Battery-Free Implants Market Size and Forecast 2025 to 2034

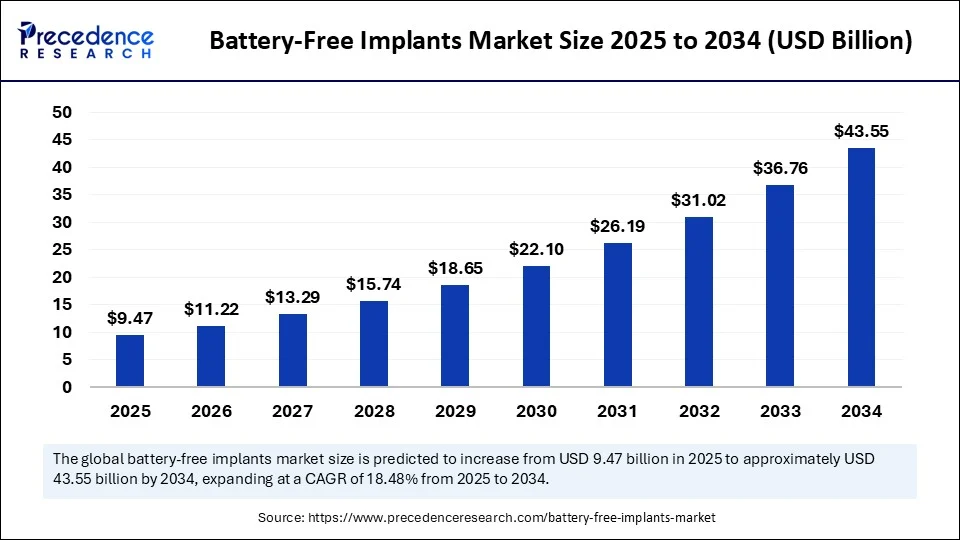

The global battery-free implants market size accounted for USD 7.99 billion in 2024 and is predicted to increase from USD 9.47 billion in 2025 to approximately USD 43.55 billion by 2034, expanding at a CAGR of 18.48 % from 2025 to 2034. The market growth is attributed to the increasing adoption of energy-efficient medical devices that enhance patient outcomes while reducing surgical risks and long-term maintenance.

Battery-Free Implants Market Key Takeaways

- In terms of revenue, the global battery-free implants market was valued at USD 7.99 billion in 2024.

- It is projected to reach USD 43.55 billion by 2034.

- The market is expected to grow at a CAGR of 18.48% from 2025 to 2034.

- North America dominated the global battery-free implants market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By application, the cardiac monitoring and pacing devices segment held the major market share in 2024.

- By application, the orthopedic monitoring devices segment is projected to grow at the highest CAGR between 2025 and 2034.

- By therapeutic area, the cardiology segment contributed the biggest market share in 2024.

- By therapeutic area, the orthopedics segment is expanding at a significant CAGR between 2025 and 2034.

- By energy harvesting technology, the radiofrequency (RF)-based devices segment led the market in 2024.

- By energy harvesting technology, the piezoelectric energy conversion segment is expected to grow at a significant CAGR over the projected period.

- By material, composite materials generated the largest market share in 2024.

- By material, bioresorbable materials segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end user, the hospitals and clinics segment held the major market share in 2024.

- By end user, the homecare settings segment is projected to grow at a significant CAGR between 2025 and 2034

Impact of Artificial Intelligence on the Battery-Free Implants Market

Artificial intelligence is transforming the development and deployment of battery-free implants by enabling intelligent, rapid, and precise clinical integration. AI-based modeling and optimization of energy harvesting mechanisms for engines, utilizing body heat and body movement, enable them to maintain a steady state in harsh biological environments. The application of AI-based data analytics in clinical settings can be used to identify the most suitable patients for the battery-free solution. Furthermore, AI also speeds up the move to more sustainable, less invasive, and personalized implantable electronics by minimizing the use of batteries and maximizing functionality.

Market Overview

Battery-free implants are medical devices that are implanted into the human body and operate without an internal power source, unlike traditional batteries. These devices harness external energy sources such as radiofrequency (RF), ultrasound, magnetic induction, or bioelectricity to function. Their advantages include miniaturization, longer life cycles, reduced replacement surgeries, and improved patient safety, making them increasingly viable for chronic disease management, monitoring, and therapeutic delivery.

The increasing demand for minimally invasive and long-term health monitoring devices is likely to boost the demand for battery-free implants in various clinical practices. These implants incorporate energy-scavenging technologies, eliminating the need for internal batteries and resulting in smaller, safer, and longer-lasting devices. The clinical viability and safety of these battery-free neuromodulation and cardiac devices have been demonstrated through multiple U.S. Food and Drug Administration (FDA) approvals, utilizing wireless energy transfer systems. In 2024, the National Institutes of Health (NIH) allocated a substantial amount of funding to body-powered implant development, driven by a reduced risk of complications and enhanced patient comfort.

Battery-Free Implants Market Growth Factors

- Growing Emphasis on Preventive Healthcare Delivery: Rising demand for early diagnosis and continuous monitoring is driving adoption of maintenance-free implants across clinical pathways.

- Boosting Integration with Telehealth Platforms: Expansion of digital health infrastructure fuels real-time data transmission from battery-free implants to remote care teams.

- Rising Government Support for Medtech Innovation: Increased funding and regulatory acceleration programs are propelling the commercialization of next-generation bioelectronic implants.

- Advancing Precision Medicine Models: Personalized treatment approaches are driving the need for smart implants that operate autonomously and adapt to individual patient profiles.

- Surging Demand in Geriatric and Home-Based Care: Aging populations and the shift to decentralized care models are boosting the deployment of passive, wireless implants in home settings.

- Accelerating Development of Biodegradable Materials: Innovations in eco-friendly and resorbable implant materials are fuelling interest in battery-free systems with zero-extraction requirements.

- Expanding Collaborations Between Academia and Industry: Joint R&D initiatives between universities and medtech companies are driving faster translation of experimental implants into clinical use.

Market Sope

| Report Coverage | Details |

| Market Size by 2034 | USD 43.55 Billion |

| Market Size in 2025 | USD 9.47 Billion |

| Market Size in 2024 | USD 7.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.48% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Therapeutic Area, Energy Harvesting Technology, Material Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Shift Toward Minimally Invasive Procedures Driving the Growth of the Battery-Free Implants Market?

Increasing demand for minimally invasive medical procedures is expected to drive the market in the coming years. The growth in demand for less invasive procedures in medicine led to the increased use of battery-free implants in multiple therapeutic applications. Doctors tend to choose battery-free options since their volume parameters are smaller, and it is simpler to implant them without worrying about infection or inflammation. Such implants are preferred over chronic diseases since patients experience shorter recovery and minimal complications.

The trend is escalating, especially in neuromodulation, cardiovascular, and orthopedic devices, where device size and device survival are crucial factors in clinical outcomes. The U.S. Food and Drug Administration (FDA) also granted approval for various next-generation wireless and passive implant systems in 2024. Its Breakthrough Devices Program further substantiates the move toward battery-free solutions in the care of chronic diseases. Battery-free implants powered through magnetic resonance showed stable operation in vivo for more than six months without the need to induce inflammatory reactions. Furthermore, the growing prevalence of chronic diseases and aging populations is projected to drive the demand for advanced implantable solutions that do not require onboard batteries.

Restraint

High Development and Integration Costs Likely to Impede Early Commercialization of Battery-Free Implants

High development and integration costs are likely to affect early commercialization efforts, further hampering market growth. The likelihood of discouraging early commercialization is the challenge of impeding market penetration due to the high costs of development and integration. Although startups and smaller MedTech companies have considerable finances when planning to incorporate wireless energy transfer into scalable projects. Furthermore, medical practitioners may be reluctant to make significant initial investments in favor of more technologically advanced implant systems that already comply with reimbursement protocols. The limited power output of energy harvesting technologies affects the functionality of battery-free implants, limiting their adoption.

Opportunity

Rising Investments in Bioelectronics

Surging investments in bioelectronics and wireless medical technologies are anticipated to create immense opportunities for the players competing in the battery-free implants market. Money invested by both the public and private sectors is allocated to R&D projects in the field of next-generation implantable devices that harness energy gathered from either biological sources or external sources. Startups and major MedTech companies are investigating wireless power transfer, energy harvesting circuits, and miniaturized sensors. In 2024, the U.S. Food and Drug Administration (FDA) approved Investigational Device Exemptions (IDEs) for a large number of companies to conduct a first-in-human study of wireless-powered implants that utilize mood and spinal therapies. Furthermore, the development of battery-free implant technologies facilitated by grants to operate during long-duration trauma care scenarios is expected to fuel the market in the coming years.

Application Insights

Why Did the Cardiac Monitoring & Pacing Devices Segment Dominate the Battery-Free Implants Market in 2024?

The cardiac monitoring & pacing devices segment dominated the battery-free implants market, accounting for a 41% share in 2024. This is mainly due to the critical gap in the clinic, which demanded long-term cardiac rhythm management in patients with arrhythmia, atrial fibrillation, and heart failure. Wireless systems or kinetic energy systems provide pacemakers and cardiac monitors with battery-free energy. This system is consistent without the need for surgical replacement of the batteries, hence providing a low risk and reducing the cost to the patient. Furthermore, such devices are increasingly used by healthcare professionals, as they facilitate continuous monitoring of high-risk cardiac patients and help them achieve better long-term results.

The orthopedic monitoring devices segment is projected to grow at the fastest rate in the coming years, driven by the increasing demand for real-time biomechanical feedback in post-surgical rehabilitation, sports medicine, and joint-related diseases. The pressure, strain, and motion data of battery-free implants in this category are wirelessly transmitted, avoiding internal battery-related complications. This enables the continuous monitoring of joint and bone performance.

These implants are gaining popularity among surgeons and physiotherapists for monitoring the healing process. They optimize treatment schedules and ensure early detection of complications. Remote data access by care crews also integrates with value-based orthopedic care models, thanks to the remote availability of data on digital platforms. These implants have demonstrated accuracy in correlation with gait and load distribution in orthopedic patients, thus further fueling the segment.

(Source:https://ethz.ch)

Therapeutic Area Insights

What Made Cardiology the Dominant Segment in the Battery-Free Implants Market?

The cardiology segment dominated the market, accounting for a 38% share in 2024, due to the increasing incidence of cardiovascular ailments and the vital need for long-term, maintenance-free monitoring. Wireless types of pacemakers, loop recorders, and intracardiac pressure sensors were energy-autonomous implants that discharged the most critical issues of traditional management. Cardiac devices are specifically defined by the frequency of battery replacements and surgeries associated with these procedures, which carry relative risks.

According to a report published by the World Health Organization (WHO) in 2024, cardiovascular diseases are the leading cause of death worldwide, taking the lives of about 17.9 million people each year. This highlights the need for innovative and reliable cardiac solutions. Breakthrough designation was established by the U.S. Food and Drug Administration (FDA) on a few battery-free systems of cardiac monitoring based on electromagnetic and kinetic energy sources that have gained speed in clinical practice approaches. Furthermore, the Centers for Medicare & Medicaid Services (CMS) has broadened its coverage policy in 2024 so that remote physiological monitoring (RPM) is expected to be used with battery-free implantable cardiac devices, thus further fueling the segment.

(Source:https://www.who.int)

The orthopedic segment is expected to grow at the fastest rate in the coming years, owing to the increasing need for real-time monitoring of joints and musculoskeletal parts during post-surgical and non-surgical movements. Orthopedic implants, such as energy-independent implants, monitor the amount of load, movement, and healing dynamics. They do not need to include internal batteries to enable round-the-clock monitoring, even in day-to-day activity. Additionally, implants that work without batteries provide more consistent long-term results, further improving patient mobility and quality of life, which in turn boosts the market.

Energy Harvesting Technology Insights

How Does the RF-Based Devices Segment Dominate the Market in 2024?

The radiofrequency (RF)-based segment dominated the battery-free implants market, capturing 46% of the share in 2024. This technology enables the wireless delivery of energy in a highly reliable and low-latency manner using external transmitters and internal targets or receivers. RF-based implants made it possible to support an extensive array of applications. They support cardiac rhythm, neuromodulation, and biosensing by operating in the environment of deep tissue without the need for costly and bulky batteries.

- In 2024, the U.S. Food and Drug Administration (FDA) approved some RF-powered neurostimulators and telemetry-based cardiac implants, fast-tracking their use in general clinical practice. Additionally, the rising demand for long-term remote monitoring systems based on RF power further facilitates segmental growth.

The piezoelectric energy conversion segment is projected to grow at the highest CAGR in the coming years, owing to its ability to provide implants with electricity through biomechanical forces, including the motion of muscles, joints, and blood. Piezoelectric systems operate by solely transducing mechanical stress into electrical energy, providing battery-less systems that work independently of external transmitters. Investigators reported that nanostructured piezoelectric films, when incorporated into implants in the spine, demonstrated stability in terms of integrity over extended loading excursions. Furthermore, the piezoelectric solutions are being implanted in places with lots of motion, such as anatomical locations, as continuous kinetic energy flow and streaming of data are guaranteed, which further shows the growing demand for this segment.

Material Type Insights

What Factors Made Composite Materials the Dominant Segment in the Battery-Free Implants Market?

The composite materials segment dominated the market with a 36% share in 2024. Such materials were a combination of polymers, ceramics, and metals, providing the best structural integrity, electrical conductivity, and biocompatibility, thereby suited to withstand long-term implantation. Implants made up of composite materials attracted wide acceptance in cardiac, orthopedic, and neuromodulation applications. They have been tested to be strong and stable under physiological conditions, which further facilitates the demand for composite material-based battery-free implants.

The bioresorbable materials segment is expected to grow at the fastest rate during the forecast period. This is mainly due to the increasing need for temporary implants that are self-destructive after their intended use. These materials avoid the need for secondary removal surgery and minimize long-term complications, especially in post-surgical use cases for patients of all ages. Furthermore, the innovations are expected to change post-operative treatment and short-term diagnostic assessment with a biodegradable, wireless solution of implants that fulfill increasing clinical and patient-centered needs.

End User Insights

Why Did the Hospitals & Clinics Segment Dominate the Battery-Free Implants Market in 2024?

The hospital & clinics segment dominated the battery-free implants market in 2024, accounting for approximately 47% of the share. The segment's dominance is attributed to the increased acceptance of battery-free implants, driven by the need for revision surgery, real-time data collection, and addressing complications associated with battery failure. Wireless cardiac and orthopedic implants are various certified wireless implants used for monitoring patients in hospitals. These implants have become early patients in orthopedic and cardiology units.

In the new coding standards released by the Centers for Medicare & Medicaid Services (CMS), outpatient and inpatient hospital settings will also be reimbursed by paying for advanced implant-based diagnostics. This strengthened their dominant role in the segment further, as hospitals worked more actively with manufacturers, such as Medtronic, Boston Scientific, Abbott Laboratories, and others, to pilot-test battery-free systems in acute care, rehabilitation, and interventional areas.

The homecare settings segment is projected to grow at the fastest rate in the coming years, owing to the increasing need for decentralized healthcare facilities, remote monitoring, and management of patient-specific chronic healthcare. Without professional battery management or frequent visits to the clinic, battery-free implants offer a non-invasive, low-maintenance solution for long-term data capture. Recently, the National Health Service (NHS) in the UK initiated homecare pilot programs offering wireless implantable bladder control and cardiac monitors. This resulted in higher patient satisfaction and lower hospital re-admissions, further facilitating the use of this type of technology in homecare settings.

Regional Insights

What Made North America the Dominant Region in the Global Battery-Free Implants Market in 2024?

North America dominated the battery-free implants market, capturing the largest revenue share in 2024. This is mainly due to its excellent regulatory framework and better healthcare facilities. There is a high adoption of state-of-the-art medical innovations, including battery-free implants. Recently, the U.S. Food and Drug Administration (FDA) approved a range of battery-free cardiac monitors and neuromodulation implants to improve clinical adoption and streamline integration into healthcare systems. Medical institutions, including Mayo Clinic, Cleveland Clinic, and Johns Hopkins University, are introducing battery-free systems in all their cardiology and neuro-rehabilitation departments to minimize surgical complications and allow constant monitoring. Furthermore, the increasing insurance coverage and patient accessibility to these technologies fuel the market in this region.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, owing to the rapid pace of healthcare digitization, growing localization of medical devices, and the rise in the demand for minimally invasive procedures. In 2024, the China National Medical Products Administration (NMPA) and the Indian Central Drugs Standard Control Organization (CDSCO) streamlined approvals on novel battery-free sensor devices. Major regulatory bodies in this region have approved the pilot implementation of piezoelectric neurostimulators, thus demonstrating increasing support for domestic innovation.

Governments throughout India, China, and South Korea introduced funding programs to ramp up domestic manufacturing of passive or energy-generating implants. Battery-free orthopedic sensors are in high demand and were previously approved by the Australian Therapeutic Goods Administration (TGA). Fraunhofer Society and ETH Zurich are constantly expanding collaborative research initiatives with APAC-based MedTech hubs to manufacture flexible electronic implantable circuits. Moreover, rising surgical procedures are likely to support regional market growth.

Europe is expected to grow at a notable rate. This is mainly due to the strong presence of regulatory authorities, vibrant clinical research environments, and rising interest in advanced bioelectronic treatment. Germany, France, and Sweden entered the first wave as hospitals in these countries have started using battery-free cardiac and orthopedic devices. Ongoing technological advances in implants to improve treatment outcomes further support regional market growth. Moreover, government initiatives promote health awareness, and growing dental tourism positively impacts the market.

Battery-Free Implants Market Companies

- Abbott Laboratories

- Biotronik SE & Co. KG

- Cochlear Limited

- EBR Systems, Inc.

- Medtronic plc

- NeuroPace Inc.

- Pixium Vision

- Profusa Inc.

- Second Sight Medical Products Inc.

- Stimwave Technologies Inc.

Recent Developments

- In June 2025, University of Arizona researchers introduced a battery-free implant that monitors bone fracture recovery using near-field and far-field wireless power transfer. The device transmits real-time data via Bluetooth Low Energy, showing reduced strain as healing progresses. It eliminates manual charging and supports sustainable, electronic waste-free healthcare.

- In September 2024, UChicago Medicine became the first Illinois center to implant the Revi neuromodulation device for treating urinary urgency incontinence. This battery-free system offers a minimally invasive option for nerve stimulation and long-term symptom relief, marking a key advancement in urologic care.

(Source: https://www.yahoo.com)

(Source: https://www.news-medical.net)

Latest Announcement by Industry Leader

- In April 2025, CELTRO, established in late 2019, is a forward-thinking startup formed by heart rhythm specialists and experts from the semiconductor industry, including seasoned engineers and executives. The company strives to transform the integration of implants within the human body by designing electronic devices that function independently of external power sources. CELTRO's inaugural initiative involves the development of a 3D-printed, battery-free pacemaker implant utilizing advanced additively manufactured electronics (AME) technology. “We are extremely excited by the progress we've made in the development and testing of our battery-free cardiac implant that has been enhanced using Nano Dimension's AME technology. We are optimistic about the prospects of creating a platform of next-generation in-body electronics that will help shape the future of the medical implant industry” – Dr.-Ing Gerd Teepe, CELTRO Co-Founder & CEO.

(Source:https://www.healthtechdigital.com)

Segments covered in the report

By Application

- Neural Stimulation Devices

- Cardiac Monitoring & Pacing Devices

- Drug Delivery Systems

- Bio-sensing and Diagnostics

- Hearing Implants

- Orthopedic Monitoring Device

By Therapeutic Area

- Cardiology

- Neurology

- Orthopedics

- Endocrinology (e.g., Glucose Monitoring)

- ENT (Ear, Nose, Throat)

- Urology & Gastroenterology

By Energy Harvesting Technology

- Radiofrequency (RF)-Based Devices

- Ultrasound Energy Harvesting

- Piezoelectric Energy Conversion

- Magnetic Resonance Coupling

- Thermoelectric & Bioelectric Harvesting

By Material Type

- Biocompatible Polymers

- Titanium & Other Metals

- Ceramic-Based Materials

- Bioresorbable Materials

- Composite Materials

By End User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Research & Academic Institutes

- Homecare Settings

- Specialty Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting