What is the Transfer Membrane Market Size?

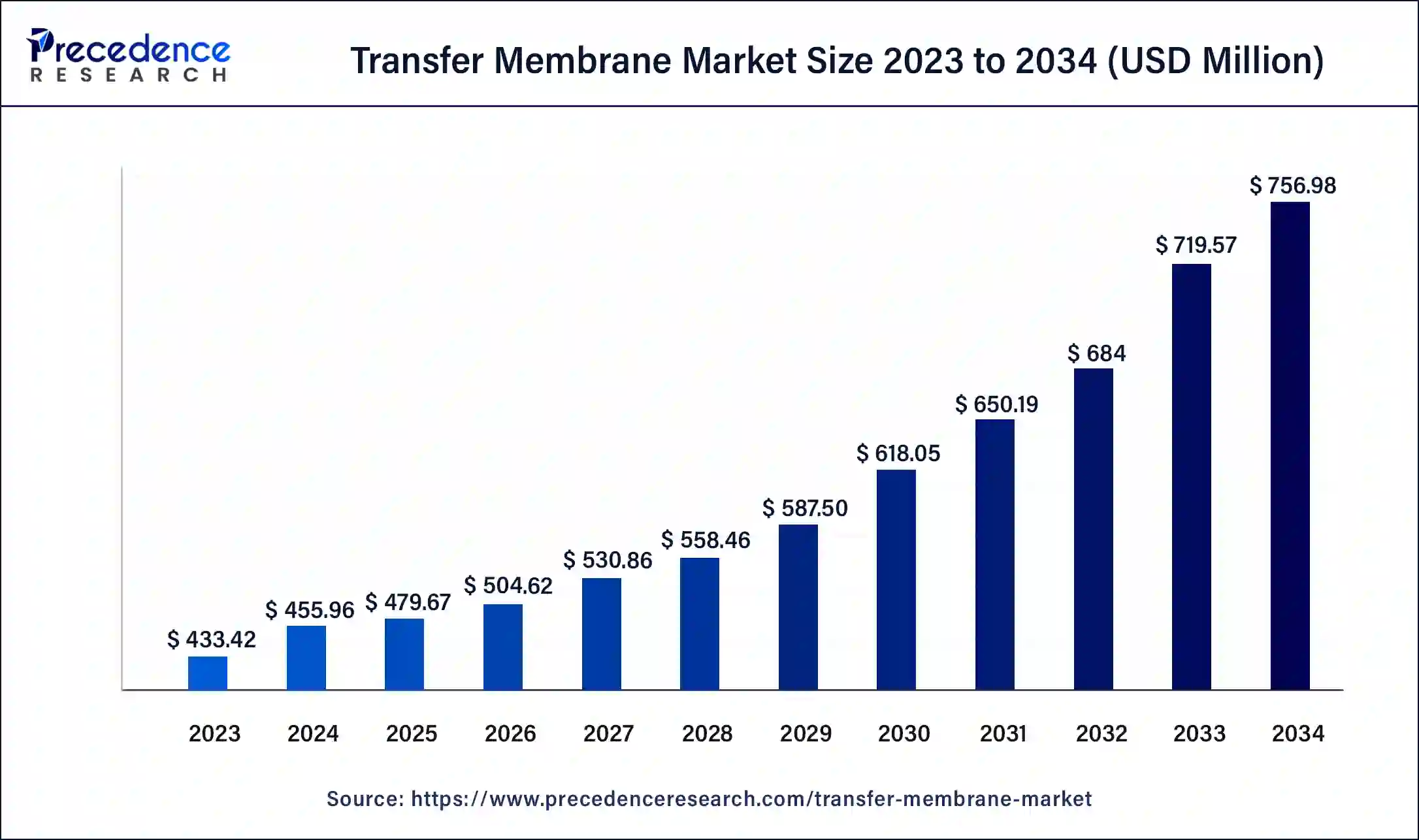

The global transfer membrane market size is accounted at USD 479.67 million in 2025 and predicted to increase from USD 504.62 million in 2026 to approximately USD 794.39 million by 2035, representing a CAGR of 5.17% from 2026 to 2035.

Transfer Membrane Market Key Takeaways

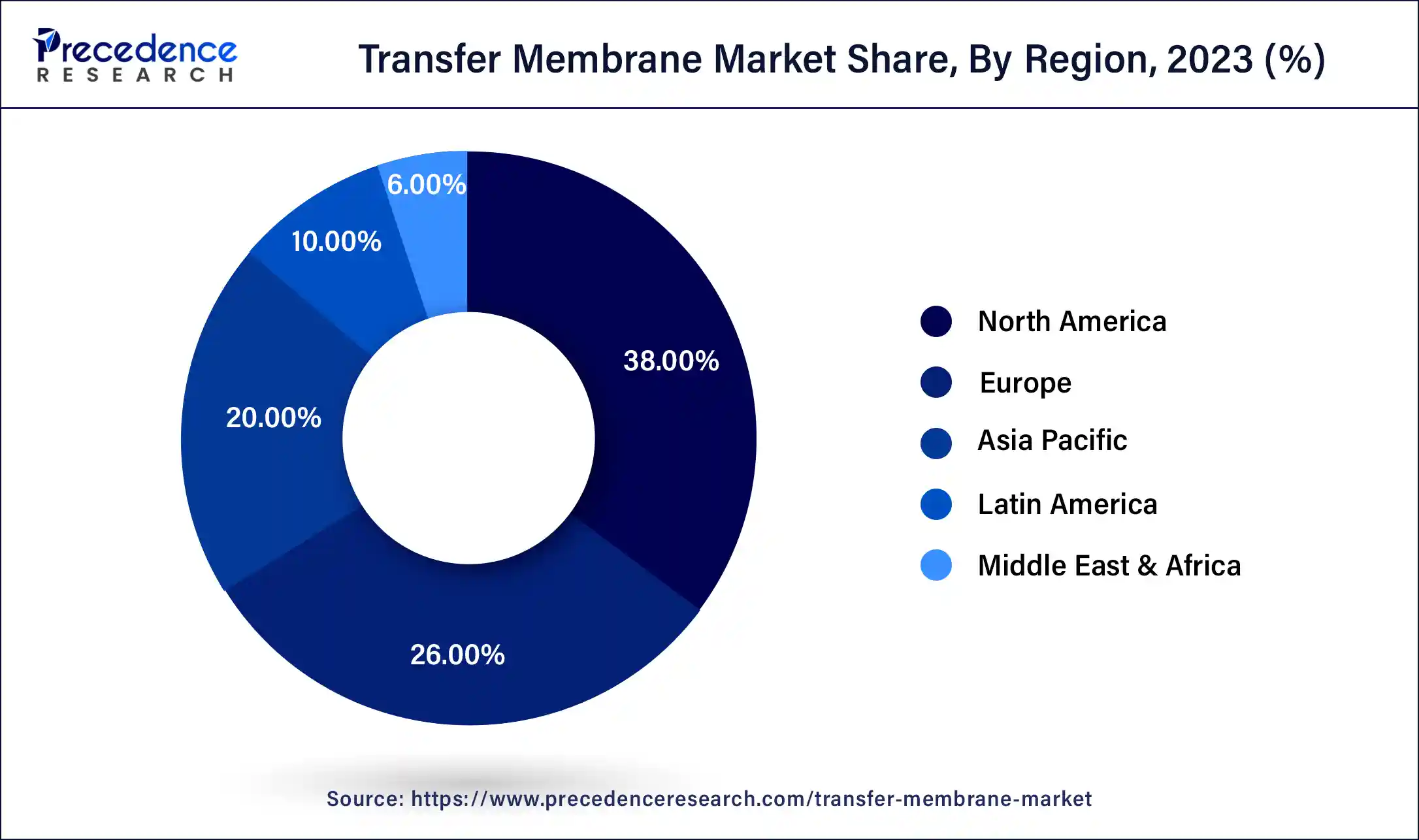

- North America has generated more than 38% of revenue share in 2025.

- Asia Pacific is predicted to grow at the quickest CAGR of 5.94% between 2026 and 2035.

- By Product, the PVDF segment captured more than 40% of revenue share in 2025.

- By Application, western blotting has recorded the highest revenue share in 2025.

- By End-User, the pharmaceutical and biopharmaceutical companies are predicted to generate the maximum market share between 2026 and 2035.

What is Transfer Membrane?

The transfer membrane market refers to the global market for various transfer membranes used in multiple applications, such as Western blotting, protein sequencing, and nucleic acid transfer. Transfer membranes are thin, porous sheets made of various materials such as nitrocellulose, polyvinylidene difluoride (PVDF), and nylon. They transfer proteins or nucleic acids from a gel or a blotting paper to solid support for analysis or detection.

The transfer membrane market includes products such as nitrocellulose membranes, PVDF membranes, nylon membranes, and other specialized membranes, as well as related accessories and consumables such as transfer buffers, filter papers, and pre-cut membranes. The increasing demand for transfer membranes in research and diagnostics applications and the growing use of transfer membranes in industries such as pharmaceuticals, biotechnology, and food testing drive the market.

Transfer Membrane Market Growth Factors

The transfer membrane market is expected to grow due to the increasing demand for protein analysis in various fields, such as medical research, biotechnology, and pharmaceuticals. The development of new transfer membrane technologies, such as improved pore size, better binding capacity, and increased sensitivity, is expected to boost the growth of the transfer membrane market. The increasing use of western blotting for protein analysis and the rising demand for this technique in the biotechnology and pharmaceutical industries are expected to drive the growth of the transfer membrane market.

The growing research and development activities in genomics, proteomics, and drug discovery are expected to drive the demand for transfer membranes. The ever-increasing demand for diagnostic testing in the healthcare industry, including protein-based diagnostic tests, is expected to drive the growth of the transfer membrane market. The increasing investments in biotechnology and pharmaceutical industries across the globe are expected to create significant opportunities for the transfer membrane market.

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases is expected to drive the demand for transfer membranes in medical research. The growing trend toward personalized medicine and the increasing use of protein-based biomarkers for disease diagnosis and treatment are expected to drive the growth of the transfer membrane market. The rising demand for point-of-care testing and the development of portable diagnostic devices are expected to drive the growth of the transfer membrane market. The increasing adoption of transfer membranes in academic and research institutes for protein analysis is expected to fuel the development of the transfer membrane market.

Market Outlook

- Industry Growth Overview:

The transfer membrane market is experiencing significant growth, driven by growing R&D in pharmaceuticals, biotech, and diagnostics, fueled by increasing disease prevalence and spending in life sciences. - Global Expansion:

The market is experiencing significant global expansion, driven by rising research in genomics/proteomics, targeted medicine, and biopharmaceutical manufacturing drives the demand. North America is dominated in the market by a robust life sciences infrastructure, massive R&D investments. - Major investors:

The major investors in the transfer membrane market are significantly large biotechnology, pharmaceutical, and life sciences companies that manufacture the membranes or utilize them extensively in their R&D and diagnostic processes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 479.67 Million |

| Market Size in 2026 | USD 504.62 Million |

| Market Size by 2035 | USD 794.39 Million |

| Growth Rate from 2026 to 2035 | CAGR of 5.2% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Transfer Method, By Application, By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers:

- Growing demand in various industries - Transfer membranes have applications in various industries, such as biotechnology, pharmaceuticals, healthcare, and food and beverage. The increasing demand in these industries is driving the growth of the transfer membrane market.

- Increasing research and development activities - Research and development activities in the biotechnology and pharmaceutical industries are driving the growth of the transfer membrane market. Transfer membranes are widely used in laboratory experiments, drug discovery, and protein analysis. According to the World Health Organization (WHO), the urgency for COVID-19 vaccines, scientific collaborations, and unprecedented financial investments are changing how vaccines are formed. For instance, some clinical trials evaluate multiple vaccines simultaneously, making the studies more rigorous.

- Technological advancements - Advancements in technology have led to the development of more efficient and reliable transfer membranes, which are driving the market's growth. New materials, improved designs, and manufacturing processes have also contributed to the development of the market.

- Government initiatives - Government initiatives to promote research and development activities in the biotechnology and pharmaceutical industries are driving the growth of the transfer membrane market. Funding for research and development activities and establishing research centers are examples of government initiatives that have contributed to the market's growth.

Market Restraints:

- Environmental concerns - Transfer membranes are typically made of synthetic materials that may not be biodegradable, which could lead to environmental concerns if not disposed of properly.

- Cost - Transfer membranes can be costly, especially for large-scale applications, which may limit the use of transfer membranes for some research projects or industries with limited budgets.

- Quality issues - Transfer membranes can be delicate and require specific handling and storage conditions to maintain quality. Handling during transport or storage could affect their performance and lead to accurate experiment results.

Market Opportunities:

- Growing demand for diagnostic testing - Transfer membranes are used in diagnostic testing for various diseases, including cancer, infectious diseases, and genetic disorders. As the demand for diagnostic testing continues to grow, the transfer membrane market is expected to expand.

- Increasing research and development activities -With the increasing focus on drug discovery and development, there is a growing demand for transfer membranes in research laboratories. This is expected to drive growth in the transfer membrane market in the coming years.

- Emerging markets - Due to the increasing demand for healthcare products and services, the transfer membrane market is expanding in emerging markets such as Asia-Pacific, Latin America, and the Middle East. These regions offer significant growth opportunities for transfer membrane manufacturers and suppliers.

Product Insights

PVDF (polyvinylidene fluoride) is a type of polymer commonly used in the production of transfer membranes for transferring proteins and nucleic acids during Western blotting and other similar techniques. One of the critical reasons why PVDF is leading the transfer membrane market is its superior properties compared to different types of membranes. PVDF membranes offer high binding capacity, excellent protein retention, and low background noise, making them ideal for various applications in molecular biology and biotechnology research. Additionally, PVDF membranes are highly durable and resistant to chemicals and solvents, which means they can be used multiple times without compromising performance. They are also compatible with various detection methods, including chemiluminescence and fluorescent detection.

Nitrocellulose membranes have been widely used in protein blotting applications for many years and are well-suited for various detection methods. However, they can be brittle and tend to shrink during transfer, resulting in distortion of the protein bands.

Transfer Method Insights

The dry electro blotting segment holds the maximum share of the market. It is a technique used to isolate proteins on a micro-level. It also helps efficiently transfer the substance with a more incredible speed. The transfer speed is faster in dry electro-blotting than in wet transfer, as there is no need to equilibrate the buffer and the transfer membrane. The transfer is also more consistent, as the electric field is applied directly to the gel matrix, resulting in uniform transfer across the entire gel. Furthermore, dry electro-blotting does not require buffer solutions, which can be expensive and require special disposal procedures. This makes dry electro-blotting a more cost-effective and environmentally friendly option.

Application Insights

Western Blotting has accounted for the largest share of the market revenue. Transfer membrane, as it serves two purposes, i.e., its ease to access the target protein and the other is a good handling facility.The emerging technological advancements based on DNA and RNA are aiding the market to grow. For instance, a study held at the Perelman School of Medicine at the University of Pennsylvania found that a new type of cells, which is not seen in mouse lungs, inhabit the alveoli and serve the metabolism required for the lining of the airway.

End-User Insights

Pharmaceutical and Biopharmaceutical Companies have the largest market globally. Increases in infrastructure, globalization, research funding by public and private bodies, and technological advancements such as next-generation sequencing, protein sequencing, and RNA sequencing are enhancing market growth. The pharmaceutical and biopharmaceutical industries heavily invest in research and development to develop new drugs and therapies, which require a lot of experimentation and analysis. As a result, these industries have a high demand for transfer membranes, making them one of the largest markets for these products.

Regional Insights

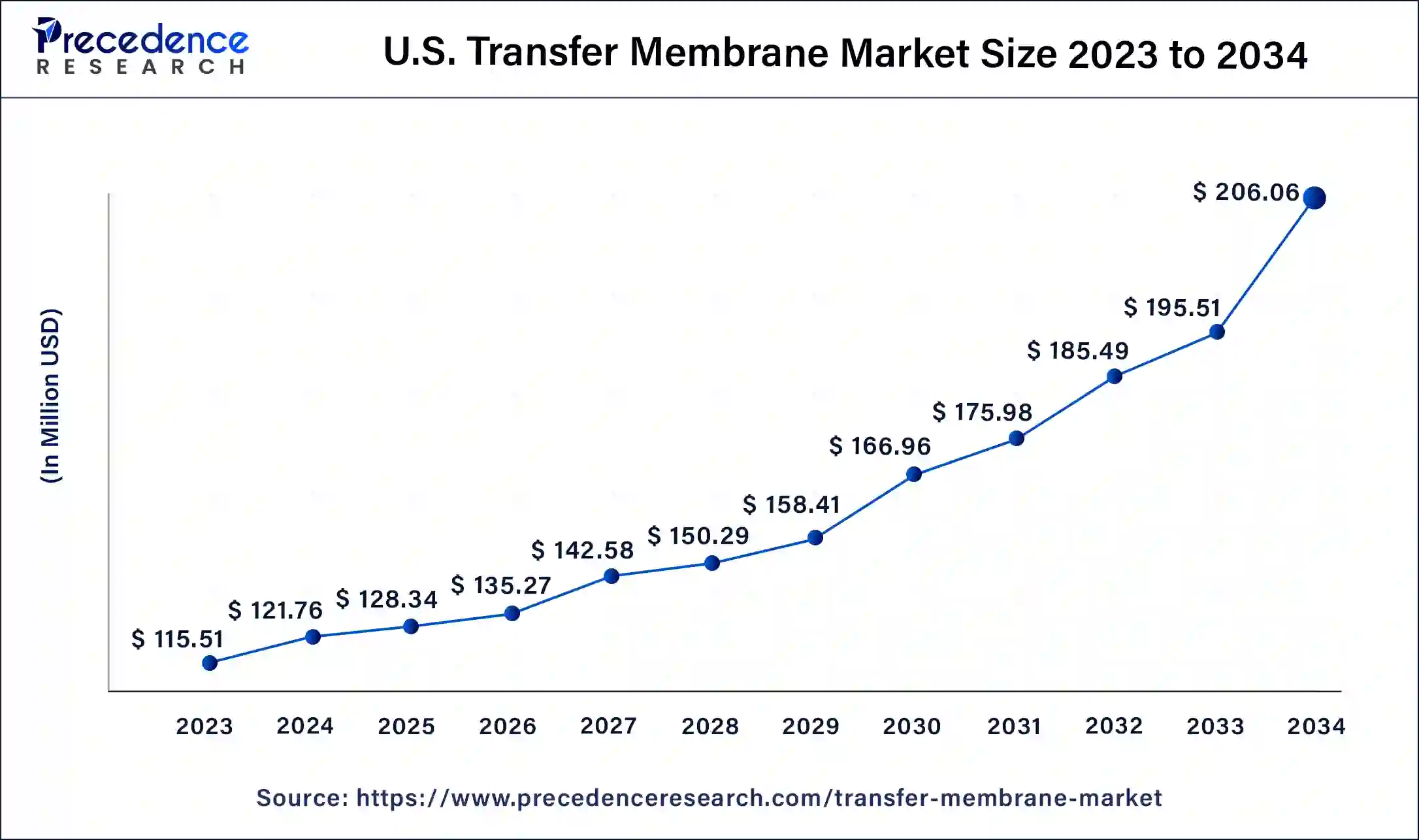

U.S. Transfer Membrane Market Size and Growth 2026 to 2035

The U.S. transfer membrane market size was estimated at USD 128.34 million in 2025 and is predicted to be worth around USD 216.61 million by 2035, at a CAGR of 5.4% from 2026 to 2035.

North America: High demand from life sciences

North America dominates the transfer membrane market across the world. North America is the home ground for multiple universities and research institutes, with the increase in government funding for research and development, demand for personalized medicine, and expanding research in genomics and proteomics, particularly for chronic diseases such as diabetes, hypertension, etc., driving the transfer membrane market to grow. The region has a high prevalence of lifestyle-related diseases such as obesity, which further causes the demand for medications. Furthermore, North America is home to many major pharmaceutical companies, which has led to a significant investment in the research and development of new drugs.

This has resulted in the availability of a wide range of medications, including innovative treatments for complex diseases. The COVID-19 pandemic has also increased the demand for pharmaceuticals in North America, particularly for vaccines and treatments for the virus. North America's high drug demand will continue in the coming years.

Asia Pacific: Rising R&D services

The Asia Pacific region has a large and rapidly growing population, which creates a large market for goods and services. With a population of over 4.5 billion, the area has a significant consumer base driving economic growth. Many countries in the Asia Pacific region have undertaken economic reforms to promote growth and development. These reforms have included deregulation, privatization, and liberalization of trade and investment, which have helped to attract foreign investment and spur economic growth.

U.S. Transfer Membrane Market Trends

In the U.S., growing adoption of automated blotting systems and digital health platforms improves research efficiency, increasing membrane applications. Government support from agencies such as the FDA encourages innovation and adoption of novel technologies. Major life science organizations like Thermo Fisher Scientific, Merck KGaA, and Danaher Corporation

India Transfer Membrane Market Trends

In India, increasing urbanization and industrialization make a massive demand for membrane bioreactors (MBRs) and reverse osmosis (RO) for wastewater treatment and water purification, increasing acceptance in municipal and industrial areas. Increasing focus on energy-effectiveness, AI-enabled, and high-recovery membranes, and local innovations.

Europe: Strong pharmaceutical and biotechnology industry

Europe is significantly growing in the market due to increasing initiatives like the European Green Deal and stringent emissions controls, driving demand for developed membranes in gas separation and carbon capture (CCS) systems. Europe has an advanced and innovation-centric pharmaceutical and biopharmaceutical field, a hub to major organizations such as Novartis, Sanofi, GlaxoSmithKline, and AstraZeneca, which contributes to the growth of the market.

The UK Transfer Membrane Market Trends

In the UK, with a world-class science base, the presence of major health and life science organizations will find that the consumers and conveniences to advance their products are in steady supply in the UK. The UK is aggressively investing in biomanufacturing abilities, focusing on digital transformation and automation for effective and high-quality production

Value Chain Analysis - Transfer Membrane Market

- R&D:

Research and development (R&D) solutions in the transfer membrane industry are significant for enhancing present technologies and developing novel applications, specifically in the biotechnology, pharmaceutical, and diagnostics sectors.

Key Players: Thermo Fisher Scientific - Clinical Trials:

Clinical trials and validation research focus on ensuring the safety, performance, and government compliance of membranes applied in medical and diagnostic applications.

Key Players: Bio-Techne - Patient Services:

Membranes are significant for Western blotting, an important process for the definitive diagnosis of infectious and chronic diseases like Hepatitis B, Lyme disease, and viral infections.

Key Players: Merck KGaA and Bio-Rad Laboratories

Recent Developments:

- In March 2023, an innovative cell therapy initiative will be the focus of a new strategic relationship between the University of Pennsylvania and Danaher Corporation. The multi-year partnership aims to create new technologies, reduce production bottlenecks, and provide next generation engineered cell products to patients with consistent clinical outcomes.

- In January 2023, the chemiSOLO, a high-performance, a portable chemiluminescent imaging device that is small and reasonably priced, has been released by Azure Biosystems Inc. A dedicated computer is unnecessary because the chemiSOLO may be operated using a state-of-the-art web-based interface on a smartphone, tablet, or laptop.

Top Companies in the Transfer Membrane Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Bio-Rad Laboratories |

California |

Broad and diverse product portfolio |

Bio-Rad's Sequi-Blot PVDF membrane delivers outstanding performance in protein sequencing, providing the binding capacity to sequence even low-abundance samples. |

|

Merck KGaA |

Germany |

Diversified business model across Healthcare, Life Science, and Electronics |

In August 2025, Merck, a leading science and technology company, successfully collaborated with company builder mantro GmbH, Munich, Germany, to establish EdiMembre, Inc., Massachusetts, U.S.A., a Deep-Tech spin-out poised to revolutionize the alternative protein sector. |

|

Santa Cruz Biotechnology, Inc. |

California |

Comprehensive automation portfolio |

In July 2024, Santa Cruz Biotechnology is a key supplier in life science research, providing essential tools like antibodies and reagents. |

|

ATTO Corporation |

United States |

High-performance and reliable storage |

ATTO offers specialized membranes and kits designed for high-efficiency protein and nucleic acid analysis |

|

Thermo Fisher Scientific, Inc. |

United States |

Production of high-quality animal sera and proteins |

Strong operational scale and efficiency |

Transfer Membrane Market Companies

- Bio-Rad Laboratories

- Merck KGaA

- Santa Cruz Biotechnology, Inc.

- ATTO Corporation

- Thermo Fisher Scientific, Inc.

- Danaher

- Azure Bio systems Inc.

- Advansta Inc.

- GVS S.p.A.

- PerkinElmer, Inc.

- Abcam Plc.

Segments Covered in the Report

By Product

- Nitrocellulose

- PVDF

- Nylon

By Transfer Method

- Wet or Tank Transfer

- Semi-dry Electro Blotting

- Dry Electro Blotting

- Others

By Application

- Northern Blotting

- Southern Blotting

- Western Blotting

- Others

By End-User

- Academic & Research Institutes

- Pharmaceutical & Biopharmaceutical Companies

- Diagnostic Labs

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting