Wearable Biometric Monitor Market Size and Forecast 2025 to 2034

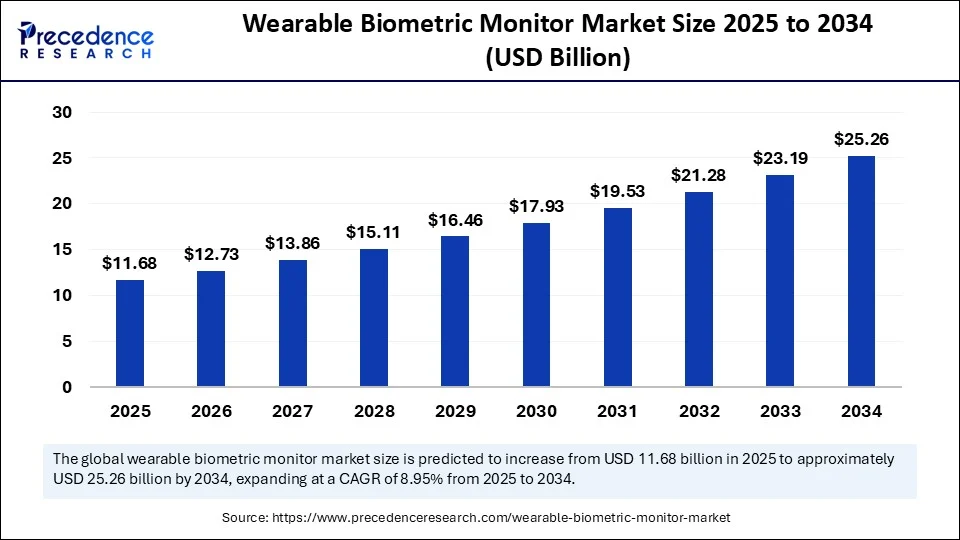

The global wearable biometric monitor market size was calculated at USD 10.72 billion in 2024 and is predicted to increase from USD 11.68 billion in 2025 to approximately USD 25.26 billion by 2034, expanding at a CAGR of 8.95% from 2025 to 2034. The market growth is attributed to rising health awareness, rapid adoption of AI-driven biosensors, and expanding integration of wearables into remote patient monitoring and chronic disease management.

Wearable Biometric Monitor Market Key Takeaways

- In terms of revenue, the global wearable biometric monitor market was valued at USD 10.72 billion in 2024.

- It is projected to reach USD 25.26 billion by 2034.

- The market is expected to grow at a CAGR of 8.95% from 2025 to 2034.

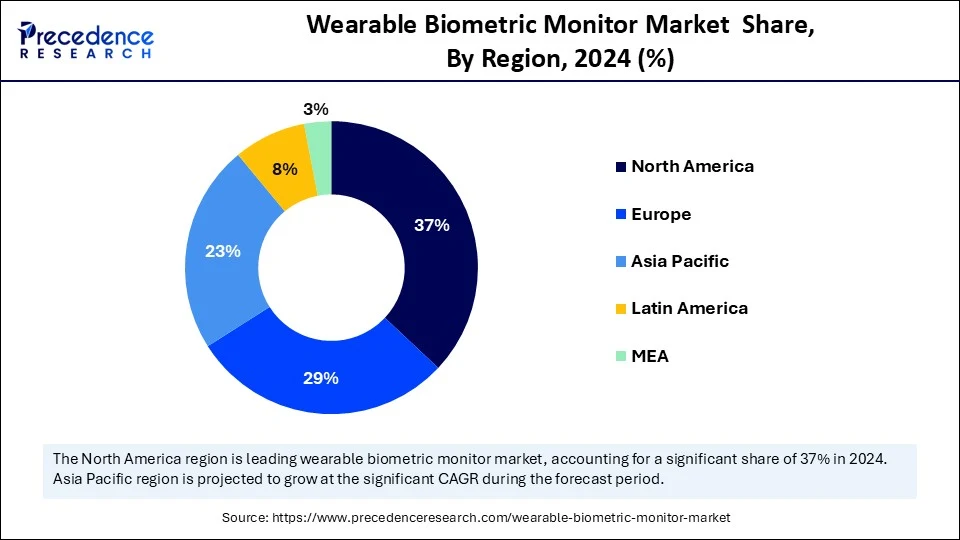

- North America dominated the global wearable biometric monitor market with the largest share of37% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By device type, the smartwatch segment held the major market share of 44% in 2024.

- By device type, the smart rings & bands segment is projected to grow at a CAGR between 2025 and 2034.

- By biometric parameter monitored, the heart rate monitoring segment contributed the biggest market share of 30% in 2024.

- By biometric parameter monitored, the glucose monitoring (non-invasive wearables security segment is expanding at a significant CAGR between 2025 and 2034.

- By authentication mode, the physiological (ECG-based identity) segment captured the highest market share of 36% in 2024.

- By authentication mode, the multimodal authentication segment is expected to grow at a significant CAGR over the projected period.

- By connectivity technology, the Bluetooth segment generated the major market share of 52% in 2024.

- By connectivity technology, the cellular (4G/5G) segment is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the health & wellness monitoring segment contributed the highest market share in 2024.

- By application, chronic disease management is expected to grow at a notable CAGR from 2024 to 2034.

- By end user, the consumers (individuals) segment held the major market share of 40% in 2024.

- By end user, the healthcare providers & hospitals segment is projected to grow at a CAGR between 2025 and 2034.

- By industry vertical, the consumer electronics segment accounted for the significant market share of 38% in 2024.

- By industry vertical, the healthcare & life sciences segment is projected to grow at a CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Wearable Biometric Monitor Market

The biometric wearable monitor market is accelerating due to artificial intelligence, which transforms raw physiological data into meaningful health data. Manufacturers of such devices rely on analytical capabilities powered by AI to establish the accuracy of data generated under a variety of parameters. Additionally, this transition transforms biometric monitors into health rather than lifestyle devices and is catalyzing uptake in the areas of preventable medicine, chronic illness, and home health monitoring. AI strengthens device efficiency by improving battery life through adaptive data collection and enhancingsensor accuracy in challenging environments. On the business side, AI-driven analytics of user data help companies refine product design, optimize marketing, and develop tailored subscription services.

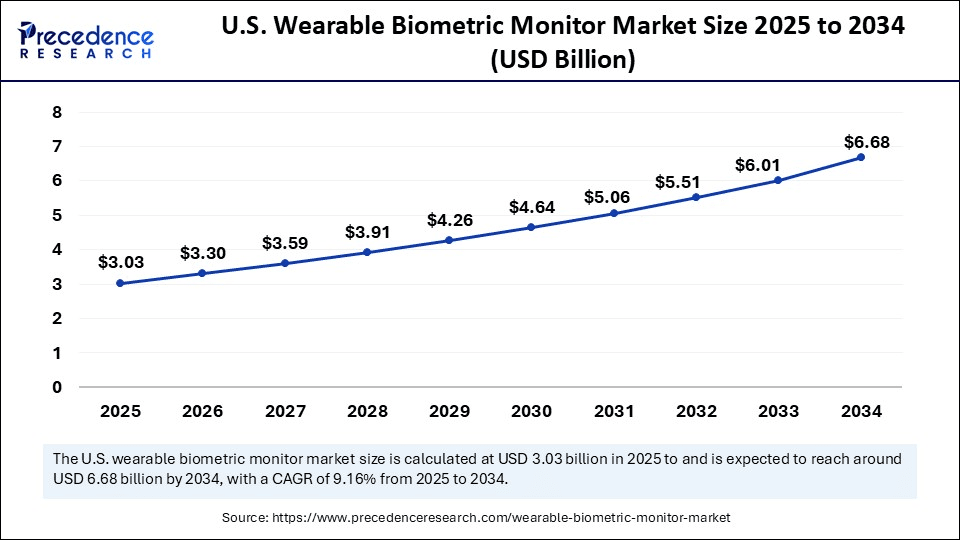

U.S. Wearable Biometric Monitor Market Size and Growth 2025 to 2034

The U.S. wearable biometric monitor market size was exhibited at USD 2.78 billion in 2024 and is projected to be worth around USD 6.68 billion by 2034, growing at a CAGR of 9.16% from 2025 to 2034.

Which Region Is Leading the Wearable Biometric Monitor Market?

North America led the wearable biometric monitor market in 2024, capturing the largest revenue share of an estimated 37%, due to high levels of adoption in both consumer and clinical segments. This increased to 36% of all adults in the U.S. using wearables in 2022, as compared to 30% in 2019, according to NIH data, and this continued into 2024 as consumers sought a more personalised wellness experience. The CDC in 2024 estimated that almost half of the adult population in the U.S. monitored at least one health-related measure digitally, which indicates the extensive consumer interest in the use of wearable biometrics. Apple, Fitbit (Google), and Garmin invested in AI-driven health capabilities that are expected to boost user confidence in the accuracy of health applications and broaden their applicability beyond the field of fitness tracking. (Source:https://pmc.ncbi.nlm.nih.gov)

- In 2024, the U.S. FDA approved more than 10 wearable health devices, such as continuous glucose monitors (Dexcom G7), wearable ECG patches, and remote respiratory monitors, which opens the door to more controlled medical uses. Furthermore, the highly developed healthcare IT infrastructure in North America, with the high awareness of consumers and favorable reimbursement ecosystems, is set to maintain its hegemony in the foreseeable future.(Source:https://investors.dexcom.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, as strong digital penetration, governmental support, and increasing healthcare demands. According to the reports of the International Telecommunication Union 2024 report, mobile internet penetration in the Asia-Pacific region was over 68%. This provides an opportunity to integrate wearable devices and telehealth services with ease. The expected countries to be first in adoption include China, India, Japan, and South Korea, with the high penetration of smartphones and digitalization of healthcare in urban areas.

- In 2024, the Chinese government expedited its Smart Healthcare 2030 framework, and wearable data integration to remote healthcare was emphasized, whereas India's National Digital Health Mission stepped up the monitoring of its rural telemedicine programs based on wearables. The low-cost devices with high-tech features, such as blood oxygen sensors, sleep staging, and early arrhythmia, produced by the local manufacturers Huawei, Xiaomi, Oppo, and Samsung, brought medical-grade features to the expanding middle segment. Additionally, the aging care uses were seen in Japan and South Korea, where wearables are expected to become fundamental towards remote care among the aging population, as they have national insurance systems in place.(Source: https://www.itu.int)

Market Overview

The increased interest of consumers in fitness and wellness drives ongoing growth in the wearable biometric monitor market. Developers embed high-end sensor arrays and machine-learning analytics into wearable bands on wrists, rings, and patches that monitor heart-rate variability, sleep phases, stress levels, glucose fluctuations, and sweat metabolites to near-clinical accuracy. According to the World Health Organization, 17.9 million people die every year due to cardiovascular diseases, which further implies that the number of adults with diabetes has now reached 537 million around the globe, and more of them are getting access to wearable-enabled glucose and heart monitors. (Source: https://www.who.int)

A 2024 MDPI review notes that the current and upcoming AI-enhanced bioelectronics include those that continuously monitor cardiac rhythms, glucose, and sweat biomarkers, pushing wearables into a new category of diagnostic-level performance. Regulatory organizations have increased permission to digital health devices in 2024, adding assurance to their medical use and making their adoption in the market for wearable biometric monitors. Furthermore, the major device manufacturers are forming increased connections with hospitals to incorporate wearables into the electronic health records (EHR), to further connect consumer products with regulated health sectors.(Source:https://www.mdpi.com)

Wearable Biometric Monitor Market Growth Factors

- Rising Demand for Preventive Healthcare: Growing awareness of early disease detection is driving the adoption of biometric wearables in routine health tracking.

- Boosting Digital Health Ecosystem Expansion: Integration of wearables with telehealth and cloud platforms is fuelling broader patient engagement.

- Propelling Sports and Fitness Innovation: Advanced biometrics tailored for athletes are enhancing performance monitoring and recovery optimization.

- Fuelling Chronic Disease Management Programs: The Increasing prevalence of diabetes, cardiovascular, and respiratory disorders is boosting reliance on continuous biometric monitoring.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.26 Billion |

| Market Size in 2025 | USD 11.68 Billion |

| Market Size in 2024 | USD 10.72 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Biometric Parameter Monitored, Authentication Mode, Connectivity Technology, Application, End User, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Does Rising Consumer Focus on Fitness and Wellness Expand Opportunities in the Wearable Biometric Monitor Market?

Rising consumer focus on fitness and wellness is projected to fuel the biometric wearables market in the coming years. Health-conscious individuals invest in products that monitor the quality of sleep, heart rate variability, calorie burning, and stress levels in order to make the most out of their lifestyles. Wearable technology had been identified by fitness professionals as the number one fitness trend in 2024. This is indicative of a long-term consumer interest in devices that help monitor bodies in support of exercise and health objectives. According to the 2024 WHO report, a recent study has shown that nearly one-third global adult population, 1.8 billion adults, are physically inactive, which creates demand for these types of devices.

A third of smartphone owners of smartphones in 2024 have used health and fitness tracking tools. That cites increased interest in digital wellness in increasing numbers. These devices provide incentive and encouragement because users find them to be more active. Apple, Garmin, Oura, Whoop, Fitbit, Samsung, and Polar developers aim at stylish, user-friendly solutions designed with a connection between consumer electronics and near-clinical monitoring in mind. Digital wear given to bio metrics is being augmented with AI dashboards and community features. This increases the customer experience in the athlete segment and the general wellness segment. Furthermore, the increasing prevalence of chronic diseases is expected to accelerate demand for wearable biometric monitors across global healthcare systems.(Source: https://www.who.int)

Restraint

Device Accuracy Limitations Restrict Sustained User Engagement

Data privacy and security concerns are expected to limit expansion and further hinder the wearable biometric monitor market. Consumers and medical practitioners are skeptical of constant biometric data recording, especially when they are relayed to the cloud. Digital health is a problematic area in terms of cybersecurity incidents that place personal data at risk of unauthorized access. This restraint has a direct effect on consumer adoption rates, and this has slowed penetration into regulated clinical environments. Moreover, the high device costs are anticipated to challenge widespread accessibility and restrain market penetration, thus hampering the market.

Opportunity

In What Ways Are Surging Technological Advancements in Sensors and AI Integration Transforming the Wearable Biometric Monitor Market?

Surging technological advancements in sensors and AI integration are likely to transform device accuracy and functionality, further creating immense opportunities for market growth. Engineers integrate miniaturized, multi-modal sensors that are able to monitor physiological and biochemical signals to a clinical-grade level. In January 2024, Nanowear received FDA 510(k) clearance of its AI-enabled cuffless continuous blood pressure monitoring solution, which verified its real-time hypertension diagnostics across a range of conditions. Experts released an in-depth 2024 overview of AI-enhanced wearable bioelectronics that measure cardiac processes, glucose, and sweat biomarkers, leading to early disease diagnosis and customized treatment. (Source:https://www.nanowearinc.com)

- In August 2024, Sibel Health had two more FDA clearances, allowing the ANNE chest and limb sensor. They seamlessly integrate with third-party applications so vital signs, including ECG, respiration, SpO 2, movement, and temperature, can be monitored in both the home and hospital settings. Developers release edge-AI models operating in real-time and optimising privacy and battery life, catalysing the expansion of edge-AI across the consumer and regulated medical markets. Furthermore, the growing adoption of remote patient monitoring is anticipated to strengthen the market's trajectory as healthcare shifts toward decentralized models.(Source:https://biopharmaboardroom.com)

Device Type Insights

Which Device Type Is Dominating the Wearable Biometric Monitor Market?

The smartwatches segment dominated the wearable biometric monitor market in 2024.accounting for an estimated 44% market share, accounting for an estimated 71% market share, due to their combined multi-sensor stacks, which monitor heart rate, SpO2, ECG, temperature trends, and activity information on one wrist-based platform.

- In 2024, a study indexed in PubMed showed that 95% of patients in radiotherapy had their Apple Watch biometric data reviewed in electronic medical records (EMRs) by clinicians, which indicates the potential of real-time integration. Furthermore, the smartwatch is expected to continue to play a central role in chronic care management by being cross-platform and interoperable with EMR connectors and value-based care models.(Source: https://pubmed.ncbi.nlm.nih.gov)

The smart rings & bands segment is expected to grow at the fastest rate in the coming years, owing to the discrete form factors, 24/7 comfort, and high compliance in sleep and recovery tracking. In October 2024, Happy Health received FDA approval of its Happy Ring, a device that measures sleep, blood oxygen, heart rate, temperature, and brain activity- mixing comfort with clinical precision for consumer and home-care levels. Moreover, the Connection to remote patient monitoring systems through Bluetooth and cloud platforms with high security levels is expected to expand the widespread adoption in the coming years.

(Source: https://www.iotm2mcouncil.org)

Biometric Parameter Monitored Insights

Which Device Type Is Dominating the Wearable Biometric Monitor Market, and Why Is It Driving Large-Scale Adoption?

The heart rate monitoring segment held the largest revenue share in the wearable biometric monitor market in 2024, accounting for 30% of the market share, as the product of wrist-based PPG sensors to provide real-time cardiac information both in daily life and under clinical supervision. Additionally, this highlighted the viability of wearable devices in near-real-time remote environments, thus further boosting the market in the coming years.

The glucose monitoring segment is expected to grow at the fastest CAGR in the coming years, owing to the need of patients seeking painless, continuous glucose data, particularly people who control Type 2 diabetes without using insulin. In March 2024, the FDA approved Stelo to be used as the first over-the-counter CGM, to allow adults to continuously monitor glucose without needing a prescription. (Source: https://www.fda.gov)

- Abbott in June 2024, with FDA clearance of two OTC systems, such as Lingotm and Libre Riotm, provided more consumers and Type 2 diabetes consumers using lifestyle management the ability to monitor glucose. Miniaturized wearable spectroscopy and optical sensors were furthered by scientists who feature non-invasive tracking of glucose in rings and patches. These are projected to enhance user adoption due to form-factor ease and non-obtrusive design. Furthermore, the Collaborations between proven CGM manufacturers and new AI-sensitive companies moved at a significant pace that is expected to convert prototypes into verified ones, thus facilitating the segment growth.(Source: https://www.americanpharmaceuticalreview.com)

Authentication Mode Insights

Which Authentication Mode Is Leading the Wearable Biometric Monitor Market?

The physiological (ECG-based identity) segment led the wearable biometric monitor market in 2024, which held a market share of about 36%, as cardiac electrical patterns are unique and stable among individuals. Moreover, the increasing preference by security teams and regulators is expected to stimulate the purchase of this technology by hospitals and payers that need more assurance of identity in digital care pathways.

The multimodal authentication segment is expected to grow at the fastest rate in the coming years, as it generates layered identity verifications that are not susceptible to spoofing and sensor deterioration. Additionally, multimodal templates are undergoing interoperability profile development by standards bodies and consortia, which accelerates interoperability and portability between vendors and across devices.

Connectivity Technology Insights

Which Connectivity Technology Is Most Widely Adopted in the Wearable Biometric Monitor Market, and How Is It Enhancing Interoperability?

The bluetooth segment is the most widely adopted in the wearable biometric monitor market in 2024, accounting for an estimated 52% market share, due to its low power consumption, the wide range of devices, and consistency in transmitting data in short ranges. Furthermore, the Encrypted Bluetooth connections are embedded by developers, which meet the requirements of HIPAA and GDPR compliance standards, thus further facilitating the segment demand in the coming years.

The cellular (4G/5G) segment is expected to grow at the fastest CAGR in the coming years, as it provides the possibility to stream biometrics in real-time without the use of intermediate devices. Moreover, the more extensive 5G deployments across North America, Europe, and Asia in 2024-2025 are estimated to increase bandwidth capacity, further fuelling the segment growth.

Application Insights

Which Application Segment Is Dominating the Wearable Biometric Monitor Market?

The health & wellness monitoring segment dominated the wearable biometric monitor market in 2024, accounting for an estimated 33% market share, as fitness trackers, smartwatches, and smart rings continue to be adopted by the mainstream market.

The World Health Organization (WHO) 2024 report affirmed that lifestyle-related non-communicable diseases cause more than 70% of the deaths globally, and it was expected to speed up the need to find wearable solutions for early prevention. Additionally, the personalization, in which AI can handle real-time recovery recommendations and sleep hygiene recommendations, is expected to enhance customer interaction and decrease the rate of device abandonment.

(Source:https://www.who.int)

(Source: https://www.oecd.org)

The chronic disease management segment is expected to grow at the fastest CAGR in the coming years, as the number of long-term illnesses, including diabetes, cardiovascular, and chronic respiratory illnesses, continues to increase. The International Diabetes Federation (IDF) 2024 report indicates that there are over 537 million adults in the world with diabetes today and that the figure will surpass 640 million adults by 2045. It is projected that this increase will generate further demand for continuous glucose monitoring (CGM) devices and other wearables that are disease-specific.

- In March 2024, the U.S. FDA approved Dexcom Stelo, the first over-the-counter CGM for non-insulin users, which is expected to increase access for patients with prediabetes and lifestyle-related metabolic disorders. Philips and Abbott extended their remote cardiac monitoring platforms in 2024 and merged real-time ECG wearables into telehealth models, which allows earlier intervention and mitigates the risk of hospitalization. Furthermore, the glucose, hydration, and blood pressure monitoring technologies that are non-invasive are rapidly developing, thus further fuelling wearable biotechnology monitor technologies in the coming years.

(Source: https://idf.org)

(Source: https://www.fda.gov)

End-User Insights

Which End-User Group Accounts for the Largest Share of the Wearable Biometric Monitor Market?

The consumer segment accounted for the largest share in the wearable biometric monitor market in 2024, accounting for 40% of the market share, due to the increasing health awareness and popularization of lifestyle wearables. Retail brands and tech giants introduced sophisticated biometric features and convenient apps, and this is likely to be used more frequently by mainstream users and their retention over time. Furthermore, the individualized coaching and game-based objectives are incorporated with wearable data to encourage routine exercise, sleep, and coping with stress, which is expected to enrich habit formation among age groups.

The healthcare providers & hospitals segment is expected to grow at the fastest rate in the coming years, as they facilities implement wearable telemetry through remote monitoring and transitional care programs. Clinician programs incorporate wearable streams in chronic disease management and postoperative monitoring, and bed-to-home transitions. This is expected to lead to fewer readmissions and better early intervention. Additionally, the pilot networks and academic medical centers are publishing outcome information, which reinforces clinical guidelines, and that is expected to hasten institutional-wide adoption.

Industrial Vertical Insights

Which Industry Vertical Dominates the Wearable Biometric Monitor Market?

The industry vertical segment dominated the wearable biometric monitor market in 2024, which held a market share of about 38%, due to the mass-market penetration of smartwatches, fitness trackers, and hybrid devices. The wearables shipment was more than 534.7 million units in 2024, which showed a year-over-year growth of 5.4% and increased confidence in the continued high demand among consumers. Furthermore, the increase in the affordability of mid-range Xiaomi and Amazfit products will likely widen reach into middle-income economies, especially in the Asia-Pacific and Latin America.(Source: https://www.idc.com)

The healthcare & life sciences segment is expected to grow at the fastest rate in the coming years, owing to the growing clinical adoption of medical-grade wearables. The FDA also approved over 200 sensor-based digital health devices in 2024, such as wearable patches and continuous monitoring devices, turning this into a landmark in regulatory confidence.

The healthcare system and especially the hospitals are expected to become more massive in adopting the use of wearables in remote patient monitoring, especially with chronic illnesses, including diabetes, COPD, and cardiovascular diseases. Moreover, healthcare and life sciences become the growth driver, in line with wearable adoption and clinical outcomes, research innovation, and population health.(Source: https://www.medtechspectrum.com)

Wearable Biometric Monitor Market Companies

- Abbott (FreeStyle Libre wearable tech)

- ActiGraph

- Apple Inc.

- BioIntelliSense

- Biostrap

- Cardiac Insight

- Empatica

- Fitbit (Google)

- Garmin Ltd.

- Huawei Technologies

- Oura Health (Oura Ring)

- Philips Healthcare

- Polar Electro

- Samsung Electronics

- Valencell

- VitalConnect

- Whoop Inc.

- Withings

- Xiaomi Corporation

- Zephyr Technology (Medtronic)

Recent Developments

- In May 2025, Osteoboost Health announced the nationwide rollout of Osteoboost, the first FDA-cleared prescription medical device designed to address low bone density. Positioned as a proactive solution to support longevity and active lifestyles, Osteoboost aims to reduce fracture risks that jeopardize mobility and independence. With tens of millions in the U.S. facing limited treatment options, this device represents a groundbreaking approach to preventive bone health management.(Source: https://www.osteoboost.com)

- In June 2025, Polar, a global leader in sports and fitness technology for nearly five decades, confirmed the September release of a new screen-free wrist device that eliminates subscriptions. This product introduces a simplified, distraction-free experience for tracking sleep, health, and fitness. By offering an alternative to conventional health bands, Polar strengthens its commitment to innovation in wearable health monitoring and user-friendly design.

(Source: https://www.polar.com) - In June 2025, Wearable Devices Ltd. announced the expansion of its Large Motor Unit Action Potential Model (LMM) into predictive health monitoring and cognitive state analytics. This step broadens the scope of its AI-powered touchless sensing wearables beyond consumer fitness, creating new opportunities for healthcare providers and enterprises. By leveraging bio-signal intelligence, the company aims to deliver real-time physiological insights to support wellness and clinical decision-making.

(Source: https://www.globenewswire.com)

(Source: https://thehealthcaretechnologyreport.com)

Segments Covered in the Report

By Device Type

- Smartwatches

- Fitness Bands

- Chest Straps & Patches

- Smart Clothing & Textiles

- Smart Rings & Bands

- Smart Glasses & Eyewear

- Ear-worn Devices (hearables, earbuds)

- Implantable & Skin Patches

- Others

By Biometric Parameter Monitored

- Heart Rate Monitoring

- Electrocardiogram (ECG / EKG)

- Blood Oxygen (SpOâ‚‚)

- Blood Pressure

- Respiration Rate

- Body Temperature

- Stress / Electrodermal Activity (EDA)

- Sleep Pattern & Activity

- Gait & Movement Analysis

- Glucose Monitoring (non-invasive / CGM wearables)

- Others

By Authentication Mode

- Physiological Biometrics

- ECG-based identity

- Fingerprint sensors (on wearables)

- Skin/vein recognition

- Behavioral Biometrics

- Gait recognition

- Voice recognition (wearable-enabled)

- Gesture/interaction patterns

- Multimodal Authentication

- Continuous Authentication

- Others

By Connectivity Technology

- Bluetooth

- Wi-Fi

- Cellular (4G/5G)

- NFC

- GPS-enabled

- Cloud-synced

- Others

By Application

- Health & Wellness Monitoring

- Fitness & Lifestyle Tracking

- Chronic Disease Management

- Patient Remote Monitoring

- Stress & Mental Health Tracking

- Identity & Access Management

- Defense & First Responder Monitoring

- Workplace Productivity & Safety

- Sports Performance & Athlete Monitoring

- Others

By End User

- Healthcare Providers & Hospitals

- Consumers (individuals)

- Fitness & Sports Organizations

- Corporate & Enterprise (employee wellness/security)

- Defense & Military

- Insurance Companies

- Research & Academia

- Others

By Industry Vertical

- Healthcare & Life Sciences

- Consumer Electronics

- Fitness & Sports

- Defense & Security

- Enterprise & Corporate

- Insurance & Payers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting