What is the ATM Managed Services Market Size?

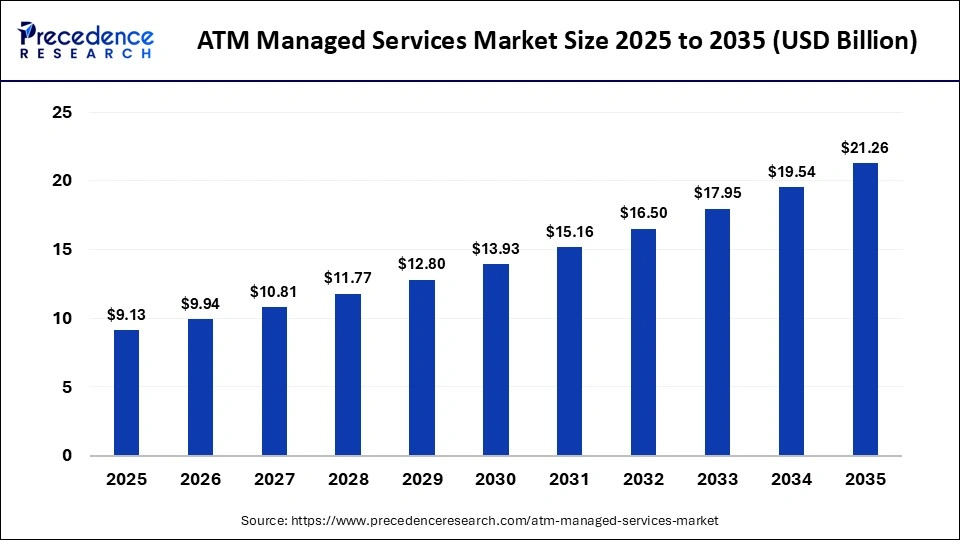

The global ATM managed services market size was calculated at USD 9.13 billion in 2025 and is predicted to increase from USD 9.94 billion in 2026 to approximately USD 21.26 billion by 2035, expanding at a CAGR of 8.82% from 2026 to 2035.There is an increasing trend in the ATM managed services market, and it is not surprising, as banks and financial institutions are keen to reduce expenses. They are outsourcing ATM maintenance and management to other firms.

Market Highlights

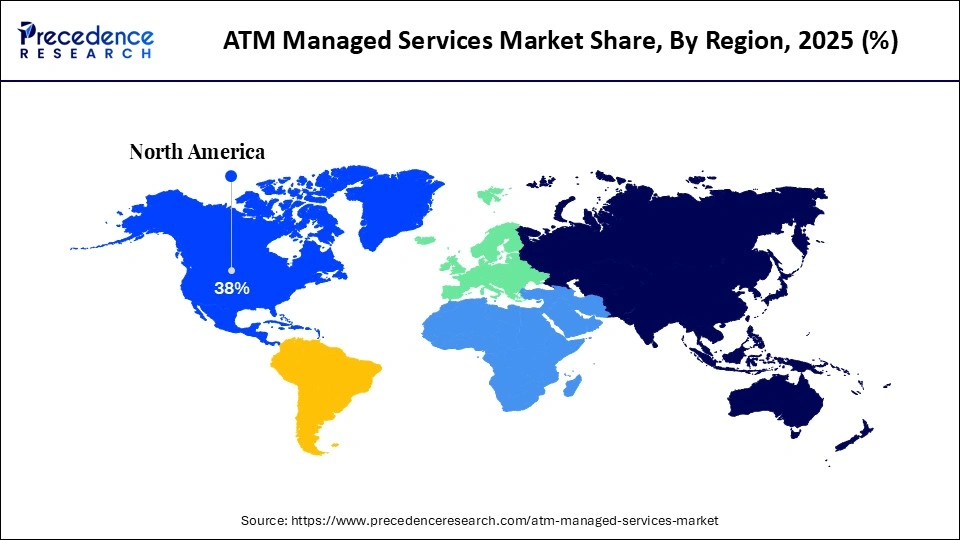

- North America dominated the global blockchain-enabled clinical trial integrity market with a share of approximately 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By service type, the cash/ATM replenishment & currency management segment held a dominant position in the market with a share of 50% in 2025.

- By service type, the security segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By ATM location/type, the offsite ATMs segment led the global market with a share of 40% in 2025.

- By ATM location/type, the Mobile ATMs segment is expected to grow with the highest CAGR in the market during the studied years.

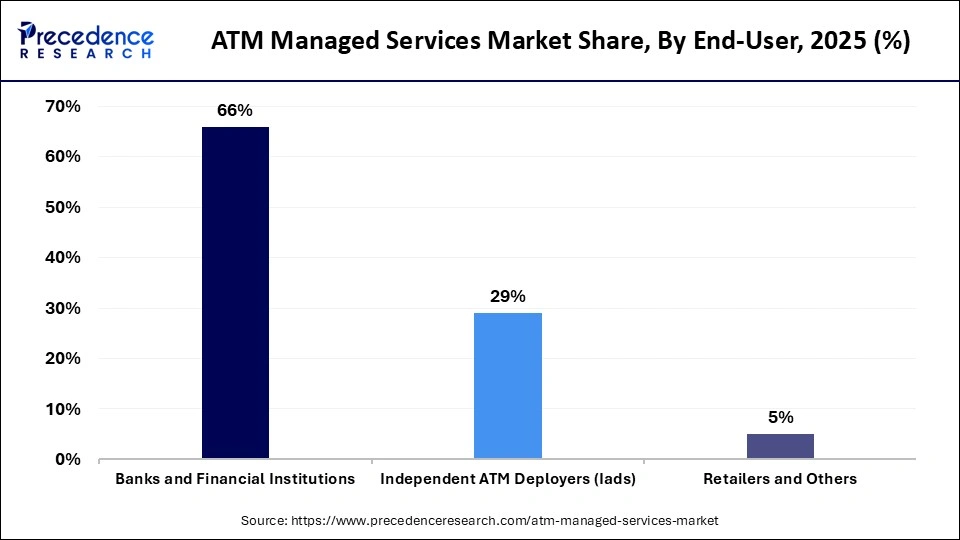

- By end-use type, the banks & financial institutions segment dominated the global market with a share of 66% in 2025.

- By end-user type, the IADs segment is expected to expand rapidly in the market with a CAGR in the coming years.

Turning the ATM Operations into Outsourced Excellence.

The ATM managed services market will involve different activities such as cash management, network management, hardware maintenance, security management, and software management. Financial institutions and banks are outsourcing tasks to concentrate on their core business. The quantity of ATMs is breaking records that are not located in bank branches, and the number of ATM is increasing.

This has triggered an increase in demand for ATM services, which are managed. Moreover, the way people bank is changing; most individuals are willing to use their smartphones to bank. To counter this, the manufacture of ATMs is taking advantage of technology to keep track of the performance and full functioning of the process, which is changing the very way ATM processes work.

Future Possibilities (EBITDA & Revenue)

- Digital transformation & recurring services will remain primary EBITDA drivers for financial tech firms like Fiserv and NCR, with increasing cloud-based offerings and subscription models enhancing margin predictability.

- Security, compliance, and AI-driven analytics in managed services may improve cost efficiency and revenue retention, indirectly boosting EBITDA margins.

- M&A activity: especially consolidation among ATM infrastructure providers could reshape EBITDA contributions, potentially lifting smaller players via scale.

- Macro factors such as interest rates, regulatory costs, and consumer payment shifts will influence near-term revenue momentum, but long-term demand for secure, integrated transaction platforms remains robust.

AI Development in ATM Managed Services Market

The development of AI is contributing to the changing of the ATM managed services market by making it efficient, secure, and more customer-friendly. Modern AI tools can be used to predictive maintenance, which helps service providers to identify possible malfunctions in an ATM before they happen and minimize the downtime.

Fraud detection, transaction monitoring, and biometrics authentication are also performed using machine learning algorithms, which enhances the security and the level of trust of the ATM networks. Furthermore, AI-based analytics are useful in assisting banks in managing cash, location planning, and user interface personalization, which helps to reduce operational expenses and improve delivery at services.

Financial Data ATM Managed Services Market

| Company | Latest EBITDA | Revenue | Notes/sources |

| The brink's company | $347M | $4.32B | Adjusted EBITDA from 2024 annual report represents core operations |

| Fujitsu Limited | $3.2 USD approx | $22-24B | Latest trailing 12-month EBITDA and revenue estimates from financial stats. |

| Cardtronics | 241M | $1.09B | Latest consistent annual figures are older due to private status; used last available series. |

| Fiserv. Inc | $9.0B | $20.5B | Based on financial data sources |

| The brink's company | $792M | $5.1B-$5.2 | Approx. figure from statistical sources. |

Key Market Trends

- Network Monitoring: Real-time network monitoring is a significant trend that has become an important consideration by banks and service providers to reduce ATM downtime and guarantee continuous transactions. More sophisticated monitoring systems will enable the detection of connectivity problems, hardware failures, and performance bottlenecks earlier, which will result in a reduced response time and better service reliability.

- Security Enhancement: The increasing cyber threats and financial frauds have compelled institutions to invest a lot in more advanced security measures. ATM systems are also being enhanced with encryption, artificial intelligence, fraud detection, and multi-factor authentication to secure customer information and transactions.

- Vanish of Independent Deployment: The independent ATM deployers are evident in the market, particularly in emerging economies and rural regions. These independent operators increase access to the ATM beyond traditional bank branches, enhancing financial inclusion and establishing new sources of revenue.

- Increased security infrastructure: Banks and financial institutions are enhancing their physical and cybersecurity infrastructure through upgrading their surveillance systems, hardening infrastructure in hardware and secure software platforms, and central control centres. This trend is an indication of the increasing demand to protect against cyber and physical ATM network attacks.

- Regulatory Compliance: Adherence to the changing government and financial policies is turning out to be a burning issue. To comply with the requirements of the regions and international standards, service providers are embracing standardized software updates, data protection, and report systems that are audit-ready to ensure transparency of operations and minimize legal risks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.13Billion |

| Market Size in 2026 | USD 9.94 Billion |

| Market Size by 2035 | USD 21.26 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type , ATM Location/Type , End-User ,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

How Did the Cash/ATM Replenishment & Currency Management Segment Dominate the ATM Managed Services Market?

The cash/ATM replenishment & currency management segment dominated the market by holding the share of approximately 50%, because of its significance in terms of untainted cash supply. Specialty service providers are essential in the attempts by banks to predict cash demand and optimize the replenishment cycles. There is an effort to reduce idle cash using advanced analytics tools that can ensure there is no outage.

This set of operations outsourced lowers the cost of operation and enhances efficiency for the financial institutions. The rise in the number of ATM devices in rural and semi-urban locations further drives the demand for professional cash logistics services. Moreover, currency management solutions are integrated to provide greater transparency, accuracy in reporting, and meeting the financial regulations.

The security segment is projected for fastest growing CAGR of 7.4% in the market, followed by financial frauds and cyber threats, which keep on changing. To enhance ATM security, the managed service providers are implementing sophisticated surveillance systems, biometric authentication, and encryption systems. Fraud tracking and AI-driven anomaly detection are getting to be a matter of course.

The growing pressure of regulations on data protection and protection of transactions is forcing banks to advance their ATM security systems. Physical security measures such as anti-skimming machines and stronger ATM enclosures are also becoming very popular. The development of closer links between cybersecurity and physical security systems is increasing the pace of segment growth.

ATM Location/Type Insights

How the Offsite ATMs Segment Led the Market?

The off-site ATMs segment dominated the market by holding the share of approximately 40%, driven by shopping malls, retail stores, airports, and fuel stations. These ATMs make banking services more convenient to customers and increase access to banking in other areas besides the branches. Financial institutions, like off-site ATM management, are delegating the burden to an outsourcing company.

The advent of digital banking has put strategic value on the need to have reliable off-site ATM networks. These machines have guaranteed uptime, availability of cash, and legislation by the managed service providers. This market dominance is further strengthened through expansion into the underserved regions.

The mobile ATMs segment is projected for fastest growing CAGR in the market, whereby they offer flexible banking services in the case of events and disasters, as well as in remote locations. Financial inclusion in underserved communities is achieved using mobile ATMs by governments and banks. These units come in especially handy in times of emergency when normal infrastructure is affected.

The managed services facilitate a hassle-free connectivity, security, and real-time monitoring in mobile deployments. The growing concern about the rural outreach programs is helping provide them with momentum. The portability and effectiveness of these ATM units are being enhanced by technological advancements

End-User Insights

How the Banks & Financial Institutions Segment Led the Market?

The banks and financial segment dominated the market by holding the share of approximately 66%, since they have large ATM networks. They count on the services of managed services to simplify operations, save money, and improve the quality of services. Outsourcing helps banks concentrate on customer-centric innovations and digital transformation. Constant shifts in regulation demand professional compliance and reporting management. Banking networks that are large require centralized monitoring and predictive maintenance services.Their dominant status is supported by the necessity to have high uptime and customer loyalty.

The IADs segment is projected for fastest growing CAGR in the market, since they increase the ATM presence in busy and underserved areas. IADs own white-label ATMs and rely on third-party managed services to support their operation. They have an advantage in managing their cash flow and having cost-efficient maintenance policies. The increasing trend in financial inclusion is motivating IAD to participate in the emerging markets. Their niche opportunities are enabled by the flexible deployment strategies. Their collaborations with banks and fintech companies only enhance their growth rate.

Regional Insights

How Big is the North America ATM Managed Services Market Size?

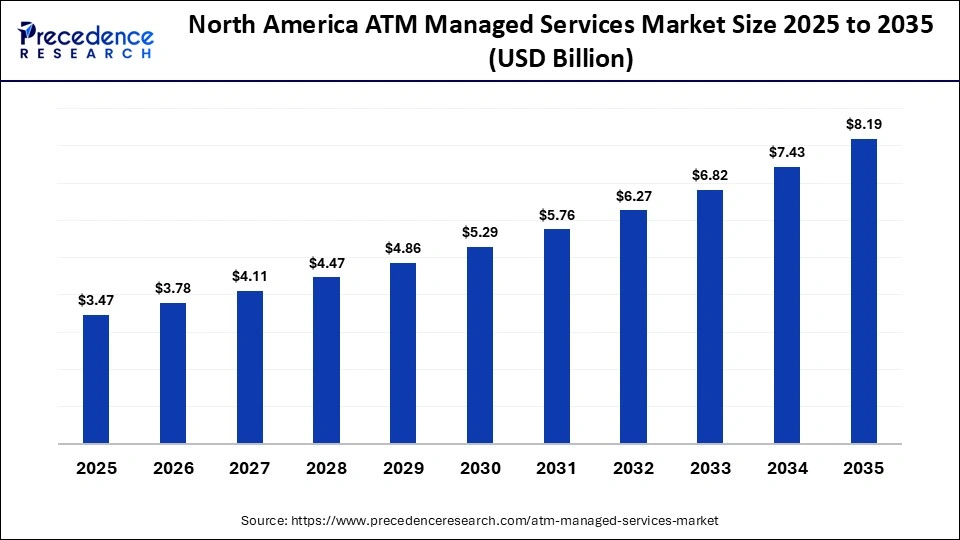

The North America ATM managed services market size is estimated at USD 3.47 billion in 2025 and is projected to reach approximately USD 8.19 billion by 2035, with a 8.97% CAGR from 2026 to 2035.

How Did North America Dominate the ATM Managed Services Market?

North America dominated the ATM managed services market, because of the developed banking infrastructure and the large networks of ATMs. In the region financial institutions are focusing on efficiency in operations and high levels of security solutions. Good usability of AI-based monitoring and predictive maintenance systems facilitates market growth. Competitive intensity is increased by the existence of managed service providers who are leading. The permanent modernization of ATM fleets also helps to enhance the demand of outsourced services. Professional compliance management is also brought about by high regulatory standards.

What is the Size of the U.S. ATM Managed Services Market?

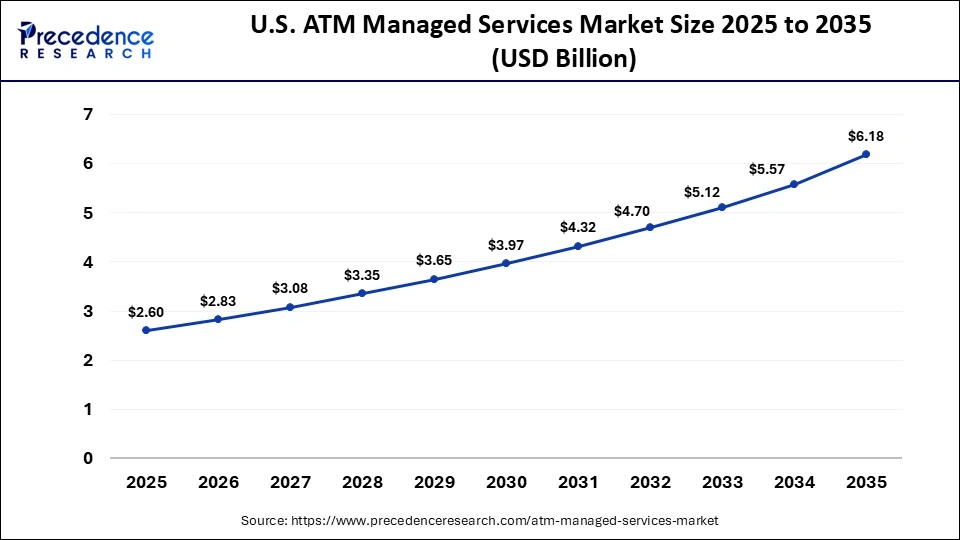

The U.S. ATM managed services market size is calculated at USD 2.60 billion in 2025 and is expected to reach nearly USD 6.18 billion in 2035, accelerating at a strong CAGR of 9.04% between 2026 and 2035.

U.S. ATM Managed Services Market Analysis:

The U.S. dominates the regional market at the national level through the widespread use of ATMs and intensive use of technologies. U.S. banks are progressively outsourcing the operation of ATMs so that they can maximize costs and enhance uptime. Canada is also playing a major role, which is aided by stable banking institutions and modernization programs. Cybersecurity is another area that focuses on risks of fraud fighting in both countries. The independent ATM deployers are increasing through retail and convenience store networks. The continued investments in digital banking infrastructure have been helping to maintain a leadership position in the market.

Will Asia-Pacific Grow in the ATM Managed Services Market?

Asia Pacific is the region that is growing fastest because of the rapid urbanization and growing banking penetration. Financial inclusion is growing at an alarming rate, with emerging economies increasing the number of ATMs. Governments are in full support of digital payment ecosystems without the need to make cash less available.

The managed service providers are taking advantage of the cost-efficient outsourcing in the area. The growth is driven by the increased use of sophisticated security and monitoring technologies. Increasing rural outreach programs increases demand even more.

Top Asian Countries in ATM Managed Services Market:

China and India are major growth drivers at the country level since they have huge populations, and their banking network is growing. The financial inclusion efforts in India and the applications of white-label automated teller machines are major factors in market expansion. China keeps updating its ATM systems with in-built surveillance systems.

Japan and South Korea focus on the latest security technologies and automation. Southeast Asian countries are also spreading ATM penetration in semi-urban regions. The emergence of increased collaborations between banks and managed service providers is a positive development in the region.

Is Europe on the Verge of Growth in the Market?

There is a significant growth in Europe due to the modernization of ATM and regulatory compliance. To enhance efficiency in the operation of the banks, banks are outsourcing the management of ATMs. The area focuses on high levels of cybersecurity and data protection. Increasing the use of cash recycling ATM sustains the demand for the services. Banks are streamlining the networks of branches, but ensuring that there are ATMs. Managed service contracts are turning into long-term strategic alliances.

Country Analysis

The U.K. is very big at the country level with a good network of independent ATM deployers. Germany and France play their roles in the constant upgrading of banking infrastructure. Offsite ATM deployment in retail sites is steadily being implemented in Italy and Spain. There is an expansion of ATM in countries that are in Eastern Europe in rural areas. The regulatory compliance and the security improvement are also considered to be one of the key issues nationwide. The market trend in Europe is still being determined by technological innovation and the outsourcing of operations.

Who are the Major Players in the Global ATM Managed Services Market?

The major players in the ATM managed services market include Diebold Nixdorf, NCR Corporation, Fujitsu , Cardtronics, Euronet Worldwide, Inc. , AGS Transact Technologies Ltd, Hitachi Payment Service, CMS Info Systems, Brinks Company, G4S plc, Cashlink Global System, Prosegur Cash S.A,. GRG Banking Equipment Co., Ltd, Glory Global Solutions

Recent Developments

- In August 2025, Diebold Nixdorf introduced its Branch Automation Solutions portfolio to assist banks in simplifying cash management, ATM services, and general branch operations with a managed services package. The solution integrates various operational functions into a single platform, which allows them to have better coordination, efficiency, and performance. It is scalable and flexible and can be deployed in a way that suits the needs of a financial institution, in both scale and to improve customer experience.

- In January 2026, the State Bank of India gave CMS Info Systems a 1,000 crore, ten-year contract to provide integrated cash management services to approximately 5,000 ATMs owned by the SBI all over the country. The contract is one of the very first large-scale direct cash outsourcing deals by a large public sector bank and is to start in January 2026, to improve the ATM uptime and customer convenience. It is estimated that the deal will add a lot of supplementary revenue to CMS and strengthen its long-time relationship with SBI.

- In March 2025, NCR Atleos published a detailed white paper on how to enhance ATM operations, specifically focusing on the ATM as a Service (ATMaaS) model. Having been developed with the support of Datos Insights and using industry research and interviews, the paper reveals the ATM Continuum Index to assist financial institutions in evaluating and optimizing their ATM management strategies. It describes the way banks and credit unions can improve their efficiency, control their operations, and satisfy the evolving customer needs through the implementation of ATMaaS.

Segments Covered in the Report

By Service Type

- Cash/ATM Replenishment & Currency Management

- Network Management

- Security Management

- Incident Management

By ATM Location/Type

- Onsite ATMs

- Offsite ATMs

- Worksite ATMs

By End-User

- Banks & Financial Institutions

- Independent ATM Deployers (IADs)

- Retailers & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting