What is Agarose Resin Market Size?

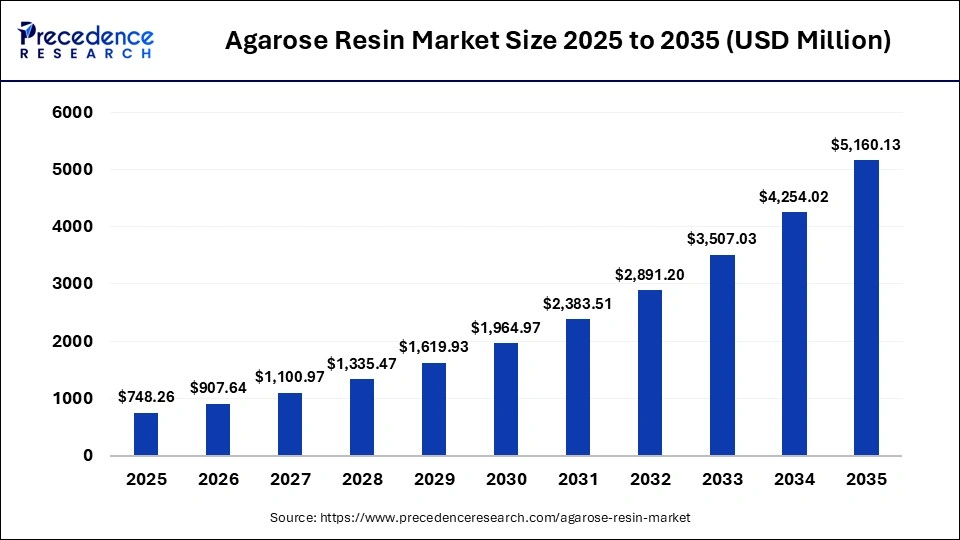

The global agarose resin market size accounted for USD 748.26 million in 2025 and is predicted to increase from USD 907.64 million in 2026 to approximately USD 5160.13 million by 2035, expanding at a CAGR of 21.30% from 2026 to 2035. The agarose resin market is driven by rising biopharmaceutical manufacturing, increasing demand for high-purity biologics, and advances in chromatography technologies.

Market Highlights

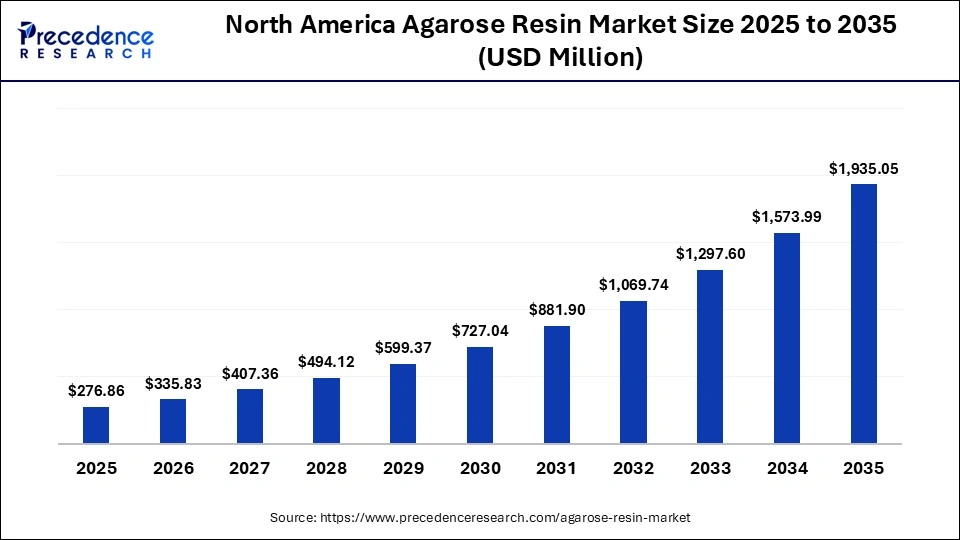

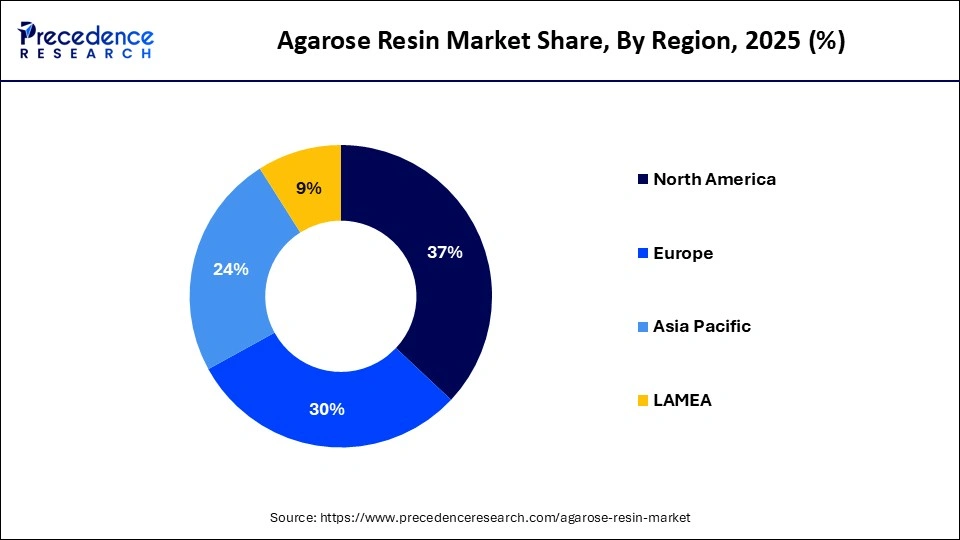

- North America dominated the market, holding the largest market share of 37% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 21.40% in between 2026 and 2035.

- By product type, the functionalized agarose resins segment contributed the largest market share of 45% in 2025.

- By product type, the pre-packed agarose columns segment is growing at a remarkable 20.50% between 2026 and 2035.

- By application, the protein purification segment held the largest market share of 38% in 2025.

- By application, the vaccine & viral vector purification segment is poised to grow at a remarkable CAGR of 20.80% between 2026 and 2035.

- By end-user industry, the biopharmaceutical & biotechnology companies segment generated the biggest market share of 42% in 2025.

- By end-user industry, the CDMOs segment is expanding at a remarkable CAGR of 21% CAGR between 2026 and 2035.

Advancing Separation Science: Innovation Driving Growth in the Agarose Resin Market

The globally produced agarose resin is important in the separation, purification, and analysis procedures in biopharmaceuticals, life sciences, diagnostics, and industrial biotechnology. Agarose resins are variants of agarose, a natural polysaccharide obtained from seaweed and commonly used as chromatography media because they are highly biocompatible, chemically stable, and can have their pore size varied. These resins are designed in functionalized beads and matrices to facilitate other techniques like gel filtration, ion-exchange chromatography, affinity chromatography, and size-exclusion processes.

The high growth in the market is due to the boom in biopharmaceutical manufacturing, especially the production of monoclonal antibodies, vaccines, and recombinant proteins. The growing investments in proteomics and genomics research are driving the need to use high-resolution and reproducible technologies in purification. Market growth is further being increased through technological advances in speed, increased yield, and scalability across academic, clinical, and industrial end-market consumers.

Agarose Resin Market Outlook

- Industry Growth Overview: The Agarose resin market is experiencing consistent development due to the increased level of biopharmaceutical manufacturing and the adoption of advanced chromatography. Market growth is also supported in the long term by the increasing demand for high-purity biologics and vaccines.

- Global Expansion: The market is dominated by North America and Europe, which have a good biopharma infrastructure and R&D investments, and the Asia Pacific is growing at a fast pace. The rising biologics production and government-sponsored life sciences projects facilitate growth in China and India.

- Major Investors:The major players and investors are Cytiva (Danaher), Merck KGaA, Bio-Rad Laboratories, and Thermo Fisher Scientific. These firms have large chromatography resin development and manufacturing capacities.

Key AI Integration in the Agarose Resin Market

Artificial intelligence is transforming the agarose resin market through improved resin design, process optimization, and advanced quality monitoring in chromatography applications. AI-driven modeling and machine learning algorithms are being used to predict resin performance, optimize pore size distribution, and enhance ligand binding efficiency, reducing reliance on trial-and-error during product development. AI-based data analytics are also improving scale-up from laboratory to commercial manufacturing while supporting batch-to-batch consistency and regulatory compliance. As biopharmaceutical manufacturers transition toward digital and smart manufacturing platforms, AI is becoming a strategic enabler of efficiency, innovation, and competitive differentiation.

AI tools are further supporting real-time monitoring of resin degradation and lifecycle performance during repeated chromatography cycles. Predictive analytics help manufacturers anticipate fouling, pressure changes, and performance loss, reducing downtime. Integration of AI with process analytical technology is improving in-line quality control during resin production. These capabilities are shortening development timelines for next-generation agarose resins. Collectively, AI integration is strengthening reliability, scalability, and performance optimization across the agarose resin value chain.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 748.26 Million |

| Market Size in 2026 | USD 907.64 Million |

| Market Size by 2035 | USD 5160.13 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 21.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Form, Application, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Did the Functionalized Agarose Resins Segment Hold a 45% Share in 2025?

In 2025, the functionalized agarose resins segment commanded a 45% market share in the agarose resin market because of its skillfulness and central position in the separation of biomolecules at high resolution. Affinity agarose resins, ion-exchange agarose resins, cross-linked agarose resins, gel filtration/size-exclusion agarose, and other special functional media have become popular due to their high level of selectivity, high binding capacity, and stability in chemical conditions. These resins play vital roles in the purification of complex biomolecules of monoclonal antibodies, recombinant proteins, enzymes, nucleic acids, and viral particles. The continuous inventions in the sphere of ligand chemistry, cross-linking phenomenon, and optimization of resin pores contributed to more, as well as longevity and reusability, to decrease the price of the functioning.

The pre-packed agarose columns segment took 20.50% in 2025 and proved to be the most dynamic segment. Rising demand for standardized chromatography solutions that are simple to operate and less time-consuming. The increasing use of single-use and disposable types of technologies in downstream processing also contributed to the growth of this segment. Additionally, the small- and mid-sized biotech companies are becoming more inclined to use pre-packed columns because of low infrastructure and the lack of skilled labor. Manufacturers are also developing application-specific columns that are better suited to protein purification, vaccine processing, and viral vector isolation, which are accelerating uptake and positioning pre-packed agarose columns as a fast-growing market.

Application Insights

Why Did the Protein Purification Segment Hold a 38% Share in 2025?

In 2025, this protein purification segment had a 38% share, due to the growing biologics and biosimilars environment. The use of agarose resin in protein purification is very popular because it has soft separating characteristics, high resolutions, and is applicable in affinity, ion-exchange, and size-exclusion chromatography methods. The production of monoclonal antibodies, therapeutic enzymes, and recombinant proteins was increased, which increased the demand in a large way, since the products cannot be made without several purification stages to achieve the high regulatory and quality standards. Market expansion was further aided by growth in proteomics research, structural biology research, and research in academic life sciences. Also, there were developments of functionalized agarose resin with increased binding capacities and flow properties to increase the process efficiency and yield.

The vaccine & viral vector purification segment received the 20.80% share in 2025 due to the increasing world need for vaccines and gene-based treatments. With the agarose resin in downstream processing, the use of agarose resin increased tremendously due to the activities of infectious disease preparedness, as well as the activities of public health in the application of vaccine development. Chromatography using agarose is critical in aiming to satisfy the high levels of purity, safety, and potency of antigens in vaccines and viral vectors. Also, the high rate of gene and cell therapy pipeline development led to the need to expand the purification of viral vectors, in which agarose resin can offer effective isolation of viral particles and host cell contaminants. Agarose matrices are suitable for viral products that are sensitive owing to their scalability and biocompatibility.

End-User Industry Insights

Why Did the Biopharmaceutical & Biotechnology Companies Segment Lead the Agarose Resin Market in 2025?

The biopharmaceutical & biotechnology companies segment led the market while holding a 42% share in 2025, as they involve high dependence on chromatography purification. Agarose resin is utilized by these companies in drug discovery, clinical development, and large-scale production of biologics, vaccines, recombinant proteins, and emerging gene therapies. Jeopardy-like R&D pipelines, escalating turnover of therapeutics (biologic) approvals, and rising demand for high-purity therapeutics fostered uninterrupted consumption of resin. Also, the investments in the development of in-house production facilities and the incorporation of advanced downstream processing technology enhanced demand. The reliable, scalable resins made of agarose are a key part of quality-based biopharmaceutical processes and are regulatory-compliant.

The CDMOs segment is projected to grow at a significant CAGR over the forecast period, holding an 21%. The major factor contributing to growth is the tendency of small and mid-sized biotech companies to outsource biopharmaceutical manufacturing in an attempt to gain the benefits of cost-effectiveness, scalability, and regulatory experience. The nature of the pipelines of various clients makes the CDMOs demand flexible as well as high-performance chromatography solutions that demand agarose resin. The emergence of biologics, biosimilars, and gene therapies has also aggravated the need to use specialized purification services. Also, CDMOs are expanding their downstream processing speedily and shifting to single-use and modular manufacturing, both of which are well aligned with agarose-based chromatography technologies.

Regional Insights

How Big is the North America Agarose ResinMarket Size?

The North America agarose resin market size is estimated at USD 276.86 million in 2025 and is projected to reach approximately USD 1,935.05 million by 2035, with a 21.46% CAGR from 2026 and 2035.

Why Did North America Lead the Global Agarose Resin Market in 2025?

In 2025, North America was the largest market with a 37% share of the agarose resin market due to its mature biopharmaceutical and life sciences ecosystem. Pharmaceutical manufacturers, CDMOs, research institutions, and biotechnology firms across the region widely rely on agarose-based chromatography for downstream purification. High investment in biologics, vaccines, monoclonal antibodies, and gene and cell therapies has intensified demand for high-performance agarose resins. Regulatory oversight from bodies such as the U.S. Food and Drug Administration enforces strict standards for purity, consistency, and validation, reinforcing adoption of premium chromatography media. Early uptake of advanced purification technologies, continuous innovation by leading resin manufacturers, and strong investment in genomics and proteomics research further strengthen North America's leadership.

This dominance is supported by large-scale commercial biomanufacturing facilities that require reproducible, high-capacity resins. Growing numbers of late-stage biologics entering commercialization are increasing resin consumption volumes. Integration of single-use and continuous bioprocessing platforms is expanding application scope for agarose resins. Strong academic–industry collaboration is accelerating resin performance optimization. Together, these factors are sustaining North America's position as the primary demand center for agarose resins globally.

What is the Size of the U.S. Agarose ResinMarket?

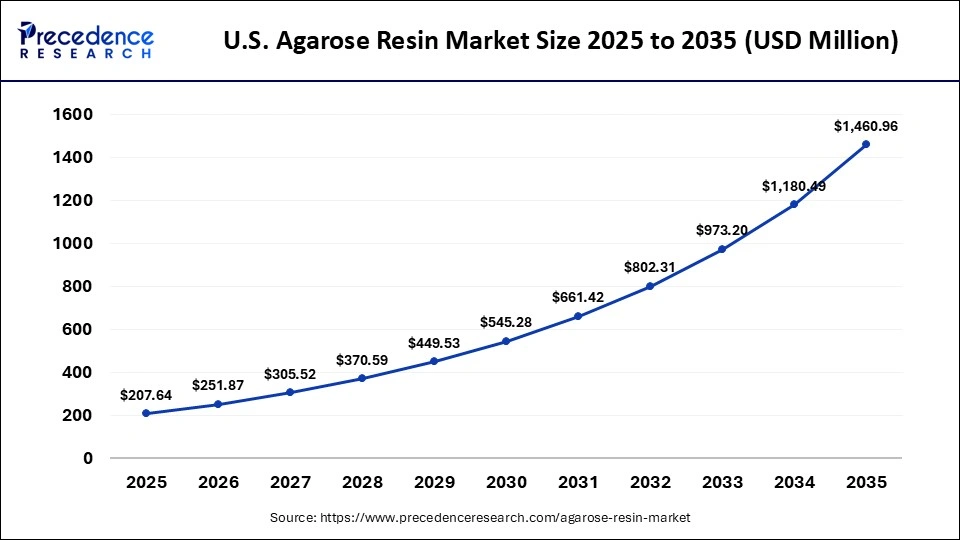

The U.S. agarose resin market size is calculated at USD 207.64 million in 2025 and is expected to reach nearly USD 1,460.96 million in 2035, accelerating at a strong CAGR of 21.54% between 2026 and 2035.

U.S Agarose Resin Market Analysis

The U.S. has the largest market share in North America because it has the best research and innovation in the pharmaceutical and biologics industries. Consistent demand for resin is driven by high R&D spending and a robust pipeline of monoclonal antibodies and vaccines and gene therapies and widespread use of chromatography in downstream processing. The availability of many CDMOs and facilities for large-scale biologic manufacturing also increases acceptance. The steady consumption of agarose resins is contributed to by academic research institutions and government-funded programs, which are dedicated to genomics, proteomics, and molecular biology.

Why Is Asia Pacific Undergoing the Fastest Growth in the Agarose Resin Market?

The Asia Pacific is expected to grow at a double-digit CAGR of 21.40% in between 2026 and 2035, supported by rapid expansion of biopharmaceutical manufacturing capacity across China, India, Japan, and South Korea. Heavy investment in biologics, biosimilars, and vaccine production is increasing demand for high-performance chromatography resins used in downstream purification. Government-backed life sciences programs, improved research infrastructure, and rising healthcare expenditure are accelerating adoption of advanced separation technologies. Cost-efficient manufacturing environments and access to skilled technical labor are encouraging global biopharma companies to establish regional production and purification facilities.

This growth is further reinforced by expanding academic and contract research activity in genomics, proteomics, and molecular biology. Rising numbers of clinical-stage biologics entering scale-up are increasing resin consumption volumes. Local resin manufacturing and supply chain development are improving availability and reducing dependency on imports. Together, these factors are positioning Asia Pacific as the fastest-expanding demand center for agarose resins.

China Agarose Resin Market Trends

China is also one of the major players in the development of the Asia Pacific market because of the booming biopharmaceutical and biotechnology industries in China. Government push in the production of domestic biologics, vaccine development, and life sciences innovation has augmented the demand for agarose resins. The emergence of local biotech companies and CDMOs has necessitated the use of scalable and cost-effective chromatography. Research and development in genomics, antibody drugs, cell therapy, and the production of viral vectors also boost the growth of the market. With China establishing itself as a formidable competitor in the biologics production and manufacturing industry, the sale of agarose chromatography resin is set to grow continuously.

Why Is the European Agarose Resin Market Experiencing Notable Growth?

The European agarose resin market is recording significant growth, supported by a strong pharmaceutical manufacturing base and well-developed research infrastructure. High levels of biologics and biosimilars production across Europe are creating sustained demand for efficient, reproducible chromatography purification technologies. Rising focus on gene therapy, cell therapy, and personalized medicine is further increasing utilization of high-performance agarose resins. Strict regulatory requirements across the EU, enforced by bodies such as the European Medicines Agency, emphasize product purity, consistency, and validation, reinforcing adoption of premium-grade resins. Public and private investment in life sciences research, combined with robust academic-industry collaboration, continues to drive innovation and market development across leading European economies.

This growth is reinforced by expansion of CDMO capacity supporting late-stage clinical and commercial biologics. Increased adoption of continuous and intensified bioprocessing is raising demand for high-capacity agarose matrices. Research institutes are expanding use of agarose resins in protein characterization and molecular separation workflows. Local resin manufacturers are investing in process optimization to meet evolving regulatory expectations. Together, these factors are sustaining Europe's position as a stable and innovation-driven market for agarose resins.

UK Agarose Resin Market Trends

The UK agarose resin market is evolving progressively and has a stable academic research history and an established biopharmaceutical industry. The major universities and research centers create a continuous need for agarose resin in genomics, molecular biology, and protein purification applications. Growth in the production of biologics, vaccine development, and gene therapy development also contributes to the growth of the market. The innovations in life sciences and the growth of investments by the private sector, supported by government programs, enhance the strength of the research. The alignment with the international quality standards in regard to regulations promotes the embracing of the advanced chromatography solutions.

Why Is the MEA Agarose Resin Market Gaining Momentum?

The Middle East and Africa agarose resin market is gaining momentum due to expanding biotechnology activity and steady modernization of healthcare and research infrastructure. Rising investment in pharmaceutical manufacturing, diagnostics, and vaccine production, particularly in Saudi Arabia and the United Arab Emirates, is increasing demand for chromatography resins used in downstream purification. Governments across the region are prioritizing life sciences development, local drug manufacturing, and research capacity building under national diversification and health security programs. Although the market remains smaller than in North America and Europe, growing awareness of high-purity purification technologies and improving regulatory frameworks are accelerating adoption.

Momentum is further supported by the establishment of biopharmaceutical parks and vaccine manufacturing facilities. Academic research centers are expanding molecular biology and protein analysis workflows that rely on agarose resins. Strategic partnerships with global biopharma companies and CDMOs are transferring purification expertise into the region. Increased focus on self-sufficiency in biologics production is translating into sustained, long-term demand growth.

UAE Agarose Resin Market Trends

The United Arab Emirates agarose resin market is gaining traction as the country expands its biopharmaceutical manufacturing and research capabilities. Investments in vaccine production, biologics purification, and advanced diagnostics are increasing demand for high-purity chromatography resins. Government-backed life sciences initiatives and healthcare diversification strategies are supporting the adoption of modern downstream processing technologies. Research laboratories and emerging CDMOs are incorporating agarose-based chromatography for protein purification and molecular separation workflows. Strategic partnerships with global biopharma suppliers are improving local access to validated, regulatory-compliant agarose resins.

Why Is the Latin American Agarose Resin Market Emerging Rapidly?

The Latin American agarose resin market is expanding rapidly due to strengthening pharmaceutical manufacturing capacity and rising adoption of biologics across the region. Countries such as Brazil, Mexico, and Argentina are increasing investment in vaccine production, biosimilars manufacturing, and academic life sciences research. Government-led initiatives to expand domestic drug production and improve healthcare access are directly supporting demand for chromatography-based purification technologies. Growing partnerships with international biopharmaceutical companies and structured technology transfer agreements are strengthening regional downstream processing capabilities.

This momentum is reinforced by the expansion of public health laboratories and university research centers using agarose resins for protein and nucleic acid purification. Regulatory frameworks for biologics manufacturing are becoming more standardized, improving confidence in resin quality requirements. Rising participation of regional CDMOs is increasing commercial-scale resin consumption. Together, these developments position Latin America as a structurally strengthening and opportunity-rich market for agarose resins.

Brazil Agarose Resin Market Trends

Brazil is emerging as a key market for agarose resins in Latin America due to expanding biologics and vaccine manufacturing capacity. Public health institutions and pharmaceutical manufacturers are increasing use of agarose-based chromatography for protein purification and quality control workflows. Government support for local drug production and biosimilar development is strengthening demand for reliable downstream purification media. Academic and research institutes are expanding genomics and molecular biology research, further driving resin consumption. Collaboration with international biopharma partners is improving access to validated, high-purity agarose resins and technical expertise.

Who are the Major Players in the Global Agarose Resin Market?

The major players in the agarose resin market include Cytiva (Danaher Corporation), Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Bio-Works Technologies AB, Agarose Beads Technologies (ABT), Cube Biotech GmbH, Lonza Group Ltd., Merck KGaA, New England Biolabs, Inc., Promega Corporation, Purolite (Ecolab), Repligen Corporation, Takara Bio Inc., Thermo Fisher Scientific Inc., and Tosoh Bioscience LL.

Recent Developments

- In October 2025, Agarose Bead Technologies (ABT) declared that it would continue to expand to enhance its production capacity and international presence. This action strengthens the ability of ABT to be a strategic partner of biopharmaceutical firms that are creating next-generation and sophisticated biologic therapies. (Source:https://pharmaceuticalmanufacturer.media)

- In May 2025,DuPont had increased its bioprocessing portfolio by introducing DuPont™ AmberChrom™ TQ1 chromatography resin bioprocessing, which is meant to utilize oligonucleotides and peptides for efficient purification, which is advantageous for a wide range of biopharmaceutical uses. (Source:https://www.dupont.com/news)

Segments Covered in the Report

By Product Type

- Agarose Beads / Base Resin

- Functionalized Agarose Resins

- Affinity Agarose Resins

- Ion-Exchange Agarose Resins

- Cross-linked Agarose Resins

- Gel Filtration/Size Exclusion Agarose

- Other Functional Agarose Media

- Pre-packed Agarose Columns

By Application

- Protein Purification

- Antibody/Monoclonal Antibody (mAb) Purification

- Nucleic Acid Purification

- Vaccine & Viral Vector Purification

- Enzyme & Peptide Purification

- Diagnostics Reagents & Kits

- Other Research Applications

By End-User Industry

- Biopharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Academic & Government Research Institutes

- Diagnostic Laboratories

- Industrial Biotechnology

- Others (food, environmental testing)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting