U.S. Pantoprazole Market Size and Forecast 2025 to 2034

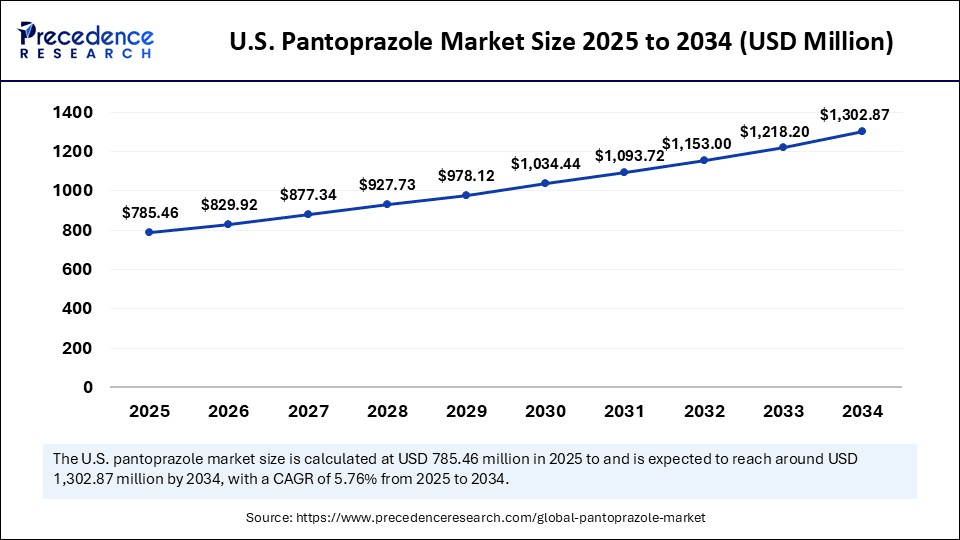

The U.S. pantoprazole market size was estimated at USD 743.96 million in 2024 and is predicted to increase from USD 785.46 million in 2025 to approximately USD 1,302.87 million by 2034, expanding at a CAGR of 5.76% from 2025 to 2034. The market is growing due to rising cases of gastroesophageal reflux disease (GERD) and other acid-related disorders worldwide.

U.S. Pantoprazole Market Key Takeaways

- By formulation, the oral tablets segment held the largest share of 70% in 2024.

- By formulation, the intravenous (IV) injections segment is expected to grow at the fastest CAGR during the forecast period.

- By distribution channel, the hospital pharmacies segment captured the biggest market share of 45% in 2024.

- By distribution channel, the online pharmacies segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the gastroesophageal reflux disease (GERD) segment contributed the highest market share of 50% in 2024.

- By application, the others (NSAID-induced ulcers, gastritis, etc.) segment is set to grow at the fastest CAGR in the forecast period.

- By end user, the hospitals segment generated the major market share of 55% in 2024.

- By end user, the home healthcare settings segment is expected to grow at the fastest CAGR during the forecast period.

What Is the Impact of AI on the U.S. Pantoprazole Market?

Artificial Intelligence (AI) is increasingly impacting the U.S. pantoprazole market by enhancing drug development, quality control, and supply chain efficiency. Predictive maintenance systems driven by AI are being integrated into American factories to help minimize production line downtime, guaranteeing a steady supply of pantoprazole in different formulations. Additionally, machine learning models help maintain the strict quality standards needed for regulatory compliance, optimize manufacturing parameters, and increase yield. Furthermore, more precise production scheduling is made possible by AI-driven demand forecasting tools, which lessen shortages and overstock conditions in pharmacies and hospitals.

On the clinical and commercial side, well-equipped U.S. healthcare providers can now tailor treatment for disorders related to acid reflux by using AI to analyze prescription data and patient demographics to find trends in pantoprazole use. AI-enabled pharmacovigilance systems track actual safety data to identify adverse events faster, enhancing patient safety and the effectiveness of regulatory reporting. Additionally, in an otherwise mature market AI AI-enabled market intelligence tools help businesses track pricing trends and competitive dynamics, allowing for agile decision making. The combined effect of these AI applications is improving patient outcomes, expediting processes, and fortifying manufacturers' competitive positions in the U.S. pantoprazole market.

Market Overview

The U.S. pantoprazole market encompasses the production, distribution, and sales of pantoprazole, a proton pump inhibitor (PPI) drug used to treat gastrointestinal conditions such as gastroesophageal reflux disease (GERD), erosive esophagitis, Zollinger-Ellison syndrome, and peptic ulcers. Pantoprazole reduces stomach acid production, providing relief from symptoms and promoting healing of acid-related damage. The market includes branded and generic pantoprazole formulations available in oral tablets, capsules, and intravenous injections. Growth is driven by increasing prevalence of acid-related disorders, expanding geriatric populations, and rising awareness of effective treatments.

U.S. Pantoprazole Market Growth Factors

- Rising prevalence of GERD, peptic ulcers, and acid reflux disorders due to changing dietary habits and sedentary lifestyles.

- A growing elderly population is more susceptible to gastrointestinal issues.

- Increased awareness and diagnosis of digestive disorders.

- Expanding use of proton pump inhibitors (PPIs) in both prescription and over-the-counter segments.

- The availability of generic pantoprazole makes treatment more affordable and accessible.

- Increasing healthcare spending in emerging economies.

- Improved distribution channels, including e-pharmacies and hospital networks.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,302.87 Million |

| Market Size in 2025 | USD 785.46 Million |

| Market Size in 2024 | USD 743.96 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.76% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Formulation, Distribution Channel, Application, and End User |

Market Dynamics

Drivers

High Global Burden of Gastrointestinal Disorders

The U.S. market for pantoprazole is largely driven by the rising incidence of gastrointestinal disorders like GERD, functional dyspepsia, gastric ulcers, and erosive esophagitis. Acid-related disorders have become more common in younger populations as well as among older adults due to changes in lifestyle, poor eating habits, and stress. More patients are entering the treatment pipeline as a result of the growing healthcare infrastructure in emerging economies and better diagnostic capabilities. Pantoprazole is still the preferred treatment for these chronic conditions and is a commonly prescribed first-line proton pump inhibitor (PPI), guaranteeing consistent demand in both developed and developing markets.

Shift Towards Self-Medication with OTC Porton Pump Inhibitors

Without a prescription, in many places, consumers are increasingly using over-the-counter PPIs like pantoprazole for quick and efficient relief from acidity and heartburn. Brand recognition has increased due to aggressive marketing and awareness campaigns, and access has become simple thanks to pharmacies, supermarkets, and internet platforms. Repeat purchases are encouraged by the affordability and ease of OTC formats, and as non-prescription sales are authorized by regulatory bodies such as the FDA in a number of nations, including the United States and Canada, allowing pantoprazoles to reach among populations that self-medicate quickly.

Restraints

Intense Generic Competition Driving Down Margins

After patents expired, generic pantoprazole became widely available at low prices, causing fierce competition in the U.S. pantoprazole market that has forced manufacturers into price wars and reduced their profit margins. Because of this commoditization, businesses are now less able to differentiate their products, make significant marketing investments, or develop new formulations, which has slowed the growth of the market's overall value despite stable volume demand. Premium goods are now at a disadvantage in a saturated market due to a significant decline in brand loyalty and the increased influence of cost-based bidding on procurement decisions.

Long Term Safety Concerns Dmapening Prescribing Habits

More cautious prescribing of proton pump inhibitors has resulted from new research that links prolonged use to risks like bone fractures, chronic kidney disease, vitamin B12 deficiency, and magnesium depletion. Many doctors are now suggesting shorter treatment plans or referring patients to other treatments, which reduces the amount of pantoprazole that is used over the long term and affects the volume of repeat prescriptions. Increased patient reluctance is also a result of this growing safety awareness; even for chronic conditions, many patients are demanding shorter treatment courses or non-pharmacological interventions, leading to hampering of growth in the U.S. pantoprazole market.

Opportunities

Product Innovation & Advanced Formulations

In an industry that is dominated by generics, the creation of innovative pantoprozole formulations such as dual delayed release capsules, oral disintegrating tablets and sustained release tablets and sustained release tablets can enhance patient adherence and distinguish the product. The premium U.S. pantoprazole market segment can be captured by innovations that aim for a longer duration of action or a faster onset.

OTC Market Growth

The change from prescription-only to over-the-counter (OTC) status of pantoprazole is being made possible by changes in regulatory environments in several countries, including the United States. Because of this, a large number of people, especially in cities self self-medicate for acidity and heartburn.

Formulation Insights

Why Did the Oral Tablets Segment Dominate the U.S. Pantoprazole Market in 2024?

The oral tablets segment underwent notable growth in the U.S. pantoprazole market during 2024, motivated by their affordability, ease of use, and suitability for long-term use in conditions involving acid reflux. In the United States. S. They continue to be the go-to option for outpatient treatment of GERD, peptic ulcers, and erosive esophagitis. Their long shelf life, ease of storage, and broad availability in hospital and retail pharmacies guarantee consistent demand from both branded and generic producers. The straightforward once-daily dosing schedules associated with tablets also result in higher patient adherence rates. Generics' lower prices have made them more accessible, further solidifying the market leadership of this segment. Growth is maintained by expanding insurance coverage for oral formulations.

The intravenous (IV) injections segment is anticipated to expand rapidly because it plays a crucial part in acute care situations where quick acid suppression is necessary. U. S. For patients who cannot take oral medications, those recovering from surgery, and patients with urgent gastrointestinal disorders, hospitals rely on intravenous pantoprazole. Adoption in the U.S. pantoprazole market is being accelerated by the rise in emergency room visits and surgical procedures. In critical care situations, IV formulations are essential due to their quick onset times and accurate dosage. Hospitals can now maintain steady stock levels thanks to improvements in formulation stability that have also increased shelf life. The need for IV pantoprazole is anticipated to increase as hospital infrastructure grows in rural areas.

Distribution Channel Insights

Why Did the Hospital Pharmacies Segment Dominate the U.S. Pantoprazole Market?

Hospital pharmacies segment registered its dominance over the U.S. pantoprazole market in 2024, motivated by their ability to manage expedited dispensing for inpatients and extensive procurement. They ensure continuous supply and adherence to treatment protocols in the United States by acting as the main channel for both oral and intravenous pantoprazole in acute care and post-operative recovery. U.S. medical care facilities. Strong supply chains and agreements for bulk purchases allow hospitals to bargain for lower prices, increasing their market share. Additionally, hospital pharmacies can handle specific compounding needs and dosage requirements that retail pharmacies might not be able to. They are essential to the distribution of pantoprazole because of their function in integrated care pathways.

The online pharmacies segment is anticipated to grow with the highest CAGR in the market during the studied years, due to the convenience of digital prescription services and the growing consumer preference for home delivery. Pantoprazoles reach through e-commerce channels is growing thanks to competitive pricing, auto-refill subscription models, and increased acceptance of telehealth prescriptions. Younger tech-savvy patients, as well as those living in remote areas who want simpler access to prescription drugs, are contributing to this expansion. Real-time prescription verification and refill reminders are now possible through improved digital platforms, which increases adherence. In the years to come, the segment's growth is probably going to be accelerated by the move to direct-to-patient models.

Application Insights

Why Did the Gastroesophageal Reflux Disease Segment Dominate the U.S.Pantoprazole Market?

The gastroesophageal reflux disease segment dominated the U.S. market for pantoprazole in 2024, driven by the high prevalence of acid reflux disorders in the U.S. population. Pantoprazole's proven ability to control symptoms and promote healing of the esophagus makes it the standard choice among physicians for both short-term relief and long-term disease management. The increasing incidence of obesity, poor dietary habits, and stress-related conditions has amplified demand. Physicians also favor pantoprazole due to its favorable safety profile and minimal drug interaction risks. Awareness campaigns about GERD symptoms and complications have led to earlier diagnosis, which further sustains prescription volumes.

End User Insights

Why Did Hospital Segments Dominate the U.S. Pantoprazole Market in 2024?

The hospitals segment dominated the U.S. pantoprazole market, motivated by their ability to offer complete care that calls for pantoprazole that is both injectable and oral. High patient turnover, the need for critical care, and the incorporation of pantoprazole into emergency and post-operative treatment protocols all contribute to hospitals' steady demand. Early therapy initiation is also facilitated by the hospital's advanced diagnostic capabilities. Pantoprazole is frequently used consistently in hospitals by following standardized treatment pathways. The growth of this segment is also being aided by the expansion of tertiary care facilities in suburban areas.

The home healthcare settings segment is the fastest growing, owing to the increasing adoption of at-home treatment for chronic gastric disorders. Support from home health nurses, telemedicine follow-ups, and patient-friendly dosing formats contribute to stronger uptake in this segment. The growing elderly population, many of whom prefer home-based recovery, is boosting demand for self-administered therapies. Improved packaging, such as blister packs and pre-measured doses, enhances convenience for patients managing their medication schedules. As insurance providers expand coverage for home-based treatments, this segment is expected to see accelerated growth.

Country-Level Analysis

U.S. dominates the pantoprazole market owing to its high prevalence of GERD and other acid-related illnesses, which are bolstered by a robust healthcare system and popular access to both name-brand and generic medications. Strong physician prescription trends, hospital-integrated treatment plans, and early diagnosis rates maintain a steady level of demand. The nation enjoys the advantages of a strong domestic pharmaceutical manufacturing sector and a dependable multi-source generic supply, which guarantees availability through retail online and hospital channels. A wide range of people can access treatment thanks to comprehensive insurance coverage and patient assistance programs, and product uptake in acute and chronic care settings is strengthened by innovations in ready-to-use intravenous (IV) formulations and patient-centric packaging. Further solidifying the U. S. is the rapid adoption of telehealth-driven e-prescribing, sophisticated distribution networks, and established regulatory frameworks. S. as the world's top market for pantoprazole.

U.S. Pantoprazole Market Companies

- Pfizer Inc.

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Aurobindo Pharma Ltd.

- Mylan N.V. (Viatris)

- Sandoz (Novartis)

- Cipla Ltd.

- Zydus Cadila

- Lupin Limited

- Torrent Pharmaceuticals

- Siegfried Holding AG

- Glenmark Pharmaceuticals

- Hetero Drugs Ltd.

- Alembic Pharmaceuticals Ltd.

- Ipca Laboratories Ltd.

- Bionpharma Inc.

- Kremers Urban Pharmaceuticals

- Accord Healthcare

- Fresenius Kabi

Recent Developments

- On 9 April 2024, Camber Pharmaceutical launched pantoprazole sodium for delayed-release oral suspension, expanding its portfolio with a formulation indicated for GERD, erosive esophagitis, and Zollinger-Ellison Syndrome.(Source: https://www.camberpharma.com)

- On 1 April 205, Alembic Pharmaceuticals received final U.S. FDA approval for pantoprazole sodium for injection, 40 mg/vial.

(Source: https://www.business-standard.com)

Segments Covered in the Report

By Formulation

- Oral Tablets

- Intravenous (IV) Injections

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others (Wholesale, Clinics)

By Application

- Gastroesophageal Reflux Disease (GERD)

- Erosive Esophagitis

- Zollinger-Ellison Syndrome

- Peptic Ulcers

- Others (NSAID-induced Ulcers, Gastritis, etc.)

By End User

- Hospitals

- Clinics & Ambulatory Care Centers

- Home Healthcare Settings

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting