What is the Biosurgery Devices Market Size?

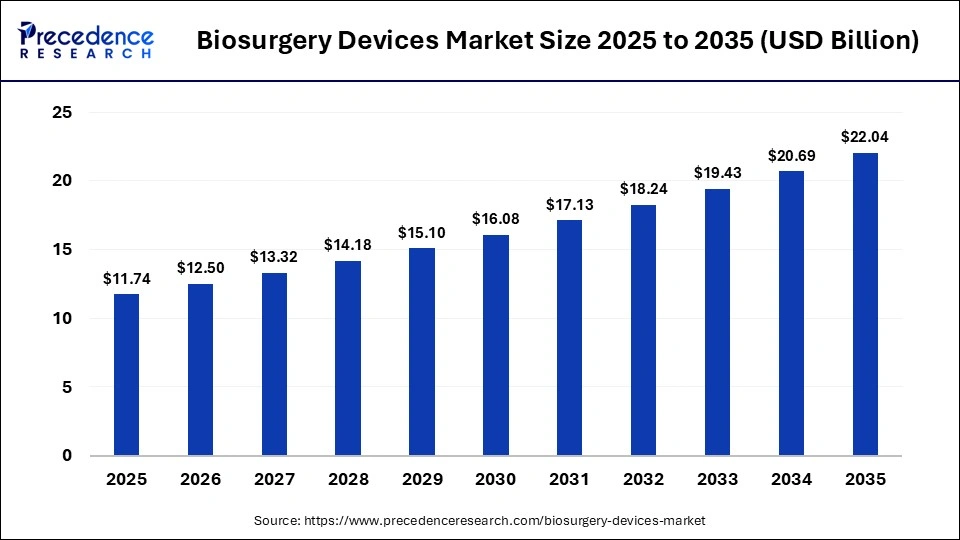

The global biosurgery devices market size was calculated at USD 11.74 billion in 2025 and is predicted to increase from USD 12.5 billion in 2026 to approximately USD 22.04 billion by 2035, expanding at a CAGR of 6.5% from 2026 to 2035. The biosurgery market thrives on innovative hemostatic agents, sealants, and tissue repair products that improve the quality of surgery by making it minimally invasive and accelerating recovery.

Market Highlights

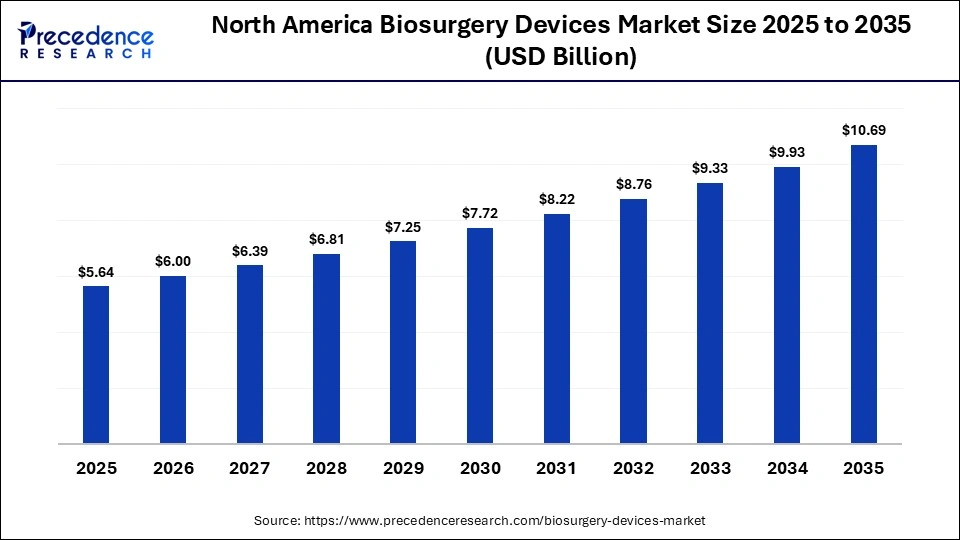

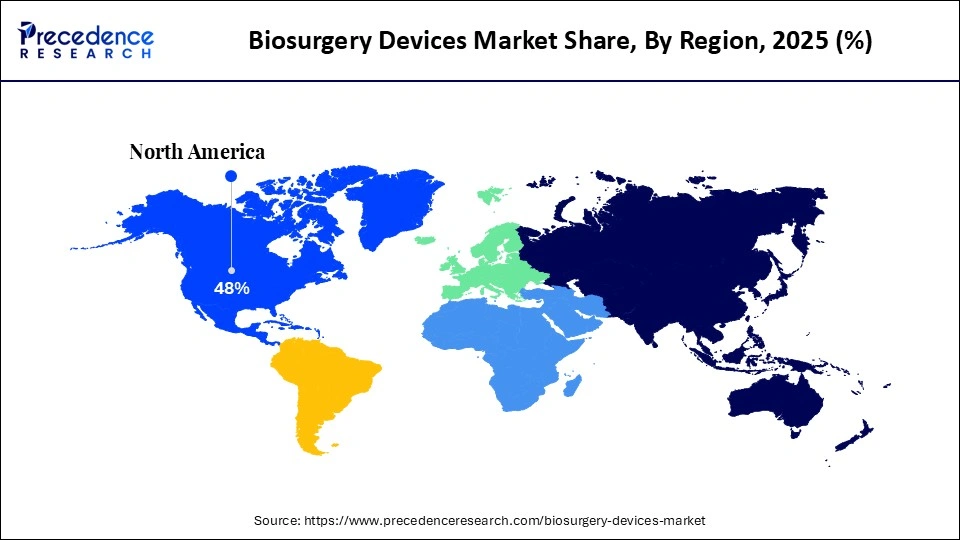

- North America dominated the global biosurgery devices market with a share of 48% in 2025.

- Asia Pacific is expected to host the fastest-growing market in the coming years.

- By product type, the bone-graft substitutes segment held a dominant position in the market with a share of approximately 38%.

- By product type, the surgical sealants & adhesives segment is expected to show the fastest growth with a CAGR of approximately 8% over the forecast period.

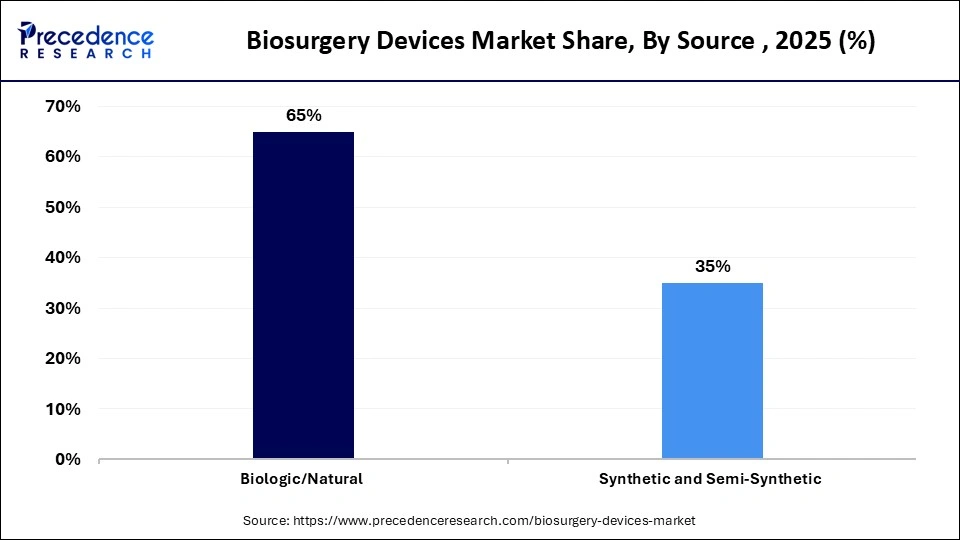

- By source, the biological/natural segment accounted for the largest revenue share of approximately 65% in the biosurgery devices market in 2025.

- By Source, the synthetic products segment is expected to expand rapidly in the market with a CAGR of 9% in the coming years.

- By application, the orthopedic surgery segment held a major revenue share of 30% in the market in 2025.

- By application, the cardiovascular surgery segment is expected to witness the fastest growth in the market with a CAGR of 9.2%.

Market Overview

The biosurgery devices market comprises advanced medical tools and biological materials, such as hemostats, sealants, and bone grafts, that are designed to control bleeding, facilitate tissue repair, and prevent post-operative complications. These devices utilize biocompatible or natural substances to enhance the body's healing process during complex, minimally invasive, and reconstructive surgical procedures.

What is the role of AI in the market's growth?

AI plays a transformative role in the biosurgery devices market by helping surgeons with smarter tools that help them sharpen their precision during complicated and delicate surgeries. These devices are infused with intelligent algorithms and sift through intricate images in real-time, while spotting and highlighting vital tissues and steering robotic arms with a steady grace in order to avoid any errors and spare the healthy areas. Beyond the surgery table, AI anticipates hurdles by studying patient patterns, tailoring plans that almost feel intuitive, and helping with easy recovery through adaptive monitoring.

What are the different market trends?

- The biosurgery devices market has been thriving on a heartfelt push towards natural healing, where surgeons are favoring the gentle sealants and patches that help coax the body to mend itself swiftly during complex surgeries.

- The innovative robotics and smart imaging naturally and seamlessly blend in order to offer tailored precision, turning the high-stakes procedures into a much smoother process that helps to prioritize patients' comfort and helps them to get back quicker to their day-to-day life.

- This good shift draws global enthusiasm, as fresh materials and adaptive tools create hospitals a more nurturing space, fostering hope through scar-free recoveries and resilient outcomes.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 11.74 Billion |

| Market Size in 2026 | USD 12.5 Billion |

| Market Size by 2035 | USD 22.04Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.5% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why the Bone-Graft Substitutes Segment Dominated the Market in 2025?

The bone-graft substitutes segment held a dominant position in the market with a share of approximately 38%, because of escalating prevalence of musculoskeletal disorders, coupled with heightened demand for efficacious alternatives to autologous grafts, which circumvent donor-site complications while optimizing bone regeneration through advanced biomimetic scaffolds and growth factor integrations. The bone graft substitutes constitute a pivotal segment within the biosurgery devices market, leveraging osteoinductive, osteoconductive, and osteogenic biomaterials, such as allografts, xenografts, and synthetic ceramics, which facilitate skeletal regeneration and structural augmentation in orthopedic, spinal, and maxillofacial interventions.

The surgical sealants & adhesives segment is expected to show the fastest growth with a CAGR of approximately 8% over the forecast period. This segment represents another cornerstone, employing synthetic polymers, fibrin-based formulations, and cyanoacrylate derivatives in order to achieve hemostasis, airtight closure, and tissue apposition across cardiovascular, thoracic, and general surgical applications, hence diminishing postoperative leakage risks, expediting recovery, and supplanting traditional suturing in a minimally invasive way by enhancing adhesive tenacity and biocompatibility.

Source Insights

What made the Biological/Natural Segment Dominant in the Market in 2025?

The biological/natural segment accounted for the major revenue share of approximately 65% in the biosurgery devices market in 2025 due to its superior biocompatibility and capacity to emulate physiological clotting mechanisms. The biological/natural sources segment within the market encompasses hemostatic agents, sealants, and adhesion barriers derived from human or animal tissues, such as fibrin glues extracted from plasma and collagen matrices sourced from bovine origins, which emulate the body's intrinsic clotting cascades in order to achieve rapid hemostasis and seamless tissue integration during intricate surgical interventions. These products excel in orthopedic, cardiothoracic, and neurosurgical applications by fostering a biocompatible microenvironment that minimizes inflammatory responses and accelerates endogenous repair mechanisms.

The synthetic products segment is expected to expand rapidly in the market with a CAGR of 9% in the coming years. This segment in the biosurgery devices market features engineered polymers, cyanoacrylates, and polyethylene glycol-based sealants meticulously designed in order to provide robust mechanical reinforcement and customizable degradation profiles tailored in order to diverse surgical exigencies, in particular in minimally invasive and laparoscopic procedures. Synthetic formulations distinguish themselves through hypoallergenic properties and consistent performance independent of patient-specific coagulation variances, thereby reducing variability in clinical endpoints and facilitating broader accessibility in resource-constrained settings.

Application Insights

What made orthopedic surgery dominate the 2025 market?

- In 2025, the orthopedic surgery segment secured approximately 30% biosurgery devices market share, driven by increasing degenerative diseases and trauma. Key growth factors include advanced bone graft substitutes, hemostatic agents, and adhesion barriers in spinal fusions, joint replacements, and fracture repairs. These biologics promote osseointegration and reduce pseudarthrosis. Surgeons' preference for minimally invasive techniques and flowable sealants to manage bleeding in aging populations boosts demand for these products, supporting faster recovery and improved implant longevity.

The cardiovascular surgery segment is expected to witness the fastest growth in the market with a CAGR of approximately 9.2% over the forecast period. Cardiovascular surgery is a high-growth segment in the biosurgery devices market due to the rising prevalence of heart diseases, a rapidly aging population, and the urgent need for advanced, minimally invasive solutions to manage complex cardiovascular procedures and reduce bleeding. The increasing demand for innovative products like tissue sealants, hemostatic agents, and adhesives in this sector is driven by the goal of reducing surgery time and improving patient outcomes.

Regional Insights

How Big is the North America Biosurgery Devices Market Size?

The North America biosurgery devices market size is estimated at USD 5.64 billion in 2025 and is projected to reach approximately USD 10.69 billion by 2035, with a 6.6% CAGR from 2026 to 2035.

North America's Biosurgery Devices Market Analysis

North America dominated the global market with a share of 48% in 2025. North America asserts preeminence in the market through its sophisticated healthcare ecosystem, where orthopedic and cardiovascular procedures integrate advanced hemostats, sealants, and bone graft substitutes to optimize outcomes amid increasing musculoskeletal and cardiac pathologies.

Robust reimbursement frameworks, paired with prolific clinical research at leading institutions, propel the adaptation of biologic matrices and synthetic adhesives in trauma centers and ambulatory surgical suites, mitigating complications such as adhesions and pseudarthroses while accelerating discharge timelines. Surgeon training paradigms emphasize minimally invasive applications, fostering innovation in flowable hemostatics for spinal fusions and CABG reinforcement, underpinned by stringent regulatory oversight that ensures biocompatibility and efficacy.

What is the Size of the U.S. Biosurgery Devices Market?

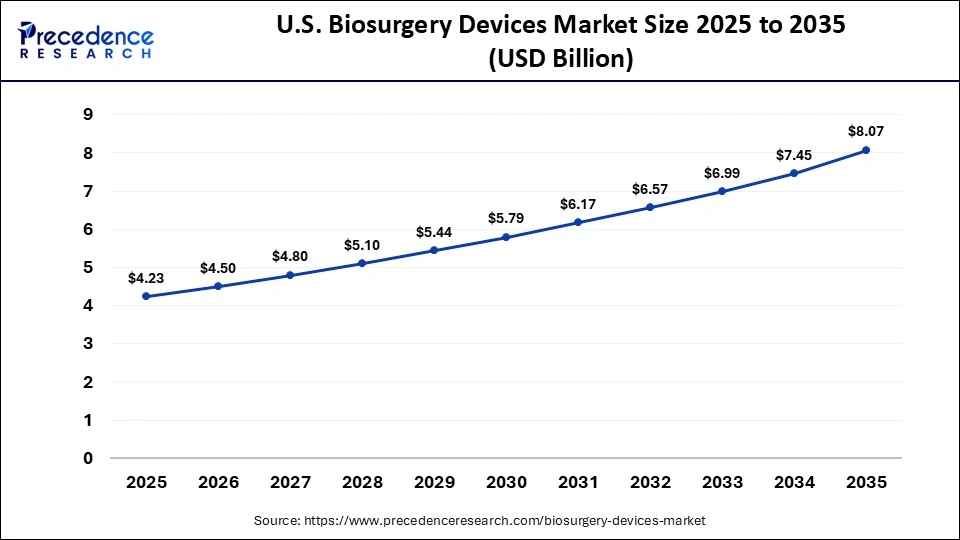

The U.S. biosurgery devices market size is calculated at USD 4.23 billion in 2025 and is expected to reach nearly USD 8.07 billion in 2035, accelerating at a strong CAGR of 6.67% between 2026 and 2035.

U.S. Biosurgery Devices Market Trends

The U.S. biosurgery landscape is experiencing a rapid integration of Artificial Intelligence (AI) and Augmented Reality (AR) in surgical sealants, particularly for orthopedic applications like total joint arthroplasty, spinal surgery, and tumor resection. This shift is driving improvements in real-time hemostasis and reducing reoperation rates by enabling more precise, data-driven surgical procedures.

What Factors support the Asia Pacific's Market Growth?

Asia Pacific is expected to host the fastest-growing market in the coming years. The Asia Pacific is emerging as a powerhouse in the biosurgery devices market, propelled by rapid urbanization, expanding middle-class access to elective surgeries, and government-led healthcare modernization in key economies, where bone grafts and adhesion barriers address trauma epidemics and congenital deformities.

Proliferating medical tourism hubs integrate fibrin sealants and synthetic polymers into neurosurgical and gastrointestinal portfolios, capitalizing on cost efficiencies. Local manufacturing scale-ups, alongside technology transfers from global majors, democratize bioactive scaffolds for orthopedic reconstructions and cardiovascular anastomoses, mitigating import dependencies while tailoring formulations to regional disease profiles like tuberculosis-related bone infections.

China Biosurgery Devices Market Trends

China is rapidly advancing its biosurgery sector, particularly in cardiovascular applications, by promoting indigenous synthetic sealants to reduce dependency on foreign medical adhesives. This initiative is characterized by significant state-subsidized clinical trials, regulatory support for innovative materials, and a focus on replacing imported, often high-cost, international products.

What Supports the Market Growth in Europe?

The biosurgery devices market in Europe is expanding due to an aging population and higher incidences of chronic diseases requiring surgery, alongside a strong shift toward minimally invasive techniques. Increased demand for advanced hemostats and sealants to reduce operative blood loss and improve patient recovery times drives this rapid growth.

Germany Biosurgery Devices Market Trends

Germany dominates this market, fueled by its highly advanced healthcare infrastructure and significant R&D in medical technology. High procedural volumes, particularly in orthopedics and cardiovascular, along with favorable reimbursement policies, make it the fastest-growing region, with major manufacturers introducing innovative, user-friendly, and tissue-friendly products.

Value Chain Analysis

- R&D: Researchers in R&D labs channel rigorous innovation into developing advanced hemostatic agents and bioactive scaffolds that usually harmonize with the body's innate regenerative processes, thereby engineering biosurgery devices with enhanced biocompatibility and therapeutic efficacy.

Key Companies: Johnson &Johnson (Ethicon), Medtronic, Baxter, Integra LifeSciences, Becton Dickinson (BD), B. Braun SE, Stryker, CSL Behring, Pfizer, Sanofi, and Zimmer Biomet form some of the core companies across the biosurgery devices market. - Clinical Trials and Regulatory Approvals: Clinical trials and regulatory approvals constitute a meticulous validation framework, in which empirical patient data informs comprehensive evaluations and compliance along with stringent standards, culminating in the assurance of safety and reliability of these medical devices and technologies.

Key Companies: Johnson &Johnson (Ethicon), Medtronic, Baxter, Integra LifeSciences, Becton Dickinson (BD), B. Braun SE, Stryker, CSL Behring, Pfizer, Sanofi, and Zimmer Biomet form some of the core companies across the biosurgery devices market. - Patient Support and Services: Patient support and services usually form an integrated continuum of care, which helps with delivering tailored educational resources and compassionate assistance to facilitate seamless postoperative recovery and optimize long-term health outcomes.

Key Companies: Johnson &Johnson (Ethicon), Medtronic, Baxter, Integra LifeSciences, Becton Dickinson (BD), B. Braun SE, Stryker, CSL Behring, Pfizer, Sanofi, and Zimmer Biomet form some of the core companies across the biosurgery devices market.

Who are the Major Players in the Global Biosurgery Devices Market?

The major players in the biosurgery devices market include Johnson & Johnson (Ethicon), Baxter International Inc., Medtronic plc, Becton, Dickinson and Company (BD), Stryker Corporation, B. Braun Melsungen AG, Zimmer Biomet Holdings, Inc., Integra LifeSciences, Smith & Nephew plc, Artivion, Inc. (formerly CryoLife), Sanofi S.A,Terumo Corporation, Advanced Medical Solutions Group plc, Kuros Biosciences AG, Orthofix Medical Inc.

Recent Developments in the Biosurgery Devices Market

- In January 2026, Royal Biologics, a leader in innovative biologic solutions for wound care and tissue repair, signed an exclusive distribution agreement with Aroa Biosurgery for Myriad Matrix Restore to expand access to advanced soft tissue repair solutions across outpatient and mobile care settings in the United States. Royal Biologics Announces Exclusive U.S. Distribution Agreement with Aroa Biosurgery for Myriad Matrix Restore

- In June 2025, Dilon Technologies, a leader in medical devices for biosurgery, breast cancer treatment, and diagnosis, decided to make a $9 million growth capital investment from JGB Management. This investment was to support Dilon's continued growth in double digits and operational scaling. HEMOBLAST Bellows is an advanced hemostatic agent used in a wide range of surgeries, which includes cardiac, general, and orthopaedic procedures. It remains the only FDA-approved product specifically indicated for the control of minimal, mild, and moderate bleeding.

Segments Covered in the Report

By Product Type

- Bone-Graft Substitutes

- Hemostatic Agents

- Surgical Sealants & Adhesives

- Soft-Tissue Attachments

- Adhesion Barriers

- Staple-Line Reinforcement

By Source

- Biologic/Natural

- Synthetic & Semi-Synthetic

By Application

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Gynecological & Other Surgeries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content