What is the Battery-as-a-service (BaaS) Market Size?

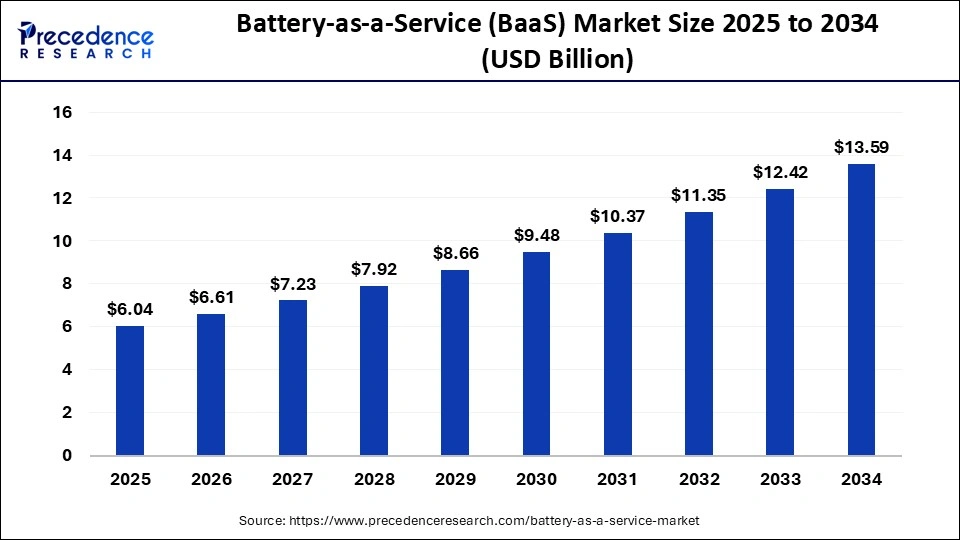

The global battery-as-a-service (BaaS) market size accounted for USD 6.04 billion in 2025 and is predicted to increase from USD 6.61 billion in 2026 to approximately USD 13.59 billion by 2034, expanding at a CAGR of 9.43% from 2025 to 2034. The global battery-as-a-service (BaaS) market is witnessing robust growth driven by government incentives for EV infrastructure, rising adoption of electric vehicles (EVs), and rapid advancements in battery and swapping technology. This report covers market trends, production volumes, technological developments, and competitive dynamics across North America, Europe, and APAC between 2025 and 2030.

Major Key Insights of the Battery-as-a-Service (BaaS) market:

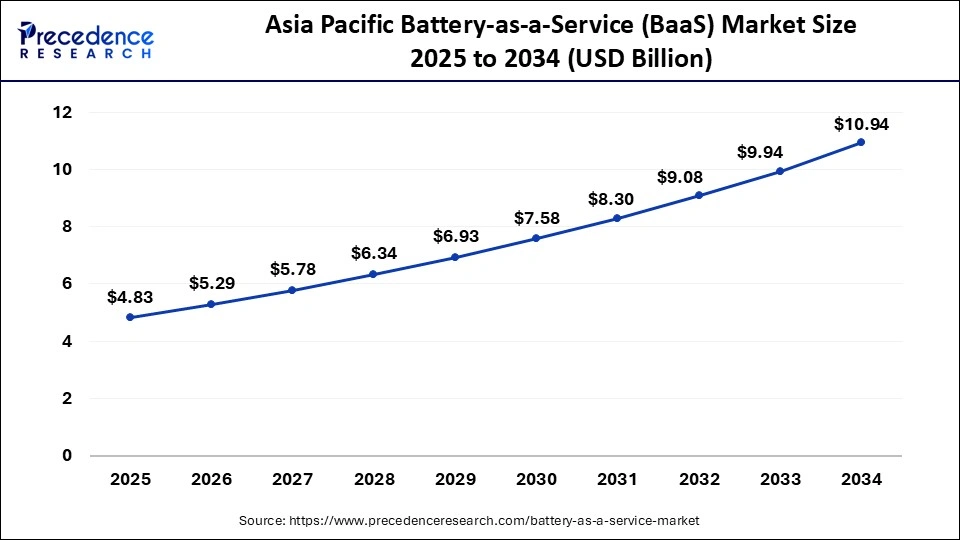

- Asia Pacific held the largest market share of 80% in 2024.

- The North America is expected to grow at the fastest CAGR from 2025 to 2034.

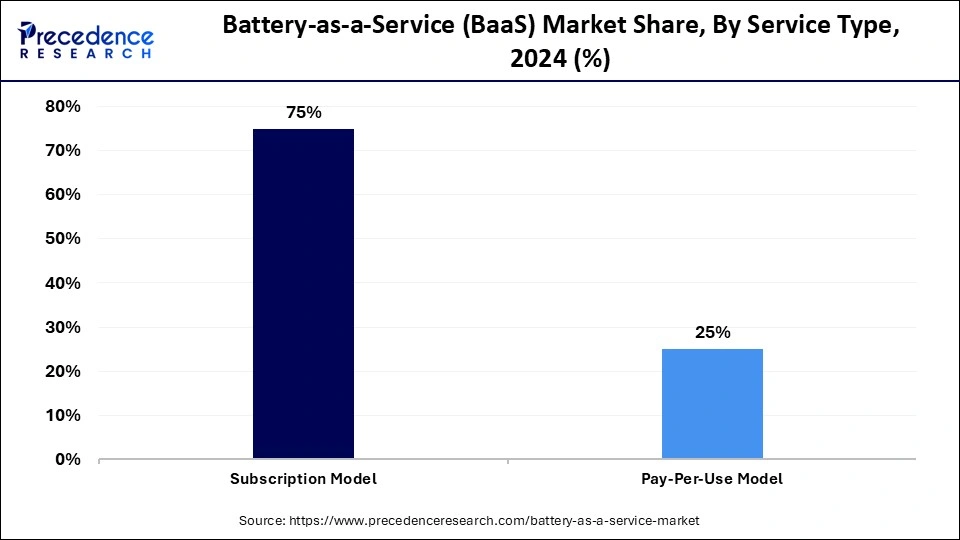

- By service type, the subscription model segment accounted for the dominating share of 75% in 2024.

- By service type, the pay-per-use model segment is expected to witness a significant share during the forecast period.

- By vehicle type, the three-wheeler segment held the major share of 40% in the battery-as-a-service (BaaS) market during 2024.

- By vehicle type, the passenger vehicles segment is projected to grow at a CAGR between 2025 and 2034.

- By battery capacity, the below 50 kWh segment held a dominant presence in the market in 2024, with 45%.

- By battery capacity, the above 100 kWh segment accounted for considerable growth in the global high-power graphite electrode market over the forecast period.

- By end-user demographics, the individual consumers segment registered its dominance with 55% over the battery-as-a-service (BaaS) market in 2024.

- By end-user demographics, the commercial users segment is expected to grow significantly during the forecast period.

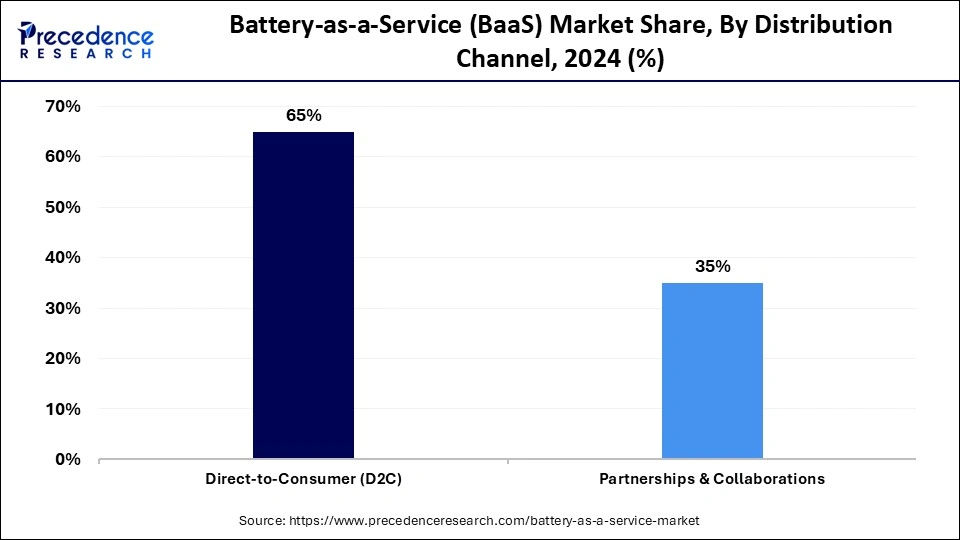

- By distribution channel, the direct-to-consumer (D2C) segment dominated the market with the largest share of 65% in 2024.

- By distribution channel, the partnerships & collaborations segment is experiencing rapid growth in the battery-as-a-service (BaaS) market during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 6.04 Billion

- Market Size in 2026: USD 6.61 Billion

- Forecasted Market Size by 2034: USD 13.59 Billion

- CAGR (2025-2034): 9.43%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What Is Battery-as-a-Service (BaaS)?

The high upfront costs of electric vehicles (EVs), long charging times, and increasing demand for EVs are expected to drive the expansion of the battery-as-a-service (BaaS) market during the forecast period. The market for battery-as-a-service (BaaS) refers to the provision of battery leasing, swapping, and subscription services for electric vehicles (EVs) and other electric mobility solutions. BaaS decouples battery ownership from vehicle ownership, reducing upfront costs, enabling flexible energy management, and facilitating longer vehicle lifespans. BaaS serves individual consumers, commercial fleets, shared mobility providers, and industrial EV applications globally.

Battery-as-a-Service (BaaS) Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the industry is expected to see accelerated growth owing to the increasing adoption of electric mobility, urbanization, technological advancements in battery management systems, and sustainability initiatives. Major trends shaping the market include smart battery management, automated swapping stations, shared mobility platforms, and a supportive government framework.

- Sustainability Trends: The market is experiencing a push for a sustainable and circular economy. Battery-as-a-service (BaaS) significantly promotes sustainable energy solutions and circular economy principles by minimizing electronic wastage and improving battery lifecycle management. Additionally, BaaS is expanding beyond EVs into renewable energy storage, offering a cost-effective and flexible way to manage clean energy resources.

- Major Investors: Private equity and strategic investors are actively engaged in the market. For instance, in February 2025, Electric vehicle ecosystem platform Vidyut secured $2.5 million in funding from global fintech investor Flourish Ventures, the company announced Wednesday. The investment will support Vidyut's expansion of its Battery-as-a-Service (BaaS) model across both passenger and commercial electric vehicle segments in India. (Source: https://www.autocarpro.in)

Key Artificial Intelligence (AI) Shifts in the Battery-as-a-Service (BaaS) Market:

The battery-as-a-service (BaaS) market is undergoing key AI technological shifts. As electric vehicles rapidly revolutionize the transportation landscape, an innovative business model is emerging to significantly accelerate EV adoption. AI integration in battery-as-a-service (BaaS) focuses on smarter, data-driven battery management, enhancing battery lifespan, enabling predictive maintenance, and efficient operations for electric vehicle (EV) fleets. The integration of AI significantly monitors the health of batteries, reduces downtime, lowers operational costs by optimizing battery swaps, predicts potential failures, prevents unexpected breakdowns, and improves energy management through real-time analytics. AI automates battery swaps for fleets and facilitates efficient energy utilization, which leads to significant cost reductions.

Market Trends in the Battery-as-a-Service (BaaS) Market

In June 2025, Hero MotoCorp announced its plans to introduce a subscription-based Battery-as-a-Service (BaaS) model for its upcoming electric scooter, VIDA VX2, starting next month. The company stated that this model, combined with a flexible 'pay-as-you-go' ownership option, would significantly lower the upfront cost of ownership, making electric mobility more accessible and affordable for a broader range of customers. They explained that customers would have the option to finance the scooter chassis and battery separately, which would help reduce substantial initial expenses into manageable monthly payments. (Source: https://www.indiatvnews.com)

In June 2025, Ather Energy launched Battery as a Service (BaaS) Model for e2Ws. The electric two-wheeler maker, which targets to double its retail footprint to over 750 stores this year. Ather Energy unveiled an innovative new business model as it looks to intensify the competition in the electric two-wheeler market with legacy players such as TVS Motor and Bajaj Auto, as well as new-age players such as Ola Electric. The Bengaluru-based automaker plans to introduce a battery-as-a-Service model for its two-wheelers. The model consumers pay for battery usage on a subscription basis or per kilometer driven. This reduces the upfront cost of an electric vehicle as the battery accounts for 30-40% of the cost of an electric vehicle.

In December 2024, Mahindra Last Mile Mobility Limited and Vidyut (VT) announced a collaboration for battery-as-a-service (BaaS). Both companies have collaborated to launch Battery-as-a-Service (BaaS) financing for MLMML's EVs, including the Mahindra ZEO (4W) as well as Zor Grand and Treo Plus (3Ws). Under the BaaS program, customers will pay a minimal rental fee starting at ₹ 2.50 per kilometer. This initiative enables EV owners to rent the battery, reducing the upfront vehicle acquisition cost by up to 40% compared to traditional ICE vehicles. (Source: https://www.saurenergy.com)

Major Benefits Offered by the Battery-as-a-Service (BaaS)

| Top Feature | Benefits |

|

Lower Upfront Costs |

EV owners pay monthly fees for battery use. Costs depend on battery size and how much it is used. The battery is the most expensive part of an EV. Leasing the battery lowers the vehicle's purchase price. BaaS significantly reduces upfront EV costs, which often represent 30% to 50% of the total cost. This makes EVs more affordable and accessible. |

|

Flexibility |

BaaS lets users adjust their battery size based on their trips. Lowering concerns about range anxiety since it is possible to quickly switch from a discharged to a fully charged battery. Lowering the initial cost of an EV and giving consumers more flexibility through the use of subscription batteries. |

|

Reduce maintenance burdens |

The BaaS provider handles all aspects of battery health, maintenance, and eventual replacement, eliminating long-term performance concerns for the owner. |

|

Greater Sustainability |

Making the move to BaaS assists in increasing the sustainability of the company. This is due to the large number of green choices that are available, including solar-powered batteries. Some suppliers will even assist with carbon emissions offset. |

|

Battery Swapping Stations |

Swapping stations allow users to exchange empty batteries for charged ones. This process takes only a few minutes. It eases range anxiety by offering quick battery swaps and provides a practical charging solution for urban areas without home charging infrastructure. Swapping stations can use solar or wind power. Batteries can store extra energy and release it during peak hours. |

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.04 Billion |

| Market Size in 2026 | USD 6.61 Billion |

| Market Size by 2034 | USD 13.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.43% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type,Vehicle Type,Battery Capacity,End-User,Demographics, Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Which Segment Is Dominating the Market by Service Type in the Battery-as-a-Service (BaaS) Market?

The subscription model segment dominated the battery-as-a-service (BaaS) market in 2024, as this segment includes monthly subscription, annual subscription, and tiered subscription (based on battery capacity or range). Subscription model involves battery leasing, renting, or swapping for electric vehicles (EVs) and other applications. Subscription model alleviating range anxiety through faster battery exchanges, reducing upfront vehicle costs, and improving sustainability by promoting recycling.

On the other hand, the pay-per-use model segment is expected to witness remarkable growth during the forecast period. The segment includes per swap payment, per kWh consumption payment, and flexible usage plans. Customers increasingly prefer leasing and paying for the use of batteries from a BaaS provider rather than purchasing them upfront, significantly lowering the initial cost of an electric vehicle (EV). Such factors are bolstering the segment's growth during the forecast period.

Vehicle Type Insights

Why Are Three-Wheelers Dominating the Battery-as-a-Service (BaaS) Market?

Three-wheelers have emerged as the dominant vehicle type with a 40% share in the Battery-as-a-Service (BaaS) market due to their extensive use in last-mile connectivity, logistics, and urban transportation. The rapid adoption of electric three-wheelers, especially in emerging economies like India and Southeast Asia, has accelerated the demand for battery-swapping and subscription-based energy solutions.

One of the key factors driving this dominance is high vehicle utilization. Three-wheelers, particularly those used for goods delivery and passenger transport, operate for long hours daily, making frequent charging impractical. BaaS offers a convenient and time-efficient solution by enabling drivers to quickly swap depleted batteries for fully charged ones—minimizing downtime and maximizing earnings.

On the other hand, passenger vehicles are the fastest-growing segment in the Battery-as-a-Service (BaaS) market due to the rising adoption of electric cars among consumers, fleet operators, and ride-hailing services seeking affordable and efficient mobility solutions. The high upfront cost of EV batteries, often accounting for a large portion of a vehicle's price, has made BaaS an attractive alternative, as it allows users to purchase electric cars without owning the battery. This separation significantly lowers the initial investment and offers flexibility through subscription or pay-per-use models. The growing network of battery-swapping stations and advancements in modular, standardized battery technologies are also fueling this growth, making it easier and faster for passenger vehicles to exchange depleted batteries and extend driving range without long charging times.

Battery Capacity Insights

What Causes the Below 50 kWh Segment to Dominate the Battery-as-a-Service (BaaS) Market?

The below 50 kWh segment held a dominant presence in the battery-as-a-service (BaaS) market in 2024 because the below 50 kWh segment is driven by the increasing demand for scooters, three-wheelers, and moderate-use passenger vehicles. Below 50 kWh provides budget-conscious consumers with a more affordable way to own EVs.

On the other hand, the above 100 kWh segment is expected to grow at a notable rate, owing to the rising adoption of electric buses and heavy-duty trucks. Large vehicles require significant energy and benefit from solutions that reduce downtime and allow for rapid battery swaps.

End-User Demographics Insights

How Did the Individual Consumers Segment Dominate the Battery-as-a-Service (BaaS) Market in 2024?

The individual consumers segment held a 55% share of the battery-as-a-service (BaaS) market in 2024 because individual consumers prefer paying a monthly fee to lease a battery for their electric vehicle, which reduces the significant barrier of purchasing an expensive EV battery. Individual consumers get flexibility through subscription-based models or pay-per-use structures.

On the other hand, the commercial users segment is projected to grow at a CAGR between 2025 and 2034. Commercial users prefer battery-as-a-service (BaaS) to eliminate the need for upfront costs, enhance operational efficiency, and improve battery lifecycle management for large fleets of electric vehicles (EVs). Commercial applications include e-taxis, last-mile delivery, and public transport benefit from battery leasing, renting, and swapping, which lower investment costs associated with charging.

Distribution Channel Insights

What Has Led the Direct-to-Consumer (D2C) Segment to Dominate the Battery-as-a-Service (BaaS) Market?

The direct-to-consumer (D2C) segment accounted for a 55% share in the battery-as-a-service (BaaS) market in 2024, as the segment includes mobile apps & subscription platforms and battery swap stations. Direct-to-consumer (D2C) distribution is a significant distribution channel in the battery-as-a-service (BaaS) market.

Direct-to-consumer (D2C) offers reduced upfront costs, access to the latest technology, flexibility, and enhanced customer service. On the other hand, the partnerships & collaborations segment is experiencing rapid growth in the market during the forecast period. The segment includes OEM collaborations and Shared mobility platform partnerships. Key partnerships & collaborations include vehicle makers and battery swapping companies, for instance, Mahindra and Vidyut, partnered to launch battery-as-a-service (BaaS) financing programs for their commercial electric vehicles (EVs) like the ZEO (4W), Zor Grand, and Treo Plus (3Ws).

Regional Insights

Asia Pacific Battery-as-a-service (BaaS) Market Size and Growth 2025 to 2034

The Asia Pacific battery-as-a-service (BaaS) market size is evaluated at USD 4.83 billion in 2025 and is projected to be worth around USD 10.94 billion by 2034, growing at a CAGR of 9.49% from 2025 to 2034.

Why Is the Asia Pacific Dominating the Battery-as-a-Service (BaaS) Market?

Asia-Pacific dominated the global battery-as-a-service (BaaS) market in 2024, accounting for the largest share in both production and consumption. This region dominance is primarily due to the robust manufacturing ecosystems of steel manufacturing in China and India, which serve as critical hubs for industries such as construction and automotive. Manufacturers in these countries have established global networks, leveraging regional players and strategic partnerships or collaborations to distribute products globally. The growth of the region is attributed to the growing demand for Ultra-High Power (UHP) graphite electrodes, rising steel production, rapid infrastructure development, increasing environmental awareness, and a supportive government framework. The rapid urbanization and industrialization have resulted in a surge in construction activities in the region, fuelling the overall market's growth. The rapid technological innovations have led the steel industry to shift toward more sustainable electric arc furnace (EAF) production.

On the other hand, North America is anticipated to grow at the fastest CAGR. The region's growth is driven by the rapid expansion of the steel manufacturing industry and the increasing adoption of electric arc furnaces (EAFs), growing demand for sustainable steel manufacturing methods, growing environmental consciousness, and a rise in construction activities. The steel industry is experiencing rapid advancements, which is fueled by increased demand for EAF-produced steel and rising focus on sustainability, accelerating innovation in high-power graphite electrodes to enhance performance and environmental compliance.

Country-Level Investments and Trends for the Battery-as-a-Service (BaaS) Market:

China is the clear epicenter of BaaS investment and deployment, driven by heavy private capital from battery makers and EV OEMs and active local government pilots that favor swapping for high-utilization vehicles. Major strategic moves include CATL's “Choco-Swap” push and large-scale spending commitments. CATL announced plans to scale battery-swap stations (initially targeting ~1,000 in its early rollouts and a longer-term aim toward many thousands) and formed an ecosystem of nearly 100 partners around standardized swap modules, while reports show CATL agreed to invest in NIO Power as part of a strategic network build-out.

According to the data published by the International Energy Agency (IEA), in 2025, sales of electric cars are expected to surpass 20 million, accounting for over a quarter of cars sold worldwide. In the first three months of 2025, global electric car sales were up 35% year-on-year. Electric car sales exceeded 17 million globally in 2024, reaching a sales share of more than 20%. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022 and only 2% 5 years earlier, in 2018. In the Net Zero Emissions (NZE) Scenario, electric car sales reach around 65% of total car sales in 2030. To get on track with this scenario, electric car sales must increase by an average of 23% per year from 2024 to 2030. For comparison, electric car sales increased by almost 35% in 2023 compared to 2022.(Source:https://www.iea.org)

In January 2025, Urja Mobility, a leading Indian startup in EV battery leasing solutions, announced a strategic partnership with Sieger Technologies, a pioneer in innovative battery systems. This landmark collaboration includes a USD 1 million investment by Urja Mobility to deploy 2,500 state-of-the-art batteries, marking a significant leap toward sustainable electric transportation in India. The partnership aims to make electric mobility more accessible by addressing the high upfront costs of batteries, a major barrier for commercial EV operators.(Source: https://emobilityplus.com)

In May 2025, Kenya's electric mobility landscape received a significant boost with a USD 5 million investment in ARC Ride, a local startup offering battery-as-a-service (BaaS) solutions for electric two-wheelers. The financing, led by British International Investment (BII), the UK's development finance institution, is set to accelerate the rollout of 5,000 electric motorcycles and expand Africa's largest automated battery swapping network. The initiative aims to decarbonize Kenya's high-emission transport sector, where motorcycles are a major contributor to the country's 13% share of global greenhouse gas emissions(Source: https://theouut.com)

In January 2025, Brazil's UCB Power will prepare a battery-as-a-service solution in the country. The expansion of factories in Manaus and Extrema is anticipated to strengthen UCB's battery energy storage system (BESS) manufacturing strategy and will enable the company to offer rental of its equipment. Energy storage company UCB Power announced it had raised USD 24.8 million from the Inter-American Development Bank to expand activity at its factories in Manaus and Extrema.

Recent Developments:

- In September 2024, LG Energy Solution announced its vision to advance the development of a Battery-as-a-Service (BaaS) ecosystem, including the Battery Management System (BMS), a core technology for battery safety management. This means the company will pursue various service businesses such as battery leasing, rental, and recycling. (Source: https://www.chosun.com)

- In September 2024, JSW MG Motor India launched its latest electric vehicle, the Windsor EV, with a battery-as-a-service offering for ₹9.99 lakh. This brings down the high upfront costs associated with EVs. A customer must pay for at least 1,500 km per month under the battery-as-a-service model, bringing the usage cost of the battery to ₹5,250 per month even if the user drives it for less than 1,500 km. This excludes vehicle charging costs.

(Source: https://www.fortuneindia.com)

Top Key Players in the Battery-as-a-Service (BaaS) Market & Their Offerings

- Ample: Ample is revolutionizing EV energy infrastructure through its modular battery-swapping technology, allowing vehicles to replace depleted batteries in under 10 minutes. Its AI-driven stations identify vehicle types and optimize energy delivery, targeting fleet operations and urban electric mobility networks across the U.S., Japan, and Europe.

- NIO: NIO is redefining EV ownership with its Battery-as-a-Service (BaaS) model and an expansive network of over 2,500 automated battery-swapping stations across China and expanding into Europe. The company's advanced battery technology, combined with fast swap infrastructure, enhances driving range flexibility and reduces upfront EV costs for consumers.

- CATL (Contemporary Amperex Technology Co. Limited): CATL is the world's largest EV battery manufacturer, producing LFP, NCM, and high-nickel cathode batteries for major automakers including Tesla, BMW, and NIO. The company leads in innovation with its Qilin battery and condensed-state cells, delivering higher energy density, rapid charging, and greater safety performance.

- Tesla: Tesla continues to set global standards in EV battery technology with its 4680 cylindrical cells, offering higher energy capacity and manufacturing efficiency. Through its Gigafactories, Tesla maintains vertical integration across battery design, energy storage, and recycling, positioning itself at the forefront of sustainable mobility innovation.

- Gogoro: Gogoro operates the world's most established battery-swapping network, with over 12,000 stations enabling 400,000+ daily swaps for electric two-wheelers. Its partnership model with OEMs like Hero MotoCorp and Yamaha allows rapid expansion of smart, connected EV ecosystems across Asia's urban centers.

Other Companies in the Battery-as-a-Service (BaaS) Market

- Bounce Infinity: An Indian EV startup specializing in electric scooters with interchangeable batteries, offering battery-swapping networks and subscription-based energy models for urban mobility.

- Hero MotoCorp: India's largest two-wheeler manufacturer, Hero is developing a battery-swapping ecosystem and EV platforms in collaboration with Gogoro to accelerate electric mobility adoption.

- Gogoro: A global leader in smart battery-swapping networks, Gogoro operates thousands of battery stations powering electric scooters, with partnerships in India, Taiwan, and Southeast Asia.

- Li-Cycle: Specializes in lithium-ion battery recycling using proprietary hydrometallurgical processes to recover materials like lithium, nickel, and cobalt, supporting the EV circular economy.

- Panasonic Energy: A long-standing Tesla partner, Panasonic produces high-density lithium-ion cells and is scaling up next-gen battery manufacturing across the U.S. and Japan for EV and energy storage markets.

- Sinopec: A major Chinese energy company expanding into EV infrastructure by developing battery-swapping and charging stations integrated with its nationwide fuel network to support energy transition goals.

Segments Covered in the Report

By Service Type

- Subscription Model

- Monthly Subscription

- Annual Subscription

- Tiered Subscription (based on battery capacity or range)

- Pay-Per-Use Model

- Per Swap Payment

- Per kWh Consumption Payment

- Flexible Usage Plans

By Vehicle Type

- Two-Wheelers

- Electric Scooters

- Electric Motorcycles

- Three-Wheelers

- Electric Rickshaws

- Cargo Rickshaws

- Passenger Vehicles

- Electric Cars

- Light Commercial EVs

- Fleet Vehicles

- Ride-Hailing EVs

- Logistics & Delivery EVs

By Battery Capacity

- Below 50 kWh

- Small mobility EVs (two-wheelers, three-wheelers)

- 50–100 kWh

- Mid-size passenger EVs

- Above 100 kWh

- Large passenger EVs and commercial vehicles

By End-User Demographics

- Individual Consumers

- Private EV owners

- Shared mobility subscribers

- Commercial Users

- Delivery companies & logistics fleets

- Ride-hailing & taxi services

- Industrial Users

- Warehousing & port operations

- Corporate fleet operators

By Distribution Channel

- Direct-to-Consumer (D2C)

- Mobile apps & subscription platforms

- Battery swap stations

- Partnerships & Collaborations

- OEM collaborations

- Shared mobility platform partnerships

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting