What is the Welding Consumables Market Size?

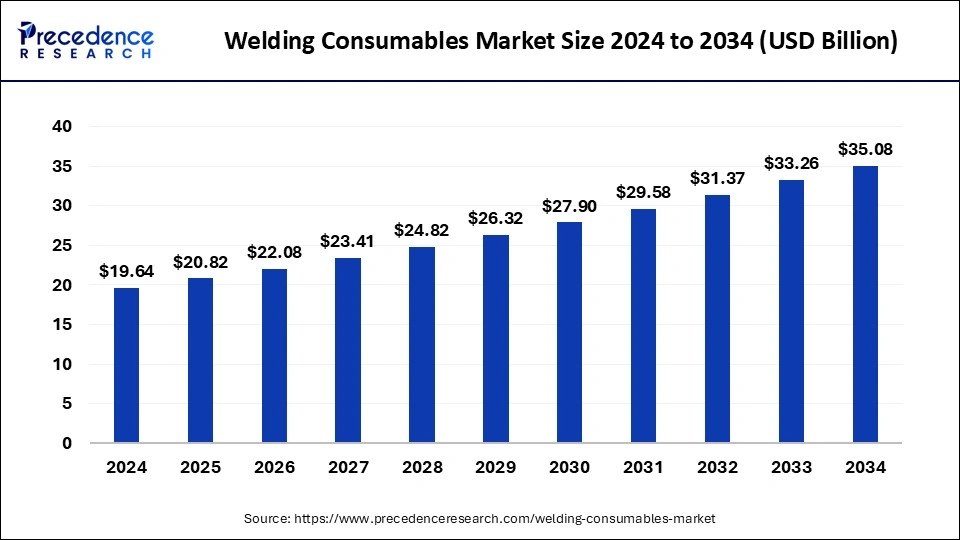

The global welding consumables market size is calculated at USD 20.82 billion in 2025 and is predicted to increase from USD 22.08 billion in 2026 to approximately USD 36.90 billion by 2035, expanding at a CAGR of 5.89% from 2026 to 2035. The expansion ofrenewable energy projects, such as wind farms and solar power installations, is driving the global welding consumables market growth.

Welding Consumables Market Key Takeaways

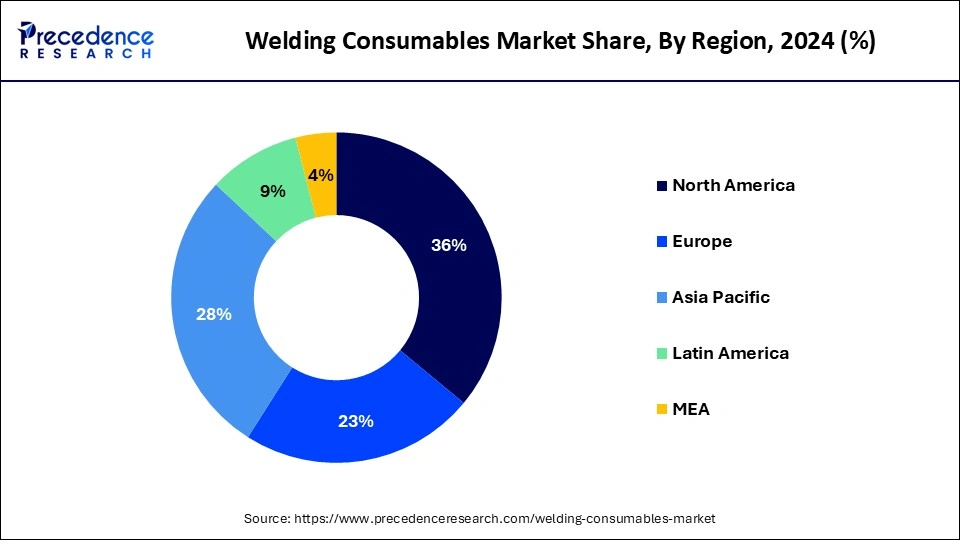

- North America has held a significant revenue share of 36% in 2025.

- Asia Pacific is expected to witness growth at the fastest rate over the projected period.

- By type, the electrodes segment dominated the market in 2025.

- By type, flux segment is expected to gain a significant share of the market over the forecast period.

- By welding technique, the arc welding segment dominated the global market in 2025.

- By welding technique, the resistance wedding segment is expected to grow rapidly during the forecast period.

Market Overview

Welding consumables are essential materials used in the welding process to create a strong joint between two metals. These materials include electrodes, filler metals, fluxes, and gases, crucial for successful welding and ensuring its durability. Fluxes, often used in processes like submerged arc welding, generate a slag that shields the weld from impurities and atmospheric contamination. Electrodes are coated metal sticks used in electric arc welding.

The coating burns to produce a shielding gas, protecting the weld from contamination. Gases such as argon, carbon dioxide, and helium are used, especially in gas metal arc and gas tungsten arc welding, to protect the molten weld pool from atmospheric elements that could weaken the weld. Filler metals are added to the weld to ensure it fills and possesses the desired mechanical properties. Filler materials, including welding electrodes, welding wires, and flux-cored wires, are added to the joint during welding to help fuse the base metals. These materials are selected based on the welding process, the type of base metals being joined, and the specific welding requirements.

Artificial Intelligence: The Next Growth Catalyst in Welding Consumables

AI is revolutionizing the wedding consumables industry by facilitating hyper-personalization, enabling couples to design unique stationery, decor, and favors that reflect their personal stories. AI-driven design tools and platforms, such as Canva, are simplifying the creation of custom invitations, themes, and personalized favors, allowing for rapid iteration and tailored aesthetics. Furthermore, AI is enhancing sustainability in the market by analyzing data to recommend eco-friendly, locally sourced products, reducing waste in decorations and favors.

Welding Consumables Market Growth Factors

- Rapid urbanization in developing economies like China and India is expected to drive the growth of the welding consumables market.

- Rising government spending in the building and construction sector can lead to market expansion.

- Many countries will increase their focus on clean energy, which will fuel the welding consumables market growth soon.

- The expanding oil and gas sector can further propel the welding consumables market growth over the forecast period.

- Launches of more advanced and specialized welding consumables can boost market growth further.

Market Outlook

- Market Growth Overview: The welding consumables market is expected to grow significantly between 2025 and 2034, driven by the expansion of infrastructure and construction, the growing automotive industry manufacturing, and the adoption of automated and robotic welding systems.

- Sustainability Trends: Sustainability trends involve the eco-friendly formulation, sustainable packaging and logistics, and circular economy and waste reduction.

- Major Investors: Major investors in the market include ESAB Corporation, Lincoln Electric Holdings Inc., Illinois Tool Works (ITW), Voestalpine Böhler Welding, Kobe Steel Ltd., and Ador Welding.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.82 Billion |

| Market Size by 2035 | USD 36.90 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.89% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Welding Technique, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Industrialization at a global scale

Rapid industrialization and urbanization in developing economies have led to establishing numerous small and large-scale industries by boosting market growth. The construction sector, especially in countries like India and China, is experiencing robust expansion. The adoption of advanced welding automation technology in fabrication has further fueled the welding consumables market. This industry presents multiple opportunities for profitability and growth for emerging organizations, enabling them to expand and secure a strong position in the global market.

Additionally, the shortage of skilled workers in developing regions is expected to drive the growth of the welding consumables market worldwide. The flourishing construction and automotive industries are the primary drivers of the demand for welding consumables. Moreover, the increasing application of various welding techniques in diverse end-use industries, their use in maintenance and repair operations, and rising investment in energy infrastructure are anticipated to enhance product penetration.

- In September 2023, Vancouver-based Novarc Technologies, which specializes in automated welding equipment using artificial intelligence (AI), raised USD 20 million in all-equity Series A funding.

Restraint

Lack of product adoption in emerging economies

The growth of the global welding consumables market is projected to be constrained over the forecast period due to the limited adoption of innovative welding technologies. Developing nations such as China and India have been slow to embrace modern welding techniques, which has hindered market growth. Additionally, price sensitivity in these countries is a significant factor impeding expansion. The high cost of advanced welding techniques, such as electron beams and laser beams, has led to their limited adoption in emerging economies compared to industrialized nations.

Opportunity

Focus on environmentally friendly consumables

In the welding consumables market, the shift towards environmentally friendly welding consumables is gaining momentum. With stringent environmental regulations worldwide, the demand for low-emission and eco-friendly consumables is increasing, particularly in developed regions such as Europe and Asia Pacific. Companies like ITW Welding and Voestalpine Böhler Welding are focusing on developing green consumables. Brands are prioritizing sustainable products to cater to environmentally conscious consumers and comply with regulations.

Digitalization and IoT integration are also transforming the welding consumables market. Smart welding consumables embedded with sensors and IoT capabilities enable real-time monitoring and data analysis. This trend is particularly gaining traction in industries such as aerospace and automotive, driving global market growth.

- In October 2023, Nasarc launched simplified automated consumables and manual weld innovations. The company has made a name for itself with its flagship INTELLIREAM robotic torch maintenance centers and is now expanding its impact with the development of the Tip Exchange System.

Type Insights

The electrodes segment dominated the welding consumables market in 2025. Stick electrodes are increasingly in demand due to their capacity to enhance welding strength, high corrosion resistance, and tensile strength. Furthermore, numerous industries such as automotive, aerospace, shipbuilding, and manufacturing rely heavily on welding processes to fabricate and assemble components. The growth of these industries drives the increased need for electrodes across various welding applications, which can fuel the segment growth shortly.

- In July 2023, Audi began using an AI system for quality control of spot welds. The test of artificial intelligence for series production is underway. Using AI, the carmaker analyses around 1.5 million spot welds on 300 vehicles each shift at its Neckarsulm site.

The flux segment is expected to gain a significant share of the welding consumables market over the forecast period. Flux forms a slag and a gas shield, protecting and shaping the overall weld structure. It also stabilizes the arc and interacts with the weld pool to produce clean, high-quality metal. Common materials in flux include limestone, silica, dolomite, lime, borax, and fluorite. This composition makes flux suitable for various applications, such as post-weld heat treatment, pressure vessels, offshore drilling platform construction, and exploration platforms. The increasing use of flux in these applications is anticipated to drive segment expansion.

Welding Technique Insights

The arc welding segment dominated the global welding consumables market in 2025. Arc welding includes various subtypes, each designed for specific applications and materials. This diversity enables its use across many industries, such as construction, manufacturing, aerospace, and automotive, making it a preferred choice for many welding needs. Its simplicity and adaptability further reinforce its dominance. Moreover, the method's versatility across sectors like automotive, construction, and shipbuilding solidifies its status as the preferred choice. Continuous advancements in consumable materials and equipment have strengthened its market position, establishing it as the go-to method for numerous welding applications worldwide.

- In November 2023, ESAB launched a next-generation welding platform for heavy industrial welding.ESAB's Warrior Edge 500 CX system makes it possible for both new and experienced welders to achieve excellent welding results without a complex set-up process.

The resistance wedding segment is expected to grow rapidly during the forecast period. Resistance welding (RW) involves joining two metals using pressure and electrical current for a specific duration through the area to be joined. The primary advantage of resistance welding is that it does not require additional materials such as shielding gases, fluxes, or filler rods. The objective of effective resistance welding is to generate heat close to the weld interface, where the weld is desired. Generally, higher resistance results in higher heat, provided the resistance welding power supply can generate sufficient energy to overcome the resistance.

Regional Insights

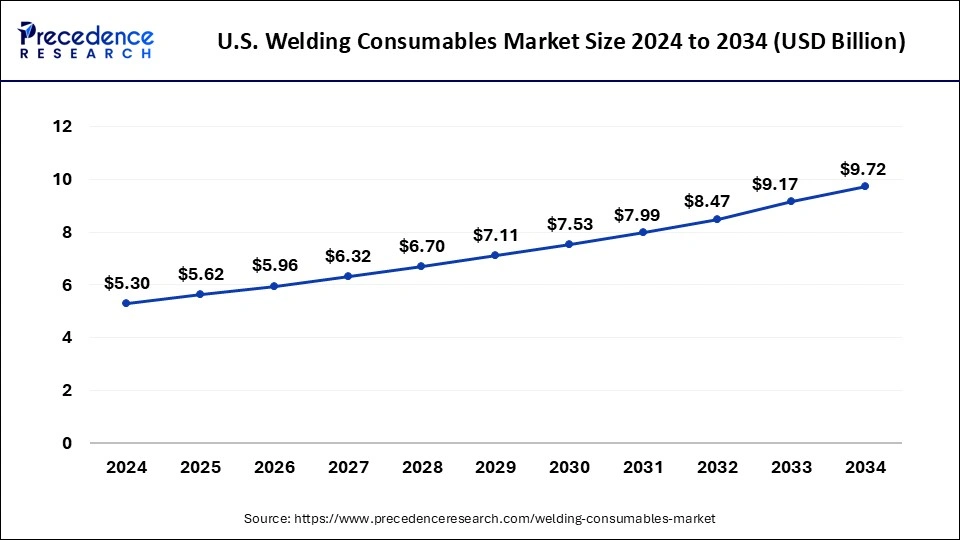

U.S. Welding Consumables Market Size and Growth 2026 to 2035

The U.S. welding consumables market size is calculated at USD 5.62 billion in 2025 and is projected to attain around USD 10.27 billion by 2035, poised to grow at a CAGR of 6.21% from 2026 to 2035.

North America had a significant share of the welding consumables market in 2025. The region is home to various industries, such asaerospace and automotive, which adhere to strict quality and safety standards. Automated welding systems in North America require consistent and reliable welding consumables. The region also hosts numerous large-scale construction and infrastructure projects, from skyscrapers to energy installations, which heavily depend on welding consumables for structural integrity and durability. North America has been a leader in adopting automation and robotics in manufacturing processes, including welding, which necessitates the use of high-quality welding consumables to ensure compliance and reliability.

U.S. Welding Consumables Market Trends

The U.S. has made massive federal and state investments in high-speed rail, road networks, and modernized transportation infrastructure. This growth is complemented by the rapid expansion of the automotive, aerospace, and shipbuilding sectors, where precision joining methods are essential for advanced manufacturing.

India Welding Consumables Market Trends

India boasts a well-developed transportation and logistics infrastructure, which facilitates the efficient movement of raw materials, finished products, and welding consumables. This streamlining of supply chains helps reduce operational costs. Businesses in the region have easy access to welding consumables, reinforcing their market dominance. Moreover, the presence of numerous educational and research institutions specializing in engineering and metallurgy in India cultivates a skilled workforce with expertise in welding technologies.

- In September 2023, Ador Welding Limited, India's leading manufacturer of welding equipment, consumables, and automation systems, announced its participation in the Schweissen & Schneiden International Trade Fair 2023.

Asia Pacific is expected to witness growth at the fastest rate in the welding consumables market over the projected period. The need for welding supplies has surged due to construction activities driven by the growth of the residential, commercial, and industrial sectors, fueled by the region's economic prosperity. The rapid expansion of the automotive industry and the high level of automobile manufacturing have also contributed to the demand for welding consumables in the region. The presence of fast-developing economies such as China, India, Indonesia, and Japan is expected to benefit the region's market growth further.

- In September 2023, The Canadian Welding Bureau and the Automotive Industries Association of Canada partnered to increase welding training opportunities for collision repairers in the country. The program will travel to repair centers across the country to train technicians at their workplaces. This will ensure more facilities in rural and urban areas of the country will be able to offer safe, quality, and timely vehicle repairs, according to CWB and AIA.

How Did Europe Experience A Notable Growth in the Welding Consumables Market?

Europe is driven by the dual pressures of the green energy transition and the rapid evolution of the automotive sector toward electric vehicles. The integration of Industry 4.0 technologies, including AI-driven robotics and advanced laser welding, has shifted demand toward premium, high-precision consumables that meet the region's stringent safety and quality standards.

Germany Welding Consumables Market Trends

Germany's strong demand for automotive and aerospace sectors, adoption of automated and robotic welding systems, rising demand for specific consumables, and focus on smart material, hyperfill solutions, and life-tracking consumables fuel the market growth. Sustainability considerations are prompting innovation in eco-friendly and low-emission consumables, aligning with broader regulatory and environmental goals in the European market.

Value Chain Analysis of the Welding Consumables Market

- Raw Material Sourcing & Procurement

This upstream stage involves sourcing materials required for manufacturing wedding decorations, favors, and stationery, including textiles, plastics, papers, floral materials, and metals.

Key Players: Songtao Artificial Tree Co. - Manufacturing & Product Design

This stage includes the transformation of raw materials into finished consumables, such as artificial flowers, decorative lighting, personalized favors, and invitation cards.

Key Players: Amscan, Wedding Design Hub, and Hallmark Licensing LLC. - Logistics & Distribution

This stage covers the transportation, warehousing, and inventory management of finished goods from manufacturing units to distribution centers and retailers.

Key Players: DHL and FedEx

Welding Consumables Market Companies

- voestalpine AG (Böhler Welding)

voestalpine provides a comprehensive, high-quality portfolio of welding consumables, including solid wires, flux-cored wires, and stick electrodes, designed for specialized industries like oil & gas, energy, and construction. - Colfax Corporation (ESAB)

Colfax Corporation holds a leading market position through its subsidiary ESAB, which manufactures a comprehensive range of welding consumables, including flux-cored wires, stick electrodes, and specialized filler materials. - The Lincoln Electric Company

As a global leader, Lincoln Electric contributes by developing advanced, high-performance welding consumables and innovative, automated, or robotic-ready filler materials. - Air Liquide

Air Liquide contributes to the market by supplying specialized shielding gases, such as their ARCAL range, which are essential for ensuring high-quality, defect-free welding in industries like shipbuilding and automotive. - Hyundai Welding Co., Ltd.

Hyundai Welding offers a broad, competitive portfolio of welding consumables, specializing in flux-cored wires and solid wires for high-intensity industries like shipbuilding, construction, and petrochemicals.

Welding Consumables Market Companies

- voestalpine AG

- Colfax Corporation

- The Lincoln Electric Company

- Air Liquide

- Hyundai Welding Co., Ltd.

- Obara Corporation

- Panasonic Corporation

- Illinois Tool Works Inc.

- Denyo Co., Ltd.

- Fronius International GmbH

- Tianjin Bridge Welding Materials Co., Ltd.

- Kemppi Oy

- Arcon Welding Equipment

Recent Developments

- In February 2023, Miller Electric Mfg. LLC, which is considered one of the prominent manufacturers of welding equipment and consumable products, has recently unveiled its Copilot collaborative welding system. This system will enable welders to achieve better quality of welding and optimize the use of consumables enabling the users to meet augmented demand.

- In February 2022, Miller Electric Mfg., which offers arc welding equipment under its brand name Miller, has recently announced that the company is venturing into a collaboration with NCCER (National Center for Construction Education & Research). The collaboration efforts will provide NCCER welding levels 1 and 2 to integrate its augmented reality welding system.

- In May 2022, Lincoln Electric, engaged in developing, manufacturing, and supplying welding equipment and consumables across diverse geographies, has increased diversity in its existing product portfolio by offering hyperfill solutions into its Flux-Cored wire applications.

Segments Covered in the Report

By Type

- Electrodes

- Flux

- Shielding Gas

- Filler Metals

- Others

By Welding Technique

- Arc Welding

- Resistance Welding

- Oxy-Fuel Welding

- Laser-Beam Welding

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting