What is Blood Glucose Monitoring Market Size?

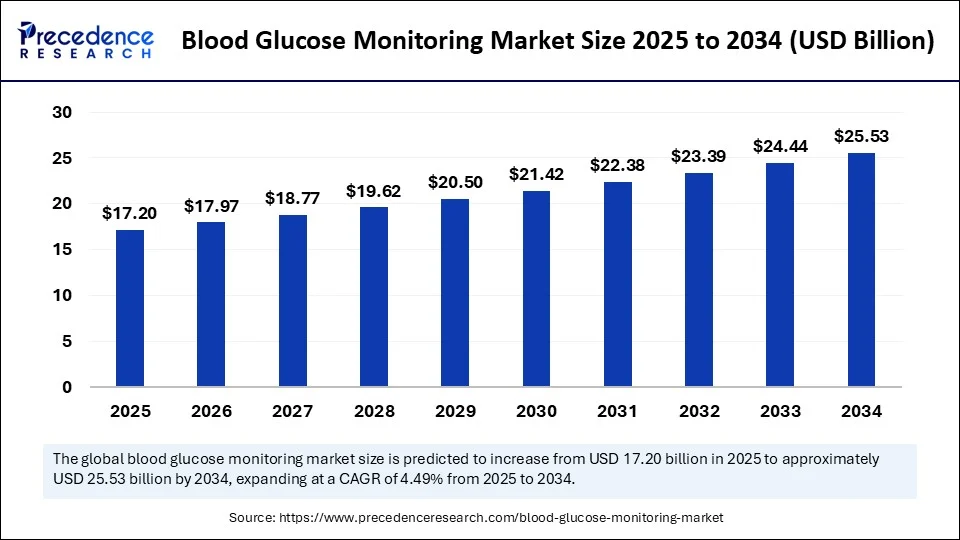

The global blood glucose monitoring market size is calculated at USD 17.20 billion in 2025 and is predicted to increase from USD 17.97 billion in 2026 to approximately USD 26.59 billion by 2035, expanding at a CAGR of 4.45% from 2026 to 2035. The growth of the market is driven by advancements in technology and the rising prevalence of diabetes worldwide.

Market Highlights

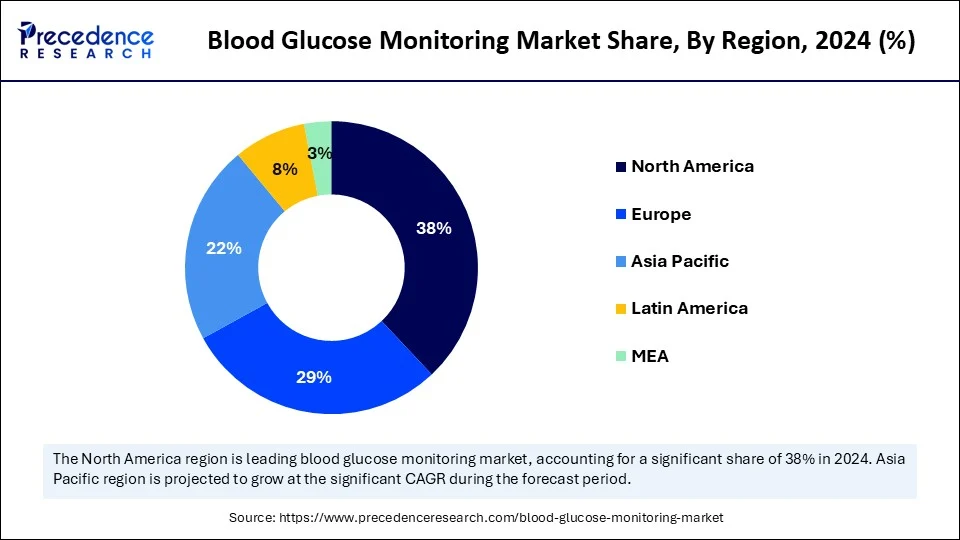

- North America dominated the blood glucose monitoring market with the largest market share of 38% in 2025.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2026 to 2035.

- By product type, the self-monitoring blood glucose (SMBG) devices segment held the biggest market share of 31% in 2025.

- By product type, the continuous glucose monitoring (CGM) systems segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By modality, the invasive segment captured the highest market share of 78% in 2025.

- By modality, the non-invasive segment is expected to grow at the fastest CAGR between 2026 to 2035.

- By end-user, the home care settings segment generated the major market share of 46% in 2025.

- By end-user, the hospitals & clinics segment is expected to grow at a remarkable CAGR between 2026 to 2035.

- By patient demographics, the type 2 diabetes segment held the largest market share of 64% in 2025.

- By patient demographics, the prediabetes / at-risk population segment is expected to grow at a remarkable CAGR between 2026 to 2035.

- By distribution channel, the retail pharmacies segment accounted for the significant market share of 39% in 2025.

- By distribution channel, the online pharmacies segment is expected to grow at a remarkable CAGR between 2026 to 2035.

- By technology, the electrochemical biosensors segment captured the highest market share of 58% in 2025.

- By technology, the wearable and AI-integrated segment is expected to grow at a remarkable CAGR between 2026 to 2035.

Impact of AI on the Blood Glucose Monitoring Market

Artificial intelligence is revolutionizing the blood glucose monitoring market by enabling real-time monitoring, predictive analytics, and treatment personalization. AI algorithms can now forecast glucose fluctuations based on a user's historical data, lifestyle habits, and food intake. These insights help prevent hypo or hyperglycemic episodes more efficiently than traditional methods. Integration with wearable devices and mobile apps offers patients intelligent alerts and actionable recommendations. For healthcare providers, AI enables remote monitoring and trend visualization, improving decision-making for insulin therapy and medication adjustments. This intelligent automation is elevating patient outcomes while reducing clinical workload.

Market Overview

The blood glucose monitoring market encompasses devices and technologies used to measure and track blood glucose (sugar) levels in individuals, primarily for the management of diabetes. These devices are critical for diagnosing hyperglycemia and hypoglycemia, personalizing treatment plans, and preventing long-term complications of diabetes. The market includes both invasive and non-invasive systems, such as Self-Monitoring Blood Glucose (SMBG) devices, Continuous Glucose Monitoring (CGM) systems, and Integrated Insulin Delivery Systems, along with accessories like sensors, strips, and lancets.

The blood glucose monitoring market is evolving rapidly, driven by innovation in sensor technology, user-friendly interfaces, and compact devices. Both self-monitoring blood glucose devices and continuous glucose monitoring systems are seeing increased adoption, offering flexibility based on user needs. Consumer preference is shifting toward non-invasive, wearable, and smartphone-integrated solutions. The market is witnessing increased penetration in home care, remote care, and outpatient settings. Key players are focusing on affordability and interoperability with digital health ecosystems. As monitoring becomes more proactive and less invasive, market participation is expanding across all age groups and geographies.

Key Market Trends

- Rise of Non-Invasive Technologies: There is a significant shift toward non-invasive glucose monitoring solutions as consumers increasingly prefer methods that do not require finger-pricking. This trend is expected to drive innovation and demand for wearable devices that track glucose levels continuously and painlessly.

- Integration of AI and Smart Technologies: The incorporation of artificial intelligence in blood glucose monitoring devices is transforming how patients manage their diabetes. AI algorithms analyze data to provide real-time insights and predictive analytics, leading to better glucose management and personalized treatment plans.

- Shift Toward Home Care and Remote Monitoring: The demand for blood glucose monitoring devices in home care settings is growing, driven by the rise in telehealth and remote patient monitoring solutions. This trend reflects a broader movement towards self-management and patient empowerment in healthcare.

- Focus on User-Friendly Interfaces and Connectivity: As technology evolves, there is an emphasis on creating devices with user-friendly interfaces. Integration with smartphones and health apps allows for seamless data tracking and enhances user engagement, making it easier for patients to manage their condition.

- Growing Prevalence of Diabetes and At-Risk Populations: With rising obesity rates and lifestyle-related diseases, the prevalence of diabetes and prediabetes is increasing globally. This surge ensures a steady demand for blood glucose monitoring products, as more individuals seek effective management solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.20 Billion |

| Market Size in 2026 | USD 17.97 Billion |

| Market Size by 2035 | USD 26.59 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.45% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Modality, End User, Patient Demographics, Distribution Channel, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Diabetes Prevalence and Technological Advancements

The escalating global burden of diabetes is the most significant driver of the blood glucose monitoring market. Rising health awareness and a growing population of pre-diabetic individuals are prompting early adoption of monitoring tools. Technological advancements in sensors, connectivity, and mobile integration are improving user compliance and convenience. Government health programs and reimbursement policies are also supporting device adoption across public healthcare systems. The increasing inclination toward preventive healthcare and self-care is accelerating adoption among younger demographics. Moreover, the rise of remote patient monitoring has solidified these devices' role in chronic disease management.

Restraint

High Costs and Regulatory Hurdles

Despite rapid growth, cost barriers remain a major challenge in low- and middle-income countries. Continuous glucose monitoring systems and test strips can be expensive and require recurring investments. Device accuracy, calibration issues, and skin irritation in wearables also pose limitations. Low awareness and poor digital literacy in rural areas hinder the adoption of digital technologies. Regulatory complexities and approval delays can restrict market entry for innovative devices. Furthermore, data privacy concerns related to AI-enabled devices and mobile integration raise trust issues among users.

Opportunity

Beyond Diabetes: Unlocking Market Opportunities

The market holds immense potential in expanding the role beyond diabetes management. Integration with fitness wearables opens the door to glucose monitoring for wellness and preventive care. Emerging markets offer vast opportunities with their growing middle-class population and improving healthcare infrastructure. Demand for CGM and non-invasive solutions in gestational and pediatric diabetes is creating niche segments. Public awareness campaigns play a vital role in encouraging preventive measures and timely medical consultations. Personalized health tracking platforms powered by glucose data are enabling lifestyle coaching and diet optimization. Innovations in biosensor technologies could lead to a multi-analyte device that monitors hydration, ketones, and glucose simultaneously.

Segment Insights

Product Type Insights

Why did the self-monitoring blood glucose (SMBG) devices segment dominate the market?

The self-monitoring blood glucose (SMBG) devices segment dominated the blood glucose monitoring market in 2024, with test strips holding the largest share as a sub-segment. Test strips are a critical component in blood glucose monitoring systems, particularly for self-monitoring of blood glucose (SMBG) by individuals with diabetes. These small, disposable strips play a vital role in providing accurate readings of blood sugar levels and are essential for effective diabetes management.

Test strips are designed to work with glucose meters. Users apply a small drop of blood onto the strip, which contains reagents that react with glucose to produce an electrical signal. This signal is then interpreted by the glucose meter, displaying the blood sugar level within seconds. The ease of use and quick results make test strips highly valuable for daily glucose monitoring.

Innovation in test strips has improved accuracy, reduced costs, and enhanced user experience. Advances in technology have led to the development of more efficient strips that require smaller blood samples and offer quicker results. Additionally, some manufacturers are working on integrating test strips with digital health platforms, allowing for better data tracking and analysis.

The continuous glucose monitoring (CGM) systems segment is expected to grow at the fastest rate over the projection period. These systems provide immediate data, trends, and notifications, enabling patients to proactively manage their diabetes. In contrast to traditional SMBG devices, CGMs deliver continuous glucose monitoring without the need for frequent finger pricks. The connection with smartphones and cloud-based systems facilitates effortless data sharing with healthcare professionals. This ongoing feedback loop improves decision-making regarding insulin, diet, and lifestyle choices. The comfort and discreet nature of wearables are attracting more users, particularly among younger age groups.

As healthcare shifts toward predictive and individualized care, integrated CGM systems are perfectly suited for this evolution. Their usage is rapidly increasing in hospitals and home healthcare, especially for individuals with type 1 diabetes or significant glycemic fluctuations. The growing interest in closed-loop insulin delivery systems (artificial pancreas) is also driving the adoption of CGMs. Furthermore, wearable sensors are becoming smaller, more durable, and less intrusive. Government subsidies and private insurance coverage are starting to include CGMs in certain markets, further accelerating their use. This category is anticipated to transform the benchmarks of contemporary diabetes management.

Modality Insights

How does the invasive segment lead the blood glucose monitoring market in 2024?

The invasive segment dominated the market in 2024. This segment includes finger-prick test strips and sensor-based CGM systems that require skin penetration. Despite advancements in non-invasive technologies, healthcare professionals and patients still trust invasive methods for consistent results. The maturity of these technologies makes them widely available, affordable, and FDA-cleared. For insulin dosing decisions, the precision offered by invasive tools is often considered irreplaceable. Their embeddedness in diagnostic protocols ensures continued relevance.

Many patients are familiar with invasive monitoring, leading to high compliance in daily routines. Device manufacturers have reduced invasiveness with thinner lancets and improved sensor designs. In critical care and gestational diabetes, invasive systems are often preferred for clinical accuracy. Hospitals and clinics also rely on these tools for baseline glucose monitoring. SMBG devices are typically the first recommendation for newly diagnosed patients. Thus, despite innovation in non-invasive options, invasive modalities continue to serve as the gold standard in diabetic care.

The non-invasive segment is expected to expand at the fastest CAGR in the upcoming period. Non-invasive technologies use optical sensors, spectroscopy, and electromagnetic waves to estimate blood glucose levels without skin puncture. Patients, especially children and the elderly, are more willing to adopt non-invasive alternatives for daily management. These devices are gaining attention in wellness, sports nutrition, and preventive health sectors beyond traditional diabetes care. Consumer interest is driven by wearable formats like wristbands, skin patches, and smart lenses. With enhanced comfort and convenience, non-invasive devices are reshaping user expectations.

Startups and tech giants alike are investing in developing reliable, regulatory-compliant non-invasive devices. Though not yet a clinical replacement, these tools are valuable for trend monitoring and early detection. Users appreciate the discretion and aesthetic appeal of these devices in public settings. The market is benefiting from convergence with fitness wearables and personalized health platforms. Advancements in sensor calibration and data interpretation are narrowing the accuracy gap with invasive methods. As trust grows, the non-invasive segment is poised to shift from complementary to mainstream in the coming years.

End User Insights

What made home care settings the dominant segment in the market in 2024?

The home care settings segment dominated the blood glucose monitoring market in 2024, as these settings have become increasingly prevalent, especially for individuals needing ongoing observation and management of chronic issues such as diabetes. These settings provide patients with more independence while ensuring they receive appropriate care and support. One key benefit of homecare is the precision of monitoring tools, which facilitate prompt interventions. Patients can monitor their blood glucose levels regularly with devices like self-monitoring blood glucose (SMBG) meters and continuous glucose monitors (CGMs) within their own homes.

This immediate access to information empowers patients to make well-informed choices regarding their health, which enhances adherence to treatment plans. In a homecare context, patients receive customized care that is adapted to their individual requirements. Healthcare providers can utilize integrated data monitoring systems to observe patients' progress, modify treatment protocols, and offer assistance through telehealth services. This method boosts patient involvement and cultivates a sense of ownership in their health journey.

The hospitals & clinics segment is expected to grow at the fastest rate during the projection period. This is mainly due to the increasing prevalence of diabetes and related health conditions. Healthcare providers are adopting advanced monitoring technologies to enhance patient care and treatment outcomes. Continuous glucose monitoring systems, in particular, are being integrated into clinical practices to facilitate better management of diabetes, allowing for real-time data analysis and timely interventions.

Additionally, the emphasis on personalized medicine encourages hospitals to utilize data-driven approaches to optimize insulin therapy and medication adjustments. As healthcare facilities increasingly focus on improving patient engagement and self-management, the demand for effective blood glucose monitoring solutions is likely to rise. This trend reflects a broader shift toward more integrated care models that prioritize patient-centered solutions within clinical environments.

Patient Demographics Insights

How does the type 2 diabetes segment lead the blood glucose monitoring market in 2024?

The type 2 diabetes segment dominated the market in 2024. This is mainly due to the high prevalence of type 2 diabetes, especially in aging population. Patients with type 2 diabetes often rely on regular monitoring to adjust medication, diet, and lifestyle. SMBG remains widely used, while CGM adoption is gradually increasing in this segment. The diversity of patient needs, from newly diagnosed to insulin-dependent, drives a wide range of product use. Health campaigns and digital coaching tools are also empowering these patients to self-manage effectively.

With urbanization and lifestyle changes, the prevalence of type 2 diabetes is rising, especially among younger adults, broadening the user base of blood glucose monitoring devices. These patients often prefer compact, smart-enabled devices that align with modern routines. Community health programs are actively targeting type 2 patients for screening and follow-up. Many commercial health insurance plans now cover blood glucose monitors for this group. Doctors frequently recommend monitoring blood glucose levels as part of a holistic approach to cardiovascular and metabolic health. This ensures the continued dominance of the type 2 demographic in the market.

The prediabetes / at-risk population segment is expected to expand at a significant CAGR in the coming years. Early detection, preventive care, and lifestyle monitoring are driving device adoption in this group. Many health-conscious individuals now use glucometers to track how diet, stress, and sleep affect their glucose levels. Digital wellness platforms and fitness coaches are incorporating glucose tracking into preventive health regimes. The rise of wearable CGMs for non-diabetics is a game-changer in this space. Government health screenings and employer wellness programs are identifying at-risk individuals earlier, prompting the need for blood glucose monitoring devices.

Distribution Channel Insights

What made retail pharmacies the dominant segment in the blood glucose monitoring devices market?

The retail pharmacies segment dominated the blood glucose monitoring market in 2024, due to their strong presence and consumer trust. Patients rely on pharmacies for both glucometer devices and refills of test strips and sensors. Pharmacists play a vital role in guiding patients on product use, storage, and interpretation. In-store access ensures convenience, especially for older adults and non-digital users. Pharmacies also support on-the-spot demonstrations and free glucose check-up camps. These features make them a go-to channel for immediate, informed purchases.

The online pharmacies segment is expected to grow at a rapid pace in the upcoming period. As e-commerce continues to grow and the demand for convenient healthcare products increases, online pharmacies are taking advantage of this trend. They provide a variety of diabetes care devices, such as blood glucose monitors and insulin delivery systems, along with the perks of home delivery and potentially lower costs. Patients can conveniently order their essential diabetes care devices from home, eliminating the need for a visit to a physical pharmacy. Online pharmacies offer access to a range of products that may not be found in local drugstores, particularly specialized tools for diabetes management. E-commerce sites frequently present competitive prices and discounts compared to traditional stores, making diabetes management more affordable. Numerous online pharmacies also offer educational materials and support for diabetes management, assisting patients in making informed decisions about their healthcare.

Technology Insights

Why did the electrochemical biosensors dominate the blood glucose monitoring market?

The electrochemical biosensors segment held the largest market share in 2024. The dominance of electrochemical biosensors stems from their accuracy, reliability, and ease of use, making them a preferred choice for both patients and healthcare providers. These sensors leverage biochemical reactions to measure glucose levels, providing real-time results that are crucial for effective diabetes management. As technology advances, improvements in sensor design and functionality are enhancing the performance of electrochemical biosensors. Additionally, manufacturers are focusing on reducing production costs, making these biosensors more accessible to a broader audience.

The wearable and AI-integrated segment is expected to expand at the fastest CAGR over the forecast period. These technologies combine real-time glucose monitoring with predictive analytics, allowing users to manage their condition more effectively. By utilizing machine learning algorithms, blood glucose monitoring devices can analyze patterns and provide personalized insights to users based on their lifestyle and dietary habits. This personalization enhances the user experience and encourages proactive diabetes management. Furthermore, the seamless integration of these technologies with smartphones and health apps boosts user engagement and data tracking capabilities. As demand for non-invasive and convenient monitoring solutions rises, the wearable and AI-integrated technologies segment is poised for rapid growth.

Regional Insights

U.S. Blood Glucose Monitoring Market Size and Growth 2026 to 2035

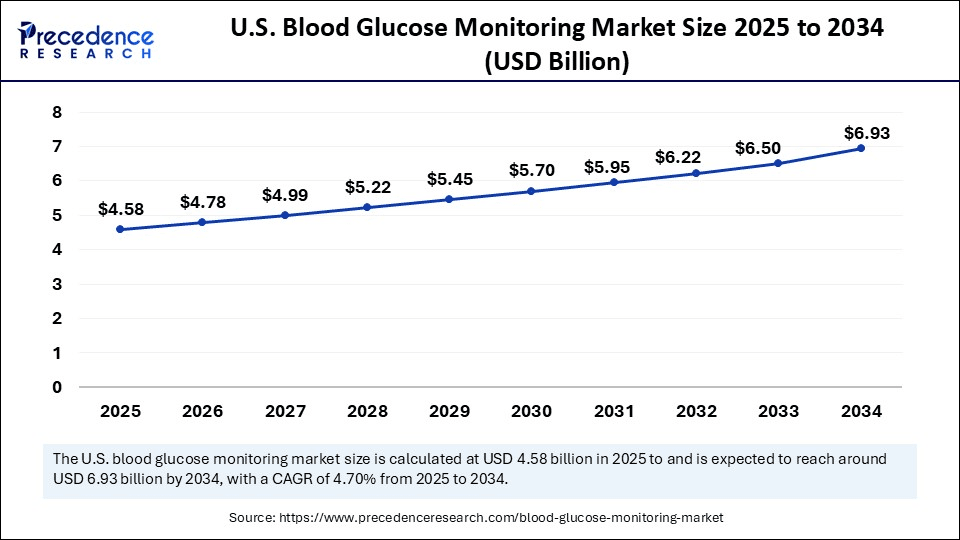

The U.S. blood glucose monitoring market size is exhibited at USD 4.58 billion in 2025 and is projected to be worth around USD 7.26 billion by 2035, growing at a CAGR of 4.71% from 2026 to 2035

What Made North America the Dominant Region in the Market in 2025?

North America dominated the blood glucose monitoring market while holding the largest share in 2025, due to robust healthcare infrastructure and high awareness about the management of diabetes. The region benefits from early adoption of advanced technologies like CMG systems, AI-integrated platforms, and smartphone-linked meters. High diabetes prevalence and supportive reimbursement policies also contribute to market leadership. A strong network of retail pharmacies, home healthcare providers, and digital platforms ensures easy accessibility. Robust R&D and the presence of global market leaders have fostered innovation and competition. The integration of glucose monitoring with digital therapeutics and insurance-based wellness programs further accelerates market growth.

The U.S. is a major contributor to the North American blood glucose monitoring market due to the increased telehealth integration and adoption of remote patient monitoring post-pandemic. Investment in diabetes specific virtual care platforms is expanding usage beyond hospitals into the home. The availability of Medicare/Medicaid coverage for certain monitoring devices is encouraging uptake among older adults. Personalized diabetes management apps linked to glucose readings are on the rise. Additionally, health-conscious consumers are adopting glucose tracking for nutrition and fitness optimization, beyond medical necessity.

Why is Asia Pacific emerging as the fastest-growing market?

Asia Pacific is emerging as the fastest-growing market for blood glucose monitoring due to the increasing diabetes burden and growing health awareness. Urbanization, sedentary lifestyles, and rising obesity rates are contributing to the diabetes burden. Countries like China, India, and Japan are experiencing a surge in demand for compact, affordable, and easy-to-use devices. Government health initiatives and public and private partnerships are actively supporting screening programs. The growth of middle-class populations and improved healthcare infrastructure is impacting market growth.

India plays a major role in the market within Asia Pacific. The rising healthcare spending is influencing market growth. CGM devices are gaining attention among urban populations, especially tech-savvy youth and working professionals. Local startups are innovating with Bluetooth-enabled glucometers and app-based monitoring platforms. Rural healthcare outreach programs are incorporating basic SMBG kits into primary care systems. Online pharmacies and e-commerce are becoming vital distribution channels for glucose monitoring products. Shifts toward preventive health and the influence of fitness trends are creating new avenues for market growth. Moreover, government support to boost the domestic production of medical devices contributes to market expansion in the country.

What are the Advancements in the Blood Glucose Monitoring Market in Latin America?

Latin America is witnessing substantial growth in the market. This growth and development are driven by the increasing demand for biobanking services and various advancements in biotechnology. The region has a diverse population and rich biodiversity, which presents unique opportunities for the collection and preservation of biological samples. This is further supported by government initiatives aimed at promoting biobanking and enhancing research capabilities.

Brazil Blood Glucose Monitoring Market Trends:

Key drivers that are propelling the region's market include increasing investment in healthcare infrastructure and rising prevalence of chronic diseases. The market is also witnessing a surge in partnerships and collaborations. Overall, technological advancements, broader awareness of diabetes care, and strengthened healthcare infrastructure are key trends shaping the future of Brazil's blood glucose monitoring market.

What are the Advancements in the Blood Glucose Monitoring Market in the Middle East and Africa?

The Middle East and Africa region is witnessing steady growth in the market. This growth is driven by increasing healthcare investments and a rising awareness of biobanking practices. Various governments in this region are starting to recognize the importance of cell banking, which is leading to favorable regulatory changes. Countries like South Africa and the UAE are leading players in the region and are starting to actively develop their cell banking capabilities.

Saudi Arabia Blood Glucose Monitoring Market Trends

The region's overall landscape still appears to be emerging, with few key players currently operating. As the market matures, there will be more opportunities for international firms to enter and establish a presence. Government initiatives under Vision 2030, including diabetes awareness campaigns, screening programs, and expanded healthcare investment, are improving early diagnosis and access to monitoring devices. The expansion of digital health and telemedicine services is further supporting remote monitoring and ongoing patient care.

What are the Advancements in the Blood Glucose Monitoring Market in Europe?

The demand for blood glucose monitoring devices in Europe is driven by a combination of an aging population, increasing diabetes prevalence, and the growing adoption of advanced monitoring technologies. The European market is also supported by healthcare policies that promote diabetes care and management. Countries like Germany, the UK, and France are leading the region in terms of market size, with increasing investments in digital health solutions and diabetes management programs.

Value Chain Analysis of the Blood Glucose Monitoring Market

- Raw Material and Component Sourcing

Raw material sourcing focuses on biosensor components, electronic parts, and medical-grade consumers. Core materials include enzymes, glucose, mediator chemicals, conductive inks, and electrode materials.

Key Players: Roche, Merck, DuPont - Manufacturing Process

This stage involves biosensor fabrication, test strip coating, cutting, meter assembly, and sensor integration. High-volume precision manufacturing is required here to ensure accuracy and consistency.

Key Players: Abbott, Roche, Dexcom - Distribution Process

The distribution process is carried out through hospitals, clinics, pharmacies, diabetic care centers, and e-commerce platforms. Purchasing decisions focus on brand reliability, accuracy, ease of use, cost, and digital integration.

Key Players: CVS Health, Cardinal, Amazon

Blood Glucose Monitoring Market Companies

- Abbott Laboratories

- Acon Laboratories Inc.

- Arkray Inc.

- Ascensia Diabetes Care

- B. Braun Melsungen AG

- Bioptik Technology Inc.

- Dexcom Inc.

- F. Hoffmann-La Roche AG

- GlySens Incorporated

- i-SENS Inc.

- LifeScan Inc.

- Medtronic plc

- Nemaura Medical Inc.

- Nova Biomedical

- Owen Mumford Ltd.

- Senseonics Holdings Inc.

- Sinocare Inc.

- Tandem Diabetes Care

- Terumo Corporation

- Ypsomed Holding AG

Recent Developments

- In July 2025, Researchers from BITS Pilani's Hyderabad campus have developed a revolutionary smartwatch capable of monitoring glucose levels using sweat, eliminating the need for traditional finger-prick tests. Created by PhD scholar Abhishek Kumar under the guidance of Prof. Sanket Goel, the device also tracks additional biomarkers such as uric acid and lactate, offering real-time health monitoring.(Source: https://english.mathrubhumi.com)

- In September 2024, Senseonics Holdings, Inc. announced that the U.S. FDA has cleared the next-generation Eversense 365 CGM system for people with Type 1 and Type 2 diabetes aged 18 years and older. Eversense 365 is the world's first One Year CGM system, representing a significant breakthrough in diabetes technology and management.(Source: https://www.senseonics.com)

Segments Covered in the Report

By Product Type

- Self-Monitoring Blood Glucose (SMBG) Devices

- Glucometers

- Test Strips

- Lancets

- Control Solutions

- Continuous Glucose Monitoring (CGM) Systems

- Sensors

- Transmitters

- Receivers/Display Devices

- Integrated/Smart Glucose Monitoring Devices

- Smartphone-connected Glucometers

- Smartwatches & Wearables

- Closed-loop Systems (Hybrid Closed-Loop Insulin Pumps)

- Others

- Implantable CGM

- Non-invasive Glucose Monitors (In-development/early-stage)

By Modality

- Invasive

- Minimally Invasive

- Non-Invasive (Emerging)

By End User

- Hospitals & Clinics

- Home Care Settings

- Diagnostic Centers

- Ambulatory Surgical Centers

- Others (Rehabilitation Centers, Long-term Care Facilities)

By Patient Demographics

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

- Prediabetes / At-risk Population

- Others (e.g., Rare Metabolic Disorders)

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Diabetes Clinics

- Others (Health & Wellness Chains, NGO Supply Channels)

By Technology

- Electrochemical Biosensors

- Optical Biosensors

- Microfluidics-based

- Wearable and AI-integrated

- Others (Infrared-based, Sweat/Saliva-based)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting