Weathering Steel Market Size and Forecast 2025 to 2034

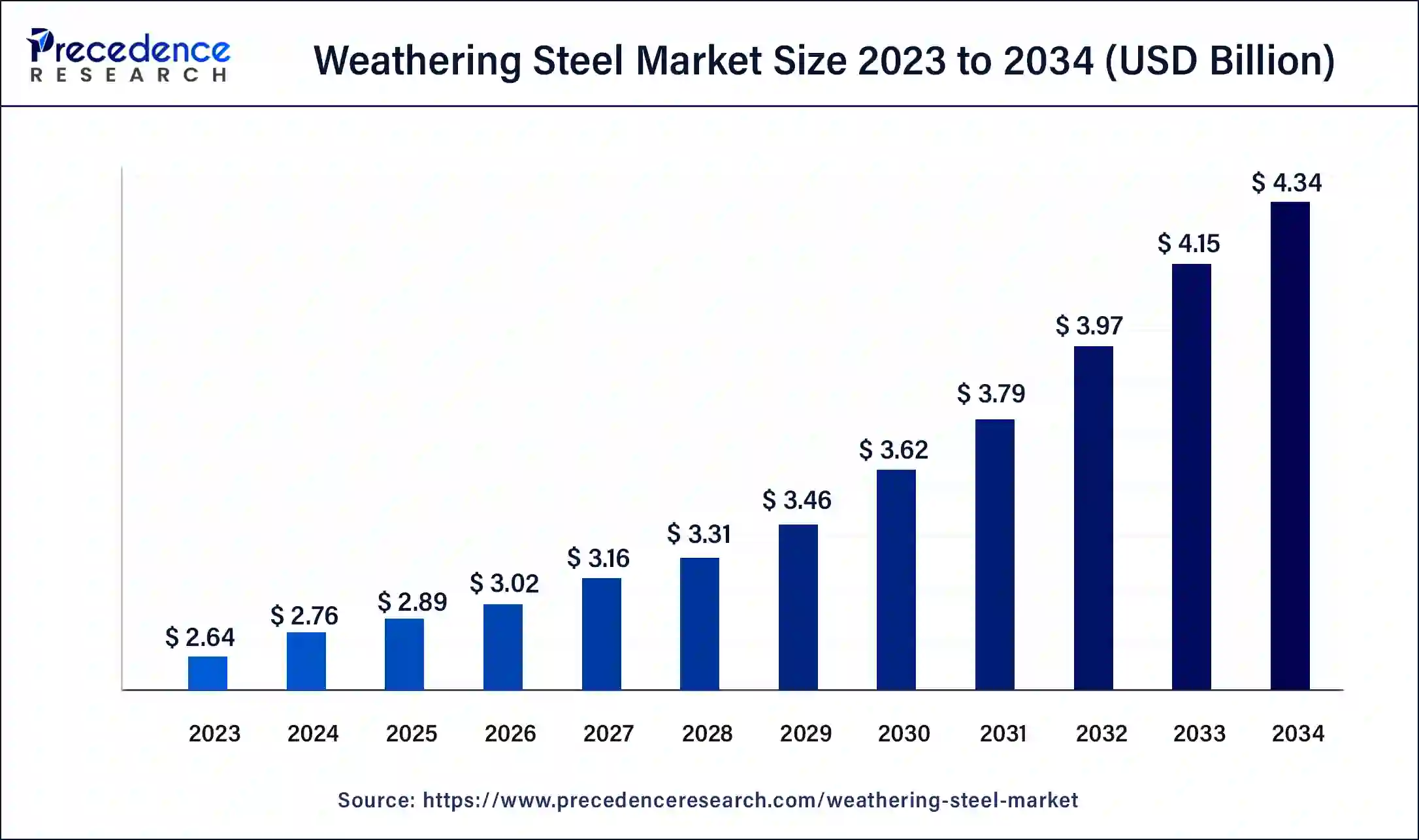

The global weathering steel market size was valued at USD 2.76 billion in 2024, and is projected to be worth USD 2.89 billion by 2025, and is anticipated to reach around USD 4.34 billion by 2034, growing at a CAGR of 4.63% over the forecast period 2025 to 2034.The rising investment in the construction sector and demand for sustainability drive the weathering steel market.

Weathering Steel Market Key Takeaways

- In terms of revenue, the weathering steel market is valued at $2.89 billion in 2025.

- It is projected to reach $4.34 billion by 2034.

- The weathering steel market is expected to grow at a CAGR of 4.63% from 2025 to 2034.

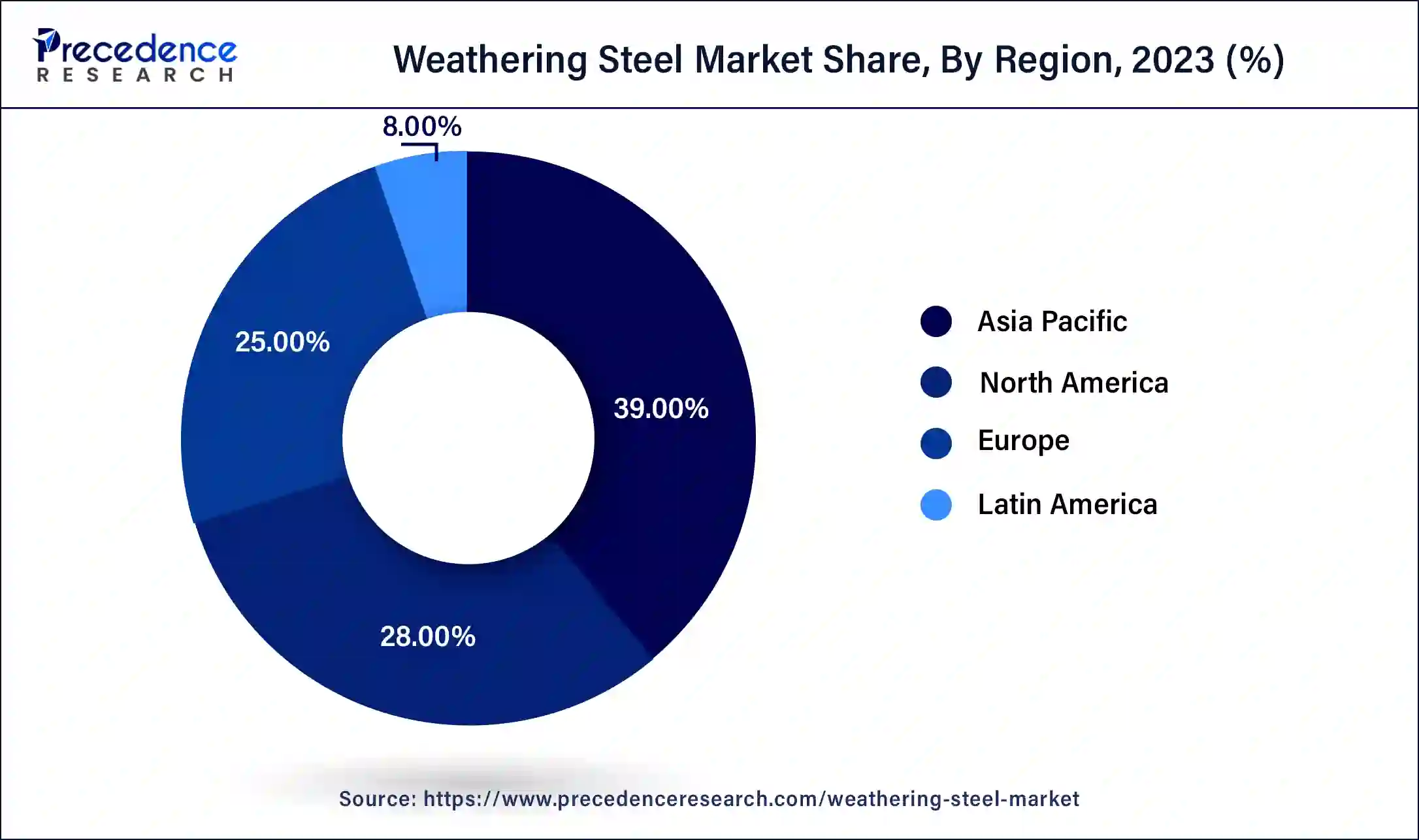

- Asia Pacific contributed the largest market share of 39% in 2024.

- North America is anticipated to grow at the fastest rate in the market during the forecast period.

- By product, the plate segment held a dominant presence in the market in 2024.

- By product, the sheet segment is projected to expand rapidly in the market in the coming years.

- By grade, the ASTM A588 segment accounted for a considerable share of the weathering steel market in 2024.

- By grade, the ASTM A242 segment is predicted to witness significant growth in the market over the forecast period.

- By end-use, the construction segment dominated the market in 2024.

- By end-use, the automotive segment is estimated to be the fastest-growing during the forecast period.

How Can AI Help the Weathering Steel Market?

Artificial Intelligence(AI) can play a significant role in the weathering steel market, promoting its development and use. The major application of AI in weathering steel is to recognize its corrosion grade. Many researchers have investigated the role of severalmachine learningmodels like convolutional neural networks (CNN) anddeep learning to determine the extent of corrosion. Such advanced technologies to evaluate the corrosion grade of weathering steel can save time and manpower. These are also helpful for the safety evaluation of the steel structures. Additionally, AI can predict the lifespan of the material by obtaining real-time environmental data like humidity, temperature, and pollution.

Asia Pacific Weathering Steel Market Size and Forecast 2025 to 2034

The global asia pacific weathering steel market size is worth around USD 1.13 billion in 2025 and is anticipated to reach around USD 1.71 billion by 2034, growing at a CAGR of 4.70% over the forecast period 2025 to 2034.

Asia-Pacific dominated the weathering steel market with the highest market share of 39% in 2024. The rapidly growing infrastructure in the region, especially in developing countries, augments the market growth. The real estate and architecture industry recorded about 12,000 crores in the year 2019 and is estimated to be about 65,000 crores by 2040. Also, India's “Make in India” policy boosts India's construction and manufacturing sector. According to the National Bureau of Statistics (NBS), the first-half fixed-asset investment rose 3.9% year-on-year to $3.38 trillion in the second half of 2024 in China. Additionally, increasing public investment and public-private partnerships drive the market. According to the World Bank's Private Participation in Infrastructure (PPI) database, investment in infrastructure projects in Thailand amounted to $28 billion over the past two decades.

- In December 2022, the Bureau of Indian Standards (BIS) awarded the first license to produce Corten Steel to Tata Steel's Jamshedpur plant. It will be used to manufacture shipping containers, rail wagon side panels, rice mill containers, building construction, and street furniture.

The surge in infrastructure development in countries like India, China, Japan, and Singapore is expected to boost the growth of the market in the region. For instance, in March 2024, Prime Minister of India Narendra Modi inaugurated and laid the foundation stone of 112 National Highway (NH) projects spread across the country worth over ₹1 lakh crore at Gurugram. The projects include development works from Karnataka, Kerala, and Andhra Pradesh in South India, Uttar Pradesh and Haryana in North India, West Bengal and Bihar in East India, and Maharashtra, Punjab as well and Rajasthan in West India. In August 2024, Dubai Chambers signed a Memorandum of Understanding (MoU) with China Construction Bank (CCB), DIFC Branch, intending to promote investment cooperation and strengthen joint efforts to support Chinese companies wishing to expand in the Dubai market.

North America is expected to grow at the fastest rate during the forecast period. The rising investment in end-use applications like construction, automotive, and transportation drives the weathering steel market. The U.S. government's Bridge Investment Program planned to invest $40 billion over five years. The program invested $2.4 billion in the planning and construction of 37 bridges in the year 2022. According to the Bureau of Transportation Statistics (BTS), the public and private investment in transportation infrastructure and equipment was around $403.9 billion in 2022 in the US. Additionally, the government's initiatives to maintain a sustainable environment in the North American region boost market growth.

- In February 2024, Page Southerland Page, Inc., a U.S. studio, added a Corten steel extension to a museum in Texas and was designed to look like “a chunk of landscape”. Corten steel was used to provide a progressive look and ruggedness to the museum.

Market Overview

Weathering steel is a chemically formulated steel with additional alloying elements to eliminate the need for painting or polishing. On prolonged exposure to the atmosphere, it develops a protective patina layer, i.e., a rust-like appearance on its surface. This provides better strength and more corrosion resistance to the steel. The important elements in weathering steel are nickel, copper, chromium, silicon, and phosphorus. Weathering steel is used for outdoor applications where the chances of rusting are higher. It offers numerous benefits, including very low maintenance, rapid construction, attractive appearance, shallow construction depth, and long-term performance. It has widespread applications in houses, buildings, bridges, structures, heavy transport, and process industries, including heat exchangers.

Weathering Steel Market Trends

- The rapid growth in the architecture and construction industries, including houses, buildings, and sculptures, especially in developing countries, increases the demand for weathering steel.

- Weathering steel protects the environment, thereby increasing sustainability and increasing its demand.

- The long-term performance property of weathering steel increases its demand, especially in emerging economic countries.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.34 Billion |

| Market Size in 2025 | USD 2.89 Billion |

| Market Size in 2024 | USD 2.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.63% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Grade, End-use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Environmental sustainability

The rising demand for environmental protection has led to the use of weathering steel in diverse sectors. Weathering steel offers environmental advantages as it neither causes problems with the paint's volatile organic compounds (VOCs) nor the disposal of blast-cleaning debris. Additionally, the production of weathering steel requires less energy compared to other corrosion-resistant steels.

At the end of its lifespan, weathering steel structures can be dismantled, and the steel can be reused or recycled without any loss of material properties. Hence, it contributes to energy savings, resource conservation, and a decrease in the amount of waste dumped in landfills. Other weathering steel characteristics include longevity, resource efficiency, and lifecycle assessment. Thus, architects, builders, and engineers can encourage sustainable practices and create a greener built environment by using weathering steel in their construction projects.

Restraints

Limited application in high saline areas

Along with several benefits, weathering steel has certain disadvantages. The major disadvantage is its limitation in a highly saline atmosphere. In marine environments, weathering steel has long wet times and is not dried. Hence, the protection layer erodes, and corrosion proceeds. Another disadvantage is its high initial cost compared to other steels. It has also disrupted supply chains, affecting growth potential.

Opportunity

Growing research and development

The rising demand for weathering steel in diverse sectors like construction, architecture, and transportation has potentiated interest in the innovation of weathering steel. Researchers are investigating several alloys along with copper, nickel, and chromium to increase their resistance and strength. The changing environmental conditions, like cycles of wet and dry conditions and long wetness times, demand superior quality weathering steel. Conventional weathering steel does not protect marine environments because it does not form any protective rust layer due to high atmospheric salinity. Hence, researchers are investigating the role of the mixture of various alloys like manganese and nickel that can resist corrosion in the marine environment.

- In April 2024, ArcelorMittal developed a new type of weathering steel to reduce corrosion in foundations and other structures, such as towers for offshore wind turbines and offshore substations. The steel was developed at its R&D center in Ghent, Belgium, offering good corrosion resistance, mechanical properties, and weldability.

Product Insights

The plate segment held a dominant presence in the weathering steel market in 2024. Weathering steel plates offer an extensive range of thicknesses for various applications. Plates are the thickest options and the thickness of the plate is generally 6 mm or more. They are commonly used in outdoor structural applications like bridges, buildings, sculptures, and facades. The rising construction of bridges, sculptures, etc. drives the market.

The sheet segment is projected to expand rapidly in the weathering steel market in the coming years. Weathering steel sheets vary in thickness depending on requirements and have a medium thickness range of less than 6 mm. They are widely used in bridges, railcars, and outdoor sculptures, panels, and installations.

Grade Insights

The ASTM A588 segment accounted for a considerable share of the weathering steel market in 2024. ASTM A588 is a type of high-strength, low-alloy structural weathering steel offering exceptional corrosion resistance. They can withstand high temperatures up to 842 F. They are widely used in applications where strength and durability are required. ASTM A588 finds application in bridge construction, building facades, curtain walls, and roofing systems. Additionally, they are extensively used in outdoor structures like stadiums, pavilions, and open-air theatres.

The ASTM A242 segment is predicted to witness significant growth in the weathering steel market over the forecast period. ASTM A242 is a type of high-strength, low-alloy structure steel for structural members. They can withstand high temperatures up to 800 F. They are often used in applications where weight-savings and high corrosion resistance are required. It is commonly used carbon steel forgings used for manufacturing bolts, screws, stud bolts, nuts, and similar fasteners. They are primarily used in the fabrication of industrial air pollution stacks, air ducts of pollution control equipment, and water tanks.

End-use Insights

The construction segment dominated the weathering steel market in 2024. Weathering steel is predominantly used in the building & construction sector. It is used for constructing bridges and houses to enhance durability and pleasing appearance. It also reduces construction and maintenance costs and lowers environmental impact. Additionally, it protects from hazardous environmental impacts like the emission of volatile organic compounds (VOCs) due to oil-based coatings. The rise in population, government initiatives, technological advancements, investments in the construction sector, and rapid urbanization drive market growth. China, the US, Japan, and India are the top four countries with the largest construction market globally.

- In April 2024, delaVegaCanolasso, a Spanish architecture studio, designed a new Corten cabin in Barcelona, Spain. The new cabin, tini Montsey, a 128-square-meter cabin, was made with a fusion of Corten steel and heat-treated wood on facades and lattices.

The automotive segment is estimated to be the fastest-growing in the weathering steel market during the forecast period. Weathering steel is highly used in the automotive sector due to its strength, durability, and corrosion resistance, especially in vehicle manufacturing and railways. In railway vehicles, weathering steel offers strength, hardwearing, and the ability to take higher payloads. Hence, they provide exceptionally long service life with low maintenance costs. The strategic investments in the automotive sector augment the market. The US Federal Railroad Administration (FRA) has opened applications for $2.4 billion of funding through its Consolidated Rail Infrastructure and Safety Improvements (CRISI) program.

Weathering Steel Market Companies

- ArcelorMittal

- BlueScope Steel Ltd.

- Central Steel Service

- DIS-TRAN Steel

- Hobart Brothers

- JFE Steel Corporation

- Masteel UK

- Nippon Steel Corporation

- SSAB

- Tata Steel

- Zahner Company

Recent Developments

- In October 2022, British Steel, a company offering weathering steel structural sections for the construction market, extended its range of “Advance” structural sections for the construction sector by 71 additional beams and columns. The range provides greater design flexibility due to the inclusion of often difficult-to-find intermediary dimensions.

- In December 2022, the Bureau of Indian Standards (BIS) awarded the first license to produce Structural Weather Resistant Steel (Corten Steel) to Tata Steel's Jamshedpur plant. The license is given to Tata Steel as part of India's larger endeavour to reduce the country's dependence on the import of shipping containers manufactured using Corten Steel. This special grade steel is widely used in the manufacturing of shipping containers and other heavy-duty weather-proof applications, including rail wagon side panels, rice mill containers, building construction, street furniture, and others.

- In April 2024, Reliance, Inc. announced the acquisition of American Alloy Steel, Inc. American Alloy is a leading distributor of specialty carbon and alloy steel plate and round bar. The acquisition of American Alloy increases Reliance's value-added processing and fabrication capabilities and expands the Company's specialty carbon steel plate product portfolio.

- In May 2024, TW Ryan Architecture completed a wildfire-resistant house in the American West featuring a weathering steel exterior and pyramidal roofs. The house was designed to withstand the ever-changing weather conditions while promoting a sophisticated interaction with the site's natural surroundings.

- In October 2023, Omar Gandhi Architects, a Canadian studio, constructed an elevated cabin in Corten steel on a forested hillside in Nova Scotia. The 1500-square-foot cottage was made to embrace a unique approach, blending craft, design, texture, and light variation.

Segments Covered in the Report

By Product

- Plate

- Sheet

- Coil

- Angles

- Beams

- Bars

By Grade

- ASTM A588

- ASTM A242

- EN 10025-5

- AS/NZS 3679.1

- SSAB Weathering

- COR-TEN

By End-use

- Construction

- Automotive

- Infrastructure

- Energy

- Mining

- Heavy Equipment

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting