What is the Automotive Micromotor Market Size?

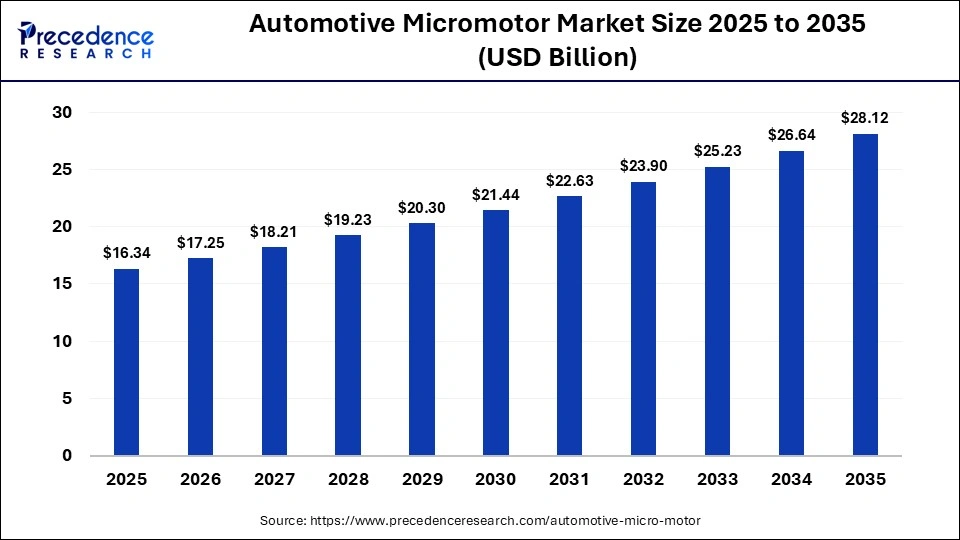

The global automotive micromotor market size accounted for USD 16.34 billion in 2025 and is predicted to increase from USD 17.25 billion in 2026 to approximately USD 28.12 billion by 2035, expanding at a CAGR of 5.58% from 2026 to 2035. With constant evolution and innovations in the automobile industry, the need for passenger comfort, along with simple automatic controls while riding, micromotors play an essential role as a component in modern vehicles. The growing demand for environmental sustainability and innovations in the automotive sector drives the market.

Market Highlights

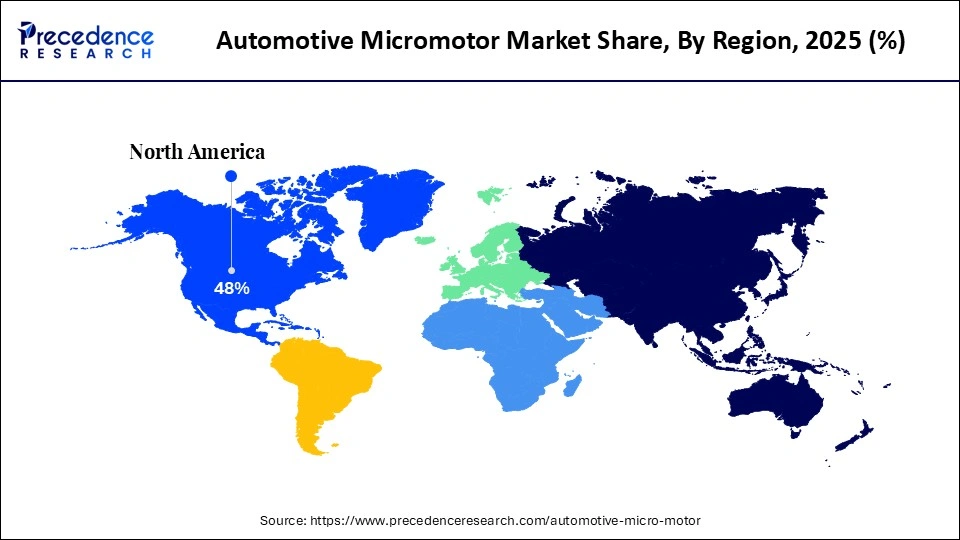

- Asia-Pacific dominated the global market with the largest market share of 48% in 2025.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

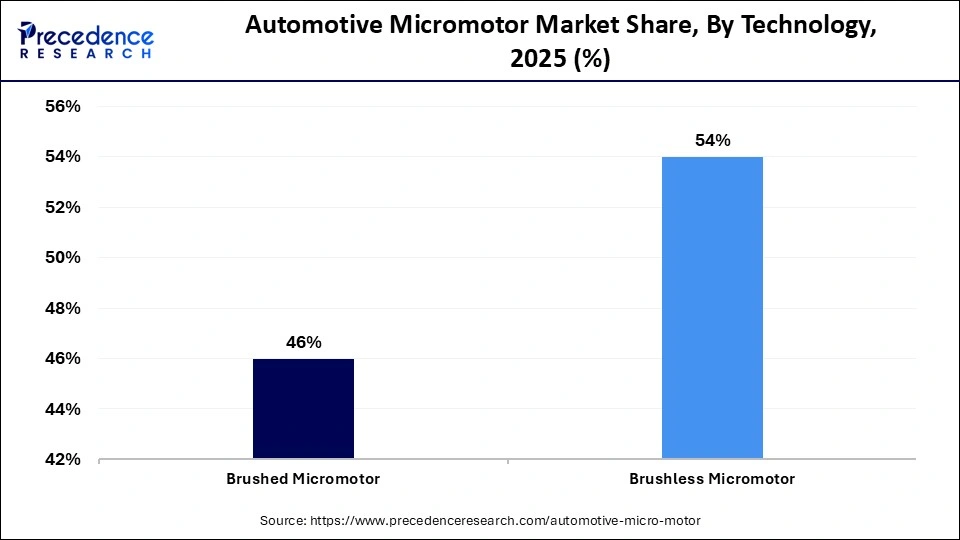

- By technology, the brushed micromotor segment held a major market share of 54% in 2025.

- By technology, the brushless micromotor segment is expected to grow with the highest CAGR in the market between 2026 and 2035.

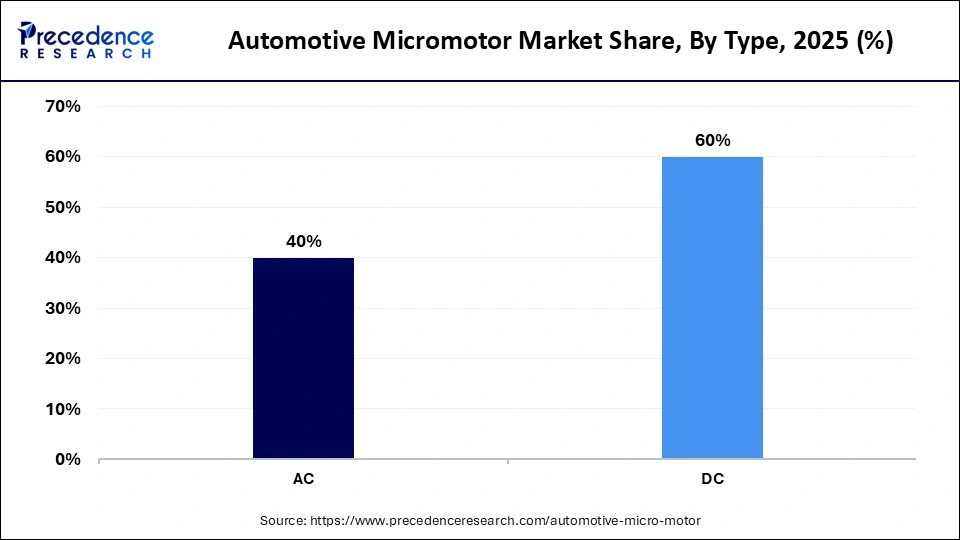

- By type, the DC segment accounted for the highest market share of 54% in 2025.

- By type, the AC segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By power consumption, the 12-24 V segment held a dominant position in the market in 2025.

- By application, the power steering motor segment held a dominant position in the market in 2025.

- By application, the heating, ventilation, air conditioning (HVAC) motor segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

What is an Automotive Micromotor?

Automotive micromotors are small, lightweight electric motors that are designed for high precision, low power consumption, and durability in vehicles. With the rapid growth of the automotive industry, demand for the automotive micromotor market is also increasing. An automotive micromotor is mainly used to improve comfort and convenience in vehicles. In vehicles, the automotive micromotor is widely used in electric seat adjustment, electric tailgate, screen rotation, seat ventilation and massage, electric window adjustment, and electric side door opening.

As technological innovations are shifting the market, micromotors are also used in electric power steering and electric parking. Other functions, such as electronic water pumps, electric air outlets, and windshield cleaning pumps, are also some applications where a micromotor is used. Moreover, as the demand for autonomous and electric vehicles is growing, the market is also flourishing to enhance safety, comfort, and entertainment features in vehicles, as it plays a vital role in these vehicles.

What is the Role of AI in the Automotive Micromotor Market?

AI has a transformative impact on micromotor manufacturing by enhancing the ability of automation and precision in assembly lines, reducing human errors. It also analyzes all production data and is used to predict equipment failures, helping in maintenance to minimize downtime. It enhances precision and efficiency in the manufacturing of motors and enables faster stimulation, which reduces R&D time for new motor designs. It also help motor to adapt to changing conditions, which ensures optimal performance in applications such as seat adjustment. AI-based micromotors can be up to 50% more compact and 70% more dynamic than traditional micromotors.

Automotive Micromotor Market Trends

- Rising Advancements in Autonomous and Electric Vehicles: With the increasing trend for automation, demand for micromotors is also rising in the industry. Manufacturers are focusing on high-efficiency, lightweight technologies to enhance the efficiency of electric vehicles. For the advanced driver assistance system (ADAS) connectivity, motors play an important role in integrating sensors and microcontrollers. It helps to provide comfort and luxury features such as power-adjustable mirrors and adjustable seats to enhance the experience.

- Growing Trend to Shift to Higher Performance Motor Types: As consumers focus on luxurious and personalized interiors, the shifting trend towards high-performance motor types is transforming the industry. To enhance energy efficiency and weight reduction in EVs, micromotors are essential in modern vehicles. Brushless DC motors offer longer lifespans, better reliability, and a reduction in vehicle vibration and noise.

- Rising Demand for More Features in Vehicles: As the new age car buyers demand continuous connectivity while traveling and enhanced safety features on their vehicles, the market is driven by rapid adoption of luxury, convenience, and safety features, increasing the demand for micro motors. Furthermore, the rising preference for various features, including electric sunroof, power windows, automatic seat adjustment, and an advanced HVAC system, all rely on micro motors for operations.

- Aftermarket Growth:As modern cars have numerous electronic components, the demand for repairing and replacing these components increases the demand for micromotor aftermarket. To replace the traditional brush motors with more efficient brushless motors with longer lifespan also plays a significant part in the aftermarket demand. Also, with the age of vehicles, cooling fans and HVAC blower motors require replacement, helping in the growth of the aftermarket.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.34 Billion |

| Market Size in 2026 | USD 17.25 Billion |

| Market Size by 2035 | USD 28.12 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.58% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology, Type, Power Consumption, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Which Technology Segment Dominated the Automotive Micromotor Market?

The brushed micromotor segment dominated the market in 2025 because of its simple design, reliability, and lower cost in vehicle applications. It is widely used in automotive components such as wipers and power windows. Also, their ability to handle high loads during short time makes it a primarily used technology. It is also widely preferred because it is relatively cheaper to manufacture, provides high starting torque, and good speed control.

The brushless micromotor segment is expected to expand rapidly in the market in the coming years, due to their higher efficiency and longer lifespan in using continuous use applications. High-performance brushless motors are increasingly used in electric vehicles, hybrid vehicles, personal transporters, and electric aircraft. They can be used at various speeds, offering high output power.

Technology Insights

Why Did the DC Segment Dominate the Automotive Micromotor Market?

The DC segment held the largest revenue share in the market in 2025, due to their affordability, easy installation, and simple designs, making them a suitable type of motor in automotive production. They are widely used in power windows, mirrors, and cooling fans due to their high torque and easy control systems. They also operate efficiently at the standard power supply of vehicles.

The AC segment is expected to grow with the highest CAGR in the market during the studied years due to its high efficiency and reliability. In autonomous and electric vehicles, AC motors are more powerful and dependable than their single-phase counterparts. They may perform various applications, from powering conveyor belts in manufacturing facilities to driving pumps and fans in HVAC systems.

Power Consumption Insights

How the 12-24 V Segment Dominated the Automotive Micromotor Market?

The 12-24 V segment contributed the biggest revenue share in the market in 2025, owing to high efficiency and strength. It provides a clean, regulated output voltage that keeps electronics protected from voltage spikes. It is also cost-effective and wastes less energy during the task. It is used in HVAC systems, seat adjustment, wiper systems, and cooling fans. Another feature of a 12-24V motor is its speed control, helping electric vehicles start and stop smoothly. It can also handle heavy loads, useful for carrying people or goods.

Application Insights

Which Application Segment Dominated the Automotive Micromotor Market?

The power steering motor segment accounted for the highest revenue share in the market in 2025, as it provides comfort and luxury in vehicles. The use of power steering is more energy efficient and lighter, providing passenger comfort and added convenience. It also provides effortless operation over manual operation of windows and adjusting the seat, providing accessibility to users. The electric power steering system offers numerous advantages, such as environmental protection and good recoverability.

The heating, ventilation, air conditioning (HVAC) motor segment is expected to grow with the highest CAGR in the market during the studied years, due to its superior benefits over other motor systems, including long life, low electromagnetic noise, and potential for energy saving. The shifting trend towards electric vehicles and a higher interest in sustainability potentiate the demand for compact and lightweight HVAC motors.

Regional Insights

How Big is the North America Automotive Micromotor Market Size?

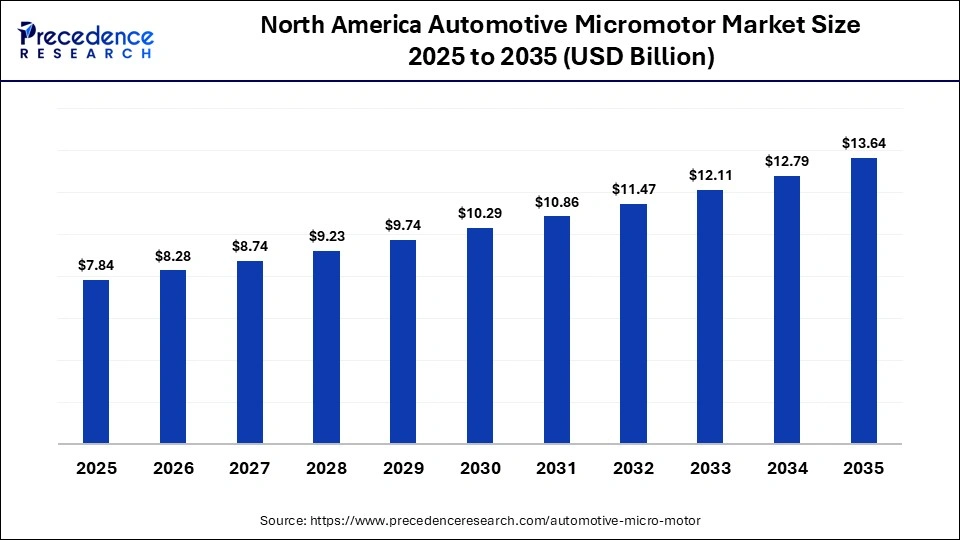

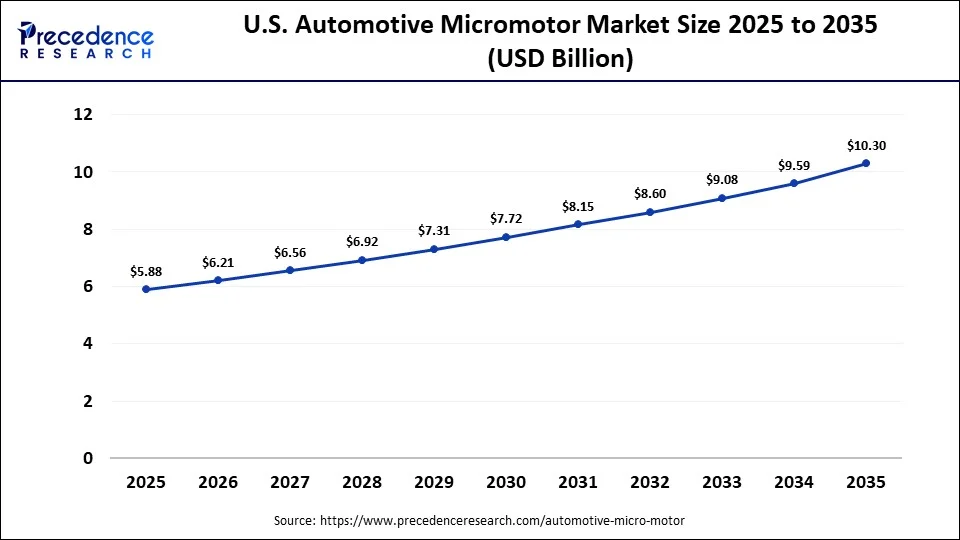

The North America automotive micromotor market size is estimated at USD 7.84 billion in 2025 and is projected to reach approximately USD 13.64 billion by 2035, with a 5.69% CAGR from 2026 to 2035.

How Will North America Grow in the Automotive Micromotor Market?

North America is expected to host the fastest-growing market in the coming years, due to its high consumer demand for advanced, luxury, comfortable, and electric vehicles. The automotive sector is burgeoning at a rapid pace in North America owing to favorable trade policies, high production, and government initiatives. The U.S., Canada, and Mexico form a unique co-production platform for manufacturing auto parts.

North Americans increasingly prefer automated vehicles embedded with autonomous driving systems and battery management systems. The rising development of a suitable infrastructure for electric vehicles also augments the market. The growing awareness of environmental sustainability and reducing carbon emissions propels market growth.

What is the Size of the U.S. Automotive Micromotor Market?

The U.S. automotive micromotor market size is calculated at USD 5.88 billion in 2025 and is expected to reach nearly USD 10.30 billion in 2035, accelerating at a strong CAGR of 5.77% between 2026 and 2035.

U.S. Automotive Micromotor Market Trends

The U.S. holds a major market share in North America, due to strong research opportunities and high R&D spending, along with the presence of leading automotive companies like Tesla. Tesla is a dominant leader in the U.S. that produced more than 1.6 million vehicles and delivered over 1.5 million vehicles in 2025. With awareness of environmental standards and regulations, innovations of compact fuel-efficient micromotors in vehicles are increasing in the market.

Which Factors Drive the Automotive Micromotor Market in Asia-Pacific?

Asia-Pacific held a majority revenue share of the market in 2025, due to large manufacturing capacity and the increasing demand for electric vehicles. Countries like China, Japan, and India are leading the production of automobile components, including micromotors. The increasing integration of smart technology in vehicles, such as ADAS, automated systems, and multiple micromotors, necessitates the use of micromotors.

The region is home to numerous key players that focus on the development and distribution of automotive micromotors, strengthening the region's position as a global leader. This is further supported by government initiatives to promote the indigenous development of automotive components. The rising adoption of advanced technologies and the growing awareness of electric motor components boost the market.

China Automotive Micromotor Market Trends

China is the leading country in the region, due to strong supply chain management and the availability of raw materials. China is a global EV manufacturing hub and accounts for more than 70% of the global production. It witnessed sales of over 11 million electric cars in 2024. Policy support and relatively affordable electric car imports from China played a pivotal role in increasing sales in some emerging electric vehicle industries. Chinese imports accounted for approximately 75% of the increase in electric car sales in 2024.

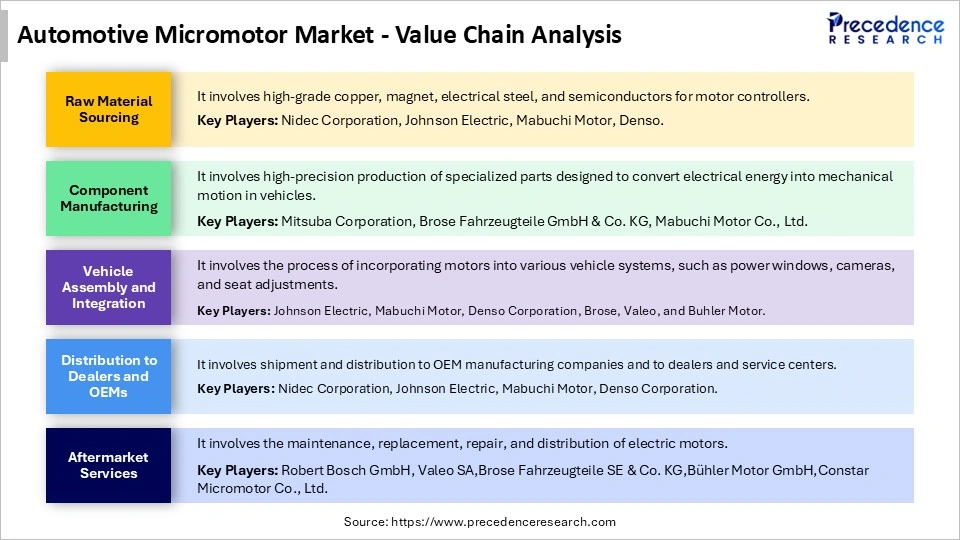

Automotive Micromotor MarketValue Chain Analysis

Who are the Major Players in the Global Automotive Micromotor Market?

The major players in the automotive micromotor market include Johnson Electric Holdings Limited, Nidec Corporation, Mabuchi Motor Co., Ltd., Denso Corporation, Robert Bosch GmbH, Mitsuba Corporation, Brose Fahrzeugteile SE & Co. KG, Valeo SA, Maxon Motor AG, Buhler Motor GmbH, Constar Micromotor Co., Ltd, AMETEK, Inc., MinebeaMitsumi Inc., Continental AG, Portesca, Faulhaber Group, Allied Motion Technologies Inc., Hitachi Astemo, Ltd, LG Innotek Co., Ltd., Pelonis Technologies, Inc., Shinano Kenshi Co., Ltd., and Telco.

Recent Developments

- In November 2025, NIDEC announced the opening of a new manufacturing hub, ‘the Orchard Park', in Karnataka, India. The facility was launched to cover multiple core product lines under the Motion & Energy business segment. The Phase II Elevator Motor Factory can manufacture a variety of ultra-thin outer rotor motors, inner rotor motors, and high-performance, high-speed, heavy-duty 500-series motors.(Source: https://www.nidec-kds.com)

- In September 2025, izmomicro announced the launch of its Galvanic Isolated Hex Bridge with integrated controllers and drivers, an in-house innovation, designed for demanding industrial, electric vehicle, and next-generation energy applications. The product addresses the need for compact, high-efficiency, and high-safety motor control solutions.(Source: https://www.izmomicro.com)

Segments Covered in the Report

By Technology

- Brushed Micromotor

- Brushless Micromotor

By Type

- AC

- DC

By Power Consumption

- Below 11 V

- 12-24 V

- 24-48 V

- Above 48 V

By Application

- Power Window Motor

- Wiper Motor

- Heating, Ventilation, Air Conditioning (HVAC) Motor

- Seat Adjustment Motor

- Power Steering Motor

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content