What is the Cardiac Monitoring and Cardiac Rhythm Management Devices Market Size in 2026?

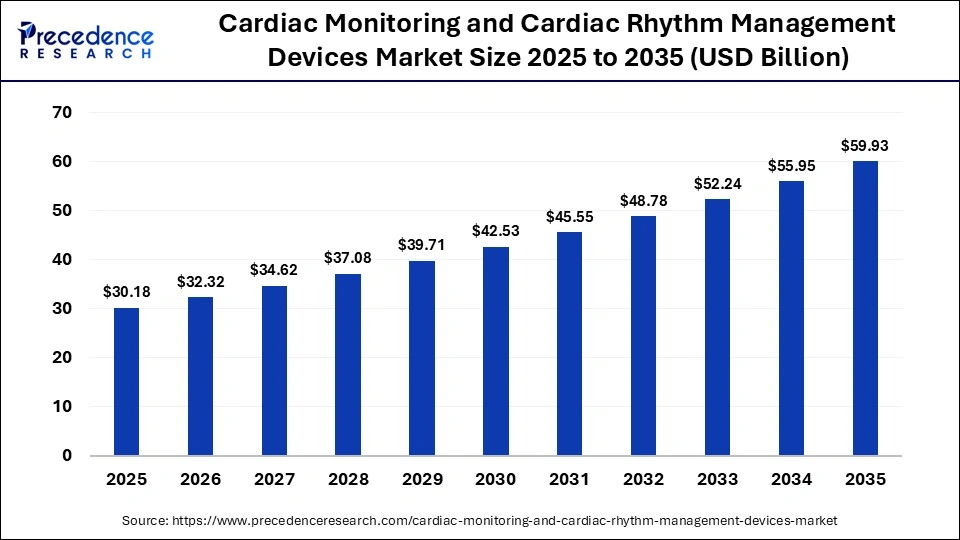

The global cardiac monitoring and cardiac rhythm management devices market size was calculated at USD 32.35 billion in 2025 and is predicted to increase from USD 34.89 billion in 2026 to approximately USD 68.82 billion by 2035, expanding at a CAGR of 7.84% from 2026 to 2035. The cardiac monitoring and cardiac rhythm management devices market is rising due to the prevalence of cardiovascular diseases, aging global population, technological innovation, increased awareness & early diagnosis, among others.

Market Highlights

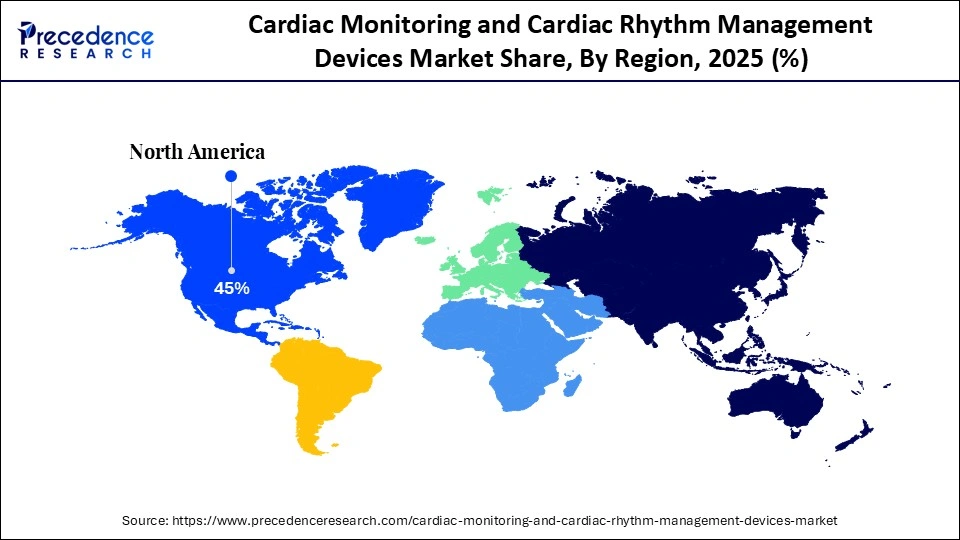

- North America led the market with approximately 41% of the market share in 2025.

- The Asia Pacific is estimated to expand at the fastest CAGR of approximately 8.07% between 2026 and 2035.

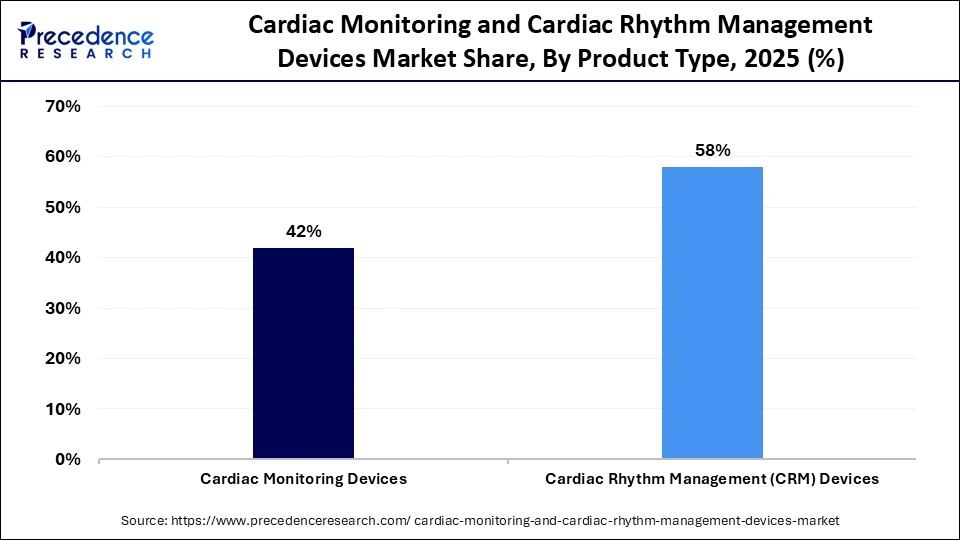

- By product type, the cardiac rhythm management (CRM) devices segment captured approximately 58% market share in 2025.

- By product type, the cardiac monitoring devices segment is growing at the highest CAGR between 2026 and 2035.

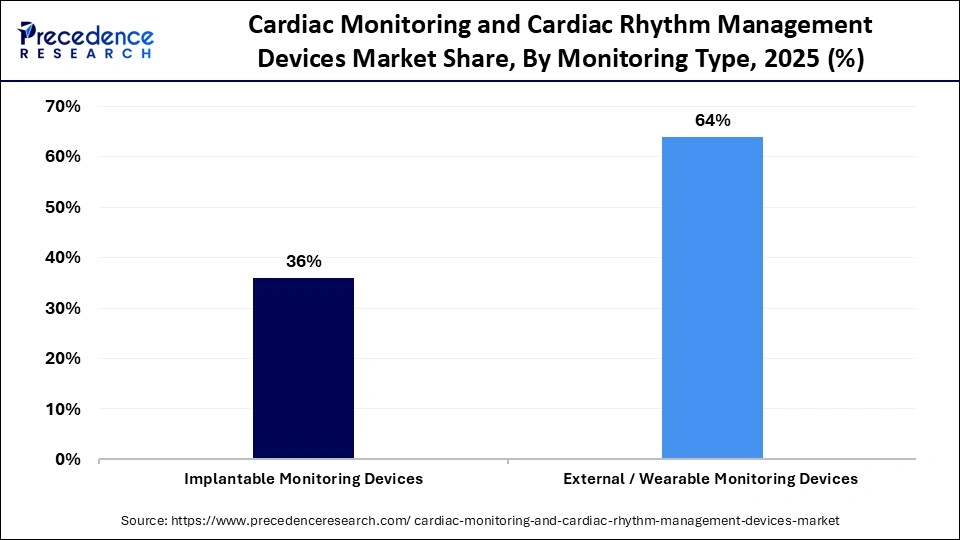

- By monitoring type, the external/wearable monitoring devices segment led the market and held approximately 64% market share in 2025.

- By monitoring type, the implantable monitoring devices segment is growing at the fastest CAGR from 2026 to 2035.

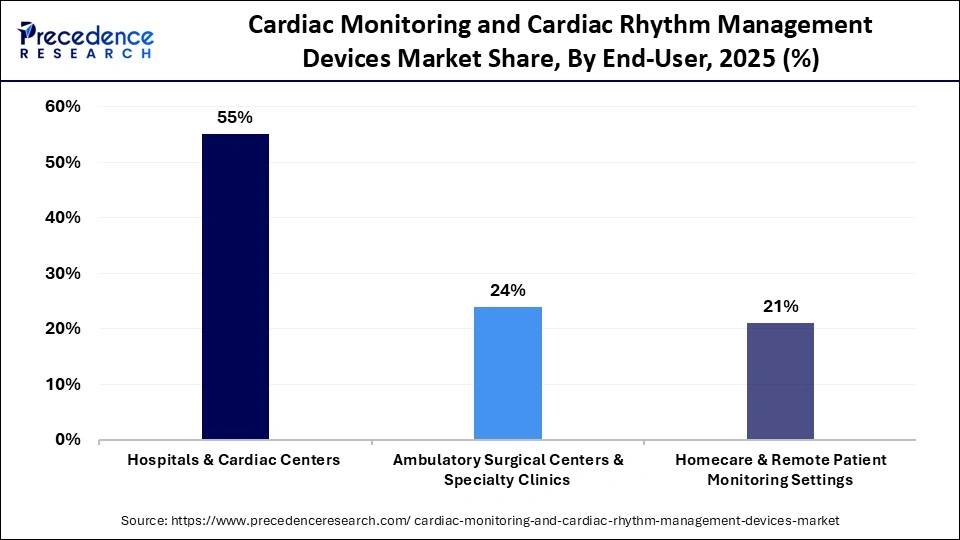

- By end-user, the hospitals & cardiac centers segment captured more than 55% of the market share in 2025.

- By end-user, the homecare & remote patient monitoring settings segment is poised to grow at a healthy CAGR between 2026 and 2035.

- By technology, the conventional cardiac monitoring & CRM devices segment contributed the biggest market share of 62% market share in 2025

- By technology, the remote/AI-enabled & connected devices segment is projected to grow at a solid CAGR between 2026 and 2035.

How are Cardiac Monitoring and Rhythm Management Devices Transforming Cardiovascular Care?

Cardiac monitoring and rhythm management devices are medical technologies used to continuously or intermittently track heart activity and manage abnormal heart rhythms. These devices help detect arrhythmias, monitor cardiac performance, and deliver corrective electrical therapy to maintain normal heart rhythm and prevent life-threatening cardiac events. The cardiac monitoring and cardiac rhythm management devices market is driven by the rising prevalence of cardiovascular diseases, aging populations, growing adoption of remote patient monitoring, technological advancements in implantable and wearable devices, and increased awareness of early diagnosis and preventive cardiac care.

How is AI Revolutionizing Cardiac Monitoring and Rhythm Management Devices?

Artificial intelligenceintegration can significantly improve the cardiac monitoring and cardiac rhythm management devices market by enhancing the accuracy and speed of arrhythmia detection, enabling early identification of abnormal heart patterns before symptoms worsen. AI-driven analytics support continuous data interpretation from wearable and implantable devices, reducing clinician workload and minimizing false alarms. Predictive insights help personalize treatment plans, optimize device settings, and improve patient outcomes. Additionally, AI supports remote monitoring by enabling real-time alerts, improving follow-up efficiency, and facilitating proactive, preventive cardiac care across diverse healthcare settings.

Primary Trends Influencing the Development of the Cardiac Monitoring and Cardiac Rhythm Management Devices Market

- Wearable and Minimally Invasive Cardiac Monitoring Technologies: The adoption of wearable devices such as ECG patches, smartwatches, and chest straps is increasing due to their ability to provide continuous heart monitoring in daily life settings. Minimally invasive implantable devices, including loop recorders and leadless pacemakers, improve patient comfort, reduce procedural risks, and support long-term cardiac rhythm tracking.

- Remote Patient Monitoring and Telecardiology Expansion: Remote monitoring capabilities are becoming a core feature of modern cardiac devices, enabling real-time transmission of heart data to clinicians. This trend supports telecardiology services, reduces hospital admissions, enables early detection of rhythm abnormalities, and improves disease management for patients with chronic cardiovascular conditions, especially in home-care settings.

- Device Miniaturization and Leadless Rhythm Management Solutions: Manufacturers are focusing on smaller, lightweight, and leadless cardiac rhythm management devices to minimize surgical complexity and complications. These compact solutions improve patient mobility, lower infection risks, and simplify implantation procedures, making cardiac rhythm therapies safer and more accessible across diverse patient populations.

- Cloud Connectivity and Integration with Digital Health Platforms: Cardiac monitoring and rhythm management devices are increasingly connected to cloud-based platforms and electronic health records. This integration allows continuous data storage, remote access for physicians, better longitudinal patient analysis, and improved coordination among healthcare providers, supporting more personalized and preventive cardiac care.

- Extended Battery Life and Enhanced Device Longevity: Advancements in battery technology and power-efficient circuitry are extending the operational life of cardiac monitoring and rhythm management devices. Longer battery life reduces the need for frequent replacements or surgical interventions, improves patient safety, and lowers long-term healthcare costs while ensuring uninterrupted cardiac monitoring.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.35 Billion |

| Market Size in 2026 | USD 34.89 Billion |

| Market Size by 2035 | USD 68.82 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Monitoring Type, Technology and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Was the Cardiac Rhythm Management (CRM) Devices Segment Dominant?

Cardiac Rhythm Management (CRM) Devices

The cardiac rhythm management (CRM) devices segment dominates the cardiac monitoring and cardiac rhythm management devices market with a share of approximately 58% due to their critical role in treating life-threatening arrhythmias through pacemakers, defibrillators, and cardiac resynchronization therapy devices. Their proven clinical effectiveness, long-term implantation needs, rising prevalence of rhythm disorders, and continuous technological advancements support widespread adoption across hospitals and specialized cardiac care centers.

Cardiac Monitoring Devices

The cardiac monitoring devices segment is the fastest-growing segment with the highest CAGR due to increasing demand for early detection of heart abnormalities, rising adoption of wearable and remote monitoring technologies, and growing preference for non-invasive diagnostic solutions. Continuous monitoring outside clinical settings, expanding telehealth services, and technological improvements in data accuracy and connectivity further accelerate their adoption across diverse patient populations.

Monitoring Type Insights

What Is the Reason for External/Wearable Monitoring Devices to be the Leader in This Market?

The external/wearable monitoring devices segment dominates the cardiac monitoring and cardiac rhythm management devices market with a share of approximately 64% due to their non-invasive design, ease of use, and ability to continuously monitor cardiac activity in daily life settings. These devices support early detection of heart abnormalities, enable remote patient monitoring, reduce hospital visits, and are widely adopted for outpatient care, preventive screening, and long-term cardiac health management.

The implantable monitoring devices segment is estimated to be the fastest-growing segment with the highest CAGR due to their ability to provide long-term, continuous, and highly accurate cardiac data for detecting infrequent or asymptomatic arrhythmias. Rising use in stroke evaluation, improved miniaturization, minimally invasive implantation procedures, and strong clinical reliability are accelerating adoption across advanced cardiac care settings.

End-User Insights

Why did hospitals & cardiac centers dominate the market in 2025?

Hospitals & Cardiac Centers

The hospitals & cardiac centers segment dominates the cardiac monitoring and cardiac rhythm management devices market with a share of approximately 55% due to their advanced infrastructure, availability of specialized cardiologists, and capacity to perform complex diagnostic and interventional procedures. These settings handle high patient volumes, support implantation and monitoring of advanced devices, and ensure continuous post-procedure care, driving sustained adoption of cardiac monitoring and rhythm management technologies

Homecare & Remote Patient Monitoring Settings

The homecare & remote patient monitoring settings segment is the fastest-growing segment with the highest CAGR due to rising demand for continuous cardiac surveillance outside hospitals, increasing adoption of wearable and connected devices, and growing emphasis on cost-effective, patient-centric care. Advances in telehealth infrastructure, improved data connectivity, and preference for early diagnosis and chronic disease management further support rapid adoption.

Technology Insights

Why Conventional Cardiac Monitoring & CRM Devices Dominate the Market in Terms of Technology in 2025?

The conventional cardiac monitoring & CRM devices segment dominates the cardiac monitoring and cardiac rhythm management devices market with a share of approximately 62% due to their long-standing clinical validation, widespread availability, and established use in hospitals and cardiac centers. Proven accuracy, physician familiarity, standardized treatment protocols, and strong reimbursement support ensure continued preference for these devices in routine diagnosis and management of cardiac rhythm disorders.

Remote/AI-Enabled & Connected Devices

The remote/AI-enabled & connected devices segment is expected to be the fastest-growing segment with the highest CAGR due to increasing demand for continuous, real-time cardiac monitoring and early detection of rhythm abnormalities. Integration with telehealth platforms, improved data connectivity, reduced hospital dependence, and enhanced clinical decision support enable proactive care, driving rapid adoption across home-based and outpatient settings.

Regional Insights

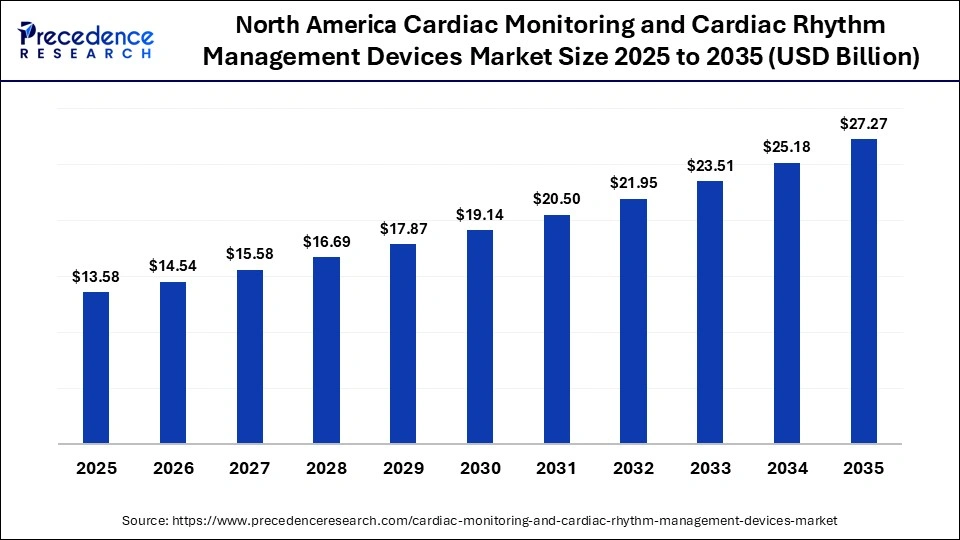

How Big is the North America Cardiac Monitoring & CRM Devices Market Size?

The North America cardiac monitoring and cardiac rhythm management devices market size is estimated at USD 13.26 billion in 2025 and is projected to reach approximately USD 28.56 billion by 2035, with a 7.99% CAGR from 2026 to 2035.

Why is North America the top region for the market in 2025?

North America dominates the cardiac monitoring and cardiac rhythm management devices market with a share of approximately 41% due to advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and early adoption of innovative medical technologies. Strong presence of leading device manufacturers, favorable reimbursement policies, widespread use of remote monitoring solutions, and high awareness of early cardiac diagnosis further support regional leadership.

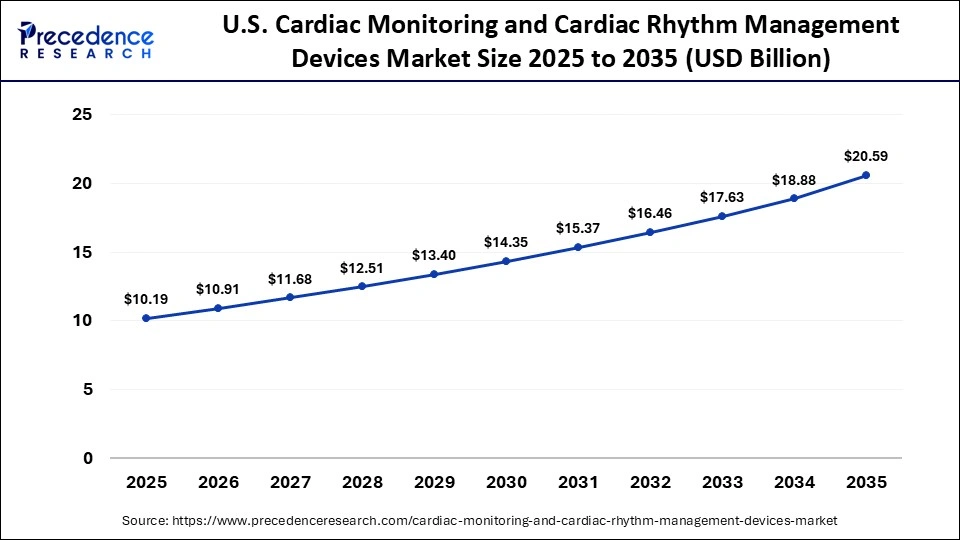

What is the Size of the U.S. Cardiac Monitoring & CRM Devices Market?

The U.S. cardiac monitoring and cardiac rhythm management devices market size is calculated at USD 9.95 billion in 2025 and is expected to reach nearly USD 21.56 billion in 2035, accelerating at a strong CAGR of 8.05% between 2026 and 2035.

U.S. Market Trends

The U.S. dominates the North American cardiac monitoring and cardiac rhythm management devices market due to its highly developed healthcare system, large cardiovascular patient population, and strong adoption of advanced medical technologies. The presence of major device manufacturers, extensive clinical research activities, favorable reimbursement frameworks, and widespread use of remote cardiac monitoring solutions further reinforce market leadership.

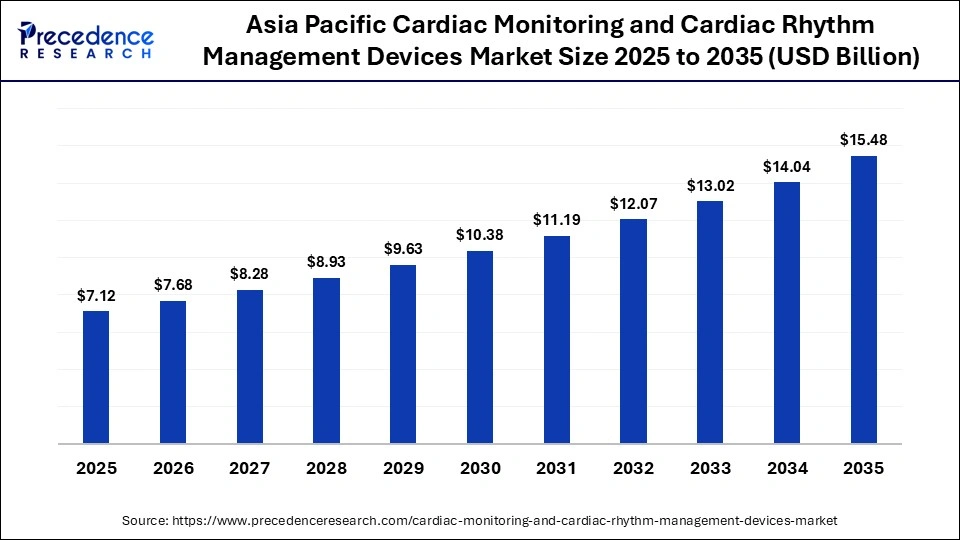

What is the Asia Pacific Cardiac Monitoring & CRM Devices Market Size?

The Asia Pacific cardiac monitoring and cardiac rhythm management devices market size is expected to be worth USD 15.48 billion by 2035, increasing from USD 7.12 billion by 2025, growing at a CAGR of 8.07% from 2026 to 2035.

Why is Asia Pacific experiencing the fastest growth in the Market?

Asia-Pacific is the fastest-growing region with the fastest CAGR in the cardiac monitoring and cardiac rhythm management devices market due to its large and aging population, rising prevalence of cardiovascular diseases, and increasing healthcare expenditure. Rapid expansion of hospital infrastructure, growing adoption of wearable and remote cardiac monitoring devices, improving access to advanced diagnostics, and supportive government initiatives for digital health are accelerating regional market growth.

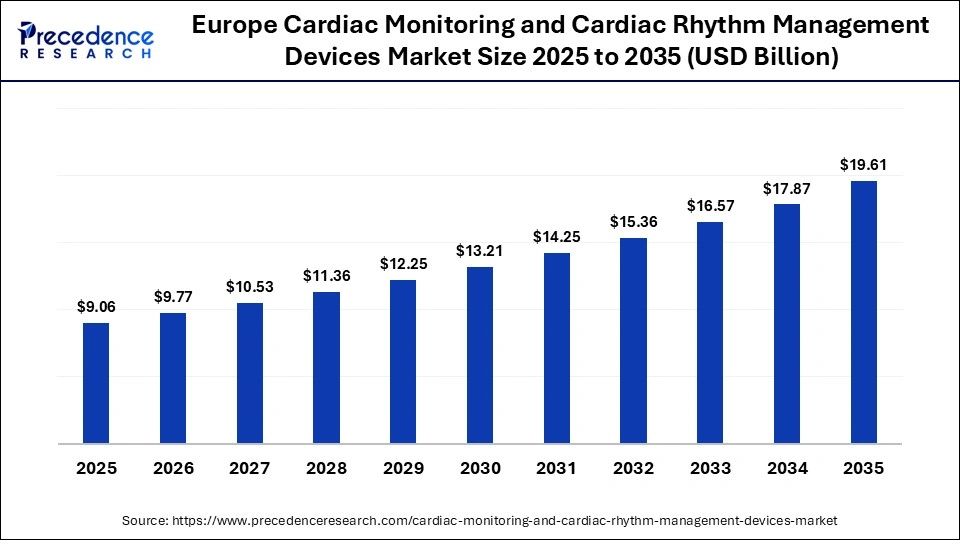

What is the Europe Cardiac Monitoring & CRM Devices Market Size and Growth Rate?

The Europe cardiac monitoring and cardiac rhythm management devices market size has grown strongly in recent years. It will grow from USD 9.06 billion in 2025 to USD 19.61 billion in 2035, expanding at a compound annual growth rate (CAGR) of 8.05% between 2026 and 2035.

What Makes Europe a Notably Growing Region in the Market?

Europe is expected to grow at a notable rate in the market during the projection period. This is because of its robust regulatory frameworks, well-established healthcare systems, and a high level of awareness regarding the management of thrombotic disease. The extensive use of cutting-edge medical equipment in hospitals and specialty clinics benefits the area. The demand for these pumps in the area is still being sustained by an aging population and an increase in surgical procedures.as the European Gaming and Betting Association (EGBA) and governments can help to increase confidence in society.

China Cardiac Monitoring and Cardiac Rhythm Management Devices Market Trends

China is the fastest-growing country in the Asia-Pacific cardiac monitoring and rhythm management devices market due to its large patient population, rising incidence of cardiovascular diseases, and expanding healthcare infrastructure. Increasing adoption of advanced wearable and remote monitoring technologies, government support for digital health initiatives, and growing awareness of early diagnosis and preventive cardiac care drive rapid market growth.

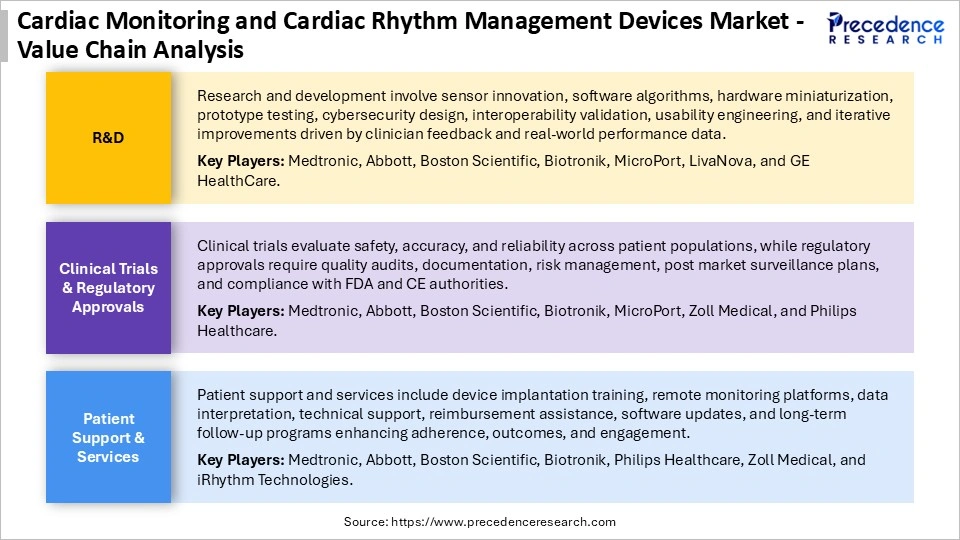

Cardiac Monitoring and Cardiac Rhythm Management Devices MarketValue Chain Analysis

Who are the Major Players in the Global Cardiac Monitoring and Cardiac Rhythm Management Devices Market?

The major players in the cardiac monitoring and cardiac rhythm management devices market include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, BIOTRONIK SE & Co. KG, Koninklijke Philips N.V., GE HealthCare Technologies Inc., MicroPort Scientific Corporation, ZOLL Medical Corporation, Nihon Kohden Corporation, Schiller AG, AliveCor, Inc., LivaNova PLC, Mindray Medical International Limited, Spacelabs Healthcare, Fukuda Denshi Co., Ltd., Cardiac Science Corporation, OSI Systems, Inc., iRhythm Technologies, Inc., Hillrom Holdings, Inc. (Baxter), Preventive Solutions, Inc.

Recent Developments

- On January 9, 2026, FineHeart secured €83 million in funding, combining private investment and European grants, to accelerate the development of its implantable cardiac devices, including the FlowMaker system for advanced heart failure. The funding supports clinical trials, production scale-up, and European innovation initiatives, enabling FineHeart to expand its presence in the implantable medical device market. [Source: (Source: https://www.businesswire.com)

- In January 2026, AccurKardia received U.S. FDA 510(k) clearance and launched AccurECG 2.0 on January 9, 2026. The platform delivers automated, real-time ECG analysis across multiple cardiac rhythm types, helping clinicians reduce diagnostic delays and manage high patient volumes more effectively. [Source: (Source: https://www.businesswire.com)

- In December 2025, Zoho's MedTech division is advancing its next-generation Variable Cardio Viterb Defibrillator, designed to provide adaptive pacing and defibrillation personalized to each patient's arrhythmia profile. The device integrates advanced diagnostics, real-time monitoring, and remote management features to enhance clinical decision-making and improve patient outcomes.(Source: https://www.thehindubusinessline.com)

Segments Covered in the Report

By Product Type

- Cardiac Monitoring Devices

- Holter monitors

- Event monitors

- Mobile cardiac telemetry (MCT)

- Implantable loop recorders

- Cardiac Rhythm Management (CRM) Devices

- Pacemakers

- Implantable cardioverter defibrillators (ICDs)

- Cardiac resynchronization therapy (CRT) devices

By Monitoring Type

- Implantable Monitoring Devices

- External / Wearable Monitoring Devices

By End-User

- Hospitals & Cardiac Centers

- Ambulatory Surgical Centers & Specialty Clinics

- Homecare & Remote Patient Monitoring Settings

By Technology

- Conventional Cardiac Monitoring & CRM Devices

- Remote/AI-enabled & Connected Devices

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting