What is the Automotive Remote Diagnostic Market Size?

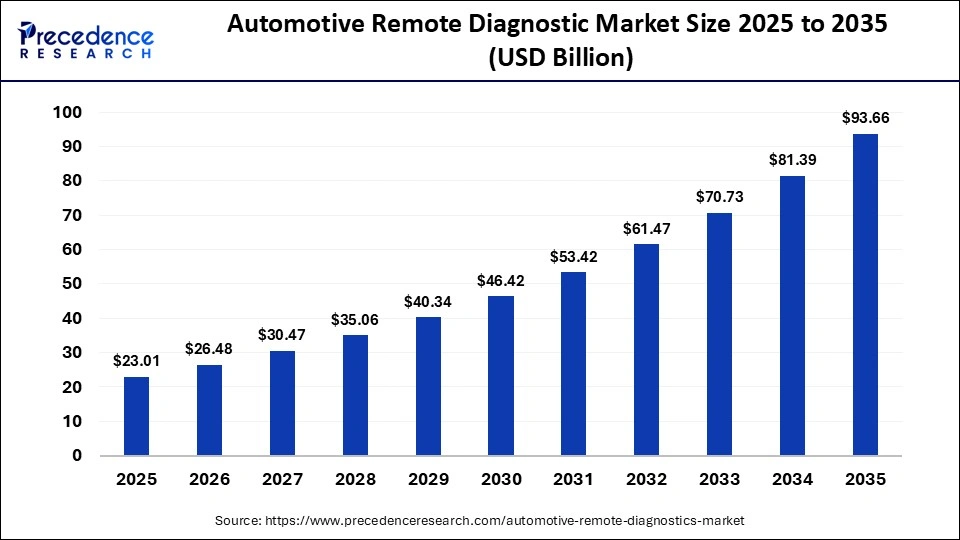

The global automotive remote diagnostic market size was calculated at USD 23.01 billion in 2025 and is predicted to increase from USD 26.48 billion in 2026 to approximately USD 93.66 billion by 2035, expanding at a CAGR of 15.07% from 2026 to 2035.This market is growing due to the rapid adoption of connected vehicles, enabling real-time vehicle health monitoring, predictive maintenance, and reducing downtime for automakers and fleet operators.

Market Highlights

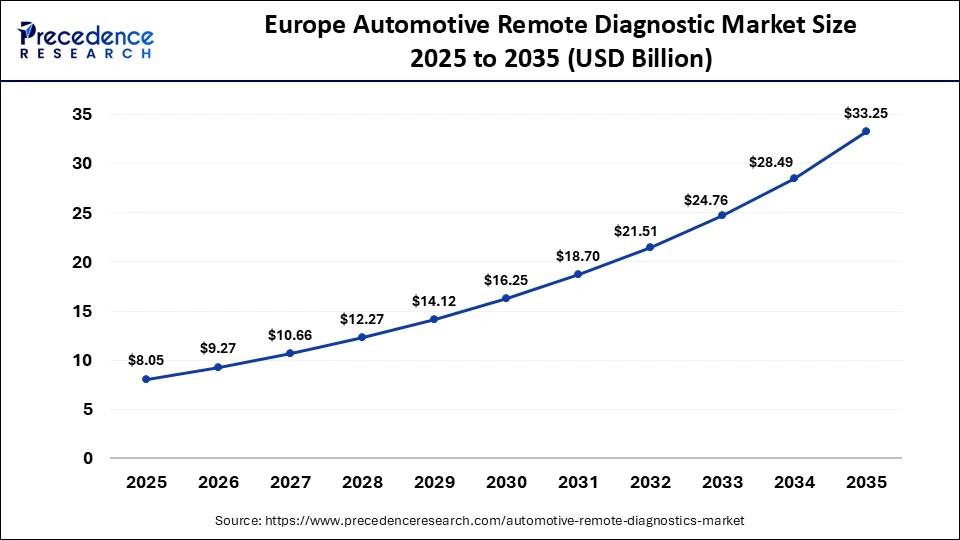

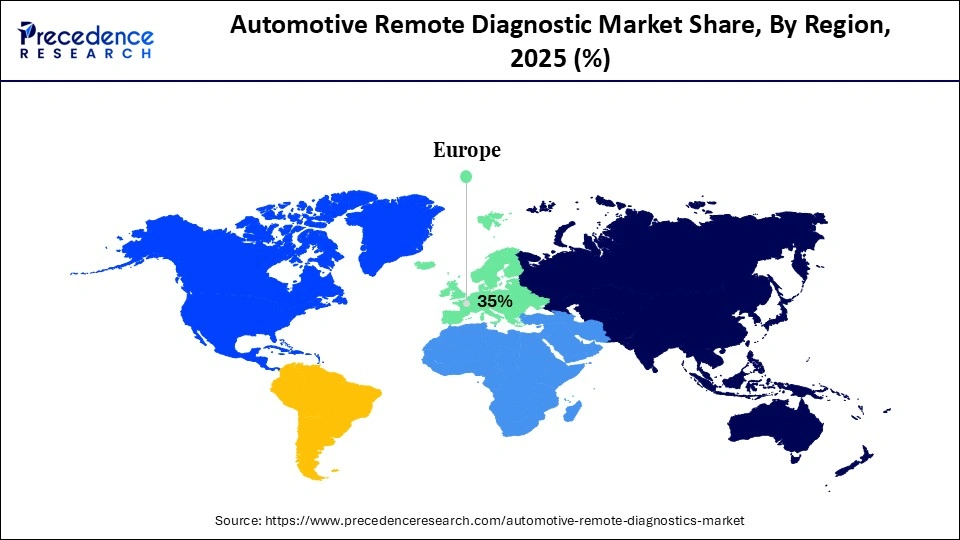

- Europe dominated the global market with the largest market share of 35% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

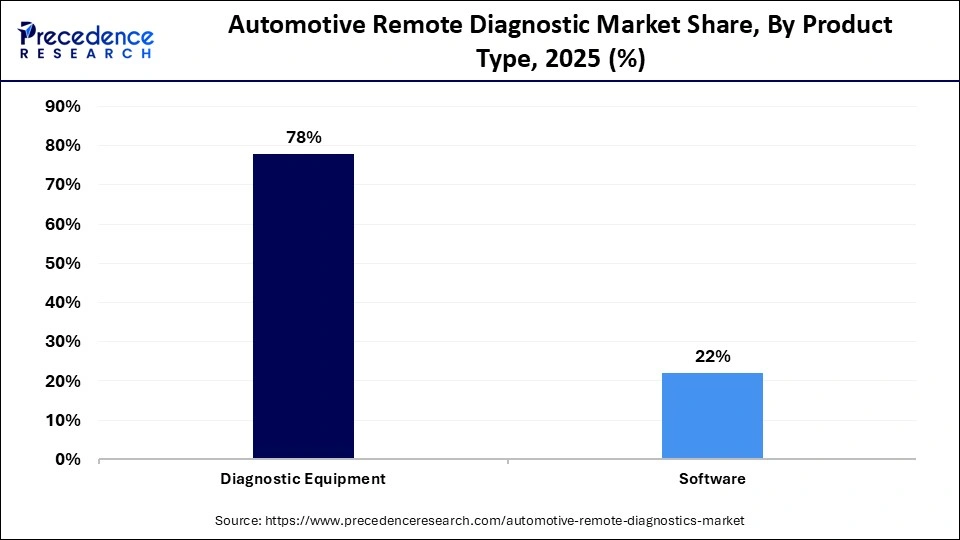

- By product type, the diagnostic equipment segment held the biggest market share of 78% in 2025.

- By product type, the software segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By vehicle type, the SUV segment captured more than 36% of market share in 2025.

- By vehicle type, the LCV segment is expected to grow at a strong CAGR between 2026 and 2035.

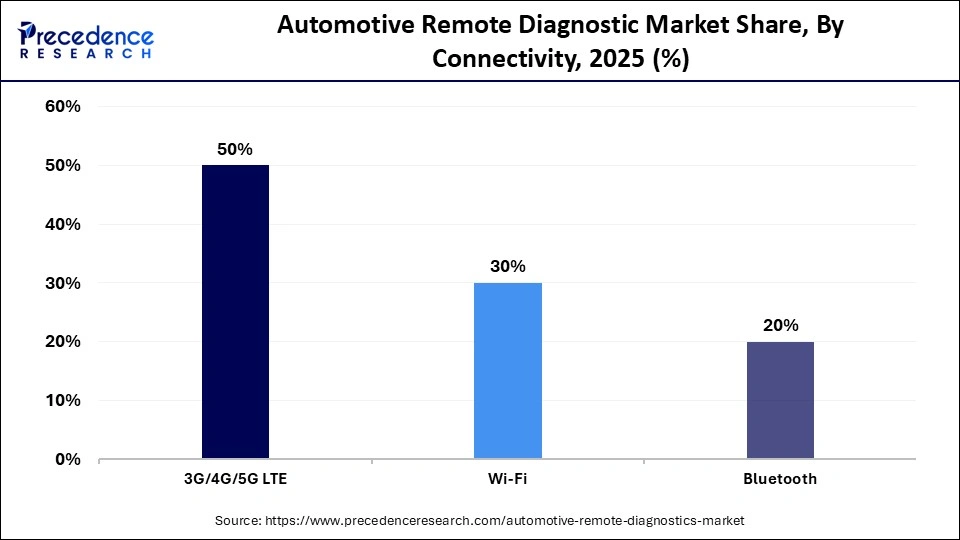

- By connectivity, the 3G/4G/5G LTE segment contributed the major market share of 50% in 2025.

- By connectivity, the Wi-Fi segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By application, the vehicle health alert system segment generated the biggest market share in 2025.

- By application, the vehicle tracking segment is expected to expand at the fastest CAGR between 2026 and 2035.

Market Overview

The automotive remote diagnostic market involves technologies that allow vehicles to transmit performance, engine, and system data to manufacturers or service providers for real-time monitoring and fault detection. By supporting over-the-air software updates, enabling predictive maintenance, and assisting in the early detection of faults, these technologies lower service expense and vehicle downtime. The market is expanding due to several important factors, including growing demand for effective fleet management, growing adoption of connected and electric vehicles, and increased emphasis on vehicle safety and emission compliance. The transition of automakers to digital and data-driven vehicle management is making remote diagnostics a crucial part of contemporary automotive ecosystems.

Future Market Overview

- Rising demand from fleet operators for cost-efficient, predictive maintenance solutions.

- The expanding electric vehicle industry is creating the need for diagnostic solutions for batteries and power electronics.

- Integration of AI-driven analytics for personalized vehicle health insights and alerts.

- Growth of mobility-as-a-service (MaaS) and shared mobility platforms require continuous vehicle monitoring.

- Untapped potential in emerging markets with improving vehicle connectivity infrastructure.

- Development of advanced diagnostics for autonomous and semi-autonomous vehicles.

- Increasing adoption of subscription-based remote diagnostic services by OEMs

- Opportunities to integrate remote diagnostics with insurance and usage-based pricing models.

How Are Government Initiatives Supporting the Growth of the Automotive Remote Diagnostic Market?

Government initiatives are supporting the growth of the market through policies promoting connected vehicles, digital mobility, and road safety. OEMs and fleet operators are being pushed to incorporate remote diagnostic solutions by regulatory frameworks that promote the use of telematics, vehicle emission monitoring, and real-time safety compliance. The need for advanced diagnostics that facilitate predictive maintenance and data-driven vehicle management is further accelerated by investments in smart city initiatives, intelligent transportation systems, and electric vehicle infrastructure. Furthermore, government-supported digitalization projects and improvements in data connectivity are fortifying the groundwork for the broad use of remote diagnostic technologies.

How Does Automotive Remote Diagnostics Improve Return On Investment (ROI)?

Automotive remote diagnostic solutions significantly improve return on investment by reducing unplanned vehicle downtime, lowering maintenance costs, and extending vehicle lifespan through predictive maintenance. Real-time fault detection and early warnings reduce repair costs and help OEMs and fleet operators avoid expensive malfunctions. Additionally, by eliminating the need for in-person inspections, remote diagnostics improve vehicle utilization rates while lowering labor costs and service time. Moreover, data-driven insights facilitate enhanced resale value, better asset management, and optimized fuel efficiency, all of which contribute to long-term cost savings and a quicker return on investment for operators of both commercial and passenger vehicles.

How is AI Influencing the Automotive Remote Diagnostic Market?

Through the analysis of historical and real-time vehicle data, AI improves automotive remote diagnostics by enabling proactive maintenance, predicting failures, and increasing diagnostic accuracy. Machine learning models learn from component wear, driving patterns, and fault histories to continuously improve insights. This makes it possible for automakers and service providers to optimize service schedules, send out personalized maintenance alerts, and raise customer satisfaction and overall vehicle reliability

Key Trends in the Automotive Remote Diagnostic Market

- Rapid integration of AI and machine learning for predictive vehicle maintenance.

- Growing adoption of connected and software-defined vehicles across passenger and commercial segments.

- Increasing use of cloud-based diagnostic platforms for real-time data analysis and remote access.

- Rising demand for over-the-air (OTA) updates to fix issues without physical service visits.

- Expansion of remote diagnostics in electric and hybrid vehicles to monitor battery health and performance.

- Growing focus on fleet telematics solutions to reduce downtime and improve operational efficiency.

- Enhanced cybersecurity measures to protect vehicle data and diagnostic systems.

- Increasing collaboration between automakers and technology providers for advanced diagnostic solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 23.01Billion |

| Market Size in 2026 | USD 26.48 Billion |

| Market Size by 2035 | USD 93.66 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.07% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Vehicle Type, Connectivity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

What Made Diagnostic Equipment the Dominant Segment in the Automotive Remote Diagnostic Market?

The diagnostic equipment segment dominated the market with the largest share in 2025. This is mainly due to its vital role in predictive maintenance, performance monitoring, and real-time vehicle fault detection. Advanced diagnostic hardware was widely embraced by OEMs and fleet operators to guarantee quicker troubleshooting, less downtime for vehicles, and enhanced safety compliance. There is a greater need for reliable diagnostic tools that can process massive amounts of sensor and vehicle data due to the growing complexity of automotive electronics, particularly in connected and electric vehicles.

The software segment is expected to grow at the fastest CAGR in the coming years, driven by an increase in the use of over-the-air update solutions, cloud-based diagnostic platforms, and analytics driven by artificial intelligence. There is a growing need for scalable diagnostic software that permits remote monitoring, predictive insights, and ongoing feature upgrades as automakers move more toward software-defined vehicles. The segment growth is also being accelerated by the integration of software with fleet management systems and subscription-based business models.

Vehicle Type Insights

What Made SUV the Leading Segment in the Automotive Remote Diagnostic Market?

The SUV segment led the market by holding a major share in 2025, driven by its substantial volume of sales worldwide and growing incorporation of cutting-edge safety and connectivity technologies. For maintenance and performance optimization, remote diagnostics are crucial because SUVs frequently have numerous infotainment systems, electronic control units, and driver assistance features. The segment's dominant position in the market is further reinforced by growing consumer preference for SUVs, especially in North America and Europe.

The LCV segment is expected to grow at the fastest CAGR in the coming years due to the rapid expansion of e-commerce, last-mile delivery, and urban logistics operations. Fleet operators are increasingly deploying remote diagnostic solutions to monitor vehicle performance, minimize downtime, and reduce maintenance costs across large fleets. Additionally, the rising focus on fleet digitalization, real-time tracking, and predictive maintenance is accelerating the adoption of remote diagnostics in the LCV segment.

Connectivity Insights

Why Did the 3G/4G/5G LTE Segment Dominate the Automotive Remote Diagnostic Market?

The 3G/4G/5G LTE segment dominated the market while holding the largest share in 2025. This is mainly due to its capacity to support real-time diagnostics, dependable data transmission, and extensive network coverage. Continuous vehicle monitoring, immediate fault alerts, and smooth data transfer between cars and cloud platforms are all made possible by this connectivity.

5G enables high-speed data processing and low-latency communication, which further improves diagnostic capabilities.The Wi-Fi segment is expected to grow at the fastest CAGR in the coming years, driven by the growing need for constant vehicle connectivity and developments in next-generation communication technologies. Vehicle-to-cloud communication, improved data analytics, and integration with intelligent mobility ecosystems are all supported by emerging connectivity solutions. It is anticipated that demand for Wi-Fi connectivity solutions in remote diagnostics will increase quickly as the use of connected and autonomous vehicles increases.

Application Insights

What Made Vehicle Health Alert System the Leading Segment in the Automotive Remote Diagnostic Market?

The vehicle health alert system segment led the market in 2025, driven by its critical role in providing early warnings of component failures and maintenance needs. These systems support proactive maintenance, improve vehicle safety, reduce repair costs, and minimize unexpected breakdowns. Strong adoption by OEMs, fleet operators, and insurance providers significantly contributed to the segment's dominant market share.

The vehicle tracking segment is expected to grow at the fastest CAGR in the coming years, driven by growing demand for fleet optimization, theft prevention, and real-time location monitoring. By combining remote diagnostics and tracking systems, operators can obtain location and performance information from a single platform. Additionally, rising concerns over vehicle theft, regulatory compliance requirements, and the expansion of logistics and mobility services are further accelerating the growth of this segment.

Region Insights

What is the Europe Automotive Remote Diagnostic Market Size and Growth Rate?

The Europe automotive remote diagnostic market size has grown strongly in recent years. It will grow from USD 8.01 billion in 2025 to USD 33.2 billion in 2035, expanding at a compound annual growth rate (CAGR) of 15.24% between 2026 and 2035.

Why Did Europe Dominate the Automotive Remote Diagnostic Market?

Europe dominated the market while capturing the largest share in 2025, driven by the robust presence of top automakers, sophisticated infrastructure for vehicle connectivity, and stringent laws governing vehicle safety and emissions. The region's leading position in the market is further reinforced by the widespread use of connected cars and the early OEM integration of remote diagnostic technologies. Government programs that support sustainable transportation and digital mobility further support market growth.

Germany Automotive Remote Diagnostic Market Trends

Germany leads the market within Europe due to its strong automotive manufacturing base and the presence of leading OEMs and technology suppliers. Early adoption of connected car technologies, advanced telematics systems, and Industry 4.0 practices further strengthened its market position. Additionally, stringent vehicle safety and compliance regulations are encouraging automakers and fleet operators to integrate remote diagnostics solutions for real-time monitoring, predictive maintenance, and performance optimization.

How is the Opportunistic Rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years, fueled by a surge in the adoption of connected vehicles, a rapid increase in vehicle production, and a growing focus on automotive digitalization projects. Nations like China, India, and Japan are making significant investments in telematics and smart mobility solutions. Growing consumer awareness of connected vehicle technologies, cost-effective maintenance, and increased demand for fleet management are all driving regional market expansion.

India Automotive Remote Diagnostic Market Trends

The market in India is expanding rapidly, driven by rising sales of LCVs and connected two-wheelers, rapid expansion of e-commerce logistics, and increasing collaboration between automakers and tech startups. The growing availability of OEM-integrated telematics solutions and affordable cloud-based diagnostic platforms is improving access for small and mid-sized fleet operators. Together, these factors position India as a high-growth market in the coming years.

Who are the Major Players in the Global Automotive Remote Diagnostic Market?

The major players in the automotive remote diagnostic market include Robert Bosch GmbH, Continental AG, Aptiv PLC , Snap-on Incorporated, Delphi Technologies / BorgWarner Inc,. Verizon Connect, OnStar LLC, Marelli Holdings Co., Ltd,. Denso Corporation, Vector Informatik GmbH, Geotab Inc., Trimble Inc., ACTIA Group, Softing AG, Autel Intelligent Technology Corp,. Octo Group S.p.A

Recent Developments

- In January 2024, Stellantis announced the acquisition of an artificial intelligence framework and assets from CloudMade to bolster its STLA SmartCockpit. This launches AI-driven features for predictive maintenance and personalized vehicle diagnostics(Source: https://www.reuters.com)

- In February 2024, THINKCAR has launched the ThinkTool Master X2, a 10.1-inch Android touchscreen tablet and successor to the Master X, designed for automotive professionals worldwide. Its key feature, video remote diagnosis, allows users to connect with expert technicians for real-time OE-level and remote diagnostics. The Master X2 also supports Bluetooth, wired, and WiFi-based diagnostic connector communication for faster, more efficient vehicle maintenance in complex environments.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Product Type

- Diagnostic Equipment

- Software

By Vehicle Type

- Hatchback/Sedan

- SUV

- LCV

- HCV

By Connectivity

- 3G/4G/5G LTE

- Wi-Fi

- Bluetooth

By Application

- Automatic Crash Notification

- Vehicle Tracking

- Vehicle Health Alert

- Roadside Assistance

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting