Adult Clinical Nutrition Market Size and Forecast 2025 to 2034

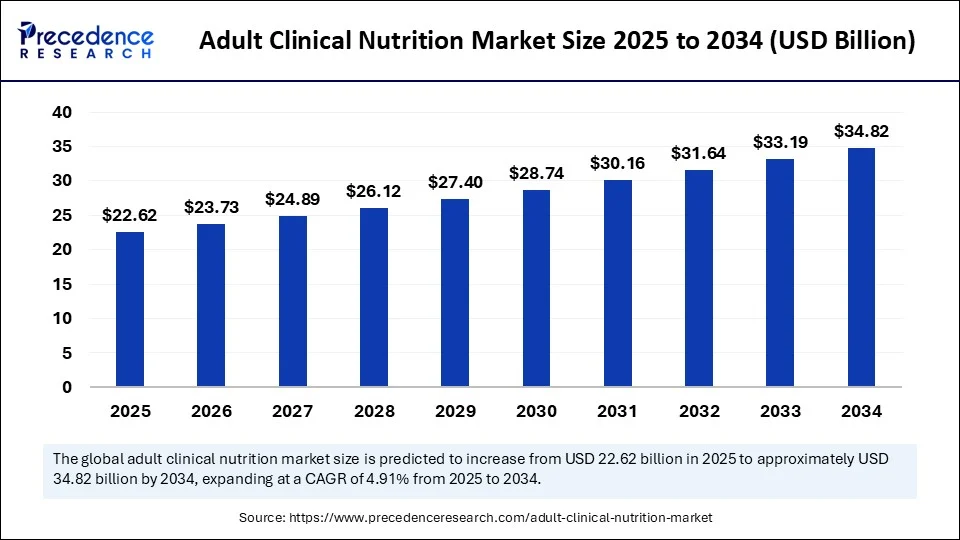

The global adult clinical nutrition market size was estimated at USD 21.56 billion in 2024 and is predicted to increase from USD 22.62 billion in 2025 to approximately USD 34.82 billion by 2034, expanding at a CAGR of 4.91% from 2025 to 2034. The adult clinical nutrition market is experiencing growth due to the aging population, the rising prevalence of chronic diseases, and greater awareness of specialized nutritional needs.

Adult Clinical Nutrition Market Key Takeaways

- In terms of revenue, the global sodium tetraborate market was valued at USD 21.56 billion in 2024.

- It is projected to reach USD 34.82 billion by 2034.

- The market is expected to grow at a CAGR of 4.91% from 2025 to 2034

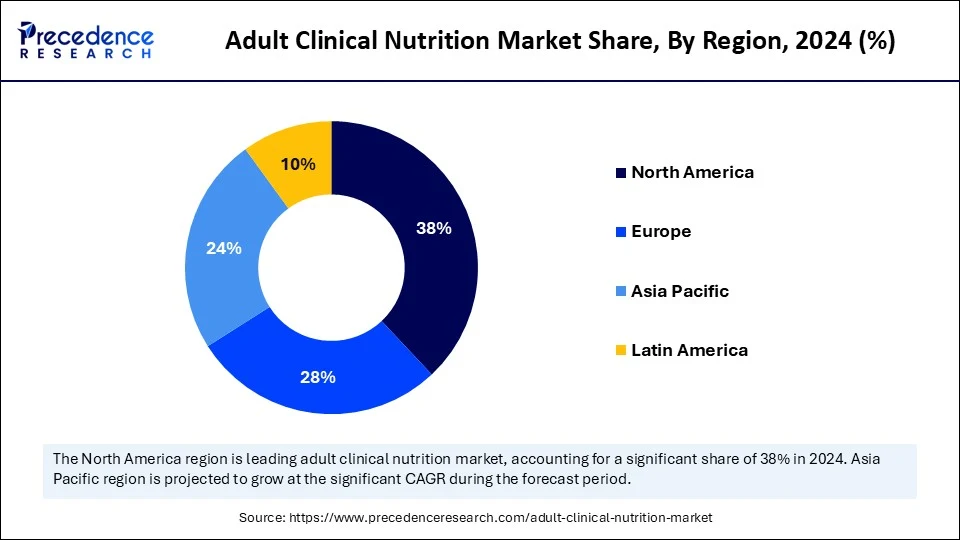

- North America held a major revenue share of 38% in the adult clinical nutrition market in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By product type, the oral nutritional supplements segment held the maximum revenue share of 47% in the market in 2024.

- By product type, the enteral nutrition segment is expected to witness the fastest growth in the market over the forecast period.

- By formulation type, the standard formulas segment held the maximum revenue share of approximately 48% in the adult clinical nutrition market in 2024.

- By formulation type, the specialized formulas segment is expected to witness the fastest growth in the market over the forecast period.

- By patient care, the geriatric patients segment held the maximum revenue share of approximately 43% in the market in 2024.

- By patient care, the oncology patients segment is expected to witness the fastest growth in the market over the forecast period.

- By distribution channel, the hospitals and clinics segment held the maximum revenue share of approximately 54% in the adult clinical nutrition market in 2024.

- By distribution channel, the online sales/e-commerce segment is expected to witness the fastest growth in the market over the forecast period.

- By end user channel, the hospitals segment held the maximum revenue share of 62% in the market in 2024.

- By end user channel, the home care segment is expected to witness the fastest growth in the market over the forecast period.

How AI Is Impacting the Adult Clinical Nutrition Market?

Artificial intelligence is transforming the adult clinical nutrition market by enabling highly personalized nutritional recommendations based on patient-specific data. AI algorithms can analyze medical histories, lab reports, and dietary patterns to craft optimized nutrition plans that address individual needs. This not only improves patient adherence but also ensures better treatment outcomes. Predictive analytics powered by AI can forecast nutrient deficiencies before they become critical, enabling preventive interventions. Moreover, AI-driven automation in manufacturing ensures consistent quality and faster formulation development. Hospitals and clinics are also leveraging AI-powered apps to monitor patient nutrition intake in real-time. Ultimately, AI is bridging the gap between science and individualization patient care in this market.

U.S. Adult Clinical Nutrition Market Size and Growth 2025 to 2034

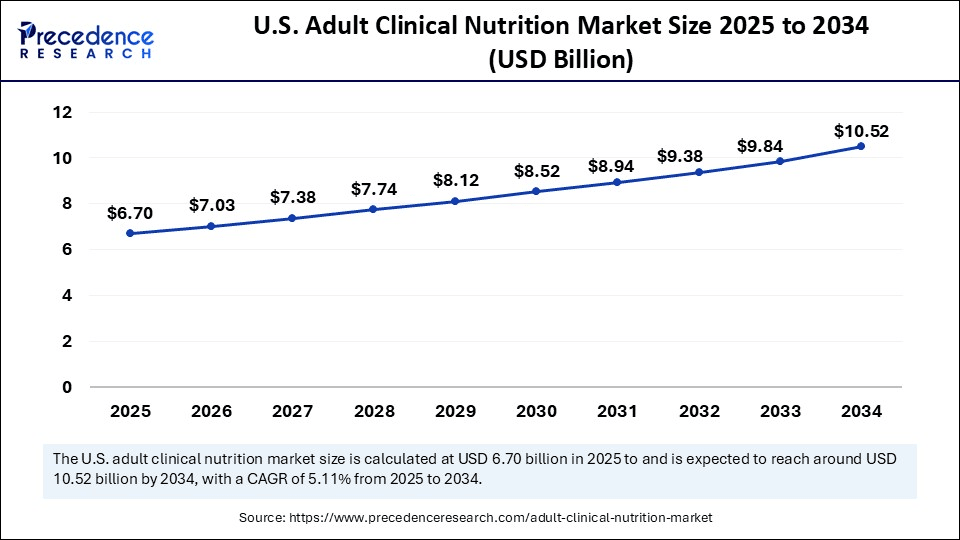

The U.S. adult clinical nutrition market size was evaluated at USD 6.39 billion in 2024 and is projected to be worth around USD 10.52 billion by 2034, growing at a CAGR of 5.111% from 2025 to 2034.

Why Is North America Known as a Nutritional Powerhouse?

North America continues to dominate the adult clinical nutrition market, due to its advanced healthcare infrastructure and strong emphasis on medical nutrition as part of patient care. High prevalence of lifestyle-related chronic diseases drives consistent demand. Leading market players in the region are heavily investing in R&D to develop specialized and disease-specific formulations. Hospitals and long-term care facilities are integrating nutrition therapy into standard treatment protocols. Public and private insurance coverage for clinical nutrition is expanding, enhancing patient access. Additionally, the region benefits from a high level of awareness among healthcare professionals and patients alike.

U.S. dominates in North America, as it is seeing the growth in home-based nutrition support programs, driven by aging demographics and patient preference for recovery outside hospitals. Technological integration, such as AI-assisted patient monitoring, is further optimizing nutrition plans. Collaboration between healthcare providers and nutrition manufacturers is ensuring a steady flow of innovative products. The presence of global leaders headquartered in North America strengthens its position as a trendsetter. Moreover, government-backed nutrition education campaigns contribute to a supportive market environment. These combined factors are expected to maintain North America's leadership in the sector.

Why Is Asia-Pacific the Rising Nutritional Frontier?

Asia Pacific continues to dominate the adult clinical nutrition market, driven by rapid urbanization, increasing healthcare expenditure, and a rising burden of diseases. The region's expanding urban centers contribute significantly to the demand for advanced nutritional solutions tailored to adults. Healthcare spending and infrastructure development in these countries have been steadily rising, allowing for greater adoption of specialized nutrition products in hospitals and clinics.

Additionally, increasing awareness among healthcare professionals and patients about the role of nutrition in recovery and overall health is fueling market growth. Governments and private entities are investing more in the development of clinical nutrition infrastructure and research. As a result, the Asia Pacific region is witnessing substantial growth opportunities in the clinical nutrition sector, shaping the future landscape of healthcare.

China is the fastest-growing in Asia Pacific, and government initiatives in China are promoting nutrition-focused healthcare programs, which in turn foster market growth. Private investments are flowing into hospital infrastructure and home care services, creating new distribution channels. Multinational players are forming partnerships with local companies to navigate regional regulations and tap into untapped markets. The rising popularity of e-commerce in healthcare distribution is also making clinical nutrition products more readily available. As affordability improves, Asia-Pacific is set to become a major growth engine for the global market.

Nourishment Meets Science

The adult clinical nutrition market refers to the commercial space involving specialized nutritional products formulated and administered to adults who require tailored nutritional support due to clinical conditions. These products are used in hospitals, nursing homes, outpatient settings, or home care for patients suffering from malnutrition, chronic illnesses, post-surgical recovery, metabolic disorders, or critical care needs. Clinical nutrition helps improve patient outcomes by addressing nutrient deficiencies, enhancing immune function, and supporting recovery and quality of life.

The adult clinical nutrition market is witnessing steady growth, driven by rising incidences of chronic diseases, an aging population, and increasing awareness of the role of nutrition in recovery. Products range from oral nutritional supplements to enteral and parenteral feeding solutions, catering to both hospital and home care settings. Technological advancements in formulation and delivery methods are enhancing patient convenience and compliance. The shift towards preventive healthcare is also boosting demand for clinically backed nutritional interventions. Furthermore, healthcare systems are recognizing nutrition as an integral part of medical treatment, not just supportive care. This evolving perception is significantly expanding market potential.

Market Key Trends

- Growing adoption of plant-based and allergen-free formulations.

- Increased preference for home-based nutritional care solutions.

- Integration of telehealth with nutrition monitoring tools.

- Expansion of clinical nutrition in preventive health programs.

- Development of nutrient-dense, low-volume formulations for critical patients.

- Rising investments in R&D for targeted medical nutrition therapies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 34.82 Billion |

| Market Size in 2025 | USD 22.62 Billion |

| Market Size in 2024 | USD 21.56 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.91% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Formulation Type, Patient Type, Distribution Channel , End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Driving Growth Towards Nutritional Awareness

One of the primary drivers in the adult clinical nutrition market is the rising global awareness of the critical role nutrition plays in patient recovery, and diseases such as cancer, diabetes, and cardiovascular disorders have increased demand for specialized nutrition support. Healthcare providers are increasingly prescribing clinical nutrition products for a wider population. Government initiatives promoting nutritional education in hospitals are further boosting adoption. The expansion of healthcare facilities in emerging economies is providing access to quality nutrition products for a wider population. Overall, patient and provider awareness is serving as a strong engine for market growth.

Restraints

Challenges in Feeding the Market

Despite strong growth prospects, the adult clinical nutrition market faces challenges such as high product costs, which can limit access in low-income regions. Stringent regulatory approvals can slow down the launch of new formulations, affecting innovation timelines. Supply chain disruptions, particularly for specialized ingredients, can impact product availability. Patient compliance due to taste fatigue or gastrointestinal discomfort is another hurdle. In certain regions, a lack of trained professionals to administer advanced nutritional therapies with innovation remains a persistent market restraint.

Opportunity

Opportunity Knocks on Nutritional Innovation

The growing focus on personalized medicine opens vast opportunities for targeted adult clinical nutrition solutions. Advancements in biotechnology enable the development of formulations tailored to genetic profiles, metabolic rates, and specific disease conditions. The rising trend of home healthcare presents an untapped opportunity for ready-to-use, portable nutrition packs. Emerging markets, with their expanding middle-class populations, are showing heightened demand for premium and specialized nutrition products. Collaborations between tech firms and healthcare providers are expected to produce innovative delivery methods and monitoring tools. This wave of innovation could significantly expand market penetration and acceptance worldwide.

Product Type Insights

Why Oral Nutritional Supplements Are Dominating the Adult Clinical Nutrition Market?

The oral nutritional supplements segment has become a dominant force in the adult clinical nutrition market. Its growth is driven by increasing awareness of nutritional health and the rising number of health-conscious consumers. These supplements are widely used to address nutritional deficiencies and enhance overall wellness. The convenience and accessibility of these products have further boosted their popularity. Manufacturers are continually innovating to offer a broader range of formulations to meet diverse dietary needs. As a result, the segment is expected to maintain its growth trajectory in the coming years.

The sub-segment of ready-to-drink supplements is dominating the oral nutrition supplements segment, due to their popularity, convenience, and no-preparation requirement. Patients with limited mobility or reduced appetite find these pre-formulated drinks highly practical. They are ideal for both inpatient and home care settings, ensuring consistent nutrient intake without an added preparation burden. Their single-serving packaging also ensures precise portion control, which is crucial for accuracy. Enhanced shelf stability and innovative packaging have further increased their adoption. As healthcare systems seek solutions that promote patient compliance, ready-to-drink formulations are emerging as a game-changer in patient nutrition care.

The enteral nutrition segment is expected to experience the fastest growth in the adult clinical nutrition market during the forecast period, driven by increasing cases of dysphagia (also this may lead to aphasia too), neurological disorders, and severe chronic conditions where oral intake is inadequate. Administered via feeding tubes, enteral nutrition ensures targeted and consistent nutrient delivery, often becoming a lifeline for critically ill patients. Its rise is also fueled by improved formulations that are easier to digest and better tolerated. In ICUs and long-term care facilities, it plays a critical role in preventing malnutrition-related complications. The ability to customize feeds based on patient-specific metabolic needs further boosts its relevance. As the aging population grows, the demand for enteral nutrition is projected to surge.

Within the eternal, formula customization is a key growth driver. Specialized formulas target diabetes management, respiratory disorders, renal insufficiency, and immunocompromised states, improving clinical outcomes while lowering healthcare costs. Technological improvements in feeding pumps and delivery systems are making administration more efficient and patient-friendly. Eternal nutrition also enables patients to transition from hospital to home settings without compromising nutritional quality. Increasing awareness among caregivers about proper tube feeding protocol is further facilitating growth.

Formulation Type Insights

How Are Standard Formulas Dominating the Adult Clinical Nutrition Market?

The standard formulas segment has become a dominant force in the market, driven by baseline nutritional requirements for most adult patients without specialized dietary needs. They are widely used across hospitals, nursing homes, and home care due to their cost-effectiveness and universal applicability. These formulations are suitable for a broad patient base, simplifying procurement and stock management for healthcare providers. Their balanced macro- and micronutrient profile supports general recovery and maintenance. Bulk availability and consistent supply make them a preferred choice in both public and private healthcare sectors. With strong market penetration, standard formulations remain the go-to solution for routine clinical nutrition.

The specialized formulas segment is expected to experience the fastest growth in the adult clinical nutrition market during the forecast period, as it caters to patients with specific medical conditions, such as renal imprints, diabetes, or gastrointestinal disorders. These products provide targeted nutrient profiles, optimizing recovery and reducing disease-related complications. They often include benefits such as enhanced digestibility, anti-inflammatory ingredients, or immune-boosting compounds. By improving clinical outcomes, they reduce the length of hospital stays and overall treatment costs. Their growing demand reflects the shift toward personalized medicine in nutrition care. As chronic diseases rise, specialized formulations are poised to be the fastest-growing segment in clinical nutrition.

Patient Type Insights

How Will Geriatric Patients Dominate in the Year 2024?

The geriatric patient segment has become a dominant force in the adult clinical nutrition market, due to age-related metabolic decline, chronic illnesses, and increased risk of malnutrition. Clinical nutrition products help maintain muscle mass, support immune function, and enhance quality of life in older adults. These patients often have difficulty chewing, swallowing, or digesting, making tailored nutrition essential. Healthcare professionals routinely prescribe oral or enteral nutrition to address these challenges. As global life expectancy rises, the need for geriatric-focused nutritional care is intensifying. This segment's stability is reinforced by ongoing medical and social support programs targeting elder nutrition.

The oncology patients segment is expected to experience the fastest growth in the market for adult clinical nutrition during the forecast period, due to severe nutrient depletion, weight loss, and reduced appetite. Clinical nutrition plays a vital role in maintaining strength and tolerance to therapies. Specially formulated products for oncology patients can help manage treatment side effects such as nausea, taste changes, and swallowing difficulties. Nutritional intervention in cancer care has been shown to improve survival rates and quality of life. The segment's growth is driven by rising cancer prevalence and the increasing recognition of nutrition as a critical part of comprehensive cancer treatment.

Distribution Channel Insights

Why Hospitals and Clinics Are the Nutritional Gatekeepers?

The hospitals and clinics segment has become a dominant force in the market, especially for patients in acute or critical care. Physicians and dietitians play a central role in prescribing and monitoring these nutritional interventions. Hospital-based sales benefit from bulk procurement, ensuring consistent availability for inpatients. Clinical settings also serve as platforms for initiating patients on specific nutrition plans before transitioning them to home care. The trust associated with medical institutions enhances product credibility and adoption. This dominance is expected to continue due to their central role in patient diagnosis, treatment, and nutritional monitoring.

The online sales/e-commerce segment is expected to experience the fastest growth in the adult clinical nutrition market during the forecast period, driven by the rise of e-commerce platforms and patient preferences for home delivery. These platforms provide easy access to a wide range of clinical nutrition products, often at competitive prices. Subscription models and direct-to-consumer offerings are making regular supply more convenient. Online education about nutrition products is also boosting consumer confidence. Online education about nutrition products is also boosting consumer confidence. For homecare patients, ordering online eliminates logistical challenges, especially in remote areas. The segment's acceleration reflects the broader digital shift in healthcare delivery.

End User Type Insights

How Are Hospitals Principal in the Adult Clinical Nutrition Market?

The hospital segment has become a dominant force in the market, due to its role in treating critically ill and post-surgical patients. They require large volumes of nutrition supplies for both short-term and long-term patient care. Hospital protocols often include clinical nutrition as part of recovery plans, ensuring high utilization rates. The presence of trained dietitians and nutrition teams enhances the effectiveness of prescribed products. Strong relationships between manufacturers and hospital procurement departments further sustain this dominance. Hospitals are also hubs for clinical trials and product testing, reinforcing their central market role.

The homecare segment is expected to experience the fastest growth in the adult clinical nutrition market during the forecast period, due to its recovery in familiar surroundings. Clinical nutrition products designed for home use enable continuity of care post-discharge. Home-based nutrition plans improve patient comfort, compliance, and long-term health outcomes. This shift is supported by advancements in packaging, making products easier to store and prepare at home. Rising healthcare costs and hospital bed shortages are pushing providers to encourage home-based recovery. While greater access to telehealth and online ordering, homecare nutrition is becoming and practical and preferred choice for many patients.

Adult Clinical Nutrition Market Companies

- Abbott Laboratories

- Nestlé Health Science

- Danone S.A.

- Fresenius Kabi AG

- Baxter International Inc.

- Mead Johnson Nutrition

- Koninklijke DSM N.V.

- B. Braun Melsungen AG

- Perrigo Company plc

- Aenova Group

- Nutricia (Danone subsidiary)

- Kate Farms Inc.

- Clinimed Ltd

- Otsuka Pharmaceutical Co., Ltd.

- Vitaflo International Ltd

- Trophic Medical

- Eastman Kodak Company

- Medtrition Inc.

- BioCare Copenhagen A/S

- Nestlé Nutrition Institute

- Amway

Recent Developments

- In July 2024, Ahmedabad-based Torrent Pharmaceuticals introduced Shelcal Total, a newly formulated nutrition supplement powder aimed at supporting adult bone health. The product blends calcium, protein, and vitamin D3, providing a comprehensive solution for strengthening bones and enhancing overall well-being. Designed to meet the nutritional needs of adults, Shelcal Total is positioned as a convenient daily supplement that helps maintain bone density and support active lifestyles.(Source: https://health.economictimes.indiatimes.com)

- In August 2025, Emami, the Kolkata-headquartered FMCG giant, is poised to break into the nutraceuticals space with a science-backed and clinically validated range of products. This move aligns with the company's ambitious strategy to cultivate new engines of growth in high-margin, high-potential categories such as health foods, nutrition, pet care, and aloe vera-based fruit juices.(Source: https://www.thehindubusinessline.com)

Segments Covered in the Report

By Product Type

- Oral Nutritional Supplements (ONS)

- Ready-to-Drink (RTD) Supplements

- Powdered Nutritional Supplements

- Modular Component

- Enteral Nutrition

- Standard Formulas

- Disease-Specific Formulas

- Diabetes-Specific

- Renal-Specific

- Pulmonary-Specific

- Gastrointestinal-Specific

- Oncology-Specific

- Others

- Specialized Formulas

- Peptide-Based Formulas

- Elemental/Free Amino Acid Formulas

- Parenteral Nutrition (PN)

- Total Parenteral Nutrition (TPN)

- Partial Parenteral Nutrition (PPN)

- Standardized Premixed Solutions

- Customized Solutions

By Formulation Type

- Standard Formulas

- Disease-Specific Formulas

- Specialized Formulas

By Patient Type

- General Adult Patients

- Geriatric Patient

- Critical Care Patients

- Oncology Patients

- Diabetic Patient

- Renal Patients

- Others

By Distribution Channel

- Hospitals and Clinics

- Retail Pharmacies

- Online Sales / E-commerce

- Home Care Settings

- Specialty Clinics / Nutrition Centers

By End User

- Hospitals

- Home Care

- Long-term Care Facilities / Nursing Homes

- Ambulatory Care

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting