Automotive Embedded Telematics Market Size and Forecast 2025 to 2034

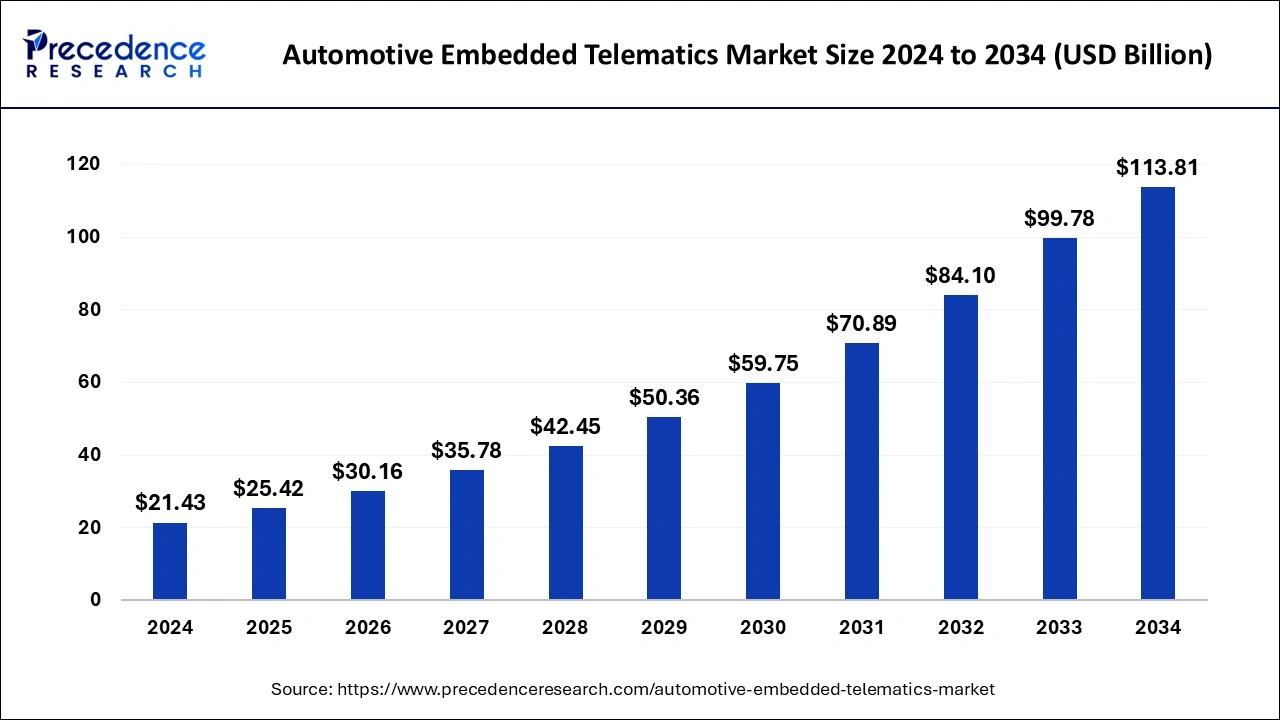

The global automotive embedded telematics market size surpassed USD 21.43 billion in 2024 and is estimated to hit around USD 113.81 billion by 2034 growing at a CAGR of 18.17% from 2025 to 2034. With the growing focus on technological advancements in the automotive industry, the demand for embedded telematics is growing, which is going to boost the automotive embedded telematics market's growth in the coming years.

Automotive Embedded Telematics Market Key Takeaways

- In terms of revenue, the global automotive embedded telematics market was valued at USD 21.43 billion in 2024.

- It is projected to reach USD 113.81 billion by 2034.

- The market is expected to grow at a CAGR of 18.17% from 2025 to 2034

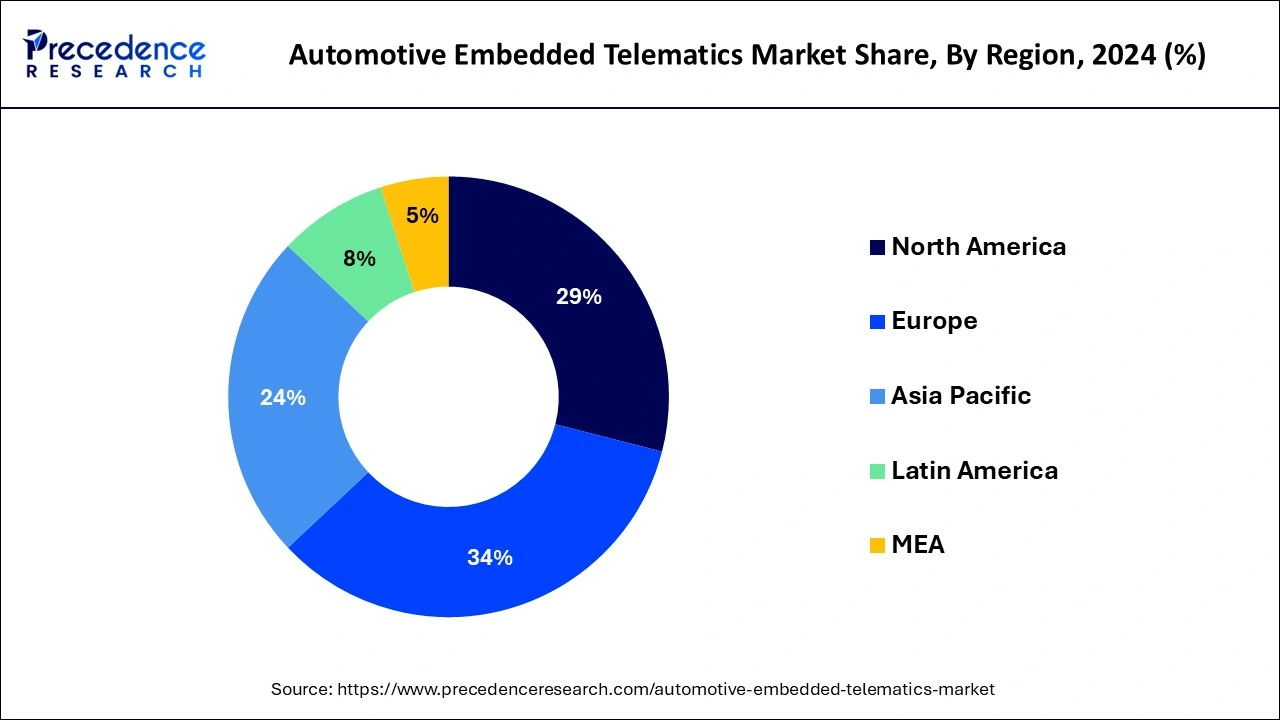

- Europe dominated the global market with the largest market share of 34% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR of 23.75% during the forecast period of 2025-2034.

- By solution, the safety & security segment held the largest market share of 49% in 2024.

- By solution, the remote diagnostics segment is anticipated to grow at a remarkable CAGR of 22.29% during the forecast period.

- By component, the services segment has generated the largest market share of 52% in 2024.

- By component, the hardware segment is growing at the fastest CAGR of 15.64% over the projected period.

- By application, the passenger cars segment has generated more than 75% of the market share in 2024.

- By application, the commercial vehicles segment is expected to grow at a CAGR of 23.70% over the projected period.

The Role of AI in the Market

Fleet maintenance scheduling may also be enhanced with AI. AI-powered telematics systems can identify possible problems before they become an issue by continuously monitoring vehicle data. By doing this, expensive downtime may be avoided and cars can continue to drive smoothly. Everyone wins when your fleet is running as efficiently and as fully as possible. Lastly, fleet car emissions may be decreased with the use of AI. AI has the potential to lower pollutants and fuel consumption by streamlining routes and cutting down on idle time. This can result in lower running expenses in addition to being beneficial for the environment.

Europe Automotive Embedded Telematics Market Size and Growth 2025 To 2034

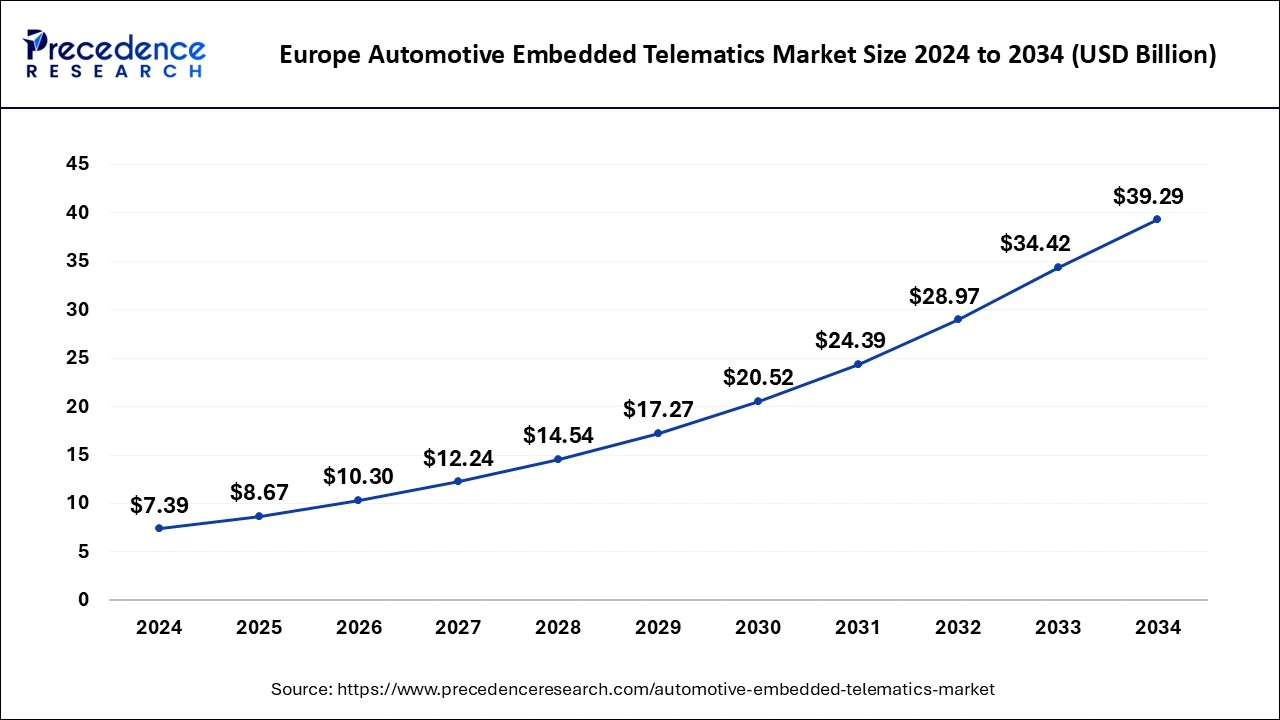

The Europe automotive embedded telematics market size was valued at USD 7.39 billion in 2024 and is anticipated to reach around USD 39.29 billion by 2034, poised to grow at a CAGR of 18.19% from 2025 to 2034.

Europe led the market with the biggest market share of 34% in 2024 due to factors such as advanced infrastructure, stringent safety regulations, and a high adoption rate of connected vehicles. The region's emphasis on road safety and the presence of well-established automotive manufacturers contribute to the widespread integration of telematics systems. Additionally, the European market benefits from a growing awareness of the benefits offered by embedded telematics, including enhanced navigation, fleet management, and connectivity features, driving its significant market share.

Asia-Pacific is set for robust growth in the automotive embedded telematics market due to increasing vehicle connectivity, rising demand for advanced driver assistance systems (ADAS), and the expansion of smart city initiatives. With a growing automotive industry, particularly in countries like China and India, there is a surge in the adoption of embedded telematics for enhanced safety features, improved fleet management, and the integration of smart technologies. This region's dynamic market landscape and technological advancements position it as a key driver of growth in the automotive embedded telematics sector.

Meanwhile, North America is experiencing notable growth in the automotive embedded telematics market due to several factors. The region has a high adoption rate of connected vehicles, driving the demand for embedded telematics systems. Stringent safety regulations, increasing fleet management needs, and a growing focus on advanced driver assistance systems (ADAS) contribute to the market's expansion. Additionally, the presence of key industry players, robust infrastructure, and a tech-savvy consumer base further accelerate the adoption of embedded telematics solutions in North America.

Market Overview

The automotive embedded telematics market offers a technology that integrates telecommunication and informatics to enhance the functionality and connectivity of vehicles. It involves the installation of electronic devices in cars, commonly known as telematics control units, to gather and transmit real-time data. This data includes information about the vehicle's location, performance, and driver behavior. Embedded telematics systems play a crucial role in providing features such as GPS navigation, vehicle tracking, remote diagnostics, and connectivity with other smart devices.

These systems not only improve driver safety and convenience but also enable advanced services like usage-based insurance and efficient fleet management. Overall, automotive embedded telematics enhances the overall driving experience by enabling smart communication between vehicles and external networks.

Automotive Embedded Telematics Market Growth Factors

- The growing consumer preference for connected vehicles is a key driver of the automotive embedded telematics market. With features like real-time navigation, remote diagnostics, and in-car entertainment systems, there is a rising demand for embedded telematics solutions.

- The integration of telematics in ADAS plays a crucial role in market growth. The development of sophisticated safety features, such as collision avoidance and lane departure warnings, relies on telematics data for effective implementation.

- Stringent safety regulations imposed by governments globally are propelling the adoption of embedded telematics. Compliance with safety standards, such as those set by organizations like the National Highway Traffic Safety Administration (NHTSA), encourages the implementation of telematics solutions in vehicles.

- The expansion of logistics and transportation industries has led to a surge in demand for efficient fleet management solutions. Embedded telematics provides real-time tracking, fuel monitoring, and maintenance alerts, contributing to improved fleet efficiency and cost savings.

- The integration of 5G technology enhances the capabilities of automotive embedded telematics. Faster and more reliable connectivity enables seamless communication between vehicles and infrastructure, opening up new possibilities for advanced telematics applications.

- The automotive insurance sector is witnessing a shift towards usage-based insurance models. Telematics data is leveraged by insurers to determine premiums based on actual driving behavior, fostering a greater adoption of embedded telematics for insurance purposes.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.17% |

| Global Market Size in 2025 | USD 25.42 Billion |

| Global Market Size by 2034 | USD 113.81 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Solution, By Component, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing vehicle connectivity

The surge in market demand for automotive embedded telematics is closely tied to the increasing connectivity of vehicles. As more cars become connected, the demand for embedded telematics systems grows, driven by the desire for enhanced features and services. These connected vehicles enable real-time communication between the car and external networks, paving the way for advanced functionalities like GPS navigation, remote diagnostics, and in-car entertainment.

Moreover, the rising trend of vehicle connectivity aligns with the broader shift towards smart and connected ecosystems. Consumers increasingly seek seamless integration of technology into their driving experience, fostering a higher demand for embedded telematics solutions. This trend not only enhances convenience for users but also opens opportunities for automakers to deliver innovative services, thereby propelling the growth of the automotive embedded telematics market.

Restraint

Concerns regarding data privacy and security

Concerns regarding data privacy and security act as significant restraints for the automotive embedded telematics market. Users worry about the potential misuse of sensitive data, such as location information and vehicle performance details, leading to apprehensions that hinder the widespread adoption of embedded telematics systems. The fear of unauthorized access and potential breaches of personal information raises skepticism among consumers and impacts their willingness to embrace this technology.

To overcome these restraints, the automotive industry needs to prioritize robust cybersecurity measures, assuring consumers that their data is safeguarded against unauthorized access. Clear and transparent communication about the security protocols implemented in embedded telematics systems is crucial to build trust. Additionally, the establishment of comprehensive and stringent data protection regulations can contribute to alleviating concerns and fostering a more secure environment, ultimately supporting the growth and acceptance of automotive embedded telematics solutions in the market.

Opportunity

Expanding usage in fleet management

The expanding usage of embedded telematics in fleet management is creating significant opportunities in the automotive market. Fleet operators are increasingly recognizing the value of telematics systems for enhancing operational efficiency and reducing costs. Embedded telematics provides real-time monitoring of vehicles, enabling fleet managers to track location, manage fuel consumption, and schedule maintenance proactively. This not only improves overall fleet performance but also contributes to fuel savings and operational optimization.

Moreover, the integration of embedded telematics in fleet management aligns with the broader trend of digital transformation in the logistics and transportation sectors. As companies seek more data-driven insights to streamline their operations, embedded telematics systems offer a comprehensive solution. The opportunities lie in providing advanced features such as route optimization, predictive maintenance, and driver behavior analysis, making embedded telematics a crucial tool for modernizing and improving the efficiency of fleet management operations.

Solution Insights

The safety & security segment held the highest market share in 2024. In the automotive embedded telematics market, the safety and security segment focuses on solutions designed to enhance driver and vehicle safety. This includes features such as emergency assistance, crash notifications, and stolen vehicle tracking. The trend in this segment involves the integration of advanced safety technologies, such as collision avoidance systems and real-time monitoring. As safety remains a top priority for consumers and regulatory bodies, automotive manufacturers are increasingly incorporating robust safety and security solutions within embedded telematics to address evolving safety concerns and improve overall road safety.

The remote diagnostics segment is anticipated to witness rapid growth at a significant CAGR of 22.2% during the projected period. Remote diagnostics, as a segment in the automotive embedded telematics market, refers to the capability of monitoring and assessing a vehicle's health and performance in real-time from a remote location. This solution enables proactive maintenance by providing insights into potential issues, reducing downtime, and enhancing overall vehicle reliability. A current trend in remote diagnostics involves the integration of artificial intelligence (AI) for more accurate and predictive analysis, allowing for timely identification of faults and enabling preemptive measures, ultimately improving vehicle efficiency and minimizing disruptions.

Component Insights

The services segment held the largest share of the market in 2024. The services segment in the automotive embedded telematics market encompasses various offerings such as maintenance, support, and consulting. These services play a vital role in ensuring the proper functioning and optimization of embedded telematics systems. A prevailing trend is the increasing demand for value-added services, including real-time support, software updates, and training, as automotive companies and users seek ongoing assistance to maximize the benefits of telematics technology. This trend reflects a growing emphasis on a holistic service approach to enhance the overall performance and user experience of embedded telematics solutions.

The hardware segment is anticipated to witness rapid growth over the projected period. Hardware in the automotive embedded telematics market refers to the physical components that form the core of telematics systems. This includes devices like telematics control units (TCUs), sensors, and connectivity modules embedded in vehicles. The hardware segment plays a vital role in facilitating data collection, processing, and transmission. Trends in automotive embedded telematics hardware focus on advancements in sensor technology, integration of 5G connectivity, and the development of compact and energy-efficient components. These trends aim to enhance the overall performance, reliability, and capabilities of embedded telematics systems in modern vehicles.

Application Insights

The passenger cars segment dominated the market with the largest share of 75% in 2024. The passenger cars segment in the automotive embedded telematics market refers to the application of telematics technology in private vehicles. This includes features like GPS navigation, real-time diagnostics, and in-car connectivity. A noticeable trend in this segment is the increasing demand for connected services, with consumers seeking enhanced safety features and personalized driving experiences. Embedded telematics in passenger cars not only improves convenience but also aligns with the growing preference for smart and connected vehicles in the automotive industry.

The commercial vehicles segment is anticipated to witness rapid growth over the projected period. The commercial vehicles segment in the automotive embedded telematics market pertains to the use of telematics systems in trucks, vans, and other commercial vehicles. This application involves integrating embedded telematics for real-time tracking, route optimization, and fleet management. A notable trend is the increasing adoption of embedded telematics in commercial fleets to enhance logistics efficiency, reduce fuel consumption, and improve overall operational productivity. This trend aligns with the growing demand for data-driven solutions in the commercial transportation sector.

Automotive Embedded Telematics Market Companies

- Verizon Connect

- Geotab

- TomTom Telematics

- AT&T

- Bosch Connected Devices and Solutions

- MiX Telematics

- CalAmp

- Teletrac Navman

- Harman International (a Samsung company)

- Continental AG

- Vodafone Automotive

- Telit

- Airbiquity

- Sierra Wireless

- WirelessCar

Recent Developments

- In September 2024, as part of the Eclipse Software Defined Vehicle project, Cummins Inc., a pioneer in power and technology worldwide, announced a partnership with Bosch Global Software and KPIT to introduce Eclipse CANought, a new open-source initiative for commercial vehicle telematics. This is a component of the Open Telematics program, which aims to lower the expenses associated with creating telematics apps for commercial cars.

- In January 2024, through Mobilisights, the Stellantis data-as-a-service company, Fleet Complete, a leader in connected fleet management solutions worldwide, announced the launch of its original equipment manufacturer telematics data support for Stellantis connected vehicles, the automaker behind well-known brands like Dodge, Ram, Jeep, and Chrysler.

Segments Covered in the Report

By Solution

- Safety & Security

- Information & Navigation

- Entertainment

- Remote Diagnostics

By Component

- Hardware

- Services

- Connectivity

By Application

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting