Copper Foil Market Size and Forecast 2025 to 2034

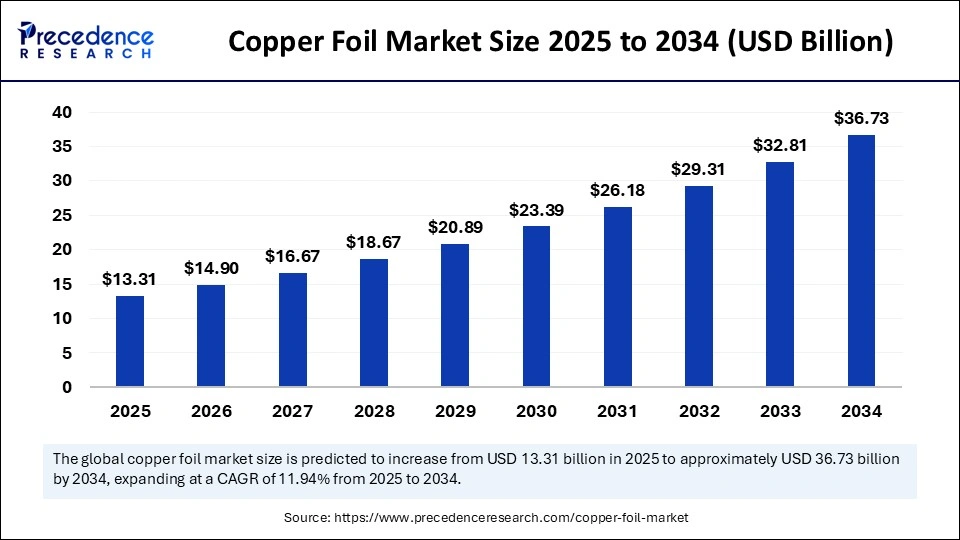

The global copper foil market size accounted for USD 11.89 billion in 2024 and is predicted to increase from USD 13.31 billion in 2025 to approximately USD 36.73 billion by 2034, expanding at a CAGR of 11.94% from 2025 to 2034. The growing demand for electronic devices, rising investment in EV batteries, rising demand for copper foil in emerging economies, increasing focus on clean energy, and supportive government frameworks are expected to drive the growth of the global copper foil market throughout the forecast period.

Copper Foil Market Key Takeaways

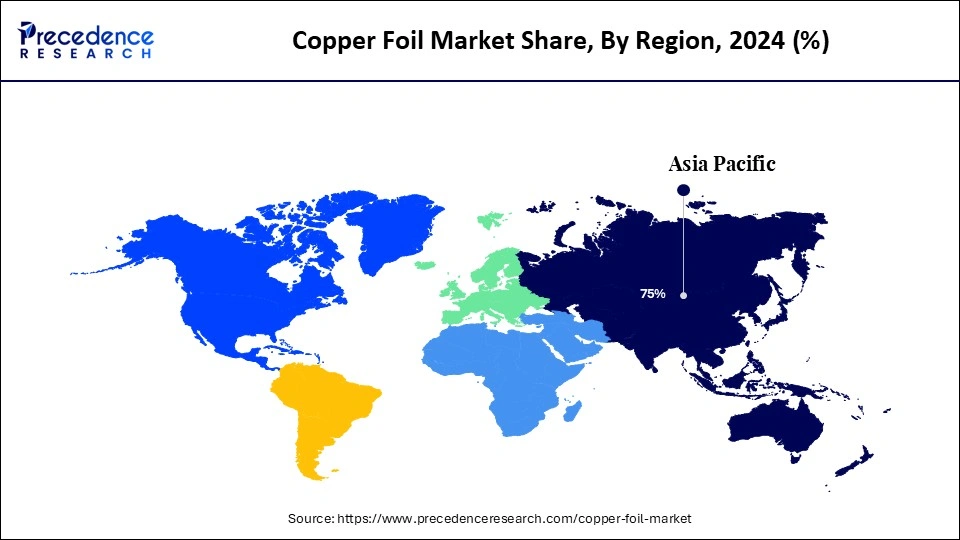

- Asia Pacific dominated the global market with the largest market share of 74% in 2024.

- North America is expected to expand rapidly during the forecast period.

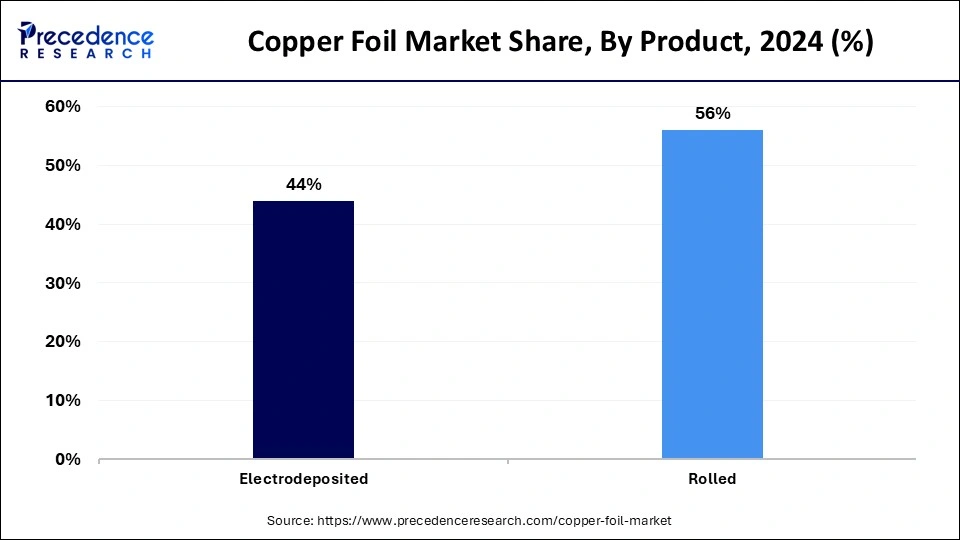

- By product, the rolled segment accounted for the biggest market share of 56% in 2024.

- By product, the electrodeposited segment is expected to witness remarkable growth during the forecast period.

- By application, the circuit boards segment dominated the market in 2024.

- By application, the batteries segment is expected to witness significant growth during the forecast period.

Role of AI in the Copper Industry

As technology continues to evolve, artificial intelligence emerges as a transformative force for the copper industry, optimizing copper production, minimizing human errors, enhancing quality control, improving supply chain management, and maintaining sustainability. AI can enhance sustainability, efficiency, and safety in copper mining processes to ensure environmental compliance. Predictive analytics and Machine Learning (ML) assist manufacturers in setting up various production parameters such as pressure, temperature, and rolling speeds, which results in minimizing material wastage, cost savings, and higher precision. Therefore, AI integration is reshaping the copper industry by bringing significant changes in numerous operational facets.

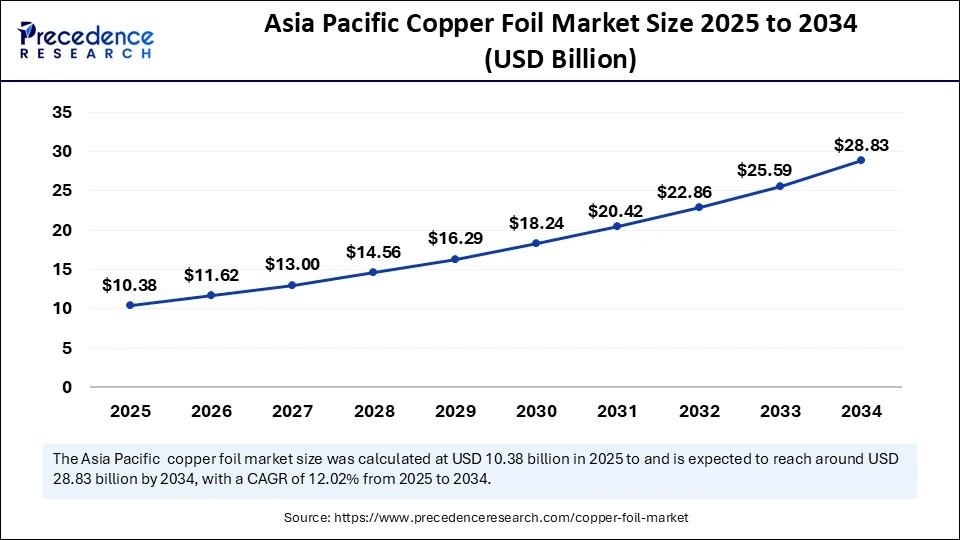

Asia Pacific Copper Foil Market Size and Growth 2025 to 2034

Asia Pacific copper foil market size was exhibited at USD 9.27 billion in 2024 and is projected to be worth around USD 28.83 billion by 2034, growing at a CAGR of 12.02% from 2025 to 2034.

Asia Pacific held the dominant share of the copper foil market in 2024. The region's market dominance is mainly attributed to the rapid expansion of the renewable energy sector, increased production of electric vehicles (EVs), and the presence of a well-established electronics manufacturing industry. Rapid industrialization, rising public-private investments in battery production, and supportive government policies further bolstered the market in the region. Countries like Japan, China, India, and South Korea are the leading producers and consumers of copper foil. There is a high adoption of electronic devices and electric vehicles, in which PCBs play a key role. Automakers in the region emphasize reducing carbon emissions due to the implementation of stringent regulations, which have led to the transition to electric mobility. Several foil producers are investing in copper foil to stay ahead in a competitive market.

For instance, in March 2025, Hindalco Industries Ltd announced an investment worth Rs 45,000 crore in India's metal business, plans copper foil unit for EVs. As part of the investment, the company plans to establish a copper foil manufacturing facility tailored for electric vehicles, a sector witnessing rapid growth in India.

China is a major contributor to the market due to the presence of a well-established electronics and electric vehicles industries. The country is experiencing an exponential rise in the production of electric vehicles. Copper foil is a crucial component in the production of lithium-ion batteries used in electric vehicles.

On the other hand, North America is expected to expand rapidly during the forecast period, owing to the rising investment in energy projects, increasing consumer demand for electronics products, supportive government frameworks, rising need for sustainable and eco-friendly energy production, and rapid consumer shift toward electric vehicles. The adoption of electric vehicles has significantly increased, which raises the need for high-performance lithium-ion batteries in the region. In addition, the rapid technological advancements, such as Internet of Things (IoT), 5G connectivity, and artificial intelligence, are likely to spur the demand for copper foil in the region.

- In February 2024, Addionics, a next-generation battery technologies provider, announced an investment worth USD 400 million to build 3D copper foil manufacturing facilities across the U.S. to support domestic EV battery production. The company's first plant is expected to begin production in 2027, with additional plants projected to be commissioned by 2032. The three-phase, multi-factory plan will produce tens of thousands of tons of 3D copper foil per year to support 90 GWh of battery capacity annually.

Europe is observed to grow at a considerable growth rate in the upcoming period. The growth of the market in the region can be attributed to the increasing emphasis on clean energy sources. There is a rising demand for consumer electronics and sustainable mobility solutions. The rapid expansion of power infrastructure, rising renewable energy projects, and rising adoption of electric vehicles further contribute to regional market growth.

Market Overview

Copper foil is a thin sheet of copper that is widely prepared by hammering and rolling copper metal. It is formed either by rolling copper sheet or the electrodeposition process. Copper foil plays an indispensable role in various industries such as electrical & electronics, industrial equipment, building & construction, medical, and automotive due to its good electrical conductivity, malleability, and corrosion resistance. The copper foil market is witnessing rapid growth due to the rising production of copper across the globe.

- According to the latest US Geological Survey data, global copper production reached 23 million metric tons (MT) in 2024.

Top 10 Copper Producers by Country in 2024

| COUNTRIES | COPPER PRODUCTION |

| Chile | 5.3 million metric tons |

| Democratic Republic of Congo | 3.3 million metric tons |

| Peru | 2.6 million metric tons |

| China | 1.8 million metric tons |

| Indonesia | 1.1 million metric tons |

| U.S. | 1.1 million metric tons |

| Russia | 930,000 metric tons |

| Australia | 800,000 metric tons |

| Kazakhstan | 740,000 metric tons |

| Mexico | 700,000 metric tons |

Copper Foil Market Growth Factors

- The rising demand for copper foil from multiple industries, such as electronics and automotive, is expected to boost the growth of the market. Copper foil is preferred for its superior conductivity and flexibility.

- The rapid expansion of renewable energy sources, such as solar and wind power, is likely to contribute to market growth. Copper foil is used in solar panels and wind turbines.

- The rising need for high-performance printed circuit boards and energy storage systems spurs the demand for copper foil.

- The rising emphasis on sustainable energy infrastructure and the rise in renewable energy projects are expected to boost the growth of the market in the coming years.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.73 Billion |

| Market Size in 2025 | USD 13.31 Billion |

| Market Size in 2024 | USD 11.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.94% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Consumer Electronics

The rising consumer demand for electronic devices such as smartphones, laptops, computers, tablets, and car electronics is driving the growth of the copper foil market. Copper foil is widely used as a conducting material in electronic products due to its superior electrical and thermal attributes. In today's era of modern technology, copper foil plays a crucial role in the manufacturing of electronic devices. Copper foil finds application in printed circuit boards (PCBs), electromagnetic shielding, and capacitors and inductors. In electronic devices, PCBs are the critical components of electronic devices, connecting electronic components via copper foil circuits to form the electronic circuit system of the devices. The copper foil is responsible for transmitting electronic signals and ensuring the uninterrupted operation of the electronic devices.

Restraint

Price Volatility

The volatility of copper prices is anticipated to hamper the growth of the copper foil market. Fluctuations in the prices of copper can create uncertainty in the market, impacting on the overall cost of production and profitability of copper foil manufacturers. In addition, the disruptions in the supply chain can impact the availability of raw materials and affect the production of copper foil, restraining the market's growth.

Opportunity

Rising Production of EV Batteries

The increasing production of lithium-ion batteries for electric vehicles (EVs) is projected to offer lucrative opportunities in the copper foil market. The rapid growth of the electric vehicles (EVs) industry has led to an increasing production of lithium-ion batteries, which increasingly rely on high-purity copper foil. It is a vital component for energy transfer and to improve battery performance. In battery production, copper foil serves as a current collector and conductor within the battery cells. The quality and performance of copper foil are crucial to enhancing the overall efficiency and longevity of batteries. Therefore, as the production of EVs increases, the demand for copper foil for lithium-ion batteries also increases.

According to the International Energy Agency, in 2023, global electric car sales soared by 35% year-on-year, increasing to almost 14 million new cars. While demand remained largely concentrated in China, Europe, and the U.S., growth also picked up in some emerging markets such as Vietnam and Thailand, where electric cars accounted for 15% and 10%, respectively, of all cars sold.

- In November 2024, Solus Advanced Materials Company, a South Korean copper foil producer, announced that it started mass production at a second copper foil plant in Hungary, as the company continues to position itself as a key player in Europe's electric vehicle (EV) battery supply chain. The company is a leading global producer of EV battery copper foil, supplying manufacturers such as LG Energy Solution and Tesla.

Product Insights

The rolled segment held the largest share of the copper foil market in 2024. This is mainly due to its superior mechanical attributes. Rolled copper foil is widely used in numerous applications across various industries, such as automotive, electronics, and energy. In addition, rolled copper foil is gaining immense popularity in high-performance applications like lithium-ion batteries, flexible printed circuits, solar photovoltaic panels, and electromagnetic shielding, where performance plays a critical role.

On the other hand, the electrodeposited segment is expected to witness remarkable growth during the forecast period. The growth of the segment can be attributed to the rising demand for consumer electronic devices and electric vehicles. Electrodeposited copper foil is manufactured by depositing copper ions onto a rotating metallic mandrel to form a thin layer of foil. This copper foil is ideal for various applications, from printed circuit boards (PCBs) to lithium-ion batteries (LIBs).

Application Insights

The circuit boards segment dominated the copper foil market in 2024. The increased production of IoT devices and other electronic gadgets increased demand for printed circuit boards (PCBs). PCBs are considered an integral component of electronic devices. Moreover, the rising miniaturization of electronic components and the expansion of industries such as automotive electronics, consumer electronics, and telecommunications bolster the segmental growth.

On the other hand, the batteries segment is expected to witness significant growth during the forecast period. The rising adoption of electric vehicles due to an increasing focus on reducing the carbon footprint is boosting the growth of the segment. Copper foil is a key component in lithium-ion batteries, which serves as a major source of power in electric vehicles. A lithium-ion battery structure consists of a cathode, an anode, an electrolyte, and a separator. Therefore, the rapid expansion of the electric vehicles industry, particularly in developed and developing countries, is offering significant opportunities to the copper foil producers to increase their production capacities. For instance, in September 2023, Lotte Energy Materials Corp., a leading battery materials maker in South Korea, unveiled its plan to build a copper foil plant in the U.S. to meet growing demand for battery components from electric vehicle makers in North America.

Copper Foil Market Companies

- Volta Energy Solutions (VES)

- Hindalco

- Lotte Energy Materials Corp.

- Circuit Foils

- Doosan Corporation Electro-Materials

- Furukawa Electric Co., Ltd.

- Lingbao

- Lotte Energy Materials Consumption

- LS Mtron

- Nippon Denkai, Ltd.

- SKC

- UACJ Foil Corporation

- Furukawa Electric Co. Ltd.

- China-Kinwa High Technology Co. Ltd.

- Chinalco Shanghai Copper Co. Ltd.

Recent Developments

- In April 2025, Destiny Copper, an innovative cleantech mineral recovery and processing company, announced a strategic partnership with BMI Group. BMI Group, a real-estate investment and value acceleration company, has purchased a minority stake in Destiny Copper. This investment is likely to support the expansion of Destiny's copper recovery to copper powder production (CR-to-CP) pipeline.

- In February 2025, Anglo American announced that it had signed a memorandum of understanding (MoU) with Codelco, a Chilean mining company. The agreement involves Anglo American's subsidiary, Anglo American Sur SA (AAS), which owns 50.1% of the company. Both firms will work together on a joint mining plan for their neighboring copper mines, Los Bronces and Andina, in Chile. This collaboration aims to increase copper production with minimal additional investment.

- In December 2024, Lotte Energy Materials Corp., a leading South Korean battery materials maker, announced that it will supply advanced copper foil to Doosan Corp.'s business group (Doosan BG) for use in glass substrates.

- In November 2024, Vedanta announced its plan to invest USD 2 billion in copper production facilities in Saudi Arabia. This initiative is a part of nine investment agreements worth over USD 9.32 billion signed by Saudi Arabia during the World Investment Conference in Riyadh.

- In May 2024, Solus Advanced Materials, a leader in global copper foil and battery copper foil manufacturing, received approval for its copper foil for AI (Artificial Intelligence) accelerators from global big tech companies.

Segments Covered in the Report

By Product

- Electrodeposited

- Rolled

By Application

- Circuit Boards

- Batteries

- Electrical Appliances

- Solar & Alternative Energy

- Medical

- Other

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting