What is the 3D Machine Vision Market Size?

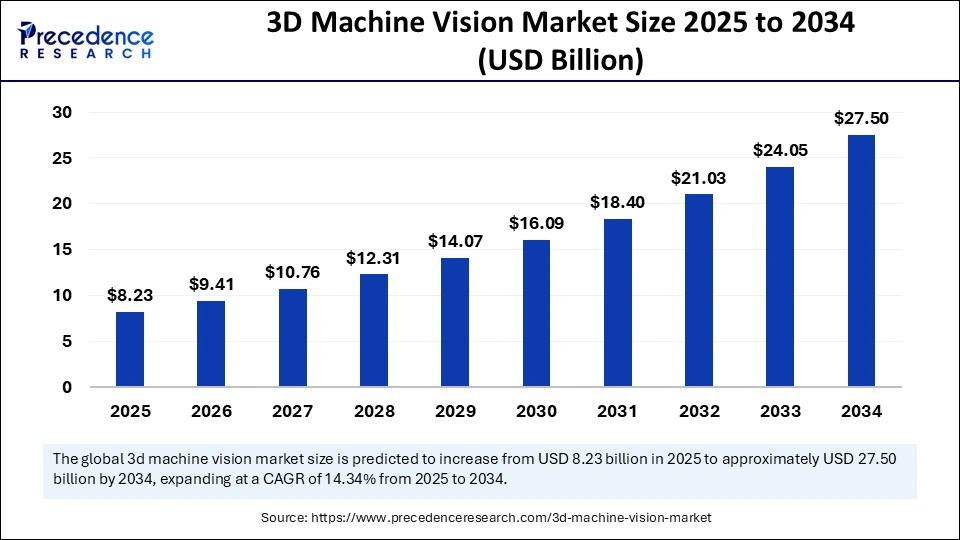

The global 3D machine vision market size is calculated at USD 8.23 billion in 2025 and is predicted to increase from USD 9.41 billion in 2026 to approximately USD 27.50 billion by 2034, expanding at a CAGR of 14.34% from 2025 to 2034. Increasing demand for automation across different industrial sectors is the key factor driving market growth. Also, the ongoing adoption of innovative technologies in 3D machine vision, coupled with the rising demand for precise inspection, can fuel market growth further.

3D Machine Vision Market Key Takeaways

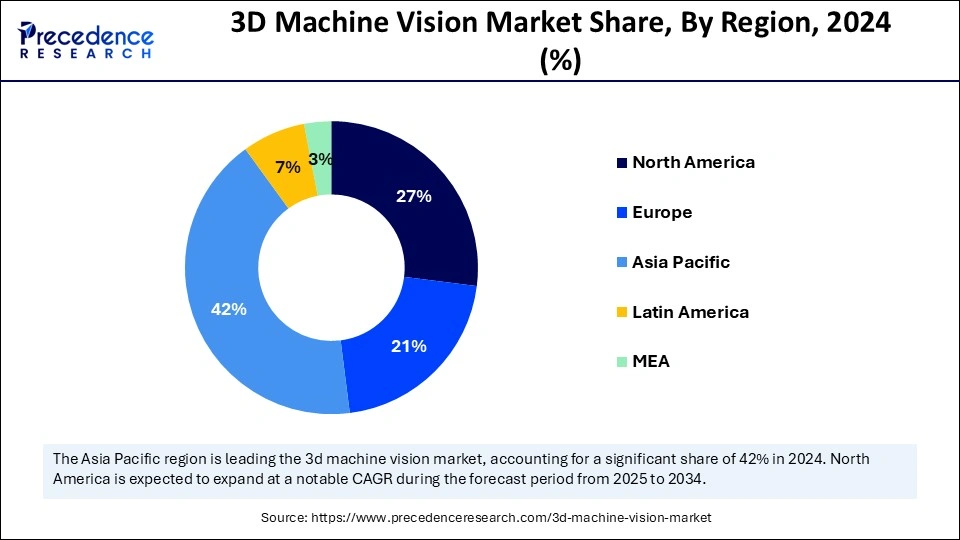

- Asia Pacific dominated the global market with the largest market share of 42% in 2024.

- North America is expected to grow at the fastest CAGR over the projected period.

- By offering, the hardware segment contributed the biggest market share 71% in 2024.

- By offering, the software segment is expected to grow at the fastest CAGR over the forecast period.

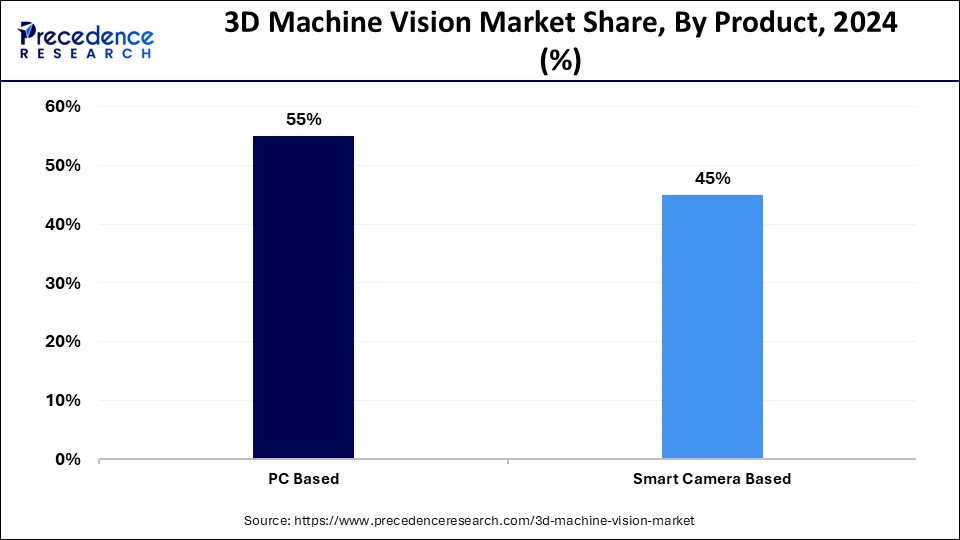

- By product, the PC-based products segment held the largest market share of 55% in 2024.

- By product, the smart-camera-based segment is anticipated to grow at the fastest CAGR over the forecast period.

- By application, the quality assurance and inspection segment captured the highest market share of 52% in 2024.

- By application, the identification segment is estimated to grow at the fastest CAGR over the forecast period.

- By end use, the automotive segment generated the major market share of 20% in 2024.

- By end use, the food and beverage industry segment is anticipated to grow fastest over the forecast period.

Artificial Intelligence: The Next Growth Catalyst in the 3D Machine Vision Market

Artificial Intelligence plays a transformative role in the market by improving capabilities such as precise measurements, automated defect detection, and integration with robotics, which leads to increased accuracy and efficiency in different industries. Furthermore, AI-driven 3D vision systems can easily identify and classify defects, minimizing manual inspection efforts and enhancing overall product quality. AI can be utilized to process vast datasets generated by these systems.

- In December 2024, Zebra Technologies, a leading digital solution provider enabling businesses to intelligently connect data, assets, and people, announced it intends to acquire Photoneo, a leading developer and manufacturer of 3D machine vision solutions.

Strategic Overview of the Global 3D Machine Vision Industry

The 3D machine vision market encompasses the technology that enables machines to understand and perceive the 3D structure of objects in their surroundings. This is done by capturing images from many angles, using sensors and cameras, and then utilizing software to create a 3D model. This ability of 3D machines enables a more detailed understanding of an object's size, shape, and spatial orientation, which makes it valuable in applications like logistics, manufacturing, and quality control.

3D Machine Vision Market Growth Factors

- The surge in production of automobiles across the globe is expected to boost the 3D machine vision market growth shortly.

- The growing use of 3D vision in metrology and inspection applications can propel market growth soon.

- The increasing demand for vision-guided robotics, especially in warehousing and logistics, will likely contribute to the market expansion further.

Market Outlook:

- Market Growth Overview: The 3D Machine Vision market is expected to grow significantly between 2025 and 2034, driven by the rising industrial automation, innovation in imaging hardware and software, enhanced system capabilities, and expansion in diverse sectors.

- Sustainability Trends: Sustainability trends involve waste reduction and resource efficiency, energy efficiency in hardware, and sustainable manufacturing processes.

- Major Investors: Major investors in the market include Hexagon AB, Siemens and Emerson Electric Co., Avnet, and T. Rowe Price Associates.

- Startup Economy: The startup economy is focused on robotic guidance and automation, specialized hardware components, and sector-specific solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 27.5 Billion |

| Market Size in 2025 | USD 8.23 Billion |

| Market Size in 2026 | USD 9.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.34% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Product, Application, End Use and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing adoption of Industry 4.0 technologies

The increase in emphasis on Industry 4.0 by major players is the key factor driving the growth of the market. Machine vision is the most important component of automation technologies in Industry 4.0. Combining 3D machine vision in factories enables more flexible and efficient production. In addition, quality control can be substantially enhanced by incorporating 3D machine vision to detect faults in the products.

In April 2024, Cognex Corporation, the leader in industrial machine vision, released the Insight L38 3D Vision System, which combines AI, 2D, and 3D vision technologies to solve a range of inspection and measurement applications.

Restraint

Complexity of integration

3D imaging systems are generally hard to maintain, difficult to install, and challenging to run without skilled personnel. Cost-sensitive customers may prefer 2D vision systems over 3D imaging as they are less expensive than 3D systems. However, many end-user requirements create substantial hurdles for companies, particularly the manufacturing industry, which emphasizes product customization, hindering market expansion further.

Opportunity

Rising need for automated quality inspection technology

The surge in demand for automation and quality inspection across various end-user industries will likely create future market opportunities in the market. Also, the demand for vision-guided robotic systems in food and beverage, pharmaceutical and chemical, automotive, and packaging is impacting market growth positively. Furthermore, major pharmaceutical companies are creating innovative anti-obesity drugs for weight management and loss, which can be inspected by 3D machine vision.

- In May 2024, Orbbec, an industry leader dedicated to 3D vision systems, announced its partnership with global distributors DigiKey and Computech, bolstered by the recent expansion of its management team. This initiative aims to streamline the purchasing process for developers and enterprise customers, offering a contemporary e-commerce experience.

Offering Insights

The hardware segment dominated the 3D machine vision market in 2024. The dominance of the segment can be attributed to the growing demand for innovative sensor technologies and imaging systems. Hardware components like lasers, cameras, and lighting systems play an important role in offering precise and high-resolution data in machine vision systems. Additionally, the forward push towards automation and growing demand for high-quality inspections in manufacturing can drive segment growth shortly.

The software segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing emphasis on the Internet of Things (IoT) and smart manufacturing that supports the growth of software offerings. Companies need adaptable solutions that smoothly combine different hardware systems. Also, deep learning in technology is contributing to the segments' overall growth.

Product Insights

The PC-based products segment held the largest 3D machine vision market share in 2024. The dominance of the segment can be linked to the rising digitalization of daily work and life, along with the surge in e-commerce, gaming, and digital services. The increasing shift towards online education and remote work has propelled the demand for high-performance and reliable PCs, especially tablets and laptops.

The smart-camera-based segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by a surge in the use of these cameras for high-resolution purposes. In addition, without any human intervention, these cameras are capable of interpreting guiding objects and labels. These properties of smart cameras are influencing how technology can be utilized across various industrial sectors.

- In March 2025, ADLINK announced a partnership with LIPS to launch the AMR 3D x AI Vision Solution, utilizing NVIDIA Isaac Perceptor to enhance autonomous mobile robots (AMRs) with advanced 3D vision and edge computing capabilities.

Application Insights

In 2024, the quality assurance and inspection segment led the 3D machine vision market by holding the largest market share. The growth of the segment can be linked to the growing focus on product quality and compliance across different end-user industries like packaging and labeling, and automotive. Also, market players prioritize adherence to strict quality standards to decrease costs related to returns and rework, which impels them to adopt 3D machine vision systems.

- In January 2025, Rockwell Automation introduced FactoryTalk Analytics VisionAI, a cutting-edge inspection solution that leverages artificial intelligence (AI) and machine learning to revolutionize quality control in manufacturing.

The identification segment is estimated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the growth of the e-commerce industry and the surge in the need for precise order fulfillment. Additionally, organizations rely more on automated systems for managing and tracking inventory, which makes identification technologies important.

End Use Insights

The automotive segment dominated the 3D machine vision market in 2024. The dominance of the segment is owing to the growing use of 3D Machine vision systems in this industry for inspection purposes, which consists of assembly verification, error proofing, absence/presence checking, and final inspection. Moreover, the need for mechanized imaging is substantial across the automobile sector and is expected to grow substantially.

The food and beverage segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the rising demand for automation, quality control, and efficiency in areas such as sorting, packaging, and inspection. Furthermore, this technology can be extensively utilized in packaging and bottling operations for tasks such as barcode recognition, label scanning, and defect detection.

Regional Insights

Asia Pacific 3D Machine Vision Market Size and Growth 2025 to 2034

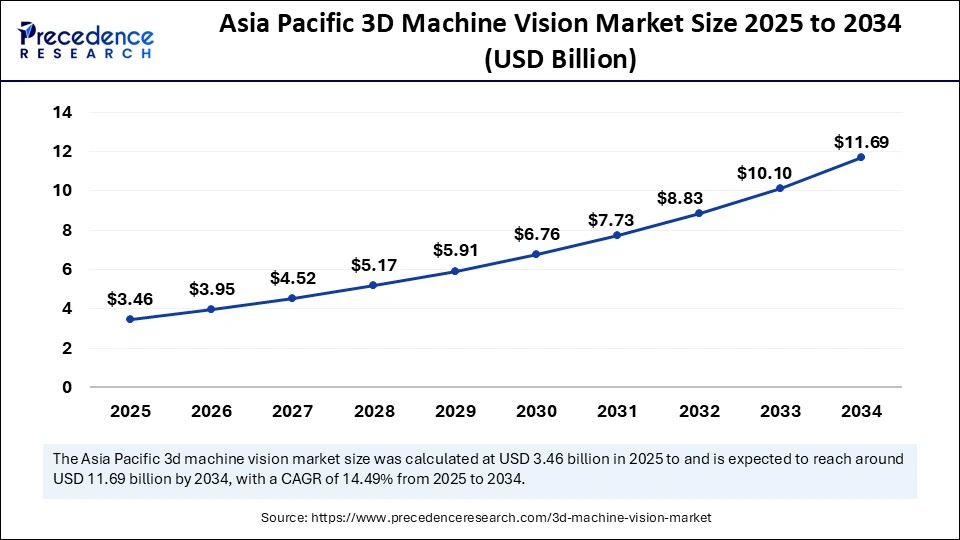

Asia Pacific 3D machine vision market size is exhibited at USD 3.46 billion in 2025 and is projected to be worth around USD 11.69 billion by 2034, growing at a CAGR of 14.49% from 2025 to 2034.

Asia Pacific dominated the 3D machine vision market in 2024. The dominance of the region can be attributed to the growing adoption of automation across different sectors like automotive and pharmaceuticals, coupled with the rapid industrialization in emerging economies. Moreover, countries like China and Japan are heavily investing in technological and manufacturing development. Also, government initiatives focusing on improving production capabilities are impacting positive regional growth further.

In Asia Pacific, China led the 3D machine vision market owing to the strong presence of major market players in the country. A large number of organizations are rapidly introducing strategic initiatives such as mergers, distribution agreements, and acquisitions, which in turn result in a surge in R&D expenditure in the market.

North America is expected to grow at the fastest rate over the projected period. The growth of the 3D machine vision market can be credited to the region's increasing emphasis on innovative manufacturing technologies and industrial automation. Furthermore, the region is rapidly prioritizing operational efficiency and quality control, which leads to a growing need for technology that combines smoothly with current systems and decreases product defects.

- In April 2024, Cognex Corporation, a global player in industrial machine vision, released the In-Sight L38 3D Vision System. The system combines AI, 2D, and 3D vision technologies to solve a range of inspection and measurement applications.

In North America, the U.S. dominated the 3D machine vision market. The dominance of the region can be driven by the ongoing expansion of the automotive sector in the country, along with the country's growing focus on advanced manufacturing technologies. The U.S. is a world leader in using automation, which drives the demand for efficient and precise manufacturing processes.

China 3D Machine Vision Market Trends

China's increased industrial automation, robotics, and strong government support through initiatives, deeper integration of AI, and deep learning to enhance inspection accuracy and automate processes in sectors such as electronics and automotive. The increasing demand for 3D machine vision systems for increased accuracy in robotic guidance and quality control in industries, such as automation, logistics, and electronics.

- In October 2025, Hikvision and SenseTime partnerships, these major Chinese AI and video surveillance companies, are heavily involved in developing and applying AI algorithms to machine vision systems, demonstrating the strong local push for intelligent imaging solutions. (https://www.hikvision.com)

U.S. 3D Machine Vision Market Trends

The U.S. 3D machine vision market is driven by increasing industrial automation, integration of AI, and deep learning to enhance inspection accuracy and automate processing for improved precision and efficiency. The advancements in imaging hardware and significant R&D spending align with Industry 4.0 and smart manufacturing initiatives.

Value Chain Analysis of the 3D Machine Vision Market

- Research & Development (R&D) and IP Development

This stage involves the foundational research to develop new imaging technologies, advanced algorithms for 3D reconstruction, and AI-powered analysis, and core intellectual property.

Key players: Cognex Corporation, SICK AG, Basler AG, and LMI Technologies. - Hardware Component Manufacturing

This stage focuses on producing the physical components required for 3D vision systems, such as cameras, sensors (e.g., Time-of-Flight, structured light, stereo vision), lighting systems, optics, and processors.

Key players: Intel (RealSense technology), Basler AG (cameras), and Sony (sensors) - Software Development & Integration Platforms

This involves creating the software that processes the 3D data, performs analysis, and interfaces with other factory automation systems.

Key players: MathWorks, MVTec Software GmbH (HALCON), Cognex, Keyence, and LMI Technologies. - System Assembly & Manufacturing

System manufacturers integrate the hardware components and software platforms into complete, functional 3D machine vision systems.

Key players: Keyence Corporation, Hexagon AB, FANUC Corporation, and ISRA VISION GmbH. - Distribution & Sales

The completed systems are distributed through a combination of direct sales teams, value-added resellers (VARs), and system integrators. - Installation, Integration & End-User Operations

After the sale, experts install the systems into production lines or robotic cells, train personnel, and ensure seamless integration with existing manufacturing execution systems (MES) or ERP software.

Key players: General Motors, Samsung, and Amazon Logistics

Top Companies in the 3D Machine Vision Market & Their Offerings

- Basler AG: Basler is a leading manufacturer of high-quality cameras and components for machine vision applications, including a wide range of 3D camera technologies.

- Cognex Corporation: Cognex is a dominant player in the machine vision market, providing integrated 3D vision systems that combine lighting, optics, camera, and processing software in an easy-to-deploy package.

- National Instrument Corporation (new part of Emerson Electric Co): National Instruments (NI) provides a flexible, software-centric platform, including hardware and software that engineers use to build custom 3D machine vision systems.

- OMRON Corporation: Omron offers a comprehensive suite of automation solutions, including advanced 3D vision sensors and smart cameras that are integrated with robotics and manufacturing systems.

- SICK AG: SICK is a leading sensor manufacturer that contributes a wide range of 3D vision sensors and systems using various technologies like Time-of-Flight and stereo vision.

- Allied Vision Technologies GmbH: Allied Vision specializes in industrial camera technology and provides high-performance cameras, including those specifically designed for 3D image capture.

- Software Solution Inc.: Software Solution, now an Avnet company, contributes to the market through its expertise in AI, data analytics, and digital transformation services for 3D machine vision.

- Visionatics Inc.: Visionatics focuses on providing high-performance 3D vision software and solutions for industrial automation applications.

- Keyence Corporation: Keyence provides comprehensive 3D machine vision systems, offering integrated hardware and software solutions that are easy to use and deploy directly on the factory floor.

- National Instruments Corporation (Duplicate of third company): As mentioned previously, National Instruments (NI) provides a flexible, software-centric platform including hardware and software that engineers use to build custom 3D machine vision systems.

3D Machine Vision Market Companies

- Basler AG

- Cognex Corporation

- National Instruments Corporation

- OMRON Corporation

- Sick AG

- Allied Vision Technologies GmbH

- Softweb Solutions Inc. (An Avnet Company)

- Visionatics Inc.

- Keyence Corporation

- National Instruments Corporation

Latest Announcement by Market Leaders

- In December 2024, OMRON Electronic Components, a global leader in electronic components and products, announced the latest edition of its G5Q global standard compact power relay, G5Q-HR. The G5Q-HR was designed with innovative features that work to enhance performance and extend operational life, even in challenging environments.

- In November 2023, Basler AG announced its new partnership with the technology company Siemens. This strategic partnership will make it much easier for automation customers in all industries to integrate machine vision solutions directly into their automation systems. The cooperation between Basler and Siemens will bring significant benefits to customers.

Recent Developments

- In August 2024, SICK AG and Endress+Hauser Group Services AG entered a strategic partnership focused on process automation to support decarbonization in the industry. The collaboration involves establishing a joint venture for developing process-related solutions. This partnership aims to enhance innovation and provide comprehensive solutions for the process industry.

- In September 2024, Basler AG, a company that manufactures imaging components for computer vision applications, launched Pylon AI software that enhances machine vision applications by integrating AI capabilities, allowing users to implement advanced image processing and analysis.

- In October 2023, KITOV Systems Ltd., a smart inspection planning company, announced the launch of the K-BOX line of machine vision systems that integrates 3D imaging, AI, and other advanced technologies. The K-Box machine vision system can be used for various applications, including automated inspections.

Segment Covered in the Report

By Offering

- Hardware

- Camera

- Frame Grabber

- Optics

- LED Lighting

- Processor

- Software

- Application Specific

- Deep Learning Software

By Product

- PC Based

- Smart Camera Based

By Application

- Quality Assurance and Inspection

- Positioning and Guidance

- Measurement

- Identification

By End Use

- Automotive

- Pharmaceuticals and Chemicals

- Electronics and Semiconductors

- Pulp and Paper

- Printing and Labeling

- Food and Beverage (Packaging and Bottling)

- Glass and Metal

- Postal and Logistics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting