mRNA Therapeutics Market Size and Forecast 2025 to 2034

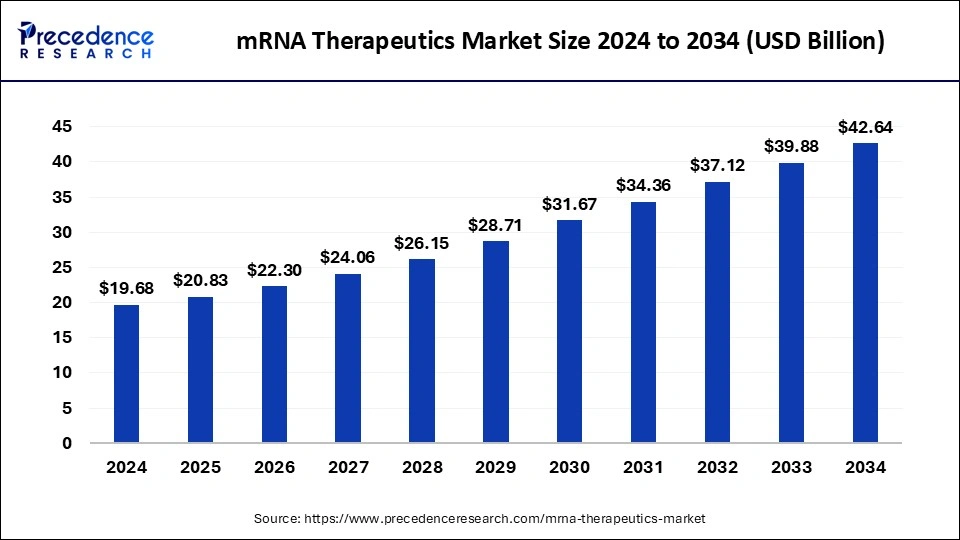

The mRNA therapeutics market size accounted for USD 19.68 billion in 2024 and is predicted to increase from USD 20.83 billion in 2025 to approximately USD 42.64 billion by 2034, expanding at a CAGR of 8.28% from 2025 to 2034.

mRNA Therapeutics Market Key Takeaways

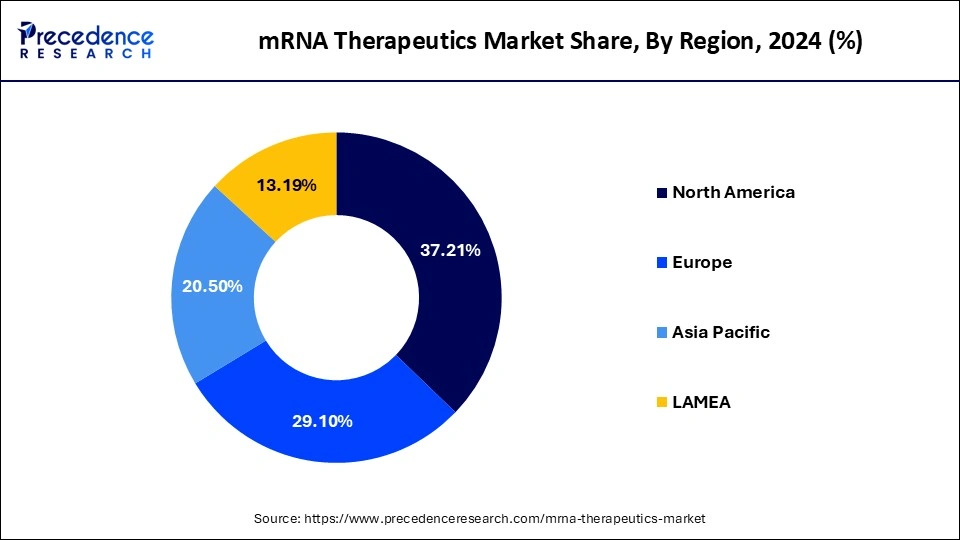

- North America dominated the market with over 37.21% share in 2024.

- By end user, the other end-use segment is projected to experience the highest growth rate in the market between 2025 and 2034.

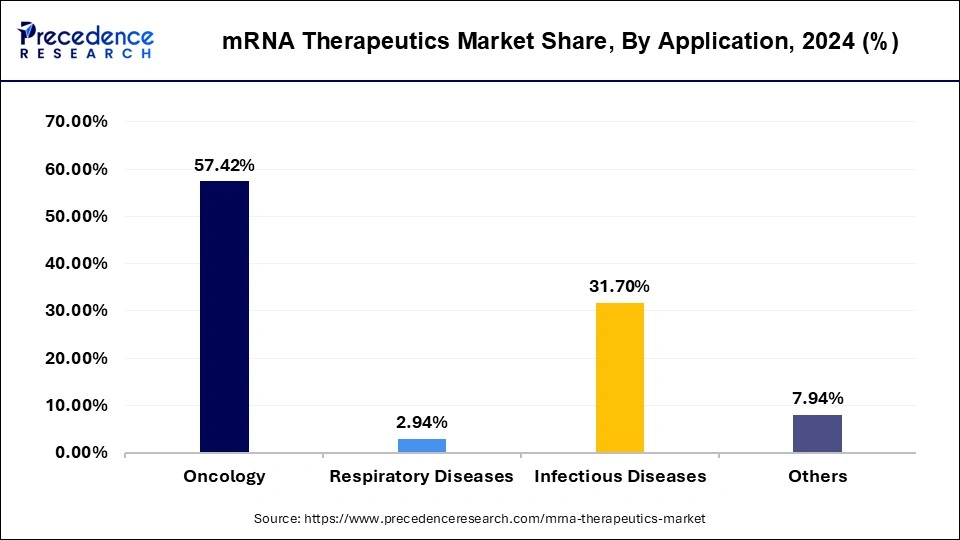

- By application, the oncology segment is anticipated to grow with the highest CAGR in the market over the forecast period of 2025 to 2034.

- By type, the therapeutic segment is predicted to witness significant growth in the market over the studied period of 2025 and 2034.

- By region, Europe is expected to experience the fastest rate of market growth from 2025 to 2034.

How AI has been effected on the market?

Artificial intelligence (AI) is playing a transformative role in the mRNA therapeutics market by accelerating every stage of the research, development, and commercialization process. In drug discovery, AI algorithms are being used to predict optimal mRNA sequences, improve Condon optimization, and design stable structures that maximize protein expression while minimizing immune system over activation. Machine learning models help identify promising therapeutic targets for diseases, specially in oncology and rare genetic disorders, by analysing massive datasets from genomics, proteomics, and clinical studies. In manufacturing, AI enhances process optimization, quality control, and predictive maintenance of production lines, assuring consistent batch quality and reducing costs.

Additionally, AI driven clinical trial design enables more efficient patient recruitment, adaptive study protocols, and real time monitoring of trial data to improve success rates. Beyond research and development, AI also supports regulatory submissions by automation data analysis and documentation, as well as enabling personalized medicine approaches where mRNA therapies can be tailored to a patient's unique genetic profile. Together, these capabilities are significantly shortening development timelines, improving therapeutic precision, and expanding the scope of conditions that can be addressed with mRNA technology.

U.S. mRNA Therapeutics Market Size and Growth 2025 to 2034

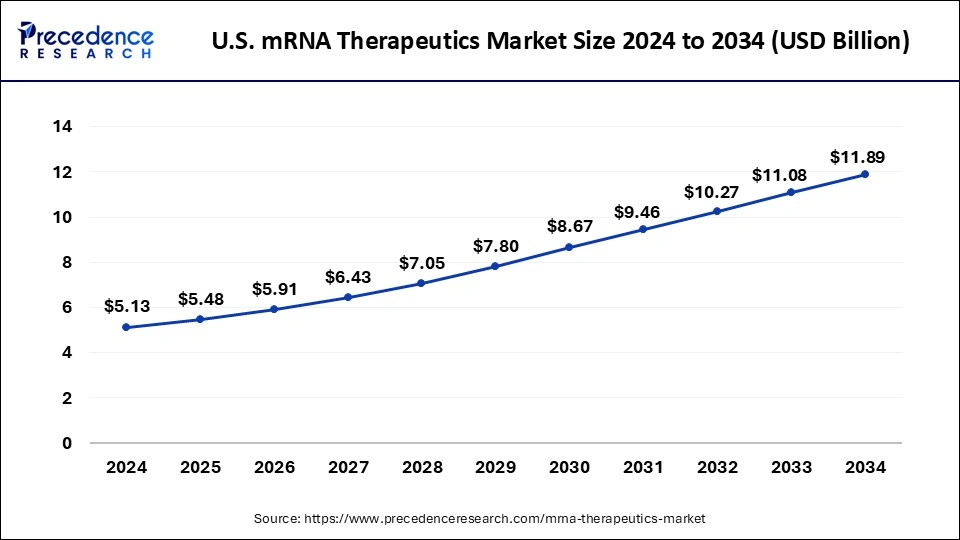

The U.S. mRNA therapeutics market size was exhibited at USD 5.13 billion in 2024 and is projected to be worth around USD 11.89 billion by 2034, growing at a CAGR of 9.00% from 2025 to 2034.

North America was the market's dominant region with a share of approximately37.21% in 2024, North America was the market's dominant region and would have the quickest growth throughout the projected period. The market in North America will be driven by the accessibility of sizable research money, escalating centralized programs for RNA-based therapies, and a rising number of numerous medical studies. For instance, Graham as well as others' basic research was supported by the Defense Department, National Institute of Health, and government-financed university institutions in Nov 2020. This assistance was a key factor in the rapid discovery of vaccines for COVID-19. An administration has given vaccine producers an extraordinary because the pandemic began to speed up the distribution of their goods. Due to a rise in patients and knowledge of rare hereditary diseases, Europe accounted for another major profit share in 2021.

Europe is expected to experience the fastest rate of market growth from 2025 tp 2034. The region's supportive regulatory environment, strong academic research base, and growing biotech investment landscape and driving rapid advancements in mRNA technology. Countries such as Germany, France, and the UK are home to several pioneering mRNA companies and have implemented defunding programs to accelerate vaccine and therapeutic development. Additionally, the post pandemic momentum in Europe has created an ecosystem where government agencies, universities and private companies collaborate to fast track clinical studies, enhance manufacturing capacity, and foster cross border research initiatives.

Market Overview

The enormous potential for treating chronic illnesses has made RNA-based therapies a hot topic in recent years. Additionally, RNA vaccinations have a portion of advantages over Gene delivery in regards to production, dissemination, and efficacy. The need for mRNA vaccinations and therapies has grown as an outcome of them showing improvement in human clinical investigations. Furthermore, the popularity of the COVID-19 vaccinations developed by Moderna with Pfizer-BioNTech has led to a sharp increase in the amount of protein expression vaccine treatments being tested in cancer clinical studies.

Additionally, 2021 saw the second-highest amount of mRNA vaccination studies for people with cancer after the COVID-19 studies in people with cancer, which fueled the industry's expansion. A singular protein-coding gene serves as the foundation for protein biosynthesis in cells and is known as messenger ribonucleic acid (mRNA). The desired immunologic characteristics are combined in mRNA vaccinations and RNA interference (RNAi) treatments, which are created in labs utilizing stem cells. Non-replicating, Self-amplifying, self-replicating, and in vitro dendrite cells with non-replicating mRNA are some of the frequently used vaccine and treatment varieties. They are administered to the body that activates immunological sensors that recognized viruses and cause cell production of viral epitope protein. As a result, the body's T- and B-cell responses are improved, which helps to strengthen resistance.

The COVID-19 epidemic has positively affected the expansion of the worldwide market because of the expansion in the quantity of COVID-19 patients all over the world as well as the large external finance for the production of messenger RNA-created COVID-19 vaccinations. Furthermore, because mRNA vaccinations offer a strong defense against different varieties the COVID-19 disease, the desire for them surges when they arrive in several countries around the world. Because of this, it is anticipated that the demand for mRNA-based treatments would rise throughout the COVID-19 epidemic, and the industry will expand.

mRNA Therapeutics Market Growth Factors

A prospective therapeutic device, messenger RNAs has emerged as a result of recent advances in technology in delivery translations, and stabilization. mRNA fact, mRNA vaccinations have opened up fresh pharmacologic frontiers and become a significant therapeutic subclass. A new phase of vaccine advance has begun with the assistance of this mRNA vaccine for the next immunizations. For instance, Moderna, Inc. as well as the National Academy of Allergies and Communicable Diseases created the mRNA-1273 in collaboration in March 2020. (NIAID). It exhibits 94.1% effectiveness in symptomatic COVID-19 prophylaxis, and in Dec 2020, the United States Food and Drug Regulation (US FDA) granted emergent use permission for broad immunization of humans.

Furthermore, mRNA treatments, a fast-expanding class of drugs for many diseases, will revolutionize personalized medicine and change the established treatment guidelines. The product market for products depends on mRNA and is therefore predicted to increase in the upcoming years. This market expansion is being driven by the increased incidence of rare conditions including propionic metabolic acidosis, sufficient concentration diabetic ketoacidosis, carbohydrate diseases, genetic defects, metabolism, and immunological disorders as well as persistent illnesses such as heart disease, cancer, pulmonary, CKD, and others. For example, rendering to Globo can, there have been 10.6 million melanoma fatalities and new instances of cancer in the world in Dec 2020. Increasing operational player expenditures in the development of cutting-edge and efficient vaccines and medicines are likely to accelerate market growth over the anticipated period.

The market for mRNA vaccinations and treatments also rises as a result of the widespread use of mRNA vaccinations, the creation of tailored cancer medicines, and a robust portfolio of innovative products, which all contribute to the sector's development throughout the forecast period. For example, during Apr. 2021, American mRNA pharmaceutical company Arcturus Pharmaceuticals established a Japanese corporation near Chiba Territory and thus is currently building a manufacturing plant in Minamisoma Town, Fukushima Province. This was done in a partnership between Axcelead, Inc. In the upcoming years, such expenditures are projected to support market growth in addition.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.28% |

| Market Size in 2034 | USD 42.64 Billion |

| Market Size in 2025 | USD 20.83 Billion |

| Market Size by 2024 | USD 19.68 Billion |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Type, End User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Prevalence of Long-lasting and Communicable Diseases

- Over the last ten years, there has been a rapid rise in the incidence of chronic and infectious diseases worldwide. Despite all of the safeguards and personal grooming measures adopted, chronic and infectious illnesses are spreading over the world. As nourishment and food are among the most important determinants for the prevention of illness, this is due to the declining nutritious content in the diet. Some of the most common chronic conditions are diabetes, cancers, osteoporosis, neurological disorders, and cardiovascular problems. According to Health Organisation, cancer will account for approximately ten Mn expiries in 2019, creating it one of the major causes of passing worldwide.

Increasing financial support for the creation of leading-edge and efficient pharmaceuticals and vaccines

- Increasing operational player expenditures in the development of cutting-edge and efficient vaccines and medicines are likely to accelerate industry expansion throughout the anticipated period. For example, American mRNA therapeutic manufacturer Arcturus Pharmaceuticals established a Japanese company in Chiba Prefecture in early April 2021 as part of a joint partnership with Axcelead, Inc., and is currently building a production plant in Minamisoma Town, Fukushima District. In the upcoming years, these expenditures are probably going to complement market expansion.

Increasing acceptance of mRNA vaccinations

- This market expansion is being driven by the increased incidence of rare conditions including methylmalonic acidemia, propionic metabolic acidosis, glycogen illness, phenylketonuria, metabolism, and immunological disorders as well as chronic illnesses such as heart disease, cancer, pulmonary, CKD, and others. For example, according to Globocan, there have been millions of cancer-related deaths and millions of new occurrences of cancer in the world in Dec 2020. Additionally, the desire for mRNA vaccinations and therapies rises due to the popularity of mRNA vaccinations, the advancement of tailored cancer medicines, and a robust portfolio of existing innovations, which spurs market growth throughout the projected timeframe.

Restraints

Complexities of Expenses

One of the most significant challenges facing the mRNA therapeutic market is the complexity and expense of manufacturing. Unlike traditional pharmaceuticals, mRNA products require advanced bioprocessing facilities capable of handling stringent conditions for synthesis, purification, and encapsulation into delivery systems like lipid nanoparticles. Marinating the integrity if mRNA strands demands a controlled environment to prevent degradation, and even small variations in process parameters can impact quality, potency, and stability. Setting up and operating such specialized facilities involves high capital expenditure and skilled workforce requirements, creating barriers for smaller biotech firms. Moreover, the cost of raw materials, advanced delivery technologies, and regulatory compliance adds to the financial burden, which can limit the scalability and accessibility of these therapies particularly in low and middle income regions.

Key Market Challenges

Safer administration and low manufacturing cost

- In the industry for mRNA vaccinations, mRNA-based COVID-19 immunization are a more viable option than traditional vaccination methods since mRNA vaccine candidates get the potential for quick growth and excellent efficacy, both of which will contribute to the products' continued growth. Additionally, the manufacture and delivery of these vaccinations could be simpler and more affordable. Therefore, by solving all of the market's existing issues, mRNA immunizations have transformed the field of vaccination.

Key Market Opportunities

Utilizing mRNA technology and creating mRNA biomarkers

- Due to rising rates of chronic and infectious diseases, as well as government initiatives for huge following the previous, the international demand for mRNA vaccinations and RNAi treatments is predicted to grow throughout the forecast timeframe.

- Additional market dynamics that contribute to the expansion of the mRNA vaccines & RNAi therapies industry are targeted specialization, sensitivity of therapy, and increased awareness of immunization. However, it is projected that the high price of studies, the risk of failing, and difficulties in quantifying mRNA will restrain market expansion.

- For the leading market participant, however, the use of mRNA technologies and the creation of mRNA biomarkers is anticipated to present a profitable market potential for mRNA vaccinations and RNAi therapies.

Type Insights

The therapeutic segment is predicted to witness significant growth over the studied period. While prophylactic vaccines gained early attention, therapeutic mRNA applications are now expanding into diverse areas such as rare genetic disorders, protein replacement therapies, autoimmune diseases, and regenerative medicine. Unlike traditional drugs, therapeutic mRNA enables the body to produce specific proteins on demand, opening possibilities for treatments that were previously infeasible.

Advances in chemical modification of mRNA strands and optimization of delivery platforms are improving stability, reducing immune rejection, and increasing treatment success rates, which is drawing strong interest from both biotech startups and established pharmaceutical firms.

mRNA Therapeutics Market Revenue, By Type, 2022-2024 (USD Million)

| By Type | 2022 | 2023 | 2024 |

| Prophylactic Vaccines | 14,229.94 | 9,770.68 | 10349.05 |

| Therapeutic Drugs | 13,030.49 | 8,875.65 | 9325.95 |

Application Insights

The oncology segment is anticipated to grow with the highest CAGR in the coming years. The surge in cancer focused mRNA therapeutics stems from advancements in personalized cancer vaccines, which train the immune system to target tumour specific antigens. This approach allows treatments to be highly customized to individual patients, improving efficacy and reducing off target effects. The increasing prevalence of cancer globally, combined with the urgency for more effective targeted therapies, is encouraging pharmaceutical companies to invest heavily in clinical trials progress in delivery systems, such as lipid nanoparticles, is also making it possible to safely transport these molecules into the body for precise therapeutic action.

End User Insights

The other end use segment is projected to experience the highest growth rate includes specialized research institutes, contract development and manufacturing organizations (CDMOs), and dedicated biotech laboratories that are increasingly engaging in mRNA development work to niche facilities is fuelling this growth. These entities benefit from the agility to adopt new technologies quickly, focus on experimental therapies, and address rare or complex diseases without the operational constraints faced by larger hospital networks.

mRNA Therapeutics Market Revenue, By End User, 2022-2024 (USD Million)

| By End User | 2022 | 2023 | 2024 |

| Hospitals & Clinics | 16,271.75 | 11,172.88 | 11834.51 |

| Research Organizations | 6,741.50 | 4,594.46 | 4830.21 |

| Other | 4,247.17 | 2,878.99 | 3010.28 |

Type Insights

The therapeutic segment is predicted to witness significant growth over the studied period. While prophylactic vaccines gained early attention, therapeutic mRNA applications are now expanding into diverse areas such as rare genetic disorders, protein replacement therapies, autoimmune diseases, and regenerative medicine. Unlike traditional drugs, therapeutic mRNA enables the body to produce specific proteins on demand, opening possibilities for treatments that were previously infeasible. Advances in chemical modification of mRNA strands and optimization of delivery platforms are improving stability, reducing immune rejection, and increasing treatment success rates, which is drawing strong interest from both biotech startups and established pharmaceutical firms.

mRNA Therapeutics MarketCompanies

- Alnylam Pharmaceuticals

- Arcturus Therapeutics

- Argos Therapeutics Inc.

- AstraZeneca plc.

- BioNTech SE

- CRISPR Therapeutics AG

- Curevac AG

- Etherna Immunotherapies

- Ethris GMBH

- GSK plc.

- IN-CELL-ART

- Ionis Pharmaceuticals, Inc

- Moderna Therapeutics

- Nutcracker

- Pfizer Inc.

- Sangamo Therapeutics, Inc.

- Sanofi AG

- Sarepta Therapeutics

- Tiba Biotech

- Translate Bio, Inc.

Recent Developments

- BioNTech has recently supercharged its mRNA therapeutic capabilities by acquiring CureVac, a significant move that enhances its research, development, manufacturing, and commercialization strength in personalized cancer immunotherapy. This acquisition, valued at approximately $1.25 billion, consolidates BioNTech's position in the oncology segment and unifies intellectual property, expertise, and pipeline assets. At the same time, BioNTech settled a patent dispute with CureVac and GSK through a compensation agreement that includes upfront payment and ongoing royalties, smoothing the way for future collaboration and synergy. This maneuverer not only eliminates legal hurdles but also signals BioNTech's commitment to aggressively advancing next-gen mRNA cancer therapies.

(Source: BioNTech settles Covid-19 patent dispute with CureVac ) - A scientific breakthrough emerged from a collaborative research team in Warsaw, who identified the enzyme TENT5A as a natural regulator that extends the poly (A) tail of mRNA therapeutic molecules effectively prolonging their stability and functional lifespan inside cells. This discovery is akin to Turing an hourglass upside down, granting mRNA therapies extended time to produce desired proteins or antigens within the body. By stabilizing mRNA therpaeutucs, TENT5A has the potential to significantly improve the efficacy of future treatments across various applications, from vaccines to protein replacement therapies.

(Source: ‘Tremendous uncertainty' for cancer research as US officials target mRNA vaccines | Trump administration | The Guardian )

Segments Covered in the Report

By Application

- Oncology

- Respiratory Diseases

- Infectious Diseases

- Others

By Type

- Prophylactic Vaccines

- Therapeutic Vaccines

By End User

- Hospitals & Clinics

- Research Organizations

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content