Vaccine CDMO Market Size and Forecast 2025 to 2034

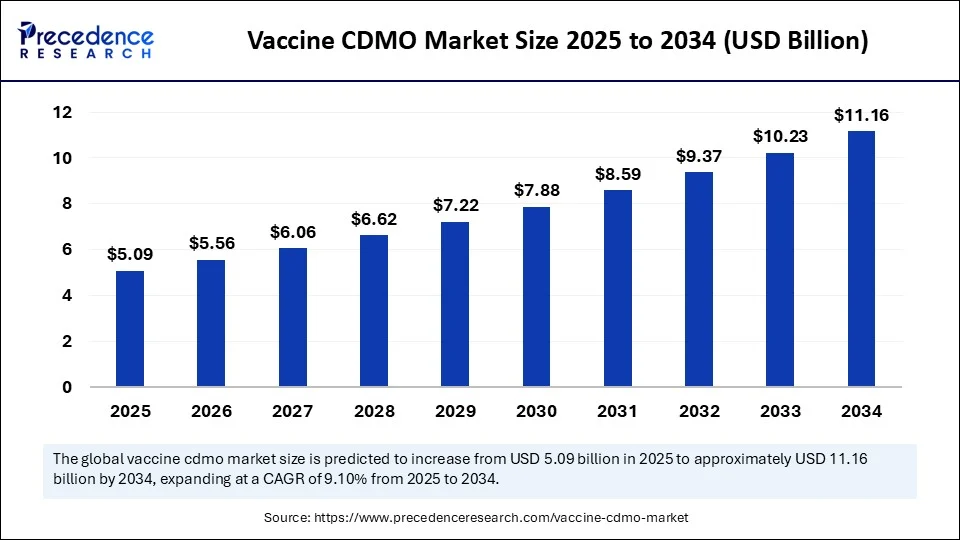

The global vaccine CDMO market size was calculated at USD 4.67 billion in 2024 and is predicted to increase from USD 5.09 billion in 2025 to approximately USD 11.16 billion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034. The vaccine CDMO market is growing due to the raised funding from both the public as well as private sectors seeks to encourage innovations in vaccine design along with production processes.

Vaccine CDMO Market Key Takeaways

- In terms of revenue, the global vaccine CDMO market was valued at USD 4.67 billion in 2024.

- It is projected to reach USD 11.16 billion by 2034.

- The market is expected to grow at a CAGR of 9.10% from 2025 to 2034.

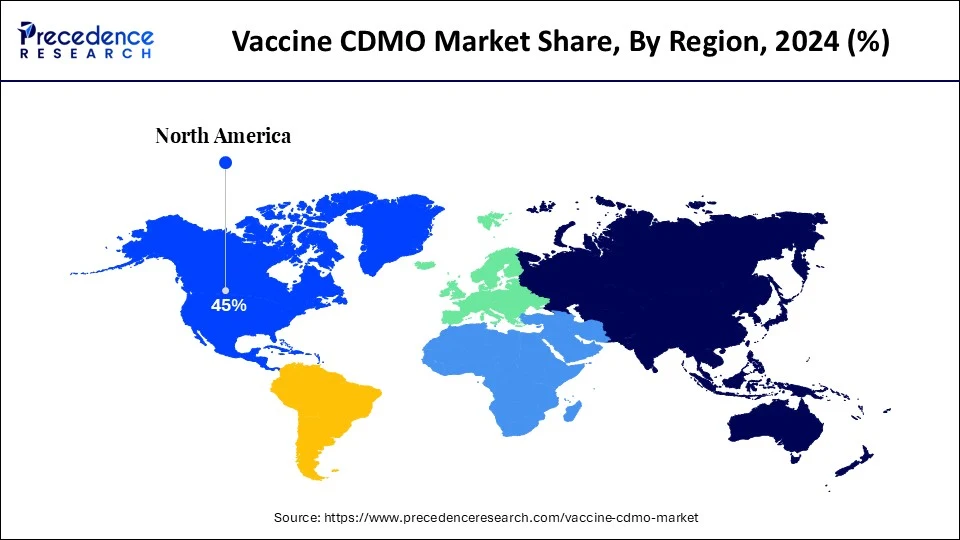

- North America dominated the vaccine CDMO market with the largest share of 45% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By Service, the manufacturing segment is projected to grow at a significant CAGR from 2024 through 2030.

- By phase, Phase 2 is expected to experience the fastest CAGR between 2024 and 2030.

- By therapeutic area, the rare diseases and orphan indications segment is expected to witness significant growth during 2025 to 2034.

Impact of AI on the Vaccine CDMO Market

Artificial intelligence is significantly accelerating the growth of the vaccine CDMO market by improving vaccine research and development, streamlining manufacturing together with production processes, and optimizing clinical trials. Machine learning models forecast optimal antigenic epitopes and assess the immunogenicity of potency vaccine candidates, while generative models along with molecular dynamics enhance the stability and coverage of immunogens.

AI improves vaccine trial efficiency via predictive analytics, assigning to design more effective trials and even select suitable patients. By determining production data, AI systems can detect patterns along with anomalies, leading to enhanced productivity, lowered downtime, as well as consistent, high-quality vaccine production.

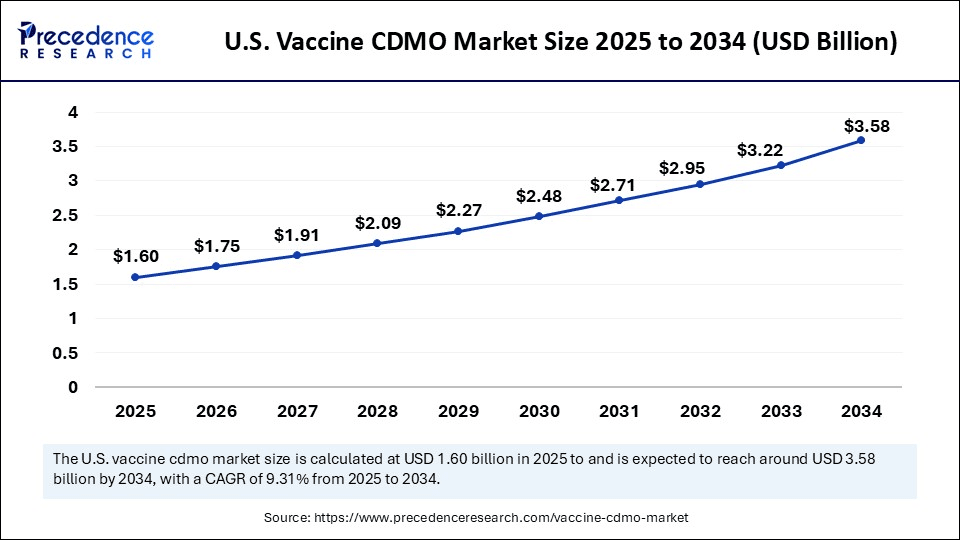

U.S. Vaccine CDMO Market Size and Growth 2025 to 2034

The U.S. vaccine CDMO market size was exhibited at USD 1.47 billion in 2024 and is projected to be worth around USD 3.58 billion by 2034, growing at a CAGR of 9.31% from 2025 to 2034.

Why did North America dominate the vaccine CDMO market in 2024?

North America dominates the vaccine CDMO market due to its developed healthcare infrastructure, strong pharmaceutical and biotechnology sectors, and robust regulatory environment, which includes a high concentration of major firms and research institutions. The concentration of universities as well as research establishments led to a continuous pipeline of new drug research, demanding specialized CDMO services along with maintaining a skilled workforce. Strict but clear regulatory standards, like those from the FDA, promote partnerships with CDMOs which can demonstrate proven compliance, thereby in turn incentivizing investment and expansion in the sector.

- In April 2024, FUJIFILM Diosynth Biotechnologies declared the additional investment of USD 1.2 billion to stretch its biomanufacturing facility in Holly Springs, North Carolina. This expansion target to add eight 20,000-liter mammalian cell culture bioreactors by 2028, improving large-scale production capacity for biologics as well as vaccines. (Source: https://www.biopharminternational.com)

The Asia Pacific is the fastest-growing region in the vaccine CDMO market due to its cost advantages as well as skilled labor, coupled with growing government support for vaccine development and even expanding immunization programs. Governments in the region are increasingly funding vaccine research and development, contributing to greater investment in CDMO capabilities as well as infrastructure. Top CDMOs in the region are meeting international standards, which includes WHO-cGMP compliance, which is vital for global public health buyers and also instills confidence in their quality and reliability.

- In June 2025, Indian pharmaceutical firm Zydus Lifesciences declared its entry into the contract development and manufacturing organization (CDMO) space via its acquisition of US-origin manufacturing facilities from cancer immunotherapy developer Agenus Inc. (Source: https://www.bioprocessintl.com)

Market Overview

The importance of the tvaccine CDMO (Contract Development and Manufacturing Organization) market lies in its role in speeding up vaccine innovation and accessibility, mainly during public health crises such as the COVID-19 pandemic. CDMOs assist bring vaccines to market faster by managing complex production processes, from process development to fill-finish. Outsourcing manufacturing permits pharmaceutical firms to avoid significant capital investments in specialized facilities as well as personnel, decreasing operational expenses.

The market is crucial for supplying vaccines to tackle global infectious disease threats, encourage preventive healthcare, and enhance global immunization programs. Public-private partnerships as well as government investments in strengthening vaccine production capabilities fuel market expansion.

- In July 2025, Lonza announced a solid start to the first half of 2025 with sturdy overall performance by its contract development and manufacturing organization (CDMO) business, which includes positive momentum in mammalian, bioconjugates, and even small molecules, correcting lower sales from cell and gene therapy (CGT) and microbial. (Source: https://manoxblog.com)

Vaccine CDMO Market Growth Factors

- A basic driver is the consistent and increasing global need for effective vaccines to combat numerous oncological, infectious, and autoimmune diseases.

- Strong collaborations between biopharmaceutical firms and CDMOs are important for navigating the complex vaccine development as well as manufacturing process.

- CDMOs are investing in developed technologies such as single-use systems, lipid nanoparticle formulation, as well as sophisticated fill-finish capabilities to meet these new demands.

- Significant public along with private investments are flowing into vaccine research and development, which in turn drives demand for CDMO services to scale up manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.16 Billion |

| Market Size in 2025 | USD 5.09 Billion |

| Market Size in 2024 | USD 4.67 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Modality, Expression System / Platform, Manufacturing Scale, Dosage Form / Presentation, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing trend of biopharmaceutical companies outsourcing complex manufacturing to specialized CDMOs:

The growing outsourcing trend by biopharmaceutical companies to specialized CDMOs drives the vaccine CDMO market by offering access to cutting-edge technology as well as specialized expertise, decreasing high capital costs, accelerating time-to-market, along with providing scalable, flexible solutions for complex vaccine production, such as mRNA or viral vector platforms. CDMOs possess in-depth expertise in developed technologies, including high-containment bioreactors, viral vector production, and sterile fill-finish, which are vital for complex vaccine modalities.

Restraint

Regulatory compliance:

Evolving regulatory requirements are a restraint on the vaccine CDMO market, as they require constant investment in the latest technologies, facilities, along with expertise to meet diverse and even increasingly stringent global standards. This increases operational expenses, lengthens development timelines, as well as raises the risk of costly non-compliance. Adapting to new, stricter regulations need CDMOs to continuously invest in specialized equipment, upgraded quality systems, facility upgrades, as well as ongoing staff training. Smaller and also mid-sized CDMOs may struggle to assign sufficient resources to maintain compliance over different regulatory jurisdictions, making it challenging to compete.

Opportunity

Convergence of vaccines and immuno-oncology

The convergence of cancer vaccines and immuno-oncology creates opportunities for vaccine CDMOs by driving need for personalized, complex vaccines as well as combination therapies, necessitating developed manufacturing capabilities for neoantigens, cell therapies, mRNA, and adjuvants. There is an increasing need for CDMOs to support novel vaccine platforms, which includes mRNA vaccines, which can encode antigens as well as immune-stimulatory factors to improve the anti-tumor response. CDMOs can grow their value proposition by providing a broader range of services beyond basic production, including clinical trial services, regulatory support, formulation development, and support for post-marketing studies.

Modality insights

Why did the mRNA vaccines segment dominate the vaccine CDMO market in 2024?

The mRNA vaccine segment dominates the CDMO market due to the proven speed along with efficacy demonstrated during the COVID-19 pandemic, contributing to a rise in investment and growth of CDMOs' capabilities for mRNA production. The success of mRNA vaccines during the COVID-19 pandemic exhibited their ability to be developed as well as deployed rapidly, setting a new benchmark for speed in vaccine development. The proven success of mRNA technology has encouraged CDMOs to invest remarkably in specialized equipment, facilities, and expertise for mRNA production.

- In March 2025, Emergent BioSolutions Inc. and Rocketvax Ltd declared entry into an agreement for Emergent's planned financial investment into Swiss Rockets Ltd, the parent firm of Rocketvax Ltd, to fund research, infrastructure development, and even the growth of Swiss Rockets' innovative biotechnology portfolio. Further, the parties intend to form a strategic collaboration whereby Emergent would contribute the U.S. manufacturing as well as commercialization efforts for four of Rocketvax's pipeline candidates for cancer, infectious diseases, and also autoimmune disorders. (Source: https://investors.emergentbiosolutions.com)

Expression system / Platform insights

How did the mammalian cell culture segment dominate the vaccine CDMO market in 2024?

Mammalian cell culture dominates the vaccine CDMO market because it is the most effective way to manufacture complex therapeutic proteins with human-like post-translational modifications, which are important for biological activity and lowering immune rejection. Proteins manufactured in mammalian cells are inherently more like human proteins, decreasing the risk of immune responses in individuals and making them suitable for therapeutic use. The increasing global need for complex, human-like biologics, which includes monoclonal antibodies, drives the demand for mammalian cell-based production systems.Boehringer Ingelheim, a well-known Western CDMO in the biopharmaceutical space, offers mammalian cell culture manufacturing capabilities.

The bacterial/E. coli segment is witnessing the fastest growth due to its high yield, low expense, and rapid growth rates make it applicable for large-scale production of simpler proteins such as subunit vaccines. E. coli's robustness together with fast growth rates make it an excellent option for large-scale manufacturing of biologics, mainly for applications such as vaccines and simpler recombinant proteins. The FDA has accepted various therapeutic proteins manufactured using E. coli, which adds to the credibility as well as commercial viability of E. coli-based manufacturing processes.

Manufacturing scale insights

Why did the commercial scale segment dominate the vaccine CDMO market in 2024?

The commercial scale segment dominates the vaccine CDMO market because it includes large-scale, continuous manufacturing of established together with approved vaccines, driving high revenue for CDMOs. Pharmaceutical firms outsource commercial-scale production to CDMOs to benefit from expense savings, access specialized facilities and even expertise, and decrease time-to-market. Big pharma and even biotech firms increasingly outsource commercial-scale manufacturing to CDMOs to focus on R&D, marketing, and distribution.

The clinical scale segment is growing rapidly, fueled by an increasing number of new viral vaccine individuals are entering early-stage clinical trials, demanding CDMOs with flexible manufacturing capabilities. Many pharmaceutical and biotech firms outsource clinical-scale production to CDMOs to elude significant upfront capital investments in modified equipment and infrastructure. This permits them to focus on their core competencies in drug discovery and development.

Dosage form / presentation insights

Why did the liquid formulation segment dominate the vaccine CDMO market in 2024?

The liquid formulation segment dominates the overall pharmaceutical CDMO market due to their patient compliance, stability, and cost-effectiveness for chronic disorder treatments. However, liquid formulations are undergoing the fastest growth, mainly sterile liquids, driven by the increasing global need for biologics and vaccines, especially newer modalities such as mRNA-based vaccines, along with antibody treatments. The established nature and even widespread application of solid dosage forms make them a cost-effective alternative for many pharmaceutical products, boosting outsourcing of these contracts.

The lyophilized (dry) presentation segment is growing rapidly, due to the significantly improved stability along with extended shelf life for vaccines, which greatly reduces the demand for stringent cold-chain storage and distribution. This permits for easier and even more affordable vaccine distribution to resource-poor regions, simplifies logistics, and also ensures product potency over longer periods as well as at room temperature. The process handles the integrity and also potency of sensitive biological components, guaranteeing that the vaccine remains effective even with longer storage durations as well as at room temperature.

Therapeutics Area Insights

From a therapeutic standpoint, rare diseases and orphan indications are positioned as the fastest growing area in clinical trial supply and logistics. Advances in genomics and precision medicine have spurred development of highly targeted therapies for conditions with limited or no existing treatment options. These trials often involve smaller patient populations spread across multiple geographies, making the supply chain highly complex and logistically demanding. Tailored solutions are required to ensure timely and secure delivery of investigational products to dispread trial sites. Additionally, strong regulatory incentives and rising investment in orphan drug research are accelerating activity in this space. As a result, the rare disease segment is gaining prominence, fuelling rapid growth in the demand for specialized trial supply and logistics support.

Value Chain Analysis

- R&D

For a vaccine contract development and manufacturing organization (CDMO), R&D includes taking an early-stage vaccine concept from a client as well as developing the process and materials to bring it to market, which includes pre-formulation work, analytical method development, process optimization, and stability studies for clinical trials as well as commercialization.

Key Players: Lonza, Thermo Fisher Scientific, Catalent

- Patient Support and Services

These are developing to meet the complex requirements of vaccine developers and patients, with CDMOs offering integrated services such as patient hubs, digital platforms, call center support, and logistical support for vaccine delivery along with administration, ensuring seamless communication, adherence to regulations, and efficient record management.

Key Players: Catalent, ICON plc, PCI Pharma Services

Vaccine CDMO Market Companies

- Lonza

- Catalent

- Thermo Fisher Scientific

- Siegfried (formerly Swiss fill & finish or Siegfried Switzerland)

- Wacker Biotech

- Alcami

- Virchow Biotech

- BioNTech Manufacturing

- Emergent BioSolutions

- Alcami

- Novasep

- Samsung Biologics

- Boehringer Ingelheim BioXcellence

- Fujifilm Diosynth Biotechnologies

- Recipharm

- Almac Group

- Vetter Pharma

- Thermogenesis

- AGC Biologics

- Richter-Helm BioLogics

Recent Developments

- In May 2025, Recipharm, a leading worldwide contract development and manufacturing organization (CDMO), and ProductLife Group (PLG), a global manufacturer product development and regulatory affairs services, declared a strategic collaboration targeted at supporting (bio)pharmaceutical firms in accelerating time to clinical trials as well as market approval while decreasing supply chain, compliance, and even regulatory challenges during product development. https://www.recipharm.com/press-releases/recipharm-and-plg-announce-strategic-partnership-accelerate-development-projects

- In May 2025, SK Bioscience declared that IDT Biologika, a Germany origin CDMO (Contract Development and Manufacturing Organization) and even a subsidiary of SK Bioscience, is speeding up its efforts to explore the latest business opportunities and strengthen its existence as a global CDMO via major international industry events. https://firstwordpharma.com/story/5963734

- In November 2024, FUJIFILM Biotechnologies, a world-leading contract development and manufacturing organization (CDMO) for biologics, advanced therapies, vaccines, and oncolytic viruses, proudly discloses that the first phase of its growth at the Hillerød site is ready to bring the latest production capacity into operation. https://fujifilmbiotechnologies.fujifilm.com/about/news/fujifilm-diosynth-biotechnologies-launches-first-phase-of-global-cdmo-ecosystem-expansion/

Segments Covered in the Report

By Modality

- mRNA vaccines

- Viral-vector vaccines

- Recombinant protein vaccines

- Inactivated/subunit vaccines

By Expression System / Platform

- Mammalian cell culture (e.g., CHO, Vero)

- Bacterial/E. coli

- Yeast cells

- Insect cells (baculovirus)

By Manufacturing Scale

- Clinical scale (Phase I/II)

- Commercial scale

- Emergency / surge-capacity (pandemic response)

By Dosage Form / Presentation

- Liquid formulation (vials/syringes)

- Lyophilized (dry) presentation

- Multi-dose presentations

- Novel delivery forms (e.g., nasal sprays, patches)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting