What is the CAD and PLM software Market Size?

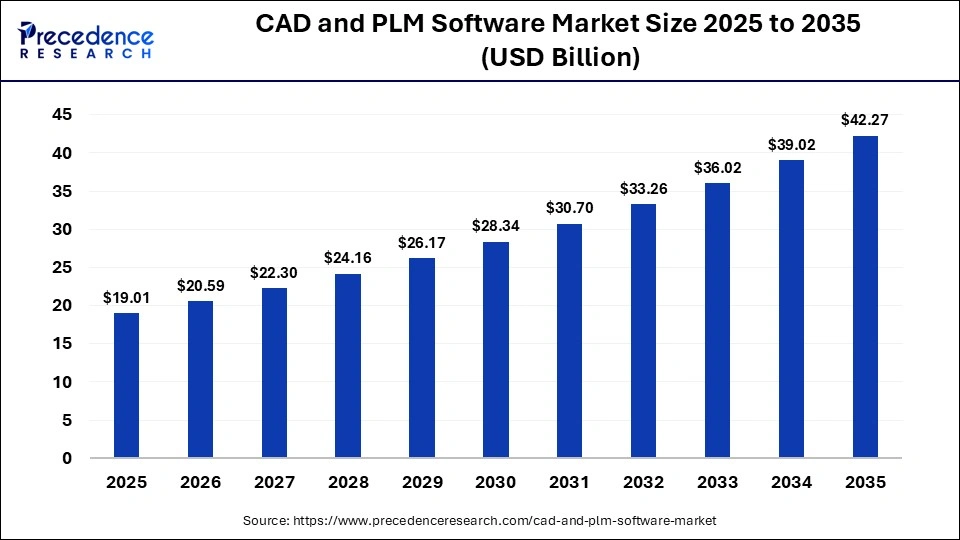

The global CAD and PLM software market size accounted for USD 19.01 billion in 2025 and is predicted to increase from USD 20.59 billion in 2026 to approximately USD 42.27 billion by 2035, expanding at a CAGR of 8.32% from 2026 to 2035. The global CAD and PLM software market is witnessing robust growth, driven by rising digitization in the product development cycle and growing demand across various industries.

Market Highlights

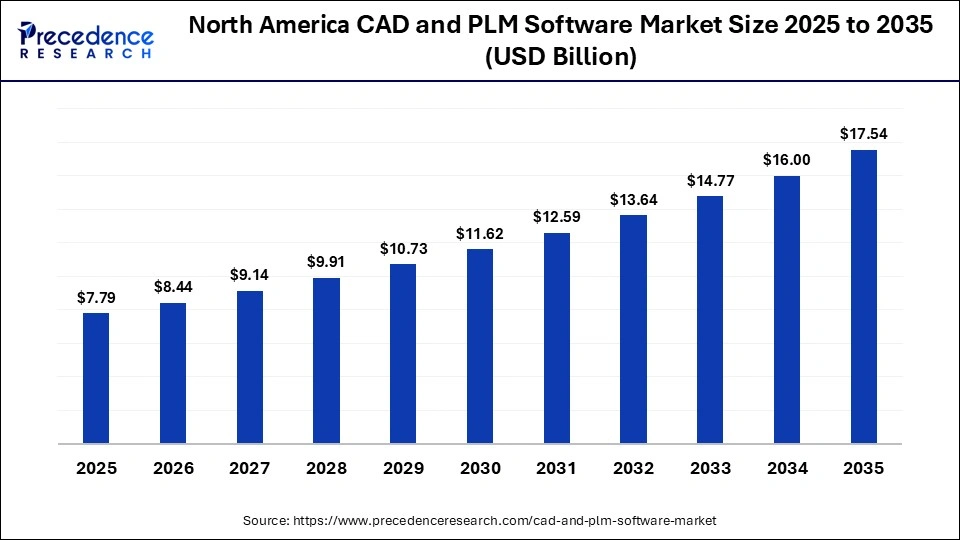

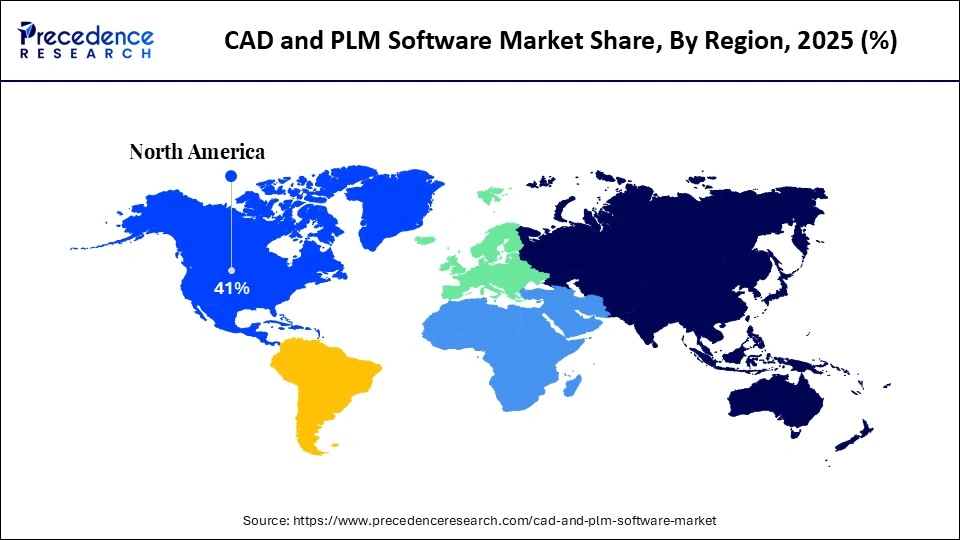

- North America dominated the global CAD and PLM software market with the highest market share of 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

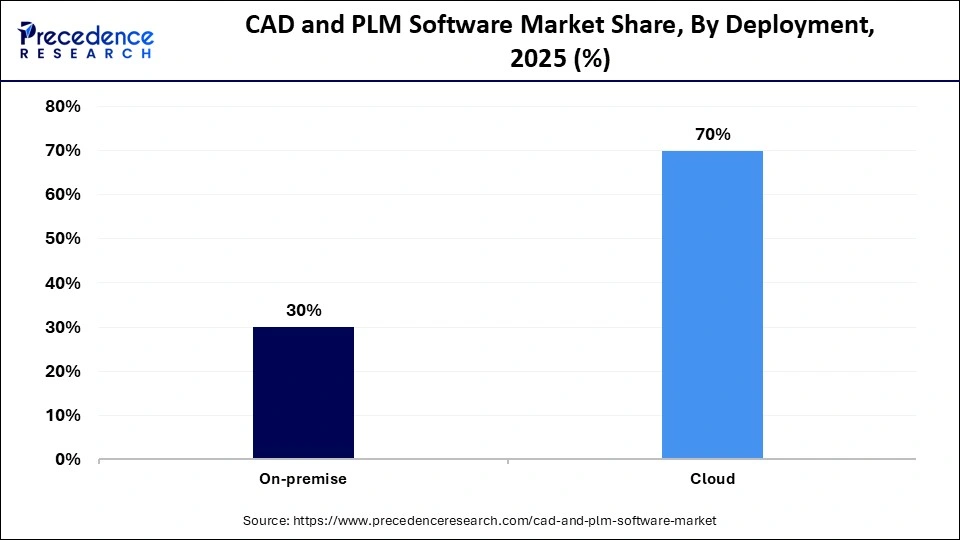

- By deployment, the cloud segment held the largest market share of 70% in 2025.

- By deployment, the on-premise segment is expected to grow at a remarkable CAGR between 2026 and 2035.

- By industry verticals, the automotive segment contributed the biggest market share in 2025.

- By industry verticals, the manufacturing segment is expected to grow at a significant CAGR between 2026 and 2035.

CAD and PLM Software Market Overview

CAD and PLM provide a robust infrastructure and have the power to transform the way brands design and develop products in today's fast-paced industries. CAD delivers the precision and creativity needed for product design, while PLM ensures that all product-related data is properly organized, accessible, and actionable throughout the entire product lifecycle. PLM software is widely used to track lifecycle status for a product as it makes its way through the marketplace. PLM software manages all of the information and processes at every step of a product or service lifecycle throughout supply chains. This primarily includes the data from items, products, parts, documents, engineering change orders, and quality workflows.

Computer-Aided Design (CAD) aids in crafting precise and detailed 3D models of products digitally. It allows designers to test their ideas before creating a prototype. The combination of CAD and PLM creates an environment that is highly efficient and productive. Integrated CAD and PLM systems allow real-time design collaboration, minimize delays, and avoid miscommunication. These tools save time by automating tasks, reducing manual paper trail, and facilitating easy information access.

How are AI-driven innovations reshaping the growth of the market?

In the era of a rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) is driving innovations and accelerating the growth of the CAD and PLM software market. The AI integration in CAD and PLM marks a major shift in how companies approach product development, offering new opportunities for rapid innovation and growth. AI is significantly transforming how products are designed, developed, and managed.

AI allows companies to build smarter products faster by automating their routine tasks, optimizing designs, and streamlining workflows. Through generative design, predictive maintenance, and supply chain optimization, AI is making a crucial impact on CAD and PLM software solutions. AI efficiently analyzes historical data to assist companies in making informed decisions about future products by identifying patterns in evolving consumer preferences.

- In September 2025, CIMdata, Inc., a global research, consulting, and education firm specializing in product lifecycle management (PLM) and digital transformation, has announced the launch of a new artificial intelligence (AI) practice. The new practice will advise solution providers, investors, and industrial organizations on practical applications of AI across the product lifecycle.

What are the emerging trends in the CAD and PLM software market?

- The growing demand for high efficiency in engineering, design, and lifecycle management is expected to promote the growth of the market in the coming years.

- The integration of digital twins and IoT into smart manufacturing is anticipated to boost the growth in the market. These technologies enhance product design, simulation, and operational efficiency across sectors, particularly within the automotive and aerospace industries.

- The supportive government-led digitization initiatives, along with the growing need for faster time-to-market is anticipated to accelerate the growth of the market during the forecast period.

- The rising adoption of cloud solutions is expected to contribute to the overall growth of the CAD and PLM software market. Cloud-based solutions offer improved accessibility and flexibility. The rising use of cloud-based CAD and PLM solutions eliminates high initial infrastructure costs and enables better collaboration for global teams.

- The rising industry 4.0 integration and the growing demand for customized manufacturing are anticipated to fuel the expansion of the market in the coming years.

- The rising trend of sustainability and stringent regulatory compliance is anticipated to bolster the market's growth. Manufacturers are increasingly using Product Lifecycle Management (PLM) software to manage product data, ensuring compliance with RoHS and ISO.

- The increasing adoption of 3D modelling is expected to create significant growth opportunities for the CAD and PLM software market during the forecast period. 3D models allow for enhanced visualization and precision, improving product quality and reducing design errors.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.01 Billion |

| Market Size in 2026 | USD 20.59 Billion |

| Market Size by 2035 | USD 42.27 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Industry Verticals, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Insights

What causes the cloud segment to dominate the market in 2025?

The cloud segment held the largest market share in the CAD and PLM software market. Cloud-based deployment offers improved accessibility, flexibility, scalability, and cost-effectiveness. Cloud-Based Solutions allow for real-time updates, improved collaboration across teams, and lower infrastructure costs, which increased their significant adoption, especially among small and medium enterprises (SMEs). Cloud-based PLM is increasingly adopted across various industries such as electronics, automotive, and other industries. Several companies are shifting toward Software as a Service (SaaS) models, owing to the increasing need for remote collaboration, 3D design integration, and reduced IT infrastructure costs.

The on-premise segment is expected to grow at the fastest CAGR between 2026 and 2035. The growth of the segment is driven by the ongoing demand for high data security, the growing need for full control over sensitive intellectual property, and strict regulatory compliance. Industries like defense, aerospace, manufacturing, and others prefer on-premise solutions for their superior performance, customization, and addressing security concerns. These industries adopt on-premise systems for stringent data compliance and to adhere to regulatory requirements.

Industry Verticals Insights

What has led the automotive segment to dominate the market in 2025?

The automotive segment dominates the CAD and PLM software market, holding the highest market share in 2025. The growth of the segment is primarily driven by the high production volumes of automobiles, increasing complexity of electric and autonomous vehicle development, and rising regulatory pressure to meet strict safety and environmental regulations. CAD and PLM software are commonly used during the product development stage, which begins before the automobiles are manufactured. PLM software efficiently manages throughout the design, manufacturing, and maintenance stages. The rising transition to electric and autonomous vehicles has led to an increasing demand for advanced CAD for designing complex powertrains and electronic systems. With the rising focus on reducing time-to-market and costs, automakers are heavily relying on integrated CAM and PLM, enabling collaboration across global teams and suppliers.

The manufacturing segment is the fastest-growing in the CAD and PLM software market. The segment's fastest growth is supported by the rapid digital transformation, increasing need for faster product development, improved collaboration, regulatory compliance, and growing demand for shorter time-to-market. Several manufacturers are increasingly leveraging AI for generative design and digital twins for digital prototyping to optimize production, enhance operational efficiency, reduce material usage, and significantly shorten development cycles. The emergence of Industry 4.0 has accelerated the adoption of smart technologies such as AI, IoT, cloud-based solutions, and digital twins, allowing manufacturers to optimize designs and simulate production.

In April 2025, Siemens Digital Industries Software announced new versions of its Teamcenter X software so that organizations of all sizes can leverage best-in-class SaaS Product Lifecycle Management (PLM) to digitally transform and drive innovation across the manufacturing industry. This expansion of Teamcenter X continues Siemens' mission of making SaaS PLM more accessible for companies of all sizes.

Regional Insights

How Big is the North America CAD and PLM Software Market Size?

The North America CAD and PLM software market size is estimated at USD 7.79 billion in 2025 and is projected to reach approximately USD 17.54 billion by 2035, with a 8.45% CAGR from 2026 to 2035.

North America CAD and PLM Software Market Analysis

North America dominates the market, holding the largest share in 2025. The region benefits from established technology-driven infrastructure and a strong presence of global CAD and PLM software vendors. The growth of the region is also characterized by the early adoption of cloud-based solutions (SaaS), increasing demand for product lifecycle efficiency, significant investment in R&D, and increasing demand from numerous sectors. Moreover, the strict regulatory compliance and rising adoption of advanced technology, such as AI, IoT, generative design, and digital twins, are optimizing production, improving product quality, and reducing errors. Such factors significantly contribute to the growth of the market during the forecast period.

What is the Size of the U.S. CAD and PLM Software Market?

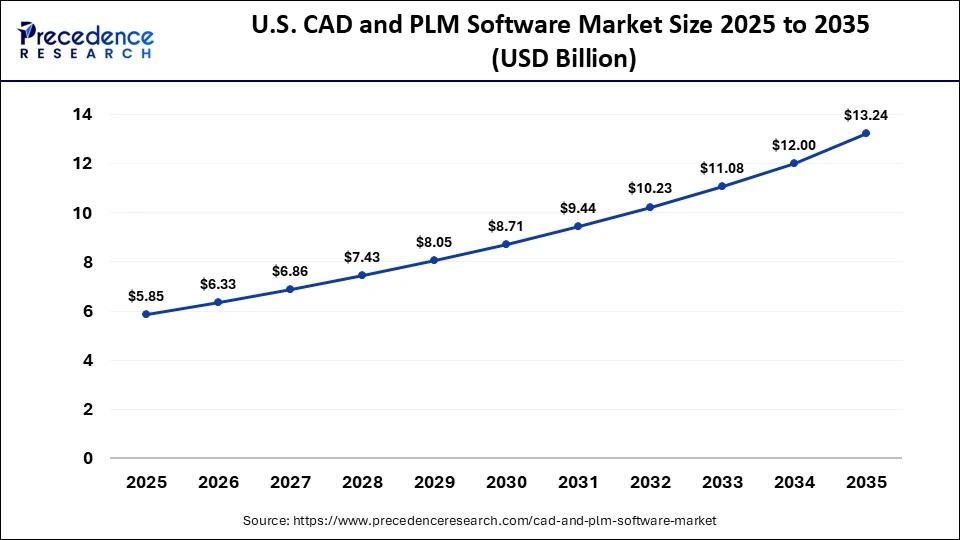

The U.S. CAD and PLM software market size is calculated at USD 5.85 billion in 2025 and is expected to reach nearly USD 13.24 billion in 2035, accelerating at a strong CAGR of 8.51% between 2026 and 2035.

United States CAD and PLM Software Market Analysis

The U.S. leads the market. The United States is a major contributor to the market. The country is home to the leading market players such as Autodesk Inc, PTC Inc., Oracle Corporation, Siemens Digital Industries Software, Infor Inc., Aras Corporation, Propel Software Solutions Inc., DuroLabs, Bentley Systems, and ANSYS Inc. The country's growth is driven by the rapid digital transformation, growing demand from the automotive and aerospace industries, surging need for remote work capabilities, and the integration of AI and IoT technologies.

The rising need for generative design for rapid prototyping, AI-powered predictive analytics for maintenance, and cloud-based integration for improved collaboration are anticipated to fuel the country's growth during the forecast period. The increasing adoption of Industry 4.0 principles and smart manufacturing strengthens the country's position in the North America region.

In December 2025, PTC announced the connection of its Onshape Government computer-aided design (CAD) and product data management (PDM) platform with its Arena product lifecycle management (PLM) and quality management system (QMS) solution for Amazon Web Services (AWS) GovCloud. The connection is intended to help support US government agencies, defense contractors, and other regulated industries that must comply with strict security and regulatory requirements.

Asia Pacific CAD and PLM Software Market Analysis

Asia Pacific is the fastest-growing region in the market. The region's growth is primarily driven by the shift toward digital transformation, the presence of an advanced manufacturing ecosystem, the increasing need to streamline design processes, the increasing adoption of cloud-based solutions for enhanced remote collaboration, and rising government support for digital modernization across various sectors. Several manufacturers and engineering companies are increasingly utilizing sophisticated technologies such as AI, digital twins, IoT, and generative design to boost product innovation and significantly reduce time to market, which also facilitates collaboration across functions.

In addition, the region is experiencing strong demand from sectors like manufacturing, electronics, automotive, aerospace, and other high-tech industries for advanced design and lifecycle management solutions, bolstering the country's growth during the forecast period. These collective factors are expected to boost the growth of the market during the forecast period.

India's CAD and PLM Software Market Analysis

India's market is experiencing growth. The country's growth is supported by the rising digitalization in product development cycles, strong manufacturing bases, rapid industrialization, increasing demand for faster time-to-market, growing demand for automation, favorable government initiatives toward smart factories, increasing investment in infrastructure projects, and increasing adoption of SaaS-based models among small and medium enterprises (SMEs).

The country is also experiencing a strong demand owing to the ongoing digital transformation across industries like manufacturing, construction, aerospace, and automotive, which encourages organizations to adopt innovative software solutions to remain competitive and efficient. Moreover, the increasing focus on sustainability and strict regulatory compliance pushes manufacturers to leverage PLM systems for ensuring compliance and tracking product lifecycles. Such a combination of factors is expected to drive the growth of the CAD and PLM software market in the coming years.

Who are the Major Players in the Global CAD and PLM Software Market?

The major players in the CAD and PLM software market include SAP SE, Siemens Digital Industries Software, Autodesk Inc., Dassault Systemes, PTC Inc., Oracle Corporation, Siemens AG, Infor Inc., Aras Corporation, Propel Software Solutions Inc, DuroLabs, Aras Corporation, Bentley Systems, Hexagon AB, ANSYS Inc., and Infor Inc.

Recent Developments in the Market

- In September 2025, PTC announced the release of a new Artificial Intelligence Assistant for its Arena product lifecycle management (PLM) and quality management system (QMS). This latest innovation enables design and manufacturing teams to accelerate time to value, delivering real-time, context-aware expertise and best practices for PLM and QMS workflows in a conversational interface.(Source: https://www.themanufacturer.com)

- In May 2025, Morgan Tecnica, the leading Italian innovator in cutting room solutions, announced the global launch of its new CAD software subscription platform, Morgan Dynamics the software division of Morgan Tecnica. This marks a bold new chapter in digital design technology, offering an entirely new, future-ready 2D CAD system and supported via subscription (SaaS), globally.(Source: https://www.morgantecnica.com)

Segments Covered in the Report

By Deployment

- On-premise

- Cloud

By Industry Verticals

- Automotive

- Electronics

- Manufacturing

- Oil and Gas

- Chemicals

- Healthcare

- Others (Pharmaceuticals, Petroleum, Others)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content