Wearable Cardiac Devices Market Size and Growth 2025 to 2034

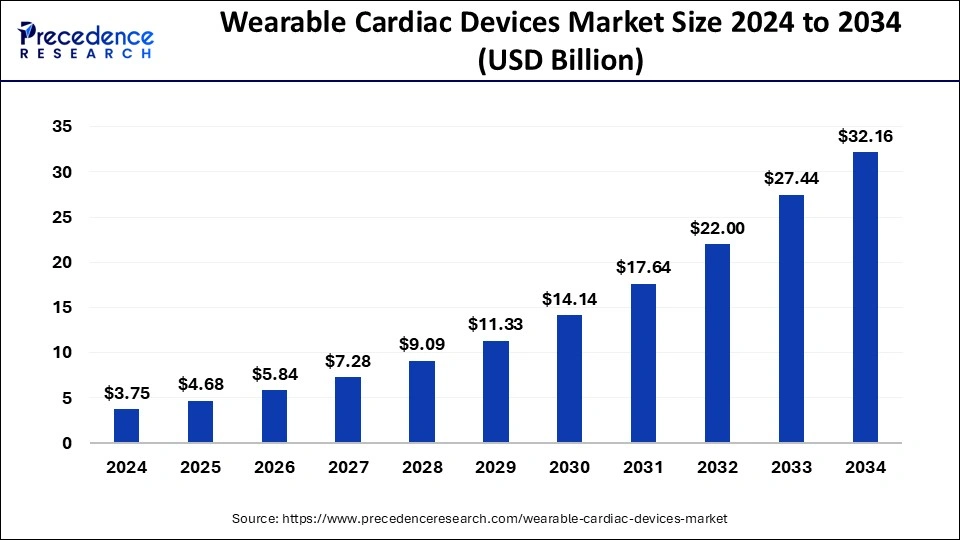

The global wearable cardiac devices market size was calculated at USD 3.75 billion in 2024 and is predicted to increase from USD 4.68 billion in 2025 to approximately USD 32.16 billion by 2034, expanding at a CAGR of 23.97% from 2025 to 2034.The rising awareness and surging expenditure on health by the population is boosting the growth of the market.

Wearable Cardiac Devices Market Key Takeaways

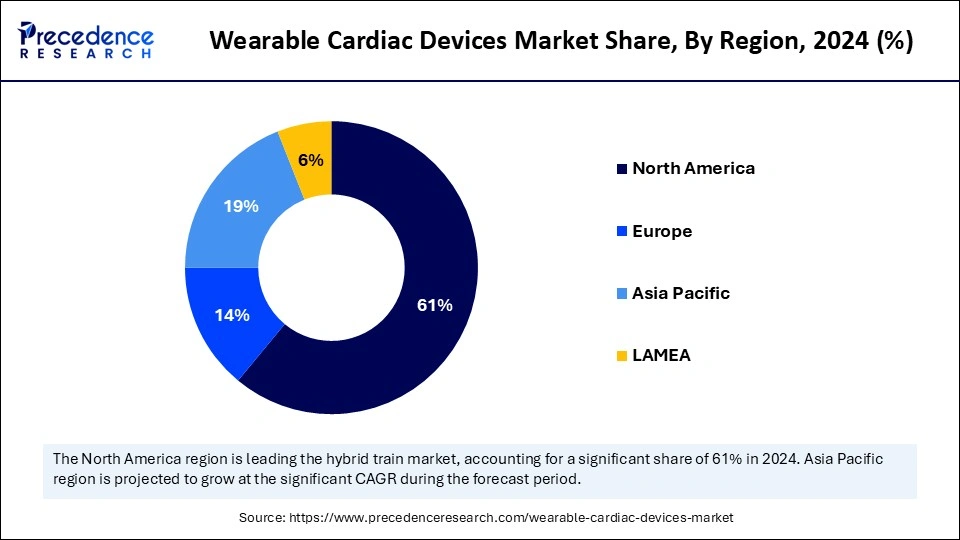

- North America led the wearable cardiac devices market with the largest market share 61% in 2024.

- Asia Pacific is expected to witness the fastest growth in the market during the forecast period.

- By product, the defibrillators segment dominated the market in 2024.

- By product, the patch segment is anticipated to show considerable growth in the market over the forecast period.

- By application, the home healthcare segment dominates the market and is expected to grow at the fastest rate during the forecast period.

How is AI Integration Transforming the Wearable Cardiac Devices Market?

The use of AI is potentially revolutionizing the wearable cardiac devices market by increasing the intelligence of devices, the precision of the diagnosis, and user engagement. AI helps to improve battery life of the device, power optimization, and data processing, making sure that the health insights are received faster and more accurately. In addition, AI makes it easier to connect such wearables to telehealth systems, so patients and clinicians can monitor their activity and communicate in real-time. This integration assists in early-stage intervention, improved control of the disease, and increased accessibility to healthcare even in the underserved or rural communities.

U.S. Wearable Cardiac Devices Market Size and Growth 2025 to 2034

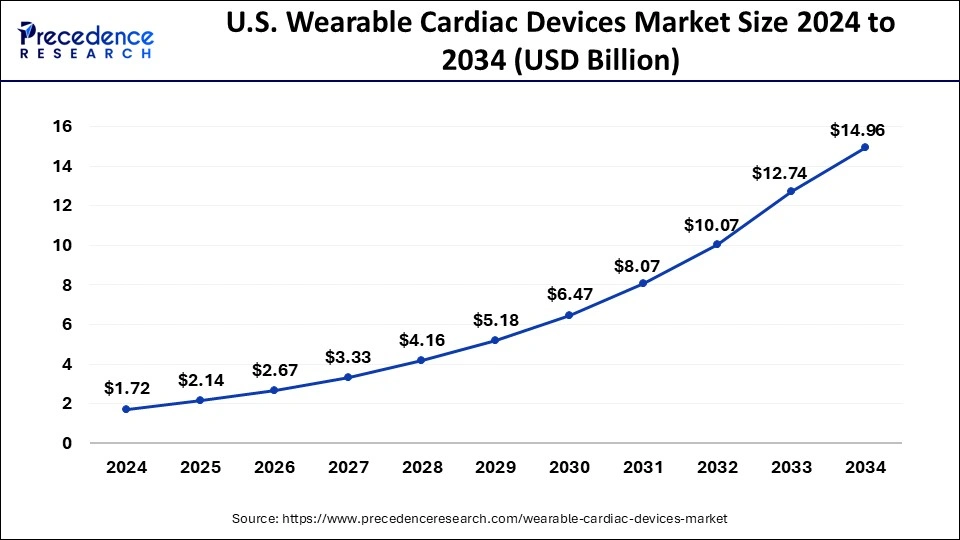

The U.S. wearable cardiac devices market size was estimated at USD 1.72 billion in 2024 and is predicted to be worth around USD 14.96 billion by 2034 with a CAGR of 24.15% from 2025 to 2034.

North America led the wearable cardiac devices market with the largest market share in 2024. The market growth in the region is attributed to the rising cases of cardiac-related diseases in the population due to lifestyle habits and aging factors. The rising geriatric population is one of the major reasons for the higher number of chronic cardiovascular diseases in the region. The population's early adoption of technology in healthcare and the well-developed healthcare infrastructure are driving the expansion of the cardiovascular treatment ratio. The higher availability of the leading technology companies participating in the development of wearable healthcare devices contributes to the growth of the wearable cardiac devices market in the region.

- For instance, 40% of adults in the U.S. are using any type of health application, and 35% are using wearable healthcare devices in 2024. According to the survey, the use of wearable healthcare devices increased by 8% from 2018, and healthcare application usage increased by 6% from 2018 to 2024. 47% and 40% of adults aged 18 to 34 use wearable and healthcare apps, respectively.

- For instance, 38% of adults with cardiovascular diseases regularly use wearable devices. Almost or more than 80% of wearable device users share their regular health information with their physicians to support health monitoring.

In North America, the U.S. led the market owing to the growing incidence of cardiovascular diseases, technological innovations in remote patient monitoring, along with the rising awareness regarding preventive healthcare. Also, wearable cardiac devices are playing a key role in patient monitoring, allowing continuous heart health tracking and minimizing the need for frequent hospital visits. Major companies in the US market are Cardiac Rhythm, iRhythm Technologies Inc., and ZOLL Medical Corporation.

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The growth is owing to the expansion in population in the region's countries like India and China. The increasing prevalence of cardiac diseases in the population is driving the demand for regular health monitoring devices.

Additionally, the rising technological trend in healthcare wearable devices is driving the growth of the wearable cardiac devices market across the region. About 5–6 lakh Indians are thought to pass away from sudden cardiac death (SCD) each year, with a significant percentage of those deaths occurring in those under 50. In India, stroke ranks as the second most prevalent cause of death. In India, there are over 1,85,000 recorded stroke cases annually, with one stroke fatality occurring every four minutes and a stroke occurring every forty seconds.

The critical emphasis now turns to improving cardiac-related illness monitoring, early identification, and prevention tactics in light of these concerning developments. Indian cardiac care is undergoing a fundamental transformation thanks to recent technological developments. The emergence of smart gadgets has brought about a transformation in the field of cardiac care by providing more options for managing daily health. These developments provide people the ability to actively engage in their healthcare process and give medical professionals vital resources for better monitoring and treating heart issues.

In the Asia Pacific, China dominated the market due to the surge in the aging population, rising health awareness, and innovations in healthcare technology. Government awareness and campaign programs are fuelling the demand for wearable medical devices in the country. Moreover, demand for minimally invasive cardiovascular procedures, those enabled by advanced stents and transcatheter valves, is also expanding the market reach in the country.

Europe Wearable Cardiac Devices Market Trend

The European wearable cardiac devices market is expected to account for a substantial market share in 2024, due to a high rate of cardiovascular diseases, improved awareness among people towards healthcare, and the high rate of technological adoption within healthcare facilities. The devices provide continuous monitoring, early warning of unusual situations, and easy integration with telemedicine services to enable more effective management of chronic diseases. The aging populations and the increased need of having constant home-based monitoring to decrease the number of hospital readmissions and enhance patient outcomes contribute to the demand as well. Moreover, innovation and implementation are also being accelerated by the existence of robust partnerships between the medical technology companies and healthcare organizations in the region.

The U.K. can be considered a country with a strong regulatory system, which facilitates the safe and effective process of making wearable cardiac devices available on the market. The Medicines and Healthcare Products Regulatory Agency (MHRA) will guarantee high-quality control and device performance and will ensure a trustworthy situation on the manufacturers' and end-users' side. The U.K. possesses an advanced digital infrastructure in addition to having a well-developed infrastructure in terms of government encouragement of telemedicine and remote healthcare technologies.

Market Overview

Wearable cardiac devices are one of the segments of wearable healthcare devices that are used to monitor and track the physical activity of patients suffering from any type of cardiac issues. Wearable devices are used to capture data by mobile sensors and generate behavioral and physiological insights like heart rate, physical activity, sleep, and heart rhythm. Wearable devices are minimally invasive and used for the diagnostics process.

The rising popularity of wearable healthcare devices is driving the demand for the wearable cardiac devices market. It helps in positively influencing lifestyle changes such as prevention measures, remote monitoring of patients, and arrhythmia screening of at-risk individuals with peripheral artery diseases and other chronic cardiovascular disorders. The rising geriatric population and the accepting sedentary lifestyle are causing an increased number of cardiac issues in people, driving the demand for the wearable cardiac devices market.

Wearable Cardiac Devices Market Growth Factors

- The increasing prevalence of cardiovascular diseases among the population due to changing lifestyle habits, environment, and aging factors drives the demand for the wearable cardiac devices market.

- The increase in the geriatric population, which is more likely to be affected by chronic diseases like cardiovascular diseases and diabetes, drives the demand for early treatment, which boosts the demand for the market.

- Wearable cardiac devices are daily health activity trackers used by cardiac patients to manage their well-being. The devices give physicians accurate insights into the patient's health so that they can make proper decisions regarding their health.

- The rising preference for home healthcare and the increasing adoption of wearable healthcare devices like smartwatches, smart rings, and others are further contributing to the market's growth.

- The technological evolution in healthcare and investments in research and development activities for the new launch of technologically advanced healthcare devices is accelerating the expansion of the wearable cardiac devices market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 32.16 Billion |

| Market Size in 2025 | USD 4.68 Billion |

| Market Size in 2024 | USD 3.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.97% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wearable Cardiac Devices Market Dynamics

Driver: Rising cases of cardiovascular diseases (CVD)

The rising chronic diseases like cardiovascular diseases, diabetes, and respiratory illness in the population due to the changing life standards, eating and sleeping habits, rising consumption of alcohol, and smoking increase the risk of chronic illness in the population. The increase in the geriatric population globally is one of the major factors that drive cardiovascular disease cases.

The increasing popularity of wearable devices in the healthcare industry is due to their beneficial properties, like healthcare monitoring and real-time insights into patient health. Wearable technology allows us to tackle cardiovascular diseases by personalizing atrial fibrillation management, refining stroke prevention strategies, and maintaining the physician-patient relationship. Thus, the rising awareness about wearable healthcare technologies is driving the growth of the wearable cardiac devices market.

- For instance, cardiovascular diseases are the leading cause of death in the world. Among the total population, 620 million people live with circulatory and heart diseases worldwide. Every year, approximately 60 million people develop a circulatory or heart disease, which leads to 1 in 3 deaths globally.

Restraint: Regularities issues

The wearable cardiac devices market faces challenges in various regional markets due to strict regulations and lower awareness about these devices. Many countries have stringent regulations regarding adopting wearable healthcare devices, citing concerns about their accuracy. Additionally, limited awareness among the population about the benefits and capabilities of wearable cardiac devices hinders their widespread adoption.

This lack of understanding and acceptance contributes to the slower market growth in these regions. Overcoming these challenges will require efforts to educate healthcare professionals and the general public about the potential advantages of wearable cardiac devices and work towards meeting regulatory standards. By addressing these issues, the market for wearable cardiac devices may see increased acceptance and growth in regions where such challenges currently exist.

Opportunity

Advancements in wearable cardiac devices

Technological advancements in wearable cardiac devices help enhance the efficiency and accuracy of health monitoring systems. It improves the patient and physician experience by collecting data and monitoring ECG-based cardiac activities. The latest wearable cardiac devices can be worn all seven days, anywhere, due to their compact size, water resistance, lightweight, and disposable properties.

The advancements in wearable devices offer great efficiency and save time for both patients and physicians. It has the ability to track any symptoms without any issues. The rising geriatric population and the pandemic drive the sustainable growth of wearable cardiac devices in the global market due to the rising demand for home healthcare. Additionally, the increasing participation of major technology leading companies in wearable healthcare devices is further driving the opportunity for the wearable cardiac devices market.

Product Insights

The defibrillators segment dominated the wearable cardiac devices market during the forecast period. The increasing acceptance of cardioverter-defibrillators is enhancing the efficiency of monitoring and increases the survival rate at high risk of sudden cardiac death from ventricular tachyarrhythmia. The devices are responsible for continuous recording and transmission via modem in both bradyarrhythmias and tachyarrhythmia. Clinical studies state that wearable defibrillators had higher efficiency in terminating ventricular fibrillation (VF) and ventricular tachycardia (VT). Thus, the higher efficiency and accuracy of devices drive the expansion of the wearable defibrillator segment.

- In April 2024, Stryker previewed a next-generation monitor/defibrillator, which got approved by the FDA. LifePak 35 has a touch screen, data manipulation, and connectivity with different devices. The software used in the defibrillator can aid in CPR administration, better battery life, and various communication features.

The patch segment is expected to grow at a significant CAGR over the forecast period. The device is more affordable since it is lightweight and compact, with the possibility of being used long-term and continuously. These patches can be applied directly onto skin and they provide an irritation-free, non-invasive, and comfortable way of heart monitoring in comparison to the traditional heart monitoring devices, letting the wearer continue with their day without interference. They have sophisticated sensors, which provide indispensable cardiovascular measures, such as heartbeats, ECG, and rhythm in real time. Furthermore, they can be compatible with remote monitoring systems; they can be effectively used in clinics and at home. As FDA approvals of AI-powered wearable patches continue to grow, they are also proving important in the treatment and management of acute and chronic cardiac diseases.

Application Insights

The home healthcare segment dominates the wearable cardiac devices market and is expected to grow at the fastest rate during the forecast period. The increasing preference for home healthcare in the population at the time of the outburst of the COVID-19 pandemic is contributing to the growth of the segment. Wearable devices allow monitoring and tracking of healthcare data and provide valuable insights to physicians from anywhere, resulting in a reduction in hospital visits. The rising awareness about wearable healthcare technology in people minimizes routine hospital visits and enhances the home healthcare segment.

- In March 2024, a physician-owned healthcare company with a focus on heart health services was able to cut hospital cardiovascular readmission rates by 50%. These rates result from Cardiac Solutions' utilization of chronic care management and remote patient monitoring via an MD Revolution relationship. 26,689 individuals were assessed by Cardiac Solutions. Those who included remote care management in their therapy had a 30-day readmission rate of 7%, whereas those who did not had a rate of 15%.

The remote patient monitoring segment is expected to grow substantially in the wearable cardiac devices market. With the growing prevalence of cardiovascular diseases, healthcare systems tend to use RPM technologies to treat chronic heart conditions in more efficient ways, even outside of the common clinical environment. RPM also applies to monitoring patient heart health with wearable cardiac devices that provide real-time alerts to healthcare professionals in case of an abnormality and direct medical interventions. Also, RPM gives patients in rural or underserved locations access to cardiac care without the complications of traveling long distances. RPM, as facilitated by AI, ultimately improves the constituency of these systems, making the treatment options personalized and the risk variables predictable.

Wearable Cardiac Devices Market Companies

- Heartbit Holdings Plc.

- Qardio, Inc.

- General Electric Company (GE Healthcare, Inc.)

- iRhythm Technologies, Inc.

- Boston Scientific (Preventice Solutions, Inc.)

- ACS Diagnostics, Inc.

- Hemodynamics Company LLC

- Koninklijke Philips N.V. (BioTelemetry, Inc.)

- Asahi Kasei Corporation (ZOLL Medical Corporation)

- Vital Connect, Inc.

- Baxter

- Medtronic plc

Wearable Cardiac Devices Market Recent Developments

- In June 2024, India Medtronic Private Limited announced a strategic collaboration with Cardiac Design Labs (CDL) to launch, scale up, and expand access to CDL's novel diagnostic technology, Padma Rhythms, an external loop recorder (ELR) patch designed for comprehensive, long-term heart monitoring and diagnosis.

(Source: https://www.financialexpress.com) - In July 2024, Dr. Fadi Mansour performed the first Canadian implant of BIOTRONIK's newest pacemaker and CRT-P generation earlier this year at the Centre Hospitalier de l'Université de Montréal. The patient received an Amvia Sky HF-T QP triple-chamber pacemaker device.

(Source: https://www.dicardiology.com) - In January 2024, Rudolf Riester GmbH, a global leader in medical technology, announced the full market launch of its comprehensive Telemedicine offering. Already in active use across Europe, the Middle East, and Africa, the solution from the trusted Riester brand delivers industry-leading quality and versatility through integration of a broad range of medical devices to meet the needs of diverse user scenarios.

(Source: https://www.businesswire.com) - In May 2024, Samsung, a leading technology company, introduced its Galaxy Ring at the Mobile World Congress (MWC) early in the year. The organization confirmed the launch of its Galaxy Ring in the second half of 2024. The ring can be used to track health, with features for monitoring respiratory rate, heart rate, sleep movement, and onset time of sleep.

- In May 2024, OMRON Healthcare India, an Indian subsidy of a Japanese medical equipment company, announced its partnership with AliveCor India, a leading company in personal electrocardiogram (ECG) technology, for the launch of the first home BPM+ECG Monitoring FDA-cleared device for the early management and detection of AliveCor's FDA-cleared pocket-sized personal ECGs.

- In May 2024, Vivalink, a leading player in digital healthcare solutions, introduced a technology solution designed for Holter monitoring and Mobile Cardiac Telemetry (MCT). The design includes advanced arrhythmia detection algorithms and remote patient monitoring (RPM) technologies to maintain deployment, increase patient care, and fulfill the demand for ambulatory ECG monitoring solutions.

- In May 2024, Teltonika launched the multifunctional smart wristband system designed in association with Lithuanian industry and universities. The system has received the CE MDR (Class IIa) medical certification, which will open the door for the product to enter the medical device industry.

Segments Covered in the Report

By Product

- Defibrillator

- Holter monitors

- Patch

- Others

By Application

- Home Healthcare

- Remote Patient Monitoring

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting