Metal Stamping Market Size and Forecast 2025 to 2034

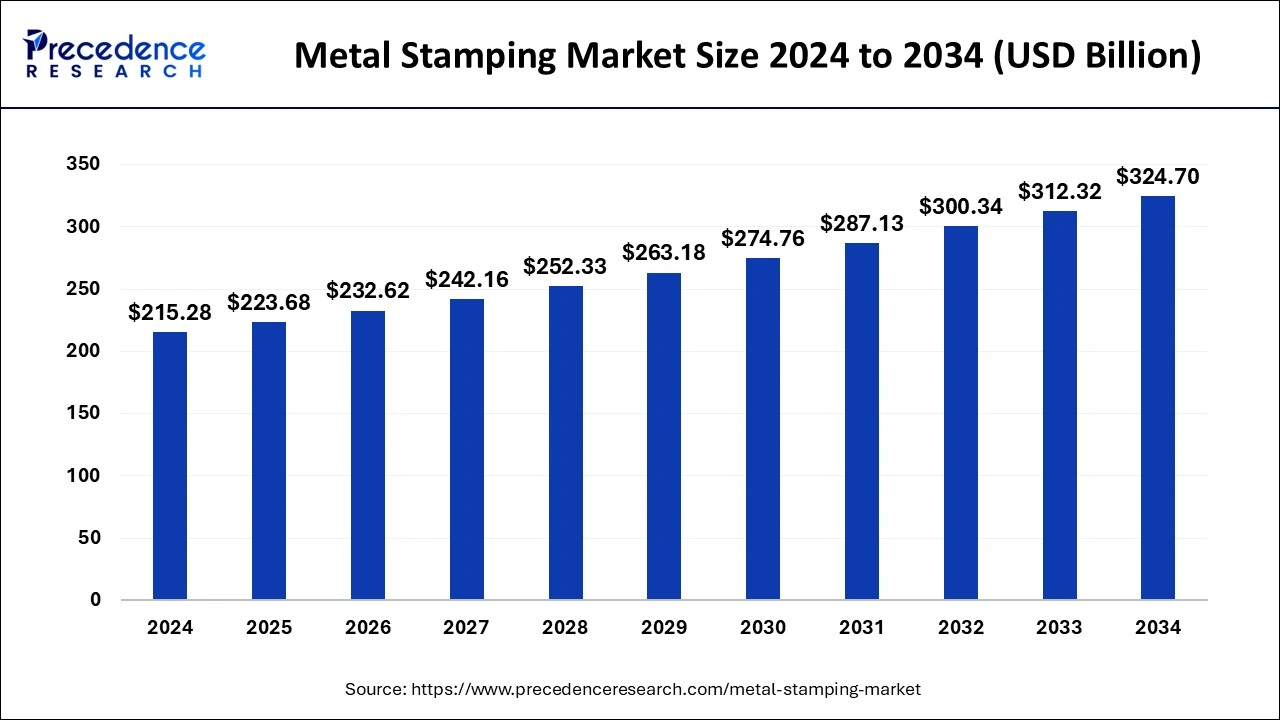

The global metal stamping market size was calculated at USD 215.28 billion in 2024 and is predicted to reach around USD 324.70 billion by 2034, expanding at a CAGR of 4.20% from 2025 to 2034.

Metal Stamping Market Key Takeaways

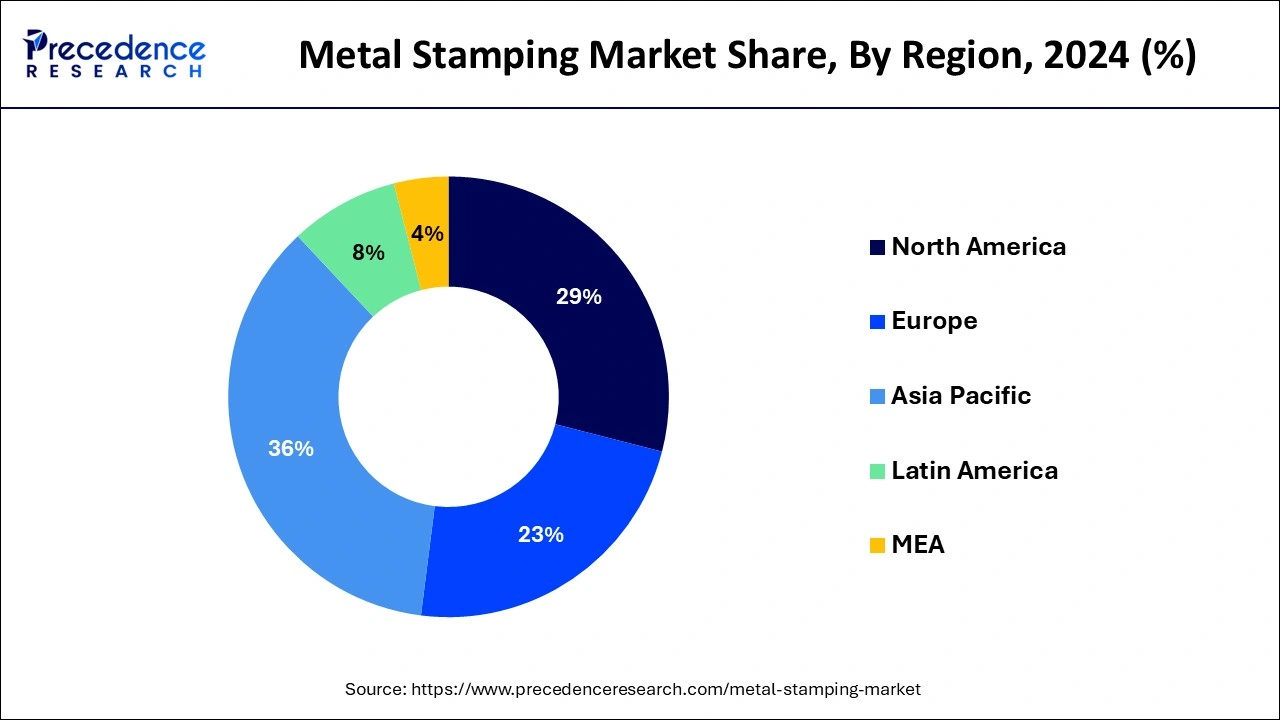

- Asia Pacific dominated the global market with the largest market share of 36% in 2024.

- North America is projected to expand at a notable CAGR during the forecast period.

- By product, the blanking segment has held the largest market share in 2024.

How the Artificial Intelligence (AI) integration positively impact the growth of the metal stamping market

As technology advances, Artificial intelligence (AI) and machine learning (ML) are leading in advancing the metal stamping process by offering precision, efficiency, and innovation. AI and machine learning are significantly revolutionizing metal stamping and have guided an era of modern manufacturing. By combining AI and ML, these technologies hold great potential to reshape how metal stamping is approached and executed such as enhanced design, predictive maintenance for stamping presses, optimized tooling and die design, real-time quality control, material waste reduction, adaptive process optimization, supply chain optimization, and others. As manufacturers adopt Industry 4.0 and smart manufacturing, the integration of AI streamlines operations and paves the new way for innovative designs and more sustainable production methods.

Asia Pacific Metal Stamping Market Size and Growth 2025 to 2034

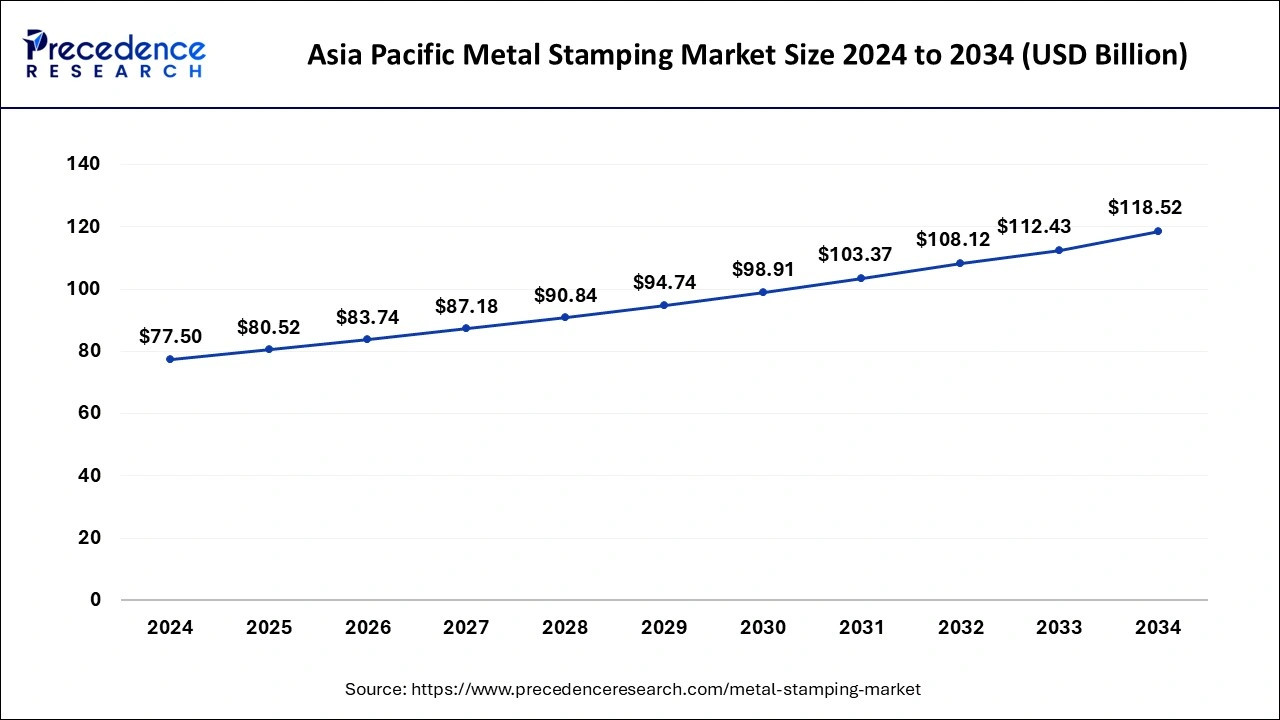

The Asia Pacific metal stamping market size was evaluated at USD 77.50 billion in 2024 and is projected to be worth around USD 118.52 billion by 2034, growing at a CAGR of 4.34% from 2025 to 2034.

Asia Pacific accounted for the largest profit share of more than 36% in 2024 owing to the growing demand for cars and consumer electronics in the region and is anticipated to witness the fastest growth rate over the cast period. The growth is majorly driven by developing countries similar as India, China, Bangladesh, Pakistan, and Indonesia where the rising demand for phones along with other consumer electronics is anticipated to foster the growth of the market. Furthermore, growing industrialization coupled with structure development and growth in the defense industry is anticipated to have a positive impact on the demand for equipment and machinery in Asia Pacific. Countries similar as China and India are adding their investments in the defense industry. For instance, China increased its defense budget by7.5% in 2019 to upgrade the defense outfit, and launch advanced defense aircraft. The rising demand for defense outfit is anticipated to drive the market during the forecast period.

China Metal Stamping Market Trends

China is a key contributor to the metal stamping market. The growing manufacturing in various sectors like consumer products, automotive, and electronics leads to higher demand for metal stamping. The growing production &sale of vehicles increases demand for metal stamping for the production of chassis components, body panels, and other parts, which helps in the market growth. The growing production of various electronic devices like laptops, smartphones, wearables, and computers increases demand for metal stamping for components like shielding, housings, and connectors. The strong government's support for technological advancements in manufacturing and a well-established supply chain for raw materials like aluminium, steel, and other metals for the production of metal stamping drives the market growth.

India Metal Stamping Market Trends

India is growing in the metal stamping market. The growing production of various automotive components like body panels, chassis, and others, and the rise in electric vehicles, increases demand for metal stamping. The growing production of consumer electronics like smartphones, tablets, televisions, wearables, laptops, and many more fuels demand for metal stamping, which helps in the market growth. The growing construction industry increases demand for metal stampings to be used in infrastructure development and building materials. The growing production of aircraft parts and the growth in the telecommunications and industrial machinery sectors drive the overall growth of the market.

On the other hand, in North America, product consumption is likely to be driven by rising demand from the automotive industry. Automakers in the region are focusing on adding the product of lightweight vehicles by using metal similar as aluminum in various factors to reduce energy consumption. As of 2018, nearly 50% of the vehicles manufactured in the region comprise of aluminum hoods and this figure is anticipated to reach 80% by 2032. The adding product of aluminum hoods is anticipated to drive the market during the forecast period.

United States Metal Stamping Market Trends

The United States is a major contributor to the metal stamping market. The strong presence of the aerospace sector and the presence of major companies like Raytheon, Boeing, and Lockheed Martin increase production of defense components, aircraft components, and turbine fueling demand for metal stamping. The strong manufacturing base in various industries like construction, electronics, and appliances helps in the market growth. The ongoing

technological advancements in the metal stamping industry and substantial investment in defense increase demand for metal stamping. The presence of major automotive manufacturers like Stellantis, Ford, and General Motors, growing production of various parts like battery housings, chassis, & body panels, and a rise in electric vehicles drive the overall growth of the market.

Europe is growing in the metal stamping market. The presence of advanced manufacturing infrastructure and a skilled workforce increases the production of metal stamping. The strong presence of suppliers and logistics of metal stamping helps the market growth. The growing adoption of energy-efficient manufacturing processes increases demand for metal stamping. The strong presence of the automotive industry, with key manufacturers like Mercedes-Benz, Volkswagen, and BMW, increases demand for metal stamping for the production of vehicles, driving the overall growth of the market.

Market Overview

Metal stamping is a complex manufacturing process that converts flat metal sheets into a specific shape by keeping them in either blank or coil form in a stamping press. Various metal forming techniques can be used, including punching, blanking, piercing, bending, embossing, coining, and flanging. In addition, metal stamping can produce many identical metal components at a lower cost.

Metal Stamping Market Growth Factors

- The rising demand from the automotive, aerospace, industrial machinery, electronics, consumer goods, construction, and others is expected to contribute to the significant growth potential of the metal stamping market.

- The increasing popularity of advanced stamping techniques is anticipated to propel the expansion of the metal stamping market during the forecast period.

- The rising demand for metal pieces of innovative and desired shapes or components is expected to promote the market's growth during the forecast period.

- The increasing automation in stamping processes, including progressive and transfer stamping, allows quick production and shorter lead times. This efficiency plays an important role in meeting stringent production schedules and rapidly meeting the evolving market demands, accelerating the market's growth in the coming years.

- The rising investment in various companies in R&D activities to introduce automated metal stamping technology for the production of agricultural equipment significantly fuels the growth of the global metal stamping market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 223.68 Billion |

| Market Size in 2034 | USD 324.70 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.20% |

| Base Year | 2024 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Application, Press Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for consumer electronics

The up-surging consumer electronics market will likely remain a major boost for applying metal frames in headphones, mobile phones, speakers, gamepads, and controllers. In mobile, metal stamping is utilized in manufacturing chassis, camera lens holders, and antennas, providing high corrosion resistance, tolerance, electrical conductivity, and a smooth finish. According to the secondary data, as of January 2025, an estimated 4.69 billion people own a smartphone. That's an increase of 440 million new smartphone users over the past year alone (between 2024 and 2025). The number of smartphone users worldwide has grown by 38.38% since 2022, adding 1.3 billion new smartphone owners. Such factors will likely boost the demand for phones and metal stamping during the forecast period.

Restraint

Rising demand for substitute products

The increasing demand for substitute products is projected to hamper the growth of the global metal stamping market. Several governments have implemented stringent regulations, such as Corporate Average Fuel Economy (CAFE) regulations, to boost the production of lightweight vehicles. This has increased demand for substitute products such as plastics and carbon fiber. Reducing vehicle weight significantly assists in fuel efficiency. Such factors are likely to limit the expansion of the market during the forecast period.

Opportunity

Growing demand from the automotive industry

The growing demand from the automotive industry is projected to offer lucrative growth opportunities for the metal stamping market in the coming years. The automotive industry, including light commercial vehicles (LCVs), passenger vehicles, heavy trucks, and buses uses metal stamping parts in manufacturing body panels to maintain the utmost safety standards and control end costs. In the automotive industry, metal stamping is widely adopted for body panels, interior and exterior structural elements, engine components, and suspension parts. Therefore, the growing automobile production is expected to drive the demand for metal stamping during the forecast period,

According to the data released by The Society of Indian Automobile Manufacturers (SIAM) in January 2024, the auto industry witnessed a massive 11.6 percent YoY increase in domestic sales in the calendar year 2024. During the year, the industry saw total domestic retails of 2,54,98,763 units compared to 2,28,39,130 units retailed in 2023. The passenger vehicle segment saw its highest-ever sales in 2024 with total domestic retails of 42,74,793 units, representing a 4.2 percent YoY increase. The total production of Passenger Vehicles, Three-Wheelers, Two-Wheelers, and Quadricycles in December 2024 stood at 19,21,268 units. Passenger Vehicles (PV) sold 3,14,934 units, up 10% compared to December 2023.

Process Insights

The blanking segment held the largest profit share of further than 30% in the year 2024. Blanking is an integral part of manufacturing motorcars on account of its precise and superior stamping capability. The technique involves the use of a die to gain the asked shape. The growing use of blanking in the machine industry on account of its capability to cater to mass product lines is anticipated to augment segmental growth over the coming times.

Embossing was the second largest member in 2020 owing to its advantages similar as the capability to produce different patterns and sizes, depending on the roll dies. This is performed by passing a metal sheet between rolls of the required pattern. Embossing a distance essence reduces disunion, enhances stiffness and severity, and enhances traction.

Material Insights

Based on material, steel stamping market captured the worldwide market in 2024. Attributable to high & easy accessibility of steel, minimal effort, high quality, and low cost. However, the market is estimated to foster a quick growth during the forecast period. The increasing growth of metal stamping market is exponentially attributed to the upsurge in interest from the automotive and aerospace sectors in order to keep fuel weight and expenses down.

Metal Stamping Market Companies

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- D&H Industries, Inc.

- Kenmode, Inc.

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- Tempco Manufacturing Company, Inc

- Interplex Holdings Pte. Ltd.

- CAPARO

- Nissan Motor Co., Ltd

- AAPICO Hitech Public Company Limited

- Gestamp

- Ford Motor Company

Recent Developments

- In February 2024, Sewon Precision Industry Co., a South Korean company and Hyundai supplier, announced its plan to invest USD 300 million to build a 740-employee stamping plant in Rincon, GA, near Savannah. This would make Sewon Precision Industry Co. the region's fifth Hyundai Motor Group supplier. Once the Rincon factory is complete, the company expects 1600 employees between the two plants.

- In February 2024, American Cadrex unveiled a new facility in Mexico. The 150,000-square-foot building sits adjacent to Cadrex's other location in an office park in Juarez, part of the Monterrey metropolitan area. This addition gives Cadrex 405,000 square feet of manufacturing space in Mexico, making the combined sites the largest operational location in the company.

- In May 2024, the IMTS 2024 Conference was conducted to address improving productivity; improving part quality; and developing a stable, competent workforce to lower the cost of manufacturing in the United States and create new levels of market demand. AI-assisted feedback to sheet metal stamping processes for automotive applications. This research is performed in collaboration among ORNL, AutoForm, and USCAR (US Council for Automotive Research). The members of USCAR are Ford, GM, and Stellantis.

Segments Covered in the Report

By Process:

- Blanking

- Embossing

- Bending

- Coining

- Flanging

By Material

- Steel

- Aluminum

- Copper

- Others

By Application

- Automotive & Construction

- Industrial Machinery

- Consumer electronics

- Aerospace

- Electrical & Electronics

- Telecommunications

- Building & Construction

- Others

By Press Type

- Mechanical Press

- Hydraulic Press

- Servo Press

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting