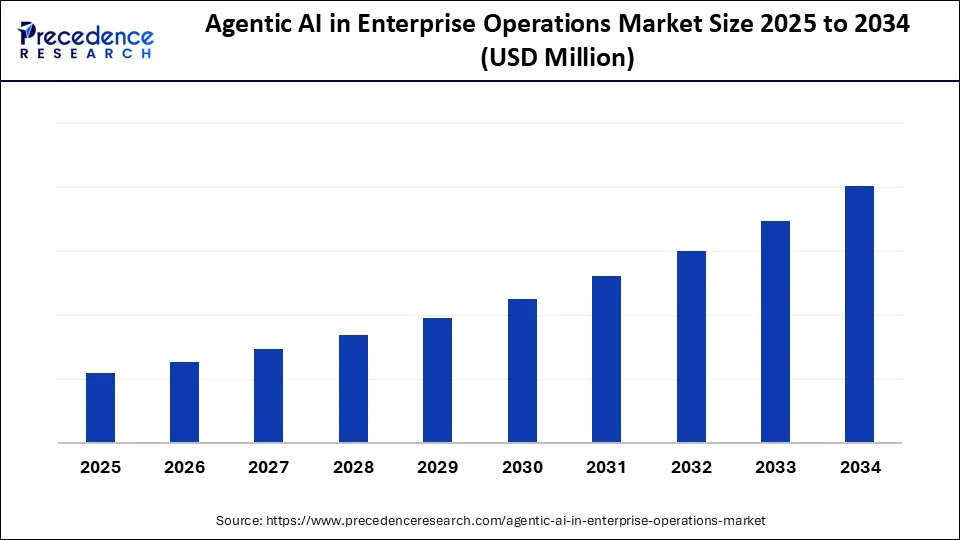

Agentic AI in Enterprise Operations Size and Forecast 2025 to 2034

The global agentic AI in enterprise operations market is driven by the rise of AI-powered agents that adapt, learn, and act within enterprise ecosystems. The market is experiencing significant growth, led by rapid digital transformation, increasing demand for autonomous decision-making for business activities, and increasing integration of AI with enterprise software.

Agentic AI in Enterprise Operations Market Key Takeaways

- North America dominated the agentic AI in enterprise operations market with the largest market share of 42% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR in the market between 2025 and 2034.

- By component, the core platform/agent runtime segment held the largest market share of 35% in 2024.

- By component, the prebuilt agent templates segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By deployment mode, the public cloud (SaaS) segment captured the biggest market share of 58% in 2024.

- By deployment mode, the edge deployment segment is expected to expand at a notable CAGR over the projected period.

- By functional use-case, the IT service management automation segment contributed the highest market share of 18% in 2024.

- By functional use-case, the supply chain planning & exception handling segment is expected to expand at a notable CAGR over the projected period.

- By autonomy type, the human-supervised agents segment generated the major market share of 42% in 2024.

- By autonomy type, the collaborative multi-agent systems segment is expected to expand at a notable CAGR over the projected period.

- By industry vertical, the banking, financial services & insurance (BFSI) segment held the largest market share of 20% in 2024.

- By industry vertical, the healthcare & life sciences segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The agentic Artificial Intelligence in enterprise operations market relates to the ecosystem of platforms, solutions, and tools that support autonomous or semi-autonomous Artificial Intelligence Agents used to plan, decide, and complete operational tasks across enterprise systems, with little human interaction. These agents combine reasoning, memory, decision-making, and actions to help simplify and optimize complex workflows in IT, finance, HR, supply chain, and manufacturing. This market is establishing a foothold as enterprises evolve from predictive systems to autonomous, in search of a more efficient, cost-effective, and adaptive intelligence. Deeper integration with enterprise software and the speed at which AI is developing mean that agentic AI will cause a paradigm shift within enterprise operations.

Agentic AI in Enterprise OperationsGrowth Factors

- Shift toward autonomous operations- Organizations are moving toward autonomous systems that limit human decision-making. This movement helps spur the adoption of agentic AI because AI can find the right sequence of actions and minimize human involvement in the enterprise workflow.

- Increasing complexity of enterprise data- Data is being produced quickly and is getting bigger and more unstructured, and organizations need intelligent systems to manage that data. Agentic AI agents can autonomously examine data and extract meaning from it, and act upon insights to speed up decision-making and improve accuracy in different departments.

- Compatibility with enterprise information systems- Connectivity and compatibility with ERPs, CRMs, and Supply Chain Management systems an important accelerants for the adoption of AI tools in enterprises, especially when the tool works natively on the enterprise information systems that exist, so the enterprise can realize value quickly.

- The need to reduce cost- Organizations are under pressure to reduce costs, reduce mistakes in processes, and return on investments. Agentic AI automates repetitive, resource-consuming tasks with greater accuracy and smarts that improve efficiencies and free up employees to do the strategic portions of their jobs.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Mode, Functional Use-Case, Autonomy Type, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What is fueling the growth of agentic AI as the next driver in enterprise capabilities?

The growth of agentic AI is, to a certain extent, tied to the growing demand for organizations to make autonomous decisions. Agentry AI offers organizations the potential for lower manual intervention in tasks, contributory workflows, and acquisition agility in open environments. Initial applications that can be observed are real-time uses of agentic AI, such as AI-driven intelligent customer service agents, financial risk assessments, autonomous supply chain and logistics platforms, and workflows. As two primary examples, Microsoft has announced its new Copilot Studio, and OpenAI has equally introduced enterprise-grade agentic models, all of which are uniquely instrumented to develop AI agents that can independently plan, reason, strategy, and execute tasks on behalf of a decision maker.

Finally, many of the industries that are adopting agentic AI include those that are experiencing talent and workforce shortages and organizational inefficiencies. Many of these industries identify agentic AI as the most affordable option compared with traditional automation. With all of this considering real-time applications, R&D activity, and the opportunity for efficiency across enterprises, agentic AI is moving to market, and adoption is accelerating.

Can agentic AI enable hyper-personalized operations in the enterprise?

The agentic AI in enterprise operations market is driven by is the shift to hyper-personalization at scale. Unlike legacy automation approaches, agentic AI can learn user preferences dynamically, autonomously reconfigure workflows, and respond contextually across various enterprise functions (e.g., HR, customer engagement, supply chain). For example, when addressing customer service challenges, AI agents won't merely respond with scripted answers, but will project into user needs, proactively provide solutions, and achieve higher satisfaction.

Research initiatives from Salesforce and SAP indicate that their investments in AI-driven personalization engines are tailored to support enterprise ecosystems. This also allows enterprises to differentiate through highly customized operations, advance in client relationships, and enable workforce employee productivity. As enterprises pursue a shift in automation from efficiency-focused to experience-focused, providing hyper-personalization on demand will be a foundational growth opportunity for agentic AI adoption.

Restraint

What Limits the Widespread Uptake of Agentic AI for Enterprises?

A key limiting factor around agentic AI in enterprise operations is the issue of perceived reliability and accountability of autonomous decisions. Although agentic AI can create plans and implement them, enterprises are often still reticent because of the potential for incorrect reasoning, lack of explainability, and possible bias in the decision-making process. Many applications of real-world operations, such as finance, health, or legal-related processes, must operate under extensive scrutiny and compliance in order to adhere to existing regulations and audits.

If agents operate but do not provide a clear audit trail, i.e., how does one even know what to trust, then there are concerns of trust and governance. As indicated by the shift in perspective reported from many global technology forums, enterprises struggle with autonomy and oversight, and we have to slow down large-scale implementations. Without a strong potential pathway for oversight and monitoring accountability constraint by ethical guardrails, this issue will hold back any faster adoption.

Opportunity

Agentic AI transforming the future of cognitive enterprises and intelligent operations

Agentic AI is rapid changing how enterprises operate by enabling autonomous agents to plan, coordinate, and carry out end-to-end business workflows. By putting together large-scale enterprise data, predictive analytics, and continuous learning, these systems allow organizations to proactively make decisions, optimize ongoing processes, and achieve operational resilience. One of the greatest technology trends in agentic AI is the evolution of multi-agent collaboration approaches, composable architectures allowing for maximum flexibility, and trusted governance frameworks related to these approaches that ensure security and accountability across all enterprise functions.

Recent developments in organizational industry efforts reinforce the broader strategic and operational momentum of agentic AI adoption. In July 2025, Capgemini announced it had acquired WNS to help create the global leader in Agentic AI-powered Intelligent Operations. This combination of expertise in digital business process services with scale and capabilities to transform end-to-end processes illustrates the continued investment in agentic AI providers focused on improving operational efficiency and business agility.(Source:https://www.capgemini.com)

Component Insights

Why are core platform/agent runtimes dominant in the agentic AI in enterprise operations market?

The core platform/agent runtime segment in agentic AI in enterprise operations market in 2024, by providing the basic infrastructure to build, deploy and manage intelligent agents used across enterprise systems. This segment is the best-performing because it supports growth, can easily integrate into existing legacy systems and workflow patterns (especially complex networks), and is critical to all enterprise solutions seeking to create efficiencies and automated processes for large organizations.

The prebuilt agent templates segment is emerging as the fastest-growing subsegment. More companies want ready-deployed templates because they help create a faster time to value, minimize the overall technical debt associated with new development, and allow them to easily pivot towards their specific use case (HR automation, customer support, finance operations). This is a sign of the accelerated demand for fast AI adoption across industries without the full commitment to resources or building agents from the ground up.

Deployment Mode Insights

Why does public cloud dominate the agentic AI In enterprise operations market?

The public cloud (SaaS) segment in agentic AI in enterprise operations market in 2024. Companies like using public cloud environments because they allow for scalability, cost advantages, and, most importantly, accessing advanced AI more quickly without investing heavily in infrastructure. Public cloud environments allow enterprises to implement AI agents on a global scale simultaneously, while improving reliability, flexibility, benefit from cloud service provider updates, and most importantly, speed.

However, the fastest-growing segment of deployment is the edge deployment segment is growing because enterprises want low-latency processing, real-time decisions, and improved data privacy. Edge deployment allows AI agents to operate closer to the data source, which is often a priority in this type of situation (e.g., manufacturing, logistics, healthcare, etc.), where rule-based decisions and decreased dependence on centralized processing are important.

Functional Use-Case Insights

Why is IT service management automation the dominant in the agentic AI in enterprise operations market?

The IT service management automation segment dominated in agentic AI in enterprise operations market in 2024. Enterprises are using agentic AI to improve IT operations (automate ticket resolution, streamline monitoring, etc.). Agentic AI can eliminate downtime and allow organizations to reduce manual intervention or workarounds, enhancing their service experiences, improving the quality and reducing the cost of operations, as well as increasing the speed of problem resolution, making it a priority use case for many large organizations and tech companies.

The supply chain planning & exception handling segment is expected to be the fastest-growing with global supply chains becoming more complex, there is a greater need for insights, real-time intelligence, an agile approach to planning, and advanced remedial capabilities. Agentic AI agents are already building the future state of estimation in demand forecasting, optimization of inventory, and minimizing response time to minimize disruptions. This mindset of relying on agentic AI for supply chain resilience will continue to see growth across retail, manufacturing, and logistics.

Autonomy Type Insights

Why are human-supervised agents the leading end user in the agentic AI in enterprise operations market?

The human-supervised agents segment lead the agentic AI in the enterprise operations market. Humans tend to prefer these systems for companies; they offer the possibility of automation and human oversight, ensuring that accuracy, compliance, and accountability exist. These systems are heavily utilized in heavily regulated industries (finance, government, etc.) when human intervention is required to properly assess and acknowledge complex decisions before making risks decisions requiring ethical and moral scrutiny.

The expected fast-growth group is the collaborative multi-agent segment. Many AI systems and agents will be able to work collectively, interact with each other, share information, and create solutions to complex problems independently. The advantages of intelligent agents in multi-agent systems to produce solutions to interdependent tasks that demonstrate the ability to make/match adaptive responses and to optimize systems across departments are evident for efficiency, collaborative problem-solving, and cross-functional business functions in logistics, telecom, and smart manufacturing industries.

Industry Vertical Insights

Which industry vertical dominated the agentic AI in enterprise operations market?

The banking, financial services & insurance (BFSI) segment is the leading markets in 2024. Agentic AI is utilized within banking and financial services organizations for areas such as fraud detection, risk management, customer engagement, and regulatory compliance. This segment is benefiting from the high digital maturity level of the sector and the continual drive for increasing efficiency, lowering costs, and providing secure AI services in a manner that improves customer trust and keeps groups competitive.

The healthcare and life sciences segment is expected to grow at the fastest rate during the projected period, with an emerging focus on the deployment of agentic AI in areas such as clinical decision support, patient engagement, drug discovery, and administrative automation, and is forecasted to experience the highest growth. As investments in digital health and precision medicine continue to ramp up, companies that develop AI agent-based construct services have become integral to improving patient outcomes, accelerating clinical research, and optimizing cue-specific workflows in hospital and life sciences companies..

Regional Insights

Will North America remain the strategic origin of agentic AI in enterprise operations?

North America is currently in the lead, as its established cloud & data infrastructure, significant enterprise R&D budgets, and rich space of platform providers enhance production deployments. US-based cloud providers and enterprise software providers are embedding agentic workflows into CRM, data platforms, and public-sector use-cases seamlessly creating reusable frameworks, security baselines, and procurement pathways that minimize time-to-value for large customers. Recent acquisitions and strategic platform pushes demonstrate an anxiety in vendor ranks about low-latency data and agent orchestration to power mission-critical workflows.

Due to concentrated workforce talent, the amount of product innovation in hyperscalers, and a regulatory-compliant product delivery to market, the US remains the strongest case as it relates to enterprise proofs-of-concept and large-scale rollouts. With a vision to foster strategic acquisitions or product go-lives, US firms are cautiously reducing integration periods between real-time data planes and agent runtimes, lowering reliance on implementing services, and positively impacting ROI predictability for operations, service desks, and automation teams. These factors produce a landscape in which buyers can pilot to learn with measurable KPIs (MTTR, FTE-hours saved, SLA uplift) prior to deploying agents across global estates.

Why is Asia Pacific emerging as the fastest growing region for agentic AI in enterprise operations market?

Asia-Pacific is emerging as an ever-faster-growing base for agentic AI due to its high cloud adoption rates, mobile-first-enabled businesses, and government digital transformation policies. Organizations in verticals such as manufacturing, telecommunications, and BFSI have begun deploying physical and digital AI agents to provide workflow automation, predictive analytics, and customer engagement. National governments throughout the Asia-Pacific region invested heavily in building AI infrastructure and regulatory frameworks to make the deployment of intelligent agents for experimentation easier.

China is leading this growth due to a strong ecosystem of AI, massive amounts of data, and rapid adoption cycles by enterprises. With a well-defined local tech sector, the region has enticed both emerging and established vendors to develop domain-specific agentic AI applications for a wide array of verticals such as logistics, e-commerce, and financial services. The governments' AI-first policies and large-scale investments in smart manufacturing and digital governance have been expediting adoption. In addition, Chinese enterprises are utilizing local large language models and cloud-edge maturity to limit deployment costs based on pilot projects, qua operable production workflows.

Agentic AI in Enterprise Operations Market Companies

- Microsoft

- Google Cloud

- Amazon Web Services (AWS)

- OpenAI

- IBM

- Oracle

- NVIDIA

- UiPath

- ServiceNow

- Salesforce

- Snowflake

- Databricks

- Dataiku

- DataRobot

- Hugging Face

- Aisera

- Moveworks

- Olive

- Beam AI

- OpsVeda

Latest Announcement

- In February 2025, IBM launched Granite 3.2, a portfolio of small AI models with reasoning, vision, and guardrail functionality, accessible under a developer-friendly license for enterprise use. David Tan, CTO, CrushBank, said, "Granite 3.2 takes it further with new reasoning capabilities, and we're excited to explore them in building new agentic solutions."(Source: https://newsroom.ibm.com)

Recent Developments

- In May 2025, NTT DATA announced the launch of its Smart AI Agent Ecosystem, which includes autonomous agents designed for specific industries, as well as an even patented plug-in that upgrades legacy RPA bots to intelligent agents, improving automation across the enterprise. The company has deployed hundreds of Smart AI Agent instances to support complex processes and decision-making for clients(Source:https://aimagazine.com)

- In March 2025, PwC introduced its AI Agent Operating System platform, aimed at integrating and scaling intelligent agents into business workflows, providing organizations with enterprise automation capabilities. PwC's agent OS provides a consistent, scalable framework for building, orchestrating, and integrating AI agents across a wide range of platforms, tools and business functions.(Source: https://www.pwc.com)

Segments Covered in the Report

By Component

- Core Platform / Agent Runtime

- Orchestration & Workflow Engine

- Decisioning & Planning Module

- LLM & Reasoning Layer

- Tool & API Connectors

- Memory & Context Management

- Monitoring & Observability Tools

- Security & Governance Layer

- Development & Low-code Builder Kits

- Prebuilt Agent Templates

- Professional & Integration Services

By Deployment Mode

- Public Cloud (SaaS)

- Private Cloud

- On-Premises

- Hybrid Deployment

- Edge Deployment

By Functional Use-Case

- IT Service Management Automation

- Customer Service & Support Automation

- Supply Chain Planning & Exception Handling

- Manufacturing Process Automation

- Logistics & Transportation Operations

- Finance & Accounting Automation

- Procurement Automation

- HR & Talent Operations

- Facilities & Maintenance Automation

- Security Operations Automation

- DevOps & Site Reliability Automation

- Legal & Compliance Operations

- Sales Operations Automation

- Marketing Operations Automation

- Quality Control & Testing Operations

- Customer Success Operations

By Autonomy Type

- Task-specific Agents

- Collaborative Multi-agent Systems

- Hierarchical Agent Structures

- Human-supervised Agents

- Fully Autonomous Closed-loop Agents

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Healthcare & Life Sciences

- Manufacturing & Industrial

- Retail & E-commerce

- Telecommunications

- Energy & Utilities

- Transportation & Logistics

- Public Sector & Government

- Education

- Professional Services

- Hospitality & Leisure

- Pharmaceuticals & CRO Operations

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting