Water Recycle and Reuse Market Size and Forecast 2025 to 2034

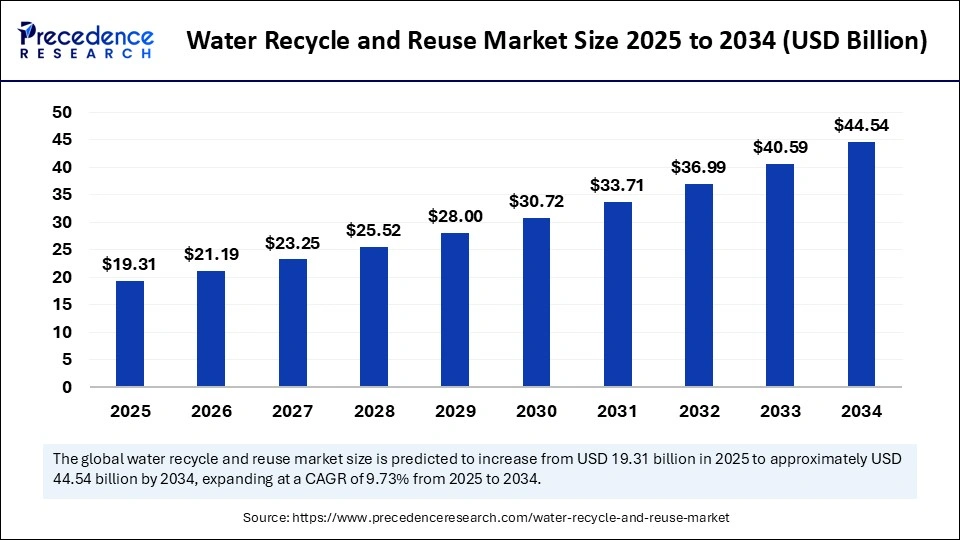

The global water recycle and reuse market size accounted for USD 17.6 billion in 2024 and is predicted to increase from USD 19.31 billion in 2025 to approximately USD 44.54 billion by 2034, expanding at a CAGR of 9.73% from 2025 to 2034. The growth of the market is attributed to increasing water scarcity, stringent environmental regulations, technological advancements, and rising corporate sustainability initiatives.

Water Recycle and Reuse MarketKey Takeaways

- In terms of revenue, the market is valued at 19.31 billion in 2025.

- It is projected to reach 44.54 billion by 2034.

- The market is expected to grow at a CAGR of 9.73% from 2025 to 2034.

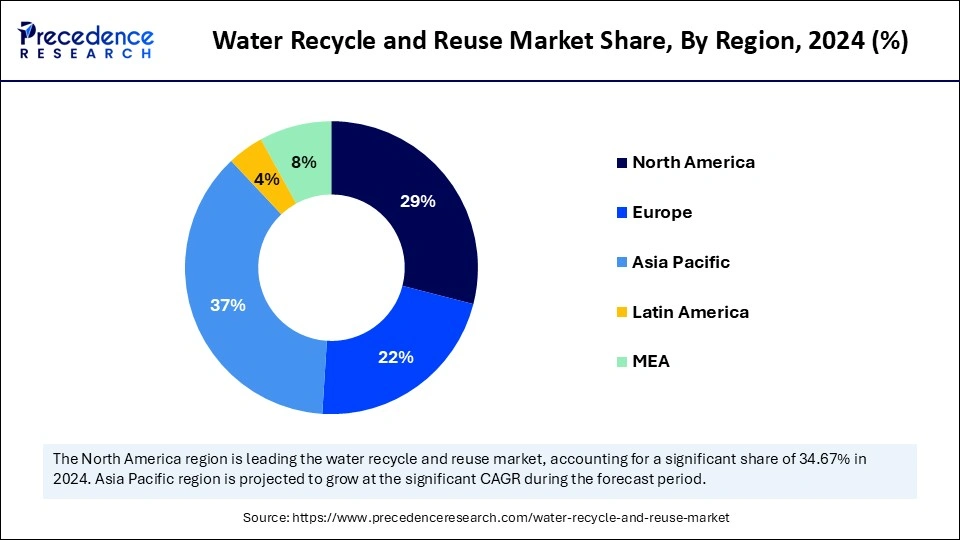

- Asia Pacific dominated the global market with the largest share of 37% in 2024.

- North America is expected to expand at the fastest CAGR during the forecast period.

- By equipment, the filtration segment captured the biggest market share of 37% in 2024.

- By equipment, the tanks segment is expected to witness significant growth during the predicted timeframe.

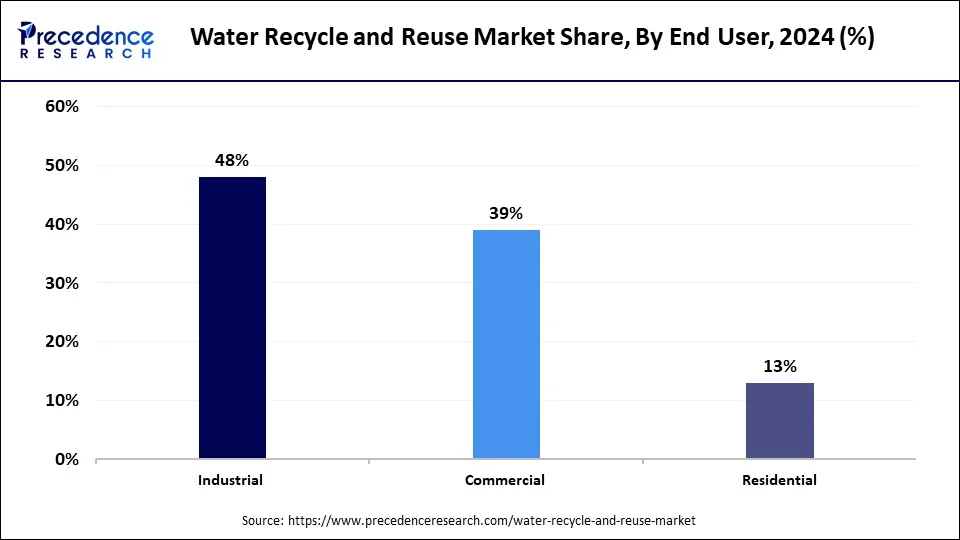

- By end user, the industrial segment contributed the highest market share of 49% in 2024.

- By end user, the commercial segment is projected to grow at the fastest CAGR in the coming years.

How is Artificial Intelligence Transforming Water Recycling Processes?

Artificial intelligenceis revolutionizing water recycling procedures, increasing accuracy and efficiency. AI can forecast system failures, optimize energy and chemical use, and monitor water quality in real time. It makes it possible to automate treatment operations, which lowers human error and enhances system performance. Integrating AI makes water recycling systems more intelligent, dependable, and quick.

Asia Pacific Water Recycle and Reuse Market Size and Growth 2025 to 2034

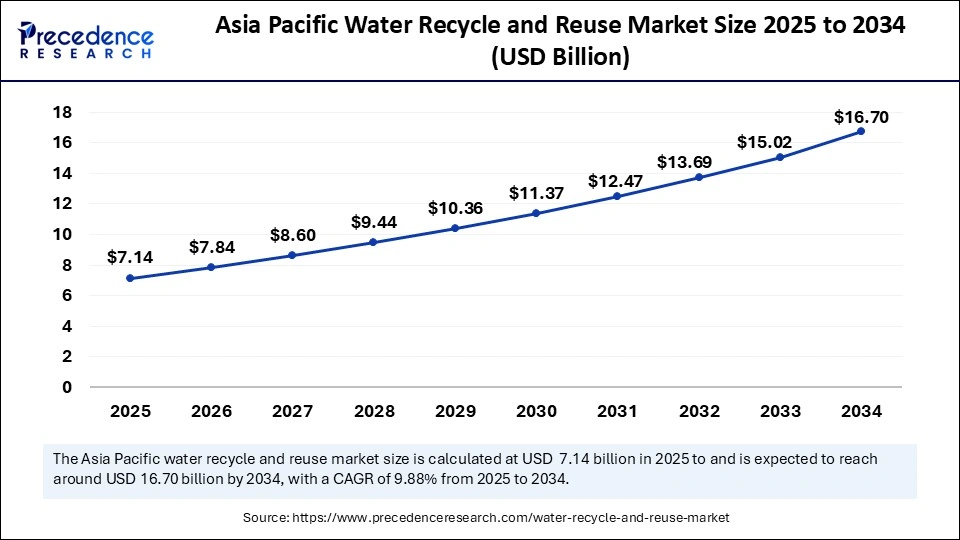

Asia Pacific water recycle and reuse market size was exhibited at USD 6.51 billion in 2024 and is projected to be worth around USD 16.70 billion by 2034, growing at a CAGR of 9.88% from 2025 to 2034.

Asia Pacific dominated the water recycle and reuse market with the largest share in 2024. This is mainly due to rapid urbanization and industrialization. The extensive use of water treatment and reuse technologies is being fueled by government programs and rising infrastructure development. With the growing population and environmental concerns, the demand for sustainable water solutions has increased, sustaining the long-term growth of the market. Rising concerns over water scarcity and increasing focus on wastewater treatment contribute to regional market growth.

North America is expected to grow at the fastest rate in the upcoming years, driven by a strong focus on sustainable water management and strict environmental regulations. The region is witnessing a surge in the adoption rate of water recycling solutions across municipalities and industries, thanks to cutting-edge technologies and public-private partnerships. Rising funding for water treatment projects and infrastructure improvements further supports market growth. Moreover, the demand for effective reuse systems is rising due to growing water scarcity, driving the growth of the market in the region.

Europe is considered to be a significantly growing area. The growth of the water recycle and reuse market in Europe is driven by a strong commitment to sustainability and stringent wastewater regulations. The region is an early adopter of water reuse systems, particularly in the agricultural and industrial sectors. The market in the region is expanding rapidly, thanks to government incentives and innovations in water management solutions. Growing awareness of the need to lessen environmental impact is promoting wider adoption in both urban and rural areas.

Market Overview

The water recycle and reuse market is experiencing rapid growth, driven mainly due to stricter environmental regulations, growing water scarcity worldwide, and advancements in treatment technologies like reverse osmosis and membrane bioreactors. Businesses and local governments are implementing recycling procedures to reduce reliance on freshwater use, adhere to legal requirements, and promote sustainability projects. Growing demand for affordable water management solutions and corporate efforts to lessen their negative effects on the environment are driving market expansion. The need for water recycling is increasing in several sectors, including manufacturing, agriculture, and residential, contributing to the market's growth.

Water Recycle and Reuse MarketGrowth Factors

- Water scarcity is rising due to population growth and climate change, driving the need for water recycling.

- Strict regulations push industries to adopt water reuse to meet environmental standards, supporting market growth.

- Technological advancements boost the growth of the market. New technologies make recycling more efficient and cost-effective.

- Rising corporate sustainability goals contribute to market expansion. Companies use recycling technologies to meet sustainability goals and reduce costs.

- The rising need for water recycling technologies from the agriculture sector to save freshwater drives the growth of the market.

- Increasing demand for decentralized systems boosts the growth of the market. Decentralized systems lower costs and increase recycling flexibility.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 44.54 Billion |

| Market Size in 2025 | USD 19.31 Billion |

| Market Size in 2024 | USD 17.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.73% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Equipment, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological Advancements

Technological advancements drive the growth of the water recycle and reuse market. Water treatment is becoming more effective and dependable, thanks to advancements in membrane bioreactors, smart sensors, and AI-driven monitoring. These innovations save operating expenses, enhance water quality, and use less energy. Performance optimization and predictive maintenance are now made possible by digital platforms. Even small and medium-sized facilities are implementing water reuse systems as these solutions become more reasonably priced.

Technological advancements in water recycling processes have significantly enhanced efficiency and cost-effectiveness. Higher quality water recovery at reduced operating costs is made possible by innovations like membrane filtration, advanced oxidation, and automated monitoring systems. These advancements support market expansion and sustainable water management programs by facilitating the wider adoption of recycling solutions in the commercial, municipal, and industrial sectors. Several companies are introducing advanced water recycling technologies, contributing to market growth.

- On 30 January 2025, DuPont Water Solutions received the 2025 BIG Innovation Award for launching its Sustainability Navigator, a digital tool that helps customers select the most efficient water purification technologies. (Source: https://www.dupont.com)

Industrial Demand

Industries that depend significantly on water, including food and beverage, textiles, chemicals, and electricity, are under pressure to reduce fresh water usage. Reusing treated water for cleaning, processing, or cooling lessens the need for new supplies. Additionally, it lowers the cost of wastewater disposal and water procurement. Using closed-loop systems makes operations more efficient and helps with environmental compliance.

- On 8 May 2025, Cambrian and Anheuser-Busch launched a reuse-as-a-service model at its Houston brewery, enabling water savings without upfront capital, and were named finalists for the 2025 Global Water Awards. (Source: https://www.watertechonline.com)

Restraint

Public Perception & Acceptance and Operational Complexity

Despite advancements in treatment technologies, public perception and acceptance of recycled water, especially for potable use, remain major hurdles. Concerns about health risks and the “yuck factor” often result in community resistance, delaying or canceling projects. In addition, managing and maintaining water reuse systems require technical expertise, especially for real-time monitoring and treatment adjustments. Industries without specialized staff often face issues in system efficiency and water quality compliance. Improper handling can lead to system failures, contamination risks, or regulatory violations, limiting the growth of the water recycle and reuse market.

- In February 2024, the City of Los Angeles announced delays in its Pure Water LA project due to public backlash and misinformation regarding recycled water safety, despite meeting EPA standards.(Source: https://www.latimes.com)

Opportunity

Urbanization and Sustainability Commitments

Rapid urbanization is increasing water demand and wastewater generation, creating a need for decentralized water recycling systems. Smart city initiatives are integrating water reuse practices into sustainable urban infrastructure to ensure long-term water security. More businesses are setting water neutrality and circular economic objectives. Therefore, more businesses are investing in water recycling technologies to improve brand reputation and ESG compliance in addition to lowering operating expenses.

- In March 2025, Veolia Water Technologies announced a partnership with the city of Dubai to deploy advanced wastewater recycling systems as part of the city's smart infrastructure development. (Source: https://www.veolia.com)

- In January 2025, Unilever launched its new water stewardship program, which includes deploying water reuse technologies at multiple manufacturing sites globally to reduce freshwater consumption. (Source: https://www.unilever.com)

Equipment Insights

The filtration segment dominated the water recycle and reuse market with the largest share in 2024. Filtration systems are crucial to remove pollutants from wastewater. Industrial and municipal sectors use technologies like sand filtration, ultrafiltration, and reverse osmosis to meet stringent water quality standards. The need for sophisticated filtration solutions is also being increased by growing environmental consciousness and regulatory pressure.

The tanks segment is expected to witness significant growth during the predicted timeframe. The growth of the segment is attributed to the increasing need for decentralized water storage systems. For uses like industrial reuse and irrigation, tanks are essential for storing both treated and untreated water. There is a strong emphasis on rainwater harvesting, boosting the demand for tanks.

End User Insights

The industrial segment dominated the water recycle and reuse market with the largest share in 2024 because of strict discharge regulations and increased water consumption. Industries such as manufacturing, chemicals, and textiles are heavily invested in water treatment systems to lower costs and ensure compliance with strict environmental regulations. Industry adoption of closed-loop water systems has been driven by mounting pressure to improve sustainability and lessen reliance on freshwater. Improvements in treatment technologies have also increased the economic viability and efficiency of industrial water recycling.

The commercial segment is projected to grow at the fastest rate in the coming years. The use of water recycling systems in hotels, hospitals, and campuses is being fueled by growing awareness of sustainable practices and water conservation as well as regulatory support. Businesses in the commercial sector are integrating water reuse systems in response to rising operating costs and corporate sustainability objectives. Commercial infrastructure is also encouraged to use water-efficient designs by green building certifications like LEED.

Water Recycle and Reuse Market Companies

- Veolia

- Evoqua Technologies & Solutions

- Fluence Corporation Limited

- Dow Corporate

- Hitachi Ltd.

- Kubota Corporation

- Siemens

- Alfa Laval

- Hydraloop

- Membracon

- Toshiba Infrastructure Systems & Solutions Corporation

- Genesis Water Technologies Inc.

- NEWater China

Latest Announcements

- In November 2024, Epic Cleantech secured USD 12 million in series B funding to expand its water reuse solutions for commercial real estate. The company's one water system recycles up to 95% of a building's wastewater for non-potable applications. CEO Aaron Tartakovsky remarked, “One-site reuse isn't just about conserving water, it's about equipping properties to thrive amid future uncertainties.” (Source: https://www.businesswire.com)

- In May 2024, Xylem unveiled Reuse Brew, a Bavarian beer made from treated wastewater in Munich, Germany. The initiative aims to raise awareness about water recycling technologies. Roxana Marin Simen de Redaelli, Vice President at Xylem, commented, “Reuse Brew exemplifies the vast capabilities of water recycling in combating water scarcity.” (Source: https://www.businesswire.com)

Recent Developments

- On 22 April 2025, H2O Innovations Inc. launched the Water Hub facility at the Reynolds operations center in Tobaccoville, North Carolina. This facility is designed to recycle over 60 million gallons of water annually, significantly reducing freshwater consumption and enhancing sustainability in industrial operations.

(Source: https://www.businesswire.com) - On 8 March 2025, Cambrian and Anheuser Busch were named finalists for the 2025 Global Water Awards Industrial Project of the year. Their collaboration at the Houston brewery introduced water reuse as a service model, achieving substantial environmental and cost benefits without upfront capital investment.

(Source: https://www.watertechonline.com) - On 15 February 2025, Hydraloop systems unveiled the Upfall Shower at ISH 2025 in Frankfurt. This innovative shower technology reduces water and energy use by up to 80%, promoting sustainable water consumption in residential areas. (Source: https://www.hydraloop.com)

Segments Covered in the Report

By Equipment

- Filtration

- Machinery

- Tanks

- Pipes & Drains

- Others

By End User

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting