What is the Pantoprazole Market Size?

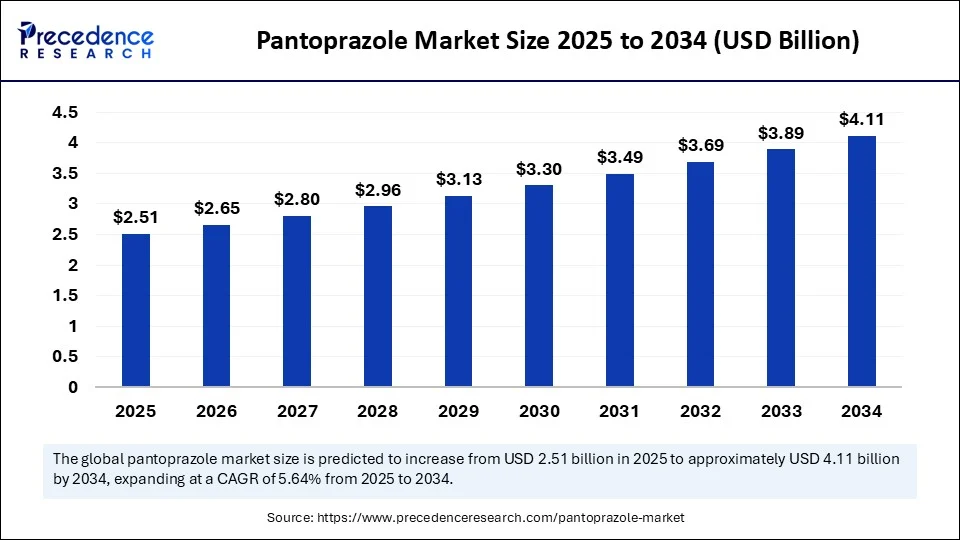

The global pantoprazole market size is valued at USD 2.65 billion in 2025 and is predicted to increase from USD 2.80 billion in 2026 to approximately USD 4.34 billion by 2034, expanding at a CAGR of 5.64% from 2025 to 2034. The rising prevalence of gastroesophageal reflux disease (GERD), increasing regulatory approvals, and rapid advancements in drug delivery systems are expected to drive the growth of the global pantoprazole market over the forecast period. Several key players in the industry are widely adopting effective strategies like new product launches and mergers to expand their market share and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, fuelled by the presence of key market players and rising increasing prevalence of gastroesophageal reflux disease (GERD).

Pantoprazole Market Key Takeaways

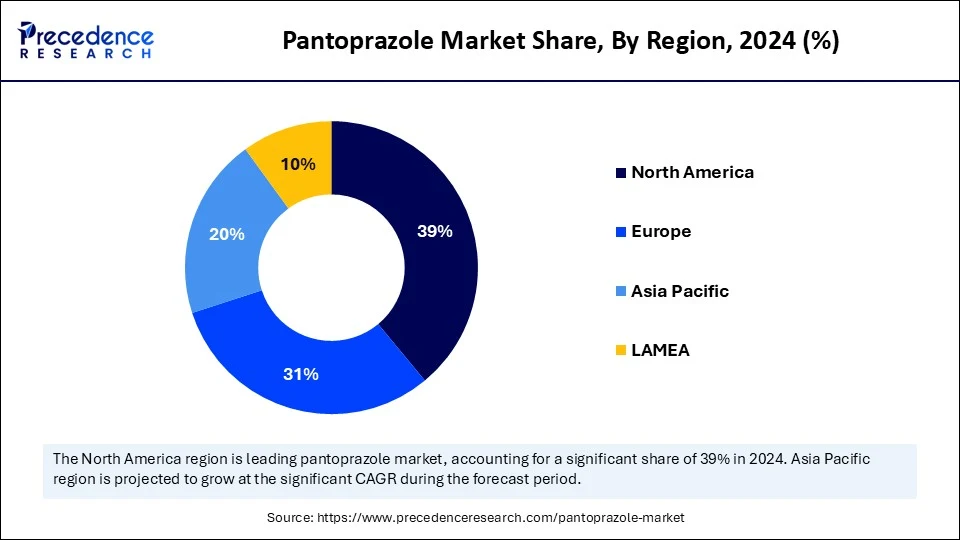

- North America led the global market with the largest share of 39% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By product type, the pantoprazole sodium sesquihydrate segment dominated the market share in 2024.

- By product type, the pantoprazole magnesium segment is also experiencing the fastest growth.

- By route of administration, the oral segment captured the largest market share in 2024.

- By route of administration, the intravenous (IV) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By formulation, the tablets (delayed-release) segment held a dominant presence in the market in 2024.

- By formulation, the injectable (IV) segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By application, the gastroesophageal reflux disease (GERD) segment held the biggest market share in 2024.

- By application, the Zollinger-Ellison syndrome segment is expanding at a significant CAGR from 2025 to 2034.

- By distribution channel, the retail pharmacies segment dominated the market with the largest share in 2024.

- By distribution channel, the online pharmacies segment is experiencing rapid growth in the market during the forecast period.

- By dosage strength, the 40 mg segment led the pantoprazole market.

- By dosage strength, the 20 mg segment is set to experience the fastest rate of market growth from 2025 to 2034.

Market Overview

The pantoprazole market refers to the global and regional markets involved in the production, distribution, and sale of pantoprazole, a proton pump inhibitor (PPI) used primarily to treat gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and erosive esophagitis. Pantoprazole works by reducing the amount of acid produced in the stomach and is available both as a prescription drug and over-the-counter (OTC) medication in some regions. The market comprises branded and generic drug formulations across various dosage forms.

How Can AI Impact the Growth Pantoprazole Market?

As technology continues to evolve, the integration of Artificial Intelligence (AI) emerges as an emerging force, holding great potential to revolutionize the pantoprazole market's growth. AI can effectively analyze the large datasets from clinical trials to identify patterns and insights that lead to a high understanding of pantoprazole's effects and potential applications. AI-powered solutions can design more effective drug delivery systems for pantoprazole to improve its absorption and efficacy. AI algorithms can analyze large amounts of datasets of biological interactions, chemical compounds, and other patient-related data to identify potential drug candidates or to identify new PPIs with enhanced properties. AI also plays a crucial role in personalized medicine, which includes lifestyle, genetic information, and medical history, to predict how an individual is likely to respond to pantoprazole treatment. This solution assists healthcare professionals in tailoring treatment plans for better treatment outcome.

Pantoprazole Market Outlook

- Industry Growth Overview: The pantoprazole market is expected to experience significant growth from 2025 to 2034, driven by the rising prevalence of gastrointestinal disorders and an aging population. The increasing demand for cost-effective generic formulations is also accelerating market expansion, as patients and healthcare providers seek affordable alternatives to branded medications.

- Green Chemistry and Accessible Generics:A key sustainability trend in healthcare is the growing adoption of green chemistry in manufacturing processes, which helps reduce waste, lower environmental impact, and improve supply chain efficiency. At the same time, the increasing availability of affordable generic medications promotes systemic sustainability by enhancing patient access to essential treatments while reducing overall healthcare costs, making healthcare more accessible and cost-effective in the long term.

- Global Expansion:Leading players in the market are expanding their reach into high-growth regions such as Asia-Pacific, Latin America, and Eastern Europe, driven by rising healthcare needs and infrastructure development. While North America and Europe currently maintain a stronghold in the market with established healthcare infrastructure and advanced technologies, emerging regions present significant opportunities for expansion as they experience rising demand for medical innovations and treatments.

- Major Investors: Major investors in the market include pharmaceutical companies such as Teva Pharmaceuticals, Sandoz, and Mylan, which invest in the development and production of generic formulations to meet the growing demand for affordable gastrointestinal treatments. These companies play a crucial role in expanding market access, improving affordability, and driving the widespread adoption of pantoprazole as a cost-effective treatment for acid reflux and other gastrointestinal disorders.

What Are the Key Trends in the Pantoprazole Market?

- The rising awareness of gastrointestinal health issues is estimated to accelerate the growth of the pantoprazole market during the forecast period.

- The rising funds by public and private organizations for clinical research are expected to propel the growth of the market during the forecast period.

- The rising technological advancements of drug formulation and delivery systems in the pharmaceutical industry are anticipated to contribute to the overall growth of the pantoprazole market.

- The rising launch of generic versions and surging investment of pharmaceutical companies that produce generic versions of pantoprazole are expected to propel the pantoprazole market's growth.

- The surge in healthcare spending is anticipated to boost the expansion of the pantoprazole market.

- The surge in the aging population around the world is anticipated to accelerate the market's growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.34 Billion |

| Market Size in 2026 | USD 2.80 Billion |

| Market Size in 2025 | USD 2.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.64% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Distribution Channel, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Gastrointestinal Treatments

The rising demand for gastrointestinal treatments has boosted the growth of the pantoprazole market during the last few years. The increasing cases of acid-related disorders like GERD, peptic ulcers, and Zollinger-Ellison syndrome around the world have led to a growing demand for effective treatments like pantoprazole. The acid-related disorders are driven by various factors such as unhealthy lifestyles and aging populations, which spur the demand for pantoprazole. The market is also experiencing the rising demand for proton pump inhibitors (PPIs), which are increasingly prescribed to substantially reduce gastric acid secretion and alleviate several symptoms such as acid reflux and heartburn. In recent years, generic alternatives have become more prevalent. Several companies that produce pantoprazole's generic versions can yield significant returns due to lower production costs and increased market penetration rate.

Restraint

Regulatory Hurdles Create Blockages

The stringent regulatory approvals are anticipated to hamper the market's growth. The market often faces regulatory challenges that result in delays in product launches and increased costs. In addition, the potential side effects of pantoprazole, such as kidney disease, bone fractures, and others, may lead to caution among healthcare providers and patients. Such factors may hinder the growth of the global pantoprazole market during the forecast period.

Opportunity

How Are Advancements in Drug Delivery Systems and Expanding Regulatory Approvals Impacting the Market Expansion?

The technological advancements in drug delivery systems are projected to offer lucrative growth opportunities to the pantoprazole market during the forecast period. The rapid innovations in drug delivery systems significantly enhance the effectiveness and convenience of pantoprazole medications, resulting in a higher adoption rate. These innovations include enteric-coated formulations, delayed-release tablets, pre-filled syringes, sustained-release injections, and orally disintegrating tablets. In addition, the increasing focus on generic drugs is anticipated to drive the market's expansion during the forecast period. The increasing number of new launches and expanding regulatory approvals are also expected to fuel the pantoprazole market expansion in the coming years. Regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are actively working to make the drug approval process more efficient.

- For instance, in April 2025, AlembicPharmaceuticals Limited secured final approval from the United States Food and Drug Administration (USFDA) for its Pantoprazole Sodium for Injection, 40 mg/vial (Single-Dose Vial). The approval of Pantoprazole Sodium Injection adds to its 221 total ANDAs, including 195 final and 26 tentative approvals. The estimated market size for this product is $48 million.

Product Type Insights

What Made the Pantoprazole Sodium Sesquihydrate's Segment Lead the Pantoprazole Market in 2024?

The pantoprazole sodium sesquihydrate segment dominated the market in 2024. Pantoprazole sodium sesquihydrate is freely soluble in water. Pantoprazole Sodium Sesquihydrate is one of the crucial pharmaceutical compounds widely utilised in the treatment of peptic ulcers, gastroesophageal reflux disease (GERD), and other acid-related gastrointestinal disorders. The increasing incidence of these health conditions globally has propelled the demand for this drug.

On the other hand, the pantoprazole magnesium segment is witnessing the fastest growth. Pantoprazole magnesium offers a longer half-life, which has potential for extended acid suppression and assists in improved control of nighttime symptoms. Several studies have shown that pantoprazole-Mg is clinically effective as compared to pantoprazole-Na for the treatment of certain stages of GERD. Additionally, the increasing prevalence of lifestyle-related gastrointestinal conditions, rising awareness about early treatment, and the availability of pantoprazole magnesium in both branded and generic forms at competitive prices are driving its demand. Thus, bolstering the segment's expansion in the coming years.

Route of Administration Insights

What Made the Oral Segment Lead the Pantoprazole Market in 2024?

The oral segment was dominant, with the biggest share of the global pantoprazole market in 2024. The oral pantoprazole includes various dosage forms such as capsules, tablets, and oral suspensions, serving the diverse patient needs. Oral Suspension is the liquid formulation of pantoprazole, offering flexible dosing options. Capsules and tablets are the most common solid dosage forms of pantoprazole, providing a precise dosing option and convenient administration for treating acid-related disorders.

On the other hand, the intravenous (IV) segment is also experiencing the fastest growth. The intravenous (IV) form of pantoprazole is widely utilised for treating conditions where oral administration is not desirable or feasible. Pantoprazole injection treats patients with conditions in which there is too much acid in the stomach. The injection formulation offers a rapid onset of action for severely ill patients or those patients that unable to take oral medications in hospital settings.

Application Insights

How Did the Gastroesophageal Reflux Disease (GERD) Segment Dominate the Pantoprazole Market in 2024?

The gastroesophageal reflux disease (GERD) segment dominated the market in 2024, owing to the increasing number of individuals diagnosed with gastroesophageal reflux disease (GERD disorders globally. Pantoprazole medication belongs to a class of drugs known as proton pump inhibitors (PPIs) and is often prescribed to manage the symptoms and complications of GERD. Pantoprazole heals and prevents damage to the esophagus in adults with GERD.

According to the article published by the National Institutes of Health (NIH), in 2024, an estimated 1.03 billion people worldwide experienced GERD, representing a 13.9% global prevalence. Gastroesophageal reflux disease (GERD) is one of the most commonly diagnosed digestive disorders in the US and Europe, with a prevalence of 20% and 25% respectively.

On the other hand, the Zollinger-Ellison syndrome segment is expected to register the fastest growth. Pantoprazole works by reducing stomach acid production, helping to alleviate symptoms and promote healing. Pantoprazole is the preferred treatment option for controlling gastric acid hypersecretion in Zollinger-Ellison syndrome (ZES) patients. Pantoprazole medication can be administered orally or intravenously for ZES treatment. The precise and appropriate dosage can be adjusted based on the patient's response and the desired level of acid suppression.

Distribution Channel Insights

Why Are Retail Pharmacies Championing the Pantoprazole Market?

The retail pharmacies segment held the largest segment of the pantoprazole market in 2024.Retail pharmacies are a crucial distribution channel for making pantoprazole accessible to patients. Pantoprazole is widely available over-the-counter (OTC) in retail pharmacies, allowing patients to purchase it without a prescription. Retail pharmacies offer convenient access and pharmacist counselling on pantoprazole's potential side effects, proper use, and storage. On the other hand, the online pharmacies segment is expected to grow significantly in the coming years. The rapid growth of online pharmacies is facilitated by the wide range of product availability. Online pharmacies as a significant distribution channel in the pantoprazole market. Online pharmacies provide attractive discounts and various additional value-added services. Such attractive discounts attract patients to online pharmacies, accelerating the growth of the segment. Thus, the rising expansion of online pharmacies is projected to fuel the segment expansion in the coming years.

Formulation Insights

Why Is the Tablets Segment Leading the Market?

The tablets (delayed-release) segment dominated the pantoprazole market because they offer a controlled release of the active ingredient, ensuring prolonged therapeutic effects and reducing the frequency of dosing, which improves patient compliance. This formulation helps protect the drug from degrading in the stomach's acidic environment, allowing it to reach the intestine intact for optimal absorption. Delayed-release tablets are also cheaper, easy to store and transport, and widely available in both branded and generic versions, making them the most accessible and preferred dosage form for both patients and healthcare providers.

The injectable (IV) segment is the fastest growing because it offers rapid onset of action, making it the preferred choice in acute or severe cases where immediate symptom relief is critical, such as gastrointestinal bleeding or severe GERD in hospitalized patients. IV administration bypasses the digestive system, ensuring full bioavailability and consistent drug delivery, which is particularly beneficial for patients who cannot take oral medications. The rising number of hospital admissions, advancements in infusion therapies, and the increasing use of injectables in emergency and critical care settings are driving this segment's accelerated growth.

Dosage Strength Insights

Why Is the 40 mg Dose Leading the Pantoprazole Market?

The 40 mg dose is leading the market because it is the standard therapeutic strength prescribed for treating moderate to severe acid-related disorders, such as GERD, Zollinger–Ellison syndrome, and erosive esophagitis, where stronger acid suppression is required for effective symptom control and healing. Its proven track record, widespread clinical use, and inclusion in treatment guidelines have made it the most commonly prescribed dosage globally.

In contrast, the 20 mg dose is the fastest growing because it is increasingly used for maintenance therapy, mild cases, and preventive treatment in patients at risk of acid-related complications. Its lower strength reduces the risk of side effects, appeals to patients seeking minimal effective dosing, and is favored in over-the-counter formulations, all of which are expanding its adoption.

End User Insights

Why Are Hospitals Leading the Market for Pantoprazole End Users?

Hospitals are leading end users because they handle a large volume of patients requiring immediate and intensive treatment for severe gastrointestinal disorders, where controlled administration, monitoring, and specialized care are essential. They are also primary points for initial diagnosis, acute care, and post-surgical recovery, making them major consumers of both oral and injectable proton pump inhibitors. On the other hand, home care settings are the fastest growing due to the rising trend of outpatient treatment, increased availability of easy-to-administer oral formulations, and the growing preference for managing chronic conditions like GERD from home. Factors such as cost savings, convenience, and the expansion of telemedicine and home delivery of prescription drugs are further accelerating demand in home-based care.

Regional Insights

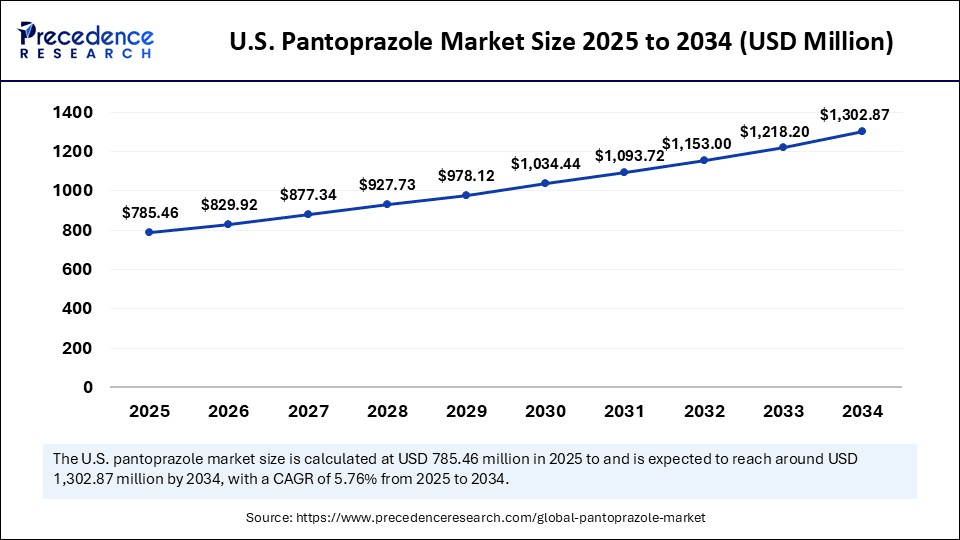

U.S. Pantoprazole Market Size and Growth 2025 to 2034

The U.S. pantoprazole market size is exhibited at USD 785.46 million in 2025 and is projected to be worth around USD 1,302.87 million by 2034, growing at a CAGR of 5.76% from 2025 to 2034.

How Did North America Lead the Pantoprazole Market in 2024?

North America held the dominant share of the pantoprazole market in 2024. The region benefits from a well-developed healthcare infrastructure and supportive healthcare regulations. The region's rapid growth is attributed to the rising prevalence of gastrointestinal disorders, a surge in the aging population, rising awareness of proton pump inhibitors (PPIs), and increasing availability of generics. The rising technological advancements in drug delivery systems improve patient convenience, compliance, and therapeutic efficacy, bolstering the pantoprazole market's growth during the forecast period.

The U.S. Pantoprazole Market Trends

The U.S. continues to be a major contributor to the global pantoprazole market, supported by its advanced healthcare infrastructure, increasing presence of key market players, high per capita expenditure on pantoprazole medication, and ongoing innovation in drug delivery systems. In addition, the country has a rising prevalence of acid-related disorders such as Gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. Several key players operating in the country are increasingly focusing on new developments in the formulation of pantoprazole injections, which are anticipated to enhance the bioavailability. The U.S. also leads in developing and adopting drug delivery technologies, such as delayed-release tablets, enteric-coated formulations, orally disintegrating tablets, pre-filled syringes, and sustained-release injections. The expiration of patents has led to an increasing number of generic versions of pantoprazole entering the U.S. market, making the medication more accessible and affordable to patients.

What Made Asia Pacific the Fastest-Growing Region in the Pantoprazole Market in 2024?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fueled by the growing demand for proton pump inhibitors (PPIs), an expanding aging population, rising prevalence of gastrointestinal disorders, and technological advancements in drug delivery systems. The expansion of the generic drug offers more affordable treatment options and increases accessibility, particularly in emerging nations. Regulatory approvals for Over-the-Counter (OTC) pantoprazole formulations have made the drug accessible without prescriptions in developing nations. The direct consumer access widens the customer base and creates an opportunity for pharmaceutical manufacturers.

India Pantoprazole Market Trends

India is a major player in the Asia Pacific pantoprazole market, serving as a key manufacturing hub and a leading exporter of the drug in various forms, including active pharmaceutical ingredients (APIs) and generic formulations. The country is home to large pharmaceutical companies like Sun Pharma and Cipla, which operate facilities that hold international quality certifications. This positions India as the world's top exporter of pantoprazole tablets by volume, especially to markets such as the U.S. and Europe.

How is the Opportunistic Rise of Latin America in the Pantoprazole Market?

The pantoprazole market in Latin America is experiencing steady growth, mainly due to the rising prevalence of gastroesophageal reflux disease and other acid-related conditions. The market benefits from the drug being listed as an essential medicine and available in affordable generic versions. Key countries like Brazil, Mexico, and Argentina are seeing increased patient awareness and better healthcare access. Although branded options still have value, the market's growth is largely driven by the affordability and wide availability of generic pantoprazole, which serves a large patient population.

Brazil Pantoprazole Market Trends

Brazil is the major contributor to the Latin American market, characterized by high demand driven by a high incidence of gastric ailments. The market benefits from a well-established pharmaceutical industry and a robust public and private healthcare system. Generic pantoprazole dominates the market, with numerous local manufacturers ensuring wide availability and competitive pricing. There is a focus on increasing patient access and managing chronic conditions, which guarantees sustained demand for this commonly used proton pump inhibitor.

What Influences the Growth of the Middle East and Africa Pantoprazole Market?

The market in the Middle East and Africa (MEA) is influenced by rising healthcare spending, increasing lifestyle-related digestive issues, and an aging population. It is mainly driven by the need for effective and affordable treatment options. Although branded pantoprazole is available, there is a slow shift toward generic alternatives to improve access in price-sensitive regions. Key countries in the MEA are focusing on building local pharmaceutical manufacturing capabilities to meet the domestic demand for essential medicines.

Saudi Arabia Pantoprazole Market Trends

Saudi Arabia plays a vital role in the MEA pantoprazole market, supported by substantial government investment in healthcare infrastructure and a focus on the pharmaceutical industry. The market benefits from high healthcare standards and increasing awareness of digestive health. Both branded and generic pantoprazole are available, with local manufacturing efforts aimed at maintaining a steady supply of essential medicines. The market remains stable, with pantoprazole recognized as a standard treatment for acid reflux and ulcers in hospitals and clinics.

Why is Europe Considered a Notably Growing Region in the Pantoprazole Market?

Europe is experiencing notable growth in the market, fueled by an aging population and a high prevalence of digestive diseases. Strict regulatory standards guarantee the high quality and effectiveness of both branded and generic products. The market is mainly made up of generic formulations, which provide substantial cost savings for healthcare systems and patients. Major pharmaceutical companies compete on price, quality, and sometimes innovative delivery methods. The use of pantoprazole is widespread across Europe, as it is a primary treatment for GERD and related conditions.

Germany Pantoprazole Market Trends

Germany is a mature and stable market for pantoprazole in Europe, supported by its strong healthcare system and high per capita use of both prescription and OTC medications. The market is highly genericized, with pantoprazole being one of the most commonly prescribed proton pump inhibitors. Efforts focus on ensuring cost-effectiveness within the national health insurance system while upholding high standards of quality and supporting a reliable supply chain for both domestic use and export.

Value Chain Analysis

Research and Development & Innovation

Involves the discovery of pantoprazole and the development of optimal formulations and delivery methods.

- Key Players: Takeda Pharmaceutical Company and generic R&D firms like Dr. Reddy's Laboratories and Lupin.

Clinical Trials and Regulatory Approval

Conducting trials and securing approval from regulatory bodies like the FDA for various formulations.

- Key Players: Dr. Reddy's Laboratories and Alembic Pharmaceuticals.

Manufacturing and Production

Includes producing the Active Pharmaceutical Ingredient (API) and the final drug formulation, adhering to GMP standards.

- Key Players: Lee Pharma Ltd., Dr. Reddy's, and Sun Pharmaceutical Industries.

Distribution and Supply Chain Management

Ensures efficient delivery to pharmacies and hospitals through wholesalers and distributors.

- Key Players: Cardinal Health and McKesson.

Service Delivery

Focuses on the medical prescription and dispensing of pantoprazole in various healthcare settings, like hospitals and clinics.

- Key Players: Healthcare professionals and facilities.

Patient Support and Payments

This involves ensuring patient access, managing costs through insurance and generics, and providing patient education.

- Key Players: UnitedHealth Group, Humana, Elevance Health.

Top Companies in the Pantoprazole Market

- Pfizer Inc.: Pfizer contributes to the market by offering both branded and generic versions of the drug, leveraging its global reach to ensure broad accessibility and compliance with treatment protocols for gastrointestinal disorders.

- Takeda Pharmaceutical Company:Takeda plays a key role in the market by manufacturing and marketing the branded version of pantoprazole, particularly in the treatment of acid reflux and ulcers, with a strong focus on research and patient-centered care.

- Sun Pharmaceutical Industries Ltd.: Sun Pharma is a leading provider of affordable generic pantoprazole formulations, making the drug accessible to a broader population and expanding market share in developing regions.

- Dr. Reddy's Laboratories Ltd.:Dr. Reddy's is a significant contributor to the pantoprazole market through its generic versions, offering cost-effective solutions for treating gastrointestinal disorders in various global markets.

- Teva Pharmaceutical Industries Ltd.: Teva, a major player in the generic pharmaceutical industry, manufactures pantoprazole in multiple dosage forms, increasing access to this essential treatment for acid reflux and related conditions worldwide.

- Mylan N.V. (Viatris): Mylan, now part of Viatris, contributes by producing a range of pantoprazole products, including generics and authorized versions, improving patient access to affordable treatments for gastrointestinal disorders.

- Sandoz (Novartis AG): Sandoz, as the generics division of Novartis, manufactures pantoprazole in various forms, offering a cost-effective alternative to branded versions and enhancing access to treatment in both developed and emerging markets.

Other Key Players

- Lupin Pharmaceuticals

- Zydus Lifesciences Ltd.

- Cipla Ltd.

- Aurobindo Pharma

- Torrent Pharmaceuticals Ltd.

- Amneal Pharmaceuticals

- Apotex Inc.

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Strides Pharma

- Alkem Laboratories Ltd.

- Wockhardt Ltd.

- Fresenius Kabi

Industry Leader Announcements

- In April 2024, Camber Pharmaceuticals announced the addition of Pantoprazole Sodium for delayed-release oral suspension to its current portfolio. Pantoprazole sodium for delayed-release 40 mg oral suspension is available in cartons of 30 unit-dose packets.

(Source: https://www.camberpharma.com)

Recent Developments

- In December 2024, Baxter launched five injectable pharmaceutical products in the U.S. The five new products, launched as part of the company's US pharmaceuticals portfolio, include Micafungin, Cyclophosphamide, Pantoprazole Sodium, Cefazolin, and Levetiracetam.(Source: https://www.baxter.com)

- In June 2024, Ahmedabad-based Torrent Pharmaceuticals entered into a non-exclusive patent licensing agreement with Takeda to commercialize Vonoprazan in India. Vonoprozan is a novel potassium-competitive acid blocker (P-CAB), used for the treatment of acid-related disorders, Gastroesophageal Reflux Disease (GERD). Torrent will market Vonoprazan under its trademark, Kabvie.(Source: https://www.torrentpharma.com)

Segments Covered in the Report

By Product Type

- Pantoprazole Sodium Sesquihydrate

- Pantoprazole Sodium Monohydrate

- Others (Pantoprazole Magnesium, etc.)

By Route of Administration

- Oral

- Intravenous (IV)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

By Application

- Gastroesophageal Reflux Disease (GERD)

- Peptic Ulcer Disease

- Zollinger-Ellison Syndrome

- Erosive Esophagitis

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting