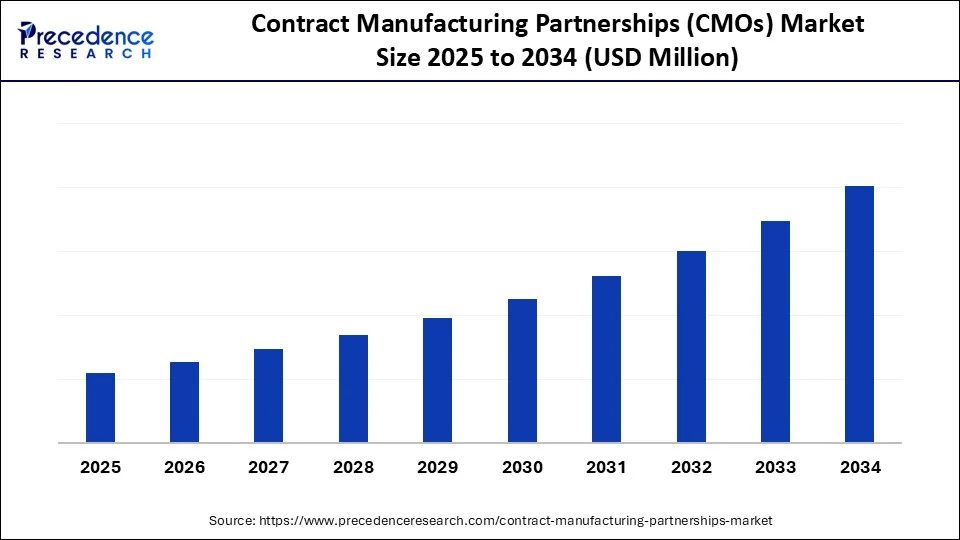

Contract Manufacturing Partnerships (CMOs) Market Size and Forecast 2025 to 2034

Contract manufacturing partnerships (CMOs) market analysis outsourcing trends, continuous manufacturing, regulatory compliance and quality assurance. The growth of the market is driven by the increased complexity of drug development, which boosts the demand for specialized expertise.

Contract Manufacturing Partnerships (CMOs) MarketKey Takeaways

- North America dominated the contract manufacturing partnerships (CMOs) market in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By service type, the active pharmaceutical ingredient (API) manufacturing segment contributed the biggest market share in 2024.

- By service type, the large molecule APIs sub-segment is expected to grow at a significant CAGR between 2025 and 2034.

- By drug type, the small molecule drugs segment held the largest share in 2024.

- By drug type, the cell & gene therapy products sub-segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By scale of operation type, the commercial-scale manufacturing segment led the market in 2024.

- By scale of operation type, the preclinical & clinical phase manufacturing segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end user, the pharmaceutical companies segment captured the highest market share in 2024.

- By end user, the biotechnology companies segment is expected to grow at the fastest CAGR between 2025 and 2034.

Impact of AI on the Contract Manufacturing Partnerships (CMOs) Market

Artificial intelligence (AI) is revolutionizing the market for contract manufacturing partnerships (CMOs) by optimizing various aspects of the operations of CMOs. From predictive maintenance to dynamic supply chain management, AI is streamlining operations like never before. It enables real-time production adjustments, improving output quality and reducing waste. AI tools are also enhancing demand forecasting and inventory management control, making the partnership model more agile. Companies can now co-develop smarter products with their manufacturers using AI-driven simulations and prototyping. Overall, AI is not just a support tool; it is becoming a strategic partner in the entire contract manufacturing lifecycle.

Market Overview

The contract manufacturing partnerships (CMO) market represents the global industry of third-party service providers that offer end-to-end or partial manufacturing services to pharmaceutical, biotechnology, nutraceutical, and medical device companies. CMOs enable their clients to outsource drug or device manufacturing to specialized vendors, reducing infrastructure costs, optimizing scalability, and accelerating time-to-market.

These organizations handle API synthesis, formulation development, packaging, clinical and commercial-scale production, and in some cases regulatory support. The market has become increasingly tech-driven, with integrated platforms, smart manufacturing, and quality assurance systems forming competitive differentiators. The global market is experiencing robust growth due to the rising need for cost optimization, faster go-to-market strategies, and access to global talent.

Key Market Trends

- Increasing demand for specialized, niche manufacturing: Companies are seeking partners with deep expertise in specific domains.

- AI and automation integration: CMOs are becoming smarter, more responsive, and data-driven.

- Sustainable manufacturing practices: Clients are demanding greener processes, and manufacturers are adopting circular economy models.

- Vertical integration and value-added services: Contractors are evolving from simple assemblers to innovation partners.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Drug Type, Business Model, Scale of Operation, End User, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need for Faster Time to Market and Cost Efficiency

A primary factor driving the growth of the contract manufacturing partnerships (CMOs) market is the relentless pursuit of cost-efficiency without compromising quality. Pharmaceutical and biopharmaceutical companies are under pressure to innovate rapidly while maintaining lean operations. Contract manufacturers offer a ready-made infrastructure, skilled labor, and economies of scale that are hard to replicate in-house. CMOs offer scalable manufacturing capabilities, allowing companies to scale up production based on market demand. They also provide regulatory expertise that may not be available in-house, enabling faster product launches.

Additionally, global access to specialized capabilities like precision tooling, biopharma synthesis, or microelectronics has made outsourcing a strategic advantage rather than a necessity. This model allows companies to focus on core competencies, such as R&D and branding. As competition intensifies globally, contract manufacturing is not just appealing its essential.

Restraint

Inconsistency in Quality Control and Regulatory Hurdles

Contract manufacturing comes with intricate challenges that can hamper the growth of the market. A key factor restraining the market growth is the inconsistency in quality control and visibility, particularly in offshore arrangements. Companies often grapple with misaligned priorities, communication lags, and inconsistent production standards. Ensuring consistent product quality and adherence to regulatory standards can be challenging for pharmaceutical and biopharmaceutical companies when working with external partners.

Intellectual property (IP) risk and data breaches also pose serious concerns, especially in tech-driven industries. Moreover, over-reliance on external partners may lead to reduced internal capabilities and flexibility in the long run. These vulnerabilities underline the need for rigorous vendor vetting, legal safeguards, and continuous oversight, without which, partnerships can quickly turn precarious.

Opportunity

Rising Demand for Personalized Medicine and Expansion into Emerging Markets

The rising demand for personalized medicine and customized therapies creates immense opportunities for CMOs. As demand for personalized and niche products grows, pharmaceutical and biopharmaceutical companies seek agile manufacturing partners who can quickly scale up limited production runs. Emerging markets also offer fertile ground for CMOs to establish production facilities and expand partnerships. Furthermore, advanced manufacturing technologies are enhancing the capabilities of CMOs to improve efficiency and production according to partners' requirements.

Service Insights

Why Did the Active Pharmaceutical Ingredient (API) Manufacturing Segment Dominate the Contract Manufacturing Partnerships (CMOs) Market in 2024?

The active pharmaceutical ingredient (API) manufacturing segment dominated the market, under which the small molecule APIs sub-segment held the largest market share in 2024. This is primarily due to their ease of formulation and convenience with oral delivery. Their synthesis, while complex, has become highly standardized and efficient in outsourced settings. Contract manufacturers are increasingly using advanced process chemistries to enhance yields and reduce impurities. These molecules are ideal for chronic therapies for hypertension, diabetes, and infections, keeping the demand consistent. Additionally, the expiration of major drug patents is driving generic small molecules production.

On the other hand, the large molecule APIs (biologics) sub-segment is likely to grow at the fastest rate in the upcoming period due to their high demand. Biopharmaceutical companies often outsource large molecule API production to CMOs due to their complex nature. CMOs with bioprocessing expertise and single-use technologies have been witnessing a significant rise in the outsourcing of large molecule APIs. This segment is becoming a preferred outsourcing choice due to the capital-intensive nature of biologics infrastructure. Global pharma companies are racing to expand their biologics pipelines, encouraging them to partner with CMOs for compliance.

Drug Insights

How Does the Small Molecule Drugs Segment Dominate the Market in 2024?

The small molecule drugs segment dominated the contract manufacturing partnerships (CMOs) market with a major share in 2024. The dominance of small molecule drugs stems from their oral availability and cost-efficiency, making them ideal for mass-market therapies. CMOs are experts in producing these drugs at scale, with high reproducibility and regulatory compliance. The demand for these drugs remains strong in areas like cardiovascular, metabolic, and infectious diseases. Outsourcing helps pharma firms meet global supply demands without massive internal investments. Even in the area of biologics, small molecules remain indispensable, facilitating segment's dominance.

Meanwhile, the biologics segment is expected to grow at the fastest rate, under which cell & gene therapy products are leading the charge. These personalized treatments require complex, low-volume, high-precision manufacturing. CMOs are rapidly developing specialized capabilities in viral vector production, plasmid purification, and cell expansion. The outsourcing model allows biotech startups and big biopharma to scale the production of these therapies without building in-house infrastructure. Regulatory approvals for CAR-T, CRISPR-based therapies, and gene editing products are accelerating the demand. In this high-stakes field, contract manufacturers are not just service providers; they are innovation enablers.

Business Model Insights

How Does the Fee-for-Service (FFS) Segment Lead the Contract Manufacturing Partnerships (CMOs) Market in 2024?

The fee-for-service (FFS) segment dominated the market in 2024 due to its clarity, flexibility, and minimal risk. It allows pharma companies to engage a CMO for discrete tasks, whether synthesis, formulation, or packaging, without long-term commitment. This model ensures cost transparency and allows clients to select best-in-class vendors for specific capabilities. It works particularly well for generic drug producers and companies with well-defined pipelines. For a broader client base and stable recurring revenue. Despite emerging models, fee-for-service revenues.

On the other hand, the co-development & risk-Sharing partnerships segment is expected to grow at the fastest CAGR in the market during the forecast period, as many pharma companies are seeking deeper, strategic alliances with manufacturers. The co-development model, where risks and rewards are shared, is gaining traction rapidly. This model fosters true collaboration, joint investment in R&D, shared regulatory responsibilities, and even co-ownership of IP. Startups and mid-sized biotechs especially benefit, as they gain access to infrastructure and expertise without upfront capital. For CMOs, it opens the door to revenue sharing and long-term value. This shift marks the transformation of contract manufacturers from suppliers to co-innovators.

Scale of Operation Insights

What Made Commercial-Scale Manufacturing the Dominant Segment in the Market?

The commercial-scale manufacturing segment dominated the contract manufacturing partnerships (CMOs) market with a major revenue share in 2024, as it enables producing large quantities of pharmaceutical products to meet market demand. It is characterized by fully operational facilities capable of high-volume production. This segment is crucial for ensuring the supply chain continuity for established drugs. Investment in commercial-scale manufacturing often indicates a company's confidence in a product's market success. It requires rigorous quality control measures and compliance with regulatory standards. As demand increases, this segment continues to expand, supporting global distribution networks.

Meanwhile, the preclinical & clinical phase manufacturing segment is expected to expand at the highest CAGR during the projection period because of the rising need to produce drugs for research and early-stage testing. It is generally conducted in smaller batches suitable for testing purposes. This segment is pivotal for developing new therapies and gathering safety and efficacy data. Manufacturing at this stage demands flexibility to adapt to different formulations and protocols. Once a drug shows promise, companies transition to commercial-scale manufacturing. The growth of this segment is driven by ongoing innovation and emerging therapies in the pipeline.

End User Insights

Why Did the Pharmaceutical Companies Segment Dominated the Market?

The pharmaceutical companies segment dominated the contract manufacturing partnerships (CMOs) market in 2024 due to the increased trend of outsourcing to reduce operational burden, improve margins, and speed up time-to-market. With expansive product portfolios, big pharma seeks versatile CMOs that offer everything from raw materials processing to packaging. Regulatory trust, quality assurance, and scalability are key reasons pharmaceutical companies prefer contract partners. Strategic partnerships with CMOs also help in geographic expansion and market entry. As pharma continues to globalize, its reliance on contract manufacturing is only intensifying.

On the other hand, the biotechnology companies segment is likely to grow rapidly over the forecast period, as they are increasingly turning to contract manufacturers to bring their breakthroughs to life. These companies focus on novel therapies, biologics, RNA drugs, and cell therapies, which require complex, tailored manufacturing solutions. Lacking large infrastructure, biotechs rely on CMOs for GMP compliance, technical expertise, and flexible scaling. As venture capital funding floods the biotech sector, outsourcing provides speed and credibility for early clinical milestones. Many CMOs are now tailoring their offerings specifically for biotech clients with smaller batch sizes and modular services. The synergy between biotech agility and manufacturing precision is creating a new era of collaborative growth.

Regional Insights

What Made North America the Dominant Region in the Contract Manufacturing Partnerships (CMOs) Market?

North America dominated the market in 2024 due to its robust infrastructure, advanced automation, and high standards for quality compliance. The region benefits from a strong presence of the pharmaceutical, electronics, aerospace, and medical devices industries that heavily rely on outsourcing. A focus on innovation, regulatory alignment, and intellectual property protection often drives strategic partnerships. Furthermore, the region's emphasis on digital transformation, such as the use of AI, robotics, and cloud-based manufacturing platforms, makes it a hub of smart production. Proximity to end markets and demand for rapid turnaround further reinforce its dominance. North America's contract manufacturers are no longer just suppliers; they are strategic co-creators of value.

The U.S. maintained a stronghold on the market due to the high demand for advanced electronics, biotech solutions, and defense-grade components, all requiring technical sophistication. American contract manufacturers often provide an end-to-end solution, encompassing design and prototyping, final assembly, and logistics. Government incentives and favorable IP laws attract both domestic firms and global brands to outsource within U.S. borders. The growing shift toward nearshoring, driven by global disruptions, has revitalized domestic outsourcing partnerships. With a rich ecosystem of R&D institutions and tech startups, the U.S. sets a gold standard for high-value manufacturing alliances.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, driven by cost advantages, rapid industrialization, and improved supply chain capabilities across countries like India, Vietnam, South Korea, and Malaysia. The region has become indispensable to industries ranging has become indispensable to industries ranging from electronics and automotive to pharmaceuticals and consumer goods. Governments in Asia Pacific are heavily investing in infrastructure and incentivizing FDI in manufacturing, accelerating the growth curve. Additionally, regional trade agreements have boosted cross-border outsourcing among Asian nations.

China is emerging as a key player in Asia Pacific, due to capabilities from low-cost mass production to high-tech precision manufacturing. It dominates sectors like consumer electronics, telecom components, and active pharmaceutical ingredients with unparalleled production scale. The Chinese government's Made in China 2025 initiative has further pushed innovation, automation, and quality standards in manufacturing. Tech giants and multinational firms continue to rely on Chinese contract manufacturers for fast prototyping and cost-effective production. However, geopolitical shifts are prompting China to focus more on self-sufficiency and strategic manufacturing partnerships. As it adopts sustainability and digital factories, China is poised to maintain its long-term leadership.

Contract Manufacturing Partnerships (CMOs) MarketCompanies

- Lonza Group

- Catalent Inc.

- Thermo Fisher Scientific (Patheon)

- Samsung Biologics

- WuXi AppTec

- Siegfried Holding AG

- Boehringer Ingelheim BioXcellence

- Recipharm AB

- Jubilant Pharmova Limited

- Piramal Pharma Solutions

- Cambrex Corporation

- Baxter BioPharma Solutions

- Almac Group

- Fujifilm Diosynth Biotechnologies

- PCI Pharma Services

- CordenPharma

- Aenova Group

- Vetter Pharma

- Curia Global

- Rentschler Biopharma SE

Recent Developments

- In July 2025, Thermo Fisher Scientific is set to acquire Sanofi's sterile manufacturing site in Ridgefield, New Jersey. This move includes the transfer of more than 200 employees and will enhance thermos fisher's sterile fill-finish and packaging capabilities in U.S. the acquisition is a strategic extension of Thermo Fisher Scientific long-standing collaboration with Sanofi and is expected to close by late 2025. (source: https://www.reuters.com)

- In June 2025, India-based Zydus Lifesciences acquired biologics manufacturing facilities from American biotech firm Agenus in California. This move marks Zydus's strategic entry into the biologics contract manufacturing space, particularly in the U.S. market. The acquisition will allow Zydus to scale up production of complex biologics and biosimilars, positioning it as a global player in the CDMO (Contract Development and Manufacturing Organization) industry.

(source: https://economictimes.indiatimes.com)

Segments Covered in the Report

By Service Type

- Active Pharmaceutical Ingredient (API) Manufacturing

- Small Molecule APIs

- Large Molecule APIs (Biologics)

- Finished Dosage Formulation (FDF) Manufacturing

- Oral Solid Dosage (Tablet, Capsule)

- Parenterals (Injectables, IV, IM)

- Topicals

- Ophthalmics

- Inhalables

- Others (Suppositories, Transdermal Patches)

- Packaging Services

- Primary Packaging

- Secondary Packaging

- Serialization & Track & Trace

- Analytical and Quality Testing Services

- Formulation Development

- Clinical Manufacturing

- Commercial Manufacturing

- Technology Transfer & Scale-up

- Regulatory Compliance Support

By Drug Type

- Small Molecule Drugs

- Biologics

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- cell & gene therapy products

- Vaccines

- Biosimilars

- Highly Potent APIs (HPAPIs)

- Controlled Substances

By Business Model

- Fee-for-Service (FFS)

- Full-Service/Integrated Model (End-to-End Solutions)

- Co-development & Risk-Sharing Partnerships

- Dedicated Facility Partnerships (Long-Term Contractual Models)

By Scale of Operation

- Preclinical & Clinical Phase Manufacturing

- Commercial-Scale Manufacturing

- Pilot-Scale / Bridge Manufacturing

By End User

- Pharmaceutical Companies (Branded & Generic)

- Biotechnology Companies

- Nutraceutical Firms

- Medical Device Manufacturers

- Academic Institutions & Research Institutes

By Therapeutic Area

- Oncology

- Cardiovascular

- Neurology

- Infectious Diseases

- Metabolic Disorders

- Autoimmune & Inflammatory Diseases

- rare & orphan diseases

- Others (Dermatology, Ophthalmology, Urology)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting