List of Contents

What is Pressure Monitoring Market Size?

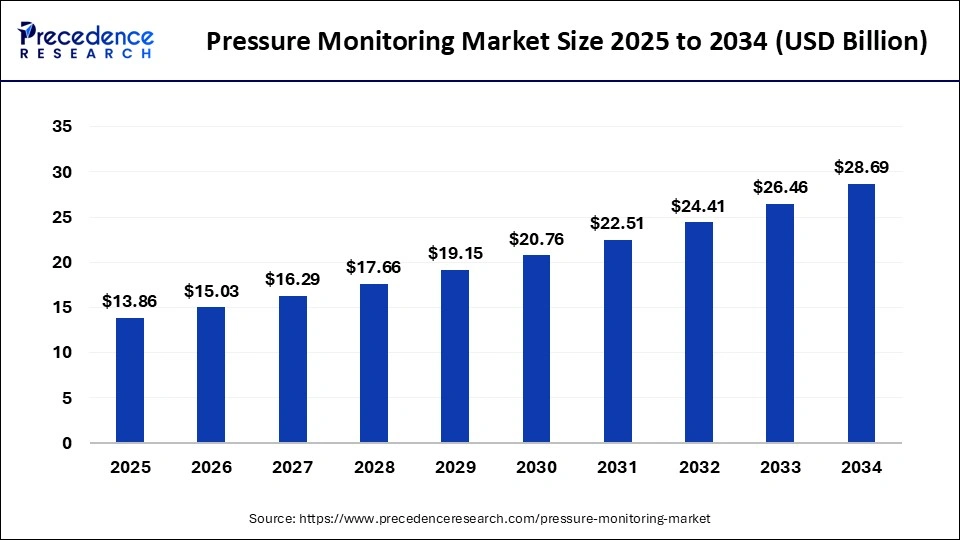

The global pressure monitoring market size is projected to be worth around USD 28.69 billion by 2034 from USD 13.86 billion in 2025, at a CAGR of 8.42% from 2025 to 2034. The rising prevalence of chronic diseases, such as hypertension and cardiovascular diseases, is the key factor driving pressure monitoring market growth. The increasing population of senior people can fuel market growth further.

Market Highlights

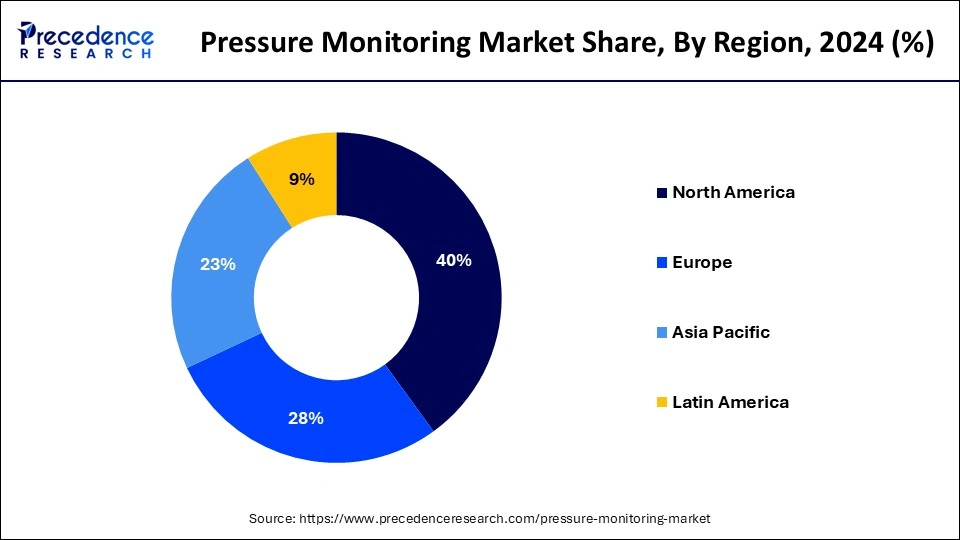

- North America dominated the pressure monitoring market with the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a significant rate in the market over the studied period.

- By product, the BP monitors/cardiac pressure monitors segment generated the biggest market share of 41% in 2024.

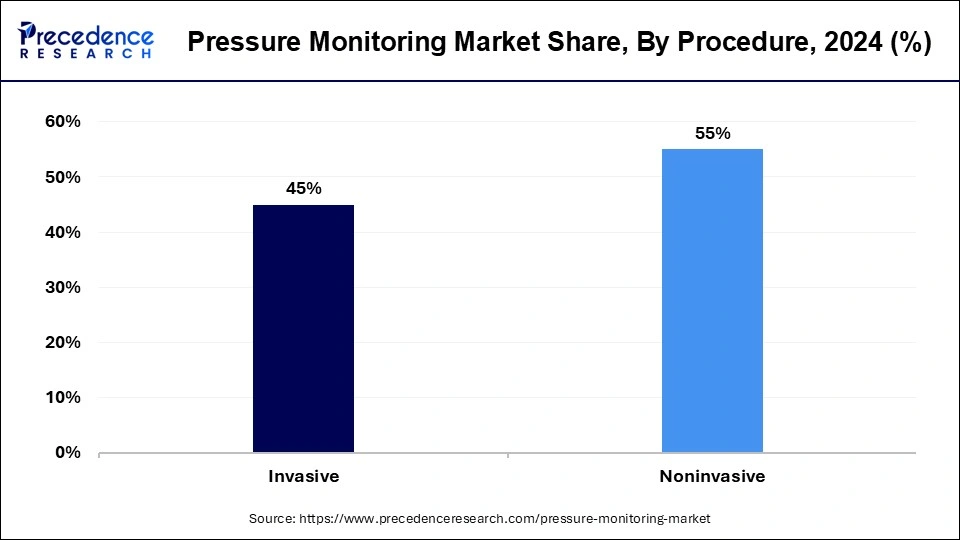

- By procedure, the noninvasive segment accounted for the highest market share of 55% in 2024.

- By application, the cardiac disorders segment generated the biggest market share of 42% in 2024.

- By application, the respiratory disorders segment is anticipated to grow at the fastest rate in the market over the projected period.

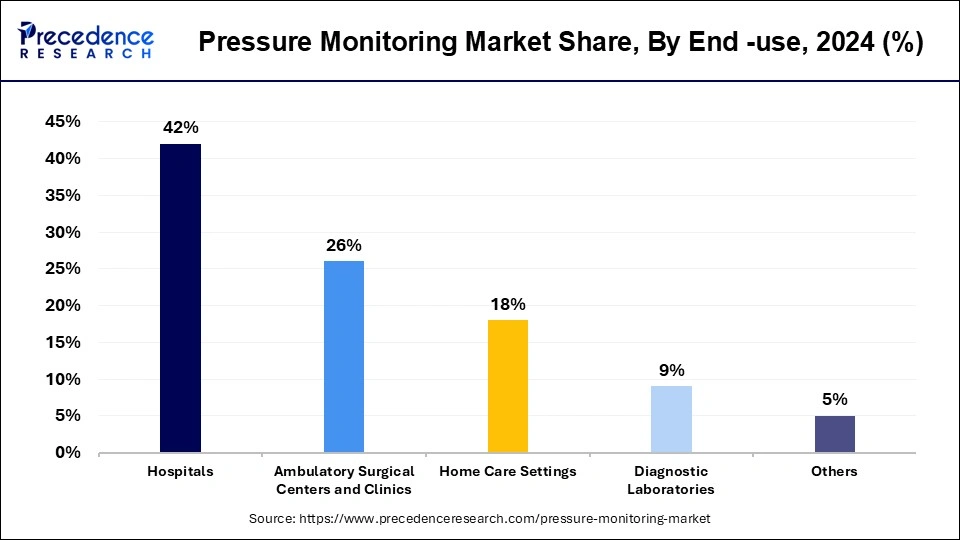

- By end-use, the hospital's segment captured more than 42% of market share in 2024.

- By end-use, the home monitoring segment is expected to witness rapid growth in the market throughout the forecast period.

Market Overview

Pressure monitoring devices are tools designed to monitor and measure pressure in different systems and environments. Pressure is defined as the force applied over a given area, which has a unit called Pascal's. Monitoring pressure is important in various medical, industrial, and environmental applications. Pressure monitoring devices have sensors that often utilize technologies such as strain gauges, piezoelectric, and capacitive sensing to detect accurate pressure changes. Pressure transducers are extensively used in medical, automotive, and industrial applications for accurate pressure measurement and control.

The AI Revolution in the Pressure Monitoring Market

AI has shown notable results in managing and predicting hypertension during pregnancy. In the pressure monitoring market, the integration of telemedicine into postmortem and prenatal care was boosted during the pandemic, which allows better BP monitoring and outpatient management. Furthermore, research using ML technology has helped develop personalized care models and understand the risks associated with them.

- In January 2024, Nanowear, a leader in healthcare-at-home remote diagnostics, announced that its nanotechnology-enabled wearable and software platform, SimpleSenseTM, has received FDA 510(k) clearance for a novel AI-enabled software-as-a-medical device (SaMD).

Pressure Monitoring Market Growth Factors

- A rise in innovations such as integration with digital health platforms and wireless connectivity is expected to drive the pressure monitoring market.

- The increasing shifts of patients from hospital care to home care settings.

- Mergers and acquisitions (M&A) activity among the key players in the pressure monitoring market.

- Growing industrial automation is expected to boost the pressure monitoring market.

- Increase in chronic conditions- The increase in hypertension, cardiovascular diseases, and respiratory conditions is driving demand for continuous pressure monitoring devices for timely diagnosis and management of disorders.

- Remote patient monitoring- The rise of remote care models is increasing the number of disposables, remote, and wearable, or home-based pressure monitoring devices that are helping to track vital signs and other patient information outside of the hospital, leading to improved long-term care.

- IoT and wireless technologies- Pressure monitoring systems are changing from traditional measures to wearables, Bluetooth-enabled, smart devices, which will help clinicians to better maintain patient data and records, monitor patients, and reference understanding of a person's blood pressure in patient records.

- Miniaturization and portability of devices- Miniaturization and advances in microelectronics are allowing new portable personal pressure monitors to emerge, which can easily be carried and used, allowing ease of use for the public and for elderly and mobile patients.

Pressure monitoring Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rising cases of hypertension in numerous countries along with technological advancements in the healthcare sector globally.

- Major Investors: Numerous medical device companies are actively entering this market, drawn by partnerships, R&D and business expansions. Various market players such as Briggs Healthcare, Rossmax International Ltd., Spacelabs Healthcare Inc. and some others have started investing rapidly for developing advanced pressure monitoring devices across the world.

- Startup Ecosystem:Various startup brands are engaged in developing advanced monitoring devices for detecting blood pressure. The prominent startup brands dealing in blood pressure monitoring includes Acorai, STAT Health, Biobeats and some others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.86 Billion |

| Market Size in 2026 | USD 15.03 Billion |

| Market Size by 2034 | USD 28.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Procedure, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing preference for home monitoring

The increasing preference for home monitoring is substantially fueling the pressure monitoring market. Many individuals nowadays take charge of their health and wellness. Additionally, there is a growing trend towards monitoring key signs within the comfort of one's home. Devices like respiratory pressure monitors and blood pressure monitors have become necessary tools for people managing chronic conditions like respiratory disorders and hypertension. These devices also help individuals to check their health regularly.

- In May 2024, OMRON Healthcare India collaborates with AliveCor to launch portable ECG monitoring devices in India. With a deeper dive into cardiovascular health, the company has unearthed the crucial role of Afib as a significant contributor to stroke and cardiovascular disease risk.

Restraint

Lack of awareness regarding hypertension treatment in developing economies

High blood pressure is the most prevalent form of disease in developing nations. These regions also have much higher BP averages than the rest of the world. In the pressure monitoring market, individuals with high blood pressure are somewhat ignorant of their illness because of a lack of access to medications that might help them control their BP and lessen the fatal risk associated with heart disease and stroke.

Opportunity

The growing popularity of wearable home blood pressure monitoring devices

The rising trend of utilizing wearable home blood pressure monitoring devices and their integration with smartphone apps can create lucrative opportunities for the pressure monitoring market. Furthermore, wearable patient-monitoring equipment observes different signs of a person, including respiratory rate, heart rate, and blood pressure. The devices also produce a large amount of data that can be used to analyze and predict the future results of patient monitoring. Moreover, smartphone apps are necessary for better analysis and processing of provided health information.

- In March 2022, India's Amrita University launched a wearable device for home monitoring of glucose and BP. Patients can use the wearable, non-invasive device to measure six body parameters, including blood glucose, blood pressure, heart rate, blood oxygen, respiratory rate, and 6-lead ECG, from the comfort of their home.

Segment Insights

Products Insights

The BP monitors/cardiac pressure monitors segment led the pressure monitoring market in 2024 and is expected to grow rapidly over the forecast period. The growth of the segment can be attributed to the rising prevalence of CVD and hypertension along with Technological advancements like wearable wireless devices. Additionally, the growth of home healthcare solutions and telehealth services can contribute significantly to segment growth. By making these devices more convenient and accessible for patients globally.

- In May 2024, Philips presents study results at the Heart Rhythm Annual Meeting, demonstrating the benefits of its AI-powered cardiac monitoring solutions. Three studies demonstrate how Philips MCOT wearable ambulatory monitoring ECG and proprietary AI models applied to ECG digital biomarkers can help to improve diagnosis, reduce readmissions, and lower costs.

Procedure Insights

The noninvasive segment dominated the pressure monitoring market in 2024. The growth and dominance of the segment can be credited to the rising patient preference for noninvasive methods because of their comfort, safety, and reduced risk of major complications compared to invasive procedures.

Application Insights

The cardiac disorders segment dominated the pressure monitoring market in 2024. This is due to the rising aging populations and increasing incidence of cardiovascular disorders among elderly populations. Also, enhanced healthcare infrastructure and ongoing government initiatives further boost market growth.

The respiratory disorders segment is anticipated to grow at the fastest rate in the pressure monitoring market over the projected period. The growth of the segment can be linked to the rising prevalence of conditions like chronic obstructive pulmonary disease (COPD), asthma, and pulmonary hypertension. Moreover, advancements in pressure monitoring technology, including noninvasive and portable devices, have enhanced patient outcomes and disease management.

End-use Insights

The hospital's segment led the pressure monitoring market in 2024. This is because of the rising need for continuous and accurate patient monitoring along with the advancement in medical technology. Additionally, the growth of healthcare infrastructure improves the adoption of convenient pressure monitoring devices in hospitals by enhancing patient care and outcomes.

The home monitoring segment is expected to witness rapid growth in the pressure monitoring market throughout the forecast period. The growth of the segment can be driven by a rising preference for home-based health management systems and the increasing availability of user-friendly monitoring devices. Furthermore, technological developments have made it easier for individuals to track their blood pressure and vital signals from home, which can help patients control their chronic conditions effectively.

Regional Insights

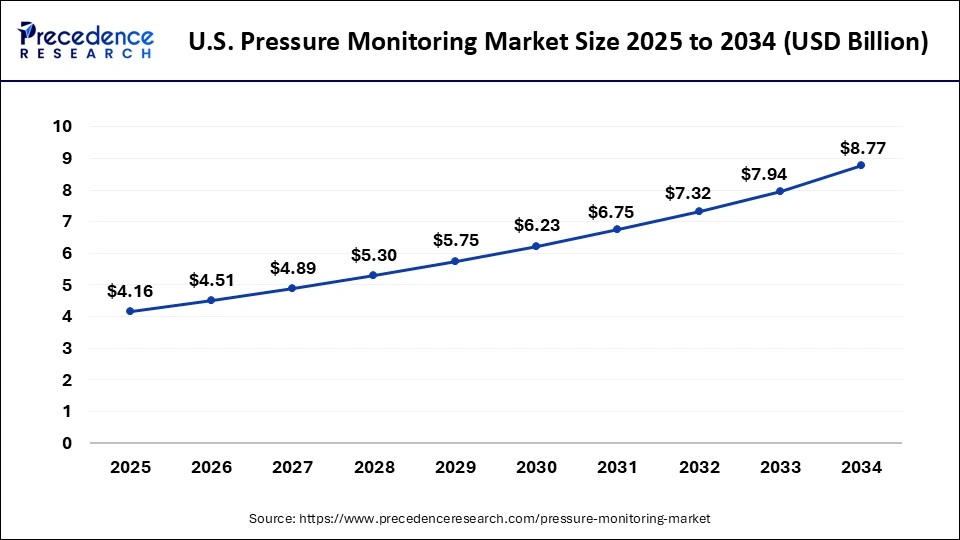

U.S. Pressure Monitoring Market Size and Growth 2025 to 2034

The U.S. pressure monitoring market size is exhibited at USD 4.16 billion in 2025 and is projected to be worth around USD 8.77 billion by 2034, poised to grow at a CAGR of 8.64% from 2025 to 2034.

North America dominated the pressure monitoring market in 2024. The region's growth can be credited to the rising incidence of hypertension and high blood pressure, along with innovative monitoring technologies and increasing health awareness among most of the population. Furthermore, more precise and user-friendly home monitoring devices are increasingly establishing an extensive trend toward preventive healthcare.

- In April 2023, Cadence and Providence introduced a remote patient monitoring program to enhance quality and access to home-based care. Two successful clinic launches in Washington have shown strong patient engagement and medication adherence among those with congestive heart failure and hypertension.

Asia Pacific is expected to grow at a significant rate in the pressure monitoring market over the studied period. The rise of online healthcare platforms stimulates easy access to innovative monitoring devices, which enables individuals to manage their blood pressure at home. Moreover, the China pressure monitoring market is experiencing advances due to significant healthcare investments coupled with the strong presence of key players in the region.

Top 10 countries with the highest hypertension treatment rate in women in 2019

| Ranking | Country | Rate as % of all Women with Hypertension |

| 1. | Republic of Korea | 77% |

| 2. | Costa Rica | 76% |

| 3. | Kazakhstan | 74% |

| 4. | United States | 73% |

| 5. | Iceland | 72% |

| 6. | Venezuela | 71% |

| 7. | El Salvador | 71% |

| 8. | Portugal | 71% |

| 9. | Canada | 71% |

| 10. | Slovakia | 70% |

What led Europe to hold a significant share of the pressure monitoring market?

Europe held a significant share of the market. The rising cases of neurological disorders in several countries such as Germany, Italy, UK, France and some others has boosted the market expansion. Additionally, rapid investment by market players for opening up new manufacturing centers to increase the production of pressure monitoring devices is expected to drive the growth of the pressure monitoring market in this region.

Why Latin America held a considerable share of the pressure monitoring market?

Latin America held a considerable share of the industry. The growing prevalence of cardiac problems in numerous countries such as Brazil, Argentina, Peru and some others has driven the market growth. Also, the presence of numerous market players along with rising sales of automated Bp monitors is expected to boost the growth of the pressure monitoring market in this region.

How is Middle East & Africa contributing to the pressure monitoring market?

The Middle East & Africa held a notable share of the market. The increasing number of respiratory disorders in various nations such as UAE, Saudi Arabia, South Africa and some others has propelled the industrial expansion. Additionally, rapid investment by government for developing the healthcare sector is expected to accelerate the growth of the pressure monitoring market in this region.

Key Players in Pressure Monitoring Market and their Offerings

- Dragerwerk: Drägerwerk, or Dräger, is a German company founded in 1889 that manufactures medical and safety technology products. The company provides solutions for hospitals (including anesthesia machines, patient monitoring, and ventilation) and for industrial/emergency sectors (such as respiratory protection, gas detection, and hazmat suits).

- Omron Healthcare: Omron Healthcare is a global company that develops and manufactures medical equipment for home and professional use, with a focus on preventing lifestyle diseases like hypertension, diabetes, and obesity. Its product line includes blood pressure monitors, thermometers, nebulizers, body composition monitors, and massage devices.

- Welch Allyn, Inc.: Welch Allyn is a U.S.-based manufacturer of medical diagnostic and monitoring devices. This company manufactures numerous products such as otoscopes, ophthalmoscopes, and patient monitors for use in hospitals, clinics, and other healthcare settings.

- A&D Medical Inc.: A&D Medical Inc. is a division of A&D Company, Limited is known for manufacturing biometric monitoring solutions including blood pressure monitors, weight scales, and activity monitors for consumer and professional use. This company is a global leader in connected health devices and technology, with a long history of producing clinically validated products that prioritize accuracy and reliability.

- SunTech Medical, Inc.: SunTech Medical, Inc. is a company specializing in clinical-grade blood pressure monitoring technology, including OEM solutions for other companies, ambulatory blood pressure monitoring, and products for cardiac stress testing and veterinary use. This brand is a global leader in motion-tolerant blood pressure measurement and operates within the Halma medical sector.

- American Diagnostics Corp.: American Diagnostic Corporation (ADC) is a global manufacturer of diagnostic medical products, including stethoscopes, blood pressure instruments, and EENT devices, founded in 1984. This company is known for designing and distributing a wide range of healthcare products, both under its own brands and as a private-label supplier.

- Withings: Withings is a health technology company that specializes in smart devices like hybrid smartwatches, activity trackers, smart scales, and thermometers that monitor health metrics like heart rate, sleep, and body composition. This brand creates a wide range of health and wellness devices including hybrid smartwatches with advanced features such as ECG and blood oxygen monitoring.

- Briggs Healthcare: Briggs Healthcare is a US-based provider of medical equipment and supplies. This company serves a wide range of healthcare markets including assisted living, home care, and hospitals, with a focus on improving operational efficiency and compliance for healthcare facilities.

- Rossmax International Ltd.: Rossmax International Ltd. is a Taiwanese-based company that develops and supplies a wide range of medical devices for hypertension, respiratory care, blood glucose management, and some others. This company's product portfolio includes devices such as blood pressure monitors, nebulizers, blood glucose meters, and thermometers, with a global distribution network.

Recent Developments

- In October 2025, UTime Limited launched blood pressure monitoring smartwatch. This smartwatch is based on the Oscillo metric method for blood pressure measurement and incorporates a micro air pump with a high-precision pressure sensor. (Source: https://in.investing.com)

- In September 2025, Huawei launched a new smartwatch. This new smartwatch is capable of monitoring blood pressure of hypertension patients.

(Source: https://www.moneycontrol.com) - In September 2025, Sky Labs launched CART BP. CART BP is ring-type cuffless blood pressure monitor designed for the patients of South Korea.

(Source: https://www.biospectrumasia.com) - In January 2024, Tire Monitoring System (TMS) launched a new tire pressure monitoring system (TPMS) specifically designed for industrial and Off-the-Road (OTR) vehicles. Their new TPMS is designed to address the needs of vehicles used in mining, earth-moving, mobile cranes, container ports, and mass-transit systems. Technical advancements have been added to all areas of the TMS system, including the Hub, Display, App, and Sensors.

- In July 2023, Smart Meter, the leading supplier of cellular remote patient monitoring (RPM) solutions, announced the launch of its latest innovative product: the first cellular-connected, multi-cuff blood pressure monitor specifically designed for RPM and chronic care management (CCM). The revolutionary cellular RPM device sets a new standard in patient care with enhanced accuracy and remote monitoring capabilities.

- In April 2023, Maxtec's MaxO2 ME+p oxygen monitor, featuring integrated pressure monitoring, received FDA clearance and is now available for purchase in the United States, according to a product launch announcement from Perma Pure Group. By providing real-time, accurate data on oxygen concentration and pressure, the MaxO2 ME+p helps healthcare providers ensure that their patients are receiving the correct therapy.

- In January 2024, Pylo Health unveiled the release of two advanced patient devices: the Pylo 200-LTE weight scale and the Pylo 900-LTE blood pressure monitor.

- In July 2024, Lindus Health and Aktiia announced the initiation of a clinical trial to assess user satisfaction with Aktiia's optical blood pressure monitoring (OBPM) device among individuals with hypertension.

- In August 2023, EPIC Health, Detroit's community-centered health system, and OMRON Healthcare announced a new partnership to tackle health disparities and lower the risk of heart attacks and strokes in underserved Detroit neighborhoods.

Segments Covered in the Report

By Product

- BP Monitors/Cardiac Pressure Monitors

- Device

- Automated Bp Monitors

- Ambulatory Bp Monitors

- Sphygmomanometers

- Bp Transducers

- Accessories

- Bp Cuffs

- Manometers

- Valves & Tubings

- Bulbs

- Device

- Pulmonary Pressure Monitors

- Device

- Oximeters

- Capnographs

- Spirometers

- Accessories

- Flanged Mouthpieces

- Nasal Probes & Plugs

- Filters

- Device

- Intraocular Pressure Monitors

- Device

- Accessories

- Prisms

- Tip Covers

- Sensors

- Intracranial Pressure Monitors

By Procedure

- Noninvasive

- Invasive

By Application

- Respiratory Disorders

- Glaucoma

- Cardiac Disorders

- Neurological Disorders

- Dialysis

- Others

By End-use

- Hospitals

- Home Care Settings

- Ambulatory Surgical Centers & Clinics

- Diagnostic Laboratories

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client