Broaching Machine Market Size and Forecast 2025 to 2034

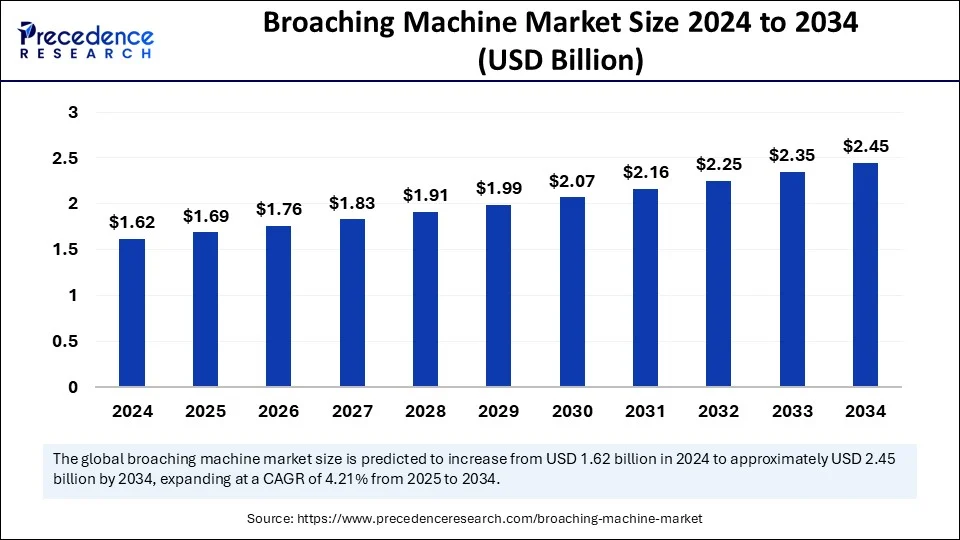

The global broaching machine market size is accounted at USD 1.69 billion in 2025 and is predicted to increase from USD 1.76 billion in 2026 to approximately USD 2.45 billion by 2034, expanding at a CAGR of 4.21% from 2025 to 2034. The market is witnessing steady growth due to rising demand for precision machining across industries such as automotive, aerospace, and manufacturing. Broaching machines are widely used for creating complex and accurate shapes in metal components, offering high productivity and efficiency.

Broaching Machine Market Key Takeaways

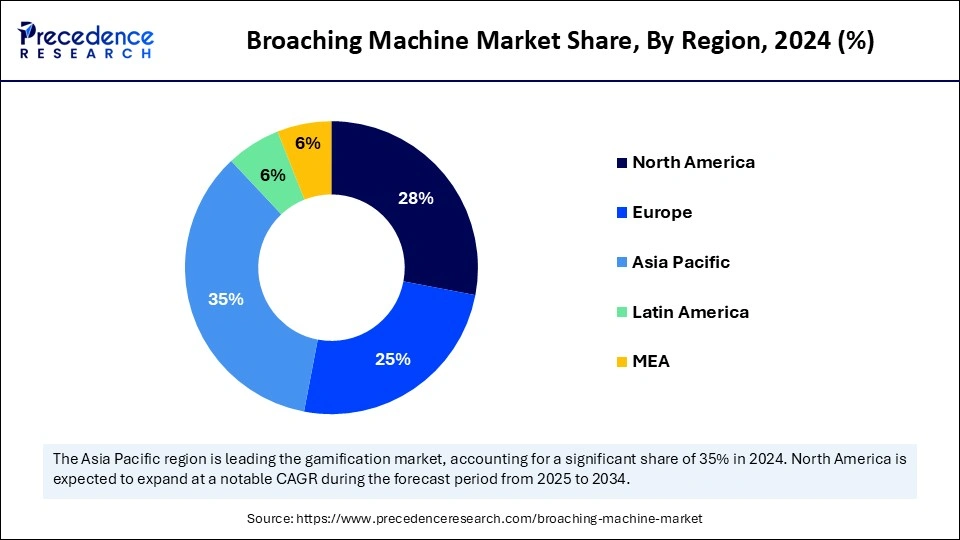

- Asia Pacific led the broaching machine market with the largest share of 35% in 2024.

- North America is estimated to grow at the fastest CAGR between 2025 and 2034.

- The European market has been expanding at a considerable rate in recent years.

- By material, the metal segment dominated the market in 2024.

- By material, the composite material segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By type, the horizontal broaching machines segment held the largest market share in 2024.

- By type, the vertical broaching machines segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By application, the automotive segment contributed the biggest market share in 2024.

- By application, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the manufacturing segment held the major market share in 2024.

- By end-user, the repair and maintenance segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

AI Transforming the Broaching Machine Market

Artificial intelligence is significantly reshaping the broaching machine market by enhancing precision, efficiency, and automation in machine operation. AI-powered systems are enabling real-time monitoring and predictive maintenance of broaching machines, reducing downtime and improving productivity. Smart sensors and machine learning algorithms collect and analyze data from the machines, optimizing cutting speeds, tool paths, and material usage for greater accuracy and consistency.

Additionally, AI is streamlining quality control processes by automatically detecting defects and deviations during production, ensuring higher standards in component manufacturing. Recent developments include AI-generated CNC broaching solutions and meeting and industrial sectors for precision and speed.

- In 2024, manufacturers like nachi-fujoshi and American Borach and Machine Company introduced AI-enabled broaching machines capable of self-diagnosis and process optimization, reducing energy consumption and extending AI as a key driver in the future growth of the broaching machine market.

Broaching Machine Market Outlook: The Path Towards the Next-Gen Broaching

- Industry Growth Overview: Increasing demand for high-precision components and integration of automation is driving the industry growth.

- Major Investors:Large industrial conglomerates and private equity firms are the major investors in the market.

- Startup Ecosystem: Developing innovative and affordable solutions and integrating advanced technologies is the focus of the startup ecosystem.

Broaching Machine Scope and Trends

The broaching machine market has experienced consistent growth over recent years, primarily driven by advancements in manufacturing technologies, increasing demand for precision machining, and the rising adoption of automation. Key consumer trends influencing this market include the shift toward automated and CNC-controlled broaching systems, which provide enhanced accuracy, speed, and efficiency. Industries such as automotive, aerospace, and heavy machinery are increasingly demanding broaching machines that offer high precision and lower production times. Moreover, there is a growing inclination toward energy-efficient and AI-integrated broaching solutions, which not only improve productivity but also reduce operational costs.

Broaching Machine Market Growth factors

- Increasing demand for precision machining: The rising requirement for high-precision components in industries like aerospace, automotive, and medical devices is fueling the demand for advanced broaching machines.

- Expansion of automotive and aerospace sectors: Rapid advancements in electricvehicles and the aerospace sector's need for lightweight, durable components in high-performance broaching solutions.

- Shift toward sustainable and energy-efficient machines: Manufacturing is focusing on developing eco-friendly and energy-efficient broaching machines, aligning with global sustainability goals, and reducing the total cost of ownership.

- Government initiatives: Governments in Asia-Pacific and Europe are investing in advanced manufacturing technologies, creating opportunities for broaching machine manufacture for broaching machine manufacturers to expand in developing economies like India, China, and Brazil.

Top 5 Countries in the Market

| Countries | Advancements | Aim/Focus |

| Japan | AI-integrated broaching machines with predictive maintenance systems. | Expand automated broaching solutions globally. |

| United States | CNC broaching systems with adaptive control technology | Improve precision and efficiency for aerospace clients |

| Germany | Hybrid broaching machines focusing on energy efficiency | Enhance presence in the aerospace and defense sectors |

| Denmark | Hydraulic broaching machines with IoT connectivity | Strengths the European market penetration |

| United States | Custom-designed broaching solutions for the automotive and defense sectors | Develop high-speed broaching systems with minimal downtime. |

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.45 Billion |

| Market Size in 2026 | USD 1.76 Billion |

| Market Size in 2025 | USD 1.69 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.21% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material , Type, Application, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for precision machining in the automotive and aerospace sectors

As manufacturers aim for tighter tolerances and enhanced productivity, broaching machines offer highly accurate finishing operations that are essential for producing complex components such as gears, splines, and keyways. Additionally, the shift toward automated manufacturing and Industry 4.0 integration is boosting the adoption of CNC-controlled and hydraulic broaching machines. These advancements ensure higher efficiency, reduced cycle times, and lower human intervention.

Restraint

High initial investment and maintenance costs

Despite technological advances, the market faces a key restraint in the high initial investment and maintenance costs associated with broaching machines, especially CNC and automated variants. Small and medium-sized enterprises (SMEs) often struggle to justify the capital expenditure required, particularly in developing regions where budget constraints and limited access to advanced technologies are common. Furthermore, the specialized skill set required for machine operation and maintenance poses an additional barrier to widespread adoption.

Opportunities

Lightweight and complex-shaped components in the electric vehicle (EV) sector

The growing demand for lightweight and complex-shaped components in the electric vehicle (EV) sector presents significant opportunities for the broaching machine market. EV components often require high precision and a surface finish, for which broaching machines are well-suited. In addition, the rise of smart manufacturing initiatives is supported by government policies.

Segment Insight

Type Insights

The horizontal broaching machines segment held the largest broaching machine market share in 2024, primarily due to their widespread use in automotive and industrial applications. These machines are highly efficient for internal keyways, splines, and surface broaching, making them the preferred choice for mass production. The automotive industry heavily relies on horizontal broaching for engine components, gears, and transmission parts.

On the other hand, the vertical broaching machines segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, especially in the aerospace and defense sectors, where precision and space-saving designs are crucial. These machines are preferred for broaching turbine components, gear teeth, and firearm parts. The integration of CNC automation in vertical broaching has further accelerated its adoption.

Material Type Insights

The metal segment dominated the broaching machine market, primarily because of the high volume of metal machining applications in the automotive, aerospace, and heavy machinery industries. The broaching process is widely used to create internal keyways, splines, and other features in steel, aluminum, and titanium components, which are standard materials in these sectors.

On the other hand, the composite materials segment is anticipated to grow at a remarkable CAGR between 2025 and 2034 due to the increased use of lightweight composites in the aerospace and automotive industries, especially for EVs and aircraft. Manufacturers are developing specialized broaching tools and machines capable of handling abrasive composite materials without compromising surface quality or structural integrity.

Application Insights

The automotive segment led the broaching machine market. This dominance is due to the increasing demand for precision-machined components, such as gears, splines, and transmission parts. As the automotive industry moves towards electric vehicles (EVs), there is a growing need for lightweight, complex parts that require precision broaching, boosting the demand for advanced broaching machines in this sector.

However, the aerospace segment is anticipated to grow at a remarkable CAGR between 2025 and 2034. Aerospace components demand extreme precision and high strength, and broaching machines offer an ideal solution for producing turbine discs, fuselage components, and landing gear systems. Additionally, government initiatives supporting aerospace manufacturing in North America and Europe have led to the increased adoption of high-end CNC and hydraulic broaching machines in this sector.

End-User Insights

The manufacturing segment held the largest broaching machine market share in 2024. This sector demands high-volume production with consistent precision, making broaching an ideal process for the large-scale manufacturing of automotive, aerospace, and industrial components.

The segment is anticipated to grow at a remarkable CAGR between 2025 and 2034, especially within the aerospace and marine industries, where retrofit parts and maintenance components require precision broaching for longevity and performance.

Regional Insights

Asia Pacific Broaching Machine Market Size and Growth 2025 to 2034

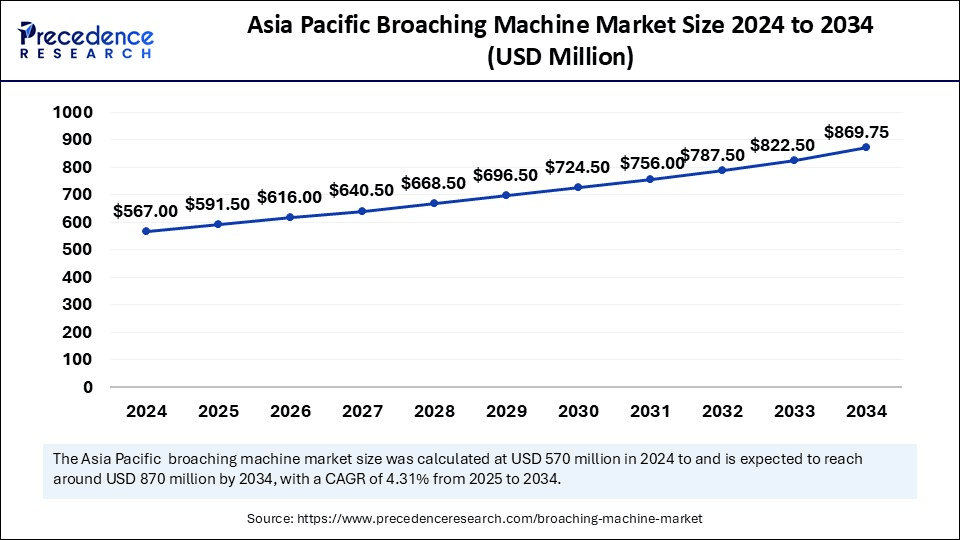

The Asia Pacific broaching machine market size is exhibited at USD 591.50 million in 2025 and is projected to be worth around USD 869.75 billion by 2034, growing at a CAGR of 4.31% from 2025 to 2034.

Government Initiatives Drive Asia Pacific

Asia Pacific dominated the broaching machine market in 2024. Countries like China, Japan, and India are major contributors. Government initiatives promotingindustrial automation and local manufacturing, such as India's Make in India and China's Made in China 2025, are driving significant investments in machine tools, including broaching machines.

- In January 2025, Nachi-Fujikoshi Corp. unveiled a hybrid electro-hydraulic broaching machine at the Tokyo Manufacturing Expo, targeting Electric Vehicle component manufacturing, with 35% increased energy efficiency compared to conventional machines.

Large Manufacturing Ecosystems Transforming China

The presence of large manufacturing ecosystems in China is driving the production of the broaching machines. Moreover, the automotive and aerospace sectors are also increasing their demand, where their affordable production is increasing their use for various applications, which is supported by the government as well.

North America Driven by the Advanced Automotive Sector

North America is observed to be the fastest growing region in the broaching machine market during the forecast period. The rapid rate of growth is primarily due to the region's strong presence in the automotive, aerospace, and defense sectors, which rely heavily on precision manufacturing. The U.S. remains the primary contributor, as the U.S. government's emphasis on revitalizing domestic manufacturing, along with the adoption of advanced CNC and AI-integrated broaching systems, has strengthened the market further.

- In February 2025, American Broach & Machine Co. announced its partnership with Lockheed Martin to supply high-precision broaching machines for aerospace defense projects, focusing on lightweight materials and energy-efficient manufacturing.

Advanced Industries Fuel U.S.

The presence of well-developed automotive, defence, and aerospace industries is increasing the demand for broaching machines in the U.S. They are being used in the development of missiles, aircraft components, turbine components, medical device parts, as well as in the development of electric vehicle components.

Well-developed Manufacturing Hubs Boost Europe

The European broaching machine market has been observed to be expanding at a considerable rate in recent years, particularly driven by Germany, Italy, and France, where automotive and aerospace manufacturing hubs are integrating Industry 4.0 solutions into broaching machines. The EU Green Deal has also stimulated demand for energy-efficient manufacturing equipment, prompting several companies to upgrade their broaching systems.

- In March 2025, Mitsubishi Heavy Industries Europe launched an AI-enabled vertical broaching machine at the Hannover Messe 2025, designed specifically for aerospace composite materials, reducing cycle times by 20% and enhancing tool life.

Expanding the Defence Sector Stimulates the UK

The expanding defence sector in the UK is increasing the demand for broaching machines for the development of splined shafts, turbine discs, etc. Similarly, the growing investments are also increasing their development, where their innovations and adoption of electric vehicles are also increasing their use.

Expanding Industries Propel South America

South America is expected to grow significantly in the broaching machine market during the forecast period, due to expanding automotive industries. This is increasing the production of the broaching machines, driving thorough use in the development of various automotive companies. Thus, to enhance their application and performance, the companies are focusing on their innovations, promoting market growth.

Brazil's Broaching Machine Market: Steady Expansion

Brazil's market for broaching machines is experiencing steady growth, driven by investments in the automotive and aerospace industries. This trend highlights increasing demand for precision manufacturing solutions across the region's key industrial sectors.

Broaching Machine Market Value Chain Analysis

Raw Material Sourcing

Raw material sourcing of the broaching machine involves sourcing of cast iron and steel alloys from metal suppliers.

- Key players: Apex Broaching Systems, Techcellence.

Testing and Certification

Testing of geometric accuracy, working accuracy, and dynamic performance is involved in the testing and certification of the broaching machine.

- Key players: Broaching Machine Specialties, TUV Rheinland.

Product Lifecycle Management

Product Lifecycle Management of the broaching machine includes the use of software to manage the entire journey from initial concept to their disposal.

- Key players: Siemens, PTC.

Broaching Machine Market Leaders: Key Players' Offering

- A. Dwyer: The company manufactures and supplies the broaching machines.

- CNC Broach Tool: CNC Broach Tools are provided by the company.

- Mitsubishi Heavy Industries: The company provides and produces the broaching machines.

- Komet: Tooling systems and solutions are provided by the company.

- Broach Masters: The company manufactures the Pro Broach Manual Broaching Machine.

Other Major Key Players

- Star SU

- Cincinnati Milacron

- Honnen Equipment

- Schmidt and Heinzmann

- Hegenscheidt

- Harris Machine Tools

- Gleason

Recent Development

- In February 2025, India's Defense Research and Development Organization (DRDO) collaborated with local machine tool manufacturers to integrate advanced broaching machines in the production of missile components, with production line upgrades completed, improving output quality and speed by 25%.

Segments Covered in the Report

By Material

- Metal

- Plastic

- Composite

By Type

- Horizontal Broaching Machines

- Vertical Broaching Machines

- Continuous Broaching Machines

- Band Broaching Machines

By Application

- Automotive

- Aerospace

- Industrial Equipment

- Marine

- Oil and Gas

By End-Use

- Manufacturing

- Repair and Maintenance

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting