What is Valsartan Market Size in 2026?

The global valsartan market size was calculated at USD 1.52 billion in 2025 and is predicted to increase from USD 1.64 billion in 2026 to approximately USD 3.22 billion by 2035, expanding at a CAGR of 7.80% from 2026 to 2035. The market growth is attributed to rising hypertension prevalence, increasing cardiovascular disease awareness, and expanding access to effective antihypertensive therapies.

Key Takeaways

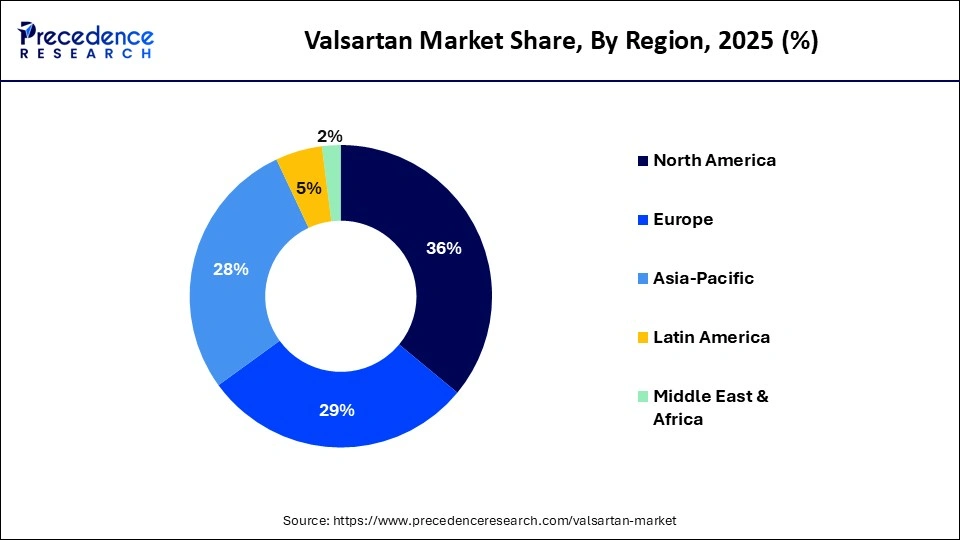

- North America dominated the market with a share of approximately 36% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of approximately 8.1% between 2026 and 2035.

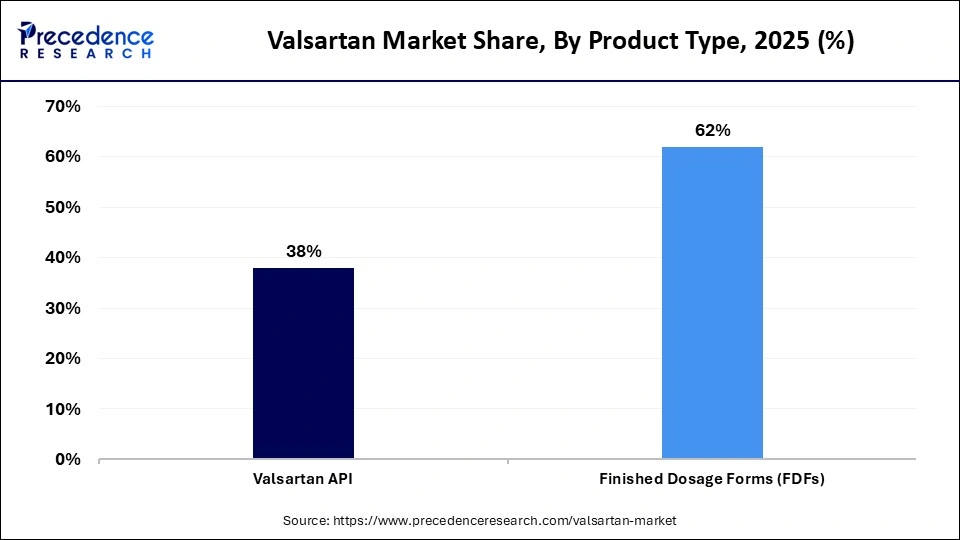

- By product type, the finished dosage forms (FDFs) segment contributed the highest valsartan market share of approximately 62% in 2025.

- By product type, the fixed-dose combinations sub-segment is expected to grow at a strong CAGR between 2026 and 2035.

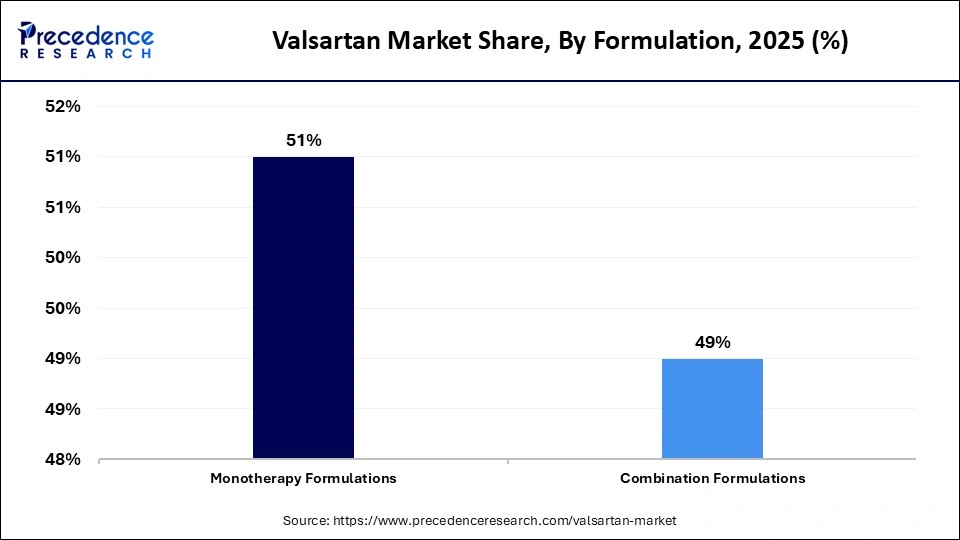

- By formulation, the monotherapy formulations segment held a major market share of approximately 51% in 2025.

- By formulation, the combination formulations segment is expected to expand at the fastest CAGR from 2026 to 2035.

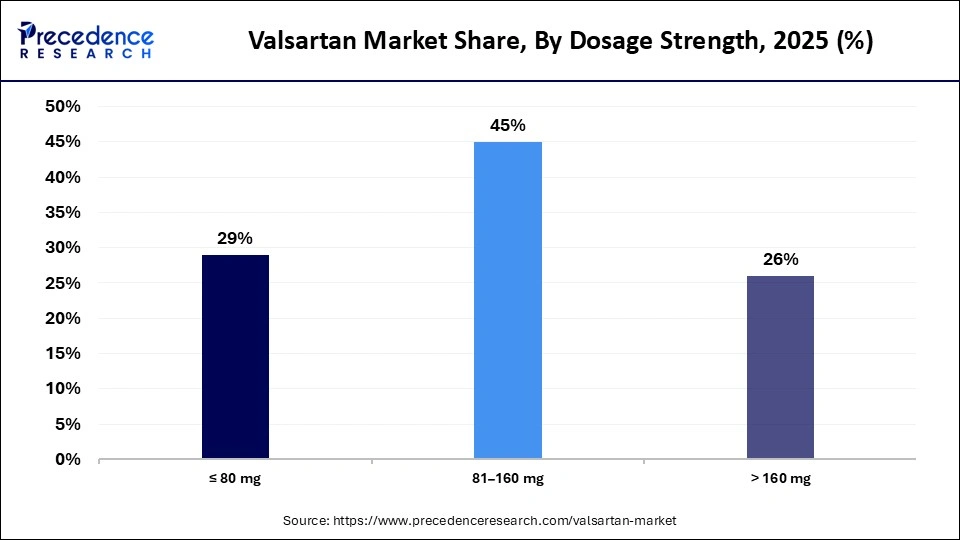

- By dosage strength, the 81-160 mg segment captured the highest market share of approximately 45% in 2025.

- By dosage strength, the > 160 mg segment is poised to grow rapidly in the market between 2026 and 2035.

- By indication, the hypertension segment generated the biggest market share of approximately 52% in 2025.

- By indication, the heart failure segment is expected to expand at the fastest CAGR during the forecast period.

- By distribution channel, the retail pharmacies segment accounted for the largest market share of approximately 48% in 2025.

- By distribution channel, the online pharmacies segment is projected to grow at a solid CAGR between 2026 and 2035.

Which Factors Drive the Demand for Valsartan?

The global valsartan market is fundamentally driven by the rapidly increasing prevalence of hypertension and cardiovascular diseases, a major public health challenge. The World Health Organization (WHO) reports that the global prevalence of hypertension accounts for over 1.28 billion adults aged between 30 and 79 years, representing 33% of the population in this age group.

A large percentage of them have not been diagnosed and treated, and they continue to demand effective antihypertensive agents like valsartan. This has made valsartan, which is an angiotensin II receptor blocker (ARB), a fundamental treatment tool. Furthermore, the market is also supported by generic formulation availability, which increases affordability and uptake across diverse populations.

Impact of Artificial Intelligence on the Global Valsartan Market

Artificial intelligence is transforming the market by enhancing the speed at which the drug is developed, optimizing production, and facilitating better patient care. Pharmaceutical companies apply AI-powered predictive analytics to design valsartan clinical trials in the most optimal way by taking into consideration patient groups. Moreover, machine learning (ML) algorithms are applied in manufacturing to monitor important process parameters and ensure a consistent quality of API and finished dosages.

Valsartan MarketGrowth Factors

- Growing Telemedicine and Digital Prescriptions: Expansion of remote healthcare services is boosting convenient access to valsartan for patients in urban and rural regions.

- Propelling Generic Drug Acceptance: Wider physician and patient preference for affordable generic ARBs is driving market penetration and consistent prescription volumes.

- Increasing Hypertension Screening Programs: Government and NGO-led blood pressure monitoring campaigns are raising early detection rates, growing the need for valsartan therapy.

Valsartan Market Trends

- Real World Evidence (RWE) Influencing Clinical Decisions

Regulators and payers are looking at real-world data more often to inform treatment regimens, confirming the effectiveness of valsartan in indications. RWE provides physicians with an opportunity to optimize therapy, which results in increased prescriptions and use. This trend is propelling overall market uptake and strengthening formulary inclusion globally. - Pharmacogenomics Guided Antihypertensive Therapy

Pharmacogenomics progresses are useful in determining patients with the most favorable response to valsartan among other ARBs. Precision therapy lessens the use of trial-and-error prescription, enhancing compliance and long-term usage. Higher targeted prescription rates are driving market penetration and revenue growth.

Global Trade Expansion and Real-World Clinical Adoption Accelerating Growth in the Valsartan Market

- Indian exports of Valsartan (API and finished drug) include over 9,410 shipments from Indian hubs to global markets as of late 2025.

- From July 2024 to June 2025, the world exported 5,205 shipments of Valsartan through 404 verified exporters and 608 buyers, with India, Chile, and Italy leading as top exporters.

- Real World Tolerability of Sacubitril/Valsartan, a clinical study initiated in February 2024, has enrolled approximately 1,039 individuals as of mid 2024 to evaluate real-world dosing, safety, and adherence in heart failure patients.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size in 2026 | USD 1.64 Billion |

| Market Size by 2035 | USD 3.22 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.80% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Formulation, Dosage Strength, Indication, Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why Did the Finished Dosage Forms (FDFs) Segment Dominate the Valsartan Market?

The finished dosage forms (FDFs) segment dominated the global market in 2025, accounting for an estimated 62% market share, due to its direct clinical application and the wide range of its acceptance by physicians in the treatment of hypertension and heart failure. Finished tablets and capsules are also available in bulk in hospital formularies, strengthening uniform purchasing and consumption behaviors.

The fixed dose combinations sub-segment is expected to grow at the fastest CAGR in the coming years, as combinations are used in the face of increasing complexities in managing patients, particularly those with moderate or resistant hypertension. Moreover, fixed-dose combinations are also getting the attention of product developers to distinguish portfolios in an established treatment area, and are expected to fuel their demand in the coming years.

Formulation Insights

Which Formulation Segment Dominated the Valsartan Market?

The monotherapy formulations segment held the largest revenue share of approximately 51% in the market in 2025, due to the longstanding clinical acceptance and simplicity of dosing. Clinicians continued to choose valsartan alone for initial hypertension management and for patients with uncomplicated cardiovascular profiles. Additionally, the monotherapy generics maintained stronger volume driven by steady supply and price competitiveness relative to newer or more complex options.

The combination formulations segment is expected to grow with the highest CAGR in the market during the studied years, as treatment paradigms shift toward multi-target strategies. Fixed-dose combinations of valsartan with diuretics or calcium channel blockers are necessary in patients with moderate to resistant high blood pressure to attain optimality in blood pressure control. Furthermore, the emerging regulatory guidance in several countries explicitly supports combination therapy for defined risk cohorts, which is projected to further accelerate growth and reshape the formulation landscape.

Dosage Strength Insights

Which Dosage Strength Segment Dominated the Valsartan Market?

The 81–160 mg segment accounted for the highest revenue share of approximately 45% in the market in 2025, due to the influence of clinical guidelines that recommend this range as a standard starting and maintenance dose in the management of hypertension in adults. This range is effective in receptor blockade of AT1 and results in a significant reduction of blood pressure within 2-4 weeks. Moreover, this dose range exhibits strong safety profiles and low discontinuation rates, which enhances prescriber confidence, thus further facilitating the segment growth.

The > 160 mg segment is expected to expand rapidly in the market in the coming years, as the upper range of the dose spectrum is estimated to have more clinical applications. Population ageing and the prevalence of multi-morbidities grow worldwide, where higher doses (320 mg) provide greater antihypertensive effects. Higher than standard doses provide greater AT1 receptor blockage and better 24-hour coverage, strengthening clinician confidence in high-dose effectiveness, which further contributes to the demand for stronger valsartan medicine.

Indication Insights

Why Did the Hypertension Segment Dominate the Valsartan Market?

The hypertension segment held the largest revenue share of approximately 52% in the market in 2025, as it is the most common cause of physicians prescribing valsartan in clinical practice. Valsartan is a highly effective agent in reducing blood pressure in diverse groups of adults. Additionally, the large epidemiological studies show that elevated blood pressure prevalence remains high globally, maintaining consistent demand for effective antihypertensive agents like valsartan over time.

The heart failure segment is expected to witness the fastest growth in the market over the forecast period, owing to demographic shifts and rising chronic disease burden, which are expanding the population requiring targeted cardiac therapies. Valsartan carries regulatory approval for reducing hospitalization risk in patients with heart failure. Increasing aging of the population and improved post-discharge survival after acute cardiac events are increasing the number of people living with heart failure. This is likely to drive the growth rates of heart failure treatment.

Distribution Channel Insights

Which Distribution Channel Segment Led the Valsartan Market?

The retail pharmacies segment led the market in 2025 with a share of approximately 48% in 2025. They serve as the most accessible point of medication access worldwide for patients managing chronic conditions such as hypertension.

According to the IQVIA 2025 report, the use of prescription drugs dispensed from retail pharmacies has continued to grow at a rate of 3.0% annually. Furthermore, the national boards and quality regulators emphasize robust pharmacy practice standards, underscoring their dominant role in dispensing long-term therapies.

The online pharmacies segment is expected to gain the highest market share between 2026 and 2035, owing to the increasing digital health use and infrastructure in telemedicine, and regulatory guidelines to provide safe online dispensation. The use of digital dispensing services has grown, which is a direct benefit to the uptake of online pharmacies. Moreover, the health insurers and telehealth services expanded online pharmacy benefits in 2025, supporting greater prescription volumes through digital fulfillment and driving faster adoption than traditional channels.

Regional Insights

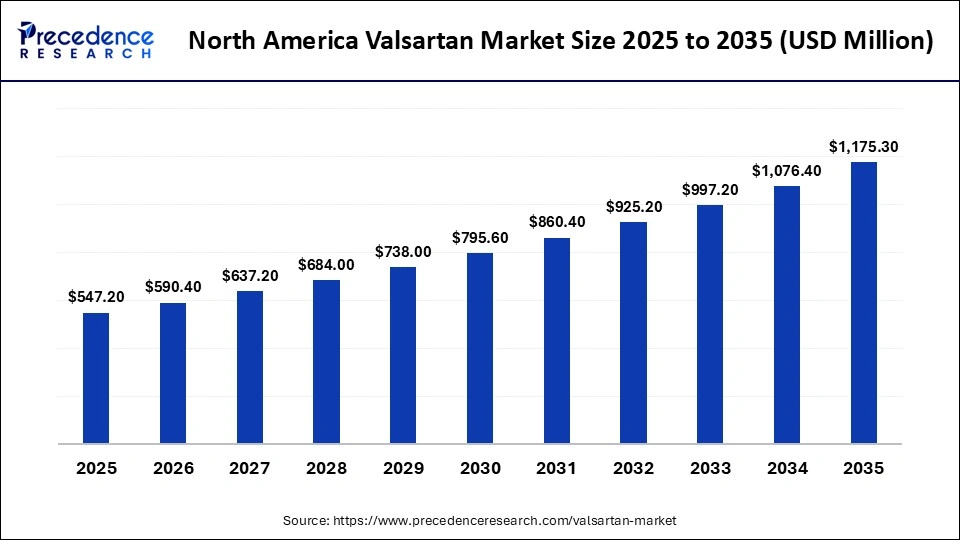

How Big is the North America Valsartan Market Size?

The North America valsartan market size is estimated at USD 547.20 million in 2025 and is projected to reach approximately USD 1,175.30 million by 2035, with a 7.94% CAGR from 2026 to 2035.

Why North America Dominated the Valsartan Market?

North America led the global market, capturing the largest revenue share in 2025, accounting for 28% of the market share, due to well established healthcare infrastructure and high diagnosis rates of hypertension and cardiovascular disease.

According to the American Heart Association (AHA), approximately 122.4 million Americans, almost half of adults, live with high blood pressure in 2025. This is a significant determinant of physician prescribing of valsartan both in the outpatient and inpatient settings. Furthermore, the high diagnosis and treatment coverage compared with other regions further propels the market in this region.

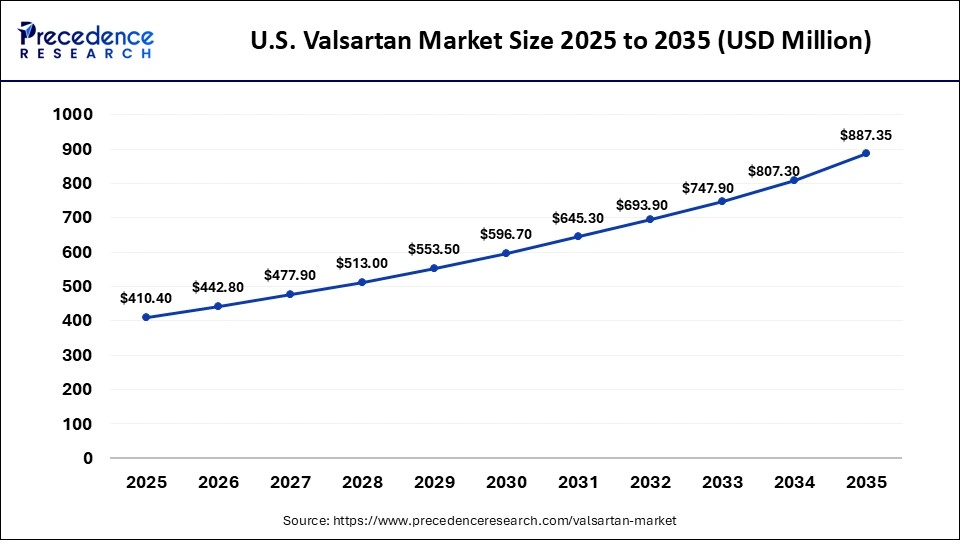

What is the Size of the U.S. Valsartan Market?

The U.S. valsartan market size is calculated at USD 410.40 million in 2025 and is expected to reach nearly USD 887.35 million in 2035, accelerating at a strong CAGR of 8.02% between 2026 to 2035.

U.S.—North America's Core Growth Driver

U.S. leads the market, driven by the high prevalence of hypertension, which directly increases demand for valsartan. Almost half of 48.1% of adults in the U.S. had high blood pressure in 2025, according to the Centers for Disease Control and Prevention (CDC). This makes blood pressure management one of the main priorities of the U.S. population. Moreover, federal programs such as the Healthy People 2030 initiative amplify long-term hypertension treatment trends, positioning the U.S. as a sustained epicenter for continuous antihypertensive drug demand.

Why is Asia Pacific Projected to Grow Fastest in the Valsartan Market?

Asia-Pacific is expected to host the fastest-growing market with a CAGR of approximately 8.1% in the coming years, owing to the increasing healthcare access, high rate of urbanisation, and increasing cardiovascular disease burden.

Global data from the World Health Organization (WHO) show that 1.4 billion adults worldwide had hypertension in 2024. Only one in five has it under control, highlighting unmet treatment needs that are especially pronounced in this region. Moreover, the increasing cardiovascular mortality in East and Southeast Asia further propels the demand for valsartan medicine in the coming years.

China — Rapid Expansion in Asia Pacific Demand

China is leading the charge in the Asia Pacific market, due to its enormous and largely under-controlled hypertension population. In 2025, approximately 270 million adults in China had hypertension, according to the World Health Organization (WHO). This indicates an inability to control the situation in the field of public health since China is one of the largest growth engines in the Asia-Pacific region. Furthermore, demographic shifts toward older population cohorts in eastern and northern provinces enhance chronic care demand, increasing long-term valsartan treatment uptake.

Valsartan Market Companies

- Global Valsartan Market Companies

- Alembic Pharmaceuticals Ltd.

- Alkem Laboratories Ltd.

- Amneal Pharmaceuticals LLC

- Apotex Inc.

- Aurobindo Pharma Ltd.

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Fresenius Kabi AG

- Glenmark Pharmaceuticals Ltd.

- Hetero Drugs Ltd.

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Mylan N.V.

- Novartis AG

- Sandoz International GmbH

Recent Developments in the Valsartan Market

- In October 2025, Sandoz Canada announced the launch of PrSandoz Sacubitril-Valsartan, a high-quality, affordable alternative to the reference medicine PrEntresto. This launch reinforces Sandoz's commitment to expanding patient access to cardiovascular therapies and strengthens its portfolio for Canadian patients across all approved indications.

- In January 2025, Lupin Limited received U.S. FDA approval for its Abbreviated New Drug Application (ANDA) for Sacubitril and Valsartan tablets in 24 mg/26 mg, 49 mg/51 mg, and 97 mg/103 mg dosages. The approval allows Lupin to offer a generic version of Entresto, marking a significant milestone in providing cost-effective options for heart failure management in the U.S.

Segments Covered in the Report

By Product Type

- Valsartan API

- Finished Dosage Forms (FDFs)

- Tablets

- Fixed-dose combinations

By Formulation

- Monotherapy Formulations

- Combination Formulations

By Dosage Strength

- ≤ 80 mg

- 81–160 mg

- > 160 mg

By Indication

- Hypertension

- Heart Failure

- Post-Myocardial Infarction

- Other Cardiovascular Conditions

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Other Channels

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting