What is Contract Sterilization Services Market Size?

The global contract sterilization services market size was calculated at USD 1.73 billion in 2025 and is predicted to increase from USD 1.80 billion in 2026 to approximately USD 2.56 billion by 2035, expanding at a CAGR of 4.00% from 2026 to 2035. The market is rapidly growing due to the rising incidence of healthcare-associated infections, the increasing number of surgical procedures, and the expansion of healthcare facilities in emerging economies, which in turn increases demand for sterilization services.

Market Highlights

- North America held the largest market share of 38% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR during the foreseeable period.

- By service type, the terminal sterilization segment held the largest market share in 2025.

- By service type, the aseptic processing segment is expected to grow at a notable CAGR during the forecast period.

- By processing type, the batch processing segment held a major market share in 2025.

- By processing type, the continuous sterilization segment is expected to grow significantly during the foreseeable period.

- By delivery mode, the off-site segment held the largest market share in 2025.

- By delivery mode, the on-site segment is expected to show lucrative growth in the contract sterilization services market between 2026 and 2035.

- By method, the steam sterilization segment held a dominant market share in 2025.

- By method, the hydrogen peroxide sterilization segment is expected to grow at a significant CAGR during the foreseeable period.

- By end-user, the hospitals & clinics segment held the largest market share in 2025.

- By end-user, the pharmaceutical & medical device manufacturers segment is expected to expand at a substantial CAGR in the coming years.

What are Contract Sterilization Services?

The contract sterilization services market comprises a strategic outsourcing model where manufacturers delegate terminal decontamination, utilizing ethylene oxide, gamma, or e-beam modalities, to specialized third-party providers. This shift from in-house infrastructure to a service-based partnership facilitates significant capex reduction and operational scalability while ensuring rigorous adherence to cGMP and ISO regulatory standards. By leveraging external technical expertise, life sciences firms mitigate bioburden risks for high-stakes products like surgical implants and biologics, effectively accelerating time-to-market.

Contract Sterilization Services Market Trends

- Industry leaders are aggressively shifting toward sustainable sterilization (VHP, nitrogen dioxide) to mitigate environmental impact and stay ahead of tightening EPA and global emission mandates.

- The proliferation of sophisticated, heat-sensitive medical electronics and bio-polymers is driving high demand for cold-sterilization technologies, ensuring material integrity without compromising efficacy

- Organizations are increasingly replacing costly in-house infrastructure with outsourced service partnerships, converting fixed capital expenditures into flexible operating costs while leveraging specialized regulatory expertise.

- The implementation of automated monitoring and robotic handling is revolutionizing traceability, providing real-time data logging and robust "compliance-by-design" frameworks to eliminate human error.

- Massive infrastructure investment in the Asia-Pacific region is creating a new center for medical manufacturing, necessitating localized, high-standard sterilization hubs to meet rising global and domestic demand.

How is AI Influencing the Contract Sterilization Services Market?

The integration of Artificial Intelligence, specifically machine learning (ML), introduces advanced, data-driven automation that enhances efficiency, safety, and compliance with stringent regulatory standards. By leveraging ML and IoT-enabled sensors, service providers can now monitor sterilization parameters, such as pressure, temperature, and humidity, in real time, allowing for dynamic cycle adjustments rather than relying on fixed, inefficient, or manual protocols. These AI systems facilitate predictive maintenance, which reduces equipment downtime by predicting failures before they occur, increasing overall operational uptime and productivity.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.73 Billion |

| Market Size in 2026 | USD 1.80 Billion |

| Market Size by 2035 | USD 2.56 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Service Type,Processing Type,Delivery Mode,Method,End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Service Type Insights

Which Service Type Segment Led the Contract Sterilization Services Market?

The terminal sterilization segment led the market by holding the largest share in 2025. This is because of various applications, cost-efficiency, and regulatory and safety standards. The rising adoption of single-use, heat-sensitive medical devices, such as catheters and surgical kits, directly boosts the need for efficient, specialized sterilization methods. Terminal sterilization removes minute traces of microbes from the product, ensuring complete sterilization.

The aseptic processing segment is expected to grow significantly during the foreseeable period due to rising demand for biologics and heat-sensitive drugs, increasing prevalence of diabetes and other chronic diseases requiring higher production of injectable drugs, and the shift towards single-use technologies in bioprocessing. Increasing outsourcing of sterile manufacturing by pharma companies and stringent regulatory compliance fuel the market growth.

Processing Type Insights

Why Did the Batch Processing Segment Dominate the Contract Sterilization Services Market?

The batch processing segment dominated the market in 2025, as they offer the flexibility to manage diverse product portfolios and variable production volumes that continuous methods cannot accommodate. By providing granulated traceability and individual cycle validation, this approach ensures rigorous adherence to the quality management systems (QMS) required for complex medical and pharmaceutical assets.

The continuous sterilization segment is expected to show lucrative growth between 2026 and 2035 due to the integration of automated, high-velocity technologies like E-beam and plasma to support large-scale manufacturing. This model aligns with the rigorous, validated standards demanded by global regulators, effectively mitigating the risks of healthcare-associated infections through uninterrupted quality assurance. By eliminating the logistical bottlenecks of batch handling, organizations achieve superior unit-cost efficiency and accelerated market delivery for complex, heat-sensitive medical devices.

Delivery Mode Insights

How the Off-Site Segment Dominated the Contract Sterilization Services Market?

The off-site segment held the largest market share in 2025, as a strategic force multiplier by converting high-fixed-cost infrastructure into a scalable OPEX model that leverages superior economies of scale. These centralized hubs provide immediate access to multi-modality technologies and specialized regulatory expertise, ensuring seamless compliance with evolving global mandates while mitigating internal operational risk.

The on-site segment is expected to grow at a significant CAGR during the foreseeable period due to the need to eliminate logistical latencies and contamination risks associated with off-site transit. This proximity is critical for managing high-cost, complex surgical assets, ensuring that instrument turnaround times keep pace with rising procedural volumes and urgent trauma requirements. By integrating advanced, automated sterilization technologies directly into the facility workflow, healthcare providers enhance patient safety and operational resilience while maintaining absolute control over the sterile supply chain.

Method Insights

How the Steam Sterilization Segment Led the Contract Sterilization Services Market?

The steam sterilization segment contributed the biggest revenue share of the market in 2025 due to the industry benchmark for operational reliability. The steam sterilization method involves the use of high-velocity moist heat to ensure rapid, high-margin pathogen eradication. Its superior cost-efficiency makes it the primary modality for high-volume, heat-stable assets, effectively supporting the accelerated turnaround times required by modern surgical units.

The hydrogen peroxide sterilization segment is expected to expand at a substantial CAGR in the coming years. This is mainly due to advanced medical technology, providing high-efficiency decontamination for heat-sensitive electronics and complex endoscopes without compromising material integrity. Its rapid cycle velocity and non-toxic, residue-free profile align with modern ESG mandates while significantly enhancing throughput for high-volume clinical environments.

End-User Insights

Which End-User Segment Dominated the Contract Sterilization Services Market?

The hospitals & clinics segment accounted for the highest revenue share of the market in 2025 due to a shift towards specialized sterilization models. This transition is further catalyzed by the rising demand for single-use device terminal processing and the necessity of maintaining rigorous compliance with evolving global regulatory standards. Consequently, hospitals are increasingly adopting outsourced partnerships to leverage technical expertise and achieve the operational scalability required for modern, high-intensity clinical environments.

The pharmaceutical & medical device manufacturers segment is expected to grow at a notable CAGR during the forecast period. This is mainly due to the necessity of navigating rigorous cGMP compliance and the technical demands of high-risk Class IIb and III medical devices. By leveraging specialized providers, manufacturers mitigate the high capital expenditure required for advanced, low-temperature modalities essential for modern biologics and heat-sensitive instruments.

Regional Analysis

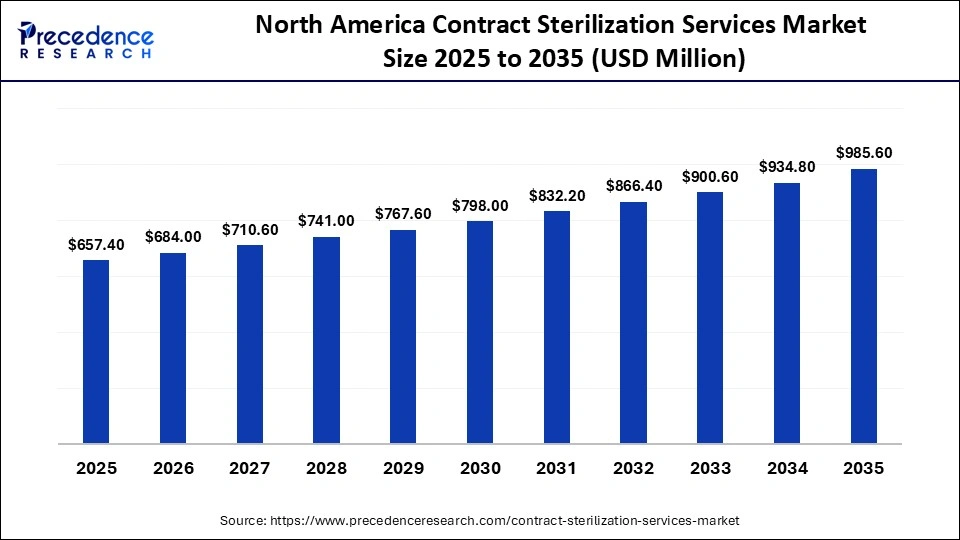

How Big is the North America Contract Sterilization Services Market Size?

The North America contract sterilization services market size is estimated at USD 657.40 million in 2025 and is projected to reach approximately USD 985.60 million by 2035, with a 4.13% CAGR from 2026 to 2035.

Why North America Dominated the Contract Sterilization Services Market?

North America registered its dominance in the market in 2025. This is mainly due to a sophisticated regulatory landscape and a high concentration of biopharma and medtech leaders who prioritize strategic outsourcing. The region's early adoption of next-gen modalities, such as X-ray and low-temperature hydrogen peroxide, enables the high-velocity processing required to support over annual surgeries.

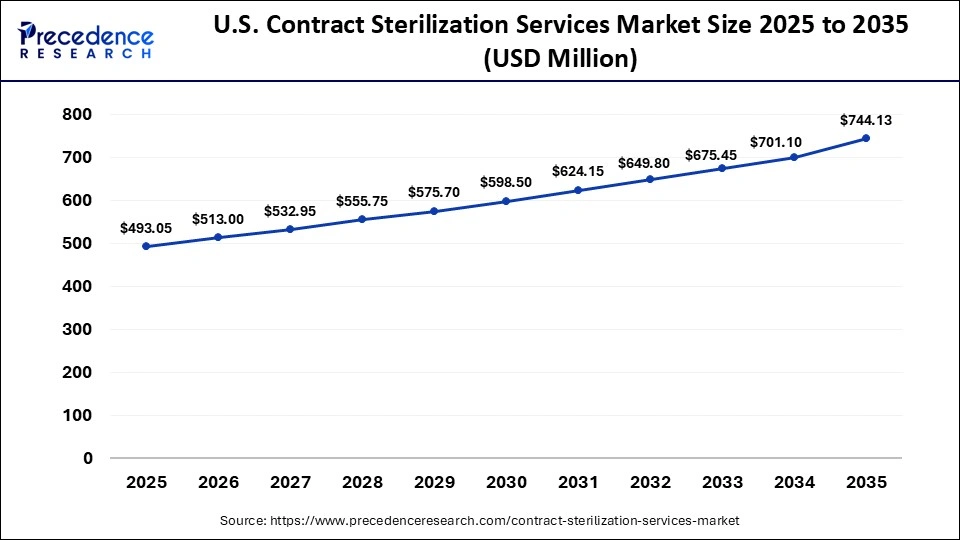

What is the Size of the U.S. Contract Sterilization Services Market?

The U.S. contract sterilization services market size is calculated at USD 493.05 million in 2025 and is expected to reach nearly USD 744.13 million in 2035, accelerating at a strong CAGR of 4.20% between 2026 to 2035.

U.S. Market Analysis

The U.S. market is growing due to the manufacturers increasingly transitioning to outsourced models to mitigate capital risk and navigate tightening FDA and CDC safety mandates. While ethylene oxide remains the dominant modality for moisture-sensitive devices, there is a clear trajectory toward advanced radiation technologies driven by environmental scrutiny and material innovation.

The U.S. government's Environmental Protection Agency (EPA) has published the “National Emission Standards for Hazardous Air Pollutants: Ethylene Oxide Emissions Standards for Sterilization Facilities Residual Risk and Technology Review, 89 FR 24090 (EtO Rule). The rule imposes new emission-control requirements on commercial sterilization facilities.

How is Asia-Pacific Rapidly Expanding in the Contract Sterilization Services Market?

Asia-Pacific is expected to grow at the fastest CAGR during the foreseeable period due to a strategic shift towards OEM outsourcing to accelerate speed-to-market and optimize operational costs. The expansion of regional healthcare infrastructure, coupled with an aging demographic, necessitates a high-volume supply of validated assets that meet increasingly stringent safety mandates. The increasing adoption of advanced technologies and stringent regulatory standards across the region fuels market growth.

India Market Analysis

In India, the market is evolving due to superior scalability and compliance capabilities. While ethylene oxide remains the foundational modality for complex devices, the industry is aggressively adopting high-velocity X-ray and E-beam technologies to enhance safety and throughput. Furthermore, the rapid expansion of healthcare infrastructure in emerging economies, combined with a pivot toward sustainable sterilization, ensures long-term growth and operational modernization across the global life sciences supply chain.

- In September 2025, STERIS launched India's first fully integrated EtO sterilization and packaging solution, providing an end-to-end service from precision mold creation to validated sterilization.

Will Europe Grow in the Contract Sterilization Services Market?

Europe is expected to grow at a considerable CAGR in the upcoming period. This is mainly due to stringent regulatory policies, favorable government support, and the presence of key players. The growing number of healthcare startups and venture capital investments promotes the demand for contract sterilization services. The rising adoption of advanced technologies favors the development of innovative sterilization technology.

UK Market Analysis

Steris, Europlaz, Sterigenics, and Mi3-Medical Intelligence provide contract sterilization services in the UK. The NHS has launched the Sterile Services and Endoscopy Decontamination Facility Solutions Framework to allow NHS organizations to procure a supplier who can design, build, and equip a sterile services or endoscopy decontamination facility and manage the facility and its equipment under a managed service contract.

Value Chain Analysis - Contract Sterilization Services Market

- Raw Material & Equipment Supply: This stage involves the procurement of sterilization agents (ethylene oxide gas, Cobalt-60 for gamma, hydrogen peroxide) and the manufacturing of specialized equipment (industrial sterilizers, E-beam accelerators, X-ray machines).

Key Players: IBA (Ion Beam Applications S.A.) - Pre-Sterilization & Validation Services: Before final sterilization, products undergo mandatory validation, microbiological testing, and packaging, ensuring they meet ISO 11135 or ISO 11137 standards.

Key Players: Nelson Labs (part of Sterigenics) and Medistri SA. - Logistics & Distribution to End-Users: The final stage involves the transportation and distribution of sterilized medical devices, pharmaceuticals, or, increasingly, food products to hospitals, clinics, and retail distributors.

Who are the major players in the global contract sterilization services market?

The major players in the contract sterilization services market include Medistri SA, STERIS, BGS, Sterigenics LLC, E-BEAM Services, Inc., VPT Rad, Inc., Microtrol Sterilisation Services Pvt Ltd., Scapa, SMC Ltd., Akacia Medical, Ensera, and Infinity Laboratories.

Recent Developments in the Contract Sterilization Services Market

- In January 2026, Halo Pharma announced the launch of its new sterile CDMO business, featuring a Groninger UFVN FlexFill line and Skan isolator capable of filling vials, syringes, and cartridges in ready-to-use formats. It offers services for oral solids, liquids, and semi-solids, alongside sterile product development, analytical testing, and formulation. (Source:https://www.contractpharma.com)

- In August 2025, Advanced Sterilization Products (ASP) launched the BIOTRACE Instant Read Steam Biological Indicator System, which delivers results in just 7 seconds, significantly accelerating workflow efficiency. The system allows for faster decision-making, improved throughput, and reduced operational strain. (Source:https://www.asp.com)

- In February 2025, Recipharm introduced an advanced modular sterile filling system capable of performing aseptic filling within a Grade A isolator, adhering to strict GMP standards. It offers unmatched flexibility, featuring interchangeable modules that support various product types. (Source:https://www.recipharm.com)

Segments Covered in the Report

By Service Type

- Terminal Sterilization

- Aseptic Processing

- Others

By Processing Type

- Batch Sterilization

- Continuous Sterilization

By Delivery Mode

- On-Site

- Off-Site

By Method

- Steam Sterilization

- Hydrogen Peroxide Sterilization

- Ethylene Oxide Sterilization

- Others

By End-user

- Hospitals & Clinics

- Pharmaceutical & Medical Device Manufacturers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting