What is the Cloud integration, migration and optimization Market Size?

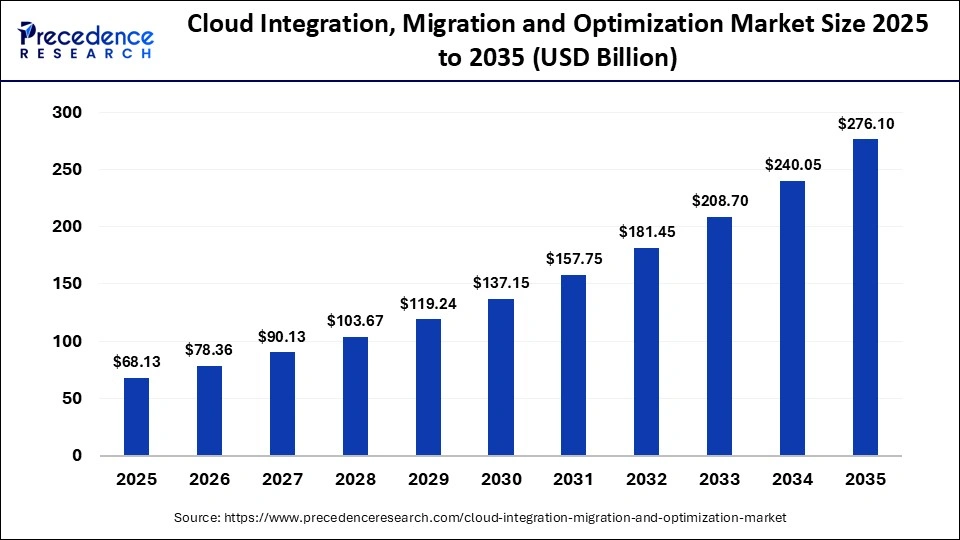

The global cloud integration, migration and optimization market size is calculated at USD 68.13 billion in 2025 and is predicted to increase from USD 78.36 billion in 2026 to approximately USD 276.10 billion by 2035, expanding at a CAGR of 15.02% from 2026 to 2035. The market is driven by the growing need for businesses to streamline operations and improve efficiency with cloud technologies.

Market Highlights

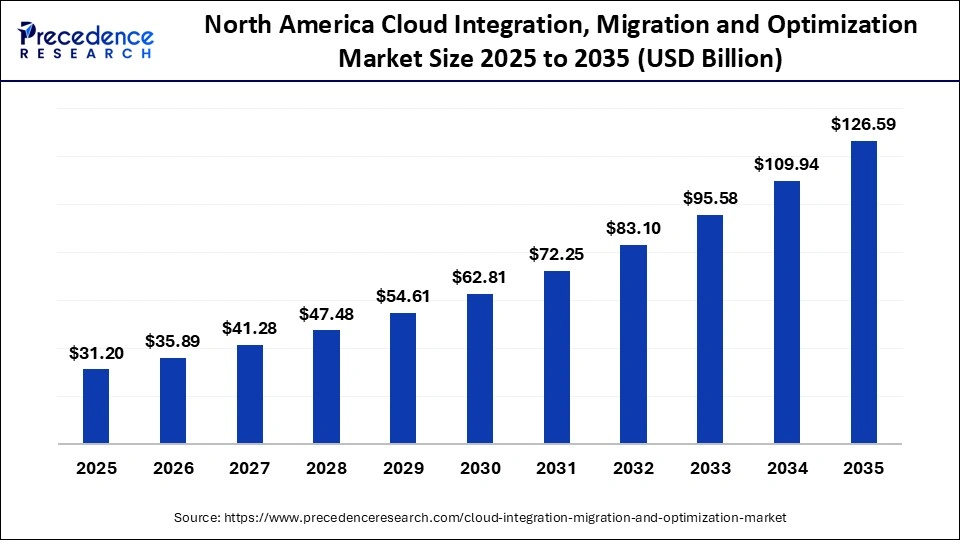

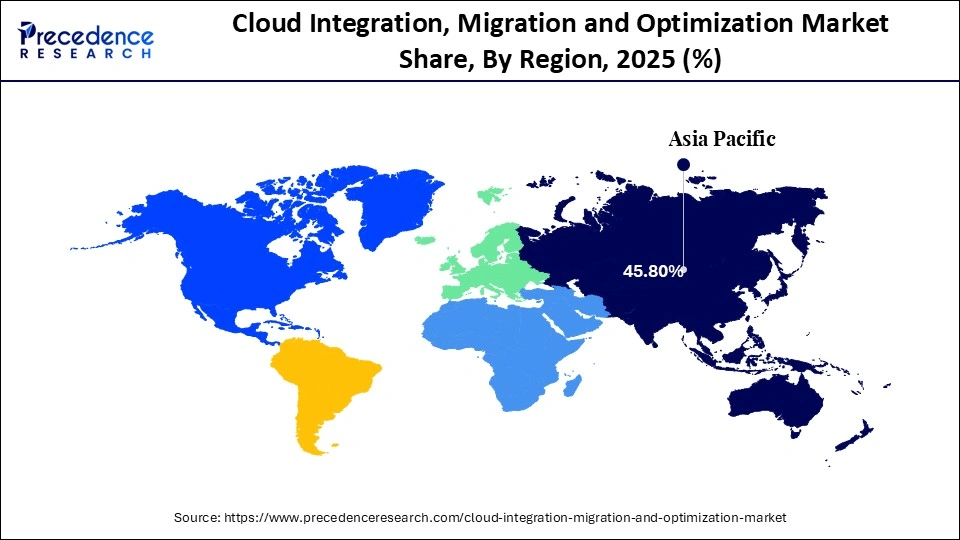

- North America dominated the market with the largest share of 45.8% in 2025.

- The Asia Pacific is expected to grow at a solid CAGR of 15.5% from 2026 to 2035.

- By component, the services segment led the market while holding the biggest market share of 73.4% in 2025.

- By component, the solutions segment is growing at the fastest CAGR between 2026 and 2035.

- By migration / integration type, the rehosting segment contributed the highest market share of 38.6% in 2025.

- By migration / integration type, the refactoring/modernization segment is growing at a significant CAGR from 2026 to 2035.

- By service type, the migration execution segment accounted for the largest market share of 36.8% in 2025.

- By service type, the optimization services segment is expected to expand at a notable CAGR of 13.8% from 2026 to 2035.

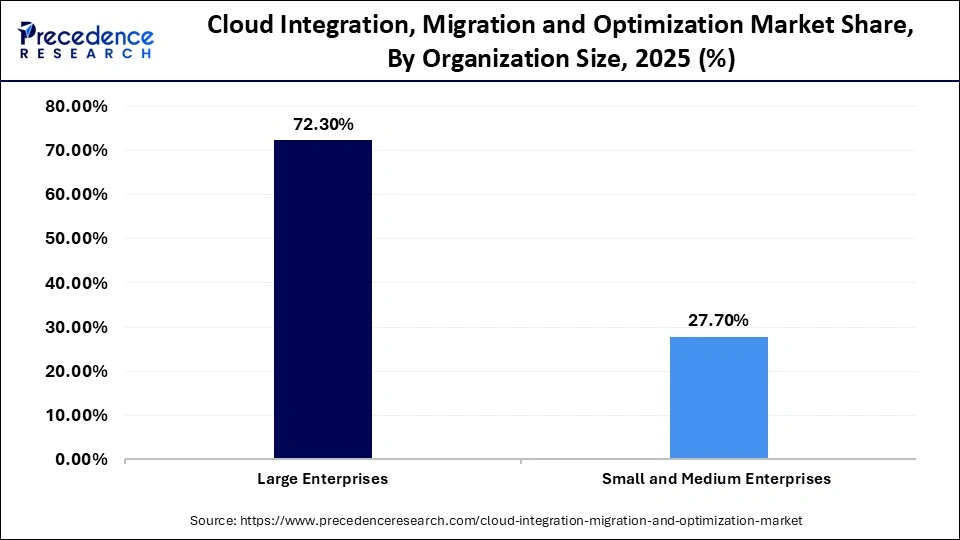

- By organization size, the large enterprises segment captured the major market share of 72.3% in 2025.

- By organization size, the SMEs segment is growing at a strong CAGR of 14% from 2026 to 2035.

- By industry vertical, the BFSI segment held the largest market share of 29.6% in 2025.

- By industry vertical, the healthcare & life sciences segment is expected to grow at a CAGR of 14.3% from 2026 to 2035.

What Is the Cloud Integration, Migration and Optimization Market?

The cloud integration, migration and optimization market covers solutions and services that help organizations move, connect, modernize, and continuously enhance applications, data, and infrastructure across public, private, and hybrid cloud environments. It includes assessment, planning, rehosting, replatforming, refactoring, data and application integration, cost and performance optimization, security hardening, governance, and managed cloud operations. The goal is to achieve improved scalability, reduced cost, higher resilience, faster deployment, regulatory compliance, and seamless interoperability across multi-cloud ecosystems.

Key Technological Shifts in the Cloud Integration, Migration and Optimization Market

The landscape of cloud integration and migration is evolving rapidly because organizations are shifting from simple lift-and-shift methods to smart, automated, and continuously optimized cloud environments. AI-driven orchestration is a key development, where machine learning engines analyze workloads, predict resource needs, and automatically adjust cloud architectures. Serverless computing, event-driven architecture, and similar approaches are also influencing integration patterns by reducing reliance on heavy middleware and enabling the setup of lightweight, responsive pipelines.

There is also a significant shift toward API-first and microservices-based integration, allowing companies to break down monolithic systems into modular, cloud-native components that can be migrated or scaled independently. Moreover, organizations are adopting FinOps platforms to monitor cost leaks, automate rightsizing, and enforce governance, making optimization a continuous, data-driven process rather than a one-time effort.

Key Trends in the Cloud Integration, Migration and Optimization Market

- Security-by-design is becoming a major trend, with migration pipelines now incorporating automated compliance checks, zero-trust access controls, and continuous threat monitoring as standard components of the integration toolkit.

- Organizations are also moving toward automation-first migration strategies, reducing manual effort through AI-driven assessment tools, self-healing pipelines, and automatically generated integration mappings. At the same time, the growing demand for multi-cloud flexibility enables businesses to remain vendor-neutral, improve resilience, and optimize cost-performance across different cloud providers.

- The increasing focus on cost optimization and sustainability is pushing companies to adopt energy-efficient cloud architectures and real-time monitoring solutions that help lower operational costs as well as their carbon footprint.

Cloud Integration, Migration and Optimization Market Outlook

- Industry Outlook: The cloud integration, migration and optimization market is poised for rapid growth from 2026 to 2035, as enterprises modernize their infrastructures, adopt multi-cloud strategies, and prioritize automation, security, and cost efficiency. Growing demand for seamless data movement, scalable architectures, and performance optimization is driving continuous innovation across tools, platforms, and professional services.

- Global Expansion: The market is growing worldwide, with emerging regions like Asia Pacific, Latin America, and the Middle East becoming major growth engines. These regions offer immense opportunities for market expansion due to expanding patient pools, rising demand for advanced medical technologies, and strategic government initiatives aimed at strengthening diagnostics, research, and healthcare delivery.

- Major Investment: Major investors in the market include global technology vendors (such as hyperscalers and enterprise software companies) and venture capital/private equity firms, who fund innovation and drive competitive offerings. These investors contribute by financing advanced tools and platforms, accelerating R&D for automation and security features, and fostering ecosystem partnerships that expand market reach and customer adoption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 68.13 Billion |

| Market Size in 2026 | USD 78.36 Billion |

| Market Size by 2035 | USD 276.10 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.02% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Migration/Integration Type, Service Type, Organization Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

How Does the Services Segment Lead the Cloud Integration, Migration and Optimization Market?

The services segment led the market, holding a 73.4% share in 2024. This is mainly due to the increasing complexity of multi-cloud architectures. Organizations are increasingly relying on expert service providers to navigate infrastructure challenges and ensure seamless transformation. These services offer customized planning, implementation, and post-deployment support that most companies lack internally. As digital transformation accelerates, enterprises prefer outsourcing to reduce risks and maintain operational continuity. The need for ongoing optimization and governance further reinforces service-led engagement models. Ultimately, services remain the backbone of enterprise cloud success, driving sustained dominance in this segment.

The solutions segment is expected to grow at the fastest rate in the upcoming period because enterprises increasingly require comprehensive tools to streamline cloud adoption, manage complex migrations, and optimize performance across multi-cloud environments. Businesses are prioritizing automation, real-time monitoring, and security features, which are best delivered through integrated software solutions rather than standalone services. Additionally, the rising demand for cost efficiency, compliance, and energy-efficient cloud operations is driving organizations to invest in robust solutions that provide end-to-end management and measurable ROI.

Migration/Integration Type Insights

Why Did the Rehosting Segment Dominate the Cloud Integration, Migration and Optimization Market?

The rehosting segment dominated the market, holding a share of 38.6% in 2024, as it allows companies to migrate workloads to the cloud quickly and with minimal complexity. Organizations with legacy systems often prefer rehosting to avoid the lengthy process of redesigning their applications, enabling faster deployment and reduced business disruption. It is also a cost-effective approach for companies in the early stages of cloud adoption or those looking to exit large-scale data centers. Many enterprises use rehosting as a foundation before deciding to modernize their systems further, making it a preferred choice due to its speed, simplicity, and lower upfront costs.

The refactoring/modernization segment is expected to grow at the fastest CAGR of 13.9% during the forecast period, driven by the increasing adoption of cloud-native features. Refactoring enables applications to leverage advanced cloud capabilities such as auto-scaling, microservices, and serverless computing. Although it is more resource-intensive, it offers greater flexibility, improved performance, and long-term cost savings. The shift to modern architectures and the focus on digital innovation are key drivers of its rapid adoption, with large enterprises viewing refactoring as a strategic approach to enhance customer experience and operational resilience.

Service Type Insights

What Made Migration Execution the Dominant Segment in the Cloud Integration, Migration and Optimization Market?

The migration execution segment dominated the market, with a 36.8% share in 2024, as organizations need an expert technical approach to move their applications, databases, and workloads without disruption. These services guarantee a well-planned, error-free migration that minimizes the time the system is unavailable. Corporations entrust external professionals with the management of assessment, planning, data transfer, and verification stages. Because of the increase in cloud adoption, migration execution is becoming the primary instrument for companies' digital transformation.

The optimization services segment is expected to expand at the highest CAGR of 13.8%, as companies realize that simply migrating to the cloud does not guarantee process efficiency or cost reduction. These services enable organizations to control resource consumption, manage systems effectively, and align cloud operations with business objectives. Rising cloud expenses and increasingly complex operations have created a need for continuous oversight, while companies also seek guidance on automation, governance, and performance benchmarking. As cloud environments become more dynamic, the demand for optimization services continues to rise.

Organization Size Insights

How Does the Large Enterprises Segment Dominate the Cloud Integration, Migration and Optimization Market?

The large enterprises segment led the market with a 72.3% share in 2024, owing to their extensive workloads, global operations, and complex legacy ecosystems. They invest heavily in cloud modernization to make their businesses more agile and accelerate digital transformation. These large organizations employ multi-layered cloud strategies, which, in turn, require advanced integration and migration services to function properly. Additionally, strict regulatory compliance is another factor fueling the rapid adoption of optimized cloud architectures.

The SMEs segment is expected to grow at the fastest CAGR of 14.0% in the coming years as cloud adoption becomes more accessible and cost-effective. They prefer cloud migration to cut capital expenses and streamline operations. User-friendly platforms and automated tools are boosting adoption among smaller organizations. SMEs also look for scalable solutions that support rapid business growth and a strong digital presence. The shift to subscription-based IT models aligns well with their budget constraints. As competition intensifies, SMEs are quickly embracing cloud modernization, driving significant growth.

Industry Vertical Insights

Why Did the BFSI Segment Dominate the Cloud Integration, Migration and Optimization Market?

The BFSI segment dominated the market by holding a 29.6% share in 2024 because it focuses heavily on security, compliance, and reliable digital infrastructure. The gradual but steady shift in banking and financial institutions toward the cloud is mainly driven by needs for data processing, risk analytics, and digital banking services. The large volume of transactions is the main reason for the demand for cloud environments, which are both scalable and resilient. Additionally, modernization is a top priority for BFSI organizations to enhance customer experience and improve operational efficiency.

The healthcare & life sciences segment is projected to grow at the fastest CAGR of 14.3% during the forecast period due to the increasing adoption of digital health technologies, electronic health records, and telemedicine platforms that require seamless cloud integration. The need for secure, compliant, and scalable cloud solutions to manage large volumes of sensitive patient data drives investment in migration and optimization services. Additionally, advancements in personalized medicine, clinical research, and AI-driven diagnostics are fueling demand for high-performance, automated, and cost-efficient cloud infrastructurein the sector.

Regional Insights

How Big is the North America Cloud Integration, Migration and Optimization Market Size?

The North America cloud integration, migration and optimization market size is estimated at USD 31.20 billion in 2025 and is projected to reach approximately USD 126.59 billion by 2035, with a 15.03% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Cloud Integration, Migration and Optimization Market?

North America dominated the cloud integration, migration and optimization market by holding a 45.8% share in 2024. This is mainly due to its early and widespread adoption of advanced digital and cloud technologies across industries. The region is home to major cloud providers, technology vendors, and enterprises with substantial IT budgets, driving strong demand for automation and multi-cloud solutions. Continuous investments in innovation, cybersecurity, and modernization further reinforce its market strength.

What is the Size of the U.S.Cloud Integration, Migration and Optimization Market?

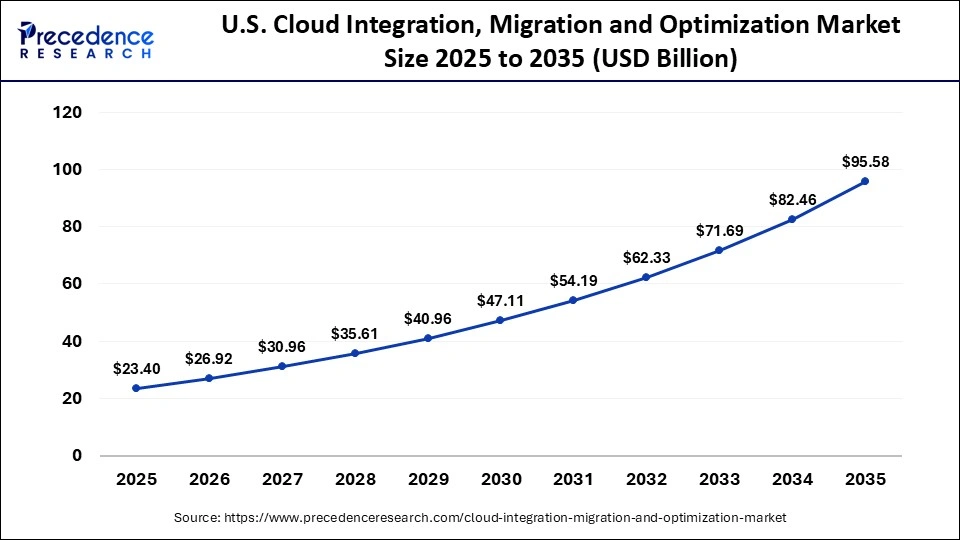

The U.S. cloud integration, migration and optimization market size is calculated at USD 23.40 billion in 2025 and is expected to reach nearly USD 95.58 billion in 2035, accelerating at a strong CAGR of 15.11% between 2026 and 2035.

U.S. Cloud integration, migration and optimization Market Trends

The U.S. is the major contributor to the market within North America. Major market trends include a rapid shift toward automation-first strategies, in which AI-driven assessment tools, self-healing pipelines, and automated integration mapping reduce manual effort. Organizations are also prioritizing security-by-design, embedding zero-trust frameworks, automated compliance checks, and continuous threat monitoring into cloud migration workflows.

What Makes Asia Pacific the Fastest-Growing Region in the Cloud Integration, Migration and Optimization Market?

Asia Pacific is expected to grow at the fastest CAGR of 15.5% during the forecast period due to its rapid digital transformation across industries, expanding IT infrastructure, and increasing cloud adoption among enterprises. Strong government initiatives promoting smart cities, cloud-first policies, and digital innovation further accelerate market growth. Additionally, a growing number of startups and SMEs investing in scalable, cost-efficient, and automated cloud solutions contribute to the region's high growth trajectory.

China Cloud integration, migration and optimization Market Trends

In China, the market is driven by the rapid adoption of multi-cloud and hybrid cloud architectures, as enterprises seek flexibility and resilience in their IT operations. There is a strong focus on automation and AI-driven solutions to streamline migration processes, optimize performance, and reduce operational costs. Additionally, enhanced data security, compliance with local regulations, and government-backed digital initiatives are shaping the deployment of advanced cloud integration and optimization strategies across industries.

Why is Europe Considered a Notably Growing Area in the Cloud Integration, Migration and Optimization Market?

Europe is a notably growing region in the market due to widespread adoption of cloud technologies across enterprises, strong investments in digital transformation, and an increasing focus on multi-cloud strategies. Strict yet robust data protection regulations, such as the GDPR, drive demand for secure, compliant cloud integration solutions. Additionally, growing government initiatives supporting innovation, sustainability, and energy-efficient IT infrastructure further accelerate market growth in the region.

Germany Cloud Integration, Migration and Optimization Market Trends

In Germany, the market is driven by enterprises increasingly adopting hybrid and multi-cloud strategies to enhance flexibility, scalability, and business continuity. There is a strong emphasis on automation, AI-driven migration tools, and self-healing pipelines to reduce manual workloads and optimize cloud performance. Additionally, stringent data protection regulations and sustainability initiatives are encouraging companies to implement secure, energy-efficient, and compliant cloud architectures.

Top Companies in the Market

- Accenture: Provides end-to-end cloud integration, migration and optimization services, combining strategy, AI-driven tools, and managed services to help enterprises modernize and optimize their cloud environments.

- Amazon Web Services (AWS): Offers a comprehensive suite of cloud migration, integration, and optimization solutions, including tools like AWS Migration Hub, AWS Application Migration Service, and cost-management services for scalable, secure deployments.

- Microsoft (Azure): Delivers cloud integration and migration solutions through Azure Migrate, Azure Arc, and Azure Cost Management, helping businesses move workloads, optimize performance, and implement hybrid/multi-cloud strategies.

- Google Cloud: Provides cloud migration and optimization services via tools like Migrate for Compute Engine, Anthos for hybrid management, and cost-performance monitoring solutions for efficient cloud operations.

- IBM: Offers cloud migration, integration, and optimization services through IBM Cloud Pak solutions, AI-driven automation, and managed services that enhance scalability, security, and operational efficiency.

Other Major Companies

- Deloitte

- Capgemini

- Cognizant

- Wipro

- Infosys

- HCL Technologies

- Oracle

- VMware

- ServiceNow

- Rackspace Technology

Recent Developments

- In September 2025, Microsoft introduced a new set of Azure Migrate capabilities designed to simplify and accelerate the shift of on-premises workloads to Microsoft Azure. The update includes an AI-driven agentic framework, enhanced Infrastructure-as-Code integration, and strengthened security features to support more efficient and secure migrations.

- In October 2025, Tessell, a multi-cloud Database-as-a-Service (DBaaS) provider, unveiled its new Exadata Integration, aimed at helping enterprises fully leverage Oracle Database and Exadata across Oracle Cloud Infrastructure (OCI) and various approved multi-cloud environments. This includes support for Oracle Database Azure, Oracle Database Google Cloud, and Oracle DatabaseAWS.

Segment Covered in the Report

By Component

- Solutions

- Services

- Consulting

- Integration & Migration Services

- Optimization Services

- Managed Services

By Migration/Integration Type

- Rehosting

- Replatforming

- Refactoring/Modernization

- Repurchasing (SaaS)

- Application Integration/APIs/Middleware

By Service Type

- Assessment & Advisory

- Migration Execution

- Optimization

- Security & Governance

- Managed Services

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Retail & eCommerce

- Manufacturing & Automotive

- Government & Public Sector

- Energy & Utilities

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting