What is the Wind Turbine Rotor Blade Market Size?

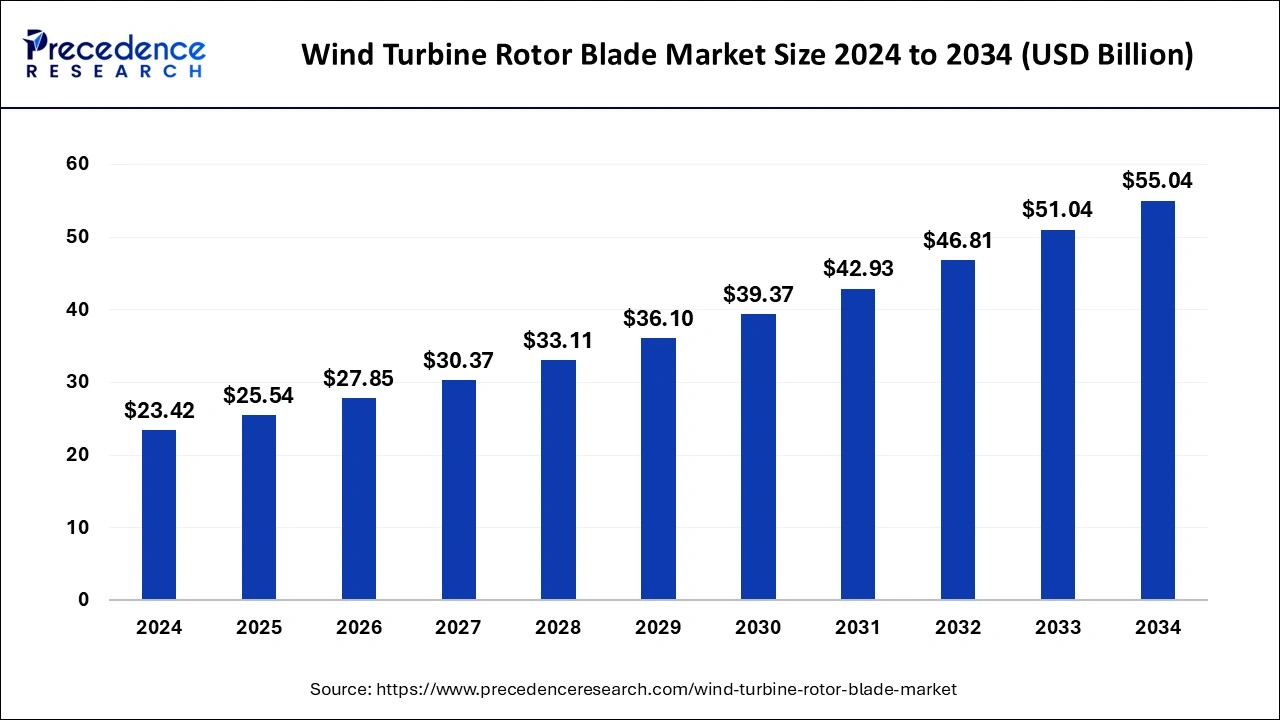

The global wind turbine rotor blade market size was estimated at USD 25.54 billion in 2025 and is predicted to increase from USD 27.85 billion in 2026 to approximately USD 59.19 billion by 2035, expanding at a CAGR of 8.57% from 2026 to 2035.

Wind Turbine Rotor Blade MarketKey Takeaways

- In terms of revenue, the global wind turbine rotor blade market was valued at USD 25.54billion in 2025.

- It is projected to reach USD 59.19billion by 2035.

- The market is expected to grow at a CAGR of 8.57% from 2026 to 2035.

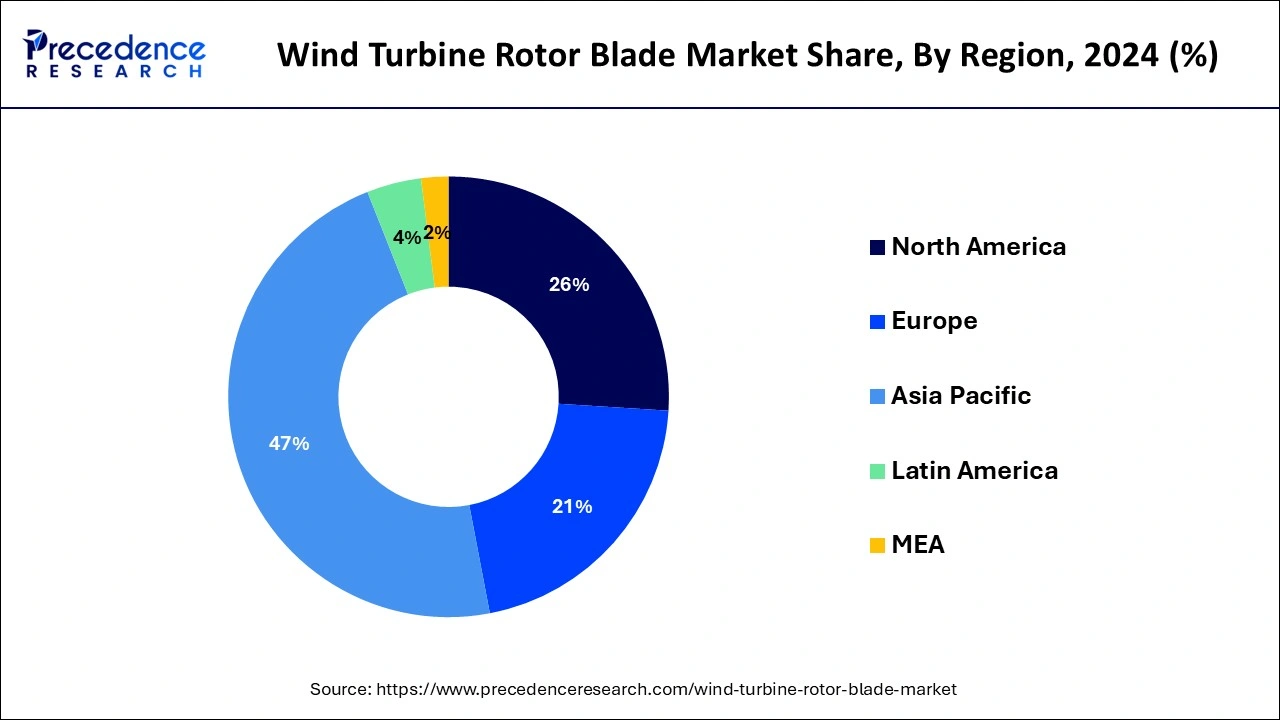

- Asia Pacific led the global market with the highest market share of 47% in 2025. The region is observed to sustain the position throughout the forecast period.

- By location of deployment, the onshore segment held the largest share of the wind turbine rotor blade market in 2024 and is expected to sustain the position throughout the forecast period.

- By location of deployment, the offshore segment is expected to grow significantly during the forecast period.

- By blade material, the carbon fiber segment held the largest segment of the market in 2025.

Market Overview

The wind turbine rotor blade market revolves around the production, innovation and application of rotor blades as a crucial component in the renewable energy production sector. Their work is to convert the atmosphere's mechanical power and energy into a rotary motion around a central hub. Wind power plants produce electricity through wind turbines.

The deployment of a wind power plant widely depends on several factors, including wind conditions, access to electric transmission, the surrounding terrain, and others. Generally, the job of the wind turbine is to turn wind energy into electricity with the help of aerodynamic force from the rotor blades, which may work as a helicopter rotor blade or an airplane wing. Wind turbine rotors, another vital part of a wind turbine, determine how well the wind turbine works for renewable energy production.

Wind Turbine Rotor Blade MarketGrowth Factors

- With the expansion of the wind energy industry, wind turbine technology has to adapt to higher demands. The wind energy industry sector continues to advance the wind turbine rotors with the most updated blades in their class and create higher capabilities to produce energy.

- The wind turbine rotor blade market largely relies on the growing popularity of eco-friendly and greener sources of energy.

- As wind-derived energy becomes an increasingly vital part of the renewable energy landscape, the demand for wind turbine rotor blades is driven by the need for efficient energy production and sustainability.

- Ongoing technological advancements and innovations in the wind turbine rotor blade market have greatly improved the efficiency and lifespan of turbines, making them more cost-effective and reliable.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 8.57% |

| Market Size in 2025 | USD 25.54 Billion |

| Market Size in 2026 | USD 27.85 Billion |

| Market Size by 2035 | USD 59.19 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Location of Deployment and By Blade Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing demand for electricity

The rising focus on wind energy expansion is expected to fuel the growth of the wind turbine rotor blade market. The rising demand for better energy production, sustainable energy sources, and placement of wind power production technology to maximize electricity generation has accelerated the growth of the market during the forecast period. Power generated from wind sources is a clean and alternative source of energy. Wind power energy is among the fastest-growing sectors within clean energy sources.

The demand for wind energy increases as the most secure and sustainable solution to meet the growing energy demand. The global shift towards clean energy and the rising use of electricity demand continues to increase globally to accelerate rapid infrastructure development. The growing number of offshore and onshore wind energy installations worldwide supports the increasing demand for electricity. Therefore, such factors are likely to propel the growth of the wind turbine rotor blade market during the forecast period.

- In June 2022, China published its 14th Five-Year Plan for Renewable Energy, which includes an ambitious target of 33 percent of electricity generation to come from renewables by 2025 (up from about 29% in 2021), including an 18% target for wind and solar technologies.

Restraint

High cost-related challenges

The high costs associated with R&D and challenges during transportation are anticipated to hamper the global wind turbine rotor blade market's growth. Handling and transporting large rotor blades from manufacturing units to installation sites for offshore wind farms act as logistic challenges. In addition, the wide availability of other alternative energy generation sources, such as solar energy, is likely to limit the expansion of the global wind turbine rotor blade market during the forecast period.

Opportunity

Rising focus on wind energy expansion

The rising focus on wind energy expansion is expected to fuel the growth of the wind turbine rotor blade market. The rising demand for better energy production, sustainable energy sources, and placement of wind power generation technology to maximize electricity gene has accelerated the growth of the market during the forecast period. Power generated from wind sources is a clean and alternative source of energy. Wind power energy is among the fastest-growing sectors within clean energy sources.

Wind energy with advanced rotor blades significantly benefits the environment by reducing the carbon footprint. Several environmental issues related to fossil fuels are promoting a rise in alternative energy sources. The establishment of wind power for electricity production plays a role. Electricity from renewables is nearly 40% of the total renewable energy supply. Moreover, the growing investments in various countries, such as China, the United States, Japan, and India, are projected to propel the market's expansion in the coming years.

- The International Renewable Energy Agency's (IRENA) World Energy Transition Outlook (2023) indicates the necessity of offshore wind to grow from 64 GW capacity to 494 GW by 2030 and reach 2,465 GW by 2050.

- According to the data published by the International Energy Agency, In April 2023, 9 European countries announced plans to significantly accelerate offshore wind deployment and increase installed power capacity from 30 GW in 2022 to over 120 GW by 2030 and over 300 GW by 2050.

Segment Insights

Location of Deployment Insights

The onshore segment held the largest segment of the wind turbine rotor blade market in 2025 and is expected to sustain the position throughout the forecast period owing to the increasing energy demand through clean sources. In recent years, wind power has delivered increasing percentages of electricity generation. Onshore wind power is the turbines that are located on land and through using the wind it generates electricity. This power generation technology is working aggressively to maximize electricity produced per megawatt capacity installed to cover more sites with lower wind speeds.

Onshore wind turbines are very quick and easy to install. The ease of installation, transportation, and other several factors make onshore wind farms less expensive than offshore wind farms. They have no adverse impact on the environment around them, and energy transportation produces very few emissions. In addition, these wind turbines do not release any toxins or contaminate the land as they usually co-exist with farming.

- According to the data published by the International Energy Agency on July 2023, of the total 900 GW of wind capacity installed, 93% was in onshore systems, with the remaining 7% in offshore wind farms. Onshore wind is a developed technology, present in 115 countries across the globe, while offshore wind is at the early stage of expansion, with capacity present in just 20 countries.

- In January 2024, Chinese wind turbine manufacturer Sany announced that it had started producing 131-metre blades for a 15MW onshore wind turbine in Inner Mongolia in a bid to combine the onshore wind sector's longest blades and highest power rating.

- In July 2023, Vestas announced an investment worth USD 40 million in Colorado factories as the U.S. onshore wind market Vestas is investing at its two Colorado factories to manufacture the V163-4.5MW wind turbine, the OEM's newest for the U.S. onshore market, which is forecast to resume modest growth in 2024.

The offshore segment is expected to grow significantly during the forecast period in the wind turbine rotor blade market. Offshore wind power is gaining popularity rapidly. Offshore wind power is referred to as when wind over open water to generate electricity. Offshore wind farms are constructed in water bodies where higher wind speeds are available, allowing for more energy collection, which wind speeds tend to be faster. Offshore wind power is a more reliable and cleaner source of energy.

- The Inflation Reduction Act (IRA), signed into law in August 2022, grants USD 40 billion in direct investment to expedite the development of the U.S. offshore wind supply chain. This allotment includes the construction of U.S.-flagged ship builds, further supporting domestic production throughout the entire industry.

- Offshore reach is expected to increase in the coming years as more countries develop or plan to develop their first offshore wind farms. In 2022, offshore technology delivered 18% of the total wind capacity growth of 74 GW.

Blade Material Insights

The carbon fiber segment dominated the wind turbine rotor blade market in 2025. Wind energy is a renewable energy source for enhancing climate conditions and environmental friendliness. Wind turbine blades are a vital element in collecting wind energy. Carbon fiber offers several benefits and has been widely recognized for its excellent overall performance in large-scale wind turbine blades.

Carbon fiber assists in reducing wind turbine blade mass due to its enhanced properties of strength and stiffness compared to fiberglass. According to some secondary research, wind blades containing carbon fiber weigh 25% less than ones made from traditional fiberglass materials. Carbon fiber blades capture more energy in locations with low wind. A shift to carbon fiber extends the blade lifetime as carbon fiber materials have a high fatigue resistance.

Regional Insights

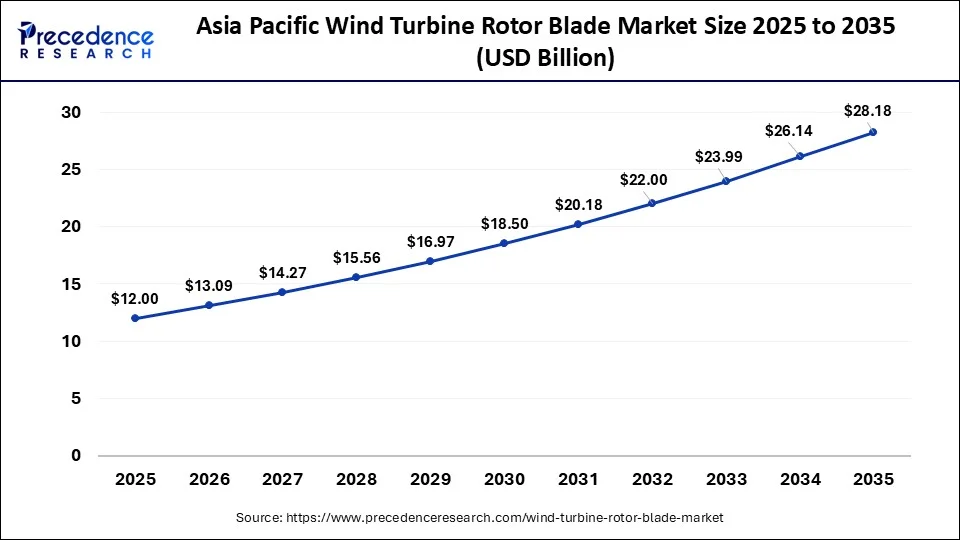

What is the Asia Pacific Wind Turbine Rotor Blade Market Size?

The Asia Pacific wind turbine rotor blade market size was valued at USD 12 billion in 2025 and is anticipated to reach around USD 28.18 billion by 2035, poised to grow at a CAGR of 8.91% from 2026 to 2035.

Asia-Pacific led the market with the biggest market share of 47% in 2025 which is observed to sustain its position throughout the forecast period. The growth of the region is attributed to the rising investment in generating clean sources of energy, increasing R&D activities in renewable energy sources, the rapid pace of urbanization, advancement in technology and requirements of improvements in energy efficiency. The market in the region is also observed to be supplemented by rapid industrialization, electrification of end-use sectors, and a supportive regulatory framework of the governments. Thus, such factors are expected to propel market ‘s growth in the region during the forecast period.

In the region, developing countries such as China, India, and Japan are the major contributors to the market. The growth of the market in these countries is attributed to the significant growth in domestic power consumption, increasing demand for sustainable sources of energy, the presence of prominent market players, the increasing number of offshore and onshore wind energy installations, the increasing adoption of advanced energy solutions, and the rising focus on wind energy expansion.

Additionally, several governments incentives and subsidies for wind energy projects and technological innovations in rotor blade design and materials resulted in enhancing the efficiency and lifespan of wind turbines, which makes them more affordable and reliable.

- India targets 412 GW from renewables by 2030, aiming to cut fossil fuel share to 41%. The Central Electricity Authority (CEA) predicts the country's power generation capacity will amount to 758 GW by FY2030, with non-fossil fuel sources like solar, wind, and hydro contributing 412 GW.

What are the Advancements in the Wind Turbine Rotor Blade Market in Europe?

Europe is expected to witness significant growth in the market. This growth is driven by the region's aggressive renewable energy targets and a well-developed, advanced offshore wind sector. Countries such as Germany, the UK, and Denmark are leading players in the region. Various incentives and policies, such as the EU Green Deal, encourage carbon neutrality and sustainability commitments, thus fostering demand.

Germany Wind Turbine Rotor Blade Market Trends: Factors such as rapid wind energy innovation, significant investments in both onshore and offshore wind farms, a highly developed infrastructure, skilled workforce, and technological leadership in wind turbine design and manufacturing help to propel the region's market forward. Local manufacturing is strong, supported by established turbine OEMs and supply chain networks, although raw material costs and regulatory compliance can impact production.

What are the Key Trends in the Wind Turbine Rotor Blade Market in Latin America?

Latin America is set to witness a substantial amount of growth in the market. This is because the region has a strong pipeline of projects, particularly in Brazil and Mexico. The region is also seeing a rise in policies and frameworks, which help to boost energy diversification goals and expand investment opportunities. Blade producers all over the world are targeting Latin America for their expansion efforts due to growth potential.

Brazil Wind Turbine Rotor Blade Market Trends: The country's market landscape is fueled by the rapid expansion of wind energy projects. This country has set ambitious goals for wind energy capacity in order to meet rising energy demands for a rapidly growing population.

How is the Middle East and Africa Region Growing in the Wind Turbine Rotor Blade Market?

The Middle East and Africa region is experiencing steady growth in the market and is expected to maintain this trajectory in the upcoming years as well. Countries such as the UAE and Saudi Arabia are leading players in the region due to their robust wind energy initiatives as part of their energy diversification strategies. Government-owned utilities are also seen issuing tenders for renewable power. Regional investments are gaining traction, strengthening blade procurement and installation services.

Saudi Arabia Wind Turbine Rotor Blade Market Trends: Projects like Dumat Al Jandal in the country are helping to open up new avenues of opportunities, marking significant milestones. Local blade manufacturing seems to be minimal, but is still under exploration. Local manufacturing is limited, so most blades are imported, although partnerships and localization efforts are beginning.

Wind Turbine Rotor Blade Market Companies

- TPI Composites Inc.

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- Nordex SE

- Siemens Gamesa Renewable Energy, S.A.

- MFG Wind

- Sinoma wind power blade Co. Ltd

- Aeris Energy

- Suzlon Energy Limited

- LM Wind Power

- Vestas Wind Systems A/S

- General Electric

- Suzlon Energy Limited

- Enercon GmbH

- Acciona S.A.

- Avangrid Inc.

- LM Wind Power

- Suzlon Energy Ltd

- Envision Group

Recent Developments

- In July 2025, Nordex SE secured major new orders from UKA for its N175/6.X and N163/6.X wind turbines, totaling 435MW in Germany. This significant achievement reinforces Nordex's position as a leading supplier of wind turbine technology for large-scale European projects.

(Source: https://www.nordex-online.com) - In October 2022, Röchling Industrial launched Pulcap, a product made of composites that enhance the stability of wind turbine rotor blades. Owing to their extremely high mechanical strength and low weight, the pultruded profiles enable wind turbines' efficient and safe operation.

- In October 2023, Mingyang Smart Energy announced the launch of a 22MW offshore wind turbine. The MySE 22MW is expected to be the world's most powerful offshore turbine with a rotor of more than 310 meters, tailored for high-wind regions with an average wind speed of 8.5 meters per second to 10 meters per second.

- In December 2023, Suzlon introduced the new 3 MW series to unlock unviable sites and to deliver improved energy yield suitable for all wind regimes. The S144 wind turbine generator is one of the largest in India, extendable up to 3.15 MW, depending on site wind conditions, available at a hub height of 140 meters going up to 160 meters by its serial launch.

Segments Covered in the Report

By Location of Deployment

- Onshore

- Offshore

By Blade Material

- Carbon Fiber

- Glass Fiber

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content