What is the Medical Batteries Market Size?

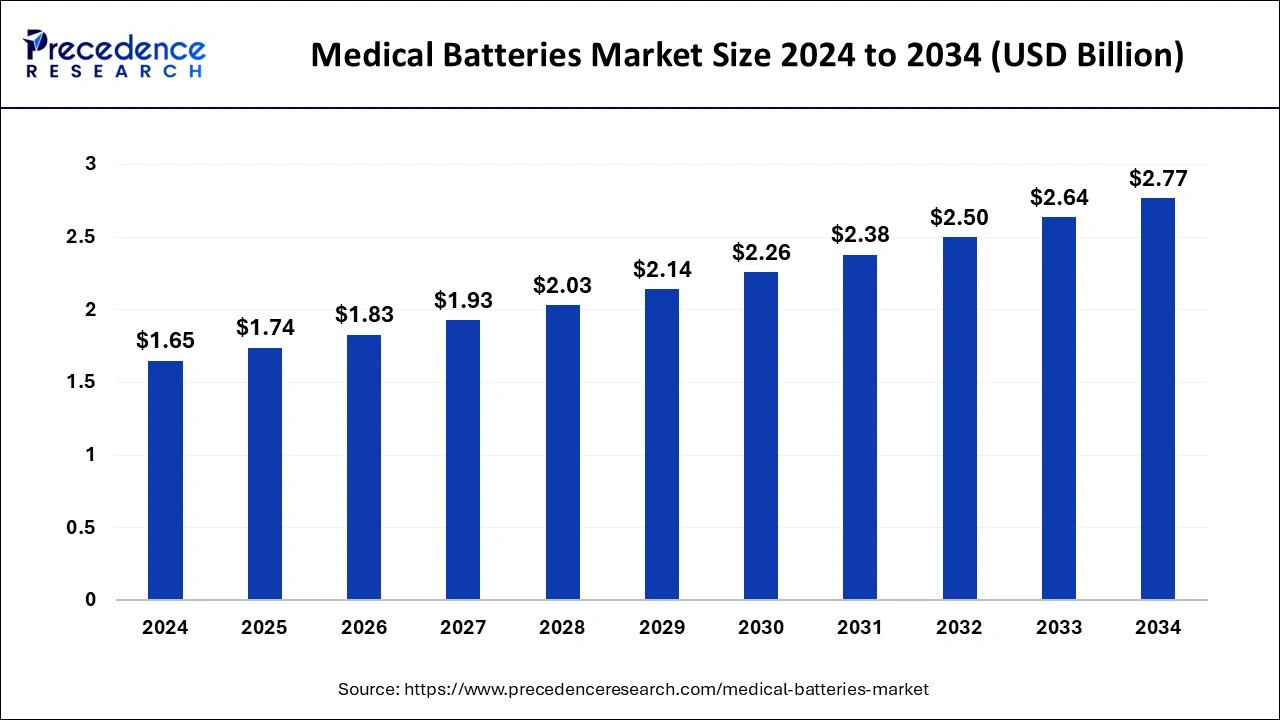

The global medical batteries market size is calculated at USD 1.74 billion in 2025 and is predicted to increase from USD 1.83 billion in 2026 to approximately USD 2.91 billion by 2035, expanding at a CAGR of 5.28% from 2026 to 2035.

Medical Batteries Market Key Takeaways

- In terms of revenue, the global medical batteries market was valued at USD 1.65 billion in 2025.

- It is projected to reach USD 2.91 billion by 2035.

- The market is expected to grow at a CAGR of 5.28% from 2026 to 2035

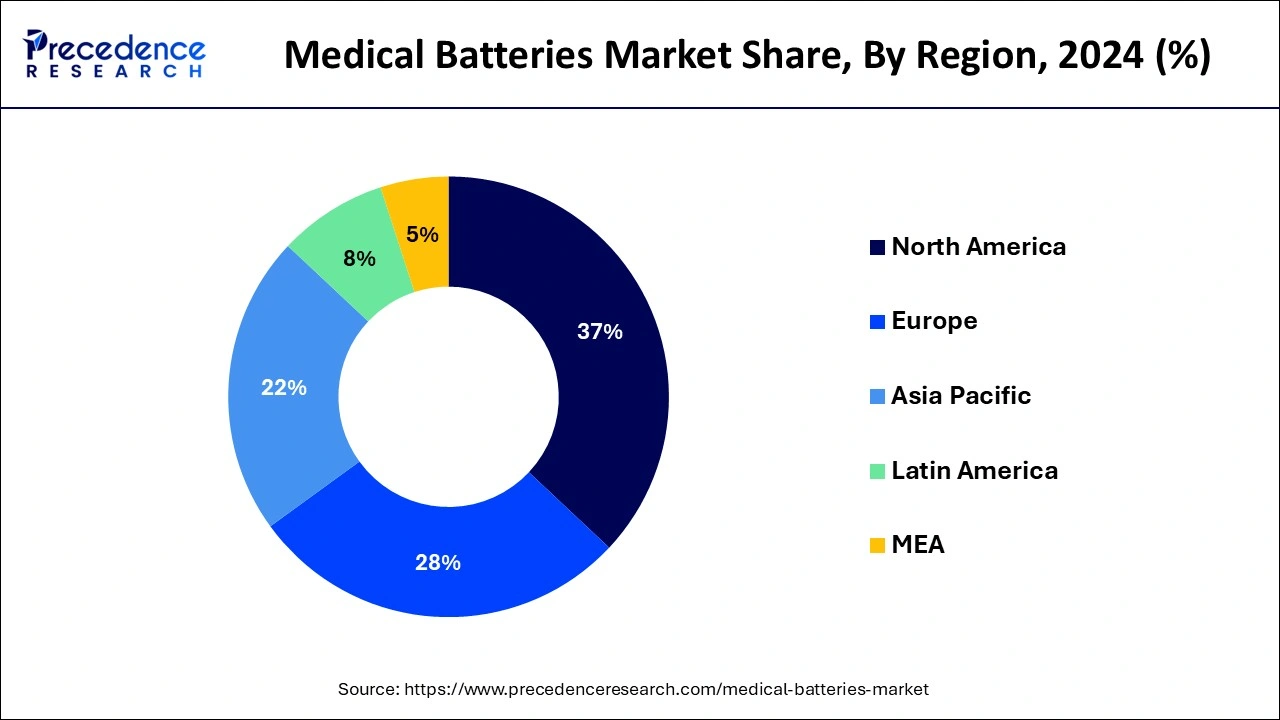

- North America dominated the global medical batteries market with a revenue share of 37% in 2025.

- Asia Pacific is projected to host the fastest-growing market over the forecast period.

- By battery type, the lithium-ion batteries segment dominated the market in 2025.

- By battery type, the nickel metal hydride batteries segment is expected to witness the fastest growth in the market over the forecast period.

- By application, in 2023, the implantable medical devices segment dominated the market.

- By application, the portable & wearable medical devices segment is expected to show significant growth during the studied period.

- By end-user, the hospitals & clinics dominated the market in 2025.

- By end-user, the ambulatory surgical center (ASCs) segment will show rapid growth over the projected period.

Market Overview

Medical batteries are designed to provide extended operational time and higher energy output for healthcare devices. These specialized power sources meet the specific requirements of medical applications, powering a wide range of devices from basic portable tools to complex, life-saving equipment. Unlike conventional batteries, medical batteries are engineered for reliability, safety, and longevity, which are essential for the proper functioning of critical healthcare instruments.

Medical Batteries Market Growth Factors

- The growing trend towards wearable healthcare technology is expected to fuel the growth of the medical batteries market.

- One significant advantage of medical batteries is their compact size, which enables seamless integration into devices like portable infusion pumps, blood glucose monitors, and electronic thermometers.

- Medical batteries are available in different forms, including disposable and rechargeable options, designed to meet the specific requirements of medical equipment and procedures.

- The rising utilization of remote patient monitoring systems can boost the medical batteries market growth during the forecast period.

- The increasing use of telemedicine, along with the growing requirement for portable, battery-powered diagnostic gadgets, can drive market growth shortly.

- Key players are constantly engaged in R&D activities, which will likely have a positive impact on market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.74 Billion |

| Market Size in 2026 | USD 1.83 Billion |

| Market Size by 2035 | USD 2.91 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.28% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Battery Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancement in medical device technology

The global rise in chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders requires continuous monitoring and management facilitated by battery-powered medical devices. Devices like glucose monitors, cardiac monitors, and nebulizers rely on batteries for portability and sustained operation. Additionally, the aging global population, which often requires ongoing healthcare and monitoring, further drives the demand for the medical batteries market.

Advancements in medical device technology, including the integration of advanced features, increased automation, connectivity, and miniaturization, aim to enhance the performance, precision, and efficiency of these devices. Hence, the medical batteries market is expected to expand rapidly in the coming years.

- In October 2023, Enovix Corporation, a silicon battery company, announced its standard IoT and Wearable-sized batteries have been chosen by Accurate Meditech for their Class II FDA-Approved “Mini” multi-vital sign monitor. The Accurate Mini continuously monitors blood pressure, pulse rate, and other vital signs.

Restraint

Battery failures

Balancing the demand for smaller batteries with the need for adequate energy storage is a delicate challenge that researchers and engineers continue to address. The risk of leakage or rupture remains a significant concern for medical batteries. Although technological advancements have reduced these risks, battery failures still occur. A battery leak in implanted devices can cause serious tissue damage and potentially endanger the patient's life. These factors are expected to constrain the growth of the medical batteries market in the coming years.

Opportunity

Government initiatives

Although ventilators typically run on electricity, battery backups ensure their continuous operation during power outages. Medical batteries are crucial for ventilators. Electric Fuel, a smart battery and charger company, was selected to supply rechargeable Li batteries to an Israeli company for automatic ventilators to support COVID-19 efforts. Furthermore, state initiatives to improve healthcare infrastructure in many countries are creating significant growth opportunities for the medical batteries market. Programs encouraging medical device start-ups are also providing substantial growth prospects for the medical batteries market.

- In July 2023, Resonetics entered into a strategic partnership with Resonant Link with the aim of integrating Resonetics' capabilities in rechargeable batteries and Resonant Link's innovative wireless charging technology to develop innovative rechargeable medical devices to improve patient outcomes.

Segment Insights

Battery Type Insights

The medical batteries market in 2025 was dominated by the lithium-ion batteries segment. This growth is due to the fact that lithium-ion batteries offer one of the highest energy densities among modern battery technologies. They provide significant energy in a compact and lightweight form, making them ideal for medical devices where space and weight are critical considerations. These attributes will drive up demand in the market, which is particularly beneficial for frequently used medical equipment as it reduces the need for frequent battery replacements.

- In April 2024, The Technology Development Board (TDB) recently announced a partnership with startup Remine India to build a commercial plant for recycling lithium-ion batteries and e-waste in Uttarakhand. The agreement provides Rs 7.5 crore in financial assistance from TDB for the Rs 15 crore project, said the Ministry of Science and Technology.

The nickel metal hydride batteries segment is expected to witness the fastest growth in the medical batteries market over the forecast period. Nickel-metal hydride (Ni-MH) batteries are commonly used in medical equipment such as infusion pumps and portable diagnostic devices due to their safety and long cycle life. Ni-MH batteries offer a versatile and environmentally friendly energy storage solution and feature advanced principles, various types, well-structured components, and broad applications. As technology continues to progress, Ni-MH batteries play a crucial role in providing reliable and sustainable power sources in the medical batteries market.

Application Insights

The implantable medical devices segment dominated the medical batteries market in 2025. The global increase in chronic diseases like cardiovascular disorders, neurological conditions, and chronic pain has boosted the use of implantable medical devices for managing and treating these conditions. This has led to a higher demand for medical batteries to power these devices, driving the growth of the medical batteries market.

- In April 2024, GC Aesthetics, a leading designer, manufacturer, and distributor of breast implants and medical devices for the global aesthetics industry, announced a micro-textured anatomical breast implant, LUNA XT. The company says it is the first breast implant in the world approved under the new European Medical Device Regulation (MDR).

The portable and wearable medical devices segment is expected to experience significant growth in the medical batteries market during the forecasted period. Wearable medical devices allow direct access to a patient's health status, potentially leading to life-saving interventions. These devices quickly detect changes in the patient's body. The increasing prevalence of chronic conditions, the expansion of wearable health technology, and the growing demand for portable medical devices in home healthcare are expected to drive segment growth in the near future.

End-user Insights

The hospitals & clinics dominated the medical batteries market in 2025. The integration of medical batteries is crucial for the efficient functioning of advanced medical equipment. These technologies, ranging from cutting-edge imaging devices to portable diagnostic kits and telemedicine setups, depend on a steady and reliable power source. Medical batteries ensure compatibility with the latest healthcare technologies, enabling hospitals and clinics to keep pace with medical advancements. As healthcare institutions prioritize sustainability, the adoption of rechargeable and environmentally friendly medical batteries aligns with these goals.

The ambulatory surgical center (ASCs) segment will show rapid growth over the projected period. Ambulatory surgery centers (ASCs) are a critical sector in healthcare, offering outpatient surgeries that are both cost-effective and convenient. The growth of the ambulatory surgical center segment is driven by factors such as a rise in surgical procedures, an increase in chronic disease prevalence, and a growing elderly population.

Regional Insights

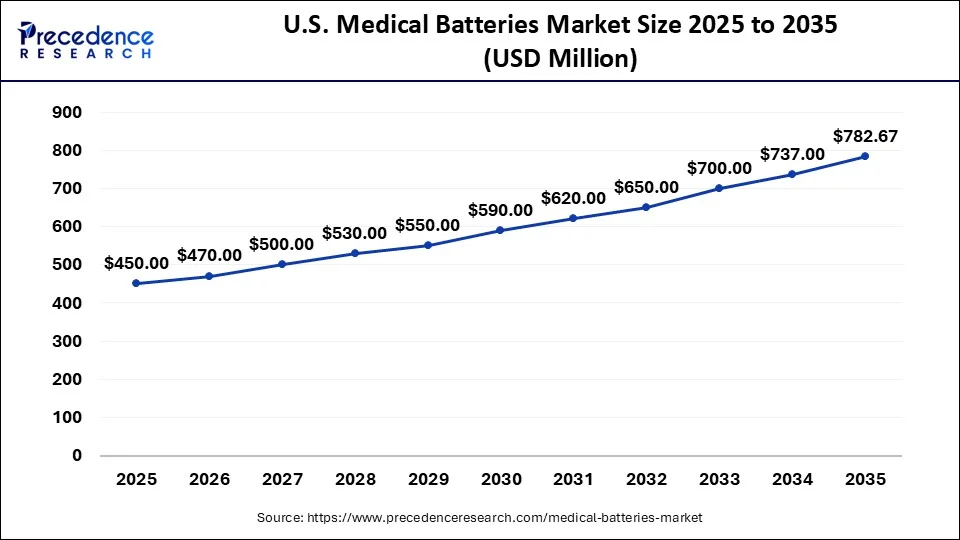

The U.S. medical batteries market size surpassed USD 450 million in 2025 and is projected to attain around USD 783.67 million by 2035, poised to grow at a CAGR of 5.70% from 2026 to 2035.

North America dominated the global medical batteries market in 2025. The rapid advancement of medical technology is a major factor driving the increasing importance of medical batteries in North America. As medical equipment becomes more advanced and mobile, there is a growing need for reliable and effective power sources. The healthcare sector's ongoing adoption of state-of-the-art technology drives the demand for medical batteries to power a wide range of devices, including implanted medical technologies and portable diagnostic equipment.

Europe is representing significant growth in the market as of this year due to its large, well-established healthcare systems, a high emphasis on technological developments, and a rapidly growing geriatric population. The region also has strict regulations and high healthcare potential. Sustainability mandates and rising battery recycling initiatives in the region also promote NiMH and lithium-replacement technologies. In addition to that, cross-border healthcare digitization continues to enhance battery standardization practices.

Asia Pacific is projected to host the fastest-growing medical batteries market over the forecast period. Regional growth is driven by the expansion of healthcare infrastructure, increased healthcare expenditures, and growing public awareness of advanced medical innovations. China dominates the market in this region. This dominance is linked to the fact that the Chinese medical battery market largely depends on imports or products manufactured locally through multinational partnerships, especially in high-end technology sectors. If regulatory reforms are successful and rural healthcare inadequacies are effectively addressed, the large number of previously untapped consumers makes China an attractive market opportunity.

- In April 2024, the Indian Institute of Technology Madras (IIT-M) launched the country's first medical device calibration facility on wheels. The facility can calibrate up to 45 different life-saving medical devices, including a defibrillator analyzer, electrical safety analyzer, gas flow analyzer, and dialysis reference meter. The regular calibration of medical devices is a must to ensure accurate diagnosis and treatment of patients.

- In March 2024, Panasonic Energy Co Ltd, a group firm of Japan-based multinational electronics company, signed a binding term sheet and initiated discussions with IOCL "to draw a framework for the formation of a joint venture" to manufacture cylindrical lithium batteries. This initiative is driven by the anticipated expansion of demand for batteries for two- and three-wheel vehicles and energy storage systems in the Indian market.

Latin America is witnessing immense market potential that is opening up due to factors like a growing burden of chronic diseases, the expansion of access to health services, and a constantly improving health infrastructure. The region also benefits a lot from growing investments by governments in healthcare and rising healthcare spends. The region also shows growing engagement with portable medical electronics, particularly in the private healthcare sector. Additionally, expanding diagnostic networks and battery import diversification are projected to increase market adoption.

Middle East and Africa region holds a significantly smaller market share, due to its limited infrastructure in the healthcare domain and low spending. However, the region is seeing a rise in government initiatives that are aimed at upgrading their healthcare services and rising investments. Middle East and Africa are estimated to see a rise in market adoption, driven by hospital infrastructure optimization and government-led healthcare modernization. Investments in import substitution and training programs are also expected to boost the region's competency.

Value Chain Analysis

- Raw Material Sourcing

Medical batteries mainly rely on high purity materials such as lithium metal, lithium cobalt oxide and nickel based chemistries. Its sourcing must meet strict medical regulatory standards, compelling suppliers to be highly specialized and certified. There is an increasing demand for safer, longer life chemistries.

Key Players: Umicore, 3M, Targray - Manufacturing Process

Manufacturing requires producing highly stable cells that can operate for years without any failure, especially with it comes to implantable categories. Its manufacturing process includes precise electrode coating, hermetic sealing, sterilization compatibility and long cycle validation. Manufacturers are seen adopting solid state designs, safer electrolytes and miniaturized cells.

Key Players: Saft, UltraLife Corporation, Renata - Quality Control and Testing

Medical batteries undergo rigorous compliance processes and testing in order to ensure efficiency, safety and reliability. Quality control includes electrical stability testing, leak proof casing validation, high temperature cycling and even vibration or shock checks. There is an increasing emphasis on increasing thermal stability, traceability and remote monitoring capabilities.

Medical Batteries Market Companies

- EaglePicher Technologies

- KAYO Battery Company Limited

- Ultralife Corp

- Panasonic

- STMicroelectronics N.V

- Tadiran Batteries Ltd.

- Arotech Corporation

- Saft Groupe S.A.

- Texas Instruments

- Shenzhen Kayo Battery Co

- Quallion LLC

- Vitec Group Plc

- Liberating Technologies

- Electrochem Solutions

- Maxim Integrated

- Others

Recent Developments

- In November 2025, Researchers at McGill University have come up with a new battery that's both stretchable and biodegradable, which are perfect for powering wearables and medical implants. It is made from gelatin mixed with magnesium and molybdenum electrodes, plus a splash of citric or lactic acid to boost voltage and lifespan. Unlike regular batteries that stick around as waste, this one breaks down in a phosphate-buffered saline solution within two months, which makes it a safer option for the environment and could help reduce e-waste from gadgets.

(Source:www.newsbytesapp.com) - In April 2025, Abbott announced late-breaking data from the AVEIR™ Conduction System Pacing (CSP) acute clinical feasibility study, which demonstrated the safety and performance of the investigational AVEIR CSP leadless pacemaker technology. The AVEIR CSP acute clinical feasibility study is the world's first assessment of a leadless pacemaker delivering conduction pacing to the heart's left bundle branch (LBB) area. CSP is a novel pacing approach that targets the LBB area by enabling pacing that mimics the heart's natural electrical rhythm.

(Source: abbott.mediaroom.com ) - In August 2023,Ilika entered into a 10-year licensing agreement with Cirtec Medical to produce the Stereax range of mm-scale batteries at Cirtec's facility.

- In March 2022, Reliance New Energy Limited (Reliance) is a subsidiary of Reliance Industries Ltd. They acquired Lithium Werks for $61 million USD, along with manufacturing facilities in China and key business contacts.

- In October 2022, Turtle & Hughes, one of the nation's leading electrical and industrial distributors, today announced a strategic investment in Cadenza Innovation, a growth-stage company that has developed a patented technology platform – the ‘superCell' – which is enabling a new generation of safe, high-performing, low-cost lithium-ion (Li-ion) batteries and energy storage solutions.

Segments Covered in the Report

By Battery Type

- Lithium-ion Batteries

- Nickel-metal Hydride (NIMH) Batteries

- Alkaline Batteries

- Zinc-air Batteries

- Others

By Application

- Implantable Medical Devices

- Non-Implantable Medical Devices

- Portable and Wearable Medical Devices

By End-user

- Hospitals

- Home Healthcare Settings

- Ambulatory Surgical Centers

- Research Institutes

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting