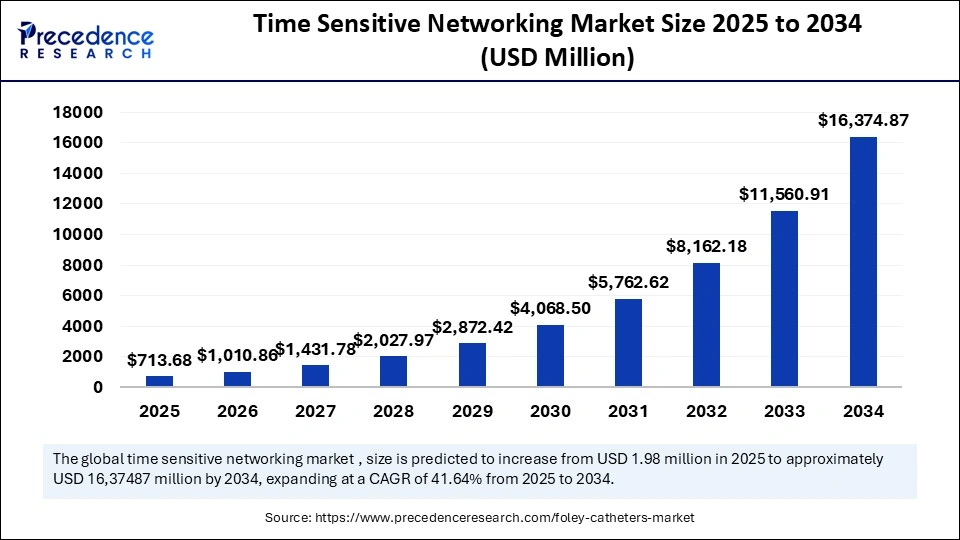

The global time sensitive networking market size is calculated at USD 5,90,769.96 thousand in 2025 and is predicted to increase from USD 8,08,777.35 thousand in 2026 to approximately USD 63,19,729.80 thousand by 2034, expanding at a CAGR of 30.68% from 2025 to 2034. The growth of the market is driven by improvements in ethernet technology, adoption of industry 4.0, and high usage of 5G and edge computing technologies, creating the need for time sensitive networking systems.

Market Highlights

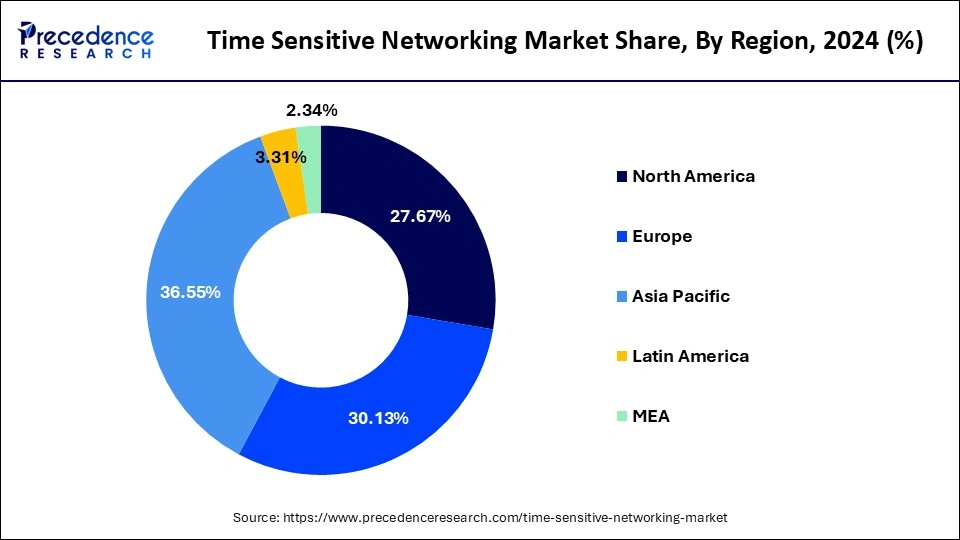

- Asia Pacific dominated the time-sensitive networking market with the largest share of 36.55% in 2024.

- Europe is expected to experience the fastest growth during the foreseeable period.

- By component, the hardware segment led the market with a major revenue share in 2024.

- By component, the services segment is expected to grow at the fastest CAGR during the forecast period.

- By standard/protocol type, the application-specific compliance segment held the largest market share in 2024.

- By standard/protocol type, the deterministic scheduling & shaping segment is expected to grow at the fastest CAGR during the projection period.

- By application/End-Use Industry, the industrial automation & manufacturing segment led the market in 2024.

- By application/End-Use Industry, the automotive & transportation segment is expected to witness the fastest growth between 2025 and 2034.

- By deployment, the on-premises segment dominated the time-sensitive networking market by holding the largest share in 2024.

- By deployment, the cloud/edge-based segment is expected to witness the fastest growth during the foreseeable period.

- By distribution channel, the direct sales segment contributed the highest market share in 2024.

- By distribution channel, the indirect sales (distributors) segment is expected to expand at the fastest CAGR during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 5,90,769.96 Thousand

- Market Size in 2026: USD 8,08,777.35 Thousand

- Forecasted Market Size by 2034: USD 63,19,729.80 Thousand

- CAGR (2025-2034): 30.68%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Europe

What is Time Sensitive Networking and Why is it Important?

Time sensitive networking (TSN) is a set of IEEE 802.1 Ethernet standards that enable deterministic, low-latency, and highly reliable communication across industrial, automotive, aerospace, and telecommunications networks. TSN ensures time synchronization, traffic scheduling, and seamless convergence of real-time and non-real-time data, supporting Industry 4.0, autonomous driving, and mission-critical systems. TSN is important because it enables synchronized and time-critical data exchange across industrial, automotive, and communication systems, making it essential for applications like autonomous vehicles, smart factories, and critical infrastructure where timing and reliability are crucial.

How is AI Transforming the Time Sensitive Networking Market?

AI is notably transforming the time sensitive networking market by offering intelligent capabilities such as real-time network optimization, enhanced security with predictive maintenance, which are highly crucial for mission-critical applications like autonomous systems and industrial automation. AI algorithms can analyze network traffic and guide resource allocation by predicting network congestion and detecting system anomalies, which ensure highly reliable, low-latency, and cost-effective communication required for time-sensitive networking. This synergy is fueling the adoption of Industry 4.0 by various leading economies.

Time Sensitive Networking Market Outlook

- Industry Growth Overview: The time sensitive networking market is projected for explosive growth between 2025 and 2034. This growth is driven by the increasing need for precise, reliable, and low-latency communication in critical applications, such as industrial automation, autonomous vehicles, and 5G networks for network management and configuration.

- Key Trend: A key trend in the market is the adoption of time-sensitive networking (TSN) as the backbone for IT/OT network convergence in Industry 4.0. TSN enables standard Ethernet to ensure timely data delivery, allowing critical operational technology (OT) and information technology (IT) traffic to coexist on a unified infrastructure, facilitating Industrial Internet of Things (IIoT) communication and enhancing vendor interoperability.

- Global Expansion:Leading players are expanding their reach globally to meet the demand for deterministic networking across diverse industries. Europe is a dominant market due to strong technological infrastructure and investments in R&D. The Asia-Pacific region is the fastest-growing market, propelled by rapid industrialization and 5G network expansion. North America also shows significant growth, driven by a strong manufacturing base and the development of autonomous vehicles.

- Major Investors: Venture capital firms, private equity funds, and strategic investors are actively funding the time-sensitive networking space, attracted by its high growth potential and alignment with Industry 4.0 and 5.0 trends. Key corporate players and investors include Cisco Systems, Intel, Siemens, Analog Devices, and NXP Semiconductors, driving innovation through R&D, strategic partnerships, and acquisitions.

- Startup Ecosystem:The TSN startup ecosystem is maturing, with innovation focused on interoperability, security, and integration with existing systems. Emerging firms are leveraging advanced techniques and open-source protocol stacks. Strategic alliances and certifications from organizations like the Avnu Alliance are helping these startups validate their solutions and compete in a market demanding standardized, multi-vendor interoperability.

What are the Key Trends in the Time Sensitive Networking Market?

- Automation & Industry 4.0: The global shift toward smart factories, digital twins, and integration of predictive maintenance across several industries is fuelling the importance of automation, which helps manage complex industrial systems and support real-time control.

- Enhanced Interoperability: An increasing effort to adopt and standardize TSN protocols and profiles is facilitating an open ecosystem, in which different manufacturers can collaboratively reduce the complexity and cost of production, a major trend in the global time-sensitive networking market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5,90,769.96 Thousand |

| Market Size in 2026 | USD 8,08,777.35 Thousand |

| Market Size by 2034 | USD 63,19,729.80 Thousand |

| Market Growth Rate from 2025 to 2034 | CAGR of 30.68% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Standard / Protocol Type, Application, Deployment / Network Architecture, Distribution Channel (Hardware Components), and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Low Latency Communication Demand

The rising demand for low-latency communication is driving the growth of the time-sensitive networking market by enabling real-time data exchange in critical applications such as industrial automation, autonomous vehicles, and smart grids. TSN ensures minimal delay and high reliability, making it essential for systems that require precise timing and rapid response, thereby increasing its adoption across multiple sectors. Real-time data exchange is becoming more necessary in telecommunications, healthcare, and the automotive industry. Mission-critical operations are supported by TSNs guaranteed low latency and consistent network performance. For uses like remote surgery, real-time monitoring, and driverless cars, TSN is essential.

Restraint

Shortage of Skilled Professionals

Industrial networking and standards knowledge are essential for implementing and maintaining TSN networks. Adoption can be hampered and operational risks raised by a shortage of trained staff. Furthermore, a talent gap still exists that impacts network performance and dependability due to the lack of training programs and certifications. Thus, the shortage of skilled professionals is restraining the growth of the time sensitive networking market by limiting the ability of organizations to implement, manage, and optimize complex TSN systems.

Opportunity

Integration with 5G and Edge Computing

The combination of TSN with 5G networks and edge computing allows ultra-low latency and high reliability. The convergence of these technologies enables new applications that require deterministic and highly reliable communication, which is crucial for driving digital transformations across the globe. Additionally, businesses are developing novel solutions for autonomous vehicles, remote monitoring, and smart grids, thereby opening up new revenue streams in the industrial automation and transportation sectors.

Segment Insights

Component Insights

Why Did the Hardware Segment Lead the Time-Sensitive Networking Market?

The hardware segment led the market with a major revenue share in 2024. This is because hardware such as switches and routers is the backbone of reliable, low-latency data transmission, which is essential for industrial applications in the automotive and aerospace sectors. Switches enable precise data flow control, while routers connect to different networks. Together, they offer high scalability and flexibility. Moreover, accuracy is required to meet TSN standards, which are able to be achieved by hardware.

The services segment is expected to grow at the fastest rate in the coming years because organizations increasingly require specialized expertise for successful TSN deployment, integration, and ongoing support, as implementing deterministic, low‑latency networks involves complex synchronization and interoperability across hardware and software components. Service offerings such as consulting, integration, and maintenance help reduce deployment risks, ensure compliance with industry standards, optimize network performance, and support lifecycle management, addressing the shortage of in‑house TSN skills and accelerating time‑to‑value for adopters.

Standard/Protocol Type Insights

Why Does the Application-Specific Compliance Segment Dominate the Market in 2024?

The application-specific compliance segment dominated the time sensitive networking market in 2024 because it guarantees that TSN solutions align with specific industry and use‑case needs, ensuring reliable interoperability, performance, and consistency across real‑time Ethernet applications, including industrial automation, automotive systems, and smart infrastructure. Compliance profiles and certifications help lower implementation risks, ease integration with existing protocols, and give end users and OEMs assurance that products meet essential standards for mission‑critical deterministic communication.

The deterministic scheduling & shaping segment is expected to grow at the fastest CAGR over the forecast period because it provides predictable, low-latency, and jitter-free data delivery, which is essential for real-time applications in industries like industrial automation, automotive, and robotics. Its adoption is driven by the need for precise traffic prioritization and time-slot allocation, enabled by IEEE 802.1Qbv, which ensures that critical communications are reliably transmitted alongside non-critical traffic, supporting deterministic performance in increasingly complex and high-speed network environments.

The time synchronization IEEE 802.1AS segment is expected to grow at a notable rate in the upcoming period. This is primarily due to its ability to provide highly precise time synchronization for deterministic communication, which is essential for modern, time-sensitive applications across industries such as automotive and industrial automation. It ensures that every device follows the same time base and has low latency for coordinated tasks. These factors are foundational to safety and efficiency in systems such as IIoT and ADAS.

Application/End-Use Industry Insights

Why Did the Industrial Automation & Manufacturing Segment Lead the Time Sensitive Networking Market?

The industrial automation & manufacturing segment led the market with the largest share in 2024. This is because these industries require low-latency, deterministic, and authentic communication for critical real-time processes, which TSN provides through precise synchronization and efficient data delivery. Process control and robotics in industrial automation are particularly dependent on precise timing and synchronization among devices, which is exactly what time-sensitive networking provides. TSN enables real-time data exchange, precise control, and improved operational efficiency, which are critical for smart factories and Industry 4.0 applications, making industrial automation the largest adopter of TSN technologies.

The automotive & transportation segment is expected to witness the fastest growth during the projection period due to the rising production of modern vehicles. Modern vehicles, including autonomous vehicles, increasingly rely on TSN for real-time, low-latency, and clear communication. These integrated technologies require high bandwidth and low latency to process sensor data and make real-time decisions. However, TSN ensures deterministic, low-latency, and synchronized data transmission across in-vehicle networks, which is critical for safety, performance, and seamless integration of multiple electronic control units (ECUs), driving its strong adoption in the automotive industry.

Deployment Insights

What Made On-Premise Deployment the Dominant Segment in the Market?

The on-premise segment dominated the time sensitive networking market by holding the largest share in 2024, as it offers excellent control over sensitive data preservation within a private organization and ensures higher reliability for applications that are mission-critical. The on-premises deployment enables an organization to remain self-reliant and offers flexibility with cloud solutions. Areas like ADAS and industrial automation are highly dependent on on-premises infrastructure due to their sensitive operations.

The cloud/edge-based segment is expected to grow at the fastest rate over the forecast period. This is because it enables real-time data processing, low-latency communication, and scalable network management closer to end devices, which is essential for industrial automation, smart manufacturing, and IoT applications. By leveraging cloud and edge infrastructure, organizations can monitor, control, and analyze TSN traffic efficiently, reduce network congestion, and support remote diagnostics and predictive maintenance, driving adoption of cloud/edge-based TSN solutions.

By Distribution Channel (Hardware Components)

Why Did the Direct Sales Segment Lead the Market?

The direct sales segment led the time sensitive networking market in 2024 because hardware manufacturers favor selling directly to large enterprises and end users, giving them greater control over pricing, customization, and integration support. This approach also enables companies to provide personalized solutions, technical guidance, and long-term customer relationships, which are essential for implementing complex TSN hardware in industrial automation, automotive, and smart infrastructure sectors.

The indirect sales (distributors) segment is expected to experience the fastest growth in the market during the projection period. This is because distributors help manufacturers reach small- and medium-sized enterprises, regional players, and new markets. They also offer logistics support, local technical assistance, and bundled solutions, making it easier for companies to adopt TSN hardware without dealing directly with manufacturers, thereby boosting market penetration.

Regional Insights

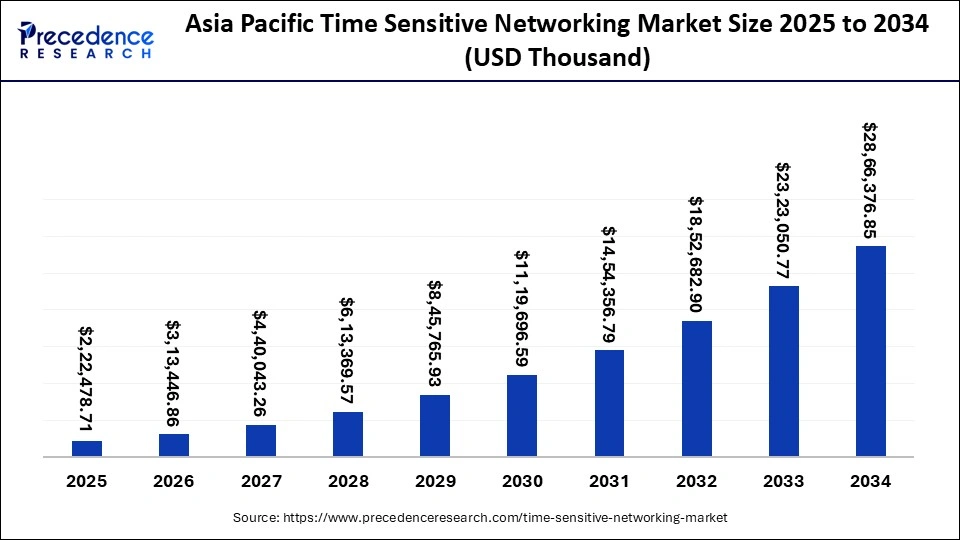

What is the Asia Pacific Time Sensitive Networking Market Size?

The asia pacific time sensitive networking market size is estimated at USD 2,22,478.71 thousand in 2025 and is predicted to be worth around USD 28,66,376.85 thousand by 2034, at a CAGR of 33.53% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Time Sensitive Networking Market?

Asia Pacific dominated the market with the largest share in 2024. This is primarily due to the expansion of industrial automation, the increased adoption of smart manufacturing technologies, and heightened investments in the automotive and telecommunications sectors. Growing government initiatives and infrastructure development to support Industry 4.0 and IoT applications are driving strong demand for TSN solutions in this region. The region's dominance is further attributed to factors such as emerging economies and well-established manufacturing hubs, which necessitate leveraging digital transformation and smart manufacturing, requiring highly reliable and synchronized communication networks. The Industry 4.0 trend also boosted the demand for TSN-enabled solutions.

What Makes Europe the Fastest-Growing Region in the Time Sensitive Networking Market?

Europe is expected to grow at the fastest rate in the coming years. This is primarily due to its robust industrial base, early adoption of Industry 4.0, a supportive regulatory framework that enhances network reliability, and strategic investments in industrial automation and digital transformation. Initiatives such as smart city projects and the integration of cutting-edge technologies, such as AI and IoT, with time-sensitive networking further fuel the market's growth. In addition, government-driven sustainability initiatives, including regulatory frameworks for data security and real-time communication protocols, have enabled organizations to leverage time-sensitive networking. Additionally, significant investments in smart manufacturing, automotive innovation, and government support for advanced networking standards are accelerating the deployment of TSN across the region.

Value Chain Analysis

Technology development and standardization

It is a foundational stage where collaboration occurred between leading tech companies and standardized bodies aiming to support and predefine the main TSN rules to ensure interoperability.

- Key players: NVIDIA, Intel, Qualcomm, TTTech Group, and Cisco Systems

Implementation of hardware & software

This stage focuses on creating physical devices and software that enable TSN to operate according to defined standards.

- Key players: NXP Semiconductors, Microchip Technology, Marvell, Siemens, and Analog Devices

Development of use cases

This step involves tailoring the basic protocols to meet the specific requirements of various industry verticals, thereby accelerating the adoption and commercialization of TSN.

- Key players: Mitsubishi Electric, OPC Foundation, Avnu Alliance, Ericsson, and PROFINET International

Top Companies in the Time Sensitive Networking Market

- Cisco Systems, Inc.: Provides industrial Ethernet switches (e.g., Catalyst IE3400 Series) and software solutions for secure, low-latency IT/OT network convergence in industrial automation.

- Siemens AG: Integrates TSN capabilities into its industrial networking components and automation systems for seamless, real-time data exchange in smart factory and Industry 4.0 applications.

- Intel Corporation:Offers processors (e.g., Ethernet Controller I225 Series) and FPGA solutions with built-in TSN support for high-throughput, time-sensitive workloads in manufacturing and autonomous mobility.

- Broadcom Inc.: Supplies high-performance Ethernet switches and controllers (e.g., StrataXGS Trident 4 Series) for applications requiring strict timing and low-latency data transfer in factory automation and data centers.

- NXP Semiconductors: Provides application processors (e.g., Layerscape LS1028A) and connectivity products for industrial control, automotive gateways, and IoT systems, focusing on secure and reliable real-time data delivery.

Other Key Players

- Marvell Technology Group

- Microchip Technology Inc.

- Analog Devices, Inc.

- TTTech Computertechnik AG

- Belden Inc.

- National Instruments (NI)

- Huawei Technologies Co., Ltd.

- Renesas Electronics Corporation

- Keysight Technologies

- Realtek Semiconductor Corp.

Recent Developments

- In February 2025, Cumucore is leveraging time-sensitive networking instead of 5G networking to deliver highly reliable wireless connectivity. TSN capabilities offer ultra-low latency and real-time synchronization.

(Source: https://cumucore.com) - In April 2024, TTTech and AMETEK Abaco Systems announced a collaboration aimed at offering cutting-edge time-sensitive networking solutions. It will be highly beneficial for next-generation targets of the North American Defense Industry.

(Source: https://abaco.com)

Segments Covered in the Report

By Component

- Hardware

- Switches

- Controllers & Processors

- Micro-controllers (MCUs)

- Field-Programmable Gate Arrays (FPGAs)

- Application-Sepcific Integrated Circuits (ASICs)

- Physical Layer Devices (PHYs)

- Hubs,Routers, & Gateways

- Connectors & Cables

- Power Supply Devices

- Isolators & Converters

- Memory Devices

- Software

- TSN Configuration & Management Tools

- TSN Protocol Stacks

- Real-Time Operating Systems (RTOS) with TSN Support

- Services

- Integration & Implementation Services

- Consulting Services

- Maintenance & Support Services

By Standard / Protocol Type

- Time Synchronization IEEE 802.1AS

- Deterministic Scheduling & Shaping

- Redundancy & Reliability IEEE 802.1CB

- Configuration & Filtering

- Application-Specific Compliance

By Application

- Industrial Automation & Manufacturing

- Automotive & Transportation

- Aerospace & Defense

- Power & Energy

- Telecom & Data Centers

- Others

By Deployment / Network Architecture

- On-premises

- Cloud/Edge-based

By Distribution Channel (Hardware Components)

- Direct Sales

- Indirect Sales (Distributors)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting