What is the Cloud Security Posture Management Market Size?

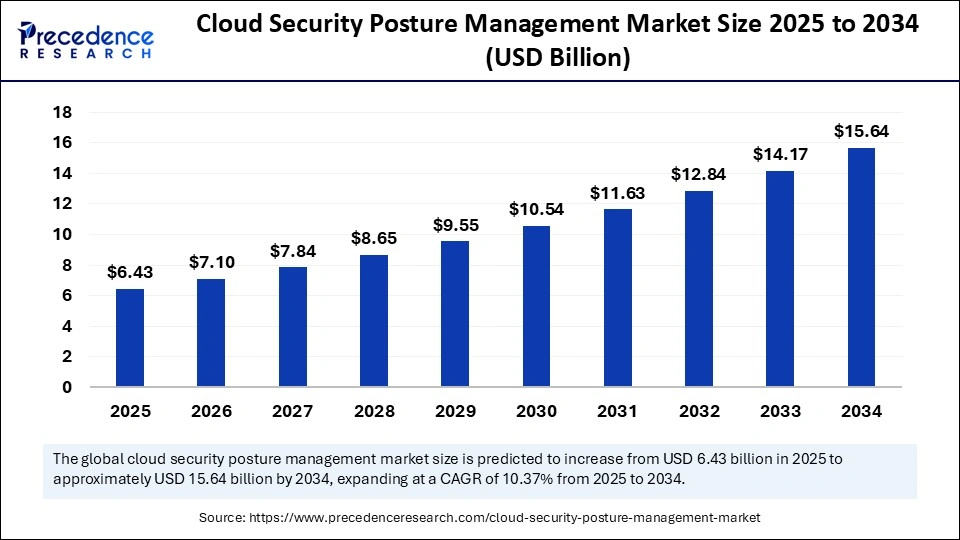

The global cloud security posture management market size accounted for USD 6.43 billion in 2025 and is predicted to increase from USD 7.10 billion in 2026 to approximately USD 15.64 billion by 2034, expanding at a CAGR of 10.37% from 2025 to 2034. The growth of the market is driven by the high adoption of cloud platforms across numerous industries, which poses security challenges and increases data breach incidents, leading to an increased demand for highly secure tools, such as cloud security posture management.

Market Highlights

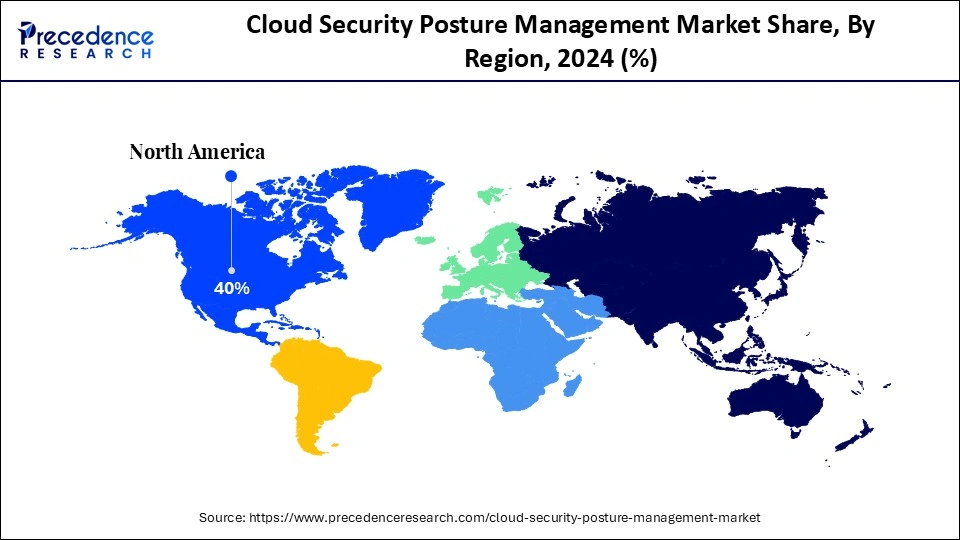

- North America dominated the market with the largest share of 40% in 2024.

- The Asia Pacific is expected to grow at a solid CAGR of 25% from 2025 to 2034.

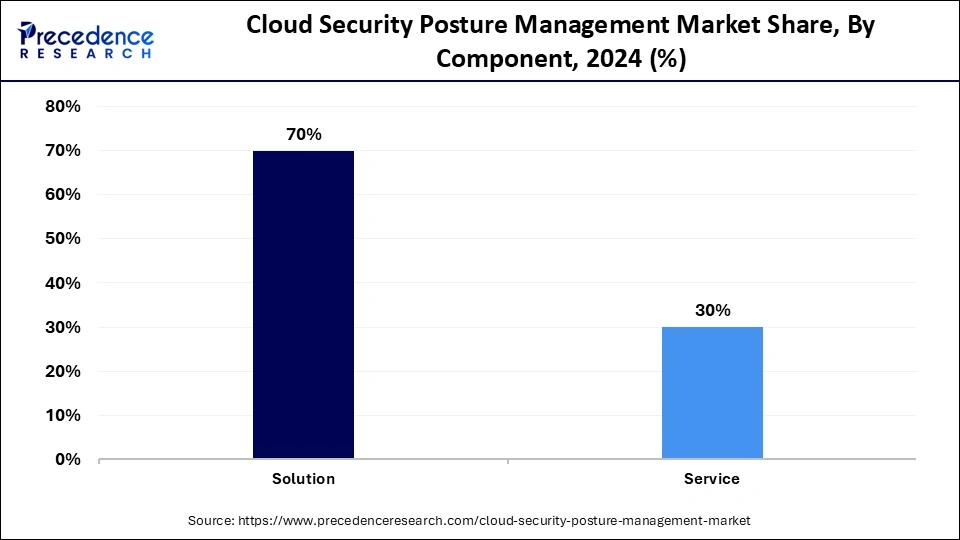

- By component, the solution segment held the largest market share of 70% in 2024.

- By component, the services segment is growing at a notable CAGR of 20% CAGR from 2025 to 2034.

- By deployment, the public cloud segment contributed the highest market share of 60% in 2024.

- By deployment, the hybrid cloud segment is expanding at a double-digit CAGR of 25% from 2025 to 2034.

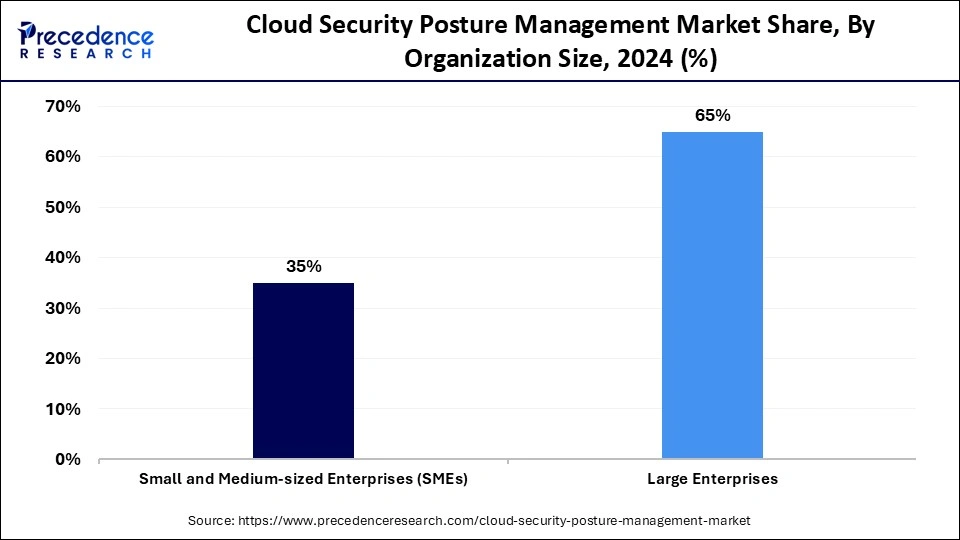

- By organization size, the large enterprise segment accounted for the major market share of 65% in 2024.

- By organization size, the SMEs segment is expected to grow at nearly 30% CAGR during the foreseeable period.

- By end-user industry, the BFSI segment held the largest market share of 30% in 2024.

- By end-user, the government & defense is expected to grow at nearly 35% CAGR from 2025-2034.

Market Size and Forecast

- Market Size in 2025: USD 6.43 Billion

- Market Size in 2026: USD7.10 Billion

- Forecasted Market Size by 2034: USD 15.64 Billion

- CAGR (2025-2034): 10.37%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Cloud Security Posture Management?

Cloud security posture management (CSPM) refers to the suite of tools and practices designed to continuously monitor and manage the security posture of cloud environments. CSPM solutions help organizations identify and remediate risks arising from misconfigurations, compliance violations, and other vulnerabilities in public, private, and hybrid cloud infrastructures. The market is experiencing rapid growth, fueled by the robust and ongoing global adoption of cloud services, driven by their reliability, and the introduction of innovative tools by marketers to support the needs of every sector. Moreover, the increasing acceptance of hybrid and multi-cloud strategies has created a complex environment that is difficult to manage at a manual level and requires solutions like cloud security posture management.

Redefining CSPM: How AI is Reshaping Cloud Security

The integration of AI with Cloud Security Posture Management (CSPM) tools is transforming traditional static cloud security approaches into dynamic, user-friendly, and interactive systems. AI enables real-time threat detection, intelligent alert prioritization, predictive risk analysis, and guided remediation, all of which enhance compliance with data security regulations and improve threat response efficiency.

With the rise of generative AI, security teams can now interact with CSPM platforms using natural, conversational language instead of complex, technical commands. Additionally, AI automates repetitive tasks, allowing security professionals to focus on higher-priority, strategic initiatives.

Cloud Security Posture Management Market Outlook

- Market Growth Overview: The market is poised for rapid growth between 2025 and 2034, driven by the increasing adoption of cloud services by various industries to manage their technological infrastructure with high levels of privacy and reliability. Strict laws for data protection, such as GDPR and HIPAA, require enterprises to continuously monitor their security status, which can be simplified with CSPM tools.

- Proactive Cloud Security Trend: In a fast-moving cloud environment, traditional periodic security assessments fall short of meeting the evolving needs of security due to the frequent and advanced methods used for data breaches. A significant key trend is shifting towards autonomous security. CSPM tools can apply code-based fixes automatically for misconfigurations, reducing manual efforts to stay constantly alert on the system. Additionally, another trend involves integrating security templates into the development cycle alongside infrastructure-as-code templates.

- Global Expansion: As enterprises worldwide accelerate their digital transformation and migrate to multi-cloud and hybrid cloud environments, the demand for robust cloud security solutions is increasing globally. CSPM tools are increasingly being adopted across regions to ensure compliance with diverse regulatory frameworks (e.g., GDPR in Europe, CCPA in California, PDPA in Asia), detect misconfigurations, and maintain security hygiene. Additionally, the increasing frequency of cloud-native application deployments in emerging markets, combined with the expanding global footprints of hyperscalers such as AWS, Azure, and GCP, is creating opportunities for CSPM vendors to offer localized, automated, and scalable posture management solutions tailored to regional cloud ecosystems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.43 Billion |

| Market Size in 2026 | USD 7.10 Billion |

| Market Size by 2034 | USD 15.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Model, Organization Size, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

Changing Threat Landscape

While CSPM tools offer numerous benefits, they also face limitations due to the rapidly evolving cloud environment and the emergence of new hacking techniques that exploit configuration vulnerabilities. To stay effective, vendors must continuously update their solutions to address emerging threats, an effort that can be both resource-intensive and costly. Additionally, some CSPM tools focus solely on misconfiguration detection, requiring organizations to integrate additional tools to cover broader threat scenarios.

Opportunity

Increasing Adoption of CNAPP

A significant opportunity that the market presents is the increasing reliance on converged platforms, such as cloud-native application protection platforms (CNAPPs). It helps integrate cloud security posture management with various security functions, such as cloud workload protection and cloud infrastructure entitlement management. Additionally, due to evolving market needs, the skills gap persists, which demands robust security services that create opportunities for marketers to offer managed security services, delivering CSPM as a service to various sectors.

Segment Insights

Component Insights

What Made Solution the Dominant Segment in the Market in 2024?

The solution segment dominated the cloud security posture management market while holding nearly 70% share in 2024. This dominance is driven by the growing need for integrated and automated tools that can continuously monitor and secure multi-cloud environments, which are inherently dynamic and vulnerable. CSPM solutions offer real-time visibility, threat detection, and ensure compliance with security standards, making them essential for modern cloud operations.

The service segment is expected to expand at nearly 20% CAGR during the foreseeable period. The growth of the segment is attributed to the increasing complexity of multi-cloud environments and the heightened risk of misconfigurations, which can lead to significant cybersecurity threats. As a result, organizations are increasingly turning to real-time managed services to address security issues proactively and safeguard sensitive data.

Deployment Insights

Why Did the Public Cloud Segment Lead the Cloud Security Posture Management Market?

The public cloud segment led the market, capturing approximately 60% in 2024. The dominance of the segment is attributed to the widespread adoption of public cloud platforms, which offer high scalability, cost-efficiency, and flexibility, factors that, in turn, increase the need for robust security measures. The complex and large-scale nature of public cloud environments further accelerates the adoption of CSPM tools to ensure continuous security monitoring and compliance.

The hybrid cloud segment is expected to grow at nearly 25% CAGR during the foreseeable period. The segment‘s growth is driven by the increasing use of hybrid infrastructures, which require unified security oversight and effective risk management across both public and private cloud environments. Hybrid cloud offers the scalability of public cloud while retaining the control and security of private cloud, making CSPM tools critical to managing compliance and security posture, thus driving the segment's expansion.

Organization Size Insights

Why Do Large Enterprises Hold the Largest Share of the Cloud Security Posture Management Market?

The large enterprises segment held the largest market share of nearly 65% in 2024. This is mainly due to the complex, multi-cloud infrastructure environments that large organizations operate, which demand advanced security and compliance measures to prevent operational failures and data breaches. These enterprises manage vast volumes of sensitive data and typically have dedicated security teams and sufficient financial resources, enabling them to invest significantly in robust CSPM solutions to strengthen their cloud security posture.

The SMEs segment is expected to grow at nearly 30% CAGR during the foreseeable period. This growth is fueled by increasing cloud adoption among SMEs and the rising availability of affordable, easy-to-use CSPM tools tailored to their needs. As SMEs increasingly migrate to cloud-based environments to enhance operational efficiency and security, the demand for accessible and scalable security posture management solutions continues to rise.

End-User Industry Insights

Why Did the BFSI Segment Dominate the Market in 2024?

The BFSI segment dominated the cloud security posture management market with nearly 30% in 2024. This dominance is primarily due to the sector's handling of vast volumes of highly sensitive financial and personal data, making it a prime target for cyberattacks. Regulatory compliance requirements and government-mandated data protection policies are also pushing BFSI organizations to adopt advanced security tools like CSPM to safeguard critical information, thereby driving global market growth.

The government & defense segment is expected to grow at nearly 35% CAGR during the foreseeable period of 2025-2034. The growth of this segment is driven by the increasing need to secure highly confidential data related to national security, defense operations, and critical infrastructure. CSPM tools provide automated risk assessment and continuous monitoring, offering governments and defense agencies a proactive approach to mitigate cyber threats and ensure regulatory compliance.

Regional Insights

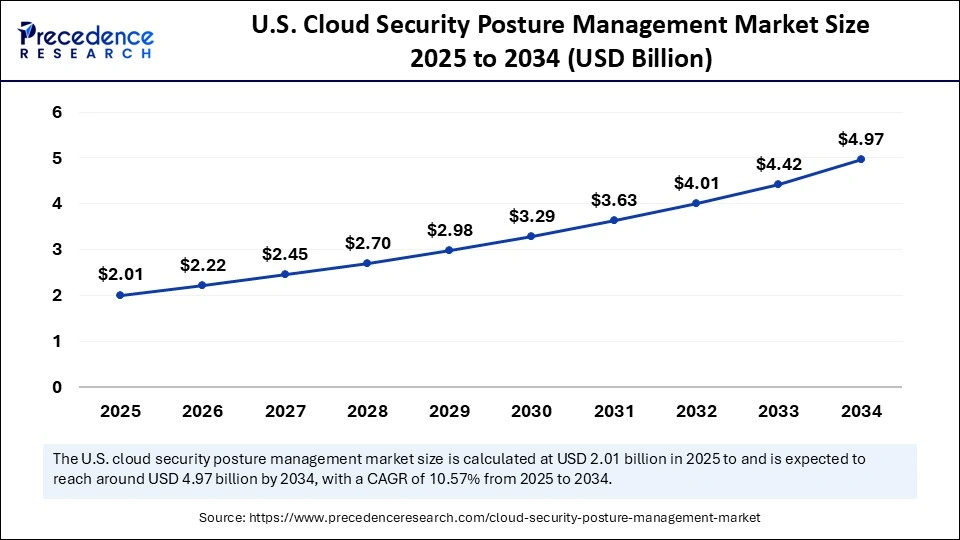

U.S. Cloud Security Posture Management Market Size and Growth 2025 to 2034

The U.S. cloud security posture management market size is exhibited at USD 2.01 billion in 2025 and is projected to be worth around USD 4.97 billion by 2034, growing at a CAGR of 10.57% from 2025 to 2034.

What Made North America the Dominant Region in the Cloud Security Posture Management Market?

North America dominated the market by capturing nearly 40% share in 2024. This region's dominance is attributed to the its high adoption of advanced cloud infrastructure, a mature regulatory landscape, and the strong presence of leading CSPM vendors. Additionally, there is a cultural emphasis on technological innovation, especially in sectors like finance and healthcare, where strict data security and compliance requirements further drive CSPM adoption.

Many major enterprises in the region have already embraced multi-cloud and hybrid cloud environments, which introduce added complexity in managing cloud security. CSPM solutions, with their automated risk assessments and continuous monitoring capabilities, help safeguard critical infrastructure—further supporting market growth in the region.

Asia Pacific Market Trends

Asia Pacific is expected to grow at nearly 25% CAGR during the foreseeable period of 2025-2034. This growth is driven by aggressive digital transformation across various sectors, which has unfortunately led to a significant rise in cybercrimes targeting sensitive data and information. In response, stringent data protection laws have been implemented, such as India's Digital Personal Data Protection Act 2023 and China's Data Security Law, mandating organizations to proactively invest in CSPM solutions to ensure robust cloud security.

Cloud Security Posture Management Landscape: Global Regulations

- General Data Protection Regulation (GDPR): It is a stringent data privacy and security law set by the European Union. According to this, enterprises must show how they are handling consumers' data with proper access and encryption.

- Health Insurance Portability and Accountability Act (HIPAA): It is a law set by the U.S. government that establishes standards to protect sensitive medical data about patients' health histories and recent treatments. Healthcare providers and partners should adhere to security guidelines and safeguard information when storing it on a cloud platform. It is possible to use the CSPM platform and ensure that protected health information cannot be exposed to any malicious or anonymous activist.

- National Institute of Standards and Technology Frameworks: It's a widely used set of security guidelines and protocols that was established by the U.S. It assists many organizations and government bodies in managing and reducing cybersecurity risks.

Value Chain Analysis of Cloud Security Posture Management Market

- Threat Intelligence with Technology Development

This is an initial stage that involves research and development to integrate core technology into the workflow. It can identify security loopholes and monitor compliance by leveraging AI technology to detect anomalies.

Key players: Wiz, Palo Alto Networks, Orca Security, and CrowdStrike

- Platform Integration with Engineering

This stage involves engineering the core technology into a user-friendly and scalable platform. This includes creation of dashboards, reporting tools, and workflow automation.

Key players: Datadog, Microsoft, Lacework, and SentinelOne

- Marketing & Sales

It's a crucial stage where a product is delivered to consumers for its application. It encompasses direct sales and marketing strategies for CSPM tools, as well as partnerships with leading cloud providers and managed security service providers.

Key players: Amazon Web Services, Google Cloud Platform, Alibaba, and Oracle

Top Companies in the Cloud Security Posture Management Market

Tier I – Major Players

These companies are dominant in the market, each holding a significant share individually, and together accounting for approximately 45–50% of the total market revenue.

- Microsoft Corporation: It offers Microsoft Defender for Cloud, a comprehensive CSPM solution that provides continuous assessment and security posture management across hybrid and multi-cloud environments.

- Palo Alto Networks, Inc.: The company provides Prisma Cloud, a cloud-native security platform offering CSPM capabilities, including real-time visibility, compliance monitoring, and threat detection across multi-cloud environments.

- Check Point Software Technologies Ltd.: The company provides comprehensive cloud security posture management through its CloudGuard platform, enabling organizations to manage misconfigurations, enforce compliance, and automate threat detection across multi-cloud environments.

- Trend Micro Incorporated: It offers Cloud One – Conformity, a CSPM solution that offers continuous monitoring and remediation of cloud misconfigurations, helping organizations maintain compliance and security across their cloud environments.

- Fortinet Inc.: Its FortiCNP, a CSPM solution, provides visibility and control over cloud security posture, enabling organizations to detect and remediate misconfigurations and vulnerabilities in real-time.

Tier II – Mid-Level Contributors

These companies have a strong presence in the CSPM market, offering specialized solutions and catering to specific customer needs, collectively contributing around 30–35% of the market.

- Lacework Inc.

- Aqua Security Software Ltd.

- Qualys Inc.

- McAfee Corp.

- IBM Corporation

Tier III – Niche and Emerging Players

These are smaller, emerging, or regionally-focused companies with limited but growing presence, together contributing about 15–20% of the market.

- Wiz

- CrowdStrike

- Zscaler

- Cloudflare

Recent Developments

- In October 2025, leading marketers Akamai Technologies and Apiiro collaborated to integrate their security application and ASPM platforms. It will help enterprises secure their applications throughout the entire software development cycle.(Source: https://finance.yahoo.com)

- In April 2025, tech giant Microsoft announced the general availability of its API security posture management within the Defender CSPM plan. This offers enterprises a unified inventory of APIs across multiple cloud environments to identify potential threats.(Source: https://learn.microsoft.com)

Exclusive Expert Analysis on the Cloud Security Posture Management Market

The market is positioned at a pivotal juncture, exhibiting robust growth trajectories driven by the accelerating migration towards hybrid and multi-cloud architectures across enterprises globally. CSPM's strategic importance is underscored by the escalating complexity and dynamism inherent in contemporary cloud environments, which exponentially amplify security vulnerabilities and compliance risks.

Market dynamics reveal a pronounced shift toward automated, AI-enhanced security frameworks that facilitate real-time threat detection, continuous compliance enforcement, and proactive risk remediation. This transition mitigates traditional manual inefficiencies and aligns with enterprises' strategic imperatives for resilient, scalable security postures in increasingly digital ecosystems.

From an opportunity standpoint, the burgeoning adoption of cloud-native technologies coupled with stringent regulatory mandates across industries, particularly within BFSI, healthcare, and government sectors, fuels sustained demand for advanced CSPM solutions. Furthermore, the rise of sophisticated cyber threats and escalating costs associated with data breaches accentuate CSPM's critical role as a foundational element of enterprise risk management.

Additionally, emerging markets in Asia Pacific and Latin America, catalyzed by rapid digital transformation and evolving regulatory landscapes, present fertile grounds for market expansion. The integration of AI and machine learning capabilities within CSPM platforms opens avenues for innovation, enabling predictive analytics and adaptive security controls, thereby offering vendors differentiation opportunities and a competitive edge.

Segments Covered in the Report

By Component

- Solution

- Service

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By End-User Industry

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Retail

- Government and Défense

- IT and Telecom

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting